News of the Week January 9-13

Progyny; Shopify; JFrog; CrowdStrike; Lululemon; PayPal; Meta; Match; Olo; Earnings Snapshots; Macro; My Activity

Today’s Piece is Powered by my friends at Savvy Trader:

Welcome to the 402 new readers who have joined us this week. We’re delighted to have you all as subscribers and determined to provide as much value & objectivity as possible.

1. Progyny (PGNY) -- Thriving

Progyny leadership used investor conference participation to pound its chest about how well things are going. Specifically, it now sees demand and profitability being “at or near the high end of its previous guide.” Utilization trends remain healthy, and its EBITDA to cash flow conversion is poised to move from 38% in 2021 to 60% in 2022. That is not a normal pace of progress and makes its 17X EBITDA multiple and 35% revenue growth all the more compelling.

For 2023, it reiterated an expectation of 370+ clients and 5.4 million+ covered lives which gears it up for another year of rapid growth and operating leverage. There were no on-boarding surprises as all new customers were seamlessly added to the network. 2023’s selling season (which impacts 2024 financial results & thereafter) is off to an “encouraging start” and “maintains the momentum Progyny enjoyed in 2022.” This provides wonderfully calming growth visibility for the next 24 months which makes me very happy.

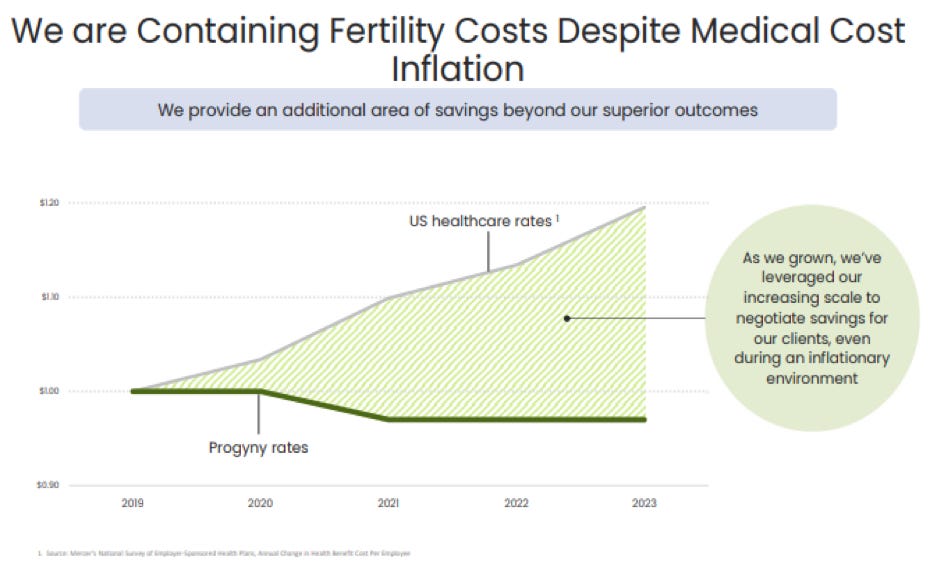

To date, Progyny has seen absolutely zero macro impact on its operations and instead continues to easily find new business. How could that be? Well, aside from its key performance indicator leads that have grown vs. the field for 7 straight years (audited by 3rd party research firms), it also saves companies an average of 25% of total fertility treatment costs vs. alternatives. Furthermore, its rapidly growing scale gives it negotiating power with clinics and pharmacies which will allow it to hold client fees flat this year compared to 6.5% healthcare inflation expected overall -- per Mercer.

Other structural tailwinds like Americans having children later in life -- which boosts fertility treatment needs -- continue to prop up the fertility industry as a whole. But these more company specific benefits are how Progyny continues to outperform the already attractive space by a mile and a half.

Not only do its clients get a much needed recruiting tool amid hectic talent competition… not only do they get happier, healthier & more productive employees… not only can they uniquely offer benefits on a pre-tax basis to save workers $14,000 per treatment… but these employers also get meaningful treatment cost savings to enjoy THEMSELVES as Progyny’s better processes pave the way for healthier, cheaper pregnancy. That matters more today than it has in a long time, and is why the poor macro environment has not been a headwind -- but instead arguably an accelerant.

