News of the Week (March 20-24)

SoFi; Shopify; Meta Platforms; Block; PayPal; Progyny; Duolingo; Lemonade; Lululemon; Cresco Labs; Nike; Macro; My Activity

Today’s Piece is Powered by Savvy Trader:

1. SoFi Technologies (SOFI) -- Investor Conference & Deposit Insurance

a) CEO Anthony Noto Interviews with Bank of America

On Liquidity & Access to Capital Markets:

SoFi has $18 billion in total available liquidity. This includes $8.4 billion in warehouse capacity (with $5 billion of that being undrawn), very sticky direct deposits of $7.3 billion and equity capital of $3 billion. It has excess liquidity.

It saw 0 material hit to financials or liquidity from its drawn $40 million SVB credit revolver. SoFi keeps its deposits with 30 different banking entities to ensure lack of reliance on any chartered institution.

Relationships with capital market loan buyers remain “great” with SoFi able to tap into asset back securitization (ABS) markets twice in the last few months at “attractive rates” and improving spreads. This is important, and not the case for most other fintechs. This is why catering to prime borrowers is such a positive -- especially now.

On Loan & Underwriting Quality & if SVB Issues Could Be Experienced by SoFi:

As I mentioned last week, SoFi’s hold-to-maturity bond portfolio is tiny at $200 million. These holdings are entirely in short-duration securities. Furthermore, unrealized losses on its balance sheet equate to just 0.2% of its tangible book value. To make it even more insulated, its average loan coupon continues to rise faster than benchmark rates and its hedging program continues to lock in cash flow and eliminate all rate sensitivity. Finally, it accounts for its loans based on fair market value accounting. This requires it to mark-to-market changes in loan value every single quarter. So there’s no build-up in loan valuation impairments here to surprise investors down the road.

Finally, its underwriting criteria continues to be extremely strict and it continues to refuse to widen credit bands to support origination growth. It will keep sending rejected borrowers to referral partners through products like Lantern. It also has some integrated 3rd party loan originators that can approve and fund loans on SoFi’s platform with their own liquidity. This lets SoFi add the customer as a member for cross-selling without taking unnecessary risk. Win, win.

It expects credit performance to fall back closer to pre-pandemic times while it will maintain “industry-high credit performance.” He has seen no recent deterioration with credit performance despite expecting that it would come.

“Regulators will have to re-think policies around accounting for unrealized losses and available-for-sale and hold-to-maturity accounting.” -- CEO Anthony Noto

SoFi’s personal loan market share ranges from 6% to 8% by month. This compares to 6% market share as of last year and 4.5% share in 2021.

All of this is to say SoFi is completely fine, just like I explained in last week’s article. And while this news is not brand new to consistent readers, it’s still reassuring to hear it from the CEO while he continues to buy more shares.

On Deposit Health & Growth:

“Importantly, growth in deposits remains strong. We expect absolute increase in deposits to be equal to or greater than the last few quarters.” -- CEO Anthony Noto

This informal guidance reflects minimum 32% sequential deposit growth to reach or eclipse $9.6 billion. Growth here remains rapid. The quality of its newest deposits is also in-line to above older direct deposit cohorts. There are 0 issues here. Business as usual with the drama serving as a small accelerant to deposit growth if anything.

On SoFi Bank:

“We’ve been able to achieve strong return on equity (ROE) in the bank after just one year and without being fully leveraged. We have a line of sight to ROE in the high 20s or higher.” -- CEO Anthony Noto

On the Student Loan Moratorium Lawsuit:

As always, I do not care about the politics of this issue. I care about the impact on SoFi’s business. You don’t read this newsletter for me to share my political opinions, so I’ll continue to exclude them. Left wing or right wing? I don’t care. It’s about alpha.

There’s a bit of confusion out there on what SoFi’s student loan moratorium lawsuit is actually about. This is NOT about select student loan forgiveness. SoFi has advocated for $10-$20 thousand in forgiveness for people earning $125,000 or less. It has also supported a cancellation of debt for permanently disabled borrowers.

“Our recommendation to the administration was similar to what was announced.” -- CEO Anthony Noto

So then what’s the issue? It is about the administration executing. SoFi is suing for payments to resume for non-eligible borrowers 60 days after the moratorium ends in June. It was the result of the administration refusing to put this spoken promise into writing, which to SoFi meant they weren’t planning on adhering to it. This was not an easy decision for the company. It carefully weighed pros and cons and decided it was in its best interest to file the suit. It saw competition in the space vacating and thought it was important to lead this charge and to preserve the market.

There has been “no change in student loan refinancing demand since filing the lawsuit… But there’s likely a larger regulatory target on its back after this move.

On the Tech Platform:

Its largest customers here are “well-funded & continue to invest in their businesses.” This was good to hear considering the tumultuous macro backdrop for fintech and how many players have pulled back on business investments.

Most of the investments in rounding out the product suite and migrating to the cloud are now “behind SoFi.” It will keep investing in Galileo and Technisys, but at a slower pace. This will drive “meaningful profit improvement” as we’ve already been told to expect tech platform contribution margin to have bottomed.

The company is in “meaningful conversation” with a “significant number” of big financial institutions. I’m candidly tired of hearing this. Stop talking about the pipeline until that pipeline starts to convert.

On How Noto Feels about the Previously Issued Q1 and 2023 Guide:

He remains “comfortable” with quarterly and annual guidance and all key performance metrics. I was encouraged to hear the reiterated annual guide as it becomes less clear if the moratorium will actually end this summer. SoFi “continues to see the positive trends” implied in the guide. He thinks its new FDIC insurance product (discussed below) could maybe provide some deposit growth and revenue upside. We’ll see.

On Financial Services:

Reiterated this segment reaching contribution profit positive by the end of the year with a “clear line of sight” to get there.

More product monetization, a slowing of building credit loss reserves and the proliferation of its higher margin credit card business are all helping mightily. It’s still not ready to go full speed ahead on growing the credit business as it continues to perfect the product.

On SoFi in 5 Years (Take with a grain of salt & remember this is the CEO of the company):

“Sky's the limit. The thing standing between us and being a top 10 financial institution is becoming a household brand name. Within the next 3 to 5 years I endeavor for us to be in the top 10… we’re setting up a series of S curves of growth so we can compound for decades, not just a year or 2.” -- CEO Anthony Noto

Quite ambitious.

A Reminder of SoFi’s 2018 Pivot:

When CEO Anthony Noto took over SoFi 5 years ago, the company didn’t look anything like it does today. It was a largely mono-line student loan vendor with a focus on volume and quantity over variable profit, cash flow and quality. In Noto’s words, “loan vintages were not as quality as needed to endure economic cycles.” So? It drastically tightened its underwriting and credit bands and skewed its focus towards maximizing loan volume ONLY while ensuring strong and durable life of loan loss rates. The effect today is an average loan customer with a 750+ FICO and over $150,000 in annual earnings.

