News of the week (March 14-18)

The Trade Desk; Progyny; Revolve Group; Match Group; SoFi Technologies; GoodRx; Ayr Wellness; Nanox; Tattooed Chef; The Boeing Company; Fed Highlights; My Activity

1. The Trade Desk (TTD) — New Partner & an Interview

a) The Trade Desk Partners with Adobe

The Trade Desk and Adobe’s Experience Cloud announced a new relationship which will free The Trade Desk to integrate emails stored in Adobe’s Customer Data Platform (CDP). The Trade Desk will then hash (or anonymize) these identifiers to use them to enhance programmatic targeting within Unified ID 2.0 (UID2). This marks a continued shift from Data Management Platforms (DMPs) to Demand Side Platforms (DSPs) like The Trade Desk which allow for more real-time, granular, actionable and scalable digestion of all this data to power auctions.

While Adobe partners with other advertising companies and UID2 alternatives, The Trade Desk will be the first to have access to its vast and lucrative email base. This deal was a year in the making as these two bellwethers carefully ironed out privacy and data-sharing issues to ensure compliance.

“This partnership is akin to how Google and Facebook have excelled by backing their ad IDs with their email data and successful Customer Resource Management (CRM) services… Adobe and The Trade Desk share many clients and this is where we’ve seen these customers getting ready for a new world.” — Director of Business Development for Adobe’s Experience Cloud Sahil Gupta

b) VP of Inventory Development Will Doherty Interviews with Rob Beeler

On the launch of Open Path:

“This is a different stance than what we’ve historically taken when working with publishers. Prior to this, the only way we were able to manifest bids for a publisher was through existing Supply Side Platform (SSP) relationships. What we’ve realized and heard from both buyers and publishers is that they wanted a means for direct connection.”

“Open Path leverages pre-bid technology to provide an opportunity for a publisher to receive the bids from us directly. We will bid into Open Path in the same way we bid into our SSP partners... All of those paths remain open. But now, for publishers with the technical capacity to manage bids directly, we will be available as a choice.”

While The Trade Desk leadership has been extremely careful in crafting this product launch as a non-competitive threat to the supply side, providing publishers with an option to directly receive bids does replace a small piece of what the supply side does. It can say it’s non-competitive all it wants — and should be doing so to remain as non-conflicted as possible — but there is a small amount of utilitarian overlap here in my calculation.

On what Open Path has to do with Google:

“This is related to Google in the sense that we’re being much more intentional within the supply chain. Google’s Open Bidding — just based on all of the law suits and un-redacted filings — really became a problematic integration. We were no longer sure which permissions had been granted to which parties. And so, if win rates are being established for other buyers, even when we had the best bid, we didn’t necessarily win because of some other agreement.”

“Buyers desire to have a more direct relationship with publishers rather than dealing with a pseudo-anonymous pool of inventory which prevents a complete understanding of where ad dollars were going. Open Path is the logical next step.”

On how this impacts relationships with SSP considering the Pre-Bid Direct approach:

“SSPs provide a wide range of services to publishers that we will never do. They have to help providers chose the best possible outcome (yield management) and we will never provide these yield services. These supply side tools are critical now and likely will be in the future.”

“The only thing Open Path will allow publishers to do is if they have those supply side capabilities internally, they can make a decision on which is the best possible outcome. Open Path is far narrower than what an SSP will do. At the end of the day, we’re still beholden to the buyer, we’re just trying the make the best possible decision via the choice for direct bidding. It’s not a one size fits all and will not work for every publisher.”

2. Progyny (PGNY) — CEO Peter Anevski Interviews with Barclays (which became a new Progyny client this year):

On macroeconomic factors fueling Progyny’s space:

While birth rates overall are falling, that drop is being driven by a sharp reduction in teen (thankfully) pregnancy. Women over 35 — who inherently need Progyny’s services at a higher clip — are having more babies today than in the past, which boosts the market share leader’s demand. Other factors cited are things like 67% of employers offering coverage vs. 50% just a few years ago. This continues to rise as employers see fertility benefits as a core enabler of hiring new talent. Tighter labor markets are accelerating demand for services like Progyny’s preservation (egg freezing).