“Multiple societal macro trends are fueling the need for family building. We see no signs of that slowing down whatsoever… We are the brand of choice for family building benefits which continues to be a top priority for employers and their employees.” -- CEO Pete Anevski

With fertility treatment penetration still just 20%-50% that of comparable nations, 50% of U.S. employers still not offering any coverage and Progyny’s ability to vastly enhance access and affordability, there is a long, long runway of growth to take advantage of. For context, 20% of U.S. women can’t conceive on their own, yet just 2% of U.S. births are via assisted reproductive treatments -- per the CDC. Nobody else is addressing this access-based gap nearly as effectively as Progyny and this announcement is simply more evidence.

Final notes from the conference:

Investors have worried about the impact of large scale tech layoffs on Progyny’s growth. Leadership assured us that its diversification across 40 industries means the impact of that trend has been “negligible and offset by growth of other industries.”

Progyny’s preconception and male infertility products announced last year are now ready for deployment as a natural extension of its treatment bundles. It’s working on maternity and postpartum women’s health products. It explored M&A opportunities here but thinks it can do better on its own.

For historical evidence of fertility treatment’s macro insulation, during the Great Financial Crisis, industry growth slightly slowed but remained strong. And at that time, most treatment was paid for out of pocket while Progyny offers a covered benefit through carriers and employers.

Click here for my Progyny Deep Dive.

2. Shopify (SHOP) -- Buy with Prime

UBS came out with a note on the threat that Amazon’s Buy with Prime (BWP) offering poses to Shopify as the logistics giant rolls it out broadly. I don’t see the competitive threat as preventing Shopify’s fulfillment success for the following reasons:

Logistics is a truly massive market. There will never be one winner. Amazon winning here doesn’t mean Shopify will lose. Its success is far more in its own court than that from my point of view.

Shopify is not trying to compete with Amazon on minimizing delivery time. It is trying to get to a point where it can guarantee 1-2 day shipping on all orders to bolster merchant conversion. It’s using DHL, FedEx etc. to do so.

While this is a white-labeled Amazon offering, most of what Amazon provides is via the 3rd party marketplace that countless merchants avoid due to losing control of brand and data. Shopify gives these merchants that control back.

Shopify removes all conflicts of interest by avoiding things like creating private label versions of products or willfully allowing cheaper knock-offs as Amazon routinely does.

Both offerings juice conversion by around 20%-30% for merchants while Shopify white labels the rest of its product suite to ensure brands are front and center ALWAYS and customer data is ALWAYS available to merchants.

The two are actively working on an integration between SFN and Buy with Prime. Furthermore, Amazon is a key partner for Deliverr already.

Shopify will never match the logistics muscle of Amazon, but it’s not trying to. It’s merely trying to unify the disparate pieces of the existing supply chain for merchants often working with 10+ vendors to move goods from port to porch. And it’s doing so in its typical software and partner first approach with self-operated warehouse hubs only being used in large municipalities like Atlanta. If it can successfully execute here, it will surely find success regardless of Amazon finding probable traction. Considering how aggressively Shopify is investing in SFN, for this investment to work, it must find fulfillment success like I think it will. I could always be wrong.

I hope to publish my deep dive before Shopify’s next earnings call. I’m through the last 5 years of transcripts and filings. I’ve read every piece of available public information since it has gone public. I just need to organize my notes, interview leadership and put it all together. I’m excited to share. I do not take the term “deep dive” lightly like many of my peers seem to.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. JFrog (FROG) -- CFO Jacob Shulman Interviews with Needham

GitLab Competition:

In previous quarters, GitLab leadership has celebrated taking customers away from JFrog as it builds out a competing binary management product. Shulman added some needed context to the misleading dialogue. He quantified the business lost over the last year + at under $50,000 of ARR or well under 0.1% of sales. Furthermore, Shulman told us that JFrog “doesn’t see GitLab in the competitive market.” The clear number 2 is still Sonatype which continues to cede material market share to JFrog.

GitLab remains a formidable competitor within source code management. But JFrog doesn’t play there. It operates solely in the world of binaries (AKA machine readable language in 0s and 1s) and continues to complement source code offerings as it’s routinely deployed alongside them. Both are needed complements, neither are substitutes for the other. GitLab could always catch up to JFrog and become a more intimidating binary management competitor. It has a long way to go to do so with JFrog constantly iterating and upgrading its own leading product suite.