This is why I like Anthony Noto so much. He didn’t wait for credit issues to surface like most other fintechs. He didn’t assume tranquil macro would last in perpetuity. Instead, he positioned the business for resilience through these moves and a rapid diversification of its product suite to offer products that do well in all macro environments. He secured a bank charter for cheaper, more reliable access to loan origination funding and an ability to offer a 4% savings APY to juice top of funnel growth. And finally, he vertically integrated the company's tech stack through M&A to become a lower cost operator and an API vendor for its competition. This lets SoFi fully capitalize on the secular tailwind of digitized financial services.

He was 5 years early, and now it’s paying off.

b) FDIC Insurance

SoFi increased its members’ maximum FDIC deposit insurance from $250,000 to $2 million this past week in a timely, savvy move to raise depositor confidence amid banking sector issues. It actually did something similar a few years ago, but the lack of consumer interest led to it ending the program. My how times have changed.

How is it possible to unilaterally 8x the insurance maximum imposed by a federal regulatory body? Good question, I was wondering the same thing. And the approach to pull this off is creative.

To offer this perk, SoFi created the SoFi FDIC Insurance Network. This network features a large cohort of banks that will allow SoFi to disperse deposit funds across a wide range of chartered institutions. Effectively, members will now just enjoy the $250,000 minimum eight times. Importantly, this will not jeopardize or delay access to full account balances as the front-end (what the consumer sees) will still show the aggregate amount while this works behind the scenes. This is a common practice for major corporations and the ultra-wealthy, but has been unavailable for all consumers…until SoFi.

I’d be shocked if other banks didn’t follow suit as I view this as an easy and effective way to juice deposit confidence during a chaotic time when more of those deposits are up for grabs. I absolutely love this move and think it will help SoFi separate itself from the commoditized pack at an immensely key time.

“By offering access to up to $2 million in FDIC insurance, we are making sure our members have peace of mind about their money at SoFi. We know the last few weeks have been unnerving for many consumers, and we hope this helps.” -- CEO Anthony Noto

The glass half empty view on this news is that SoFi is feeling the pressure to maintain depositors via added incentives like this one. Last week’s news on slashing its checking APY in half paired with Noto’s comments on continued rapid deposit growth put that argument to bed.

2. Shopify (SHOP) -- Alphabet

Shopify and Alphabet have long been tight partners. Shopify merchants can sync and push product catalogs directly into Alphabet’s properties (Google + YouTube + Maps) and update product availability in real-time to maximize search engine optimization (SEO). Shop Pay is also available for checkout for Shopify merchants and non-Shopify merchants through Alphabet. Simply put, this is a key selling channel for Shopify merchants.

The partnership deepened this past week. Shopify and Google Cloud are joining forces to “tackle search abandonment.” This type of issue is quite costly to merchants considering they’ve done the work to procure the search and the sale, yet lose the revenue for some reason. So? Google’s discovery AI tools will be directly integrated into Shopify’s largest merchant stores through Commerce Components by Shopify (CCS).

This partnership will more intelligently display search results based on inquiries by mining all relevant Alphabet data to paint a more accurate picture of what the shopper is actually looking for. Rainbow Shops is among the first merchants to use the product which raised its search volume by 48%.

Shopify continues to work on improving its search functionality – which leadership has often called lacking – through both Alphabet and OpenAI’s/Microsoft’s ChatGPT product.

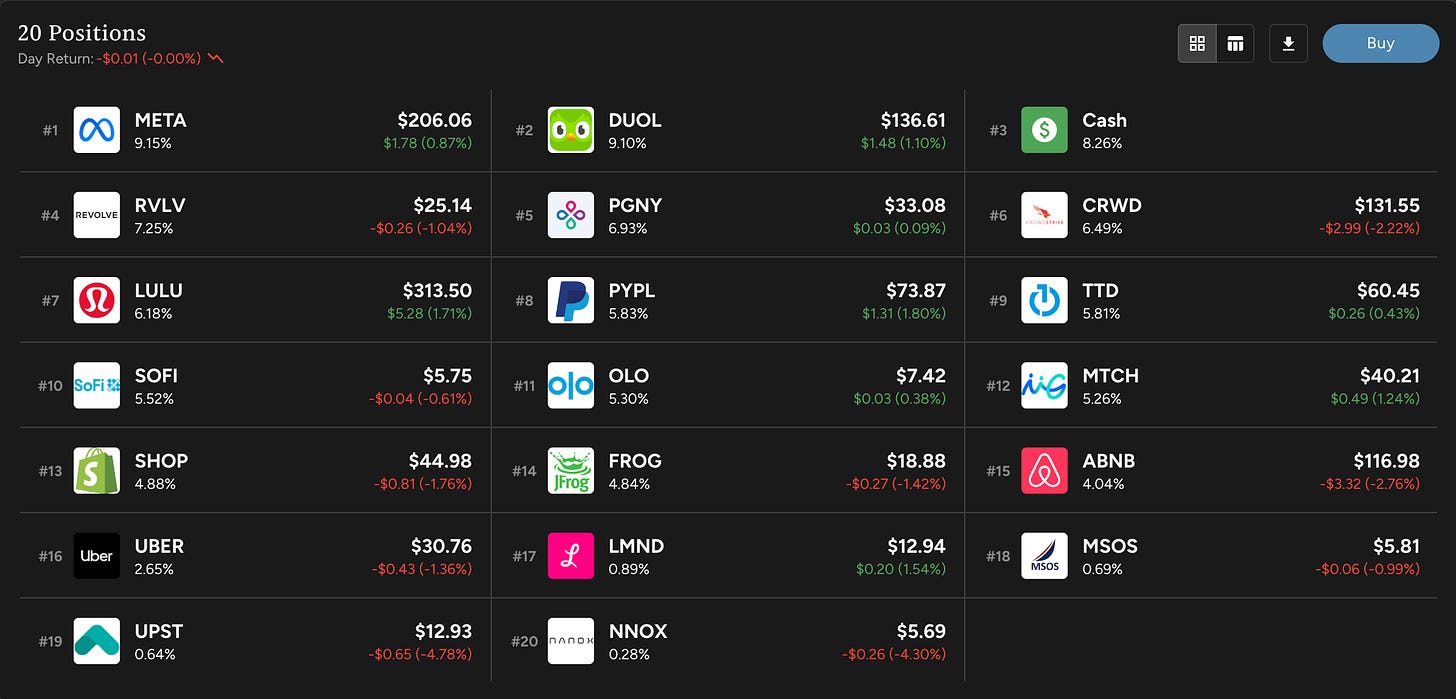

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Meta Platforms (META) -- WhatsApp, Ads & TikTok

a) WhatsApp

Zuckerberg announced new WhatsApp upgrades this week. First, Meta debuted a new WhatsApp function on Microsoft Windows. This is an expansion of its video conferencing service which now allows users to host as many as 8 people via video and 32 over audio. It brings the web version of WhatsApp more up to par with its mobile version for this specific use case. The app will be launched on Apple’s operating system soon and user limits per call will continue to be raised over time.

b) Ads

Analysts continue to come out with bullish views of Meta’s advertising revenue growth for the year. They should have read my newsletter when the company was trading in the 80s, but I digress. This week, Piper Sandler, Edward Jones and KeyBank all published fresh research notes pointing to more effective targeting, reporting and returns. Specifically, Piper Sandler called out the trend of falling ad rates slowing to the lowest level in nearly a year.