Progyny’s broad ranging offering — which includes the LGBTQ+ and single mothers by choice communities while competition doesn’t — also allows users to bolster a company’s ESG standing which is important to young investors. Progyny often finds that when it enters one of the 30 industries it currently serves, competition generally follows in a sort of domino effect to compete for coveted talent and investor dollars.

“Hospital systems around the country as clients had been a challenge. They’re now going to become an opportunity for us thanks to signing Hospital Corporation of America. As the leaders in those industries tend to adopt earlier, the rest realize this is really something they should be looking at.”

On 2022:

“Obviously we’ve had challenging utilization periods throughout the pandemic, but the impacts have been really short-lived due to the resiliency (and time sensitivity) of pursuing treatment… although we are not a subscription model, we act like one in many ways.”

“The high end of our guidance assumes normal levels or utilization and mix which is what we’ve been seeing into the second part of Q1. The rest of our range considers a variety of factors that could hit utilization and any delays in clients going live.”

As a reminder, Omicron hit Progyny’s business hard in December and January, but the recovery in utilization was far more rapid and meaningful than with past variants.

On expansion into male fertility services:

Anevski talked about the 10% of urologists who focus on male reproductive services and how Progyny wants to plug these professionals into its network to handle male-based issues and to deepen the breadth of service. According to him, “This is an opportunity for Progyny in terms of average revenue per cycle.”

On Canada:

“We want to initially address our global clients with Canadian populations but we’ll ultimately put together a go-to-market strategy to go after Canadian companies with large populations. This is us dipping our toe into the water of international expansion. There are other counties in Europe we would look at after we see how Canada goes.”

Progyny’s strong balance sheet, cash flow and no debt frees it to make enthusiastic investments in expanding its range or services and geographies. It’s great to be profitable.

3. Revolve Group (RVLV) — Co-Founder/Co-CEO Mike Karanikolas Interviews with Barclays

On inflationary pressures:

“The inflationary environment isn’t something that we’ve really seen before. That said, we know our consumer is not as price sensitive as most. They want to look and feel great with price a secondary consideration. We’re hopeful that we’ll be more insulated from it.”

On reopening helping active user growth:

“Reopening 100% benefits us. Revolve is known for going out and traveling and for people wanting to look and feel their best. You don’t wear Revolve clothing to sit around the house. A lot of consumers still haven’t returned to going out as much as they used to and we think as this shifts, we will be a continued beneficiary.”

It’s interesting to think about an e-commerce company as a pandemic ending beneficiary. Considering the type of apparel it sells and its live event marketing strategy, this is the case.

On FWRD (its other brand):

“FWRD had been on fire… the Kendall Jenner partnership really pours gasoline on this fire. We’re outgrowing all other public luxury comps… the opportunity is quite large.”

Think of this as a digitally native Sachs Fifth Avenue. It curates a collection of luxury brands (many of which are unknown/up-and-coming) to provide shoppers with a unique, data-driven selection.

On supply chains — specifically considering Revolve’s strategy to buy shallow & “read & react” to sales trends with timely reordering:

“There are challenges, but I think these challenges have hurt our competitors much more than they have hurt us as you can see in our results. Read and react really insulates you from sharp changes in consumer demand. With shallow initial ordering, we cast this very wide data net and then react quickly to whatever is working with quick, automated decision making and some human oversight. We are very much quicker than a lot of the competitors out there. It’s a challenging environment but we’ve been very successful.”

“Neither my co-founder or I had any background in fashion. We were two guys trying to sell women’s fashion. So we solved the problem with spreadsheets and computer systems.”

Karanikolas is a consumer engineer by trade who orchestrated the building of Revolve’s entire internal tech stack — from inventory to ordering to interface.

On 2022:

“Even this year, we are still not quite back to normal. What we’re guiding to for investors is to expect some reversion to the historical mean on gross margin as % of sales at full price falls from record highs. But we do think we’re in a much better ongoing place than we were pre-pandemic as we leaned even more heavily into read & react during Covid-19. So we believe a lot of those gross margin gains will stay.”