New Cloud Enterprise Trial:

JFrog changed the structure of its free cloud trial from usage based to time based last quarter. So far, this has led to a meaningful improvement in conversion of free to paid users.

Macro:

Sales cycle elongation & more approval requirements continue to slightly dampen JFrog’s momentum and growth. But still, retention rates remain wildly strong at over 130% and renewals are “healthy.” The company still beat expectations in terms of both demand and profitability and raised its full year outlook despite this macro headache.

Financial Progress:

JFrog continues to be confident in its long term growth target of 30%+.

Expect more margin expansion in 2023.

4. CrowdStrike (CRWD) -- Workplace Accolades & an Insider Buy

a) Culture

Glassdoor and “BuiltIn” both named CrowdStrike to their list of best employers to work for in 2023.

b) Insider Buy

Director Austin Roxanne bought $3.3 million worth of CrowdStrike stock via open market purchases last week. This raised her stake in the company by more than 50%. She’s “only” worth about $62 million total, so this represents more than 5% of her entire net worth. Quite the vote of confidence. She’s also on the board of Verizon and Abbott Labs, but only decided to purchase shares of CrowdStrike.

5. Lululemon Athletica (LULU) -- Q4

Lululemon pre-announced its Q4 2022 results this week. It raised its revenue guide by about 2% to $2.68 billion and reiterated its earnings per share guide with a tightened range. It also took the chance to reiterate its long-term financial targets. The only negative piece of the announcement was lowering its gross margin guide from about 15 basis points of expansion to 100 basis points of contraction. As freight & other raw material costs continue to plummet, I can only think this is a result of its large inventory position and slightly amplified discounting activity.

Still, the reiterated earnings guide shows its cost discipline and ability to find more leverage elsewhere, and its demand guidance raise is quite impressive for a luxury consumer discretionary firm amid poor macro. We’ve seen countless other vendors in the space (including one of my own holdings in Revolve) maneuver pressing exogenous obstacles with less grace than Lulu is doing. The brand power is real and if this is as bad as things get for the firm (like it should be), there’s a lot to like about this announcement and the investment going forward -- in my biased, shareholder view.

“We are pleased with our continued revenue growth and momentum in the business, as our teams navigate a dynamic macro-backdrop. In Q4, traffic remains strong across both physical and digital channels, and we anticipate delivering another quarter of solid earnings growth consistent with our updated EPS forecast.” -- CEO Calvin McDonald

6. PayPal Holdings (PYPL) -- Xoom

Xoom is PayPal’s 3rd P2P payments platform in addition to Venmo and PayPal. Its niche is sending cash, prepaid phones and bills cross-border. This week, it added the ability for U.S-based customers to send cash right to a Visa debit card in more than 2 dozen countries for an expedience upgrade vs. legacy wire transfers. This marks a deepening of an already intimate relationship between PayPal and Visa and materially bolsters Xoom’s appeal/usability.

Click here for my PayPal Deep Dive.

7. Meta Platforms (META) -- TikTok, a New Tool & More

a) Tick Tock, TikTok

This week, New Jersey’s Governor blocked the usage of TikTok on state devices. The University of Florida also warned its students about the app and advised against using it. Bipartisan legislation to ban the social media service continues to gain momentum and I continue to think its federal prohibition in the U.S. remains a when not if. It’s already blocked in India. Obviously, the most threatening alternative to the Family of Apps being blocked in Meta’s most important market would be wonderful news for the company and shareholders.

b) Variance Reduction System

In response to U.S. Department of Housing complaints around demographic targeting for housing ads, Meta launched the Variance Reduction System. This -- in a way -- side steps the regulation (as Meta often does so well) by trailblazing new ways to effectively target audiences for this type of ad. It also simultaneously appeases lawmakers by creating more equitable ads in their minds. Meta will extend this new ad model to credit cards and employment in 2023.

Whether its regulation, Apple, Reels monetization or more competition, Meta seems to have turned a corner in its ability to effectively target via new ML models, more accurate reporting, lengthened attribution windows, click to messaging ad formats and more. I think the worst is behind this mega-cap in terms of its ability to deliver strong return on ad spend (ROAS) and so grow its ad business. We’ll see.

c) Other

Roblox and Meta are working on an integration to add the gaming company’s popular content to Quest in 2023.

