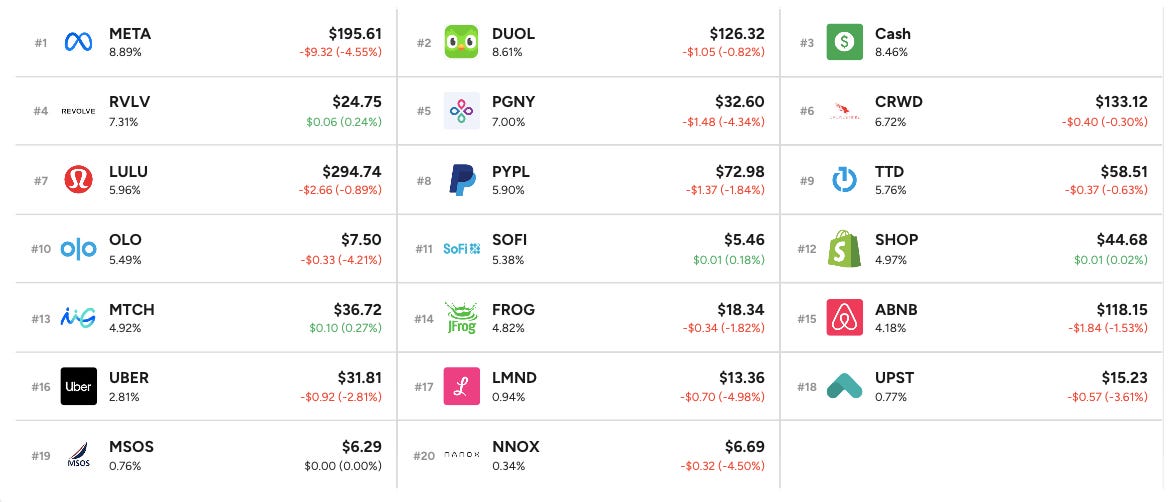

News of the Week (March 13 - 17)

Meta Platforms; Airbnb; SoFi; Uber; Progyny; PayPal; Match Group; Revolve; Adobe; SentinelOne; GitLab; Cresco Labs; Macro; My Activity

1. Meta Platforms (META) -- TikTok & Year of Efficiency:

a) TikTok

The U.S. Government is reportedly (again) asking TikTok to divest its business to avoid security and privacy concerns. This stems from unlawful surveillance and data sharing that ByteDance had promised the Western World was not taking place. It was. The Chinese Government rejected this request. We’ll see what happens. Obviously, a ban would be great news for Meta’s apps, but its engagement trends over the last several months already show that it’s taking back share from this competitive threat. It does not seem to need a ban to win in social media.

b) Year of Efficiency

Just one year after closing the billion dollar deal, Meta will divest Kustomer -- a multi-channel messaging company for businesses. It will focus instead on growth areas like click to message ads as part of its year of efficiency to focus solely on higher conviction bets.

The Family of Apps is ending its NFT investments. This is amazing news in my view and a clear sign that it truly is rationalizing its cost structure, focus and investment philosophy for the better.

Meta fired another 10,000 workers and eliminated 5,000 more open roles. The move allowed it to slash its operating expense (OpEx) guidance for 2023 from $92 billion to $89 billion. This could add nearly a dollar in earnings per share if my math is correct (it is). This is the painful, yet necessary continuation of right sizing its workforce after over hiring for 2 years. Easy for me to say. I wish these laid off employees the absolute best.

2. Airbnb (ABNB) -- Regulatory Headache

New York City continues to restrict short term rentals more stringently. Its newest law requires hosts to be present during all short-term rentals within designated city zones. NYC added 2300+ buildings to these zones this past week.

To sidestep this regulation, Airbnb is leaning more heavily into multi-family buildings. Its setting up property managers as residents to make being present alongside short term renters seamless rather than prohibitive. This is a top 15 market for it by volume. It’s important to figure this out and I think it’s doing so.

3. SoFi Technologies (SOFI) -- Annual Percent Yield (APY) & Insider Buying

a) APY

SoFi raised its savings APY from 3.75% to 4% for direct depositors to juice its top of funnel further. As of last quarter, with its bank charter in hand rather than using warehouse facilities to fund loans, the company was pocketing an extra 1.9% in pure margin. It continues to pass some of this on to customers to motivate winning their business.

The timing of this news made me a bit nervous considering regional bank withdrawal issues from SVB and others this month. Is SoFI doing this to retain depositors who are leaving the platform like we’re seeing at other regional banks? Or is this merely a luxury of having its charter to support its overall business?