On the new East Coast fulfillment center:

“Not only will there be cost benefits, but also benefits to serve our East Coast customers even faster with 1 day shipping rather than 2 days.”

Revolve sees an international distribution center as a probable investment in the long term once international meets large enough scale. It will continue to invest in experience localization by country in the meantime.

4. Match Group (MTCH) — CFO Gary Swidler Interviews with Morgan Stanley

On the metaverse and social discovery:

“The few things we’ve experimented with early on could be very different experiences from what we’ve had up until now…. we’re building experiences where people are immersed in a virtual world and moving around and sometimes taking introductions off-line: I think it could be the next phase.”

On looking ahead after a crazy 2 years:

“The business has stayed resilient, but it hasn’t gotten that tailwind from the end of the pandemic. They’ve resumed a lot of normal activity, but there’s still a lot that’s missing — events and socializing are coming back slowly but surely.”

“I think people do feel like Omicron was probably the last stand. It’s going to take time, but we’re heading towards normal… my confidence is high that we’re getting there. The spring and summer should be good. People are ready. Momentum is building.”

The USA and Europe are leading the recovery with Asia behind. Japan mobility specifically is at the lowest levels since March, 2020. This is an important Match market and is still struggling due to the pandemic. The recovery will look very different across countries.

Around 1% of Match’s revenue comes from Russia/Belarus/Ukraine.

On Google and App Store fees overall:

“They haven’t shown desire to announce a policy change. This is surprising based on the regulatory momentum. Regulators in the EU basically came out and said they weren’t listening to regulators in the Netherlands and Korea, so we’re going to clamp down harder… I think the EU and jurisdictions around the world are committed. Korea merely got the ball rolling… Changes will likely continue to come. The pace and order is hard to predict, but the momentum is there.”

As a reminder, the EU is currently considering the Digital Markets Act which would bar mandatory in-app payments usage (and so would lower overall fees) — which is what Korea and the Netherlands did with respect to dating. This would also prevent developers from being treated differently (so like Facebook getting a lower fee because they’re massive for example).

“We continue to believe change is coming in the App Store ecosystem, and we’re looking forward to it.”

On Tinder’s Explore tab:

Tinder will soon roll out Festival Mode to allow for people going to the same live event to connect.

“The key thing for the Explore Tab was building it and getting people to go check it out. That has happened really well and so now we can start to really build on it to give people different experiences and more reasons to spend time on Tinder. We’ll monetize this further down the road.”

On Hinge:

“We transformed Hinge into a great thing from a business that had nowhere to go in 2018. We thought it was a good product, but together with the Hinge team, we’ve really built it out from a marketing and product perspective.”

Swidler reminded us that Hinge is well on its way to passing Bumble as the 2nd most popular dating app globally. It’s already number 2 in many key markets according to Data.AI (formerly App Annie) and continues to grow share.

Things like voice prompts — which organically went viral on TikTok — greatly helped to accelerate Hinge’s adoption in the face of Omicron. It will expand throughout Europe in 2022 and then the rest of the world thereafter with localized products for each region.

“We keep giving the Hinge team the resources they need — from my perspective, the sky is the limit.”

On Hyperconnect (Azar and Hakuna):

“We didn’t quite get the start we wanted from Hyperconnect’s two apps. We didn’t get our arms around it as quickly as we wanted to just being in the middle of the pandemic and buying something halfway around the world.”

“I’m optimistic that we’re making the right moves and that it’s heading in the right direction. The financial performance has stabilized and started to improve. We are helping them a lot on the marketing side where they were a bit weaker in a tough environment. The product is making some tweaks and performing well. I appreciate everyone’s patience in this regard… We’re working hand in glove with the Hyperconnect team.”

Hyperconnect’s video and audio assets will be integrated in Tinder’s explore page at some point.

On the 40% long term EBITDA margin target:

“This ignores meaningful App Store changes. If that relief comes through as I think it will at some point, the goal of 40% + margins will go up from there.”