Whether it be lengthened attribution windows, the release of Advantage+ or other AI-based investments to sharpen efficacy in a post-IDFA world. Meta is clearly turning a corner – and turning this corner will be astronomically more important to its near-term financials than any developments in the Metaverse. Both firms also praised Meta’s continued cost cuts with Piper Sandler adding that it thinks more cuts are on the way. Based on CFO Susan Li’s conference comments from about 10 days ago, I would agree.

c) TikTok

TikTok CEO Shou Zi Chew spoke to congress this week. The news comes as bipartisan momentum to ban the app builds with the Biden Administration recently being granted banning power by the House Foreign Affairs Committee earlier in the month. Shou Zi took to social media to ask fans of the app to tell congress what they like about it. To me, this reeked of desperation and an awareness that a more formal ban may be becoming more likely. Privacy and security concerns here are not going away and our increasingly fragile ties to the Chinese Government certainly doesn’t help. Last week, the U.S. asked TikTok owners to divest the U.S. assets which the Chinese Government subsequently refused.

4. Block (SQ) -- Short Report

Hindenburg Research released a short report on Block this past week after a 2-year investigation. There were some parts of the report that were quite meaty & potentially concerning with other pieces including cherry-picked data and non-issues that needed more context. Here, I’ll dispassionately walk through the highlights.

On User Metrics:

This was perhaps the most potentially concerning and serious piece of the report. There are two main issues within this bucket: Fake accounts and illegal transactions. Hindenburg surveyed several Block employees that estimated Cash App users are anywhere from 40%-75% fake. All massive platforms deal with duplicate accounts and bots, but this proportion is quite elevated and alarming (if true). Like Twitter, which Dorsey also founded, there are countless fake bot accounts of popular personalities to try to scam people out of funds. Hindenberg even tried ordering a credit card using a fake Donald Trump account and Block’s compliance department issued the card.

Secondly, the report claims that Cash App has intentionally catered directly to illegal and black market activity to support its user growth. Allegedly, when Block catches users breaking drug or sex trafficking laws, they don’t ban the user, they just blacklist that specific account. The issue is that these accounts often have up to hundreds of other logins that remain active and part of Cash App’s user metrics. According to a “leading non-profit organization” and multiple DoJ complaints, Cash App is the top app for U.S. sex trafficking “by far.” Again, all major payments platforms have these bad actors. PayPal has them. Zelle has them. They all have them. It’s invariable. The issue is the sheer frequency and the lack of banning as a result (if true).

It also argued that rappers using Cash App in lyrics to talk about illegal activity was a damning red flag. I found this silly and irrelevant.

During the pandemic, it took what Hindenburg calls a “Wild West compliance approach” allowing bad actors to mass create accounts of identity fraud and to rapidly extract illegal unemployment claims. It allowed single accounts to accept unemployment for several individuals and didn’t effectively verify addresses. All of this led to hundreds of millions in funds needing to be clawed back and a 16x fraud rate in Ohio for Block vs. competing vendors. It also apparently blatantly ignored Anti-Money Laundering (AML) rules to keep this illegal vector of user growth intact & frictionless. Its rate of fraud was 16x that of its closest complement in the state of Ohio. Not a good look from a legal and regulatory perspective.

Interchange Fee Caps:

Block “quietly fueled profitability” by avoiding regulatory interchange fee caps. For banks with asset bases over $10 billion, there are strict limits. Block has $31 billion in assets yet exceeds these maximums routinely by going through a small bank. These interchange fees are 33% of all cash app revenue.

It called out the current PayPal interchange fee investigation and thinks Block will be added to it. As I mentioned in the PayPal section, I see this as a more pressing concern for Block vs. PayPal considering Block is a chartered bank and PayPal is not. This asset cap specifically applies to banks.

This also is irrelevant to me. There’s nothing illegal about taking advantage of interchange law loopholes. Is it legal? Technically yes. Is it a reason to call for 75% equity downside? Not even close.

More Items:

The note calling out rising delinquencies for AfterPay was unfair. Everyone’s delinquencies have risen from the period in question (June 2021 - March 2022) as the stimulus benefit faded away. This is comparing an artificially low period of delinquencies vs. a putrid macro backdrop that promotes delinquencies. The degree of the rise (1.7% to 4.1%) is sharper than others like PayPal, but the fact that its rising is fully expected and not unique to Block. The other Afterpay note on late fees equating to up to a 289% APR was pretty eye opening. Other vendors have no late fees.

It also called out the company warning that it may never be profitable. Virtually every non-profitable company includes that as a risk in quarterly and annual filings. Nothing burger.

The founders cashing out over $1 billion in stock during the pandemic is not ideal, but does not rise to the level of fraud. Many executives have been selling. But again, $1 billion is a large, large number.

My Take:

There were a few items in this report that could be concerning to shareholders and a few more items that shareholders should (in my innocent bystander view) brush off as irrelevant.

5. PayPal Holdings (PYPL) -- Investor Conference & Interchange Fee Caps

a) Head of Merchants and Payments Frank Keller Interviews with BofA

On Modernizing Checkout:

The sheer number of integrations and use cases that proliferated through PayPal’s platform over the last 2 decades leaves checkout flows today somewhat “fragmented” from a merchant and consumer perspective. This leads to some consumer friction and more difficult merchant site maintenance due to a lack of centralized integration and tools to pull from. PayPal is obsessively focused on removing this friction and assuming more of the maintenance and integration work on behalf of its merchants. These changes will allow it to expand into new verticals like transportation and chains where tech stack fragmentation is a real barrier to convincing large brands like McDonald’s to overhaul systems in place. Keller explicitly mentioned McDonald’s. (Perhaps a new Braintree client?)

All of this work will extend to both web and mobile channels for fully inline, eventually single click checkout to delight consumers. The effect is 6% higher merchant conversion and 3%-10% higher PayPal branded checkout share.

It’s worth noting that Shopify already has this. PayPal is playing catch-up.

Braintree’s tech stack will be the vehicle in which PayPal adds these latest flows and software kits across its merchant base. It will use natural up-selling opportunities like BNPL and tap to pay through iPhone to motivate the upgrade to this latest checkout tech by requiring it for these popular products. This evolution takes time, but with the larger merchants that are now on the latest integration kit, PayPal’s branded checkout share is stable or rising. It’s stable or falling for all others to show how important this upgrade truly is.

“With the strategy of using Braintree and PayPal Commerce Platform (PPCP which is Braintree for smaller merchants) as our core platforms, these will be the rails that all future integrations are going through. Whatever new capability PayPal offers will be through Braintree and PPCP rails and technology.” -- Frank Keller

To identify more needed changes over time, PayPal is embracing a more “scientific approach” through more extensive variable split (A/B) testing. New Head of Product John Kim has vastly accelerated the cadence of these tests. This is how PayPal can better take advantage and extract differentiating value out of its massive base of data. Within those data sets are key insights into what its stakeholders want. It’s now uncovering those insights in a more data-driven and less educated guessing manner.

