News of the Week (January 31 - February 4)

Match Group; Meta Platforms; PayPal Holdings; Penn National Gaming; SoFi Technologies; The Trade Desk; The Boeing Company; Teladoc Health; Ozon; Cannabis News; My Activity

1. Match Group (MTCH) — New Position + Earnings Review

I plan to start a position in Match Group on Monday. I will publish a deep dive detailing the investment case later this year, but I wanted to provide a brief synopsis of why I’m bullish.

a. The Industry Basics:

Online dating revenue CAGR of 12.7% from 2015-2020 will accelerate to 13.1% through 2025.

36% of adults use dating apps vs. 29% YoY and 11% in 2013 per Pew Research.

50% of Gen Z and Millennials feel positively about online dating vs. 30% for Baby Boomers.

Still, just 13% of relationships begin online.

b. A Market Leader:

Match owns 4/7 of the most popular dating apps globally — with 47% market share.

Match owns 5/7 of the most popular U.S. dating apps — with 72% market share.

I generally try to take the terms like “first mover advantage with a large grain of salt — but in Match Group’s case I believe the description is accurate. The most important piece of attracting people to a dating site over others is size of community. It’s more fun when we can swipe through hundreds of eligible candidates rather than just 5 or 10 at a time for smaller alternatives. Match Group’s services give its consumers more at-bats — or tries — to find someone special than do other sites. This is key. The more people there, the more people join; it’s a classic network effect in action.

c. What’s Next For Tinder?

Geographic Focus:

The Asia Pacific + (APAC+) region continues to rapidly grow. It now represents 20% of Match Group sales vs. 11% in 2017 and is the fastest growing company geography.

APAC — encouragingly — has been shown to offer a similar Revenue Per Person (RPP) opportunity for Match Group compared to the Americas.

Explore page:

This is a new page for quirky, unique ways to meet people with more, filter-based user control. Tinder is fixated on creating deeper “social and interactive experiences” to boost activity levels and RPP. The explore page is a big piece of this:

This boosted engagement/swipes/pay-rates and has closed the female monetization gap that Tinder deals with vs. Match’s other apps today.

Plus One is an example of a new feature allowing users to find a wedding date.

Tinder Coins:

This is Tinder’s in-app currency that is now live in 12 markets. The coins are used to trade virtual goods, augment self-expression and to buy a la carte features like Boosts.

This will be key to Match Group’s Metaverse ambitions such as “Single Town” (a virtual dating/socializing world for singles).

Users are rewarded coins for being active users (to incentivize more traffic).

One of the aims of the coin is to “unbundle its subscription features ”so people can pay for services on a per usage rather than per month/year basis. This should boost conversion rates of free users.

As a note, app store fees will rise for Match Group as a % of sales in 2022 as Hinge download growth explodes because that app is predominately Apple/iOS based. Apple has not yet lowered its fee but is being pressured to do so across the globe.

d. What’s Next For its Other Products?

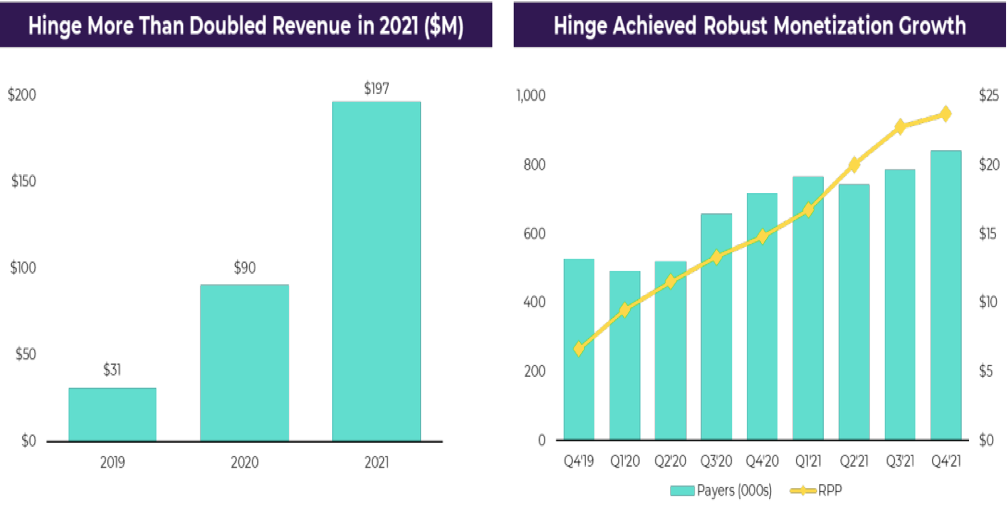

Match Group’s Hinge is growing at a triple digit revenue growth rate with an extraordinarily bright future. Impressively, the app has recently begun to outpace Bumble — Match Group’s best competition — for download and gross revenue data according to App Annie statistics. The industry is shifting to Tinder and Hinge as the most popular 2 options. This is fantastic news for Match Group (sorry Bumble).

“Hinge is well on its way to becoming the second largest global dating app within a few years’ time and is now focusing on non-English speaking market expansion.” — CEO Shar Dubey

The Hyperconnect Acquisition:

In 2021, Match bought a South Korean firm called Hyperconnect for $1.73 billion (half cash, half stock) to accelerate its expansion into entertainment & social discovery.

The main app — Azar

This is the largest live personal video/audio app on Planet Earth.

Allows users to rapidly and enjoyably connect with strangers, friends, celebrities and societies from around the world with real time voice and text translation to deepen connections.

Azar generated 540 million downloads since its launch in 2014. Notably, the primary monetization engine here is buying a la carte items via its in-app currency — this equates to 90% of its sales and is where Match Group is heading for most of its apps.

Other app — Hakuna

This is similar to Azar but allows for larger groups to stream audio/video.

Enables free toggling between video and radio mode to allow streamers to go live in remote settings with very little service.

Like Azar, the monetization is based on virtual gifting with in-app currency but there’s also a subscription tier offering monthly currency allowances and other perks. Hakuna launched in 2019 and already has 23 million downloads — it has a far higher monetization ceiling vs. Azar via multiple relevant revenue streams.

Hyperconnect is the perfect geographical and demographical complement to Match Group. 80% of its sales come from Asia vs. just roughly 20% for Match Group overall (at the time of the deal) and nearly 75% of its users are under the age of 30. The team also comes with 200 highly capable software engineers to deepen Match’s bench.

What else Match gets out of Hyperconnect:

Match will use Hyperconnect’s video capabilities to integrate the technology across most of its brands by 2023.

Match will leverage Hyperconnect’s “award-winning, on-device AI” to augment its privacy, content moderation and security capabilities. As the market share leader in a somewhat promiscuous industry such as this one, protecting users whenever and wherever possible is imperative to minimize legal liability.

Volatile Macroeconomic backdrop:

The impact of the pandemic on Match Group’s business was mixed. Lockdowns did raise screen time which led to more activity, messaging and conversation for apps. Specifically, 71% of consumers using dating apps did so more amid Covid-19 vs. before the pandemic struck. At the same time, propensity to spend sharply fell as meet-ups became less feasible (see image below). This also contributed to that flattish 2021 growth for Hyperconnect due to South Korea and Japan’s slower pandemic recovery curve. The pandemic ebbing is a net positive for Match.

e. Leadership:

The company has been led by CEO Shar Dubey since Mandy Ginsberg stepped down in 2020. Dubey started with the company more than 15 years ago where she climbed all the way up the ladder to COO in 2017 and now CEO. She has also served as the Chief Product Officer for The Princeton Review and an EVP at Tutor.com.

Gary Swidler has been the company’s CFO since 2015 and COO since 2020. Before joining Match, he was a Managing Director at Bank of America for 18 years.

f. Financials/Earnings Review

Demand:

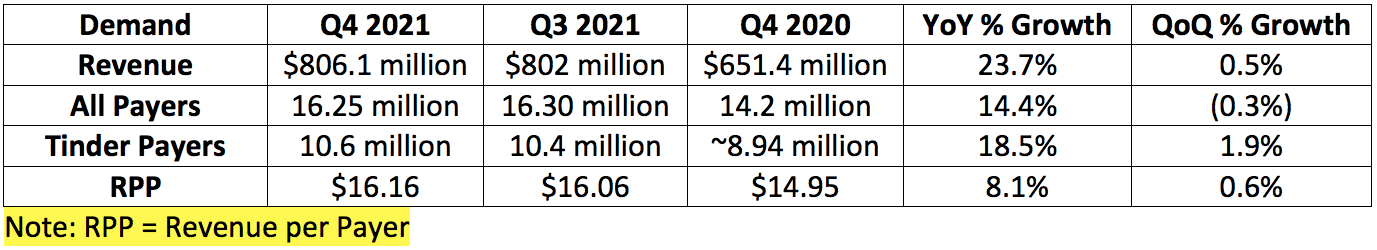

Match Group guided to a midpoint of $815 million in Q4 2021 sales and analysts were expecting $821 million. Match Group posted $806.1 million missing its guide by 1% and analyst estimates by 1.8%. This included a $9 million unanticipated foreign exchange (FX) impact via a strengthening dollar. Without this impact, revenue would have beaten internal expectations by 0.1% and missed analyst expectations by 0.7%.