Meta is further restricting teen data sharing with advertisers.

Meta is suing Voyager Labs for extracting data from Instagram without prior consent.

8. Match Group (MTCH) -- Dollar & Tinder

a) Dollar

The U.S. Dollar has precipitously weakened vs. major currencies since its peak in September 2022 -- and that’s a sight for sore eyes for companies like Match Group. About 50% of Match’s revenue is collected in currencies other than the dollar and it has no hedging programs in place (for some reason) to smooth the impact of volatile exchange rates. Specifically, these exchange rates erased roughly 8-10% from the company’s growth throughout 2022. For its Q4 2022 and 2023 guidance, it is assuming zero relief here with expectations that macro headwinds remain daunting for the next 12 months. Well? That’s not coming to fruition. The dollar meaningfully weakening -- all else equal -- will be a revenue growth tailwind in the coming quarters that is not factored into its guidance. Hello upside.

While the benefit of this among my holdings will be the most meaningful for Match Group, others like PayPal, Duolingo, Revolve Group, Meta Platforms and many more stand to gain too.

b) Ad Campaign

In other news, Match Group is launching a marketing campaign to educate online daters on the risks and prevalence of “Romance Scams.” In 2023, one of Match Group’s core goals is to improve the reputation of Tinder through brand marketing. It thinks old leadership accepted the label as the “hookup app” which has led to things like underwhelming female user growth and monetization. This is step one of Match Group and Tinder reclaiming their own labels through brand marketing. This is expected to aid female monetization along with some other subscription packages the app will launch in the coming months.

9. Olo (OLO) -- Investor Conferences

There were a lot of repeated analyst questions about Olo Pay, Borderless and its opportunity more broadly speaking. Not much new info came from the conferences, but here’s what we did learn:

On Macro:

Glass reminded us that people trade down from more upscale restaurant concepts to limited service amid recession. That’s what happened during the Great Financial Crisis, and that is what’s happening now. In his own words, “people don’t just start to learn to cook” as “convenience is king” regardless of backdrop. Yes, average order sizes shrink, but those orders still come in. And furthermore, considering around 2 in 3 Olo customers are in the limited service category, customers are trading down to Olo brands.

Restaurants are always hated in a weak economy, but perhaps it’s not fair to extrapolate that to Olo. One of the cliches of this current downturn has been vendors enabling customers to “do more with less” as talent became more expensive and input costs soared higher. That is precisely what Olo does for restaurants: Lowers the cost of ownership for maintaining a tech stack. It juices restaurant efficiency via ensuring relevant integrations for consistent customer service, acting as a unifying layer to eliminate product silos and create cohesion, and unleashing customer data to be used for guiding marketing dollars, location expansion & more. Simply put, Olo makes the digital transformation easier which fosters cost savings and more nimble business models. This is what restaurants need ESPECIALLY now.

Early Hints on 2023 Margins:

Sales & marketing (S&M) leverage is not coming in 2023. Olo spent 2022 rapidly introducing new products via R&D and M&A. It has grown its module suite from just 3 to now 12 since its IPO. So? It needs to develop enterprise sales teams to go sell these offerings to prospective clients.

It does see operating leverage coming on the R&D and General & Administrative (G&A) lines for 2023. It reassured us that it will continue to grow profitability. And considering it burned just $7 million to reach $100 million in annual revenue, its track record of delivering profitable growth is quite strong.

On the buyback:

Leadership was asked why it didn’t buy back shares in Q3. That’s because the buyback was initiated at the end of Q3. It sounded like the team hinted at commencing share repurchases in Q4. We’ll see.

“I’m grateful for all the success Olo has had in the 17 years I’ve been doing this. But at the same time I’m also very unsatisfied. There’s so much more to do. It is so early in this digital transformation journey. We are itching for the next leg of growth. I feel like I was born to do this.” -- Founder/CEO Noah Glass

Click here for my Olo Deep Dive.

10. Earnings Snapshots

4 sectors had key companies report Q4 earnings this week: Banks, Semis, Insurance & Airlines. Below are four condensed earnings snapshots walking through the main takeaways of each firm. Note that I chose Bank of America out of financials as it skews more towards consumer banking and is a better read-through to the rest of my holdings.