On Braintree’s Competitive Positioning vs. Players like Stripe & Adyen:

Braintree has industry leading authorization rates which allows it to “win a lot of deals.”

Braintree’s ability to orchestrate merchant payments to backup processors and payment providers when needed and also through other vendors in markets PayPal doesn’t cover is another key edge. Stripe and Adyen offer similar perks, but most incumbents do not.

iFoods in Brazil is a new customer.

Braintree is able to package in PayPal offerings like its branded checkout products and Happy Returns to create stickier contracts.

For many merchants with a diverse set of employee payout needs (think Uber and Airbnb) Hyperwallet allows for wonderfully flexible and broad access to payout methods globally.

Keller said Braintree is now working on a brick-and-mortar product to evolve into a more omni-channel offering.

The Braintree pipeline is “super strong” and the segment is off to a great start this year. Still, growth should slow for it as Braintree laps a historically strong year of massive merchant wins.

“We’ve taken share from incumbents, Adyen and Stripe.” -- Frank Keller

On PayPal Commerce Platform (PPCP AKA Braintree for smaller merchants):

The first pilot merchants are now live on this offering. He is “excited by early results.” PayPal will depreciate its older subscription packages like PayPal Pro in favor of this.

b) Interchange Fee Caps

Hindenburg’s Block short report (covered below) included a piece about violation of interchange fee caps. There are strict limits for institutions with over $10 billion in assets which PayPal has. PayPal has denied any wrongdoing and the investigation is ongoing, but it’s clear that the regulatory slack is shortening for the world of fintech.

While this is bad for all of them, I actually view it as a relative positive for PayPal. Why? Because it has deeper pockets, broader regulatory relationships and a brand that is trusted more by consumers than any of its direct competitors. It’s in better shape to endure and adjust to more regulation than its peers as any new developments make operating profitably and legally more difficult. It will hurt them, but it will hurt their competition more.

6. Progyny (PGNY) – CEO Pete Anevski & CFO Mark Livingston Interview with KeyBank

On the Selling Season so Far:

Leadership again reiterated that this year’s selling season is going very well. The added positive vs. last year is more pipeline from channel selling partners which boosts its covered lives target market to nearly 100 million. That means it’s less than 5% penetrated in its core market as the clear carve out market share leader. It’s the go-to vendor with miles of runway to enjoy. Great combo.

The Children’s Hospital Association (CHA) is a key example of this. This association represents 220 hospitals and over 2 million covered lives. It recently picked Progyny as its exclusive fertility service recommendation partner and so will point its member hospitals to Progyny when asked for an opinion. CHA’s decision included an extremely dense review process. Anevski thinks this stamp of approval “greases the skids” for growth considering all of the due diligence CHA did on behalf of their members. Progyny has already signed 5 of these member hospitals with more expected to come.

“We partnered with Progyny because we knew we could trust them to provide the high standard of care, education, support, and empathy that we hold ourselves to.” -- Director of Insurance Services at CHA Kritie Seibert

On Tech Layoffs:

Anevski addressed the inaccurate assumption that Progyny is overly reliant on tech comes from the firm’s beginning. In its first year to market, 80%+ of its covered lives came from tech. Now, that sits at 19%.

While that’s still material exposure, it needs more context. The tech sector has announced a combined 100,000 layoffs this cycle. Not all of those layoffs are from Progyny clients, but even if they were, that would represent a 2.1% proportion of its covered lives. To make things even less concerning, tech continues to selectively hire and the hiring across other industries Progyny is exposed to is more than offsetting this small hit to covered lives. And finally, its robust 2023 guidance already assumes no organic employee growth within existing clients.

“This is headline risk, not real risk. We are not feeling the impact of layoffs. It’s a non-event for us.” -- CEO Peter Anevski

On Utilization Assumptions Baked into the Guide:

Progyny is assuming no improvement to utilization in 2023 vs. 2022. This could be too pessimistic. Why? Because new clients begin at a utilization rate trough and see that metric build over time. Progyny outperformed with client adds last year, so a larger than expected number of new clients should see that metric rise in 2023. If that happens, there will be upside to its estimates as even a basis point rise to this metric materially boosts its business. Utilization trends with its newest clients is in line with previous cohorts.

Client Retention:

Anevski called client retention “99% or 100%” every year since inception. Previously, we’ve been told it’s “near 100%” so it was nice to hear this quantified more precisely. Sometimes “near 100%” actually means “above 90%” for some firms and there is a massive difference between 99% gross retention and 90%. The rare client that does leave is usually because it gets acquired by a firm without the Progyny benefit.

The combination of healthier and less at-risk births, less treatment cycle requirements and plan customization all foster 25%-30% cost savings to join the objective perk of better outcomes.

On the Competitive Environment:

The team was asked about the Walmart contract that Kind Body (a VC-backed competitor) won last year. Progyny was invited to bid for the contract, but refused due to the structure that Walmart was looking for. Kind Body and Walmart crafted the plan so that the national retailer only has access to 20 clinics. If you don’t live near one, you are required to fly to Alabama for a 2-week round of treatment. Most Walmart employees can’t afford this out of pocket (which the plan requires). Progyny wasn’t interested in winning this business as it “didn’t want the brand associated with such a poorly designed plan.”

“Other VC backed competition doesn’t do what we do because they can’t. The roadblocks we hit early on are now a significant moat that VC competition tried and failed at. Now they try alternative models and try to convince you that they make sense. They don’t.” -- CEO Peter Anevski

This is why it was so vital for Progyny to call massively influential firms like Amazon, Meta and Microsoft clients early on. These clients “went to bat” for Progyny and forced carriers to integrate with its plans. Kind Body and others like Carrot don’t have the clients to pull this off.

The vast majority of its competition still comes from managed care plan providers that have essentially halted all focus on perfecting their fertility treatment plans while all have integrated Progyny as a carve-out benefit. This industry is too small for these massive insurers to focus on it… but it’s certainly not too small for Progyny and its $3 billion market cap to continue finding great success.

A Slept on Source of Margin Expansion:

Progyny’s new business scales much faster than it needs to add new patient care advocates or other team members. That has been well-telegraphed, but there’s another source of operating leverage that I don’t think is talked about enough. Progyny’s sales representatives are not paid like typical insurance salespeople. Traditionally, sales commissions are paid out in annuity for as long as the policy is in place. Progyny’s is far more front loaded. So? As the business naturally matures and growth inevitably slows, that will increase SG&A leverage.

Progyny will continue to see operating leverage across all expense buckets which is why its incremental margins are so much higher than the overall book of business.

Un-billed Accounts Receivable:

Un-billed accounts receivable normalized last quarter as expected (& as I said they would). Why? Because Progyny needed time to onboard the massive roster of new clients that it signed. This roster was larger than expected. It takes time to get these plans in place and to begin collecting cash. That collection started ramping last quarter as its EBITDA to free cash flow conversion soared higher. It’s now back to a normalized level.