The company is currently around 36%.

On the guide:

“A very small piece of the guide this year is attributable to pandemic and macro improvements… we modeled out that we’d go back to pre-Omicron levels in the back half of the year. We know that could prove conservative, but we’ve all been head-faked a few times. Until we see it, we didn’t really want to call it.”

“I’m optimistic that people don’t want to go back to pre-Omicron levels, but back to 2019 levels. We started to see a glimmer of it in February in that tiny window so we’ll see how spring and summer progresses.”

On Capital Allocation:

“Buybacks are probably something we should be looking at, especially with the stock where it is. We don’t have a tremendous amount of excess liquidity at the moment as we’ve just hit our leverage targets, but it will build through this year and next.”

5. SoFi Technologies (SOFI) — Insider Buying

Over the last several weeks, SoFi CEO Anthony Noto has been aggressively buying up shares. Since the beginning of March, he has raised his stake by 6% with seven separate purchases equating to $1.2 million. He seems to think SoFi’s stock can help investors get their money right.

Along with Noto, Micah Heavener has made two purchases for $80,000 in total with board member Ahmed Ali Al-Hammadi buying $84,000 worth of stock this week as well.

6. GoodRx (GDRX) — Investor Conference

On conservative 2022 guidance:

“This year we decided it would be better not to speculate on any recovery and just to look at the world as we see it now. We feel it would be useful to constituents to understand what was in the guide… we took away all speculation and guessing around when the pandemic may be gone.”

Voermann reminded us that the weak Q1 2022 guidance was offered in January while Omicron was raging which forced them to be immensely cautious. To me, this was his wink to shareholders that there’s a beat and raise coming — and there better be.

“The pandemic’s volatility has significantly impacted healthcare providers — our biggest single source of new users.”

As a reminder, it’s assuming things like heavier subscriber churn in response to a price hike than its testing has indicated would be the case. It’s being as conservative as it can possibly be.

IQVIA’s undiagnosed condition backlog now sits at 1.3 billion vs. 1.0 billion last year. It has only grown. It will eventually unwind and that will eventually feed GoodRx’s business, but that tailwind has been removed so will be pure upside to guidance whenever it does finally come. This cost GoodRx roughly $100 million in 2021 sales.

On take rate:

GoodRx’s PBM contracts enable them to grow take rates as they provide more and more volume. This is why GoodRx’s take rate continues to rapidly rise with scale while competition isn’t enjoying the same trend.

On Competition:

Voermann reiterated that GoodRx has seen 0 impact or even presence from Amazon. Amazon’s fill volume through brick and mortar (where 95%+ of scripts and rising are filled) is a few hundred per month.

“It’s challenging for others to do what we do. There are 2 classes of competition. Entities like GoodRx that are a lot smaller like RxSaver which we bought and some larger ones. Across the board, the reality is that nobody has even close to the relative market share we do. Our next biggest competition is roughly 15-20% as big as we are … that ends up making our rate better because we drive more volume.”

“The other dimension is PBMs entering the prescription discount space. PBMs have been trying to do this for decades but it has never really taken off for 2 reasons. First, PBM customers often find out that their rates are higher vs. other PBMs which leads constituents to push the PBM to lower its pricing. The challenge PBMs have is one of channel conflict. If they tried to offer the same pricing we do, it would deflate the profit pool across the majority of their business that has nothing to do with DTC. Consumers can’t tell which PBM they’re using with GoodRx which protects the PBM and allows them to price at the right marginal cost without disrupting existing operations. This is why we’ve never really seen any encroachment here.”

“On the pharmacy side, we have deep relationships with all of them. We ran ads in the fall in collaboration with CVS. Walmart runs videos for their pharmacists on how to use GoodRx which they pay us for because they value GoodRx users.”

“One of our competitors referred to us at the Kleenex of the discount pharmaceutical space because we’re the name people think of. That makes it very hard to dis-intermediate us from Healthcare Providers (HCPs) and pharmacies.

Leading and growing scale paves the way for more savings and therefore more volume.

