News of the Week (July 26-30)

Microsoft, Facebook and Boeing earnings; Upstart; CuriosityStream; Penn National Gaming; Duolingo

1. Microsoft Earnings Summary

“Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating and it’s just the beginning” — CEO Satya Nadella

a. Demand

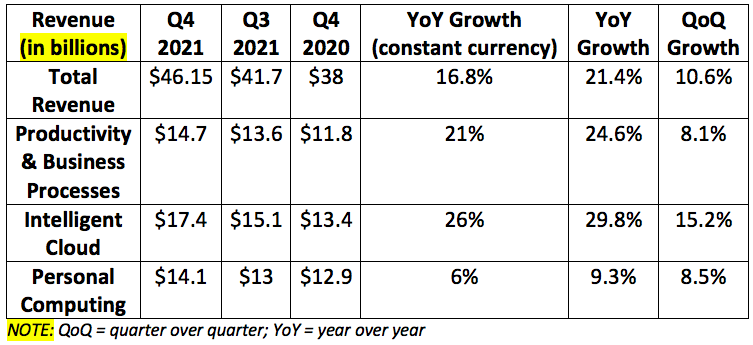

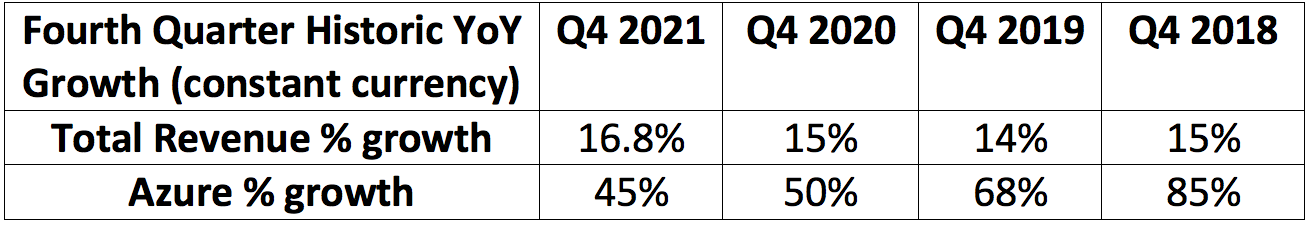

Microsoft generated $46.15 billion in total revenue. This represents 16.8% year over year (YoY) constant currency growth and beat mean analyst estimates by 4.6%.

Commercial bookings grew by 25% (constant currency) via strong Azure demand. Commercial cloud specifically surpassed $69 billion in annual revenue up 34% YoY.

3 business units (Azure, gaming and security) have all surpassed a $10 billion run rate within the last 3 years. LinkedIn also reached the same $10 billion milestone this year.

LinkedIn quarterly advertising revenue passed $1 billion for the first time thanks to 97% growth — triple the rate of its category.

The security business saw a 70% increase in small and medium business (SMB) customers with security revenues up 40% YoY.

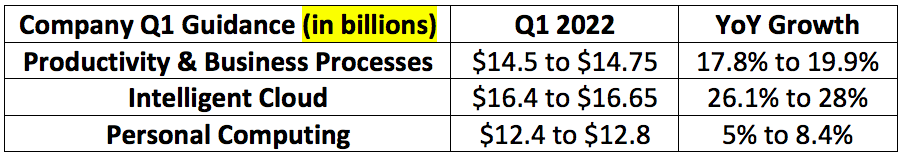

Productivity and Business Processes guidance was for $13.8 billion to $14.05 billion. The $14.7 billion Microsoft posted translates into a 5.5% midpoint beat.

Intelligent Cloud guidance was for $16.2 billion to $16.45 billion. The $17.4 billion Microsoft posted translates into a 10% midpoint beat.

Personal Computing guidance was for $13.6 billion to $14 billion. The $14.1 billion Microsoft posted translates in a 2.1% midpoint beat.

