News of the Week (January 10-14)

CrowdStrike; Upstart; Teladoc Health; Olo; GoodRx; Progyny; JFrog; Ayr Wellness + Cresco; The Boeing Company; My Activity

1. CrowdStrike (CRWD) — CFO Burt Podbere Interviews with Jefferies and Needham + A Case Study & Some Market Share Data

a. Podbere Interviews

On competition (he was specifically asked about SentinelOne in both conferences) and pricing pressure:

“SentinelOne does a great job setting up awesome demos that look great. What happens after that is another story. We frequently talk about vendors choosing them and then boomeranging back to us because it just doesn’t scale and doesn’t deploy without a lot of false positives. This has been the most favorable competitive environment that we’ve ever seen.”

“Our win rates against the competition have never been stronger while we maintain and increase our pricing… This goes back to what we’ve been talking about — we’re selling a platform and value. We’re actually going in and offering better efficacy and lower total cost of ownership when you pull out the extraneous tools and consolidate on CrowdStrike. Better efficacy at a lower price which you can see in our numbers. People are willing to pay for the best. I think about our market leadership role and where it stands as similar to a Salesforce or ServiceNow. As they increased their leadership, competitors fell by the wayside. That’s what we’re seeing.”

The demand pipeline is currently sitting at record size. While the pandemic did serve as a tailwind (needed to protect all the new remote endpoints for distributed workforces), the company continues to have no trouble finding new annual recurring revenue (ARR).

CrowdStrike continues to grow its proportion of multi-year deals vs. single year deals — this inherently lends itself to better retention and more cross-selling.

On sentiment that other players have more AI and automation built into their platform:

“When you’re known for better efficacy and lower false positive rates that is evidence of our AI/ML working better.”

On why CrowdStrike chose to be cloud native with no parallel on-premise platform:

Burt pointed to two key benefits of being cloud native and exclusive:

Ability to ingest, organize and conceptualize data more seamlessly with more scale.

Immediate “time to value” for on-boarded customers.

“With respect to if a lack of an on-premise (prem) offering prevents us from expanding into different industries or geographies, we sell everywhere — across the world and to every industry. We have turned down many opportunities that have asked for on-prem, and what happens is that those companies end up coming to the cloud. Eventually it will happen for everybody.”

He reminded us that Salesforce also has no on-premise solution.

On the Cybersecurity and Infrastructure Security Agency (CISA) win:

“The CISA deal was extremely competitive and we won because of our efficacy. We’ll start in a few agencies. From there, we’ll be able to sell to more and more agencies. They’re a big seat at the table for all civilian agencies so winning that is an on-ramp into much bigger things. The ARR will ramp over the next 3 quarters.”

CrowdStrike expects this to become “one of its largest clients” and is currently contributing $0 in ARR for the company. The growth here is entirely ahead of it.

On the cloud workload opportunity:

“Cloud workload protection (CWP) is a greenfield opportunity. It’s not like there’s a legacy player out there and we’re taking market share from them. There’s not even a legacy player there. The $10-$15 billion market is completely underserved. We think there’s a real opportunity for net new ARR to be 50% or more from CWP in the future.”

On costs moving forward:

R&D spend will outpace S&M spend going forward.

CrowdStrike expects share dilution to be in the 5-6% annual range going forward to compensate employees in a tough environment for hiring and retaining cybersecurity talent.

b. Transpak Case Study

Transpak — a logistics company founded 70 years ago in Silicon Valley — was struggling to fend off malware attacks and other breaches amid its rapid growth. The company evaluated several close alternatives and chose CrowdStrike’s Falcon Platform due to its ease of deployment, seamless anti-virus replacement/upgrading, and immediate time to value.

“The tools that CrowdStrike Falcon provides give me the ability to sustain our business processes to keep the systems running. I wish I had more tools that were as easy to deploy, maintain and manage as the CrowdStrike Falcon Platform. It increased the value of my security program.” — Direct of IT at TransPak Mark Sauer

Transpak also purchased Falcon OverWatch to take advantage of CrowdStrike’s managed hunting team.

c. Market Share Update

In late 2020, CrowdStrike published a graphic depicting its 12% market share within modern endpoint security. For 2021, it was ranked #1 by IDC for modern endpoint security share. CrowdStrike now boasts a 14.2% market share. There remains a long, long runway of legacy business for next-generation vendors like CrowdStrike to take.