Quick notes on growth:

Sequential payer growth between Q3 and Q4 is generally light as it’s Match Group’s slowest time of the year.

Payer growth was powered by 36% growth in the APAC+ region.

Established brands returned to positive revenue growth in 2021 with 5% YoY expansion.

Emerging brands — powered by Hinge — grew by 91% in 2021 vs. 2020.

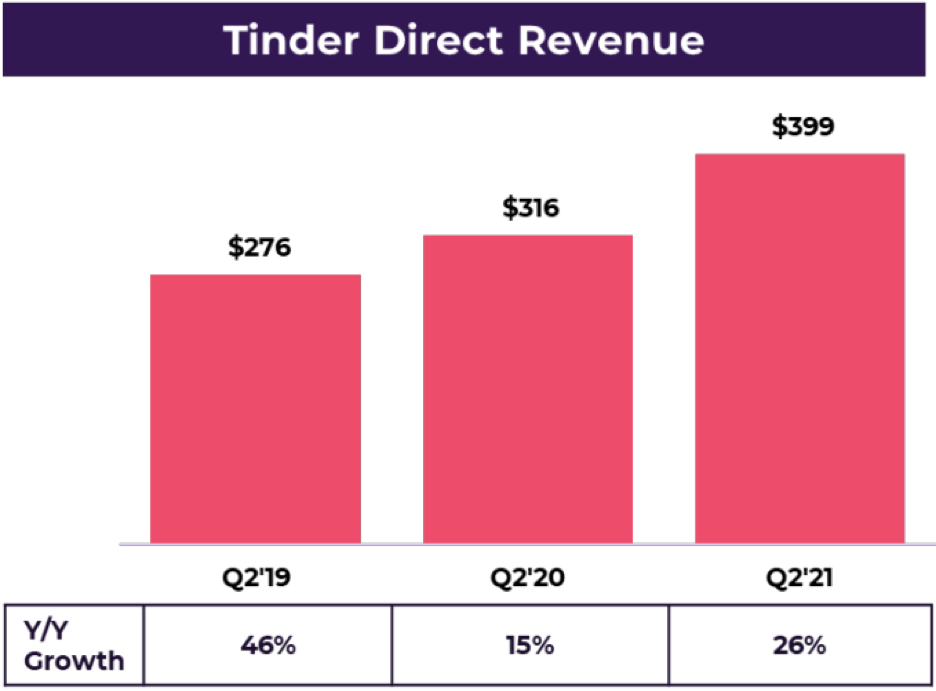

For 2021 as a whole, Tinder Direct generated $1.7 billion in revenue vs. $1.4 billion for 2020. This represents roughly 22% growth vs. 18% growth between 2019-2020. Match had guided to 20% growth for Tinder in 2021.

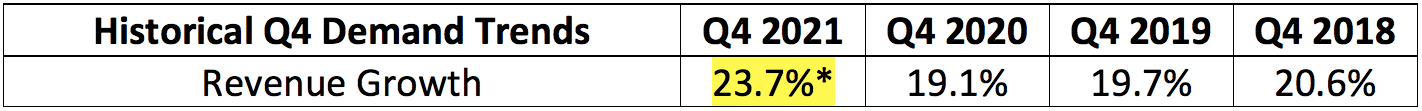

*This includes inorganic growth from the Hyperconnect acquisition. Without it, revenue would have grown at a rate of 16.1% this quarter.*

Note that Match Group changed disclosures in recent years making most Q4 demand growth trends irrelevant. Transitioning from ARPU to RPP and subscribers to payers were the 2 sources of this change which is why neither are included in historical Q4 demand growth trends.

Profitability:

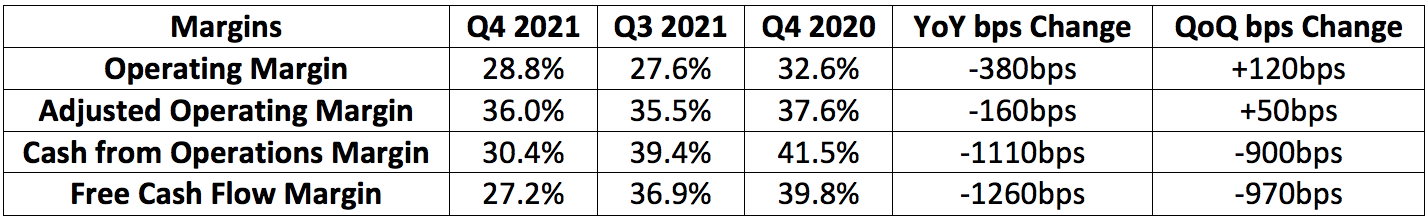

Match Group guided to $287.5 million in adjusted EBITDA (now called adjusted operating margin) which would have represented a 35.3% margin. Analysts expected the same. It posted a 36.0% margin beating estimates by 70 basis points.

Analysts expected $0.60 in earnings per share. Match Group lost $0.48 per share due entirely to a non-recurring $441 million legal settlement to former Tinder employees/founder. This fee will be funded from its cash on hand. Without this charge, Match Group would have earned roughly $0.90 per share based on a share count of 283 million.

2022 Annual Guidance:

Match Group expects a midpoint of 17.5% revenue growth (15-20%) for 2022. This implies sales of roughly $3.5 billion. Analysts were expecting $3.63 billion so this missed expectations by 3.7%.

Its previous guidance called for 20% growth including the Hyperconnect acquisition meaning this was a reduction which was driven by an additional $60 million in incremental FX headwinds added to the guide.

Match Group continues to expect 0.5%-1.0% margin profile performance driven by a reduction in Google app fees and legal costs. With Hyperconnect — margins should be similar YoY.

“The slightly more conservative outlook reflects 2 macro headwinds: FX and Omicron. Our current outlook reflects an additional 3% of negative impact on growth vs. the previous outlook — 2% from FX and 1% from the pandemic. We’re not assuming a huge summer of love right now in our outlook that would certainly provide upside or at least the ability to reach the higher ends of the outlook.” — CFO Gary Swidler

2022 Q1 2022 Guidance:

Match Group expects a midpoint of $795 million in sales ($790-$800 million) vs. analyst expectations of $837 million.

Match Group expects a midpoint of $262.5 million in adjusted operating income ($260-$265 million). Analysts were expecting $288 million.

f. Shareholder Letter + Conference Call Notes

Match Group continues to experience pandemic headwinds:

“We experienced continuing COVID impacts — especially in certain markets like Japan — and more recently due to Omicron which reduced mobility globally in early December… we pulled back on marketing spend, which increased only 3% YoY, as we maintained ROI discipline given the macro climate.” — CFO Gary Swidler

For example, Japan has had 3 states of emergency since 2020 ended which all hit mobility rates and propensity to spend on dating produces. The Omicron outbreak has Japan back into a less restrictive but still serious lockdown. Personal mobility in so many of Match’s markets are still being impacted by the pandemic. Match Group’s marketing engine also relies on word-of-mouth as a core driver and less socialization diminishes this channel for user growth.

“We’ve seen periodic uptakes in new users when COVID is not dominating the news cycle. But by and large, that has not fully recovered in a sustained way. For other categories, the pandemic pulled forward new demand. For us, non-users breaking into the category even at a normal cadence is still to come.” — CEO Shar Dubey

Tinder:

Daily swipe and messaging activity is near all-time highs as of the beginning of 2022. This is probably our best indication of future company performance.

“To date, the level of adoption of Explore has exceeded our expectations with 2/3 of active users engaging with it.” — CEO Shar Dubey

Tinder Platinum (most expensive subscription) now has over 1 million subscribers and represents 13% of total Tinder subscribers.

Hinge’s Incredible Rise:

“Hinge downloads saw a material acceleration in Q4 2021 leading to a great start for 2022. Third party data (the same App Annie data I cited) now shows that Hinge is the 2nd most downloaded dating app in several key English-speaking markets — including the UK — during this critical peak season since New Year’s Day.” — Match Group Shareholder Letter

Hinge plans to launch in certain European countries next quarter and is set to grow sales by 70%+ to at least $334 million for 2022. It now has 850,000 payers.

Hyperconnect:

“Both Azar and Hakuna saw better December performance vs. preceding months. We’re stabilizing the core business and plan to return them to growth later this year.” — CEO Shar Dubey

Match Group brands launching new features with Hyperconnect’s IP:

Meetic opened online video cafes.