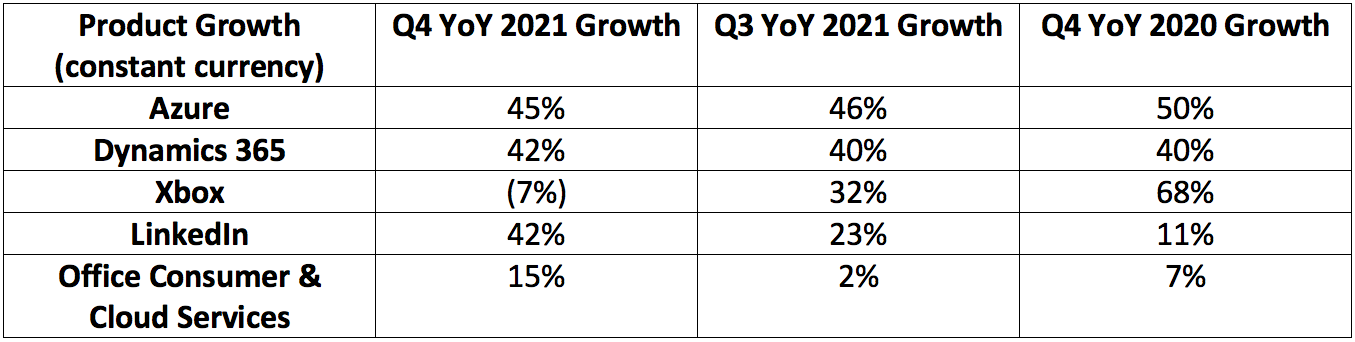

The new Xbox has already surpassed the total sales of any previous Xbox model. Both the X and S series remain supply constrained.

Note that Xbox YoY comps were tough and LinkedIn YoY comps were easy due to the pandemic.

b. Profitability

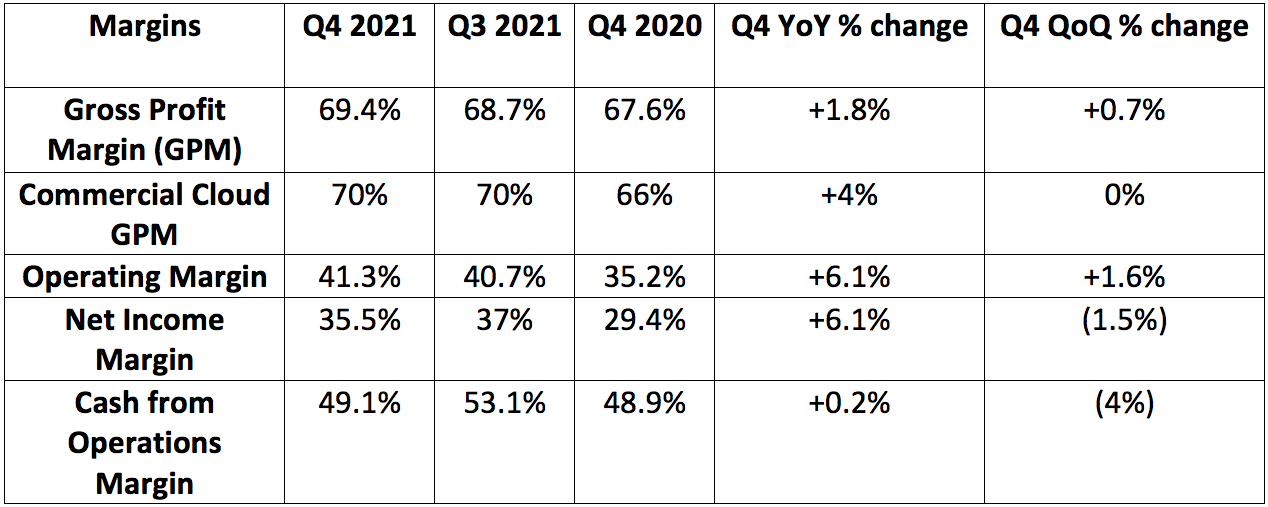

Microsoft earned $2.17 per share. This represents 42% YoY constant currency growth and beat mean analyst estimates by 14.2%.

c. Next quarter guidance

Guidance notes:

Expects LinkedIn growth in the high 30% range

Expects Xbox growth in the low single digit range

Expects Azure growth to be right around this quarter’s rate

d. Management commentary

CEO Satya Nadella on customer wins

AT&T chose Azure to power its 5G core network. This was the first tier 1 telecom operator to move its customer traffic to the cloud.

