News of the Week (January 2 - 6)

Shopify; SoFi; The Trade Desk; Airbnb; CrowdStrike; PayPal; Meta Platforms; Macro; My Activity

Today’s Piece is Powered by my friends at Savvy Trader:

Welcome to the 689 new readers who have joined us this week. We’re delighted to have you all as subscribers and determined to provide as much value & objectivity as possible.

1. Shopify (SHOP) -- Commerce Components by Shopify

This week, Shopify debuted an offering for large merchants called “Commerce Components by Shopify.” This package allows massive enterprises to select bits and pieces of the Shopify commerce operating engine to integrate into their own systems. Shopify has always allowed its merchants to select individual offerings most relevant to their ecosystems. But that flexibility really worked best for smaller companies.

For larger companies that more commonly wanted to keep parts of their legacy tech stacks, this à la carte-styled selection process did not work as well. Leadership often avoided legacy software integrations as it saw plugging into antiquated technology as diminishing the flexibility, innovation & utility needed in a rapidly evolving commerce landscape. Rather than providing what it viewed as a sub-par tooling for these large brands, it simply declined to parse its valuable tech stack.

Shopify (thankfully) has reconsidered that philosophy in a move to ease large enterprise on-boarding friction. Now it believes that its infrastructure is powerful and configurable enough to provide these un-ideal integrations without sacrificing quality of service. Not all of these brands are eager to rip and replace their entire ecosystems -- this is Shopify letting them do so in a user-friendly, step-by-step manner. It’s now willing evolve with large brands vs. requiring more of an overhaul of their infrastructure like in the past

This new package was built for the Fortune 500 clients like Netflix, Chipotle, Unilever & Match Group to transition more to Shopify while being able to keep & integrate whichever pieces of their tech stacks they want to. It features the cross-channel eligibility, omnipresent legacy compatibility and endless scalability required by giant brands like Mattel -- which will be the first to publicly use it.

Vitally, Commerce Components by Shopify offers limitless API calls (there used to be a hard cap) meaning that these large brands don’t have to pick and choose which pieces of their technology to integrate or which 3rd party apps to select. APIs are how merchants integrate the custom features, apps and designs they require for their stores. Now they can have as many of those custom features as they want while taking advantage of Shopify’s best in class checkout conversion, marketing tools and large built-in consumer base. Shopify will never be willing to fully custom build individual stores from scratch for large merchants. But by unleashing limitless integration opportunities, it accomplishes the same objectives as a custom build… and does so without crippling the nimbleness and expedient malleability of these stores.

As a company born to “arm the rebels” and “remove the barriers to entrepreneurship,” it hasn’t always been the easiest partner to work with for giant brands. This decision, plus tightening relationships with selling partners like Accenture, EY and Deloitte, point to its commitment to change that. Specifically, Deloitte was a key piece in designing this feature.

2. SoFi Technologies (SOFI) -- Savings APY Boost

This week, SoFi raised its savings annual percent yield (APY) to 3.75%. In terms of chartered bank competition, you’d be hard-pressed to find a competing rate. Looking elsewhere, Robinhood offers 4% if you pay a $60/year subscription fee and Marcus is running a temporary 4.3% promotion. But in terms of highest yield with no fees, no time limits and no deposit maximums, 3.75% is in elite territory.

Obviously, SoFi raising its APY to attract more direct deposit dollars for originations worsens its loan unit economics -- all else being equal. But all else is not equal. It’s imperative to consider that just last year, SoFi was routinely paying in excess of 5% for origination funds via warehouse facilities. With its charter in hand, it can finally use direct deposits to fund its loan business, and 3.75% cost of funds still leaves it far better off than pre-charter.

This APY also functions as a wonderful top of funnel to feed the rest of SoFi’s businesses. Direct deposit usage greatly bolsters debit interchange fees (one of its highest margin revenue streams), raises usage of investment products and even sharpens SoFi’s loan underwriting thanks to all of the financial activity data that coincides with it.