2. Upstart (UPST) — New Partner

Upstart announced AgFed Credit Union as the newest member of its referral network. The two companies had been working together for a few months, but this now frees Uptart.com-sourced loans to be referred to this credit union. Referral fees are Upstart’s largest revenue segment by a sizable margin.

AgFed is quite small with only a few hundred million in assets under management (AUM) but any bank and credit union adoption is positive as it creates a more defensible take rate and growth trajectory for Upstart. Click here to learn why.

My Upstart deep dive will be published later this month.

Click here for my broad overview of Upstart’s business.

3. Teladoc Health (TDOC) — CEO Jason Gorevic and CFO Mala Murthy Present at J.P Morgan’s Healthcare Conference

a. Preliminary Q4 2021 results and a reiterated 2021 investor day outlook

Teladoc Health released an 8K in conjunction with this presentation which offered a glimpse into the company’s most recent quarter. Gorevic augmented that release with more information on the period. Here’s what we learned:

Teladoc now expects $2.03 billion in 2022 sales vs. $2.015-$2.025 billion previously guided to. This implies a 2% 4th quarter beat.

Teladoc’s total visits are now expected to be at or above 14.7 million for the quarter vs. previous guidance of 14.5-14.7 million.

Retention rates remained in the 90% range.

Total membership is expected to be in line with expectations at 76.5 million.

The company remains “very comfortable” with its 2023 revenue guidance of $2.6 billion.

Teladoc continues to expect $260-$265 million in EBITDA for 2021 and 1-1.5% annual EBITDA margin expansion through 2024.

“We will continue driving operating leverage while investing back into our business. This is a unique moment for us where we have an unrivaled ability to expand our competitive lead.” — CFO Mala Murthy

“The 4th quarter selling season was the biggest and most successful we’ve ever had at the company. We delivered 35% sequential bookings growth vs. the 3rd quarter and we are set up well for 2022… We’ve had some great early results and launches of Primary360 in the beginning of 2022.” — CEO Jason Gorevic

b. Gorevic on data

Teladoc’s unmatched scale (2 billion unique data points powering 500 million annual virtual interactions) gives it an unparalleled data treasure chest to offer more actionable and granular insights to its members. This fosters an ability to provide whole-person care (mental/chronic/primary) all in a remote setting and unlocks several more virtual use cases. In a field like Telehealth where barriers to entry are low and competition is abundant — this is how Teladoc differentiates itself.

“In virtual care, there have always been very low barriers to entry but significant barriers to success and scale. It’s the combination of all these leading capabilities that builds our moat which continues to get bigger.”

Examples of why data matters:

More relevant referrals for pre-diabetics to go see a dietician.

Better patient/provider matching — especially in mental health where the quality of the first match powers sustainable engagement. This drives better results and lower costs for all parties involved.

Along those lines, I still believe that the Livongo transaction was a great decision. Yes, it will continue leading to bloated net losses through the end of 2022 — but that has nothing to do with the underlying profitability of the combined entity. Livongo frees Teladoc to pursue exponentially more per member per month (PMPM) fees and will be a core growth driver this decade.

Specifically, Teladoc expects PMPM expansion (so product cross-selling) to power more than 80% of its revenue growth through 2024 thanks to its chronic care management, Primary360 and myStrength Complete products all being less than 20% penetrated. Livongo was a key piece to rounding out Teladoc’s whole-person care goals and creating a true industry leader — in my biased opinion. For evidence of cross-selling traction gaining steam, 25% of Teladoc members are enrolled in multiple programs vs. less than 3% in 2019. 75% of its new business in 2021 came from multi-product sales. There’s a fully mature opportunity of $68 PMPM for Teladoc’s portfolio of products vs. the $2.57 PMPM it realizes now.

“When you bring this all together, we give a better overall experience to the consumers and more value for the clients buying on their behalf. We’re becoming the default first stop for the consumer and the very first place a consumer can go for all their healthcare needs.”