On Capital Allocation:

It’s looking for opportunities to expand the product offering via M&A.

EBITDA conversion to remain robust and will keep feeding the debt free balance sheet cash pile.

Not yet looking at buybacks or dividends but will consider it if the cash position builds enough.

7. Duolingo (DUOL) -- Music App

Duolingo is reportedly working on a new music learning app. Co-Founder/CEO Luis von Ahn had hinted at this coming in previous earnings calls, and now here it is. This marks the continued expansion of Duolingo from a language learning app to a learning app. This transition, if successful, transforms the firm’s addressable market from tens of billions in size to over a trillion.

Signs of this evolution gaining traction are clear. Its Duolingo English Test is accepted at over 3,000 universities including all top 25 by English proficiency exam volume. Its children’s literature and brand new Math product both continue to race up app store rankings. Math is about to crack the top 25 for free educational apps (Duolingo’s language app is #1). I see no reason why the music product won’t eventually follow suit.

In my view, Duolingo’s approach to product expansion is ideal. It intentionally goes slowly on developing product market fit and waits for products to build enough scale before trying to monetize.

Furthermore, its maniacal focus on product development over external marketing paired with its talented team of developers paves the way for beautiful, engaging products. These products eventually sell themselves in a wonderfully organic and efficient word of mouth manner. That’s why it continues to see such meaningful operating leverage in this model. Its loyal users are fierce advocates of the products and so an eye-popping 90% of its traffic is entirely organic. When it does externally market its brand, it seamlessly goes viral across its social media accounts to build more low-cost brand awareness.

Case studies will be written on the masterfully executed philosophy of this leadership team in the future. All I can do is tip my cap and enjoy the shareholder returns.

8. Lemonade (LMND) -- CFO Tim Bixby Interviews with JMP Securities

Net Promoter Score (NPS):

Lemonade’s NPS continues to be consistently in the 70s. Even when specifically looking at rejected claims, its NPS is in the 60s. All other insurers preside in a range of +0 to +10. Lemonade takes better care of its customers than its competition. That matters.

On a Disruptor’s Edge:

Large incumbents struggle to “collect, analyze and act on data.” Why? Because these companies are routinely 100+ years old. They’ve evolved by stitching together disparate processes and siloed functions that struggle to cohesively work with one another. Lemonade, on the other hand, was born on one system (it calls it a cortex). It updates its systems & ships those updates to the rest of its stack several times a day. Incumbents take months shipping a single update to their platform. Lemonade is objectively more agile. The analyst interviewing Tim offered a great quote from a top 3 insurance incumbent on the overarching issue:

“You try changing the wheels on a bus going down a highway at 80 miles an hour.” -- incumbent CEO

On Metromile & Telematics:

Lemonade’s integration of Metromile car insurance is well underway. It’s quickly working to a point when all car customers can enjoy precise, telematics-powered risk underwriting with their smartphone and an app. Metromile today requires a standalone piece of hardware which is a real point of customer friction.

On Inflation:

Lemonade continues to “close the gap” on rate update filings amid the inflationary environment. There has been a “step change” in the pace of its rate filings which will continue to bolster loss ratios throughout the year.

9. Lululemon (LULU) -- Bullish Note

Bank of America sees inventory gluts and gross margin pressure having peaked last quarter. It thinks robust sales growth across core categories, China and newer accessories will power best in class earnings growth “in the high teens.” I agree, Bank of America.

10. Cresco Labs (CRLBF) -- Earnings Review

a) Demand

Cresco missed revenue estimates of $203 million by 1.7%.

More Demand Context:

Full year revenue rose 3% YoY and, excluding the impact of exiting California 3rd party business, rose 6% YoY.

Full year branded unit sales of 61 million rose 37% YoY while retail transactions rose 15% YoY. The revenue decline is all basket size and pricing pressure-related.

Cresco maintained the #1 share position in Illinois and Pennsylvania while taking #1 in Massachusetts. It has the best-selling branded product portfolio overall for the second straight year per data from research firm BDSA.

The legal cannabis market is now up to $25 billion in size vs. $20 billion in 2021. Its substantially larger when including black market revenue. It took several years for black market alcohol sales to slow following the end of that prohibition roughly a century ago. This will likely look similar.

Retail revenue growth was down YoY due to new stores opening near its own shops. This will continue and Cresco, being the largest wholesaler in the country, expects it to eventually “reach a tipping point” where the wholesale benefit is larger than the retail hit.

Gained or held branded share in all markets except California (where it continues to pull back) and Maryland.

b) Profitability

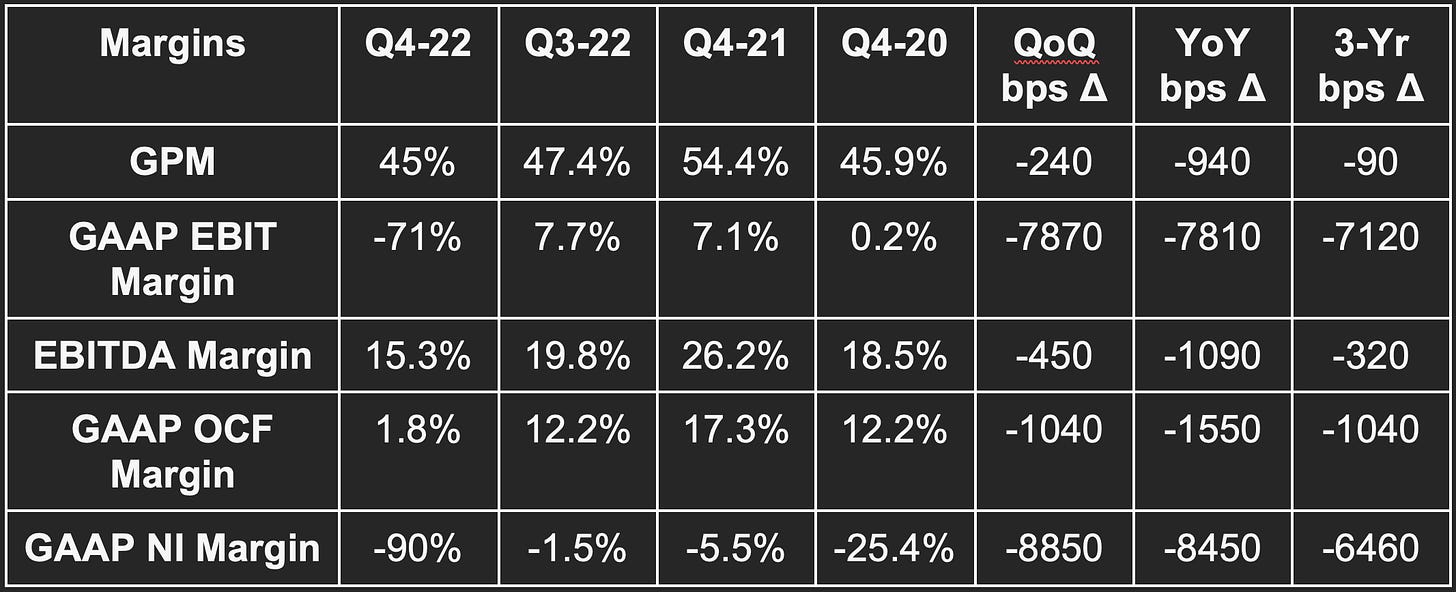

Cresco missed EBITDA estimates by 29% and missed $22.9 million GAAP EBIT estimates by over $150 million. See the “more margin context” section for an explanation.

