News of the Week (January 17-21)

PayPal Holdings; SoFi Technologies; Upstart; Olo & Revolve; Cannabis News; My Activity

1. PayPal Holdings (PYPL) — New Position

a) Brief PayPal Summary

I started a position in PayPal Holdings this week. I plan to publish a full Deep Dive into the company and my investment thesis in February (after I publish the Upstart Deep Dive this month) but I wanted to provide a brief synopsis of the investment rationale today.

In a nutshell, PayPal plays a ubiquitous role in integrating payment processors and digital payment flows for both consumers and merchants. It connects, transacts, verifies, and fulfills to enable the digital transformation of payments all without the inherently rising costs of fraud that typically coincide. Just like every other company in the financial technology space, it prides itself on a drive to democratize access to services — and it has a long, long track record of doing so successfully.

PayPal is the most accepted digital wallet in the world today with over 75% of the largest global merchants integrating with it at checkout. The company boasts an astonishing 416 million active consumer and merchant accounts thanks to seamless facilitation, authorization and settlement.

This last quarter, PayPal deepened its already extensive merchant network via new programs launched with Walmart, Booking.com, Fanatics, GoFundMe, Valero and Phillips 66. Interestingly, this strong momentum could be culminating from the end of a restrictive operating agreement with eBay (the parent company that spun PayPal off) which prevented PayPal from working with a large portion of merchants. Those cuffs are now off which is freeing PayPal to grow its network that much more freely.

Conversely, the cuffs are also off for eBay which is prompting it to shift to its own managed payments system to replace some of the same functionality PayPal has provided it in the past. As a result, total payment volume (TPV) from eBay tanked 45% year over year for PayPal this last quarter. Luckily, this business accounts for just 3% of PayPal’s volume and the freedom to pursue new contracts should be a stronger long term tailwind than this has been a short term headwind. Still, the turbulence — and also tough pandemic comps due to accelerating adoption and usage of digital payments — led to “muted” growth of 13% in the company’s last report. This is set to re-accelerate going forward.

b) Venmo and Other Growth Engines

My favorite piece of the business is Venmo — the peer to peer payment app that has achieved verb status. The platform boasts over 80 million users and did $60 billion in TPV last quarter at an annual growth rate of 36%. The massive, established user base is ripe for up-selling. Why? PayPal intends to transform the platform into a “super app” or a centralized location for all digital banking services. This ambition is no different than Block’s Cash App (or SoFi & countless others) but PayPal is behind this formidable competitor in seasoning Venmo’s product suite. While this is somewhat of a concern, it also leaves significant low hanging fruit to enhance the lifetime value (LTV) for each of its 80+ million customers. I like that.

This thesis — like all of my others — relies on a management team capable of executing and fortunately, PayPal’s leadership is impressive.

The current President and CEO is Dan Schulman — a former AT&T, AmEx and Sprint President, Virgin Module and Priceline.com CEO and a current Verizon Board Member. He sports a 93% Glassdoor rating with a significant sample size of 5600+ reviews. The CFO — John Rainey — has been with the company since 2015 in that role and previously served as the Executive Vice President (EVP) and CFO at United Airlines. He’s also a Nasdaq Board Member.

For the sake of brevity I won’t go into the rest of the team — but it’s highly capable and makes me comfortable with betting on the potential success of a Venmo super app transformation.

In recent months, Venmo launched a credit card (with the ability to directly buy crypto) and will launch Venmo Pay for Amazon this year. PayPal’s own digital wallet platform has already added more crypto features, a high yield savings account and finance management capabilities — I think it’s only a matter of time for Venmo to inevitably catch up.

Speaking of this new digital PayPal Wallet, the company has merged some of the key competencies of Honey — a $4 billion acquisition within deal and product discovery — into this new offering. Early results are promising with deal discoverability already growing 25X vs. the previous platform version. A deeper, Honey-powered presence within deal discovery pushes PayPal further up the shopping value chain and enables it to demand a larger piece of the overall margin.