Whether it’s relationship issues, inadequate primary care service, an ailment or a biomarker gone astray, Teladoc now has actionable services to seamlessly connect the end user to help. All of these pieces of healthcare are inherently connected — think about a relationship between mental health and weight loss for example — meaning gaps in care capabilities will have an adverse impact across all services provided. This reality makes whole person care not just more convenient for the employee, but more efficient and cost effective for the client. The company seamlessly integrates with hospital systems to plug people into physical care delivery wherever need be.

Gorevic frequently discusses how the separation of Teladoc from the rest of its competition is transforming the company from a vendor to a true partner for its clients and from a fee for service model to a model based on the risks of a population and the value Teladoc can provide.

“The more we expand our offering, the more we can take care of a population, positively impact their healthcare costs and therefore command a bigger part of the healthcare dollar in a value-based arrangement. We see a lot of interest from clients in leaning into value-based contracts. We’re in a unique position to do this in a way that others in the market simply can’t.”

c. Murthy on healthcare staff shortages pressuring Teladoc’s margins:

“There is some amount of inflation that we are keeping an eye on but we see no material impact on our P&L (profit & loss) in the short or medium term.”

d. Gorevic on competition and M&A/vertical integration:

“Our relationships with Centene, Aetna and Aon for virtual primary care are evidence of clients looking for a full suite of virtual solutions. They’re building an entire product and benefits package around our Primary360 product that can’t be done with a point solution.”

“With payers buying telehealth companies, it’s an interesting dynamic. Other payers are not interested in relying on a competitor for that strategic role in their product portfolio. When we think about Cigna buying MDLIVE that was actually very positive for us. It opened up a lot of the MDLIVE payer clients looking for a more neutral solution. We’ve seen growth result from that move.”

“We have a great relationship with UnitedHealth Group and Optum and we provide multiple products and services to them. We continue to grow our revenue and our role within their portfolio.”

e. Gorevic on the stock

“One of our values is keeping our promises. We’ve laid out appropriately ambitious growth targets and I’m hopeful we’ll be rewarded for keeping those promises. As we get into the second half of this year and put up more results around our new products — the investor community will begin to appreciate the returns on the investments we are making.”

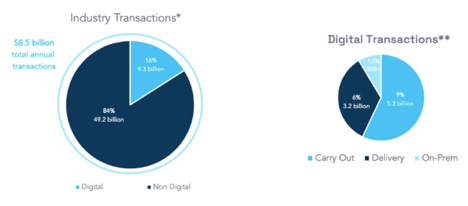

4. Olo (OLO) — TikTok News + Founder/CEO Noah Glass Presents at the ICR Conference & With Needham

a. TikTok

TikTok announced plans to launch deliver-only kitchens across the U.S. starting in March. The social media giant will partner with Virtual Dining Concepts on the project — a company that already launched the wildly successful Mr. Beast Burger in tandem with Olo. The concept will operate out of established chains like Buca di Beppo with the menu being based on the app’s “most viral food trends.”

Olo has officially partnered with TikTok on this project to bring popular food concepts on the platform directly to fans and interested consumers. It will provide its digital ordering know-how along with its delivery bidding service that can make “12-minute from store-to-door fulfillment possible for the majority of the population.” The deliver-only concept is set to open 1,000 kitchens across the U.S. this year.

b. Institutional Interviews

Glass on 2022 predictions:

“QSR goes digital this year. We saw tremendous movement in 2021 with new Olo customers like Carl’s Jr. but these are just a few of the QSR concepts embracing new ways to transact with Olo. Looking to the future, the processing of cars through a drive-thru lane is getting a long-awaited make-over. Digital enables the parallel processing of cars and many Olo clients are experimenting with dual lane drive-thru to expedite the convenience that digital can offer in this model.”

Glass also predicted that the industry would move closer to 100% of orders being managed by the front of house (FOH). Olo’s Expo module allows for the aggregation and prioritization of orders within any channel through one intuitive FOH interface — this allows front and back ends to more effectively communicate and operate.