The stock remains utterly hated, the company remains in flawless execution mode. Student loans will come back eventually (no clue when). It will be exciting to see what this company will look like then considering it’s already compounding at over 35% and expanding margins without it.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. The Trade Desk (TTD) -- Galileo

The Trade Desk debuted an extension of its Solimar ad buying platform called Galileo this week. The tool is an end-to-end customer data management solution which takes all the headaches out of integrating & leveraging a brand’s first party data. With advertising channels frequently popping up, signal loss from walled gardens, and privacy at the top of everyone’s mind, Galileo delivers. How?

It provides a secure process for uploading, organizing, contextualizing and utilizing all company 1st party data. And it does so while providing entirely open ad measurement vs. the “trust me” approaches that walled gardens such as Google take.

With this new product, advertisers can now upload 1st party data from ANYWHERE: directly into Solimar, through a cloud provider or via customer data platforms and clean rooms. No longer must advertisers concede to uploading their data in pre-set ways – it’s now entirely up to them. Galileo also enhances open internet reach by allowing for data matching across all TTD channels including connected TV. This creates full control over ad frequency in ALL channels.

And for icing on the cake, Galileo perfectly meshes with UID2 (The Trade Desk’s open internet identifier) and the rest of its platform. That frees advertisers to actually understand their audiences and to merge 1st party data with all relevant 3rd party data sources for even more precise targeting. Seamless 1st party data usage, an elite roster of 3rd party data partners to augment those first party data sets, and over a decade of model seasoning is how The Trade Desk will preserve its large return on ad spend (ROAS) leads vs. its space.

4. Airbnb (ABNB) -- Regulation

a) Mexico City

Mexico City is entertaining fresh regulations on short term rentals like Airbnb. To be candid, I actually see this as a positive for the company. Why? Because Airbnb is better equipped to handle compliance than smaller competitors. It has made it a point to preemptively sharpen its own host and guest controls AND has an intimate new partnership with the city to boost tourism. The last piece of that is probably the most important, as it could easily mean regulation crafted in a way that collaborates with and supports the Airbnb model.

Still, The Mayor seems determined to curb investment property speculation just like New York City and Barcelona have done in the past. While this can’t be called a tailwind for Airbnb’s business, it is a headwind that the company has long been preparing for. And furthermore, this type of regulation makes the unlikely outright ban of short-term rentals even less realistic by creating more organized rules to curb speculation and to tighten tax disclosures/collections.

b) Canada

Canada implemented a two year ban on foreign purchases of residential property. Canada is not all that important of a market for Airbnb (its 10th largest country by listings), but this will still surely be a material hit to new listings in that country.

I continue to take a patient approach to building out this new position. Regulation is inevitable and Airbnb must continue to overcome it for this to be a successful investment. I believe it can, which is why I’ll continue to add as these headlines come in and hit the stock.

5. CrowdStrike (CRWD) -- Two Bearish Notes

CrowdStrike was hit with two somewhat bearish notes this week. One was from Stifel that called out rising Microsoft endpoint security market share. Not to sound arrogant, but I laughed at this. Why? Microsoft has been a key source of CrowdStrike’s new business and market share. Microsoft’s consistent, high-profile breaches and blunders have been major contributors to CrowdStrike’s rapidly growing endpoint market share. Microsoft’s shortcomings are one of CrowdStrike’s best channels for new lead generation.

SentinelOne and Palo Alto are the key competitors to worry about here… not Microsoft. The mega cap can bundle endpoint add-ons into its suite of enterprise products all that it wants to. When clients want real breach protection, they won’t get it there.

The other bearish note was a downgrade from Jefferies from buy to hold. Aside from calling out valuation after it had a buy rating on the company at an exponentially more expensive multiple, it pointed to the light annual recurring revenue (ARR) guide from last quarter. I would remind this firm that the small ARR miss was a matter of DELAYED business, NOT missed business. Enterprise customers are simply taking a slower approach to on-boarding amid the putrid macro environment. That means the SIGNED CONTRACTS in CrowdStrike’s backlog will translate into new ARR over a longer period of time. The new business is coming. This is not a matter of worsening competitive positioning.