We got a second piece of APY news this week that, in my mind, answered the question. It CUT its checking APY from 2.5% to 1.25%. To me, this explicitly means that it’s not struggling to retain its depositors amid all of the sector’s recent issues. It thinks it can retain these customers with half of the yield payout. The combination of gradually boosting the savings APY yet slashing the checking APY in half is the company threading the needle of rapid user growth and signaling confidence in stability to shareholders -- in my opinion.

b) Insider Buying

CEO Anthony Noto made another small purchase of company stock this past week. Over the last 12 months, he has spent nearly $20 million to more than double his stake. This incremental investment represents 20% of his total net worth -- a chunk of which is already in SoFi equity and options.

4. Uber (UBER) -- Regulatory Win

Courts in California upheld key pieces of Proposition (Prop) 22 this past week in a ruling that contradicted the opinion of a lower court. Prop 22 allows gig economy firms like Uber and DoorDash to continue treating drivers as independent contractors rather than employees. That will allow Uber and other gig players to sidestep costly benefits paid out to its driver fleet which should be a margin tailwind in the state.

I’m not expecting much pushback from its massive driver roster considering the vast majority prefer the flexibility associated with this classification over being an official employee. Because this is a side gig for a large cohort of them, choosing hours and routes is more appealing than getting benefits for working full time.

For context, just 3% of drivers in Sacramento choose to drive for Uber full time.

This is especially true considering how strongly Uber has focused on building driver incentives over the last few years. This ruling will be appealed.

For more positive momentum, CFRA research published new data this past week concluding the net positive economic impact of allowing this type of gig economy to exist.

While Uber dealt with a lot of regulatory headwinds in previous years, this news (as well as falling future minimum wage estimates for delivery drivers in NYC) are signs that the tide is turning in its favor.

5. Progyny (PGNY) -- Male Infertility

Progyny officially launched its male infertility product. With this new tool, it’s adding a large group of U.S.-renowned reproductive urologists (RU) to its specialist network. Its existing network and industry experts helped it select the cream of the crop from a roster of potential RUs -- just like it did with its female fertility specialists. One out of three cases of infertility (so 1 out of every 24 couples) are due to male issues. This product should mean enhanced male utilization and a rising utilization rate overall -- which is already wonderfully stable.

6. PayPal (PYPL) -- Chief Product Officer John Kim & CFO Gabrielle Rabinovitch Interview with Wolfe Research

Braintree & Upgrading Checkout:

2022 was a banner year for Braintree. It won countless massive merchants and crushed internal growth expectations. Going forward Braintree “continues to win deals” and growth here should be slower, but still brisk. This year, comps become more difficult and the segment will continue to mature.

So? PayPal was not focused on infusing Braintree’s checkout flow (the best, most in-line, most click minimizing flow PayPal has) into branded PayPal and Venmo in 2022. It was focused on ensuring Braintree was scaling with all the new business. This year, the focus will turn to borrowing this flow for Venmo and PayPal. For the merchants that already have access to it, PayPal’s branded share is steadily rising. For those that don’t, share is stable or slightly falling. That’s how important expedience and convenience is within checkout.

Other tools like passkeys continue to lower checkout friction and abandonment as planned. It sees one-click checkout being fully rolled out in 2024 via Braintree's flow and PayPal’s massive vault of saved customer info to avoid manual data entry.

Venmo areas of product focus:

Splitting payments among groups (like SplitWise).

7. Match Group (MTCH) -- CEO Bernard Kim & CFO Gary Swidler Interview with New Street Research

My First Impressions:

This was one of my first times listening to Bernard Kim as Match’s CEO. To be candid, I understand why he rubs some people the wrong way. He uses words like “awesome” and “amazing” and incorporates the word “like” about twice per sentence. His personality doesn’t exude conservative professionalism like most public market peers… and I don’t really care. His track record at Zynga speaks for itself and so does the complete lack of employee attrition from Match when he took over. He reminds me of one of Revolve’s co-founders in Michael Mente. Both speak very casually and both have established excellent reputations within their sector and employee bases. They just don’t sound the same as most public market CEOs to outsiders. But so what?

On the Risk of Saturation & Execution:

CEO Bernard Kim (BK) sees zero issues with dating app market saturation. Yes, Match Group already has a commanding chunk of the space. But still, there are many more small competitors to displace and a large greenfield opportunity in regions like Asia. Furthermore, the industry is poised for 7%-8% compounded annual growth through 2023. This means there will be growth to be enjoyed even with no share gains. BK sees this bear case coming from the poor execution of Tinder’s team throughout 2021 and 2022. He thinks the opportunity to right the ship is clearly there and signs of that happening are already surfacing.