Glass with a class on SaaS:

“It has been a long held conviction at Olo that SaaS is superior to home-grown solutions — we’re excited to see the industry agrees. We’ve now proven through hundreds of instances how investing in an enterprise-grade SaaS platform is a compelling alternative to building in-house. It brings lower costs, faster time to market, tapping into platform best practices and leveraging a large partner and customer ecosystem. In short, SaaS wins over home-grown software.”

Glass referred to 2021 as a “milestone year” for helping brands re-platform from home-grown to Olo.

Glass on the Wisely acquisition (a customer data platform (CDP)):

Reminder of what Wisely adds to Olo’s abilities:

Enhances Olo’s ability to free a client to effectively and economically maintain the direct to consumer digital relationship before marketplace or other disintermediation.

“We see direct digital relationships as the new currency of 2022.” — Glass

To precisely measure and grow customer lifetime value (CLV) through data-driven marketing, customer management and data analytics/intelligence offerings.

Aggregates all of a consumer’s digital interactions (in any touch point) to create a singular profile. This enables more granular marketing and better conversion. Furthermore, it also unlocks a restaurant’s ability to identify the top 20% of their customer base which represents 60% of its total sales. This guides resource allocation and store openings.

Olo is leaning into QR code technology to grow the 1.5% of transactions coming from digital on-prem. It’s extending the utility beyond just looking at the menu through our phone to now being able to place and submit an order directly through the interface while alerting servers when necessary. This has already been shown to boost the consumer experience and throughput. Glass pointed to the deep and broad integrations the on-premise product suite comes with which eliminates the need to onboard new technology — restaurants leverage the same interface they use to service off-premise orders.

“There are now some concepts already running 100% of their business through our platform.”

“We’ve seen interest in contact-less options persevere through all stages of the pandemic — even through waves of return to on-premise dining for certain areas.”

Olo worked with existing partners during 2021 to launch “50 new all-virtual concepts” (ghost kitchens).

Glass on labor shortages:

Glass eluded to these shortages placing more pressure on restaurant chains to outsource certain tasks like delivery. Olo’s dispatch module (enables delivery through direct to consumer channels by tapping into delivery partners) allows this to be done in an auction-style manner that does two things:

Ensures the lowest cost, fastest and most profitable transaction.

Draws from all delivery service provider bids to limit labor shortage fears for any given vendor.

Glass on Olo Pay:

“Olo Pay — like a lot of the other platform level innovations that we’ve made — has been born from the use of our expert product advisory council and hearing about the current status quo of payments and the suboptimal customer experience.”

Glass spoke on legacy payment processors — which were not intended to be consumer facing — being “hoisted into the consumer payment experience.” Problems resulted from that and so Olo Pay was created to act as a gateway to existing fragmented payment processors.

“Different franchisees may be using different processors. Just like there’s point of sale (POS) fragmentation there is payment processor fragmentation. And how that manifests in a suboptimal experience is that a consumer may put a card and information on file at one location and try to use the same app to pay at a different location — but that card may not work due to the locations using different payment processors. That leads to friction and suffering basket conversion.” —> This is one of the issues that Olo Pay resolves

“A big source of inspiration to embed a payment platform into our commerce engine is what we’ve seen with Shopify and Shop Pay. One of our board members and our audit committee chair was the CFO of Shopify and the executive sponsor of Shop Pay.”

“We’re pleased with the early results we’ve seen in beta testing. We’ll continue to collect proof points of customers shifting over to Olo Pay and enjoying increased basket conversion plus lower rates of fraud and chargeback to sell Olo Pay more broadly in 2023.”

Glass on Toast:

“Toast is a POS partner and we don’t have a lot of competitive overlap. They tend to focus on SMB while we focus on the enterprise market. We also have a 5-99 unit emerging enterprise group that brings overlap between our smallest and their largest customers. In that case, Olo is serving as the digital ordering platform with Toast serving as the POS.”

Olo helps to integrate POS systems where many chains are using 5-6 different products within their franchise locations. Olo ensures effective communication and a uniform digital ordering experience between these systems.

