News of the Week (January 24-28)

GoodRx; Upstart; Penn National Gaming; Ozon; The Boeing Company; CrowdStrike; Cannabis; The Fed; My Activity

1. GoodRx (GDRX) — Mark Cuban Competition

Mark Cuban launched an online pharmacy to sell 100 generic drugs at deeply discounted prices by 2023. This will provide new competition for GoodRx but the company should be able to seamlessly cope (in my view) for the following reasons:

Nobody matches GoodRx’s PBM scale of ~15. This means GoodRx can generally offer better pricing than the rest of its competition thanks to more pricing points. SingleCare comes the closest and GoodRx still boasts “dominantly better pricing” than it does with those leads expanding. The new start-up could offer lower prices on the occasional medication — but for the vast majority GoodRx will be better.

Formidable competitors like Amazon have tried to take a piece of this market. The company has had “no success to date” and boasts just a few hundred monthly users for its competing product. Countless start-ups have come and gone with no traction.

This is a $564 billion market with the primary growth hurdle for GoodRx being the 70% of Americans who still do not know drug prices vary. This is a massive, greenfield opportunity. It’s hard to believe the outcome will be winner take all (but if it is GoodRx is better-positioned to be that winner).

The company is actively expanding into branded drugs thanks to leveraging its massive scale. Cuban’s project has miles to go before it can try mirroring this incremental value by attracting enough branded makers.

The vast majority of GoodRx’s transaction revenue is collected via brick and mortar pharmacies. There are many reasons that consumers have been hesitant to evolve prescription shopping to online — mainly that the person must be at the door to sign for most deliveries. Online penetration rates topped out at 5% during peak pandemic pain and have since fallen.

GoodRx’s success will be the effect of its product suite’s traction and management’s execution. One start-up with a wealthy founder is not alarming — but rather more proof of concept for this massive opportunity being worth pursuing.

Click here for my GoodRx Deep Dive.

2. Upstart (UPST) — New Referral Partner

Upstart announced Corning Credit Union as the newest member of its referral network. This is partner number 33 — although that amount is likely higher as Upstart generally doesn’t report on new relationships until months after consummation. The two entities began working together in September 2021, but Corning is now ready to join Upstart’s referral network which represented 62% of its total sales in the last quarter. With more than $2 billion in assets under management (AUM), Corning is a top 250 credit union in the nation by size which boasts 140,000 members spread across 1,700 employer groups.

Since the National Association of Federally-Insured Credit Unions (NAFCU) named Upstart as a preferred partner for its network, the company has rapidly added credit unions to its partner ecosystem. Considering NAFCU represents 72% of all federally-insured credit unions and Upstart is just 1 of 8 partners — this affiliation is likely boosting the momentum.

“There’s growing recognition and interest in credit unions offering unsecured personal loans to their members. We overlooked credit unions in our early days of partnerships which I think was a big miss on our part to be frank. We under-appreciated how much more consumer oriented credit unions are — a credit union the same size as a small community bank will do a lot more personal lending because they’re more interested in being consumer facing.” — Upstart SVP of Business Development Jeff Keltner

My Upstart Deep Dive will be published tomorrow.

3. Penn National Gaming (PENN) — Ontario and Louisiana

Penn National Gaming’s “theScore Bet” sportsbook in Canada received “RG Check iGaming Accreditation” from the Responsible Gaming Council (RGC). This is considered one of the largest hurdles to going live in Ontario — the Country’s most populous Province — and theScore Bet is the first private market player there to gain the label. Sports betting is now set to launch in Ontario on April 4th — and theScore Bet will be ready.

Penn National Gaming bought Score Media last year mainly to augment and vertically integrate its technology stack — but that wasn’t the only reason. The Score is the number 1 sports app in Canada (number 3 in the USA) — it has built a large, loyal following with our neighbors to the North. With Ontario having more people than 46/50 states, theScore should be poised to dominate there going forward. Barstool will be the lead brand for sports wagering and entertainment in the United States with Penn planning to lead with Score in Canada.