Kim made the Tinder Product roadmap publicly available to investors for the first time in Match’s history. This is why:

“Accountability is super important, and we know we need to execute this year. So, we look at our investors as partners in this space as we go and increase that pie, so it's really important that we execute as a team.” — CEO Bernard Kim

Maybe this is why Barclays upgraded the company to overweight this past week due to perceived risks baked into the valuation being to the upside. I agree, Barclays.

On the Asia Business:

Out of Hyperconnect’s two main apps, Azar continues to perform well with “reasonable growth and 10% profit margins.”

Hakuna -- the other app -- needs “more work.” The new leadership team for that app is entirely overhauling the service to re-release later this year. That really does not inspire confidence.

The Hyperconnect team supposedly has a “chip on their shoulders” to prove to the new Match leadership team that the acquisition was a good decision. I would hope so.

“We and our investors aren’t happy with the way Hyperconnect has turned out so far. But there's still a long way to go, and we just have to keep working and grinding it out.” -- CFO Gary Swidler

While this has certainly been a poor purchase thus far (and selfishly opened the door for me to start a position), there have been some notable positives from integrating the firm. The engineering team is now a core piece of Match Group’s investments in AI/ML.

App Store Relief:

Neither Apple nor Google are remotely close to being in compliance with Europe’s Digital Markets Act (DMA). Match thinks they’ll have to comply by the end of the year with Apple already showing signs of concession by embracing app side-loading (adding an app without going through the app store). Fairer policy would be a 2024 margin tailwind. Considering it spends $600 million per year on these app store fees (about 17% of total revenue) this could be a large source of operating leverage.

On BK Staying as Tinder’s CEO for Now:

“If we hired another CEO or if we promoted from within, it would lead to 6 months of retraining this person, doing a Tinder for Dummies course. Like, (see what I mean?) we just don't have the time for that. We want to see how this team performs, and I'm confident around our team.” -- CEO Bernard Kim

Capital Allocation:

Getting more interested in M&A as competitors become much cheaper.

Will continue to buy back stock if it thinks the stock is cheap like it thinks now.

8. Revolve Group (RVLV) -- Investor Conference

New Partnership:

Revolve is partnering with Jennifer Lopez on an “exclusive new footwear line.” This adds to key partnerships with global icons like Elsa Hosk and Kendall Jenner.

On Inflation & Pricing Power:

Revolve continues to be able to pass inflationary price increases on to its end customer for 3rd party brands.

In terms of owned-brands, it has also been able to pass on price increases and continue to price its items similarly to 3rd party offerings.

On International:

International phase 1 for Revolve is localizing the user shopping experience and infusing the same layers of convenience that North American shoppers enjoy. This means free returns, expedient shipping and localized pricing with automated duty/tariff calculation & compliance. The company is “close to being finished” with this phase. Once complete, it will focus more on product assortment per region before finally ramping up marketing spend.

On Fulfillment:

The new East Coast facility is now fulfilling returns and about to begin shipping new inventory orders. This will cut down on fulfillment miles and should offer some cost savings starting in 2024.

It continues to explore smaller international fulfillment centers to localize this process even more. Interestingly (& I think thankfully), we were told it will go about this through 3rd party logistics partners vs. doing it all internally in the U.S. This takes a sizable chunk of the execution and margin risk out of international proliferation.

As of now, most returns go all the way back to its California facility. As new centers open up, it will find fuel and delivery cost leverage.

It will NOT focus on making returns harder for customers to cut costs. Free returns and “turning your house into a dressing room” are big pieces of its value proposition and why its return rate is so high. It’s by design. Still, it WILL focus on things like augmented reality-infused shopping to better match customers with styles and sizes to reduce returns via that avenue.

Revolve modeled 0 improvement to fulfillment costs for 2023 vs. 2022. Already we’ve seen fuel prices tank. If tailwinds like this persist, there will be upside to its profit guidance.

On New Categories:

Management sees beauty growing well beyond the 3% of revenue that it makes up today over time.

Athleisure and men’s apparel are key areas of growth focus for 2023.

Inventory:

The team continues to be on track to normalize and right-size its inventory position by June. It will be conservative with new orders this year and thinks it can easily flex up orders with its vendors if need be. Its supply chain is in great shape vs. a year ago.