L’Oréal, Morgan Stanley, Mondelez, Campbell’s ServiceNow and SAP moved to Azure during the period.

Won contracts with Epic Games and Volkswagen to deploy its GitHub security product. GitHub is used by 72% of the Fortune 50 to build, send and secure code.

Additional Satya Nadella highlights

Teams now has 250 million monthly active users (MAUs). 124 organizations have more than 100K Teams users with 3K having over 1K users.

Windows 11 will be available on new PCs this holiday season. This brings the operating system (OS) to the cloud much like apps have moved to the cloud enabling enterprises to stream the OS from anywhere and on any device.

CFO Amy Hood highlights

Hood assured investors that there is more operating leverage left in the business model as Microsoft continues to pivot spend to its highest growth, most differentiated product categories.

Microsoft returned $10.4 billion to shareholders via dividends and buy-backs which grew 16% year over year.

“I feel very good about margin improvement next year. The gross margin trends are very healthy looking forward.” — Hood

e. My take

Another great quarter from Satya Nadella and his team.

2. Facebook Earnings Summary

a. Demand

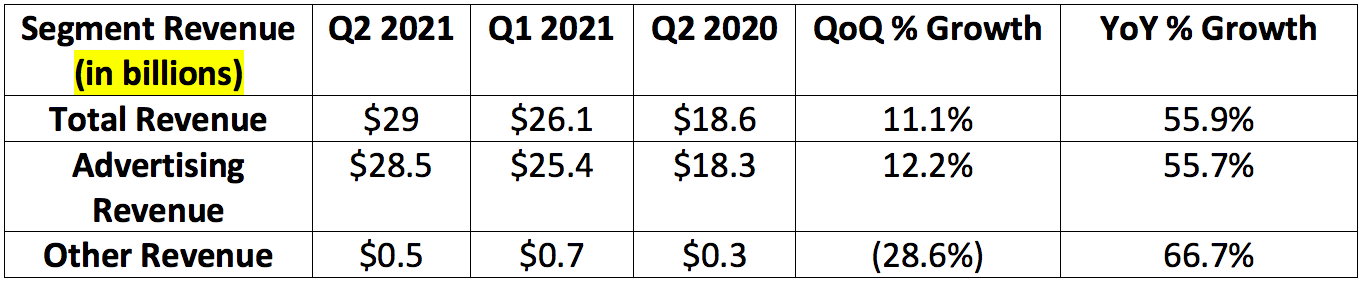

Facebook was expected to generate $27.8 billion in quarterly revenue. It posted roughly $29 billion in sales thus beating expectations by 4.3%.

The 55.9% growth metric includes a $982 million boost from a foreign exchange tailwind (weak dollar). Without the boost, Facebook beat revenue estimates by 0.7%.

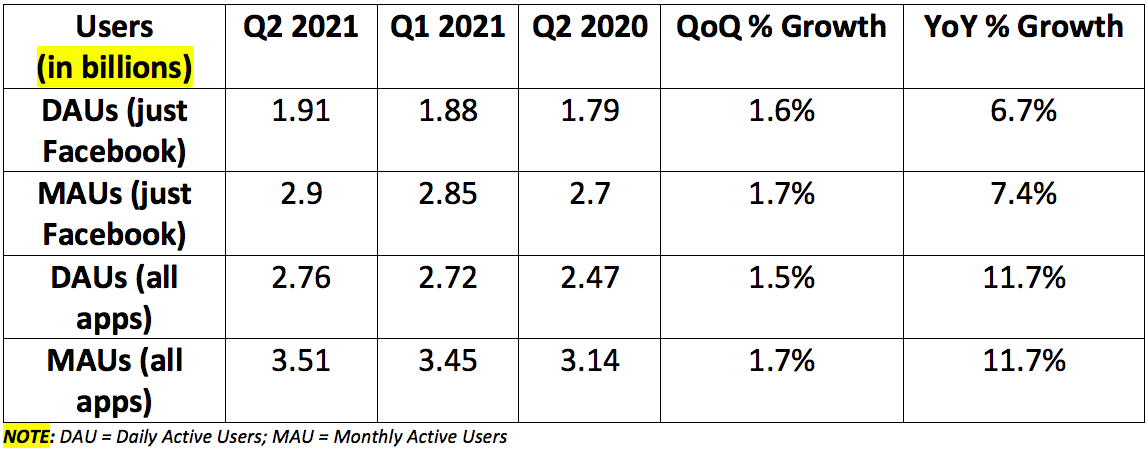

For the Facebook app specifically, daily and monthly user growth came predominately from the Asia-Pacific and Rest of World regions. In North America and Europe, sequential user growth was either flat or down slightly with YoY growth in the low single digits.