“Our team at theScore has been hard at work preparing for the Ontario market opening. As Canada’s preeminent digital sports media brand, theScore is uniquely positioned to capitalize on the introduction of the open and regulated internet gaming market in Ontario, its home territory. Launching theScore Bet in Ontario will mark an exciting expansion of our online gaming business into a major new market where we already have an established mobile sports media product in theScore app and a wide base of loyal users.” — Penn CEO Jay Snowden

Not only does Penn gain access to a team of software engineers to improve its user interface (UI), but it gains another cult-like brand in another country. Penn will continue to lean on its stable, brick and mortar business to serve as a cash cow to feed the rest of these exciting growth projects.

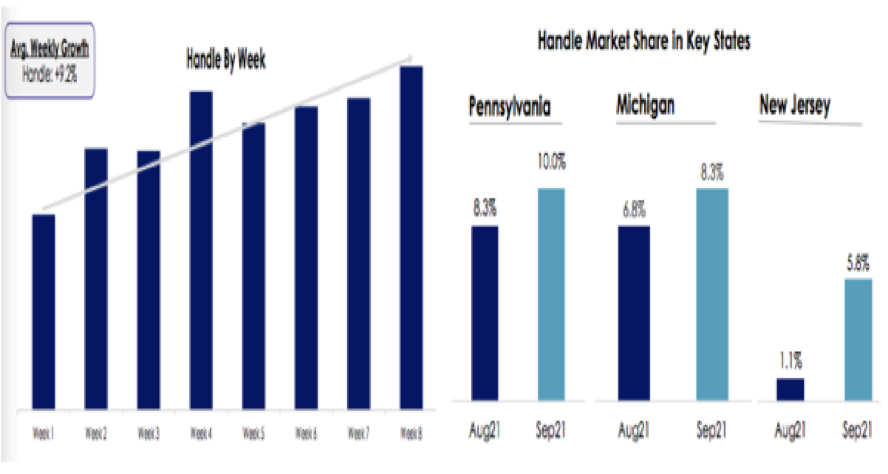

For a quick note on sports gambling — I’m not a fan of the sector overall. Competition is spending like drunken pirates to take market share and net losses across the board are wildly bloated — except for Barstool Sportsbooks. Barstool has a unique ability to tap into its more than 70 million monthly active consumers (across all social channels) and beloved personalities to market its product more efficiently. Its revenue market share per state (which was rising in key states as of last quarter) consistently outpaces its handle (bet) market share per state because the company doesn’t need to spend as much to acquire its users. Data from Pennsylvania shows that Barstool’s handle and revenue in the state has continued to tick up through the end of December.

Barstool essentially provides limitless free marketing which has allowed Penn to de-couple itself from the competition of who can burn through the most cash on promotions. Conversely, Penn expects this standalone product to be EBITDA breakeven sometime this year — before any others. Eventually, irrational market share spend will slow down and brand loyalty will become a more important piece of the equation. Nobody in the space fetches a level of loyalty that Barstool brings to the table.

In other news, Barstool has received final approval to operate its sportsbook in Louisiana. It went live on Friday. This is state number 12 for Barstool’s digital product.

4. Ozon (OZON) — Staying the Course

Ozon — the stock not the company — has had a tough quarter. A potential Russian invasion of The Ukraine is serving up daunting headline risk for the company’s share price. Its label as a hyper-growth stock in this tightening macro-environment certainly doesn’t help either. Russia is stockpiling military personnel and resources at the Ukrainian border, Ambassadors from around the world are being evacuated from the nation and The United States is asking all Americans in the Ukraine to leave the country. While seeing a stock go from $60 to $15 in a rather straight line is never fun, this is the kind of dip that I’ve been cautiously accumulating into. Why?

The worst-case scenario for Ukrainian conflict is intensifying sanctions on the Russian economy hurting its consumer. While this could impact Ozon, the company has dealt with Russian sanctions for a large part of its existence — this is nothing new. Even if a worst case scenario were to come to fruition, it’s hard to think the domestic Russian e-commerce revolution would halt (or even materially slow) as a result. Furthermore — if the sanctions actually work — Russia would be motivated to play nice which could rapidly ease this concern.

I added to my stake this week not with the expectation that we’ve found a bottom, but based on the company now sporting what I perceive to be extremely favorable risk-reward. Ozon now carries a forward gross profit multiple under 3x. The stock could continue being hurt by consistent political headlines, but these headlines have little to do with Ozon-the-company’s fabulous success and traction to date and the opportunity it has ahead of it. Short term pain could continue — but the long term potential gains are still fully intact.