On ViaCare (GoodRx’s most recent acquisition):

“VitaCare allows patients and providers to offload all of the work… VitaCare takes deductibles and co-pays and savings plans off the plate of a consumer and removes the need for providers to have to go through all of the insurance overhead. Scripts are sent to VitaCare and it then navigates the entire insurance and manufacturer process.”

“After we announced the transaction, the phone started ringing pretty much right away… VitaCare is a known entity in the space.”

This is mainly for branded drugs where only 3% of Americans who are eligible for these savings plans actually know they are.

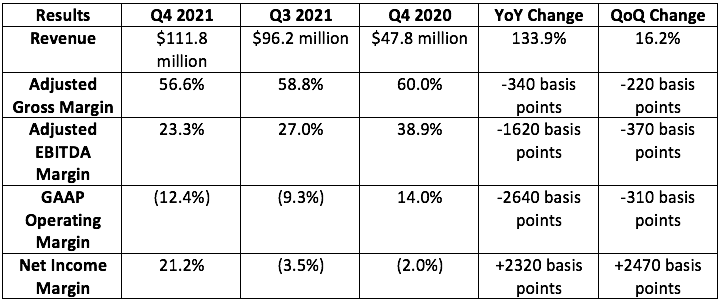

7. Ayr Wellness (AYRWF) — Earnings Review

a. Results

Ayr Wellness guided to sales of at least $105.8 million and analysts were looking for $106.2 million. Ayr posted $111.8 million in sales, beating analyst expectations by 5.3%.

Ayr also guided to adjusted EBITDA of roughly $26 million with analysts expecting the same. The company posted $26.1 million, barely beating expectations.

Ayr Wellness expanded its state footprint from 2 to 8 and added 62 stores and 8 new cultivation centers during the year. Margin compression was expected as a result of this transformative organic and inorganic spend. Full year 2021 adjusted gross margin contracted 110 basis points (so = to 1.1%) year over year (YoY) with adjusted EBITDA margin contracting 700 basis points. Margins are expected to expand in 2022.

“We are now squarely focused on making 2022 a transformative year for Ayr’s earnings power. These CapEx projects will began generating revenue throughout 2022 leading to a significant ramp. While these projects have been delayed, we are proud of what our team achieved throughout the pandemic and supply chain crisis.” — Founder/CEO Jonathon Sandelman

Notes on the results:

This includes 32% growth from its YoY, apples to apples base of 2 states. I’m hesitant to call this organic as there has been M&A in these states.

Same store sales rose 5% sequentially during a down quarter for the market.

Falling gross margin was based on temporary supply-demand mismatching while recreational programs slowly go live.

Note that the strong net income margin was vastly aided by $47.3 million in other income vs. an expense on this line item of $831,000 last year.

Net income margin would have been (21.0%) without this help.

b. Guidance

Construction delays and regulatory schedules will lead to roughly flat YoY growth over the first six months of 2022 which is in line with the industry. Revenue will meaningfully ramp thereafter.

The company is no longer guiding to 2022 results — but now expects to enter Q4 2022 with an annual run rate of $800 million in sales, $250 million in EBITDA and $100 million in operating income. No concrete guidance was offered.

c. Press Release Highlights

Regional highlights:

Northeast:

Two adult-use dispensaries in Massachusetts are finished and waiting for final regulatory approval. These should contribute to revenue in the company’s second quarter.

Its final cultivation project in Massachusetts is now in the regulatory approval process. Sales here are expected for the 4th quarter.

It’s delaying its cultivation expansion plans in Pennsylvania until adult-use goes live as it has the capacity it needs for medical already.

Ayr applied for three additional adult-use dispensaries in New Jersey and completed a 75,000 square foot cultivation center in the state. It hopes to begin adult use sales in the state in the second quarter.

“While medical stores in Massachusetts have performed well, the real growth driver will come from the opening of our 3 adult use stores and the increased demand from other adult use stores finally starting to open in Greater Boston.”

Southwest:

Ayr grew market share in Nevada to 16% vs. 13.7% sequentially — so it’s growing despite the state shrinking in size post stimulus era. Kynd premium flower is now the best-selling flower brand in the state.