It called out valid macro concerns more broadly as well, but considering cyber security is the least discretionary piece of enterprise tech spend, it’s in a relatively better position than essentially all other areas of tech. Following these cautious notes, I added to my stake. The company continues to take share, continues to find new product traction, continues to find operating leverage and now trades at 40X operating income vs. 40X+ sales in 2021 with a PEG ratio rapidly approaching 1X and a fortress balance sheet.

6. PayPal (PYPL) -- Taxes & Bullish Notes

a) Taxes

The IRS is delaying a new regulation that would require businesses transacting through payment apps like Venmo, Cash App and Stripe to disclose transactions of $600 or more. The current threshold of $20,000 will be kept in place for this tax season to enable a more organized transition. This is good news for PayPal, as it extends the laxer tax disclosure requirements for at least another 12 months and therefore makes PayPal and Venmo more efficient transaction tools.

Senator Joe Manchin (a key democrat who often votes outside of party lines), has been a loud critic of this rule as he thinks (and I agree) that it unfairly targets small businesses. I would not be surprised to see more pushback on and more delays to this new rule. Maybe the IRS should crack down on NFTs and digital doody coins instead of small businesses -- AKA the backbone of the American economy. Just a thought.

b) Bullish Notes

PayPal received a string of analyst upgrades this week. The overarching reasoning behind these upgrades was confidence in the forward guide. That’s no surprise considering CEO Dan Schulman assured us that PayPal would meet or beat expectations during a conference a few weeks ago. The notes also called out the strong balance sheet and coinciding M&A or buyback optionality.

The most interesting note, however, was a reiterated buy rating from Mizuho. Why was this most interesting? Because it actually pointed to tangible data to support the opinion. The firm called out web traffic data from PayPal’s largest 15 partners. Its market share with these merchants -- which was falling throughout 2021 and early 2022 -- has stabilized over the last 6 months.

It’s amazing what happens when macro worsens and VC-funded cash burners can no longer pay ridiculous sums for preferred checkout placement. PayPal wins with its brand notoriety, convenience and ubiquitous availability, it doesn’t need to fund negative profit placements and refuses to do so. That refusal hurt it in 2021, but now it’s helping mightily. Startups in this space are dropping like flies. This is the time for PayPal to pounce. The low hanging fruit is abundant once more.

7. Meta Platforms (META) -- Miscellaneous

The Meta Quest app dominated app store ranking during the holiday season -- climbing all the way up to spot #1. Two things: This is a tiny piece of the business and will not materially impact results for now. Secondly, this provides encouraging proof of concept evidence making me more comfortable with the aggressive spend and focus here.

Meta announced its purchase of Luxexcel. This is a 3D printing company that will be integrated into its Quest headset projects. I’m sure the FTC will have a thing or two to say about it.

8. Macro:

a) Fed Minutes Notes from the December meeting:

The labor market is still tight. Duh. Inflation is still too high. Double duh.

Taming inflation remains priority 1. A trifecta of duh.

More hikes are likely needed although policy is now approaching restrictive.

Risk of tightening too quickly was added to the language for the first time this cycle. Wink, wink.

No members support cuts in 2023. Members also are determined to remain “data dependent” which means none of them have a clue if rates will be cut in 2023.

“Not even thinking about thinking about thinking about hiking.” -- Jerome 2021

b) Economic Data from the Week:

Institution of Supply Management (ISM) Data:

ISM manufacturing employment of 51.4 beat expectations of 48.3 (48.4 last month).

ISM non-manufacturing employment of 49.8 fell into slight contractionary territory vs. 51.6 last month.

Purchasing Managers Index (PMI) Data & other manufacturing data:

Manufacturing PMI for December of 46.2 met expectations (47.7 in November).

The ISM PMI of 48.4 slightly missed expectations of 48.5 (49 last month).

The ISM non-manufacturing PMI sharply missed expectations of 55 with a contractionary reading of 49.6 (56.5 last month).