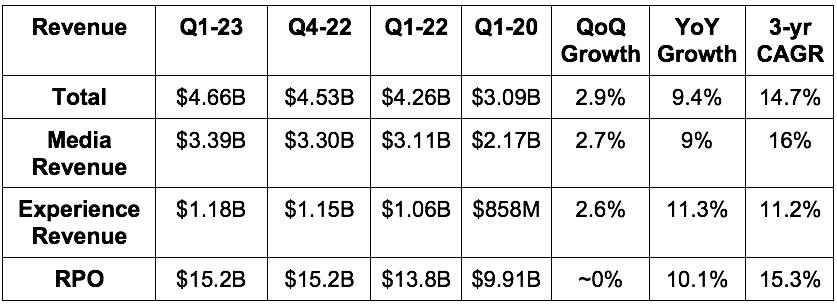

9. Adobe (ADBE) -- FY Q1 2023 Earnings Snapshot

a) Results vs. Expectations

Beat revenue estimates & its identical guide by 0.9%.

Beat net new digital media annual recurring revenue (ARR) guide by 9.3%.

Beat digital media revenue guide by 1.2%. Beat digital experience revenue guide by 0.9%.

Beat $2.65 GAAP earnings per share (EPS) estimates by $0.06 and beat its guide by $0.08.

Beat $3.68 EPS estimates & its identical guide by $0.12. EPS grew 12.8% YoY.

b) Guidance vs. Expectations:

Q2 Fiscal Year 2023:

Beat revenue estimates by 0.2%.

Missed $2.71 GAAP EPS estimates by $0.03.

Beat $3.76 EPS estimates by $0.02.

Fiscal Year 2023:

It did not include a revenue guide vs. guiding to $19.2 billion for the full year last quarter.

Raised its digital media net new ARR guide by 3%.

Raised its previous $15.30 EPS guide by $0.15 which beat analyst estimates by $0.17.

Raised its previous $10.90 GAAP EPS guide by $0.10 which missed analyst estimates by $0.03.

c) Balance Sheet

$5.65 billion in cash, equivalents & short-term investments.

$3.63 billion in long term debt.

Adobe’s diluted share count sits at 460 million vs. 466 million QoQ and 475 million YoY as it continues to buy back shares. It bought back $5 billion this quarter. Over the last 8 quarters, through buybacks, it has shrunk its overall diluted share count by 4.7%.

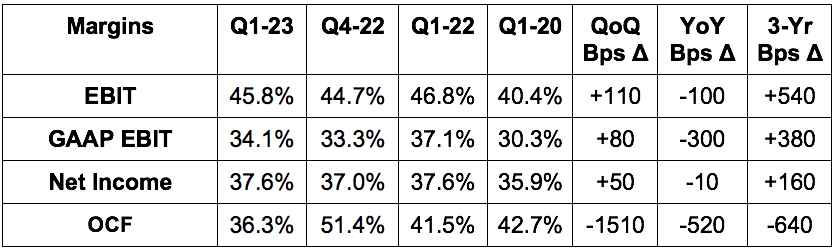

d) Call & Release Highlights:

Demand Context:

9% YoY growth was 13% YoY on an FX neutral basis.

Creative Cloud Digital Media enjoyed “healthy new demand across all creative cloud apps.” The segment won Accenture, BBC, Disney, IBM and Nintendo as customers this past quarter.

The Document Cloud business won HP, Samsung, Verizon and the Ministry of Defense of Netherlands as clients this past quarter. It enjoyed 16% YoY revenue growth to reach $634 million in quarterly revenue.

Digital Experiences enjoyed especially strong retention and demand. This business won Costco, IBM, Paramount, Pfizer and Carnival as new clients for the quarter.

New Products:

Will soon release “Adobe Podcast” as an “AI-powered audio recording and editing app.”

Added a real time customer data platform (CDP) for sharper analytics.

Macro:

Adobe continues to overcome macro headwinds hurting more software companies. Its ability to “maximize return and impact to drive top line and operational efficiency” is being prioritized even more heavily in today’s environment. That, paired with its key presence in digital economic transformation and the mission critical nature of its products, has allowed it to continue fundamentally executing.