In its most recent quarter, Ozon posted its fastest user growth rate in nearly 2 years. Revenue soared 85%, gross merchandise value (GMV) spiked 145.6% and active buyers as well as their order frequency continued to precipitously ascend. As a result, Ozon raised its 2021 GMV growth outlook to 120% vs. 110% in the previous quarter and vs. 90% at the beginning of 2021. Importantly, CapEx guidance has not changed with this spike and operating costs per delivery recently dropped 16.1% year over year. Both show very early signs of operating leverage with a long way to go.

From a margin perspective, the company continues to both briskly expand its gross margin (+340bps YoY to 36.6%) and remain in cash burn mode with a free cash flow (FCF) margin of (34.9%). While cash burn is never ideal, the company already demonstrated its ability to be FCF positive last year before it started ramping up logistics, fulfillment and other growth investments. These investments will give Ozon the largest and broadest delivery footprint in the nation already with a 98% on-time delivery rate.

I wholeheartedly support this spend because it’s working. The company’s expedient courier capabilities contribute to top of mind brand awareness for Ozon in Russia with the lead consistently growing. This top of mind brand awareness should be quite lucrative based on the make-up of Russia. The nation boasts an e-commerce penetration rate of just 10% vs. 21% in the U.S. and 27% in China. Conversely, Russia’s internet and smartphone penetration is roughly similar to these two nations. Translation? There’s ample low hanging fruit for Ozon to leverage its network and brand loyalty and shift commerce online. Consumers in Russia have the tools needed to enjoy e-commerce — now Ozon is providing the convenient, reliable service.

The spend hasn’t just been on fulfillment — but on new verticals and geographies as well. Ozon’s debit card issuances soared 60% sequentially to 1.6 million. These holders order from Ozon 60% more frequently than non-holders. Ozon’s flexible payment plan for sellers saw 109% sequential growth as well with Ozon credit now actively issuing loans to its vendors. Its one-hour delivery service extended outside of Moscow last quarter with 20,000 SKUs including private label goods like coffee and snacks. It’s pushing into Belarus and Kazakhstan (28 million more people in total vs. 144 million in Russia).

The fundamental thesis remains fully intact — and yet the geopolitical and macroeconomic risks remain intense.

So?

I have not paused adding to this name, but I have widened to multiple compression bands needed to justify adding to my stake (similarly to Lemonade due to its newness and deep cash burn). As ridiculously appealing as the valuation looks today, it could always get cheaper as war is known to create wildly irrational short term price action — along with Jerome Powell. The deep cash burn as global monetary policy tightens only amplifies the exogenous issues for the firm. Knowing this, I am leaving significant room to average down into a black swan event. I fully believe there are brighter skies ahead — but storms could continue for now.

Click here for my broad overview of Ozon.

