News of the Week (January 16-20)

Shopify; CrowdStrike; PayPal; Meta Platforms; Match; Olo; Upstart; Lululemon; Cresco Labs; Around the Market; Macro; My Activity

Today’s piece is powered by Savvy Trader:

Welcome to the 342 new readers who have joined us this week. We’re delighted to have you all as subscribers and determined to provide as much value & objectivity as possible.

1. Shopify (SHOP) -- Arming the Rebels & the Generals

Shopify was born as a company to “arm the rebels” and “lower the barrier to entrepreneurship.” With this image has come a label that its commerce platform only serves smaller merchants. That’s simply inaccurate. I wanted to address this confusion that I see constantly pop up on Twitter.

Since 2019, Shopify has been hard at work on improving its offering for Fortune 2000 brands. It added a business to business (B2B) and wholesale selling channel which fully integrates into all other consumer-facing Shopify selling vectors. Most B2B software competitors force clients to run separate stacks in parallel which makes inventory management, price customization and store configurability quite manual and difficult. Shopify allows for all channels to be run through one dashboard with lower total cost of ownership and better interoperability within segments.

Furthermore, in 2022 it added key Enterprise Resource Planning (ERP) partners in Accenture, Deloitte and EY to train and educate their workforces on selling Shopify’s suite. Most large enterprises prefer embarking on large platform transitions through ERPs and now Shopify offers far more flexibility here.

But wait… there’s more!

Shopify’s new headless commerce stack (headless means full separation of front and back ends) and its new Online Store vastly enhance its offering for large businesses. How?

Turns each store page into a drag and droppable block to power full (no-code) customization. Think of a Shopify store page like lego blocks.

Many of the largest brands want fully customized stores built for them. Shopify isn’t willing to build from scratch for individual merchants, and this is how it offers that same level of customization without needing to do so.

Allows apps to be added in a no-code manner to any piece of a store to emulate complete control of the user interface & experience without forcing Shopify to build from scratch.

Expedites front-end updates by separating them from the back end while using Application Programming Interface (API) calls to connect front and back-ends in a far less cumbersome, more expedient & configurable manner.

This bridge offers the best of both worlds → lighter weight software for faster performance but still with a real-time data channel to ensure things like inventory & promotional activity are always accurately displayed.

Uncaps API call limits to also uncap the possibilities for customization. Merchants no longer need to choose between which desired customization features to deploy. They can have it all.

You can take my word for it, or you can simply observe all of the major bellwether brands Shopify works for today:

2. CrowdStrike (CRWD) -- New Hires & an Interesting Initiation

a) New Hires

CrowdStrike hired Daniel Bernard as its new Chief Business Officer and Raj Rajamani as its new Chief Product Officer of Data, Identity Cloud & Endpoint (DICE). Interestingly, both new executives came from SentinelOne. Bernard was the Chief Marketing Officer there while Rajamani was the Chief Product Officer. In terms of prestige, Bernard’s new title at CrowdStrike is similar to his at SentinelOne. For Rajamani however, he’s now the CPO of a segment of CrowdStrike (and reports to the CPO, not CEO George Kurtz) while he was the head CPO at SentinelOne. It appears that he was willing to take a title downgrade to work for CrowdStrike vs. one of its key competitors. A small fact that speaks well for CrowdStrike among those actually embedded in that community.

This news also signals more focus on the small-medium business (SMB) segment of the market as that’s the SentinelOne bread & butter. Specifically, Bernard will lead CrowdStrike’s SMB go-to-market strategy. These hires, along with rising competitive SMB win rates for CrowdStrike last quarter plus the new Falcon Go package tailored to smaller customers, show CrowdStrike’s invigorated emphasis here is working.