Match is offering its own 1 on 1 video chat (was using a 3rd party service before).

OK Cupid is testing live video streaming.

Turkey is a large market for Hyperconnect and so its hyper-inflationary environment did weigh on its $50 million quarterly revenue result.

g. Conclusion and my take

There’s much more to cover and share about this fascinating innovator in the dating space. My Deep Dive on the company later in the year will discuss everything in more detail. For now, I wanted to give you all a sense of why I am bullish.

The quarter was underwhelming but not alarming. The company continues to be challenged by macroeconomic headwinds that will fade away at some point. When they do, we will be left with a dominate market share leader poised for profitable, accelerating long term compounding.

2. Meta Platforms (META) — Earnings Review

“If last year was about putting a stake in the ground for where we’re heading, this year will be about executing.” — Founder/CEO Mark Zuckerberg

Meta is changing its ticker symbol from FB to META by the summer of this year.

a. Demand

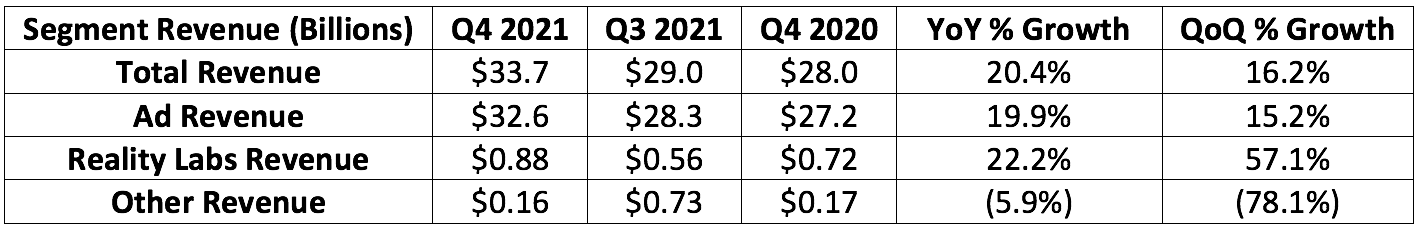

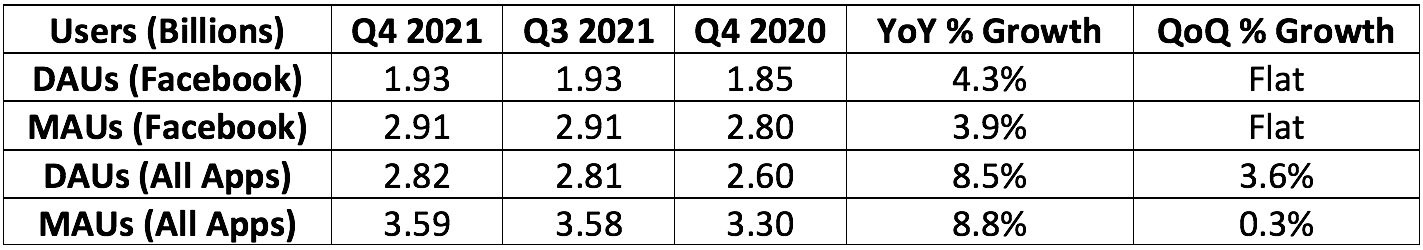

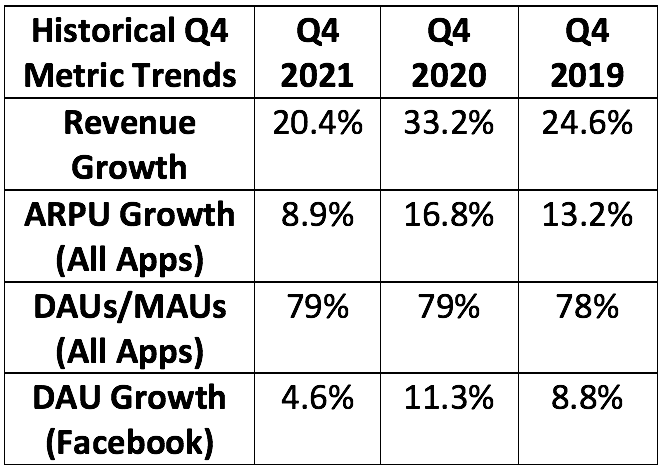

Meta guided to a midpoint of $32.75 billion in sales for the quarter ($31.5-$34 billion). Analysts were looking for $33.4 billion in sales. It posted $33.7 billion beating its midpoint by 2.9% and analyst estimates by 0.9%. The company faced a $307 million FX headwind.

Ad impressions across the Family of Apps rose 13% YoY this quarter and 10% YoY for 2021 as a whole. This was thanks to APAC and rest of world with North America impressions actually shrinking year over year.

Note that Q4 is a seasonally strong period for ad demand. This aided sequential growth.

Last quarter, ad revenue shrank sequentially as Apple’s ATT and IDFA changes impacted marketing conversions and reporting abilities. COO Sheryl Sandberg told us that Facebook would address 50%+ of the underreporting by 2022.

b. Profitability

Analysts looking for $3.84 in earnings per share. Meta posted $3.67 missing expectations by $0.17. Note that year over year net income growth comparisons here are impacted by an effective tax rate of 19% in the quarter vs. 14% in the YoY period.

Price per ad rose 6% YoY this quarter and 24% YoY for 2021 as a whole.

Meta bought back $19.2 billion worth of stock during the quarter and $44.8 billion (more than 5% of its enterprise value) in 2021. The company has $48 billion in cash and equivalents on its balance sheet.

We’ve been told over and over again that margins would compress as Meta spends heavily on new growth projects. This is no surprise.

Segment operating margins:

47.2% Family of Apps operating margin.

-377% Reality Labs operating margin

c. Guidance Updates

Q1 2022 Guide:

Meta guided to a midpoint of $28 billion in revenue which missed expectations of $30.3 billion by 7.6%. CFO David Wehner attributed this weakness to the following:

Increased competition impacting ad impressions.

An engagement shift to Reels which monetizes less compellingly than other content forms.

Comping vs. a period where Apple’s IDFA changes weren’t yet live.

The aforementioned input cost inflation.

A strong dollar.

2022 Annual Guide:

Meta expects to incur $90-$95 billion in total expenses vs. previous guidance of $91-$97 billion.

Its CapEx guide remains at $29-$34 billion in CapEx for 2022 (71% growth at midpoint).

d. Zuckerberg Conference Call Notes

On 2 business headwinds impacting Facebook’s Results:

Competition — “People have a lot of choices for how they want to spend their time. Apps like TikTok are growing very quickly. This is why our focus on Reels is so important over the long term.”

Content transition — Meta is moving to a larger reliance on short form video content for monetization. Places like the News Feed that are being cannibalized from this are better monetization vehicles at this point in time.

“As a result of these 2 things and also our focus on serving young adults over optimizing overall engagement — we’re going to continue to see some pressure on impression growth in the near term.”

“While video has historically been slow to monetize, we believe that over time, short-form video will monetize more like feed or Stories than Watch.”

Some Major Investment Priorities of 2022:

Reels:

“Reels is now our fastest growing content format by far and the biggest engagement growth contributor on Instagram. It’s growing very quickly on Facebook too.”

Ads:

“With Apples iOS changes and new Europe regulation, there’s a clear trend of less data available to deliver personalized ads.”

The iOS comp headwinds will continue through the first half of the year when YoY comps will then normalize.

AI:

Zuckerberg reminded us of Meta’s “AI Research SuperCluster” which Meta believes “will be the world’s fastest supercomputer once it is complete later this year.”

“This will enable new AI models that can learn from trillions of examples which will be key to the experience we are building.”

Metaverse:

Oculus Quest store content sales have eclipsed $1 billion.

It is aiming to release a “high-end” VR headset in 2022.

e. COO Sheryl Sandberg and CFO Dave Wehner Conference Call Notes

Ads:

“Efforts to close the iOS web conversion underreporting gap and creating tools to drive better ad insights will help mitigate some Apple targeting challenges but we expect targeting headwinds to moderately increase from Apple and regulatory changes through 2022.” — COO Sheryl Sandberg

Notice a theme?

It sounds like Meta has addressed a lot of the ad-conversion underreporting from the iOS changes but the targeting impact will take years to counteract via investments in AI/ML to enable doing more with less data.

A data pricing plan increase impacting much of India slowed advertising growth in that important market for Meta during the quarter.