More Margin Context:

GAAP EBIT and net income margins both include a $141 million impairment charge from exiting the 3rd party California business. They also include another $10 million charge from inventory and intangible asset valuation changes. Without these charges, GAAP EBIT margin was 4.2% and GAAP NI margin was -14.5%.

Without the $10 million charge from inventory and intangible asset valuation changes, GPM was 50% and EBITDA margin was 20%.

Cresco paid out more than 70% of adjusted EBITDA in taxes during 2022. Its GAAP EBIT loss of $83 million still meant it was paying $89 million in taxes. 280E reform is vital. This cannot be overstated.

c) Balance Sheet

$122 million in cash with $327 million in current assets.

Total senior secured debt of $381 million.

It is “very comfortable” with its current inventory position. Inventory fell $17 million QoQ.

“With the improvements we're making to operations, continued cost management, significantly lower capital expenditure requirements going forward and the strategic financing available, we feel good about our cash position.” -- CFO Dennis Olis

d) Conference Call Notes

On the Columbia Care Acquisition:

Agreed to extend the transaction timeline to June 30th 2023.

Now working on final agreements to sell the remaining assets in Ohio and Florida required by regulators.

Capital market conditions vastly changed since the deal was announced but the team still sees “interest from parties with a longer time horizon.”

No longer expects $300 million in cash proceeds from the asset sales. But it will look to sell off more assets (beyond what’s required by regulators) that are redundant or underutilized. That will get proceeds back up to roughly $300 million.

On a Tough 2022:

Leadership was somewhat confident in federal reform coming in 2022. It didn’t. That, paired with more competition, pricing pressure and a stressed consumer led to the challenging year. The team doesn’t expect things to brighten much in 2023 but added the long-term growth story of this becoming a massive consumer packaged goods industry is fully in-tact. That’s nice, but the short-term headwinds need to start to fade before I consider accumulating more shares.

“This industry is going to be one of the largest CPG categories in the United States & in the world, full stop. Nothing about 2022 changes this… What periods like this do is force the separation of the wheat from the chaff. That's a healthy thing and something we welcome.” -- Founder/CEO Charlie Bachtell

On Efficiency:

Ended operations in more “underutilized facilities and unprofitable products in California.” It will focus on the FloraCal brand and infrastructure.

Shut down undervalued greenhouse operations in Arizona.

It’s doubling down on more profitable and successful grow and retail businesses in Florida and Pennsylvania. It will continue to open a total of 8 stores in those states this year.

Both of these moves will impact revenue growth “modestly” for 2023 but will also lead to margin and profitability improvements starting in Q2 and building throughout the year.

On 2023:

Expects revenue to fall slightly sequentially in Q1 2023 due to seasonality and continued new competitor store openings. It expects sequential growth to kick back in starting in Q2 and to continue through the year.

It will begin to enjoy the growth from legalization in New Jersey only after the Columbia Care deal closes.

Expects core sales, general and administrative (SG&A) expenses to be flat QoQ and for these expenses to turn negative starting Q2.

Near term EBITDA margin target remains in the “low to mid 20%” range.

It expects capital expenditures (CapEx) in 2023 of under $42 million vs. $83 million in 2022.

Final Notes:

Leadership remains fully confident in a GPM of 50%+. It will return to that range starting next quarter without continued inventory and intangible asset write-downs.

Starting to see signs of bottoming prices in California (where pricing patterns lead the rest of the country).

The slow legal rollout in New York is “very recently starting to improve.”

e) My Take

Cresco has the largest wholesale business, the most productive retail business among large players and the top selling brand across the country. It’s in a great position to build a massively successful business once legal regulation allows for it. Will that be this year, next year or in ten years? Your guess is as good as mine. Federal prohibition and a lack of reform will continue to be skin-tight handcuffs on these companies until things change. That is why this cannot be more than a tiny position for me today. Politicians are the furthest thing from predictable. Frustrating, but prudent.