S&P Global Composite PMI of 45 beat expectations of 44.6.

Services PMI of 44.7 beat expectations of 44.4.

Factory order growth MoM turned sharply negative in December.

Employment:

JOLTs job openings for November came in at 10.46M vs 10M expected. The labor market is still too tight.

ADP Non-farm employment change of 235,000 for December crushed expectations of 150,000.

Jobless claims missed expectations of 225,000 with a reading of 204,000.

Non-farm payroll for December of 223,000 beat estimates of 200,000; Private non-farm payroll for December of 220,000 beat estimates of 180.000.

The unemployment rate fell from 3.6% to 3.5% in December.

Salesforce and Amazon fired tens of thousands of employees combined this week. Goldman Sachs continues to layoff more workers.

Inflation Data:

Average hourly earnings growth of 0.3% for December missed expectations of 0.4% growth.

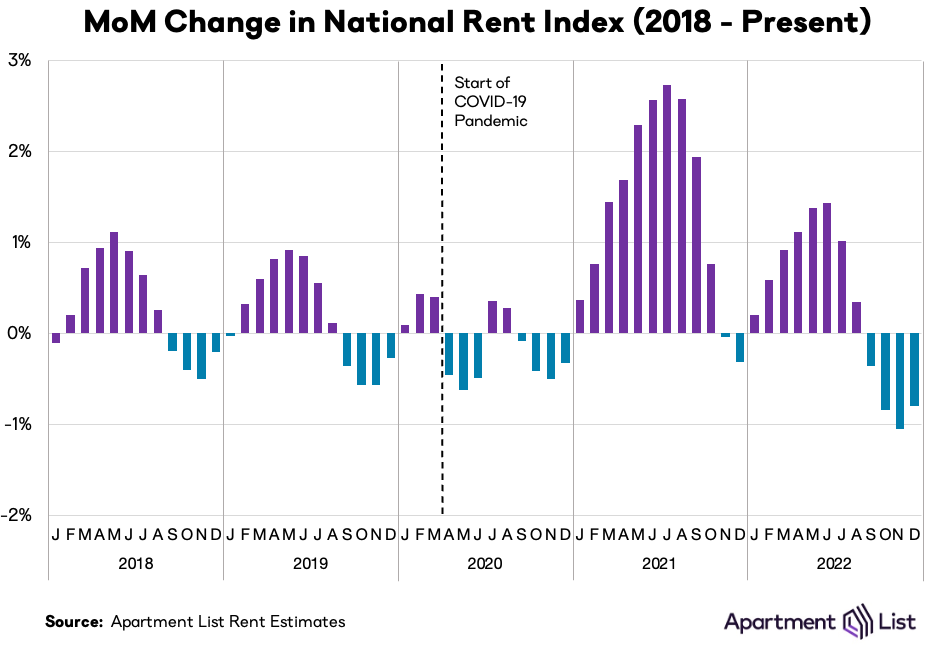

Forward looking rent inflation continues to cool:

5 year breakeven inflation continues to trend downward:

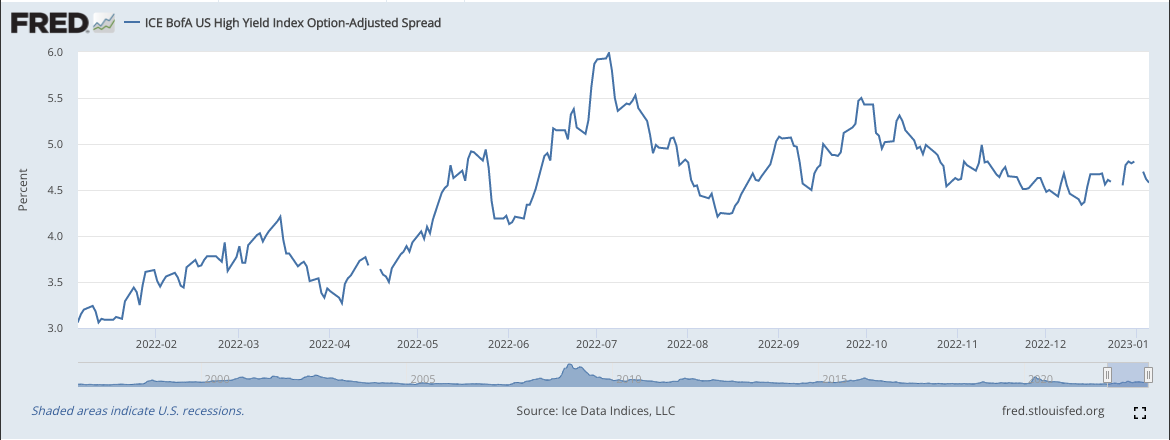

High yield option adjusted corporate credit spreads tightened a bit (a good thing) this week:

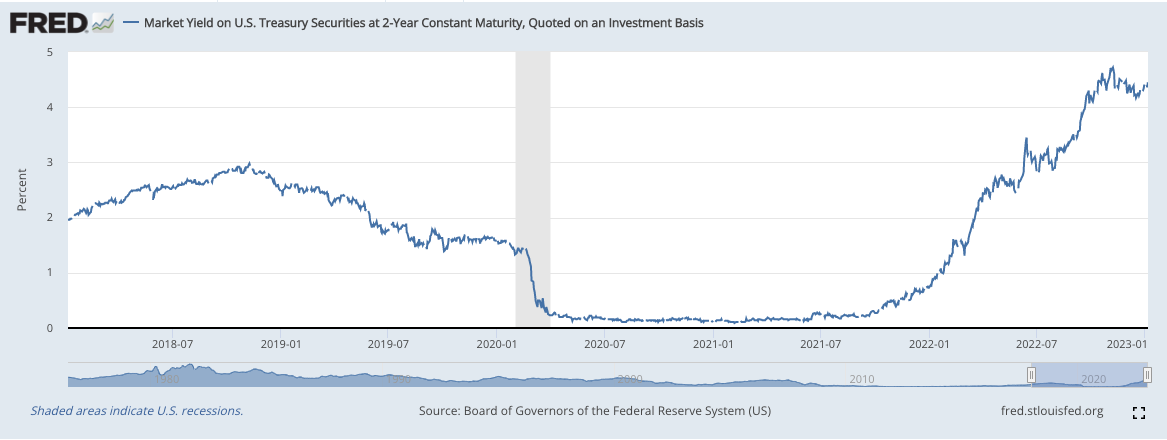

The 2 year Treasury yield is climbing back to local highs (not a good thing for equities):

C) My Take

This is going to sound like a broken record to consistent readers. Inflation is still too high with employment markets too tight for the Fed to pause today. BUT, rapidly cooling real time inflation indicators paired with previous hikes now taking effect, weakening economic and sentiment data and daily layoff news can only persist for so long before that changes. And the very first hint of a pause came in this week’s minutes with the subtle mentioning of wanting to avoid tightening too rapidly.

I expect (like everyone else) another 25-50 basis points of hikes at the next meeting and a pause thereafter as employment turns into the more pressing Fed mandate. I’ll look to incoming data to continuously confirm (or not) that opinion and will deploy a large chunk of my remaining cash this month if CPI, PPI & PCE data is largely positive. We shall see.

The Fed will be adamant about not reversing course and convincing markets of its resolve to tame inflation until it makes more progress in doing so. Rent, food, energy, freight and service inflation cooling over the last several months all points to that progress quickly coming. I still expect a 1H 2023 pause.

9. My Activity

I added to CrowdStrike this week. My cash position is currently 13.2% of holdings. Upstart and Nanox remain my only two holdings that I’m not currently willing to add to. I am seriously considering starting a position in Chipotle. Airbnb is a new position that I am hoping to aggressively add to this year. I’d like it to be an anchor holding.

Happy new year. Great post. Thanks as always.

I’d be curious to read more about why you’re considering Chipotle and why now as a new position. Cheers 🍻