Reels & Competition:

“I want to emphasize that while we’re going through a transition, we’re optimistic. We expect Reels monetization to improve over time. We’ve made successful transitions before like with web to mobile and from feed to stories. We have a playbook here.” — COO Sheryl Sandberg

“There are a lot of the characteristics of reels that make it quite similar to the content monetization transitions we’ve gone through before. For now, there’s relatively few ads on Reels today.” — CFO Dave Wehner

“We believe competitive services are negatively impacting growth — particularly with younger audiences.” — CFO Dave Wehner

g. My Take

This was the worst quarter I’ve seen for Facebook/Meta since I became a shareholder roughly 5 years ago. The fact that Mark, Sheryl and Dave all called out competition (TikTok) as a pressing threat was concerning to me and the dip is warranted. Many think this theme was to weaken monopolistic arguments against Meta — but still — there are now new questions and concerns I have related to its ability to use its family of apps as a long term cash cow to feed the new growth projects. I have 0 interest in selling any shares at this point in time — but I’m also in no hurry to add to my stake.

3. PayPal Holdings (PYPL) — Earnings Review

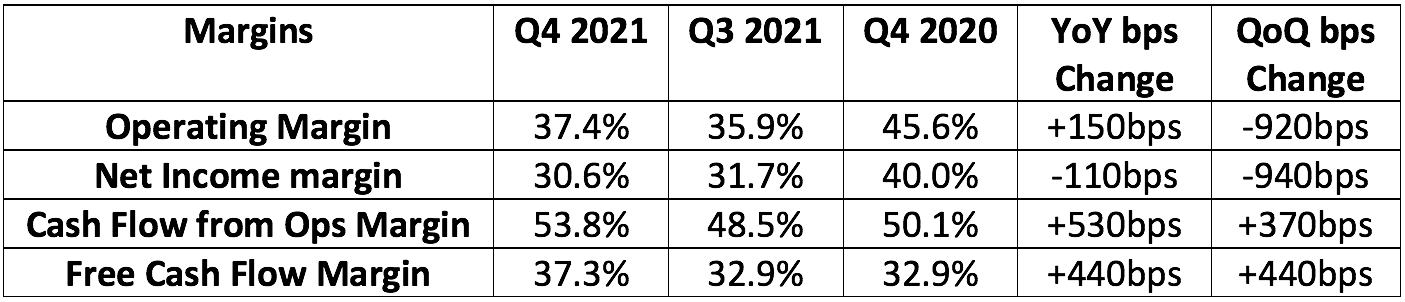

a. Demand

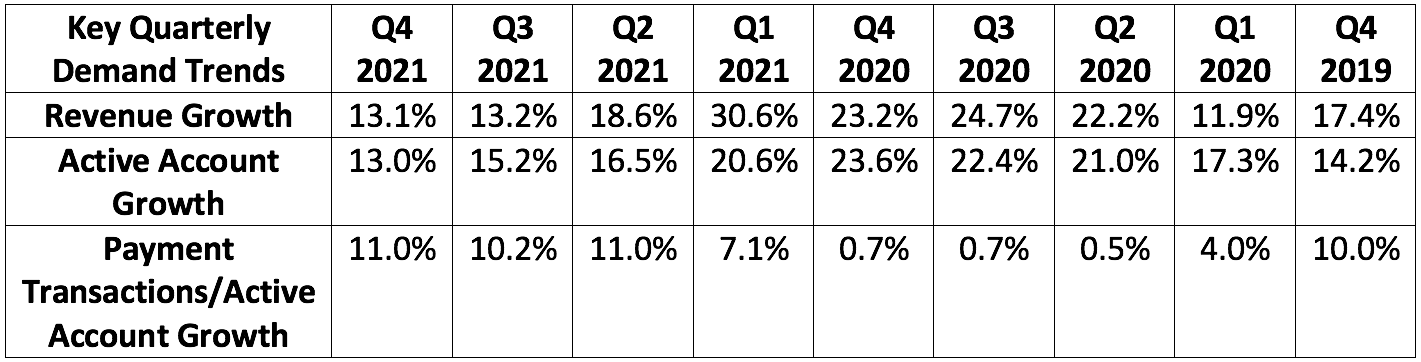

Analysts and PayPal were both looking for $6.9 billion in sales and it posted $6.92 billion — barely beating expectations. This represents 13% YoY growth and 22% growth ex-eBay business.

Note that PayPal added 9.8 million new accounts but roughly 1/3 of those were from the inorganic Paidy contribution. This light account-add number was due to a 4.5 million account adjustment to exclude illegitimate accounts previously included. Without the event, PayPal would have added 14.3 million net new accounts vs. expectations of 12.9 million. It added 13.3 million accounts last quarter.

NOTE: The rising take rate represents the reversing of an 8 quarter take rate compression trend. Transaction loss rate also improved 1 basis point to 0.09% which was the best in its history. This improvement was attributed to Venmo.

2021 annual demand performance notes:

33% TPV growth and 38% growth ex eBay ($1.25 trillion in total).

18% 2021 revenue growth and 29% revenue growth ex eBay.

eBay = 3% of sales vs. 10% YoY.

TPV within non-eBay Merchant Services grew by 31% last Q with eBay Marketplace volume shrinking 45% as the operating agreement ended.

44% Venmo TPV growth.

Added 45.7 million organic net new accounts vs. 62.5 million in the pandemic-boosted 2020 period.

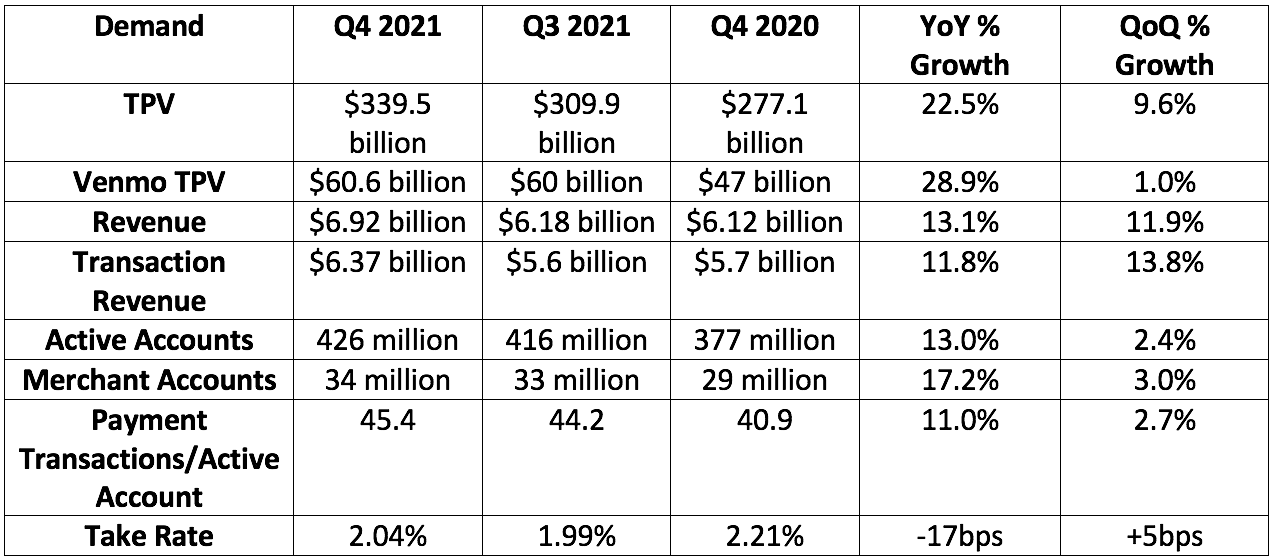

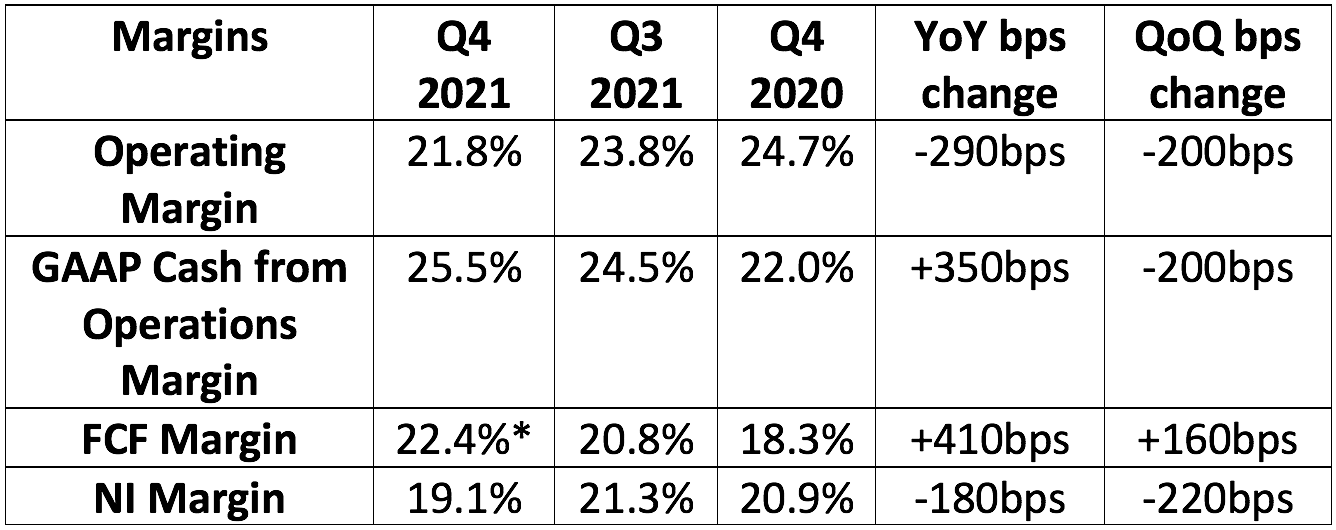

b. Profitability

Analysts and PayPal guided to roughly $1.12 in earnings per share (EPS). PayPal posted $1.11 missing expectations by 0.8%.