Florida:

Revenues and yields doubled YoY — meaning the company is getting more out of its fixed asset base which should foster long term margin expansion.

Ayr is adding 40% more capacity to its Florida cultivation centers to meet strong demand.

Its hoop houses had to be re-planted (to better suit local weather conditions). First harvest is expected in Q2 this year

“As we all know, Florida municipalities will only want so many dispensaries and our team has secured prime locations.” — COO Jennifer Drake

Balance sheet and footprint:

Ayr Wellness was able to enter into a $26.2 debt agreement with an interest rate of 4.625%! This is a phenomenal rate for an American cannabis company.

Ayr added another $147 million to the balance sheet via the sale of secured notes with a 9.8% rate.

Bought back $8.7 million worth of company stock during the quarter.

Spent $123 million in 2021 CapEx (including $97 million in bridge financing related to M&A) with plans to spend another $70 million in 2022.

It has $154 million in cash on the balance sheet.

It’s in 8 states and sees itself getting to “12-15” over time.

D. Notes from Founder/CEO Jon Sandelman

On 2022 guidance — Somewhat underwhelming guidance was attributed to:

1. Regulatory delays:

“2022 will be a transformative year for Ayr, but it will come later than we expected. Our build-out phase is nearly complete with 95% of our current CapEx cycle constructed — we are essentially past the build-out risk stage. We currently find ourselves in the regulatory risk phase and we recognize we were wrong about how long approvals would take.”

The pandemic delayed in-person inspections “beyond the cushion” it had assumed. Cultivation centers have been delayed for several months with facilities and shops across the nation waiting for final approval. Politicians suck, and as cannabis investors we have to deal with their slow, bureaucratic, inefficient timelines.

“We have no doubt that these approvals will come. It’s a matter of when .”

2. Market Conditions:

Ayr (like we’ve heard from others) currently sees a supply and demand imbalance as capacity for adult-use has largely been built out in many states but states haven’t flipped to recreational yet. This is creating temporary gluts.

“Share continues to grow or remain stable in the states we operate.”

“It makes sense for Ayr and others to build capacity ahead of expected demand. That capacity has caused a temporary supply and demand imbalance which caused price compression. We see this in Pennsylvania and Massachusetts, in particular. Pennsylvania may last longer.”

3. Inflation:

Inflation is impacting consumer spend and the need to allocate more money to goods with less elastic demand.

e) My Take

While management was praised in the past for offering several quarter guidance, that’s currently costing it. There’s a reason other companies are usually quite hesitant to guide to results — regulatory timelines are a crap shoot. Fortunately, I think management was able to level set expectations this quarter and the long term bull thesis remains fully intact. Meh quarter, but I’m very excited for what this company will look like heading into 2023.

8. Nanox (NNOX) — Investor Conference

Keep in mind that while some of this commentary below sounds exciting, none of it means anything until mass quantities of chips are sold in licensing deals or ARC units are actually distributed. Nanox remains my smallest position by far and has a lot to prove.

On executing:

“Since the beginning of the year, we’ve been focused on materializing our vision and ensuring deployment will be as planned.”

It should always be focused on execution.

Nanox is now focused on merging the hardware (its tube) the software (its interface + Zebra medical AI) and a radiologist network through USARAD to solve the main pain points of medical imaging — access and timely, reliable diagnosis.

The first batch of ARC units are now being built at its assembly plant in Israel. Shipments are still planned for this year.

On licensing the Xray tube:

Nanox dedicated a larger portion of the presentation to licensing its tube to future partners. It will “tailor the source to their specific imaging systems” and will charge a fee upfront. Considering the tube has already been cleared, licensing it could already be contributing revenue if the company had been focused here earlier on.

Fujifilm was again explicitly mentioned as an OEM licensing partner and leadership again talked about plans to expand into security and manufacturing as well.

“We believe our proprietary technology offers a wide range of applications across different industries.”

“The 510K clearance was clear validation of our technology.”