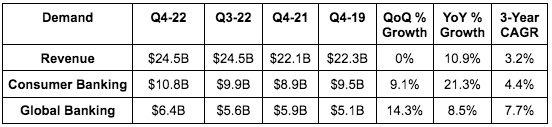

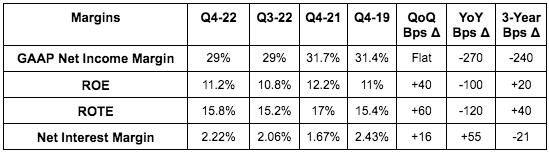

a) Bank of America Q4 2022 Earnings Snapshot

Quarterly Results vs. Expectations:

Beat revenue estimates by 1.2%..

Beat EBIT estimates by 2.6% & beat EPS estimates by 10.4%.

Key Context & Balance Sheet Data:

Total consumer spend is “healthy” at 5% YoY growth but slowed from 14% growth in early 2022.

Commercial net charge-off (NCO) rate rose to .11% vs .04% QoQ & 0.13% pre-pandemic.

All NCO metrics are up QoQ & YoY but still below pre-pandemic levels.

3.1T in assets, $1.05T in loans/leases, $1.93T in deposits (+2% YoY), $863B in total debt.

Bank of America’s base case for 2023 is a mild recession.

Credit originations remain robust for high credit quality consumers which it caters to.

Banks catering to affluent clients continue to find success amid the macro chaos. That bodes well for SoFi.

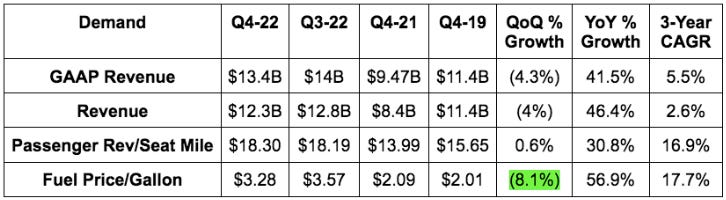

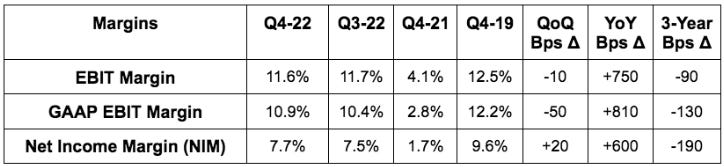

b) Delta Airlines Q4 2022 Earnings Snapshot

Quarterly Results vs. Expectations:

Beat revenue estimates by 5.5%; beat guidance by 9.8%.

Beat EBIT estimates by 7.6%; beat guidance by 16.4%.

Beat earnings estimates by 11%; beat guidance by 31%.

2023 Guidance:

Reiterated $5.50 EPS guide vs. $5.15 estimates.

Reiterated 17.5% revenue growth vs. 7.3% estimates.

Key Context & Balance Sheet Data:

It has $22.3B in adjusted net debt with an average interest rate of 4.7% and 83% of debt being fixed rate.

$6.5B in cash, equivalents & short term investments.

Consumer demand “remains robust” & business bookings “remain stable” with 95%+ of surveyed enterprises expecting to maintain or grow travel spend in 2023.

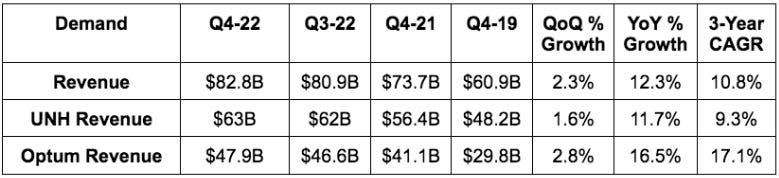

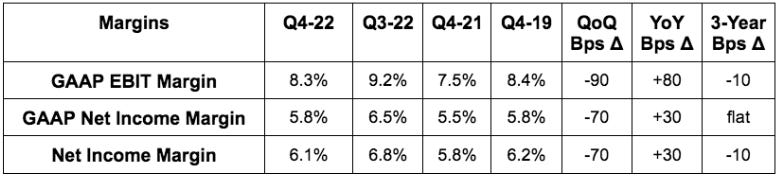

c) United Healthcare

Quarterly Results vs. Expectations:

Beat revenue estimates by 0.3%.

Beat EBIT estimates by 3.9%.