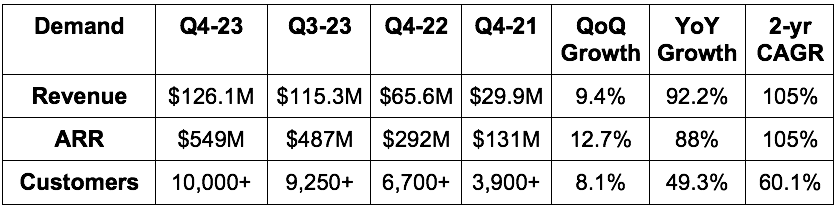

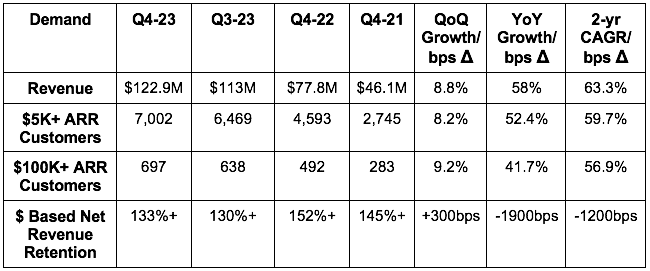

10. SentinelOne (S) -- FY Q4 2023 Earnings Snapshot

SentinelOne is a key disruptor in the endpoint security space. It directly competes with CrowdStrike and Palo Alto along with other legacy antivirus providers. It’s earlier in its growth cycle than both, so it is growing more quickly and is less profitable. All three boast compelling, yet quite different investment cases. I own CrowdStrike of the three.

a) Results vs. Expectations

Beat revenue estimates by 1.1% & beat its guide by 0.9%.

Beat EBIT estimates by 9.9% & beat its guide by 10.3%.

Beat gross profit margin (GPM) estimates & beat its guide by 300 bps.

Missed free cash flow (FCF) estimates by 91%.

Beat earnings per share (EPS) of -$0.16 by $0.03.

b) Full Fiscal Year 2024 Guidance vs. Expectations

Missed revenue estimates by 3.5%. This represents YoY growth of 51% vs. estimates calling for 55% growth. Really not that bad of a miss.

It also guided to 47% ARR growth for the year and a chance to reach 50% growth. During the previous quarter, it called out 50% as a minimum for ARR growth, so this was a reduction.

Missed EBIT estimates by 6.2%.

Beat gross margin estimates of 72.3% by 170 bps.

On track to reach non-GAAP EBIT profitability by fiscal year 2025 (calendar 2024).

On track to be FCF positive by the end of fiscal year 2024 (calendar 2023).

Will slow hiring this year as it has the talent it needs for now. Same exact messaging as CrowdStrike.

The new Wiz cloud security partnership is not included in the guide and could offer “upside potential.”

c) Balance Sheet

$1.2 billion in cash & equivalents.

No debt.

Stock comp was a lofty 36.6% of sales vs. 39.9% QoQ & 39.2% YoY. This is too high, but is greatly impacted by equity grants that were issued at a valuation about triple where SentinelOne is today. Share count growth is a better gauge of dilution here. But still, diluted share count growth remains rapid at nearly 7% YoY. Again, too high.

d) Call, Letter & Release Highlights

More on Demand:

The 105% 2-year revenue CAGR compares to 116% last quarter & 122% 2 quarters ago.

Revenue for calendar 2022 as a whole rose 106% YoY.

Dollar Based Net Revenue Retention was 130%+ vs. 134%+ last Q and 129%+ YoY. It does not disclose gross retention which always makes me wonder why that is the case. Direct competition does disclose this important metric. All we heard here is that it “got better this quarter.”

905 customers with $100K+ in annual recurring revenue (ARR) vs. 827 QoQ & 520 YoY.

Secured wins with U.S. federal agencies, global FIs and “tech pioneers.”

Its deal pipeline “nearly doubled YoY” entering FY 2024.

International revenue rose 125% YoY and is now 35% of total business.

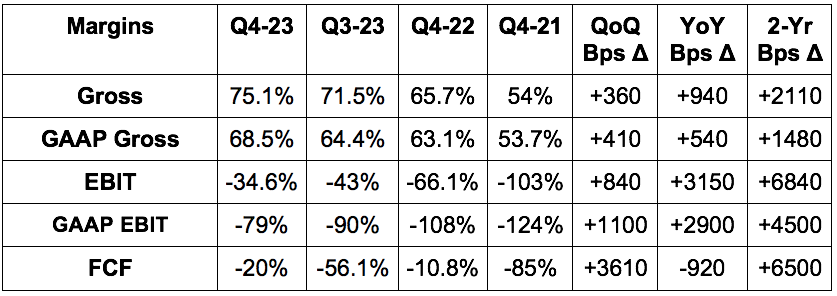

More on Margins & New Product Traction Powering Leverage:

Gross margin was boosted by 150 bps via “certain nonrecurring benefits.” It would have been 73.5% without this help. It also renegotiated its cloud hosting contract thanks to growing scale which should help gross margins a bit this year. Still, 73.5% was an outperforming result and was thanks to SentinelOne not seeing any pricing pressure in the competitive environment. CrowdStrike was asked the same question and gave the same answer.