Cash flow margins benefitted from a “favorable change in working capital” which is why they outpaced operating margin more noticeably in this quarter vs. previous periods.

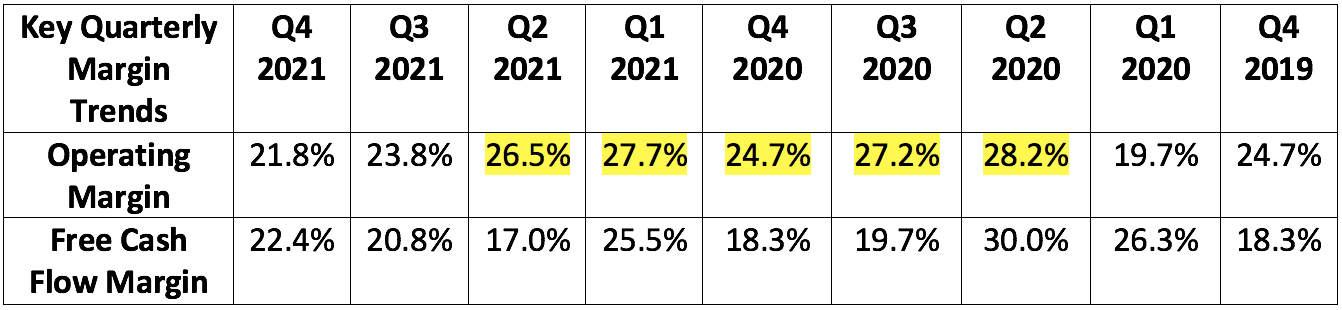

Note that PayPal’s revenues are driven by mainly online transaction volume which benefits from economies of scale. Not only was the pandemic a large revenue tailwind for the firm — but an operating margin tailwind as well as the company got more out of its mixed cost base. This idea is highlighted in yellow in the chart below. Free cash flow margins didn’t show as strong of a correlation due to unique non-cash items added back in various quarters:

PayPal has $16.3 billion in cash, equivalents and liquid investments with $9 billion in long term debt and hefty free cash flow generation. During the quarter, PayPal bought back approximately $1.5 billion in stock and $3.4 billion for 20221 as a whole.

c. Q4 Operational Highlights

New Relationships:

DoorDash deepened its PayPal relationship after the checkout product proved to lower friction and boost volumes. DoorDash moved some card processing to PayPal’s platform.

PayPal is now available through Instacart, Roku and Salesforce at checkout.

Gap added PayPal’ Buy Now Pay Later (BNPL) option.

Italy added as a new payment option for bill/tuition/tax paying.

New Launches:

Launched BNPL for Wix merchants — BNPL volumes during Holiday season were 4X that of 2020 for PayPal overall. “We continue to see rapid BNPL adoption with a $13 billion TPV run rate growing 325% YoY.” — CEO Dan Schulman

Launched its Zettle Hardware in the USA.

Launched checkout with crypto on PayPal’s new digital wallet.

New PayPal Digital Wallet:

Debuted PayPal’s new digital wallet globally.

Merchant leads are 7x higher than the previous product version.

Mobile app users have 25% lower churn vs. the rest of PayPal’s checkout suite.

Users of this (and BNPL) have been shown to foster a 2X revenue opportunity for PayPal.

The product fostered a 40% spike in first time PayPal crypto users.

Acquisitions like Honey (deal discovery/shopping tools) have been fully integrated into the new PayPal app.

The app has boosted offline usage to push PayPal closer to its omni-channel vision.

The high yield savings product (released with Synchrony Bank) is almost fully live. The waiting list here is “long.”

Venmo:

The Credit Card is live.

Check cashing is live.

Users can now Buy, hold, sell Crypto.

Venmo Pay through Amazon has yet to go live — so the revenue opportunity is entirely ahead of the company.

Pay with Venmo will soon debut with Starbucks, Salesforce and DoorDash as well.

Venmo generated $250 million in Q4 2021 revenue ($900 million for 2021) which grew 80% YoY. Venmo is expected to grow revenues by 50% in 2022 to reach $1.35 billion in sales. It has over 83 million users in the United States and has near-future plans to expand overseas.

“Eventually, you’re going to see Venmo have a lot of the capabilities the PayPal super app has because that consumer base loves Venmo, and wants to live more of their financial life on the app.” — CEO Dan Schulman

Path to omnipresence:

92K merchants offer PayPal’s upstream presentment (offering of payment options during the shopping process) vs. 65K sequentially. This essentially means that it’s participating in the earlier stages of shopping pre-purchase.

Considering 52% of online shoppers are more likely to buy with PayPal’s brand visible — this is key to merchant conversion and has been shown to directly boost sales by 4-6%+ for established brands. This is the power of PayPal’s 2-sided network and how merchants can benefit.

“Our average share of checkout among the top merchants also continues to increase.” — CEO Dan Schulman

“In some studies, it’s suggested that PayPal is second only to debit in terms of preference from consumers.” — CFO John Rainey

d. Guide

Q1 2022:

Looking for Revenues to grow 6% YoY and 14% ex-eBay. This implies revenue of roughly $6.4 billion which missed expectations of $6.76 billion by 5%.

Looking for $0.87 in earnings per share which missed expectations by $0.29.

2022 Guide:

20.5% TPV growth.

16% revenue growth and 20% ex-eBay — implies $29.5 billion in sales vs. expectations of $30 billion.

$4.68 in earnings vs. expectations of $5.26 in 2022 EPS. This includes a 12% hit from reserve releases and lower taxes in 2021. Without the hit, guidance here would have been in line.

$6 billion in free cash vs. $5.4 billion in 2021 (evidence that net income flatlining is non-cash charge-related).

Operating margin of 23% — impacted by lapping a 1.2% credit reserve benefit.

For 2022, PayPal expects to generate a mean of 17.5 million net new accounts. This is on the heels of its 2 best years as a company for account additions and is despite its new aim to “let 15-20 million minimally engaged users naturally roll off this quarter” to focus on higher ROI customers… “Over time, we feel like our net new accounts will revert back to the 30 to 40 million range.” — CEO Dan Schulman

PayPal expects the headwind from eBay shifting some of its PayPal payment contracts to managed options to erode through 2022. This is why growth in Q1 will be lackluster with acceleration thereafter. This — along with Venmo, PayPal and Merchant initiatives — should lead to a re-acceleration. Stimulus wearing off is also creating a payment volume headwind which is showing up most dramatically in the comps right now.

e. Dan Schulman Conference Call Notes

On the short-term eBay headwind:

“eBay’s migration to managed payments happened faster than we anticipated which put $1.4 billion worth of pressure on our top line along with other exogenous factors that impacted our results. It will also be a $400 million headwind next quarter and $200 million for the second quarter.”

“In the 2nd half of the year, I look forward to being able to stop adjusting for eBay and let the strength of our results speak for themselves. Our growth ex-eBay has been remarkably stable above 20%.”

“Despite lapping some of the strongest quarters of growth in our history — we once again grew market share.”

On supply chains and cross border:

“Supply chain issues disproportionately impacted our cross-border volumes and our smaller merchants. Inflationary pressures impacted spending within certain user base segments and pandemic variants cut travel and event bookings. The end of government stimulus had an impact as well.”

Lots of excuses — but they’re warranted in my view.

Interestingly, cross border commerce actually fell from 17% of TPV in Q4 2020 to 14% this quarter

Holiday e-commerce growth rates for the industry lagged expectations and December adjusted retail sales and consumer spending both sequentially shrank. All of this points to these underwhelming results being industry, not PayPal, specific.

On 2022:

“2022 is going to be a year of transformation and investment as we transition from outsized, lockdown-driven growth and finish lapping eBay’s managed payments transition. Our vision is to become an essential consumer financial super app across payments, financial services and shopping tools.”