PayPal also has a Buy Now Pay Later (BNPL) branch already posting an $8 billion TPV run rate. To extend its capabilities within the payment niche, PayPal bought Paidy — a Japanese BNPL player — for a more modest $2.7 billion. My BNPL bias leans negative — so to me the smaller the investment in the space, the better. This was certainly much smaller than some other BNPL M&A. PayPal expects to deepen its cross-border commerce presence — another key focus for the company — in Japan and Asia with the help of this purchase.

c) Quantitative

PayPal is expected to compound at a roughly 19% clip for the next few years. Its most recent free cash flow margin of 20.9% and net income margin of 21.3% did both fall YoY as the company sinks its teeth into Venmo, the new PayPal Digital Wallet and other growth engines. It also experienced slightly falling sequential TPV due to stimulus wearing off and slightly rising transaction costs. While margin compression is never ideal, it’s somewhat warranted in this environment of countless hyper-growth fintech disruptors spending like madmen to claim market share.

PayPal already has that market share, so I wholeheartedly believe that aggressive spending to round out the product suite makes all the sense in the world for preserving its competitive edge. A solid balance sheet also helps make that more doable. PayPal has $20 billion in cash and equivalents as opposed to $8.9 billion in total debt with modest rates ranging from 1.78% to 3.33%.

Despite all of this, the company trades for roughly 20X 2022 EBITDA and 30X 2022 earnings (a significant discount to Block despite loftier 2022 and 2023 PayPal growth expectations per KoyFin). To me, the growth prospects are bright, the team is highly capable, liquidity is healthy, the track record of success is established and the entry point is too good to pass up.

d) Plan

I originally planned on investing 3.0% of my overall capital into the company. I decided to invest 2.5% instead to give myself more accumulation flexibility amid the volatile macroeconomic backdrop. Considering the company relies on payment flow for transaction revenue, less liquidity sloshing around globally will be somewhat of a headwind for it going forward. A full position will be 4.0% of capital and I plan to inch the rest in over time.

I’ll go into much more detail on everything PayPal — including some of its other brands and products like Zettle and Hyperwallet — in the Deep Dive. With that still weeks away from being ready to publish, I thought this would give a good taste on the source of my bullishness.

2. SoFi Technologies (SOFI) — Banking Charter

The Office of the Comptroller of the Currency (OCC) and the Federal Reserve conditionally approved SoFi’s national bank charter application to form SoFi Bank; it also officially approved of SoFi Bank purchasing Golden Pacific Bank. One of the conditions requires SoFi Bank to avoid offering any crypto-currency related products. Importantly, SoFi Money will be able to continue offering whichever crypto products that it wishes according to my chat with CEO Anthony Noto.

Interestingly, the OCC’s press release calls it a “conditional approval” while SoFi’s calls it an “approval.” Regardless of which is more accurate (probably the OCC), this long process is now fully expected to be wrapped up in February.

“With a national bank charter, not only will we be able to lend at even more competitive interest rates and provide our members with high-yielding interest in checking and savings, it will also enhance our financial products and services to ensure they efficiently meet the needs of our members, business partners, and communities across the country, while continuing to uphold a high bar of regulatory standards and compliance.” — Anthony Noto

SoFi is expected to generate roughly $1.46 billion in revenue for 2022. Without the charter — according to its investor presentation — that revenue would have coincided with a 17.4% EBITDA margin. With it — that margin expands to 30.6%. These projections assume a full year’s benefit of having the charter which SoFi won’t enjoy. Still, the company’s EBITDA margin should be between 17.4% and 30.6% for 2022 vs. just 3.7% this last quarter. Expectations are certainly lofty here.

Here’s a list of the benefits that SoFi will enjoy from the charter:

2% lower cost of capital by using its deposits to fund loan operations rather than warehouse facilities.

No more state mandated mortgage origination maximums. Now regulated by just the OCC, FDIC and Federal Reserve which also paves the way for a more consistent user experience (UX).

It can set interest rates on savings and checking accounts to differentiate its offering of the commoditized products.