SentinelOne reiterated its long-term EBIT margin target of 20%+. This margin expansion, like for others, will be largely driven by cross-selling. New product traction and margin expansion are and will continue to be tightly correlated here. SentinelOne’s platform offers it seamless leverage via module up-selling with virtually no added operating expenses. It’s very similar to CrowdStrike in this regard.

Cross-selling newer use cases like its cloud workload protection (CWP) (called the “Singularity Cloud”) appears to be going quite well. It contributed 15% of total quarterly average annual contract value. This is now needle-moving.

Emerging capabilities equated to 33% of total SentinelOne bookings for calendar 2022 as a whole.

The strongest emerging product categories -- in addition to cloud -- are within data retention, managed detection and response and identity.

SentinelOne thinks the new cloud security partnership announced with Wiz will give it a larger lead within Cloud Security Posture Management (CSPM). CSPM automates the extensive search for vulnerability and misconfiguration across cloud workloads and environments.

On Competitive Positioning:

“Win rates increased” across all client types with its “market position strengthening across endpoint & cloud.” It told investors it’s winning a “significant majority of competitive situations” vs. legacy and next generation vendors.

It explicitly said this was a banner quarter for Microsoft displacements. It offered a specific example of a large financial institution leaving Microsoft Defender for SentinelOne to lower total cost of ownership, efficacy and ease of use.

It’s unclear how much of the win rate commentary is via winning small vendors that larger endpoint competition does not pursue as aggressively.

Leader in 2022 Gartner Magic Quadrant endpoint protection (EPP) with great scores across the most critical use cases. Strong showing here.

“We’re taking market share… I'm incredibly encouraged by our pipeline entering the year as well as our record pipeline generation so far in Q1.” -- Co-Founder/CEO Tomer Weingarten

Keep in mind that executives from both SentinelOne and CrowdStrike like to talk a very big game. The trash talk flows freely within both of these leadership teams. Both would tell you they’re superior to the other. I like to take this commentary from both with a grain of salt and focus on financial results as evidence. Results were solid for both.

On Macro & Guidance:

SentinelOne called the macro headwind intensity impacting its business roughly the same as Q3. Added budget scrutiny is leading to longer sales cycles and some shrinking deal sizes. Its guidance assumes these headwinds will persist throughout the year. That’s likely why the revenue outlook was a bit light.

We’ve already heard from CrowdStrike that its guidance – which assumed the same headwinds persist throughout the year – ignored some early green shoots it was seeing in the macro landscape. If the same is true for SentinelOne, it’s easy to see how its outlook could be raised throughout the year.

“We expect the macro-related uncertainties to persist for the full year, and a conservative view on revenue and ARR expectations is prudent in today's environment.” – CFO David Bernhardt

Vendor consolidation and lower total cost of ownership is on the forefront of executive team minds. That, paired with security being the least discretionary piece of IT budgets, puts SentinelOne in relatively better shape in terms of macro resilience vs. other pockets of software.

11. GitLab (GTLB) -- FY Q4 2023 Earnings Snapshot

GitLab’s core competency is source code enablement. It presides within one of the three buckets in the development & operations (DevOps) portion of the software industry. It mainly complements binary management platforms like JFrog and software package observability players like Datadog and Splunk. Developers build with the GitLab’s of the world. Then this source code is translated to scalable (machine-readable) binaries for securing & delivery to the endpoint. Datadog observes the efficacy and performance of these packages. That’s the 30,000 foot view of the DevOps space.

a) Results vs. Expectations

Beat revenue estimates and its identical guide by 2.8%.

Beat ($26.1) million EBIT estimates by 47.1% & beat its ($26.5) million guide by 47.9%.

Beat $0.14 loss per share estimates & its identical guide by $0.11.

Beat 88.4% GPM estimates by 60 bps.

b) Full Fiscal Year Guide vs. Expectations

Missed revenue estimates by 9.4%. This would have been worse without the announced price hike and represents 25.1% growth at the midpoint vs. expectations calling for roughly 38% YoY growth. Yikes.

Beat EBIT estimates by 29.3%. This made the revenue miss a bit more palatable.

Beat loss per share estimates of $0.52 by $0.25.