For comparison, Pinterest posted -5% YoY domestic MAU growth for the same period and at much smaller scale.

While domestic user growth may be alarming to you, here are a few things to consider:

We’re comping vs. YoY lockdown pain which dramatically helped Facebook’s user growth

Nearly 80% of Americans already use the Facebook app monthly.

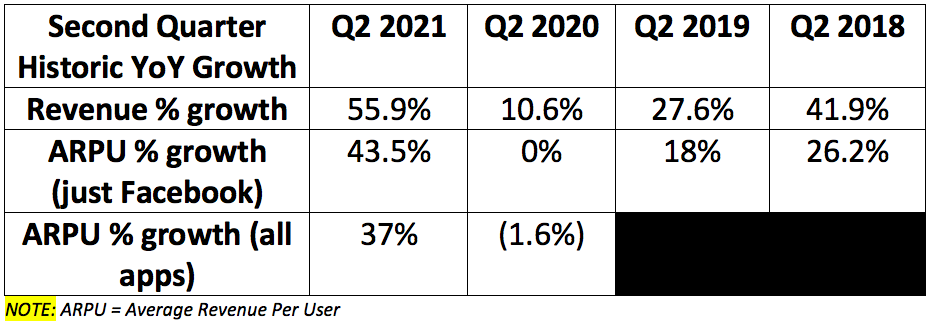

Average revenue per user (ARPU) growth remains elevated as Facebook builds out its commerce and ad solutions.

Growth will come from commerce, the rest of its apps and Oculus. The Facebook App is the stable cash cow at this point.

It grew revenue by 49% in North America during the quarter.