b) Initiation

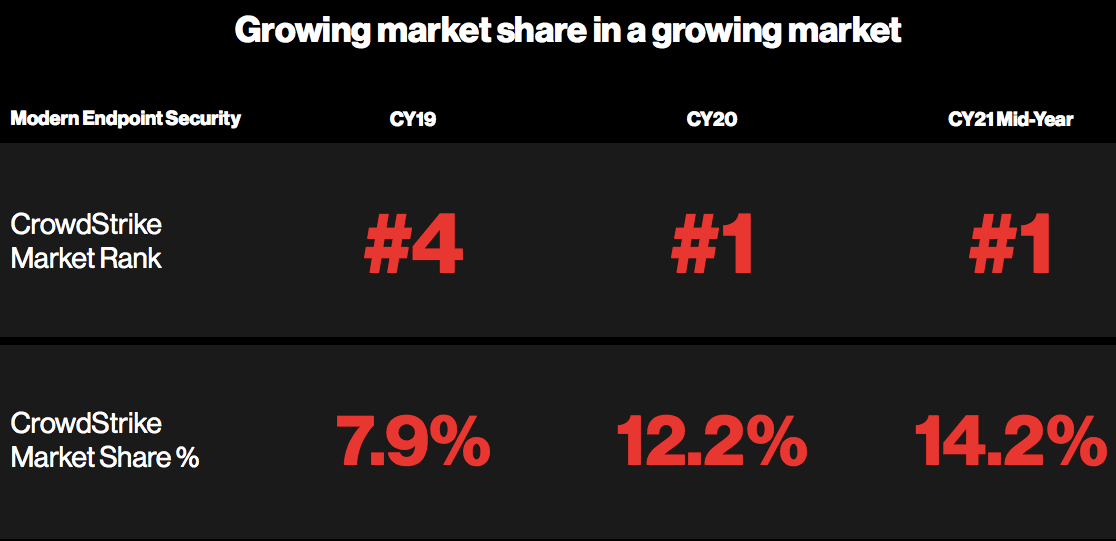

BMO Capital Markets initiated CrowdStrike at overweight. The news isn’t as interesting as the reasoning: The firm sees CrowdStrike effectively competing with Microsoft for endpoint market share. Considering CrowdStrike’s market share has nearly doubled over the last few years to overtake Microsoft as top dog in the space, this isn’t surprising, but is still nice to hear.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. PayPal (PYPL) -- Branded Checkout Share

SMBC Nikko Securities (based in Japan) expressed some caution this week in its downgrade of PayPal from neutral to underperform. The firm argued that at a minimum, the pace of PayPal branded checkout share gains was slowing and could even be stagnating. It further stated that PayPal’s focus on margin expansion and earnings growth could stifle its pace of innovation causing it to lag its peers. Here’s what I think:

PayPal branded share gains do not need to rapidly rise for this investment to work. It already has dominant share & dominant availability among merchants within e-commerce. Branded PayPal checkout is the mature cash cow feeding the rest of the company’s growth projects (Venmo and Braintree) and its buyback. As long as that checkout share is stable, like this research note suggests it could be, that cash cow will be stable. Furthermore, we are just weeks removed from a very upbeat upgrade for PayPal on the basis that its branded checkout share trends among the largest merchants in the world had turned positive once more.

If PayPal does cede material share of branded checkout due to failure to innovate, that could make the aforementioned cash cow more vulnerable and would force me to re-evaluate my holding. So far, its results and all but guaranteed strong Q4 2022 + 2023 guidance make me think that’s not happening.

Additionally, PayPal is among the most profitable, liquid & highly regarded brands in the world of fintech. It has readily used M&A to plug innovation gaps with purchases like Honey, Braintree, Hyperwallet and more. Its M&A track record is about as strong as it gets in terms of shareholder value creation. With fintech multiples greatly slashed in the last year, it could affordably plug more holes if it saw a need. Management has hinted at getting more interested in M&A very recently as those multiples have come down. It has nearly $11 billion in current liquidity on the balance sheet; there aren’t many disruptors in the space that it can’t afford to buy should it so choose.

4. Meta Platforms (META) -- User Data, AI Investments & More

Deutsche Bank research published some data this week on social media app usage in the United States. Daily usage rates for Facebook & Instagram both rose 400 bps to 82% and 78% respectively from June to December 2022. These gains were identical to TikTok’s. In terms of daily time spent market share among social media apps, Meta fared relatively well. Its share between Facebook and Instagram was 27% for December vs. 28% in June. TikTok fell from 18% to 16% as its average minutes spent fell more sharply than any other competitor.

While FinTwit had already pronounced TikTok victorious in a brisk Meta Platforms death… to that I say not so fast. The Family of Apps is more than holding its own and even taking relative engagement share vs. its 2 largest competitors -- YouTube and TikTok.