Note that mAs refers to brightness and KvP speed of electron emission. Both are positive correlated with doses of radiation meaning Nanox’s being lower hints at lower-radiation imaging. Its presentations indicate a 23% reduction in kVp and a 68% reduction in mAs per image. We’ll see.

On the Korea factory:

Still due to be fully open for commercial production of its Xray-powering semiconductors — slightly ahead of schedule for a change. Meltzer will meet with the team in Korea in 2 weeks. This also means that Nanox is resistant to semiconductor shortages.

“We are not immune to supply chain challenges but we have taken all the long lead items and have ordered them ahead of time. So this shortage should not affect us as the purchase orders for ARC items have been made.”

“This factory will create the chips for the Nanox.Arc as well as the OEM licensing partners we are currently exploring.”

On math:

Nanox reiterated plans for 20 scans per day, $14 per scan in revenue and scans being conducted 23 days per month. Based on 6,500 units in closed pre-sale agreements, this could be worth $502 million in annualized revenue and a contractual minimum of $175 million based on required scans per day of 7 or more. These units will be distributed in countries OUTSIDE OF THE FDA’s DOMAIN “to enable Nanox to accelerate the installation process.” With the FDA, Nanox is first trying to gain clearance for Nanox Arc’s bone health and heart applications.

Nanox says the global average is 60 scans per day which would allow it to easily eclipse $1 billion in annual revenue — but I think this is too optimistic. Nanox also thinks it can push that $14 per scan up to a maximum of $40 as it now provides radiologists and AI-powered diagnostic help. Again, I think it’s safer to assume $14 or something close to it.

The company is in negotiations with entitles in Northern Africa, Canada, India, Spain and a few others for more distribution deals.

On Zebra medical imaging (now Nanox.AI):

“Zebra gives us a state of the art solution to complement and to extend our offering.”

As a note, Zebra (now Nanox.AI) already has eight FDA Clearances. It is already live with its calcium scoring and osteoporosis applications with many, many more to come. It’s in negotiations with integrated delivery networks (IDNs) and providers to ensure broad adoption in the U.S. upon final clearance.

Nanox is building with Nanox.AI what it calls the “Robodiologist” — something that augments and uplifts radiologist work flows by flagging any abnormalities across a whole body scan. This will not replace doctors, it will make them more efficient and valuable. Nanox has created a marketplace to shop for its network of radiologists (first in the U.S. and later globally) and AI-applications. It will plug directly into Nanox’s “Robodiologist” and “Teleradiology” systems.

Nanox.AI will contribute 2 months of revenue for 2021. So Nanox will actually have 2021 revenue.

On 2022 milestones Nanox expects:

Korea chip factory fully operational.

Nanox.AI will continue to sign more enterprise agreements for its AI applications.

1,000 ARC units deployed (minimum $27 million in annual revenue and likely a lot more) — in countries outside of the FDA’s domain.

Nanox.AI does not currently have the current procedural terminology (CPT) code for broad ranging reimbursements for these diagnostic services. It’s working on it with IDNs and providers. This will not happen in the “near future” but more so longer term.

On the longer term:

“We do not contend to compete with the existing market… our technology will actually allow us to work with a few of these players.”

It seems that Nanox will wholeheartedly focus on urgent care and outpatient settings while partnering with hospital and medical imaging centers. Here were the brands it teased as potential partners in this endeavor:

On plans for another multi-source unit:

“We are in continuous dialogue with the FDA on the multi-source. Lately, we have been able to get through some of the challenges by going through the Q-sub process. The FDA operates on its own timeline so while I cannot say when, I believe that in the very near future, we will be able to indicate the plan there. The discussions right now are super positive.”

As a reminder, it will submit the second generation of its ARC unit when it moves from Q-sub (AKA pre-submission application for preliminary feedback) to 510K application.

Meltzer told us that there will be different tiers of the ARC system. He hinted at a “premium tier” and then a “basic tier” with more functionality that would likely just have more sources (so more angles) than other versions. These will have the same kvp and mAs, just with a few up-sell options. Nanox plans to generate more revenue on the premium version.