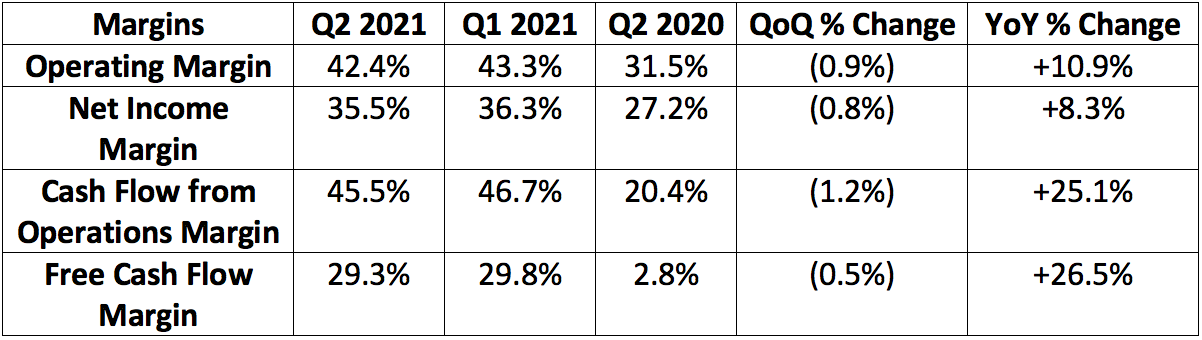

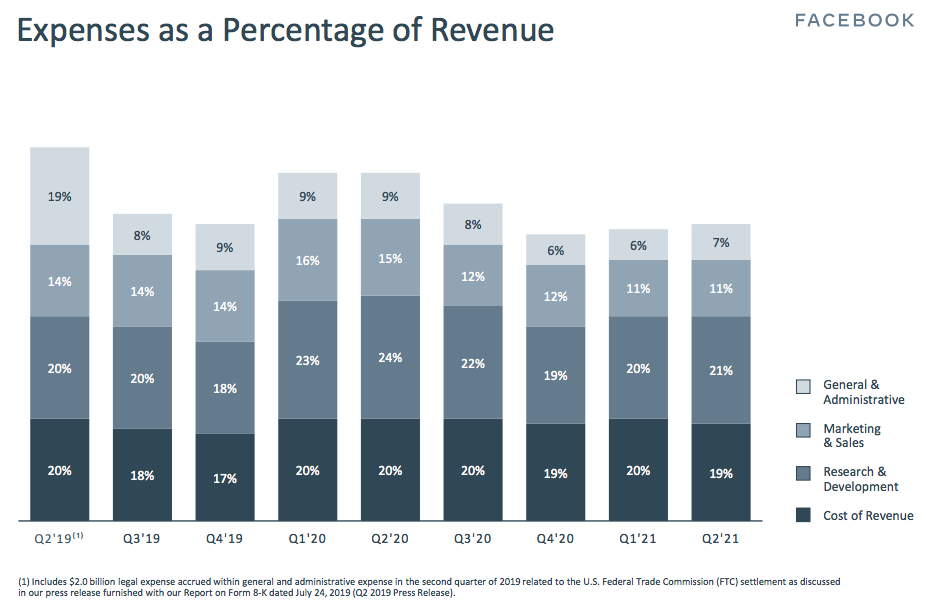

b. Profitability

Facebook was expected by analysts to earn $3.02 per share. It earned $3.61 thus beating expectations by 19.5%. Net income grew by 101% YoY.

c. Management commentary

CEO/Founder Mark Zuckerberg

Video now accounts for almost half of all the time spent on Facebook and Reels is already the largest engagement growth contributor on Instagram.

The most popular Oculus apps continue to be social, not gaming. This is why the company is so honed in on the “metaverse.” The next product launch here will be its Ray-Ban smart glasses.

“The metaverse will create value for many companies but it’s going to require significant investment over many years. In the coming years we will transition from being a social media company to a metaverse company.” — Zuckerberg

CFO Dave Wehner

Impressions rose by 6% YoY. In the YoY period, the pandemic created an impression tailwind which pulled forward some growth. Facebook is also shifting engagement to video meaning lower impressions per time engaged.

Price per ad impression rose by 47% YoY. In the comparable period, the pandemic created a large pricing headwind and fostered pent-up pricing power.

CFO Dave Wehner warned investors of slowing 2nd half growth as comparisons get more difficult and Apple’s ad-targeting headwinds persist. Facebook sends these warnings every earnings call and then subsequently posts another remarkably positive quarter. They have mastered under promise and overdeliver.

The company Bought back $7.1 billion in stock during the quarter.

d. My take

Margins continue to briskly improve and growth remains lofty. Facebook is sitting on a mountain of cash to spend on exciting projects like commerce and AR/VR. Based on its track record, I like its chances of finding success in these areas over the long term. Some were expecting a larger top-line beat, but expectations were sky-high and it still beat estimates.

Thumbs up from me.