Reels is slowly winning the world’s attention while its monetization rates improve… Younger generation app engagement remains stronger than competitors according to its Group Director Sophie Neary this week… TikTok public sector bans are happening at a rapid clip… AI investments are bearing fruit with Morgan Stanley the latest institution to point that out on Wednesday… Year over year comps are easing as we lap the impact of IDFA and the pandemic pull-forward… WhatsApp marketing and enterprise tools are finally gaining steam. This is a perfect storm of Meta tailwinds and, I believe, the time to be leaning into Meta stock (which I own). That’s why I added this week and have been consistently adding for months. Time will tell if I’m right.

5. Match Group (MTCH) -- Monetizing Power Users

Hinge’s new subscription model will be $60 per month vs. its currently most expensive plan of $35 per month. Perks of the more expensive plan will include better, more frequent placement to boost matches and more tailored profile recommendations. Tinder is also now fielding interest in a $500 per month subscription package. (For that price tag, maybe the package comes with a love potion or something along those lines).

When Bernard Kim was appointed the new CEO of Match Group, one of his key objectives described to investors was better-monetizing power users. He thought a small cohort of “highly motivated daters” had far more price elasticity than Match was taking advantage of. Well? This will be one of the ways -- in addition to a more compelling a la carte offering -- that Kim will try to extract value from that customer cohort. With Tinder growth slowing and Match entering a more mature phase of its user growth (outside of Hinge and a few other apps), revenue per user will become an increasingly important piece of this investment. We’ll see what kind of traction these packages can garner.

6. Olo (OLO) -- New Client

Olo landed Rachel’s Kitchen and its 8 locations as the firm’s newest customer. Rachel’s is starting with 4 modules immediately (vs. less than 3 overall on average for Olo customers) including the company’s newest product: Olo pay.

7. Upstart (UPST) -- Auto Lending

Upstart announced two application extensions for its Auto Retail Platform: Digital Financing & Online Searches. With these two products now available in a fully digital format, Upstart can offer dealers across the country an end-to-end digital car buying application process. While that sounds like table stakes (because it is in other sectors), it’s actually something that does not exist today without several manual controls and paperwork frustrating customers, lowering conversion & fostering time delays.

Expected benefits of the Digital Finance Product:

“Frictionless signing & contracting” with next day funding.

Higher approval rates (based on continuously sharpening its underwriting models and introducing its AI underwriting algorithm purpose-built for auto).

No learning curve for dealers; Integrates right into their current workflows.

Expected benefits of the Online Sales Product:

“Enables completion of online car purchasing -- from financing to e-signing.”

Raises conversion.

The new software will be configurable and customizable to fit the user interfaces of a dealer’s existing website theme. Additionally, customers will be able to access these tools in a truly multi-channel manner via in-store availability and from the comfort of their own phones or laptops. The press release also included a stat from Automotive Market Data calling Upstart the 2nd fastest growing auto retail software in the U.S. (it had been the fastest).

To be candid, timing on this release could not be more chaotic. Auto delinquencies are soaring while inventories spike and prices collapse. That’s not an ideal backdrop for enjoying maximum momentum out of the gate. The glass half full view is that sector turmoil will push dealers to seek efficiency gains which Upstart potentially provides. The glass half empty view is that dealers won’t be interested in infusing fancy new software while they focus on survival.

Still in the penalty box:

Upstart leadership handled late 2021 and 2022 about as poorly as any other team in its space. It vastly overestimated funding supply durability, modeled a rosy macro backdrop with far too little margin of safety, flip flopped several times on using its balance sheet to plug liquidity holes, underperformed loss expectations in specific capital market loan vintages (still outperforming in aggregate), and vastly overestimated its financial results. So? While I’ve been aggressively adding to most of my holdings recently, Upstart remains alongside Nanox on the do not add list.