Click here for my Olo Deep Dive

5. GoodRx (GDRX) — Co-CEO/Co-Founder Doug Hirsch and CFO Karsten Voermann Present at the J.P. Morgan Healthcare Conference

a. Hirsch on new products:

As he has done in the past, Hirsch hinted at GoodRx playing a bigger role in its customers’ insurance guidance and selection.

“We are working on new features specific to healthcare providers (HCPs) such as the ability to request drug samples and virtual pharma sales rep visits as well. We make it so much easier to help doctors help their patients and that’s a huge focus for us with some exciting near-future developments.”

“There are still many adjacent categories for us to enter and we will approach each with a goal of making healthcare easier, more transparent and more affordable for consumers.”

b. Voermann on take rate:

GoodRx’s take rate now sits at “~16%” vs. “15-16%” when it last updated us. This take rate has risen precipitously in recent years while competition has seen theirs shrink in attempts to maintain what little market share they have.

c. Voermann on how he expects the pharma manufacturers solutions fees and business to evolve:

“Today we like the flat fee model. It ensures we are aligned with healthcare and patients by not monetizing via driving more script volume. The other reason it’s attractive is because it creates a lot of predictability in revenue.”

“Because we can use all of our first party data to estimate the amount of value we create and to price accordingly, we can also price in a way that delivers the right ROI to manufacturers. They expect at least a 2-3X ROI and we can confidently exceed that heavily. This is a way better method for pharma manufacturers to reach consumers.”

Click here for my GoodRx Deep Dive.

6. Progyny (PGNY) — CEO Pete Anevski Presents at the J.P. Morgan Healthcare Conference

a. Stats on fertility trends:

The fertility market has enjoyed a 9.4% CAGR over the last decade per CDC Assisted Reproductive Treatment (ART) cycle data. This is being fueled by factors like better career opportunities for women leading to delaying family building. This idea is supported by birth rates rising for women over 35 years old during that 10 year period vs. declining for women aged 15-34. The later a women decides to start having children, the more likely it is that they’ll need the services that Progyny provides — the average age of a woman using these services is 36 years old.

2012-2021 per the National Center for Health Statistics:

Overall natural birth rate fell at a 1.1% CAGR.

Birth rate for women aged 15-34 fell at a 1.7% CAGR.

Birth rate for women 35+ rose at a 2.2% CAGR.

Other contributors like alternative paths to pregnancy becoming more common (single parents by choice and same-sex couples) are also helping the sector as a whole.

As a result of all of this, roughly 2/3 of large employers are expected to offer fertility benefits by the end of next year vs. roughly 1/3 in 2015.

b. Anevski on competition:

“Despite new market entrants from standalone fertility benefits solutions, we remain the only offering in the market with the core competencies we have across our program. This is what’s necessary to demonstrate our value year after year. We’re in the strongest competitive position we’ve ever been.”

Progyny has around 7% market share of ART cycles in the United States today — but only 1.5% when you consider the market is still wildly underserved. In the U.S. just 2% of babies are born from ART cycles vs. 10% in comparable nations. This is due to inadequate coverage and hefty out of pocket costs which Progyny’s product suite is designed to combat. It’s well positioned to capture the low hanging fruit from this expansion thanks to an industry-leading +81 NPS, a near 100% retention rate, leading scale, insurer integrations and growing key performance indicator (KPI) leads. Moving from 2% to the global average of 10% would boost Progyny’s market from $8 billion to $40 billion.

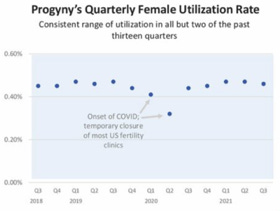

c. Chart depicting the pandemic’s impact on utilization:

Progyny attributed a sharper recovery for its utilization vs. other pieces of healthcare to the time sensitivity of fertility treatment and passion to pursue family building. Still, there is a small subset of members who continue to prove hesitant to pursue treatment in this pandemic period.

d. A reminder of Progyny’s concrete impact based on clinical data reported to the CDC:

This Chart demonstrates 2 points:

Shows that the in network (INN) doctors that Progyny selects are superior to the out of network (OON) doctors that are not picked.