The Q1 2024 guidance was similarly poor on the top line and largely in-line on profit. The profit beat came from the FY Q2-Q4 2024 outlook.

c) Balance Sheet

Stock compensation was 28.9% of overall calendar 2022 (FY 2023) sales vs. 11.9% YoY. This is going in the wrong direction, although it deserves some context. Most of this stock comp was granted at the IPO – a full 100%+ higher in terms of valuation. The comp number is valued at the time of the grant, not when it vests. Diluted share count growth, a preferable dilution gauge, grew 3.6% YoY. Not ideal, but not awful. It has roughly $935 million in cash & equivalents with no debt.

d) Call & Release Highlights

Demand Context:

GitLab – per Forrester – delivers a 427% client return over 3 years with a payback period of under 6 months.

The company raised prices for its premium plan from $19 per user per month to $29. This will take effect in April and is a new development for the company. Its guidance includes the boost from this change, so the 1300 bps revenue growth miss would’ve been worse without the tailwind.

It is actively considering raising prices on its other subscription tiers.

This month, it will begin limiting users of the free tier plan to 5 per customer to motivate faster conversion to paid subscriptions.

Its Ultimate Tier subscription (full tool access) is now 40% of total revenue vs. 37% YoY.

Gross retention is in the “low to mid 90% range.” 95%+ would be fine. 91% would be weak.

Margin Context:

Net loss was helped by allocating more losses to non-controlling interests YoY. It allocated $3.4 million vs. $980,000 in the YoY period. This is why net income margin was better than EBIT margin.

It’s still trying to de-consolidate from Jihu – its China joint venture. The guide includes $33 million in JiHu operating expenses which could be eliminated if the separation happens this year.

Macro Headwinds & Guidance:

GitLab’s leadership team was noticeably more optimistic about their macro insulation compared to other software companies in its Q3 call a few months ago. It alluded to these headwinds starting to surface in the Q3 call, but didn’t see them as all that intense or overly concerning. This set the bar higher for its quarterly report and the FY 2024 guide than perhaps any other company. It did not deliver. GitLab’s durability continued through the first two months of the quarter. The last month of the Q4 period is when things turned sour and the macro boogie-man hit it.

“Last earnings call, I cited some watchpoints that we encountered towards the end of the quarter. We started seeing greater deal scrutiny on some deals, lower expansion rates than historical trends, and a slight uptick in contraction. These factors became more pronounced during 4QFY2023.” -- CFO Brian Robins

Like other software companies, GitLab began dealing with added deal approval layers, lengthening sales cycles and more budget scrutiny leading to more seat contraction and less customer expansion than anticipated heading into the new year. Hiring slowdowns from its existing clients slowed its expansion wins as well. This is what led to it firing 7% of its staff last month. It will continue to very selectively hire.

The pipeline remains somewhat strong. The company thinks it will need more potential pipeline coverage than it normally does to translate into typical revenue due to lower expected conversion for the year.

Leadership explicitly told us there’s “no change in overall guidance philosophy. This does not seem to be a product of being overly conservative like with SentinelOne and others I’ve covered. Still, the guide does not rely on macro improving all that much this upcoming year.

Customer Success Stories:

Deutshe Telekom reduced time to software release from 18 months to 2.5 months with GitLab.

Haven Technology cut costs and cut development cycle times from 3.5 days to 12 hours.

New Tools:

Debuted its “Value Streams Dashboard.” This offers full “visibility in the process and value delivery metrics associated with their software development lifecycle.”

New AI tool to pair developer code creation with the best reviewer to expedite software delivery.

Another new AI tool called “GitLab Code Suggestion” to raise developer speed & productivity with code suggestions.”

Creating a new security solution with its existing AI models to “automatically detect and remediate code quality and vulnerabilities.”

Relative Valuation (sorry, but I have to):

After the GitLab guide down, it now trades for about 10x gross profit with 25% YoY growth expected and no other profitability.

Its binary management complement, JFrog, trades for 5x gross profit with 22% YoY growth expected. JFrog trades for 70x EBIT (growing 1200% YoY as it turns positive) and 50x free cash.

12. Cresco Labs (CRLBF) -- Earnings Review

I did not have time this week to publish the Cresco Labs earnings review – I apologize and will include it in next week’s post. The quarter was about as expected and leaves me in the same position I was in going into the report. Great company. Great team. But I still cannot accumulate more equity here until we see more clear signs of the regulatory tide finally turning in its favor. As long as it has no access to banking or insurance, has no access to affordable capital, and has no access to institutional demand, this stock will likely struggle. I’ll have much more to say about this next week. I will not sell any shares.

13. Macro

a) Key Data from the Week

February Consumer Price Index (CPI):

CPI for February came in at 0.4% month over month (MoM) vs. 0.4% expected and 0.5% last month.

Core MoM CPI (strips out food & energy) came in at 0.5% vs. 0.4% expected and 0.4% last month.