5. The Boeing Company (BA) — Earnings Review

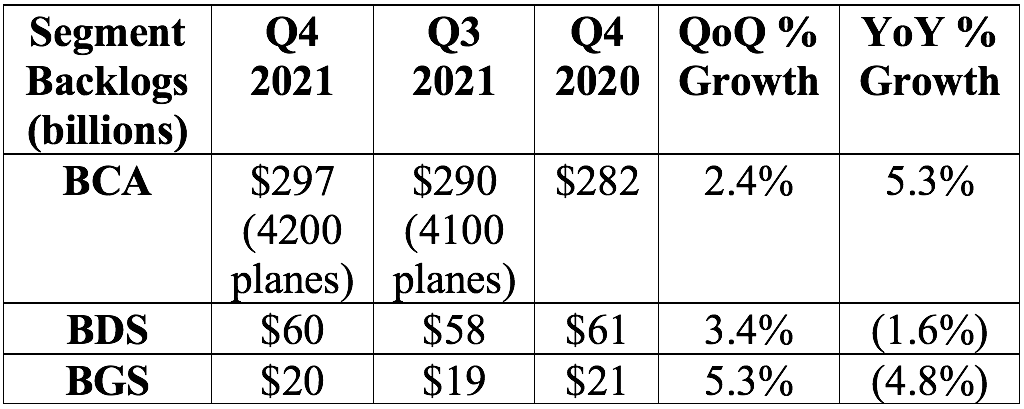

a Demand and Backlogs

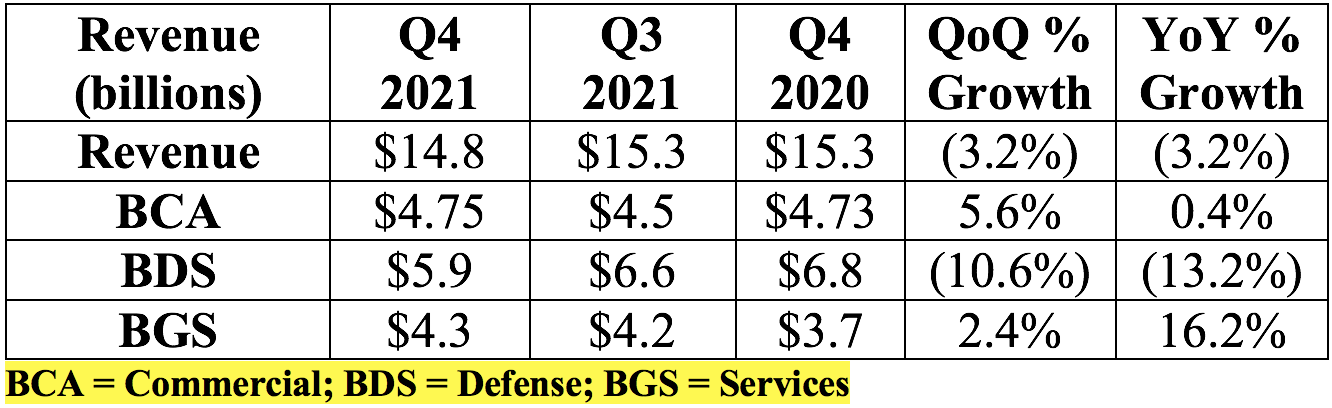

Boeing was expected to generate $17.1 billion in sales for the quarter. It posted $14.8 billion which missed expectations by 13.4%.

b. Deliveries, Orders and Charges

Deliveries:

Boeing delivered 78 737 MAX planes this quarter vs. 62 sequentially. Originally, it guided to delivering 50 737 MAX planes per period by 2022 — it’s ahead of schedule

Boeing delivered 99 planes in total vs. 85 sequentially. Analysts were expecting ~104 deliveries so this was a miss and still far off of its 2018 record of 238 quarterly deliveries.

Commercial orders:

164 new 737 MAX orders vs. 70 new orders sequentially.

24 new freighter orders vs. 24 new orders sequentially.

“As a result of increasing freighter demand, we plan to increase the combined 777/777X production rate from 2 to 3 per month.” — CFO Brian West

BDS and BGS orders:

$7 billion in new BDS orders vs. $6 billion in new orders sequentially

$6 billion in new BGS orders vs. $4 billion in new orders sequentially

The company continues to work towards a near-future 737 MAX return to service in China. Speaking of China, on Thursday China Airlines ordered $1.4 billion worth of 777 freighters in response to continued air cargo demand.