Shows that the INN doctors perform even better when treating a Progyny covered life. This is due Progyny’s elimination of dollar maximums and re-structuring of treatment plans. It provides INN specialists with members free to pursue the best course of treatment — no matter what that may be.

These better results lead to less costs incurred for all parties by enabling less Natal ICU (NICU) visits, safer births, healthier babies and less workplace disruption. Progyny also saves its members on prescriptions through ProgynyRx.

For a Quick selling season note — no clients reduced the size of their 2022 benefits packages vs. 2021. Only expanded.

e. Cross-selling Progyny Rx progress:

The revenue opportunity per client is 50% larger when ProgynyRx is purchased.

There are multiple drugs needed within fertility all with different storage and administration requirements. Within traditional carrier relationships, the insurer handles fertility services and hands-off fertility prescription duties to PBMs. This creates significant administrative headache which ProgynyRx eliminates. Over 90% of new clients elected to go with the Rx benefit in 2022 vs. just under 70% of new clients in 2019.

f. Updates on utilization trends — as a reminder, industry-wide utilization rates dropped in late summer as pent-up summer travel demand unwound and as variants popped up:

“The variants continue to create a little bit of near term bumpiness for utilization. Over the long term there’s no material impact that we see.” — Anevski

g. Growth and margin levers that leadership highlighted:

“We are making investments in other products and businesses. When we have something to share about that we will.” — Anevski

Growth vectors highlighted:

New services within the field of Women’s Health

International Expansion

University Employers

Government/Union Employers

CFO Mark Livingston attributed the brisk margin expansion to economies of scale. This scale is paving the way for things like negotiating better Rx rates within the pharmacy value chain and reduced treatment costs. This is what is contributing to an EBITDA margin on incremental revenue of 27.5% which it sees as roughly the long term target EBITDA margin.

Click here for my Progyny Deep Dive.

7. JFrog (FROG) Co-Founder/CEO Shlomi Ben Haim Interviews with Needham

a. Haim on how JFrog fits into the broader DevOps landscape:

“DevOps is about wanting software to serve us instead of the other way around yet 90% of the software updates today still require some form of manual involvement. JFrog is here to make that software securely update behind the scenes with no interference or involvement.”

“Binaries (AKA software packages/artifacts) are the primary asset of the software supply chain. For example, when you have an iPhone upgrade that is a binary coming to your device. By providing a service to manage the full life cycle of binaries we cover the DevOps landscape from A to Z. You cannot protect or build without focusing on, organizing and protecting your binaries. Still, there are some players — like GitHub and its source code niche — that complement us in order to broaden the DevOps cycle. Every code starts with source code and we integrate with all the key source code players — GitHub, GitLab, Atlassian, you name it.”

b. On the Log4J vulnerability:

“Log4J has been termed the software pandemic by the community. This was not only because of the violent binary, but also because every organization on the planet is using Java — and if you use Java you most likely use Log4J and were impacted. The community had to take this specific version of the Log4J binary and replace it while resolving any other dependencies. We had several customers call us on Christmas Eve (when this started) and thanked us for having their holiday because if you were a developer without JFrog, you had to go one by one and manually replace any Log4J dependencies.”

“JFrog Artifactory managed these binaries and replaced all infected and dependent binaries from the Log4J incident for our customers. JFrog X-ray then blocked any import of infected binaries to protect the repository from any present and future vulnerabilities. Basically, Log4J came as an unfortunate reminder of how important protecting binaries is. The moment you have this blessed repository that we have, you can automate the fix and continue building.”

While Log4J has been immensely challenging for countless companies, it essentially serves as a free marketing vehicle for JFrog.

c. Haim on binaries (0s and 1s) vs. source code (human language):

“To protect an organization, you must protect binaries. To protect developers, you must protect source code. That’s the main difference.”

“We are developers who develop products for other developers. We realized that nobody is writing code from scratch anymore. To become faster, developers use existing code and build on top of it. Source code is important, but it’s human language. The moment you use that source code to create an application, you’ve now created a binary. Binary repositories need to be continuously cleaned up and so directly integrated with log management tools like DataDog and Splunk (integrates with both) while source code is rarely deleted. Binaries are endless.”