The ability to hold more loans on its balance sheet for longer time periods to enhance and bolster net interest income.

The ability to offer mortgages in all 50 states.

It no longer needs a sweep partner or sponsors to facilitate certain tasks — this means less OpEx.

SoFi Bank can perform these sweep partner and sponsor services for Galileo’s (its business to business arm) enterprise partners.

3. Upstart (UPST) — Kroll Bond Rating Agency (KBRA) New Issue Report + AI Lending 101 with SVP Jeff Keltner

a. KBRA New Issuance Report

Results:

KBRA published new data studying the performance of Upstart’s pass-through certificate and securitization transactions. The results were mixed.

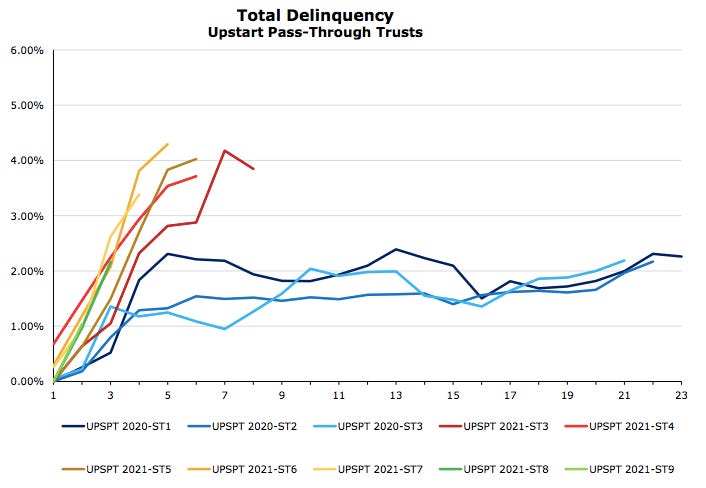

In terms of delinquency rates, Upstart’s newest Securitization trust transactions are showing a slight upward trend (a bad thing). Some of the new issuances here are also undercutting (a good thing) historical trends. The trend is far from uniform or aggressive:

Delinquency rates for the newer pass-through trusts are rising more sharply with that trend peaking at UPST 2021-ST7 (the name of Upstart’s 7th pass-through trust vehicle for 2021) and then improving for ST8 and ST9:

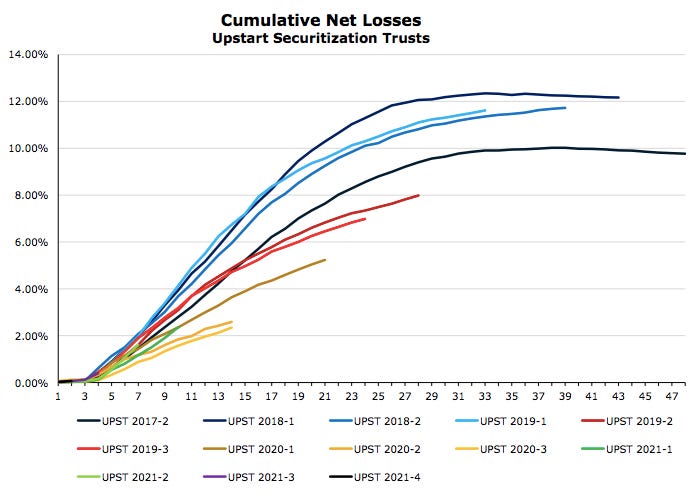

Cumulative Net Loss (CNL) rates are following a similar — slightly more encouraging theme. For Securitization trusts, current CNL trends are quite positive:

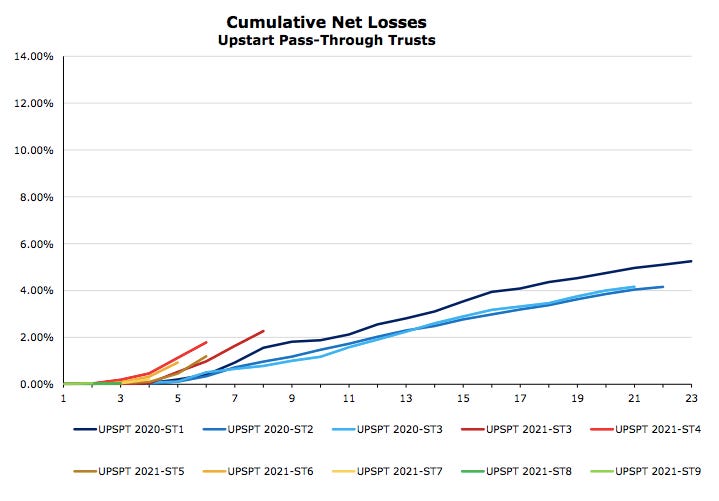

Cumulative Net Loss (CNL) rates for pass-through transactions are less positive and similar to pass-through delinquency rate trends. Again, this improved within Upstart’s 2 most recent pass-through trust transactions:

The most important thing is that these secured loan pools continue churning out acceptable payments to the ultimate capital market holders. This is the only way Upstart will be able to maintain its growth and take rate.

Fortunately, timely interest distributions have been made for all of these trusts to date with RISING levels of credit support — per KBRA. Static pool gross loss levels for these transactions also encouragingly fell across the board.

More context:

A few more things on these results. First, Upstart assumed rising rates of delinquency for Q4 2021 and 2022 as stimulus checks and things like eviction moratoriums fade further away — its guidance incorporates that anticipated headwind. Upstart’s average borrower boasts a credit score 25 points below the industry mean; It’s safe to say that the generally less affluent borrower Upstart caters to relied on stimulus more than wealthier customer cohorts.

Furthermore, underwriting model accuracy gains will be lumpy — temporary reductions in performance have been frequent throughout Upstart’s existence. It does not improve in a straight line.

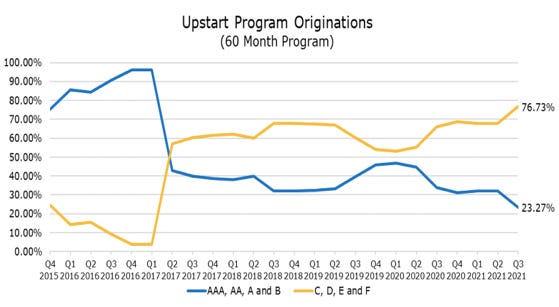

Finally — a bi-product of Upstart’s model seasoning is growing confidence in the platform’s capabilities. This has prompted many partners and capital market investors to lower credit restrictions for Upstart-sourced loans which is leading to a larger portion of those loans being in riskier classes. This inherently leads to rising delinquencies — although the jump for Upstart-sourced loans is smaller thanks to its superior underwriting. These partners are also compensated in the form of larger payments for originating or investing in these loans. This trend of serving less traditionally-credit worthy borrowers — which is really just Upstart’s business model maturing — is depicted below:

This is not a red flag to me and will not turn into one UNLESS it proves to be the beginning of a stubborn, long term pattern. I don’t expect that to be the case, but it’s always possible. I am excited for the company’s earnings results next month.

b. AI Lending 101

Keltner on where AI/ML can be used in lending — he highlighted 4 core areas:

Marketing to help predict which consumers to target and in what way. This drives down borrower acquisition cost per origination.

Underwriting — to assess borrowers in a more granular, intricate way to boost approvals without adding incremental risk.

“There’s so much unexplained risk left to uncover today and when you see loss pool ratio estimates at 10% or 20% — that really is just a guess. If you can explain more of the risk and loss, you can — without increasing loss rates — increase approvals. If you can take that 20% loss pool and truly learn who the 20% are, you can uncover a larger portion worthy borrowers and we can foster a more predictive yield.” — Keltner

On-boarding/Verification — everything from application assessment to data verification and closing.