Beat EPS estimates by 1.4%; beat GAAP EPS estimates by 2.2%.

2023 Guidance:

Reiterated its revenue guidance which beat estimates by 1.1%.

Reiterated its EPS guidance which missed estimates by 1.2%.

Key Context & Balance Sheet Data:

ROE was 27.2% in 2022 vs. 25.2% YoY

The company returned $13B to investors in 2022.

OptumHealth Revenue per consumer rose 29% in 2022 vs. 2021.

It has $27.9B in cash & equivalents, $54.5B in long term debt & $3.1B in current debt.

The 10.8% 3-year revenue CAGR compares to 10.2% last quarter.

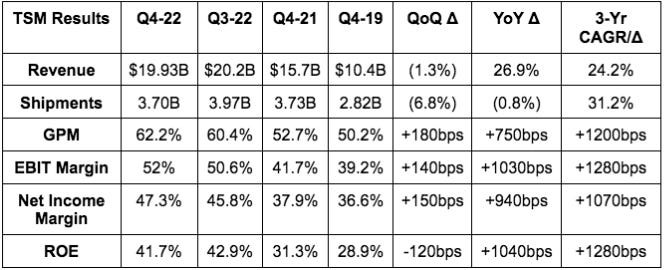

d) Taiwan Semiconductor

Quarterly Results vs. Expectations:

Missed its revenue guide by 1.8% & missed estimates by 4.4%.

Beat its GPM guide by 170bps & beat its EBIT margin guide by 200bps.

Missed EBIT estimates by 1.2%.

Met EPS estimates.

Key Context:

It has $43.7B in cash & equivalents, $27.2B in bonds payable and $7.2B in inventory up 14.5% YoY.

ROE was 39.8% for 2022 vs. 29.7% in 2021.

11. Macro

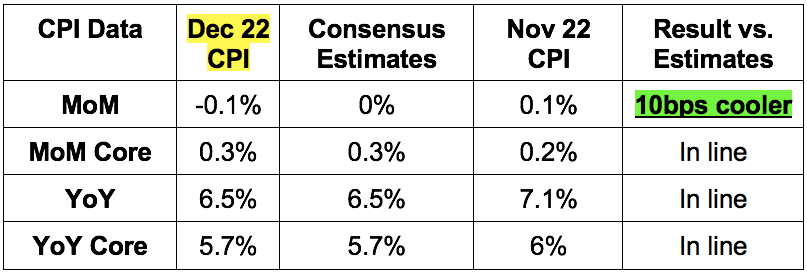

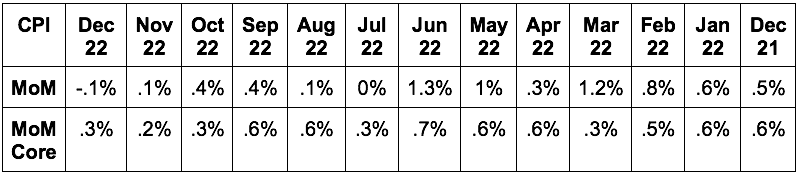

a) CPI

b) Other Key Data from the week

Jobless claims came in just below expectations to point to continued labor market resilience.

Michigan Consumer Expectations & Sentiment both convincingly beat expectations.