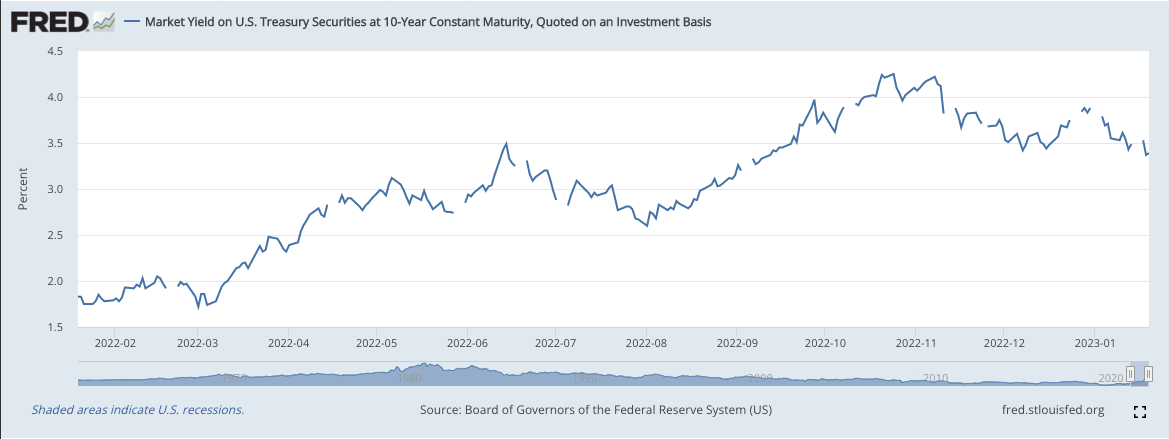

Leadership burned through my trust and is one more inexcusable misstep away from me exiting entirely. But the potential is there. It has to show signs of bank partners returning to the funding fold, has to show signs of securing higher quality, more consistent capital market funding, has to show evidence of new products working and has to operate with far less drama than this past year. Easing macro headwinds like falling yields and cooling inflation should help it regain its footing… but the company still needs to execute better than it has.

As an important aside: Its strong balance sheet gives it the time to do so and makes its missteps fixable, which is why I’ve been so patient here.

Yes, its niche as a lower credit quality originator is wildly cyclical and it did fall victim to a historically rapid rise in its cost of capital. While that reality compounded the pain the company has felt, I do believe a lot of that pain could have been avoided with better leadership on blunders discussed above. It amplified the headwinds rather than combating them.

This team comes from Google with a purely tech background. They did not have much capital market experience, and that lack of experience undeniably hurt shareholders while it proclaimed macro immunity for the better part of 2022. Hopefully it learned its lesson. The upside this company could potentially present is truly unique… but the probability of realizing that upside is -- in my mind -- too low to justify adding to my small position. I’d love to resume accumulation if fundamental execution warrants it. The backdrop is beginning to brighten up for this FinTech augmenter -- go take advantage and prove the growing list of doubters wrong.

8. Lululemon Athletica (LULU) -- New Hire

Lululemon hired former Burberry SVP Elizabeth Binder as its new Chief Merchandising Officer. While the press release did not explicitly spell out this being a move to dive deeper into high-end luxury, I personally think it’s a real possibility. Lululemon has found seamless momentum in new category expansions like Golf and Hiking to illustrate just how extendable the brand is and how eager its loyal followers are. The firm’s clout gives it the realistic ability to expand further and Binder’s experience makes that expansion easier. Furthermore, considering it will lean so heavily on international growth (where ultra-luxury shines) to meet long term targets, I expect some movement here. We’ll see.

9. Cresco Labs (CRLBF) -- Columbia Care Merger

The merger between these two companies continues to be delayed. My go-to analyst in the space (Pablo Zuanic) thinks this will probably get done eventually. I very much so want this to happen; I view scale as imperative for a rapidly growing yet inevitably commoditized space like cannabis. Columbia Care gives Cresco the retail footprint it needs to secure fair and consistent shelf placement for its wholesale business while redundant assets create the potential to add about $300 million in 0-interest liquidity. Get it done.

10. Around the Market

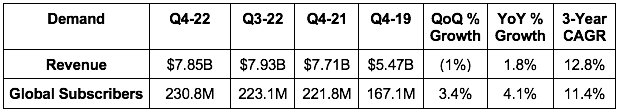

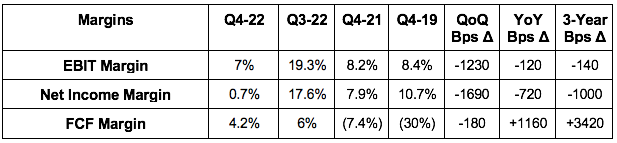

a) Netflix (NFLX) -- Earnings

Results vs. Expectations:

Met revenue estimates & beat its guide by 0.6%.

Beat EBIT estimates by 25% & its guide by 67%.

Beat its EBIT margin guide by 280 bps.

Missed EPS estimates of $0.54 by $0.42 & missed its guide by $0.24.