“We can apply machine learning to improve the predictability of fraud while reducing borrower friction. The goal is not just to minimize fraud through model accuracy but also balancing that with the effort you require from the applicant to get through the process (which is negatively correlated with conversion).” -- Keltner

Servicing — This entails uncovering who is at risk of falling behind on payments and collecting in the most efficient way possible to reduce operating costs further. Upstart offers a white-labeled servicing Application Programming Interface (API) which has automated 90%+ of re-payment activity. It does so — in part — by using its data science branch to determine the most liquid day of the month for each borrower and using that to assign payment timing (the borrower is free to change the date).

Application Programming Interfaces (APIs) defined : APIs are blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower access to data services, operating systems, and other applications to create an end product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build the platform’s UI and user experience (UX).

Keltner of the Challenges with Machine Learning:

Keltner spoke on the “kick-start” challenge that many competitors and institutions face in trying to build a competing platform of models. This challenge arises from vast sources of 3rd party alternative data — what actually enables the better results — not being readily available. This bounds many to solely having first party alternative data to use. For smaller banks and credit unions, that is quite the limiting factor for model maturity and improvement. That’s why access to Upstart’s vast and rapidly growing data network is so appealing to partners.

“There’s the perception of commoditization within the usage of machine learning with any model being able to tell us the same thing. That is not at all the case. Just like for an athlete, it takes hard work, dedication and significant time to get good at this. We’ve been doing this for a decade yet we have a long, long way to go. It’s really hard to do this well.” — Keltner

4. Olo (Olo) and Revolve (RVLV) — Leadership Tweaks

a) Olo

Olo’s COO and President — Matthew Tucker — will retire at the end of march. Replacing him will be Nithya B. Das who currently serves as the Chief Legal Officer (CLO) at the firm. Das will also retain that role. Before joining Olo in 2019, Das was the Chief Legal and People Officer at AppNexus which was acquired by AT&T. Tucker will remain with Olo as an advisor through 2022 and the next President has not yet been named.

Click here for my Olo Deep Dive.

b) Revolve

Revolve added Warner Music Group’s Chief Digital Officer — Oana Ruxandra — to its Board of Directors.

5. Cannabis News

a) Company-Specific:

Cresco Labs terminated its agreement to buy Blair Wellness — a dispensary in Baltimore. According to Co-founder and CEO Charlie Bachtell this was due to “failure of certain closing conditions to be met prior to our specified termination date.” The company plans to explore other avenues of Maryland expansion. There are no termination fees.

Cresco Labs opened its 10th dispensary (Sunnyside branded) in Ambler, Pennsylvania. The company now has 47 shops across the nation.

b) Industry News (mainly per Marijuana Moment):

A State Representative in Missouri issued legislation to decriminalize possession of up to 10 grams of cannabis.

The Mississippi State House of Representatives passed a bill to legalize medical cannabis. This bill was passed by the Senate this month and has now been sent back to the Senate to iron out final details and amendments. We are getting close here.

A Senator in Louisiana — running on cannabis and criminal justice reform — dropped a campaign ad in which he was smoking cannabis.

Ed Perlmutter on cannabis banking reform — “I have not given up. I’m going to get that darn thing passed.” I’ll believe it when I see it.

Members from both parties of the Pennsylvania Senate Banking and Insurance Committee are filing a state-wide complement to Federal Banking Reform.

6. My Activity

I started PayPal Holdings (PYPL) on Tuesday and my cash position went from 17.3% to 14.8% with the move. I also added to Upstart, GoodRx and CrowdStrike during the week to lower my cash position to 14.5%. I will continue to deploy capital into healthy companies enduring more multiple compression and the adds will likely start to get more aggressive going forward.

Very useful, thank you. One thing I think we need to be careful about the last KBRA graph is: KBRA has been upgrading Upstart's ABS in a big way, especially for their earlier years loans ABS, some got BB- when it closes, but eventually moved up all the way to AA-. So this graph might be misleading in the way that, Upstart loan quality did not change THAT much over the years, it is more about how KBRA view their loan quality, the recent years of ABS might be better quality than it shows here: it take take time for KBRA to look at the real default rate and update their model.

Great stuff, as usual! 🙌