PayPal launched more new products in the last 12 months than in any other year in its history.

“We will drive increased operating leverage in 2022 to enter 2023 with revenues and EPS growing at over 20%.”

On a changing net new account focus:

“We are shifting our emphasis more toward engagement and to driving higher-value accounts. These consumers drive growth at much higher margins and ROI. Over time, we still expect net new accounts to be in line with pre-pandemic levels with rising engagement.”

On Omni-channel checkout and cross-selling:

“We expanded our checkout capabilities to help consumers pay on their own terms — whether in-store, with QR code, over time or with emerging funding sources like crypto and rewards… We now have some of the highest authorization rates in our history.”

f. John Rainey Conference Call Notes:

On success and the 2022 outlook:

“Side by side — given the choice of PayPal and other wallets — more than 50% of the time people choose PayPal… Over the last 2 years we’ve consistently grown volumes well ahead of the industry.” (specifically it has taken 200 basis points of incremental merchant market share since 2020)

“Our digital wallet adoption is several times higher than the next is and our merchant acceptance leads all other checkout buttons by an even larger margin.”

“We are taking a more conservative outlook for 2022 revenue and earnings. We believe we will realize the revenue and earnings growth rates in the out-years of the period contemplated in our medium-term guidance” (20% revenue growth and 22% earnings growth).

On slower net new account growth:

3 Factors impacting Q4 2021 net new account growth:

Least important — supply chain issues muting e-commerce growth “and a pullback in spending by lower income consumers (stimulus helped them the most) that has continued into the first quarter.”

More important — changing customer acquisition strategy. It reduced campaigns with aggressive incentives used to motivate lower value accounts to join.

Most important — disqualified 4.5 million accounts that were no longer active or not legitimate. There were fraudsters taking advantage of the incentive-laced campaigns they were running. This was a misstep.

PayPal REMOVED its medium-term 750 million account goal set last year.

“Moving forward, we will continue to grow our users, but our focus will be on sustainable growth and driving engagement. To be very clear, this is a choice on our part. We could increase our spend and accelerate our net new active trajectory but we believe there are better ways to achieve our financial goals… That said, over the next 12 months as these less engaged customers naturally roll off, it will MATERIALLY reduce our quarterly net adds.”

The vast majority of PayPal’s revenue comes from a third of its users. This is not a subscription business where customer adds are correlated with revenue growth. Engagement is a more powerful growth driver and will be the core focus going forward.

PayPal will begin disclosing ARPU metrics in the coming months along with monthly ACTIVE unique users.

On the 2022 outlook:

The company is off to a “slower start” to 2022 than anticipated due to inflationary and supply chain pressures, personal consumption and more. This led to the company reducing its growth guidance for 2022 from 18% to a midpoint of 16%.

“Over the long term, nothing has changed as it relates to our confidence in our business and our expectations for performance beyond 2022.”

g. My Take

The eBay headwind will fade away in the second half of 2022 — and at that time we will also lap PayPal’s toughest growth comps. When that combination of events happens, metrics should re-accelerate and the narrative of “PayPal being done” will (in my view) abate. Until then, the waters could be choppy as this “conservative” 2022 guide was underwhelming. Based on this, I think I have plenty of time to continue slowly adding to my new stake before growth rates normalize and macroeconomic headwinds ebb. I made a small addition after earnings this week.

With the assets it has in place, its team (which I still fully believe in), balance sheet and forward multiples all make me confident in slowly adding to my position over time. To me, its impressive that — ex-eBay — growth accelerated after a 2020 period in which macro tailwinds were abundant for PayPal. As a reminder, I started PayPal 2 weeks ago with a half position — the position is now roughly 60% full.

4. Penn National Gaming (PENN) — Earnings Review

Penn National Gaming authorized a 3-year share repurchase program of $750 million which is nearly 10% of the company’s outstanding equity value.

a. Demand

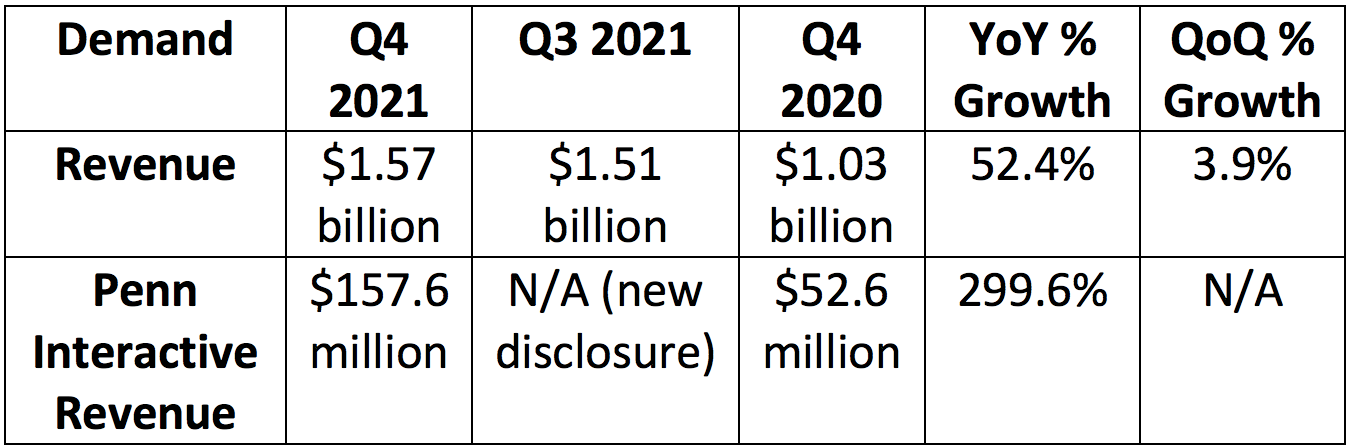

Analysts were expecting $1.51 billion in quarterly sales. Penn posted $1.57 billion beating expectations by 4.0%.

YoY revenue growth for Penn as a whole was aided by extremely easy Q4 2020 comps via the pandemic.

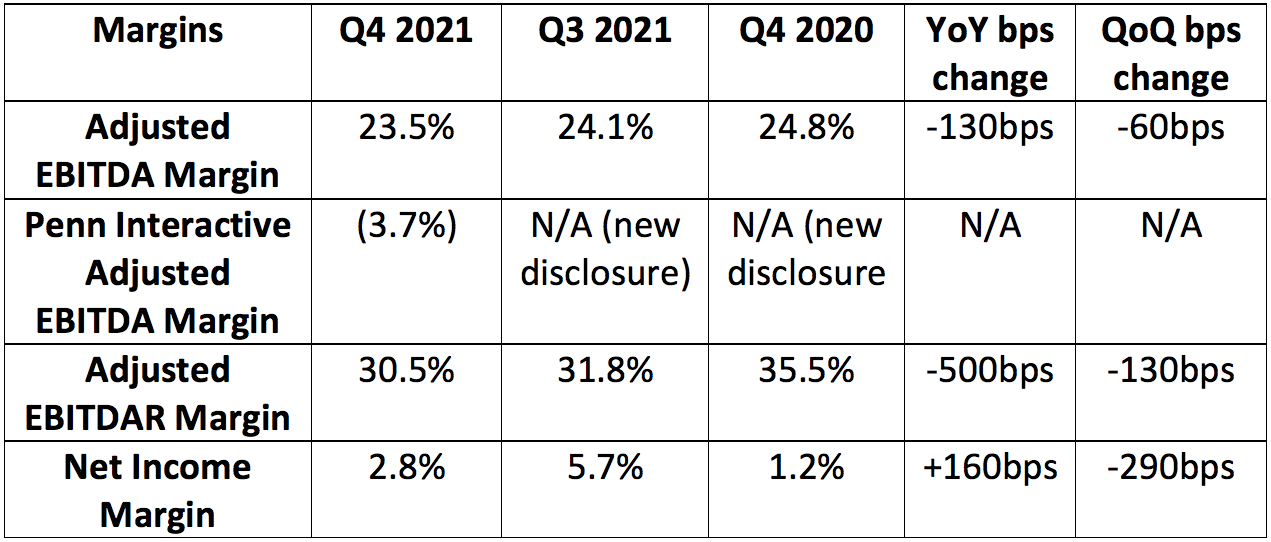

b. Profitability

Penn was expected to earn $0.52 per share in net income for the quarter. It earned $0.26, missing expectations by $0.26.