“In today’s world, binaries serve companies when it comes to DevOps, automation, security, deployment and internet of things (IoT). Binaries are the one asset that moves all the way from developer seat to device — the only asset. There is no way to fully manage your software supply chain without binaries. We know DevOps is very important but we think this is bigger than just DevOps. Where the market is taking us is much bigger than DevOps — everything is powered by binaries.”

“JFrog is currently the only solution in the world with a complete distribution solution for your binaries.”

d. On Competition:

For pure binary competition — JFrog cites GitLab (as having one that doesn’t effectively compete), Sonotype Nexus and VMWare. Google/Microsoft/Amazon are all building (and acquiring) products around binaries but all 3 continue to be JFrog’s “best partners.”

“Scalability is big. All the enterprises that are moving from other tools to JFrog speaks to the highly available, secure and scalable solution.”

“We are very happy to see GitLab and Hashicorp joining the public DevOps arena. It’s hard enough to explain what binaries are — let alone DevOps. Our TAM has gone from $22 billion at the time of our IPO to $50 billion today — this is a giant market. Most of what we replace continues to be in-house management and home grown solutions (greenfield opportunity).”

e. On JFrog Xray:

“When you think about DevSecOps — taking the developers (Dev), a security department (Sec) and the IT department (Ops) and making them one — you create one singular focus of efficiency through automation. This is what Xray helps to do. When it comes to DevSecOps, there’s difficulty with getting security and developer teams to trust each other. Binaries are the overlapping asset that bring these teams to a common ground.”

8. Ayr Wellness (AYRWF) and Cresco Labs (CRLBF) — Ayr COO Jen Drake and Cresco Chief Commercial Officer (CCO) Greg Butler Interview with ATB

a. Drake on Ayr’s last 6 Months and industry research:

“Our brand building research has found that half of our consumers strongly prefer a brand focusing on a specific category. We built our brand architecture around that.”

“Our power brands — the premium brands — were very much so driven on the backs of consumer research and surveying. Our core brands are additive to these power brands and give more variety in terms of dosage and form factor. They’re designed to address a larger part of the market with a more accessible price point.”

b. Butler on how Cresco’s brands have thrived:

“The secret to our success is a quality team creating quality products and building our brands around delighting the customer. We have a very strong rivalry right now with Green Thumb on who is number one and who is number two in wholesale. Ultimately, we are thrilled to be where we are today with wholesale.”

“We — and most MSOs — continue to spend less than 2% of our SG&A on marketing. Most insurgent start-up brands are closer to 100% of revenue. We haven’t even begun brand building. The day will come when we have to spend more but we’re not there yet and really not close.”

Butler, Drake -- and also Jushi Founder/CEO Jim Cacioppo -- all spoke at length about how some competition has mistaken branding for a “pretty box.” All adamantly argued -- thankfully -- that genetics and grow operations/scalability matter far more in M&A decisions to them vs. the branding.

9. The Boeing Company (BA) — Deliveries + China

Boeing delivered 99 planes in the 4th quarter which is up 16.4% sequentially and up 28.5% year over year. While this is undeniably meaningful progress, they still have a long way to go. The company delivered 238 planes in the same quarter for 2018. Analysts from firms like Baird were expecting closer to 80 deliveries for this quarter so the result did beat handsomely.

Bloomberg also reported that the 737 MAX — the plane enduring the 2 deadly crashes — could return to service in China this month after its Civil Aviation Authority (CAAC) issued an “airworthiness directive” to create a path to a return to service.

As a reminder, China is the second largest aviation market in the world and a vital piece of Boeing’s recovery story.

10. My Activity

I added to several names during the week resulting in my cash position falling from 19.0% to 17.3%. I will continue to deploy cash into healthy companies experiencing more multiple compression. I added to the following names during the week:

CrowdStrike

Progyny

SoFi Technologies (twice)

Upstart

Olo

Teladoc Health

GoodRx

JFrog

Duolingo

Revolve

Green Thumb Industries

Ozon

Great read as always Brad - Thanks!

Thanks for the update. Great read.