The EPS miss was via $462 million in unrealized losses from foreign currency exchange. That’s why EBIT beat while EPS missed.

Beat subscriber add guidance by 70%. Highlight of the call.

Q1 2023 estimates were in-line on revenue, 7% below consensus on EBIT and 4.7% below consensus on earnings per share.

Key demand context:

1.8% YoY revenue growth was 10% on an FX neutral basis. The strong dollar is hurting it… a lot. Which means? The recently cooling dollar vs. major currencies should help.

This 800 bps headwind is expected to fall to 400 bps in Q1 2023.

Average revenue per member growth was 5% YoY vs. 6% growth expected.

The large subscriber beat was via a “successful content slate.”

It guided to “modest net paid subscriber adds” for Q1 2023 as it no longer guides to a specific metric here as of Q4 2022.

Key Balance Sheet, Liquidity & Capital Allocation Context:

Netflix will resume its buyback program in 2023. Any excess cash above 2 months of revenue will be returned to shareholders via buybacks assuming no M&A.

It has $6 billion in cash & equivalents (above 2 months of revenue) and $8 billion in net debt.

Its net debt to TTM EBITDA ratio rose from 1.2X to 1.3X. Still modest.

The company continues to expect $3 billion in 2023 free cash flow to feed this buyback & other priorities.

Key margin context:

EBIT margin outperformance was aided by slower than expected hiring.

Netflix now expects a 21.5% EBIT margin for 2023 vs. previously guiding to 19.5%. It’s effectively controlling costs.

Key notes from the call:

Paid sharing products will debut this quarter and will help monetize profile sharers throughout 2023.

Ad plan engagement is similar to premium plans which is a “promising indication” of a strong offering & “better than expected” per Co-CEO Greg Peters

Ad plan growth is being driven by INCREMENTAL SUBSCRIBERS largely and is not materially cannibalizing its premium tier.

"We wouldn't have gotten into ads if we didn't believe it could be at least 10% of revenue and hopefully much more over time." -- Netflix CFO Spencer Neumann

My Take:

As an outsider, I found this to be an impressive report. I view Netflix as best in breed within streaming, but am not interested in owning any streamer at this point. Why? Because of how rapidly competition is coming online with live sports and news rights providing uniquely compelling offerings vs. this pure-play. So? I invest in the market share-leading company connecting ad demand to this rapidly proliferating supply: The Trade Desk (TTD). Not only does the added competition not threaten its dominant position in open internet programmatic ads… but it makes it MORE compelling by giving it more, high-value places to park demand which leads to better return metrics for its customers.

b) Microsoft (MSFT) -- Chat GPT

Microsoft is contemplating investing another $10 billion in OpenAI at a $29 billion valuation to bring its total investment to $11 billion. OpenAI is the owner of ChatGPT -- the rapidly proliferating AI-based conversational search engine. If this happens, Microsoft would gain the right to 75% of OpenAI profits until it recovered that $10 billion investment. Then it would become a 49% stake in the company overall thereafter. As a note, I’ve become a daily active user of this tool and view it as a game changer.

The tech giant also announced that ChatGPT’s software will be added to Microsoft Office’s suite of tools like Excel and PowerPoint. This will pave the way for automating workflows to make all of the pivot tables and slide decks our heart’s desire in a fraction of the time. It’s widely expected that it will also be integrated into Microsoft’s cloud platform Azure to trail-blaze new use cases like organizing stored data & messages into analytics visuals (through a product called Dall-E). This tool has been in beta testing since 2021. Other planned infusions of ChatGPT are well underway within Microsoft’s GitHub to automate more of source code creation and also its search engine: Bing. I find the Bing case especially interesting.

I’m not even remotely close to saying that Bing + ChatGPT will replace Google and its lucrative search monopoly. But still, when you have such a commanding market share of a product you rely on to power your financials, even ceding a percent or two of share could be material. We’ll see what happens… Google also has many irons in the fire for lacing more sophisticated AI models into search. And regardless, a Microsoft vs. Google showdown would be very entertaining to an innocent bystander like myself.