9. Tattooed Chef (TTCF) — Goodbye

I exited Tattooed Chef this week. It slightly underperformed vs. my benchmark over the holding period. I sold for the following reasons:

Too many accounting issues and an unwillingness to hire a qualified CFO externally.

Input cost inflation with no track record demonstrating an ability to overcome very real and somewhat durable supply chain issues.

The company grows its own food so is very much so exposed to soaring fertilizer and other input prices which is why gross margin continues to precipitously fall.

Freight costs remain sky high.

Marketing costs will need to continue in order to build more brand equity in a commoditized space. It is hard for me to assume any operating leverage in this model at this time.

The need to over-perform on total store footprint and also enter new categories to just try to meet the ambitious guidance it originally set — and a shockingly poor ability to model long term results overall.

10. Boeing (BA) — News

A few pieces of Boeing news:

According to Spirit Airlines CEO Edward Christie, the travel demand recovery post Omicron has been far more rapid than vs. previous variant outbreaks.

Delta is considering a “landmark” (over 100) 737 MAX order which would be its first in 10 years.

Arajet (new carrier in the Caribbean) ordered 20 737 MAX planes with options to buy another 15.

11. Federal Reserve Highlights

The Federal Reserve’s latest notes and commentary from Chair Powell came out this week. Here were the highlights.

The Federal Funds rate was raised by 0.25%, to 0.25%-0.50%. This was the first raise since 2018.

The Fed announced its intent to raise rates by “up to 7 more times” in 2022.

It sees the 10-year yield running above the neutral rate of 2.4% in 2023 and 2024 with a terminal rate of around 2.8% expected at the end of the hike cycle.

Balance sheet reduction could begin in May.

I don’t believe the Fed will be able to raise its benchmark rate all the way to 2% this year as forward looking economic indicators are already slowing. Furthermore, when looking back over the last 100 years of market functioning, actually getting to 2.8% would still represent a rather accommodative yield vs. a very roughly 4% rate we’ve been used to in past generations.

A 2.8% 10-year yield would offer investors a price to earnings multiple of 36X vs. 25X with a 4% rate. Translation? The supply of assets providing compelling yield will continue to be lower than it had been over the last several generations of investing, and that should lead to market multiples on equities ahead of historical means — regardless of balance sheet runoff — in my opinion. A 2.8% rate does not scare me. Brisk revenue and cash flow compounding will overcome macroeconomic cycles and deliver alpha in the long haul. That is where I’ll continue to predominately focus with macroeconomics a secondary consideration.

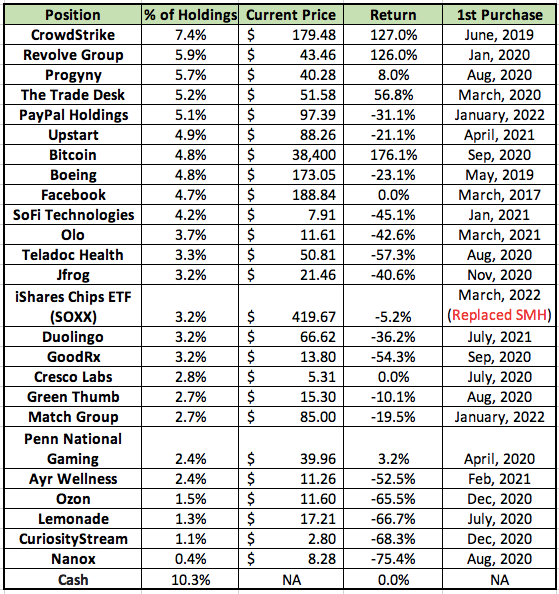

12. My Activity

Aside from exiting Tattooed Chef during the week. I added to the following names:

Olo

The Trade Desk

Duolingo

Upstart

Here is my updated portfolio as of last week. I still plan to post a full portfolio summary in April but wanted to share this for now. Note that this is a little different than the allocations I posted to twitter last week as I used too small of a denominator when calculating concentrations. My mistake. These are accurate:

thank you for your work Brad. :)