c. profitability

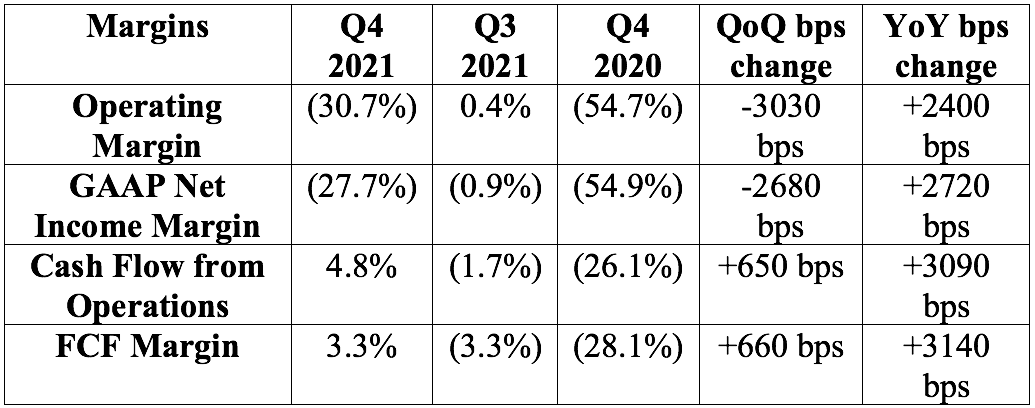

Note that the massive difference between operating/net income margins and cash flow margins stems from a $3.5 billion non-cash charge in relation to the 787 Dreamliner issue covered last quarter. It also now expects $2 billion in total additional abnormal charges vs. previous expectations of $1 billion. As a reminder, the existing 787 fleet continues to fly and be the “most utilized wide-body airplane” in the industry. Deliveries have paused, but this is NOT considered a flight risk.

“This 787 charge estimate increased due to additional rework requirements and lower production rates continuing for longer than previously expected.” — CFO Brian West

“We believe free cash flow will continue to materially improve this year and into 2023.” — CFO Brian west

The company is expected to burn a few billion in cash this quarter but be cash flow positive for 2022 as a whole.

Segment operating margin progress:

BCA operating margin = (161.8%) vs. (93.8%) YoY (all 787 Dreamliner related)

“It is important to keep in mind that commercial cash margins remain positive. Cash margins are expected to stay positive and significantly improve over time.” — CFO Brian West

BDS operating margin = 7.4% vs. (4.4%) YoY

BGS operating margin = 3.8% vs. 9.3% YoY

d. Balance sheet

$16.2 billion in cash and equivalents vs. $20 billion last quarter

$56.6 billion in debt vs. $60.9 billion last quarter (so cash drawdown used to pay off debt early)

e. Pandemic Recovery

“There’s no doubt that Omicron has paused the industry recovery but it has not changed our outlook for the medium and long term fleet plans.” — President/CEO Dave Calhoun

Commercial traffic is back above 80% of pre-pandemic levels which has been rather stable over the last several months. The company continues to expect commercial traffic to return to 2019 levels by 2024 and grow at its long term trend thereafter. U.S. domestic traffic is back to 94% of pre-COVID levels as of November with encouraging December data (but slowing down with the variant as of this month). International traffic is now 60% off pre-pandemic levels vs. 85% below at the beginning of 2021. Conversely, air cargo traffic is 7% above pre-pandemic levels as the e-commerce shock endures.

Boeing expects deliveries for both the 737 and 787 models to sharply rise in 2022 and for operating margin to briskly recover as well

f. Conference Call notes from President and CEO Dave Calhoun:

The term “5G” did not show up in Boeing’s earnings materials or transcript.

The company has 335 737 MAX planes in inventory representing roughly $16 billion in cash. Most of these will be delivered by 2024.

Supply constraints have not impacted Boeing at all. That’s the one, tiny silver lining from the 737 MAX grounding and the pandemic both fostering an inventory build-up. It has a lot of finished product to sell. It’s producing 27 new 737 MAX planes per month with plans to get back to 31/month in the coming quarters.

“China is preparing for their MAX return to service and for deliveries. We have set up a plan that allows for that in the first quarter.”

On Boeing’s $500 million investment in Wisk:

“This is the right time to invest in Wisk/Kitty Hawk — the world wants autonomy and electric. This will be our application of these 2 technologies.”

g. Conference Call notes from CFO Brian West

On 2022:

“First, we’ll resume 737 deliveries to China and 787 deliveries. As we move through the second half of the year, our revenue and margin performance should accelerate with significant opportunity to return to sustainable growth.”

High oil prices continue to amplify already strong fleet modernization interest. This should be a 737 MAX tailwind especially with it burning 25%-40% less fuel than older models.

On 2022 FCF when asked “is 2022 FCF going to be a smidge over 0 or something closer to $5 billion?”

“It’s not going to be a smidge over zero. I promise you that.”

h. My take

Boeing continues to face obstacles on its way to a full recover — yet the odds of that full recovery remain immensely stacked in its favor. A return to free cash flow was a major key and a fading away of variant fears should lead to the industry recovery re-starting. I’m continuing to hold onto my stake — any more missteps like the 787 Dreamliner could lead me to re-evaluate as my leash with this company has already been very long.