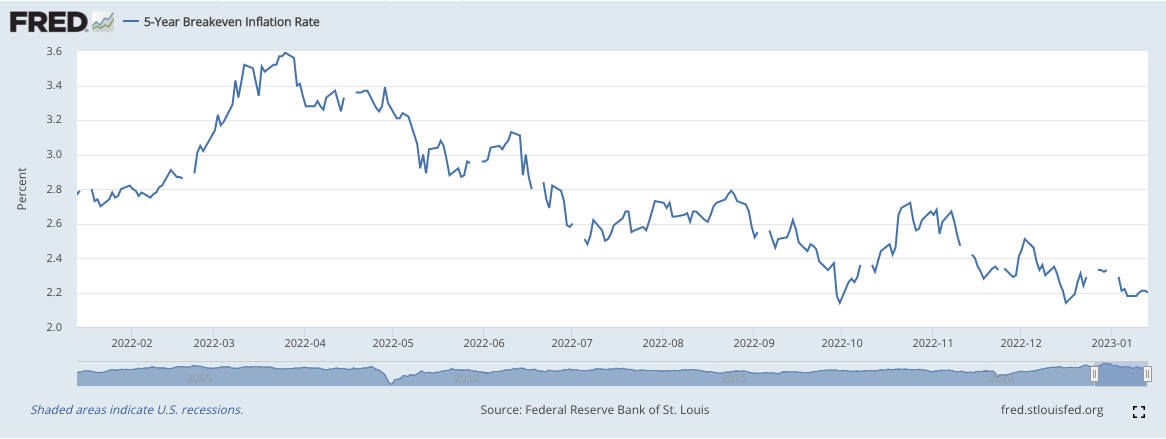

The 5 year breakeven inflation rate was stable this week:

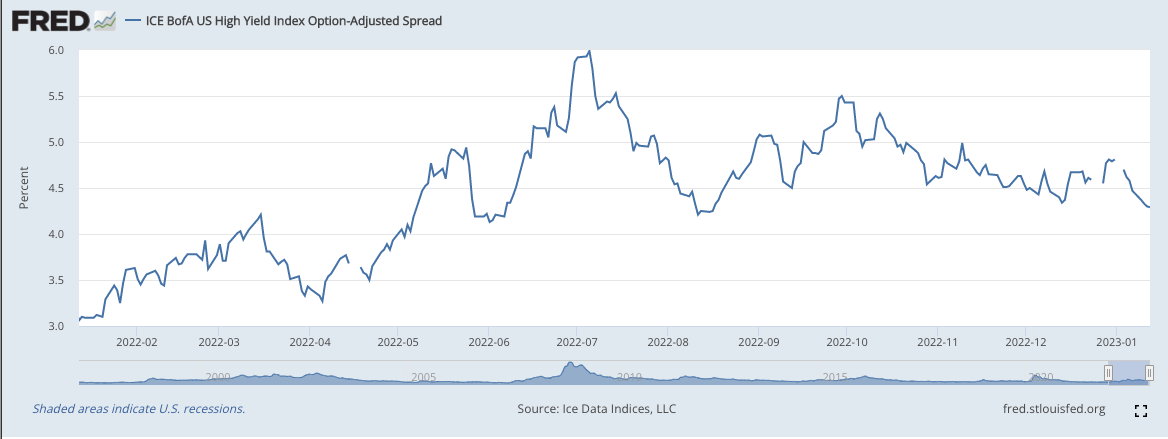

High yield option adjusted corporate credit spreads continued to encouragingly fall as liquidity conditions improve:

c) Level-Setting the Data

Inflation continues to convincingly fall while economic activity and employment continue to hold on for dear life. Layoffs and hiring freezes paired with contracting economic indexes can only continue for so long until inflation becomes the more pressing Fed Mandate. I still expect that to happen in the first half of this year with a rate hike pause coming after the February meeting (I think).

All that happened this week was positive CPI data offering me more conviction in my planned accumulation schedule for 2023. Nothing about that schedule changed (the only change would’ve been a delay) following the largely positive report. For the sake of avoiding redundancy, I’d point new readers to the last few News of the Week macro sections which all spell out this agenda. Again, my plans did not change.

I would like to call something out about the yield curve inversions everyone has been citing and using as evidence for an impending deep recession. The infamous 10 year, 2 year curve is being greatly influenced by the Fed’s quantitative tightening (QT) program. 2 year bond sales have been more frequent than 10 year sales, so that rate has comparatively risen vs. the 10 year. Yes, recessionary fears also enhance inversions, but this factor is surely bolstering the degree of inversion. To me, that makes this a somewhat different signal than it has been in the past.

It’s screaming terrible recession while a more mild recession becomes all the more likely. A mild recession would mean discount rates stop moving higher and profitable growth becomes more coveted and scarce. That’s not a bad scenario for long duration equity.

12. My Activity

I didn’t do much this week aside from adding a bit to my new Airbnb stake. In light of the positive price action my positions enjoyed, my cash position fell to 11.5% of holdings. Here’s the portfolio:

Hey Brad. I imagine your watch list is pretty long. In spite of that I suggest you add MercadoLibre (MELI) to it (if is not already there.) I reluctantly bought them because of the geopolitical risk...kept the position small...etc... They have grown to our largest holdings

Interview SHOP leadership? WHO will you talk to?