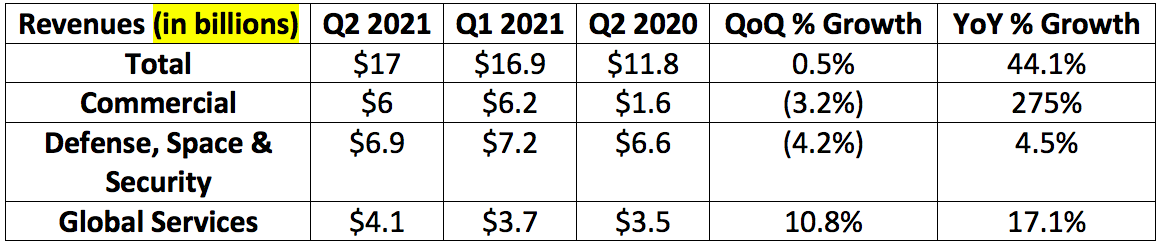

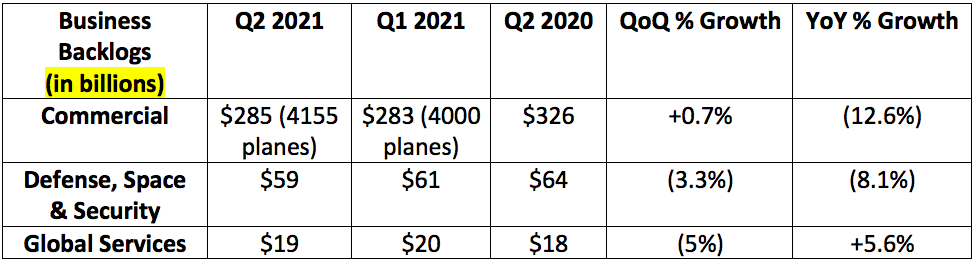

3. Boeing Earnings Summary

“Through our transformation efforts this year, we’ve reduced billions of dollars in costs. Our objective is that the majority of the savings is long-lasting, even when volume returns.” — CEO Dave Calhoun

a. Demand and backlogs

Boeing was expected to generate $17.8 billion in quarterly sales. It missed expectations by 4.5%.

Note that YoY growth rates greatly benefitted from comping over a period in which the 737 MAX was grounded and air travel was crushed by Covid-19.

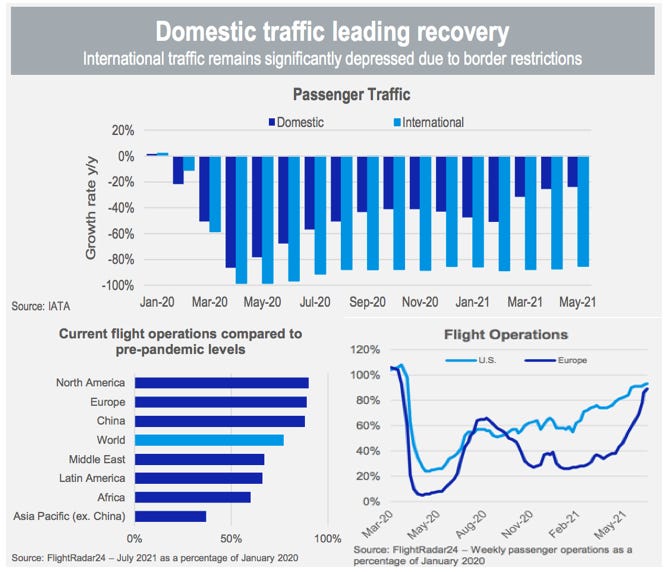

Domestic travel continues to greatly outpace the recovery rate of international travel.

Aircraft retirement rate is accelerating with a focus on lowering emissions and usage of jet fuel. 1500 planes have been retired since the pandemic began or 5% of global fleets.

Boeing still expects passenger traffic to return to pre-pandemic levels by 2023-2024 and return to its growth trend thereafter.

b. Profitability

Boeing was expected to post non-GAAP earnings of ($0.72) per share in the quarter. It earned $0.40 per share thus beating expectations by 155.5%.

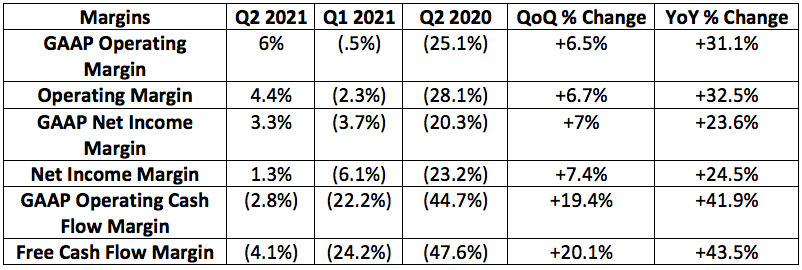

Boeing’s segment margins continue to recover from historic lows:

Commercial operating margin improved from (169.1%) to (7.8%) YoY

Defense, Space and Security operating margin improved from 9.1% to 13.9% YoY

Global Services operating margin improved from (19.3%) to 13.1% YoY

“I’m optimistic in our ability to get back to or beat our prior Boeing Commercial Airplane (BCA) margins.” — Calhoun

“The 13.9% Defense, Space and Security operating margin benefited from a non-U.S. program adjustment. Margins when taking this benefit away were above 11%.” — Interim CFO David Dohnalek

c. 787 Dreamliner

Calhoun reiterated that resources are being diverted from 787 production. He added the company will gradually return to 5 manufactured per month.