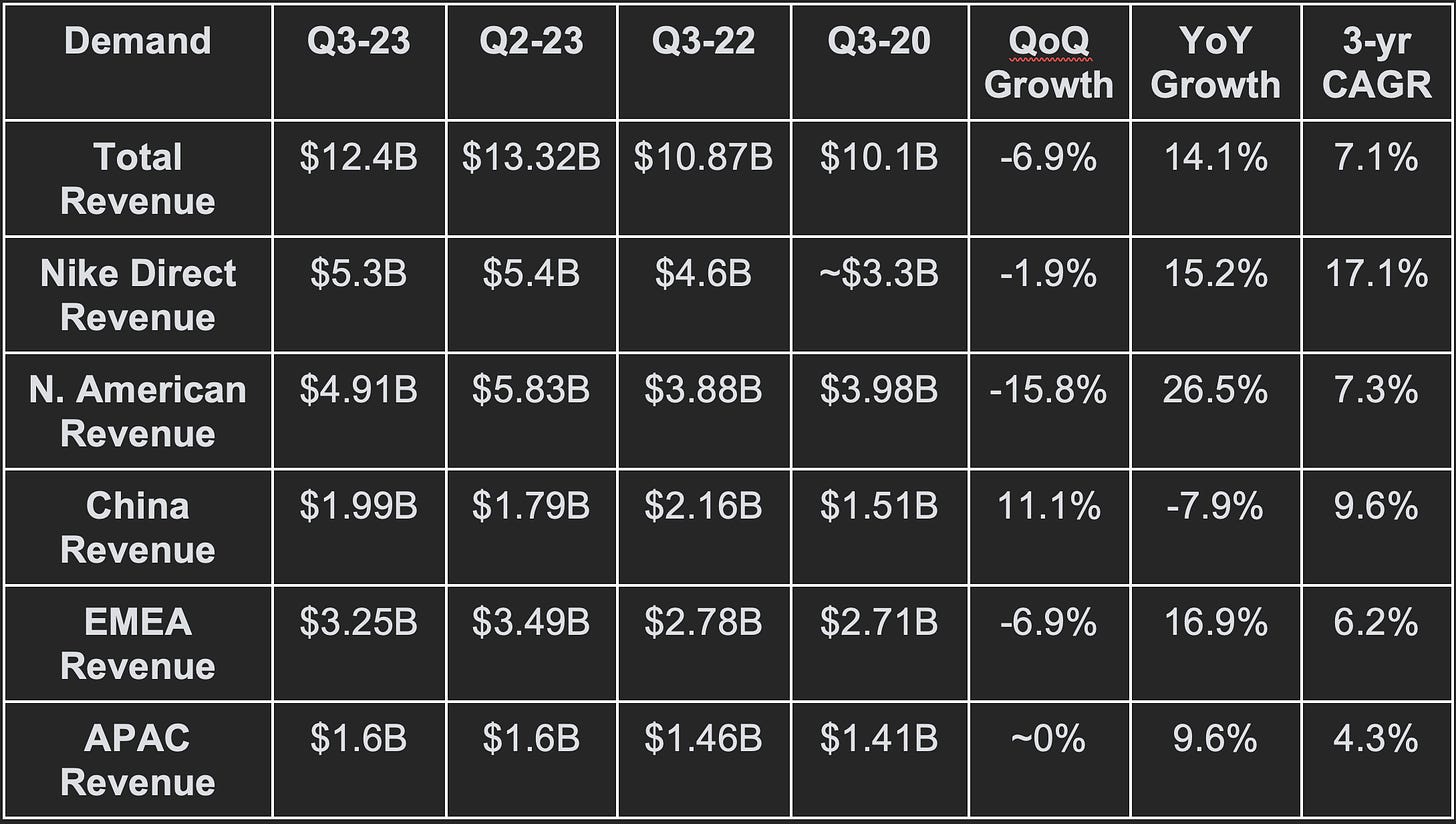

11. Nike (NKE) -- Fiscal Year Q3 2023 Earnings Review

a) Results vs. Expectations

Beat revenue estimates by a lofty 8%.

Beat GAAP EBT (earnings before tax) estimates by an also lofty 46%.

Beat $0.54 GAAP EPS estimates by $0.24.

Missed GAAP gross margin (GPM) estimates by 40 bps and missed its GAAP GPM guide by 30 bps.

b) Forward Guidance Commentary

Nike doesn’t offer formal forward guidance. But while it didn’t publish concrete details, here is what it did tell us:

Fiscal Year (FY) 2023 reported revenue growth is expected to be in the high single digits vs. mid-single digit growth guidance offered last quarter. This is being helped by an overall estimated FX revenue growth headwind shrinking from 700 bps for the year to 600 bps.

It now sees FY 2023 gross margin falling 250 bps YoY vs. previous guidance of falling by 200-250 bps.

“We continue to take a cautious approach to modeling our business.” -- CFO Max Friend

c) Balance Sheet

Paid out $528 million in dividends which rose 9% YoY.

$10.8 billion in cash & equivalents.

$8.93 billion in long term debt with another $500 million in current debt (due in the next 12 months).

Inventory of $8.9 billion rose by a modest 16% YoY vs. YoY growth last quarter of 46%. It’s working through inventory gluts like most of its industry with its inventory pile shrinking 4.5% QoQ. CFO Matthew Friend called inventory progress during the quarter “tremendous” and outperformed internal management expectations.

Nike is on track to get its inventory back to “a healthy position” by the end of this quarter. It continues to prioritize liquidating apparel to get there.

It debuted new product recommendation algorithms in its apps to subtly push shoppers towards inventory excesses.

Nike continues to aggressively buy back shares. It repurchased $1.5 billion in stock this quarter vs. $1.6 billion QoQ. It created an $18 billion buyback program in June 2022. This was supposed to last 4 years but only has $3.4 billion remaining on the plan. That is quite the vote of confidence in its stock. Diluted share count fell by nearly 3% YoY.

d) Call & Release Highlights:

More Demand Context:

Q3 2020 represented Nike’s deepest pandemic demand and margin shock which led to easier 3-year CAGR and basis point delta comps.

Overall revenue growth of 14.1% was 19% FX neutral; unit growth was 10% YoY with net price increases boosting growth further.

-7.9% YoY Greater China growth was 1% YoY FX neutral; 16.9% YoY EMEA growth was 26% FX neutral; 9.6% YoY APAC growth was 15% FX neutral.

Holiday season is its strongest demand period of the year like it is for many apparel companies. This is why QoQ growth was negative.

Wholesale revenue rose 18% YoY while Nike over-indexed across its B2B buyers. That growth is expected to slow due to timing of orders from partners.

SG&A is still growing roughly in line with revenue at 15% YoY as hiring and payroll both increase and it advertises more.

More Margin Context:

EBT margin was a tiny bit higher than EBIT margin for the quarter due to a small interest benefit.

Gross margin fell due to promotional activity to work through its inventory glut. This was offset by selective price increases for certain items. Foreign exchange and higher input costs including freight also hurt the margin line this quarter.

“Even in this promotional environment, full price sales remain strong… average selling price grew for the 7th straight quarter.” -- Nike CFO Max Friend

On China:

Growth in China was hit hard by closures in the country throughout December. The recovery began in January and accelerated in February. It sees the longer term fundamental growth story there as “strong.”

On Shoes:

Consumer reaction to its new Invincible 3 Shoe for long distance runners generated double the sales at debut vs. the Invincible 2.

Nike sees itself as positioned for more share gains in the running shoe category.

The LeBron 20 shoe was the “strongest launch in years. It took share in basketball shoes during the quarter.

The Jordan brand has a “clear path to the number 2 shoe brand in North America.”

The Air Max 270 shoe has been a top 5 launch for Nike over the last 5 years.

It will debut a new Air Max shoe this year which – for the first time – will be crafted based on app polling and consumer feedback.

On Nike Direct (Digital + Brick & Mortar DTC):

Nike direct buying frequency increased along with same store sales.

Digital sales rose 20% YoY (24% FX neutral growth).

Nike enjoyed a double-digit percent increase in mobile and app traffic YoY as its customer direct acceleration (CDA) strategy takes hold.

Repeat buying activity among app users grew at a double-digit percentage clip this past quarter.

App engagement rose by a double-digit percentage YoY as its new dedicated Jordan Member home button yielded its best app click through rate ever.

Digital Average Order Value (AOV) rose by mid-single digits with Nike.com leading the way on new member acquisition.

On Lifestyle Demand Growth:

This segment (also called “Athleisure” outperformed during the quarter. The secular tailwind of shifting wallet share to athletic apparel is fully intact. This is great news for Lululemon’s upcoming report.

On Efficiency:

Return on ad spend improved this quarter.

12. Macro

a) Jerome Powell Press Conference Highlights

The Fed hiked its benchmark rate 25 basis points to 4.75%-5% this past week.

On the Fed Funds Rate & QT:

“No longer stating that ongoing rate increases are appropriate to quell inflation.”

Median rate projection is now 5.1% for the end of 2023, 4.3% for the end of 2024 and 3.1% for the end of 2025. This hints at 0 to 1 more hikes and a pause based on market expectations. The Fed’s base case, however, is still 0 cuts in 2023 and so 0 to 1 more hikes with a subsequent long pause.

The Fed did consider pausing, but there was still a “strong consensus” to hike by 25 bps. Economic and inflationary data was still too hot to pause today.

“Too soon to determine the total impact” of the recent banking issues and so “too soon to know how monetary policy should address them.”