6. CrowdStrike (CRWD) — Workplace Accolade

CrowdStrike was named one of the best places to work for LGBTQ+ equality by the Human Rights Campaign Foundation. While this piece of news isn’t monumental — I still find it meaningful considering how talent-constrained cybersecurity is at the moment. Culture is a great way to stand out amid alternatives and this is yet another hint of CrowdStrike’s culture being another company strength.

7. Cannabis News — Mainly Per Marijuana Moment

a) Industry-Specific

New York lawmakers vastly expanded acceptable conditions for a doctor to recommend medical cannabis. Now a doctor can prescribe for any ailment or condition “as they see fit.” This paves the way for far more medical consumption in the massive state. New York is still actively working on debuting its recreational program.

Republican State Representatives in Wisconsin released a medical cannabis bill this week. This legislation is the next attempt following Wisconsin’s Republic-led Senate blocking a broader-reaching legalization bill. Hopefully, this compromise will be met with traction. We will see.

Delaware’s House Health and Human Development Committee passed a cannabis legalization bill. This is step number 1 — there’s a long way to go.

Amazon endorsed a bill to federally legalize cannabis. This sponsored bill has been spearheaded by republican representative Nancy Mace and is seen as a middle ground vs. some of the other more & less powerful legalization bills. It’s not every day that we see the Koch Brothers and Amazon support the same piece of legislation.

Mace’s bill does incorporate some social equity amendments while clearing a path for current MSOs to seamlessly transition into the federal system — it leaves much of the regulatory power with the states. It aims to regulate cannabis growers similarly to how the USDA regulates alcohol and use the ATF and FDA to regulate product forms and consumption. The bill also features a wonderfully modest federal tax of 3%.

State lawmakers in Mississippi have officially sent their medical cannabis reform bill to the governor.

Massachusetts joined the growing list of states now collecting more tax revenue from cannabis vs. alcohol.

b) Company-Specific

Green Thumb shareholders offered roughly 5.6 million shares to be sold in public markets. Green Thumb will not be raising any cash with the move and there will be no shareholder dilution. No executives were part of the sale.

Cresco Labs is releasing Wiz Khalifa’s Khalifa Kush in stores throughout California. Cresco has an exclusive cultivation contract in place with the popular musician. Cresco’s FloraCal Farms and Continnum will produce the “KK” strain.

Click here for my broad overview of American Cannabis regulation.

8. Fed

My stock picking focus is predominately micro-economically driven. Still, I do pay attention to the macroeconomic backdrop and its evolution as a piece of guiding the pace of my position accumulation. While it isn’t my main focus — it still should always be considered. Here were the highlights from the fed meeting:

No federal funds rate change with strong hints that rates will be hiked in March.

Balance sheet run-off to begin after rates start rising and will be done passively (ending re-purchases of maturing bonds), not actively (selling bonds pre-maturity). The pace of this run-off was not guided to, but Powell told us it will likely be faster than our last tightening cycle as the balance sheet is larger, the economy is stronger and inflation is higher.

The Fed continues to expect inflation to moderate as we head further into 2022.

None of this was a surprise — everything was essentially in line. I continue to believe inflation will wane faster than most currently think it will as supply chains catch up to demand and year over year inflation measures normalize. I fully expect the macroeconomic environment to keep tightening (while remaining historically favorable) and fully plan on continuing to slowly deploy cash regardless. Sentiment and exogenous factors can have severe impacts on short-term price action (like we’ve seen) — long term price action is conversely driven by the pace of revenue and cash flow compounding — not where to 10 year yield is today.

Rising rates have spooked the markets and resulted in drastic re-ratings of hyper growth stocks. There is no way to tell when this stops but as the stocks have been falling the revenues (and for some the profits) have kept growing. The spring is coiling.

9. My Activity

I started a new position in Match Group on Friday. I will post of brief summary of my investment thesis (and the earnings report coming up) in my next News of the Week post. A full position will be 4% of my investable funds and I added 1.5% of my investable funds to it this week.

I also added to the following existing holdings during the week:

Meta/Facebook

PayPal

Upstart

GoodRx

Progyny

Ozon

Cresco Labs

Green Thumb Industries

Ayr Wellness

My cash position now sits at 10.6% of holdings.

Thanks Brad ! Have your already written about $GRA ?

Thanks Brad! I look forward to your weekly summaries!!!