Microsoft is now receiving hefty resistance in the U.S. and EU for its Activision Blizzard deal. The OpenAI investment is a more under-the-radar way that it can acquire assets and claims on future cash flows with less regulatory headache. Along those lines, it also invested in Darwinbox this week which is a human resources platform. This is supposedly to sharpen its ability to attract talent which meshes very well with its recent decision to offer unlimited time off for its workers. It’s interesting to juxtapose this with it also firing 10,000 employees while other mega-caps like Amazon and now Google also fire thousands of workers. Strange times.

c) Apple (AAPL) -- Hardware

Apple announced a slew of new Mac-books powered by a new version of its semiconductor set and a HomePod. Similarly to many Apple product releases, there’s not much different about the new Mac-book models aside from better performance and battery life. In more interesting Apple hardware news, the company is delaying its planned augmented reality glasses in a pivot to launch a cheaper mixed reality headset this year. That launch will attempt to directly compete with Meta Quest.

Please note that I own shares of Meta and not Apple.

While this could eventually become a formidable Meta Platforms competitor, it has a long way to go to even approach the same ballpark. Meta is years and billions in R&D ahead on complex tools like accurate hand tracking & real-time facial expression. Furthermore, Meta will never own this market for itself. So? Another mega cap investing here and accelerating real use cases will simply create a larger metaverse opportunity for dominant market share players (like Meta) to take advantage of. I’m confident that this won’t be a winner take all scenario, isn’t a zero sum game and that Meta’s tech today is best in class by a mile and a half.

d) SnowFlake (SNOW) – M&A

SnowFlake is a company that helps enterprises store, organize, contextualize and leverage its lucrative 1st party data while infusing countless 3rd party sources to enhance analytics. Data lakes -- or gigantic pools of information -- like Amazon’s, Microsoft’s and Google’s are ripe with low hanging insights to be gleaned to enhance business processes. That’s where Snowflake comes in. It allows enterprises to isolate relevant pieces of data lakes in a truly cloud agnostic way to be queried (pulled) and used in day-to-day operations. Effectively, this creates company-specific sub-data lakes out of this sea of cluttered information.

Not every company has their databases available and operating on public clouds. On-premise storage is still quite common -- especially for highly regulated spaces like banks and healthcare. So? SnowFlake is buying SnowConvert -- owned by Mobilize -- to make the process of migrating valuable data sources to the cloud more seamless. SnowConvert translates code from on-premise to cloud in a more intuitive, less cumbersome and more expedient manner. Not only will this make SnowFlake an easier partner to evolve and work with, but that incremental ease will merely give SnowFlake more training data and insight to sharpen its data-based, AI/ML-powered digital consulting further.

e) Final Headlines:

Uber is developing custom EVs with major automakers.

Costco is restarting its buyback program.

Google is firing 12,000 people.

Nintendo is making more Nintendo Switches this year amid strong demand.

Roblox daily active users rose 18% YoY in December with sales down 4% YoY.

11. Macro

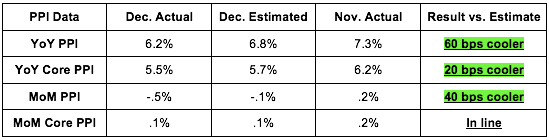

a) December Producer Price Index (PPI) Data

The numbers were quite encouraging… again.

b) More Key Data from the Week:

The U.S. hit its debt ceiling this week. As the reserve currency, this flashy headline will likely result in that ceiling being raised once more and the world carrying on with business as usual.

Treasury Auctions & Yields:

A 6-month bill auction closed at a 4.685% yield vs. 4.71% MoM.

A 20-year bond auction closed at a 3.678% yield vs. 3.935% MoM.

The MBA 30-year mortgage rate fell from 6.42% to 6.23% MoM.

Economic Output:

MoM industrial production was weaker than estimated at -.7% vs. -.1% expected and -0.6% last month.

MoM manufacturing production was weaker than estimated at -1.3% vs. -.3% expected & -1.1% last month.

Building Permits for December of 1.33M vs. 1.37M expected.

The Philly Fed Manufacturing Index came in stronger than expected but still in sharp contraction territory at -8.9 vs. -11 expected.

Consumption & Employment (Consumer):

December core Retail Sales fell more sharply than estimated at -1.1% MoM vs. -0.4% expected & -0.6% last month.

Retail Sales fell more sharply than estimated at -1.1% MoM vs. -0.8% expected and -1.0% last month.

190K initial jobless claims vs. 214,000 expected and 205,000 last month.

Existing home sales MoM for December fell less than estimated at -1.5% vs. -5.4% expected & -7.9% last month.