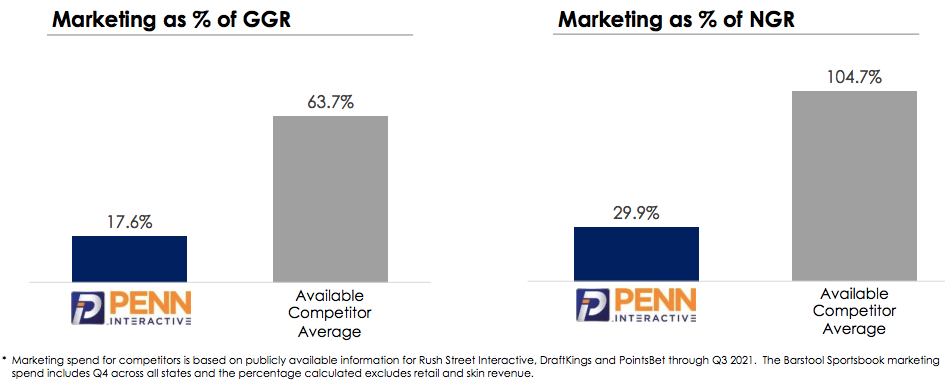

As an aside, I’m elated to see Penn split out its interactive segment. The Barstool Sportsbook is far more efficient than any other competitor. This allows the company to showcase that reality with tripling YoY revenue and near-breakeven EBITDA. No other Sportsbook is as close to breakeven. This is the power of organically leveraging Barstool’s massive cult of followers.

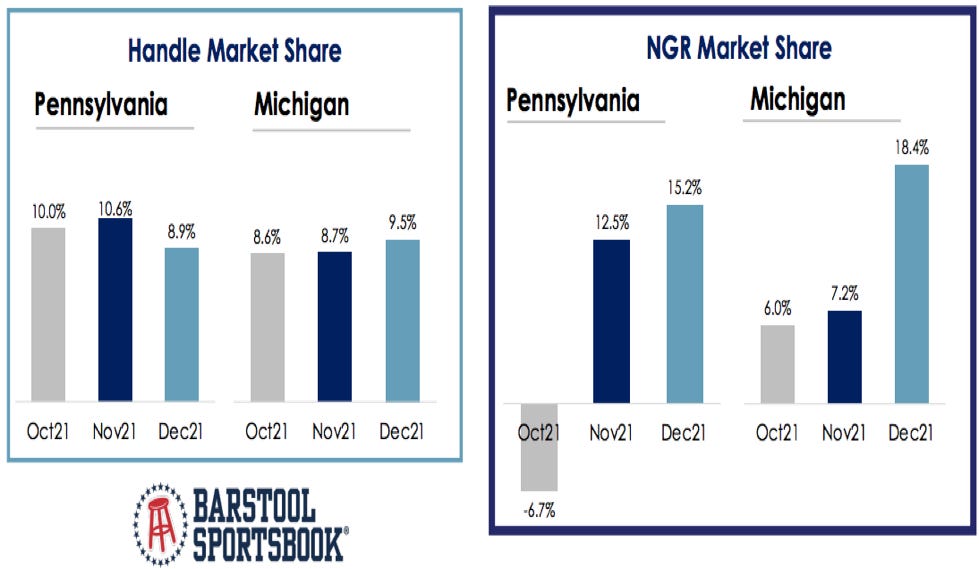

Evidence of Barstool’s value can be seen below in the sportsbook product’s net gaming revenue market share in states like Pennsylvania and Michigan far outpacing its handle (bet) market share. This is because Penn doesn’t need to spend as much to acquire new business (which can be seen in the other image below). Barstool’s followers are immensely loyal.

c. Guidance:

For 2022, Penn guided to the following:

A midpoint of $6.23 billion in sales — exactly in-line with expectations.

An adjusted EBITDAR margin of 30.5%

d. Barstool, theScore and Penn Interactive:

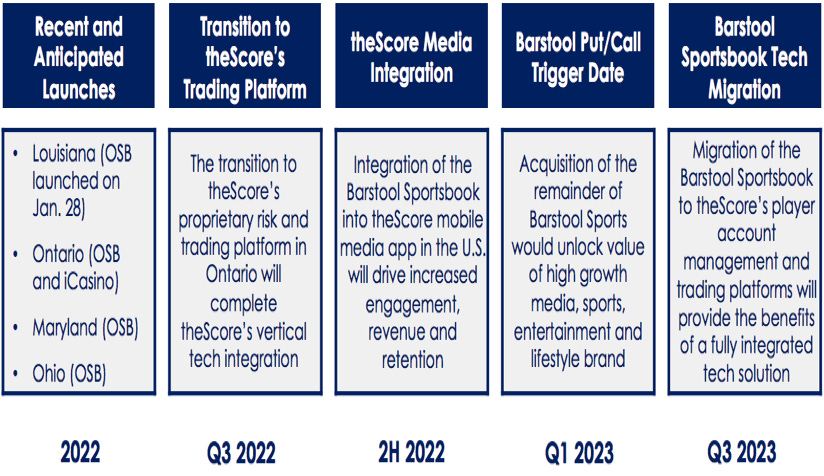

“Our disciplined market approach and growing scale at Penn Interactive set us apart from the competition as we generated a lower-than-expected EBITDA loss despite launching betting operations in 2 new states and a frenzied competitive environment. We now anticipate a lower EBITDA loss ($50 million) vs. our previous outlook ($100 million).” — CEO Jay Snowden

This is a product of Barstool’s clout and also Penn bringing more of its technology stack in-house thanks to its Score Media acquisition. Snowden expects the nascent segment to generate “meaningful EBITDA in 2023.” Penn’s one year return on investment for Barstool sports betting ALONE already sits at 2.2X vs. 1.4X sequentially. The average competitor — via heavy acquisition cost and churn — is still in the negative here.

Barstool’s social media reach exceeds 144 million people — growing at a 25% YoY clip.

The first Barstool-branded sports bar opened near Chicago in January to “strong initial demand.” The second location will soon open in Philly.

“Barstool Sportsbook mobile app saw increased traction across the board during football season. It quickly became a leading operator in New Jersey despite launching years after most peers. Our growth has been fueled by ORGANIC customer acquisition leading to what we believe is the lowest customer acquisition cost and best return on investment timeline in the industry.” — CEO Jay Snowden

Barstool’s brick and mortar sportsbooks are also dominating with its total national share of in-person betting ex-Nevada now up to 12%. Its total brick and mortar handle grew 98% YoY to $775 million and — based on a STRONG hold rate of 11% — it generated $85 million in gross revenue.

Barstool Casino (iGaming) launched its first in-house game. This segment is generating $11.6 million in monthly revenue which has doubled since July 2021.

“In early 2023, we look forward to acquiring the remainder of Barstool Sports to complement theScore’s media presence, brand and audience and to accelerate our transformation into a major entertainment company.” — CEO Jay Snowden

Penn has options to buy another 16%+ of Barstool at the original $450 million valuation. What a deal.

Penn is actively working on integrating the Barstool Sportsbook’s brand and product into Score Media’s app in the US while keeping Score as the lead Canadian brand. The two products should be fully integrated sometime in 2023.

Visualizing Penn Interactive’s 2 year plan:

Penn now runs sports betting in 12 states and iCasino in 4 of them. It plans to launch in Ontario with Score’s number one app ranking and in Maryland and Ohio with Barstool in 2022.

theScore grew revenues by 32% YoY for the quarter with 7% MAU growth comping vs. an extremely tough period. App opens are up 22% YoY as well.

“We will begin to promote theScore app to our 25 million loyalty program members.” — CEO Jay Snowden

e. Brick and Mortar

“We saw some Omicron-related weakness in December which abated in late January.” — CEO Jay Snowden

“The company believes that the EBITDAR flow-through achieved in the second half of 2021 is sustainable for the retail business.” — CEO Jay Snowden

Penn opened its 4th Pennsylvania casino during the quarter — an hour away from Philly. Thus far, 80% of the casino’s business has been generated by NEW customers.

The loyalty program app — MyChoice — grew downloads by 23% YoY during the quarter.

f. Balance sheet

The company has $2.5 billion in total liquidity with $1.9 billion in cash. Net debt sits at $886 million vs. $45.2 million sequentially due to paying for theScore acquisition. The company’s lease adjusted net leverage ratio sits at a record low of 4.1X vs. 7.0X YoY.

g. theScore Bet News

Thursday, theScore Bet (Score’s sportsbook) became one of the first products in Ontario to receive “internet gaming operator certificate of registration from the Alcohol and Gaming Commission of Ontario.”

“We are beyond excited to be able to bring theScore Bet to our home market on April 4th. Finally, the countdown to launch has begun.” — theScore CEO John Levy

As a reminder, theScore is the #1 sports app in Canada. This book should be poised to dominate within Ontario and its roughly 15 million people.

g. My Take

The earnings miss is never ideal but the strong top line number and encouraging signs from Penn’s Barstool assets make me more excited than a quarterly profit miss makes me nervous. I continue to think this is the best-positioned omni-channel player in all of sports gambling and entertainment.