On Inflation:

Powell finally acknowledged that new leases are being signed at rates that will lead to housing disinflation over the coming months.

Services disinflation outside of housing still needs to pick up a lot.

Goods disinflation continues to be material.

PCE median expectation of 3.3% by the end of 2023 and 2.5% by the end of 2024.

Still committed to that 2% inflation benchmark.

On Recent Banking Sector Issues:

Important to address the issue head on as history shows isolated banking problems left unattended can undermine banking and deposit confidence.

The Bank Term Funding Program (BTFP) “demonstrates our commitment to ensuring all depositors are safe.” All banks holding safe & liquid assets can borrow reserves at par which is meeting the “unusual funding needs.”

“Prepared to use all tools. Possible these events will have a very modest economic impact.

This will probably (definitely) tighten credit conditions and weigh on economic output and inflation.

QT is continuing (despite recently adding assets to the balance sheet via BTFP).

“SVB badly failed with growing too quickly and taking too much risk and not hedging that risk appropriately. These weaknesses are not at all broad throughout the banking system. This is an outlier.” -- Powell.

On Economic Projections:

Real GDP median projections now 0.4% for 2023 and 1.2% for 2024. Risks here are to the downside.

The labor market is still too tight with supply and demand equilibrium still out of whack. Expect unemployment to rise from 3.6% now to 4.5% by the end of the year and then 4.6% by the end of 2024.

Wage inflation is moderating.

Housing sector and other rate sensitive pieces of the economy like fixed business investments showing real signs of weakness.

Consumer spending is picking up, but he thinks this may just be seasonal as weather improves.

b) More Key Data from the Week

Economic Output Data:

Crude Oil barrel inventories rose 1.117 million this week vs. -1.565 barrels expected.

MoM core durable goods orders for February rose 0.0% vs. 0.2% expected and 0.4% last month.

MoM durable goods orders for February shrank 1% vs. 0.6% growth expected and -5% growth last month.

Manufacturing purchasing managers index (PMI) for March was 49.3 vs. 47 expected and 47.3 last month.

S&P Global Composite PMI for March was 53.3 vs. 47.5 expected and 50.1 last month.

The Services PMI was 53.8 vs. 50.5 expected and 50.6 last month.

Consumer Data:

Month over month (MoM) existing home sales rose 14.5% in February vs. 5% expected and -0.7% last month.

New home sales rose 640,000 in February vs. 650,000 expected and 633,000 in January.

Initial Jobless Claims were 191,000 vs. 197,000 expected and 192,000 based on the previous metric.

Banking Sector Data:

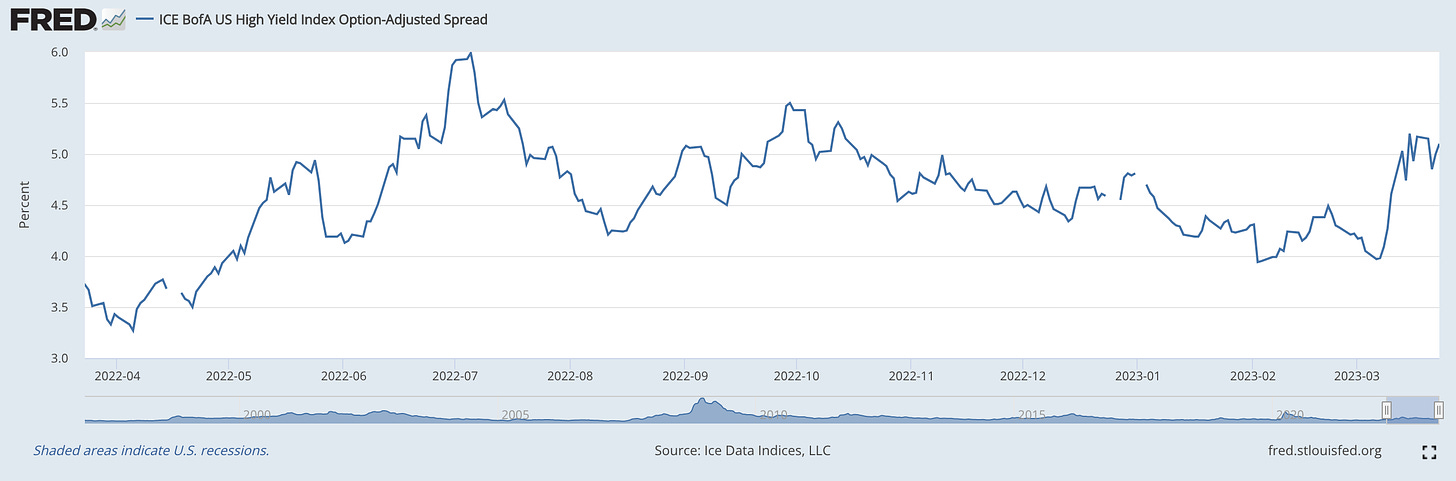

Credit Default Swaps (CDSs) are a contractual agreement. They allow a buyer to offset credit risk by purchasing the right to the value of a debt security in the event that the credit is defaulted on. The buyer pays premiums (or a spread) to the seller for this right. As perceived default risk rises for the insured credit in question, spreads rise. Deutsche bank and Charles Schwab both saw these spreads soar much higher this past week as liquidity concerns mounted. The combination of mark-to-market losses on bond portfolios hitting capital ratios and accelerating consumer withdrawals continues to weigh on this sector. Another rate hike this past week will not help.

High Yield Option Adjusted Corporate Credit Spreads Continue to Be Pressured by the Recent Banking Issues:

5 year breakeven inflation continues to look better (& banking issues are also inherently disinflationary) as pricing pressures cool overall:

c) Level-Setting the Data

Inflation has clearly peaked with strong signs of that trend continuing. Economic output data has also weakened, but at a less noticeable clip. Meanwhile, the employment market remains quite robust outside of tech. The somewhat contradicting concoction along with falling forward GDP estimates with “risk to the downside” makes my base case of a mild recession the most likely scenario in.

As I’ve said consistently in the past, that is a somewhat ideal setup for long duration assets. The Fed will be able to pause in the near future with cooling inflation allowing it to avoid hiking past a mild recession. The banking sector issues that popped up are the first sign of it breaking something, and it is needing to adjust. With as fresh as this development is, I think the adjustments will continue to come and that we are now done with the hiking cycle.

With that said, should it really matter to the long-term investor if the peak rate ends up at 5% or 5.25% and if the first cut comes late this year or early next year? I don’t think so. Fed policy mattered much more to me when we were arguing about 100 bps of hikes or 400 bps of hikes left and when runaway inflation was still a possible outcome. That’s no longer the case. We are much closer to the end than the beginning and that should guide our long-term investment strategies.

I will continue to trim into extreme multiple compression and build positions as thriving firms see their multiples shrink. Candidly, with how ideal February inflation data was, I likely will become slightly less eager to trim than I’ve been so far this year.

13. My Activity

I made no transactions this week.

Best Newsletter on Fintwitt! 👍🏽 Thanks Brad for all your work.

Thanks so much !