Fed Talk:

Waller called market expectations of the terminal Fed Funds rate “close to what the Fed is assuming.” This puts us around 5% with cuts coming late in 2023 or early in 2024 -- always pending incoming data.

Fed Member George stated a desire to see more job openings before the Fed Pivots. The labor market remains supply constrained and far too tight despite all of the recent layoffs. Other sectors are doing enough to pick up the slack from tech’s employment reductions for now.

5 year breakeven inflation rates are now 2.23% and remain in a well-defined downtrend towards 2%:

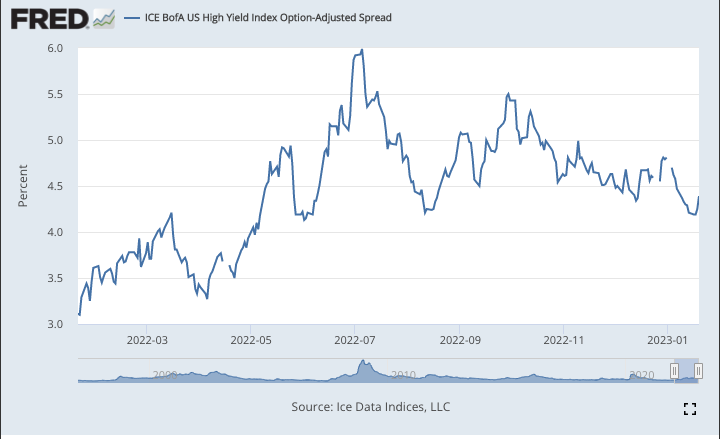

High yield option adjusted corporate credit spreads ticked higher this past week but also remain in a well defined downtrend.

c) Level-Setting the Data

The last two months of inflation data were quite positive. And as previously stated, I deployed a large chunk of cash to existing holdings following the encouraging PPI & CPI releases.

Peak inflation is obvious at this point, forward looking inflation measures point to deflationary trends continuing, previous rate hikes are taking hold, economic data is weakening in aggregate and layoffs continued this week with large-cap tech unfortunately firing 30,000 more people. This is all to say what I’ve been saying for a year: Employment will likely become the more fragile Fed mandate in 2023 and we will get a hawkish pause (not a dovish pivot!).

I continue to expect one more 25 or 50 basis point hike in February and then a pause thereafter. The scenario of a mild recession is becoming more likely with inflation cooling faster than economic data is softening. That mild recession is a perfect storm of discount rates falling and structural profitable growth being sought out as it becomes scarcer. That’s an ideal environment for holding speculative, long duration assets like I do in my portfolio. The scenario of runaway inflation forcing the Fed to hike beyond a mild recession to push us closer to a depression is thankfully unrealistic at this point.

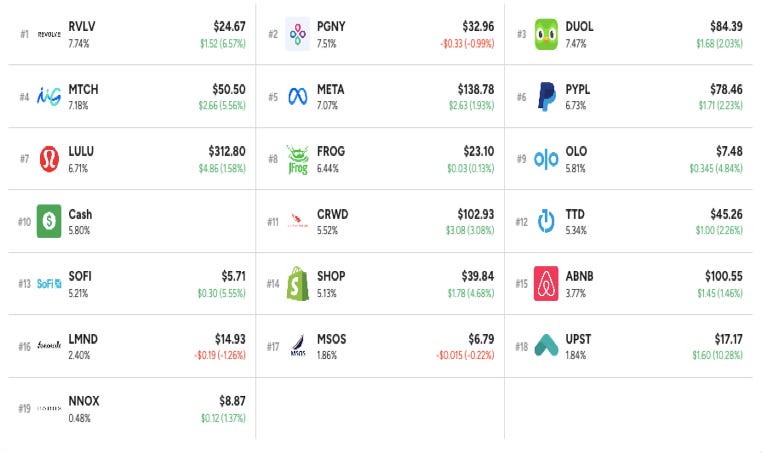

12. My Activity

Following this month’s positive inflation data, this week I added to my stakes in Airbnb, SoFi, Olo, Lululemon, Match, Meta, Revolve and Duolingo. My cash position is lower than it has been since March 2020 at 5.8% of holdings.

I love that, as a fellow Paypal holder who kinda lost hope (entered at $280).

I wish I could follow your portfolio live, are you on jika.io or etoro?