YoY CPI came in at 6% vs. 6% expected and 6.4% last month.

YoY Core CPI came in at 5.5% vs. 5.5% expected and 5.6% last month.

February Producer Price Index (PPI) data was very encouraging:

Core MoM PPI was 0% vs. 0.4% expected and 0.1% last month.

MoM PPI was -0.1% vs. 0.3% expected and 0.3% last month.

Output data

NY Empire State Manufacturing for March came in at -24.6 vs. -8 expected.

Philly Fed Manufacturing Index for March came in at -23.2 vs. -15.6 expected.

Crude Oil weekly barrel inventories rose 1.550M vs. 1.188M expected.

Building Permits for February were 1.524 million vs. 1.340 million expected.

Consumer Data:

Michigan Consumer Expectations for March came in at 61.5 vs. 64.5 expected and 64.7 last month.

Michigan Consumer Sentiment came in at 63.4 vs. 66.9 expected and 67 last month.

Initial Jobless Claims were 192,000 vs. 205,000 expected.

MoM Retail sales for February came in at -0.4% vs. -0.3% expected.

Banking Issues:

Goldman, Morgan Stanley, JP Morgan and Citi loaned First Republic Bank tens of billions in deposits to strengthen its balance sheet.

Credit Suisse got $54 billion dollars from the Swiss National Bank to solidify its balance sheet. UBS is rumored to be considering buying it.

The Fed created the Bank Term Funding Program (BTFP). This allows banks to borrow from the Fed by using treasury bonds as collateral at par value. This greatly eases the concern (for now) of mark to market losses from hold to maturity bond portfolios in connection with soaring rates.

5-year breakeven inflation is rapidly plummeting towards 2%:

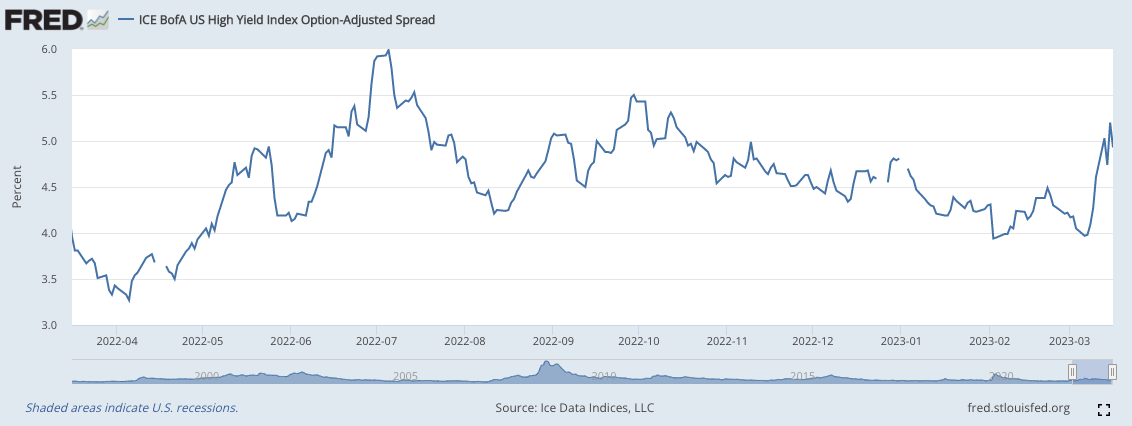

High Yield Option Adjusted Corporate Credit Spreads thankfully gave back some of their gains that followed the regional banking issues:

b) Level-Setting the Data

January inflation data stunk. February inflation data has been ideal. Not only was the CPI largely in-line with the PPI very cool vs. expectations, but that progress should continue. Backward looking rent inflation is the source of the still elevated readings. Owner equivalent rent, Apartment List’s rent index and the tanking Truflation reading all point to that inflation falling in real-time. Add to that cratering energy prices and diminishing monetary velocity via banking fragility, and the disinflationary trend is fully back.

Are the banking issues ideal? Not at all. But this issue as a systemic market risk is far more comfortable for me to invest into than runaway inflation forcing continued rapid rate hikes and quantitative tightening (QT). The Fed has even now started ADDING assets back to the balance sheet via BTFP in a move that technically puts QT on pause for now. And amazingly, Fed swaps now expect up to 4 rate cuts in 2023 vs. expecting 0 until 2024 as of early March.

The Fed finally broke something. Time to adjust. As they adjust, monetary policy should get easier, liquidity should get more favorable and long duration assets like growth stocks should fare better. Not in linear fashion… but over time with many fits and starts. We shall see.

14. My Activity

N/A