“We’re reprioritizing [787] production for a few weeks to support the inspection and rework. We are closer to the end than the beginning.” — Calhoun

“This is not the FAA getting tough on Boeing. This is Boeing getting tough on Boeing.” — Calhoun

The timing here is somewhat ideal. International travel — what the 787 is mainly used for — has not recovered giving Boeing time to fix the supply chain issue.

d. 737 MAX

Boeing is up to 16 737 MAX airplanes produced per month. It will gradually increase that rate to 31 by early 2022 and increase it further to correspond with incremental demand.

Dave Calhoun expects remaining regulatory approvals to occur this year — including in China.

There are 390 737 MAX planes in storage vs. 400 last quarter and 450 while it was grounded. Boeing expects half of these to be delivered by 2022 and “most of the rest” by the end of 2022. With an overly conservative average selling price of $50 million per 737 Max, these 400 planes represent $20 billion in possible revenue.

e. Deliveries and orders

79 total airplanes were delivered during the quarter.

47 737 MAX airplanes were delivered during the quarter. That is expected to rise to 50 per month by year’s end.

There were 280 new commercial plane orders during the quarter, 200 of which came from United Airlines.

“United has a history with both manufacturers. Competition was straight up and out of the 270 we got 200.” — Calhoun

f. Flight traffic progress visualized

g. Balance sheet highlights

Boeing has $21.3 billion in cash and marketable securities and $62.1 billion in total debt — both are stable sequentially.

The company hinted at paying down some of its delayed draw term loan early.

Management believes the company has sufficient liquidity and is dedicated to reducing debt levels going forward. It expects to turn cash flow positive in 2022.

h. My take

The United order was a win and hopefully just a sign of things to come. Boeing is finally starting to see margins significantly recover. The $20 billion it conservatively has in 737 MAX inventory should hopefully allow it to pay down some of its heavy debt load. We are not out of the woods, but this was an acceptable performance.

4. Upstart’s Win

Upstart announced an extension of its partnership with Associated Bank to cover a larger portion of their consumer loan volume. The 2 companies began working together in February and the news represents yet another positive sign on the value Upstart can provide.

This is the largest Wisconsin-based bank with branches throughout the Midwest. It calls itself “Wisconsin’s #1 mortgage lender” and boasts 1.3 million user accounts. With $34 billion in assets under management (AUM) this is one of the top 50 publicly trading banks in the United States.

Click here for my broad overview of Upstart.

5. CuriosityStream’s Distribution Deal

CuriosityStream announced a partnership with the German media conglomerate SPIEGEL TV and its partner Autentic to grow its European distribution footprint. Autentic is a “leading factual content producer and distributor.”

Germany was already CuriosityStreams’s largest international market and this will help further. SPIEGEL TV specifically has 293 million MAUs.

Click here for my broad overview of CuriosityStream.

6. Barstool’s Bowl Game

Barstool Sports (Penn National Gaming owns 36% of it) announced new naming rights for the Arizona Bowl — one of the many New Year’s college football bowl games. Not only does Barstool now own the naming rights, but it will also run the broadcasting, the merchandise and the half-time show. CBS previously owned the broadcasting rights.

This is Barstool’s first dabble in live entertainment and is hopefully a sign of more things to come with Penn’s deep pockets at the brand’s side.

Click here for more of my Penn National Gaming research.

7. Duolingo is Public

Duolingo went public at $140/share or a valuation just north of $6.4 billion fully diluted. I did purchase shares, but the steep valuation led me to buy just 10% of a full position. I will look to average in the remaining 90% over time.

Click here for my Duolingo deep dive.

8. The Week Ahead

Wednesday, August 4th

Revolve earnings after hours

Lemonade earnings after hours (call on the 5th)

Thursday, August 5th

Penn National Gaming earnings before the market

Progyny earnings after hours

JFrog earnings after hours

I will be posting an article on the American cannabis regulatory environment this week as well.

Thank you for reading!

Binge reading your newsletter :)

Thank you for writing! Looking forward to FROG (have a decent position) and PGNY (would like to learn more about).