2022 will be a year of heavy investment to integrate all of these new exciting assets. Earnings will likely be underwhelming as a result. I plan to add to my stake for the first time since the pandemic began if the multiple compression here continues.

5. Ozon Holdings (OZON) — Earnings Review

I used a spot exchange rate of 1 Russia Ruble = $0.013 dollars for all revenue and GMV numbers.

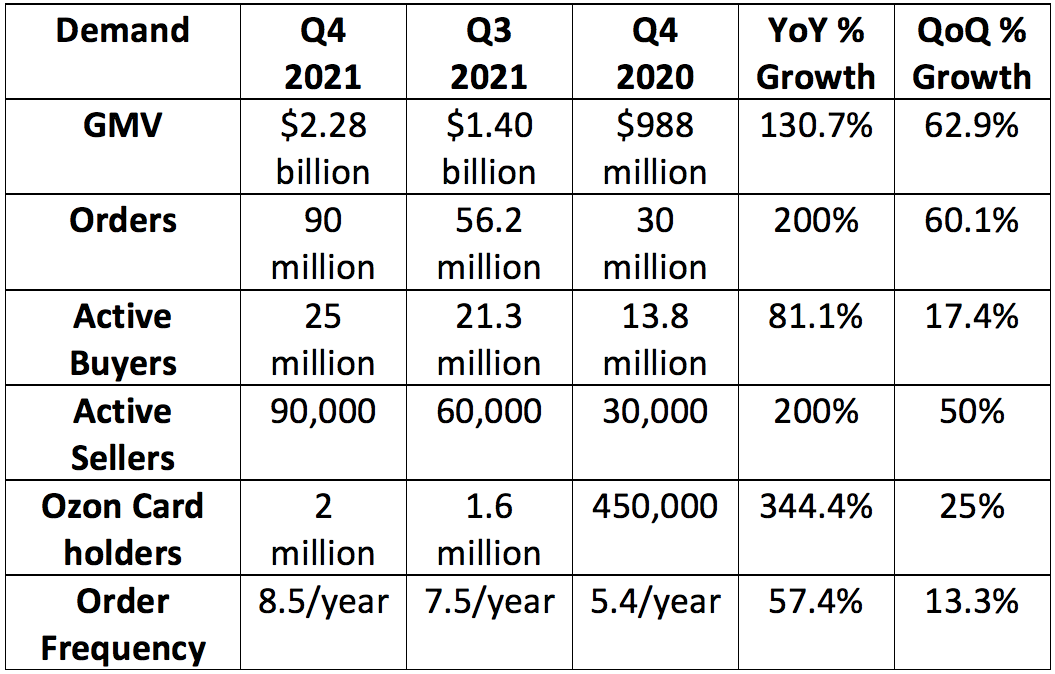

This release offered preliminary numbers into Ozon’s report (not even revenue was disclosed). Neither the webcast nor the full SEC filing have come out yet. The numbers that were shared, however, were excellent:

a. Demand

A new milestone of 1 million orders per day was reached and order growth has now exceeded 100% for 2 straight years (at impressive scale).

Growth in frequency of orders accelerated throughout 2021. Ozon entered the year with order frequency growing 31% YoY and now it’s enjoying 60% growth entering 2022. Average order values are stable despite the rising frequency.

Seller growth was powered by enhanced services within:

Fulfillment & delivery.

Advertising products.

Business analytics.

Financial services (seller financing mainly).

For the full year 2021, GMV grew by 125% YoY vs. most recent guidance of 120% YoY growth (and a 90% growth estimate at the beginning of 2021). Other 2021 highlights include:

200% order growth.

700% stock keeping unit (SKU) growth — now 80 million vs. 11 million previously.

300% warehouse capacity growth.

“Growth was despite the full re-opening of the brick-and-mortar retail and an exceptionally tough base of 144% growth in 2020.” — Founder/CEO Alexander Shulgin

Black Friday orders 5Xed vs. 2020 thanks to Ozon’s successful “Mega Sales” campaign.

b. Profitability

Ozon generated positive cash flow from operations and free cash flow the quarter. While this is wildly encouraging, it was also aided by timing of inventory stock-piling and selling. I’m not expecting free cash to be a consistent near-term trend.

“The company sequentially decreased its sales and marketing expenses as a % of GMV.” — Press release

Ozon has roughly $1.6 billion on its balance sheet.

c. Outlook

Ozon guided to 80%+ GMV growth in 2022 “with enhanced focus on efficiency gains and improvement in unit economics.”

d. My Take

There was not much meat to this preliminary release, but the metrics offered were all great. Ukrainian headlines will continue to weigh on the stock and I’ll continue to use that to carefully build out my position — at a snail’s pace.

6. SoFi Technologies (SOFI) — Golden Pacific Bancorp

SoFi’s purchase of Golden Pacific Bancorp has officially closed and the entity has been renamed to SoFi Bank with SoFi Technologies serving as the parent company. Yes, this means the banking charter has been officially wrapped up.

Golden Pacific’s CEO will stay on in her current role.

This announcement will allow SoFi to do things like offer checking and savings accounts with an up to 1% annual percent yield (APY) — 33X the national average. Interestingly, in the near future SoFi will also roll out a refreshed user-interface and new digital banking products for Golden Pacific’s/SoFi Bank’s customers specifically. A while back, CEO Anthony Noto told us that SoFi would use Golden Pacific to test new workflow and API products for physical branches. I believe this marks the beginning of that endeavor.

Click here for a broad summary of the banking charter’s benefits to SoFi’s business.

7. The Trade Desk (TTD) — New Hires and a Case Study

The Trade Desk internally promoted several employees during the week to newly created positions including Chief Client Officer and Chief Data Officer. I love internal hires coming from strong teams — especially in this labor market, it’s vital to keep talent happy.

In other news, the company released an early case study on the success of the demand side ad platform it built for Walmart. During December, France-based BIC (sells lighters, pens, razors) ran 3 product campaigns through Walmart’s new program. Its return on ad spend (ROAS) for the 3 products was 42%, 472% and 492% respectively.

“We had suspected The Trade Desk would be a powerful complement to Walmart’s capabilities and this test validated our suspicion… We’re very encouraged. — Senior BIC Manager Matt De Paolo

Click here for my Deep Dive into The Trade Desk’s business.

8. The Boeing Company (BA) — New Order

Boeing announced the launch of its 777-8 Freighter focused on meeting Cargo demand. The plane comes with a 25% fuel efficiency upgrade vs. older models like the 777 Freighter and is a derivative of the 777X family.

Qatar Airways announced a new order for up to 50 (firm order of 34) of these freighters and also signed a “Memorandum of Understanding” (less binding) for up to 50 737-10s which is the largest in the MAX family of models. The deal could be worth up to $20 billion in new revenue for Boeing in the years to come and the freighter deal specifically is the largest in the company’s long history.

Boeing has a dominate 90% market share of “dedicated freighter capacity” — a market expected to grow in excess of global GDP in the years ahead with rising oil prices and ESG motivation accelerating fleet modernization momentum (another Boeing tailwind). Things may finally be going Boeing’s way.

9. Teladoc Health (TDOC) — USAA

Credit to the twitter handle @arigoldtweet for discovering this bit of news.

USAA has officially ended its MDLive contract shortly after it was acquired by Cigna (one of USAA’s competitors) while still offering Teladoc’s Primary360. CEO Jason Gorevic told us that insurer/virtual care vertical integration was a positive for Teladoc Health as it deepened the appeal of Teladoc’s independence for all of the other potential clients not wanting to support competition. This is a small sign of him being correct.

Gorevic also told us last quarter that Teladoc’s USAA revenue opportunity continues to grow with the relationship deepening and this supports that sentiment. For such a hated stock, this company’s leadership sure does have a fantastic track record of meeting its promises.

10. Cannabis News — Mainly per Marijuana Moment

Former Trump Chief of Staff (Mick Mulvaney) expressed aggressive support for South Carolina’s GOP-led medical cannabis bill.

The House passed banking legislation — again… for a 6th time. The main hurdle will be offering enough social equity provisions to get this deal done in the more hesitant Senate.

A Representative in Maryland filed a bill outlining rules and regulations surrounding cannabis legalization if approved by voters this year.

The U.S. Department of Veterans Affairs and a University in Oregon are co-creating a new web destination to offer reliable information on the plant as well as a place for Cannabis dialogue.

Mississippi’s Governor signed the state’s newest medical cannabis bill.

11. My Activity

I added to PayPal after its earnings report. My cash position now sits at 10.5% of holdings.

Unbelievable analysis. You are a fantastic Analyst and writer

Thanks Brad, as usual, an excellent and informative read.