News of the Week (March 27-31)

Lululemon; SoFi; Block; Uber; CrowdStrike; Microsoft; Meta Platforms; Visa; Amazon; Apple; Progyny; Lemonade; Macro; My Activity

1. Lululemon Athletica (LULU) -- Q4 2022 Earnings Review

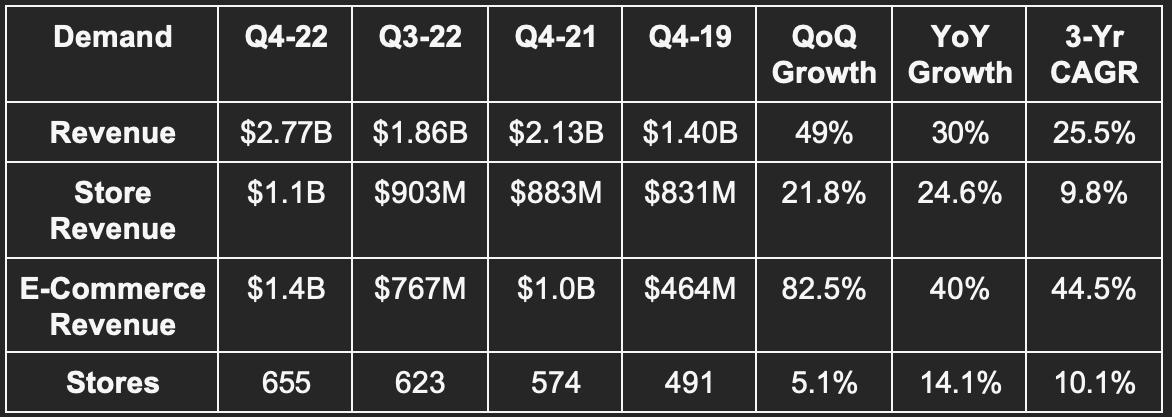

a) Demand

In January, Lululemon updated its revenue guidance from $2.63 billion to $2.68 billion. It beat this raised guidance by 3.4% and beat the subsequently raised analyst estimate by 2.6%.

Lululemon saw inventory rise by 57% YoY when excluding a Mirror inventory impairment and 50% YoY with that impact. This compares to guidance of 60% YoY inventory growth. Lower growth is preferred here.

More Quarterly Demand Context:

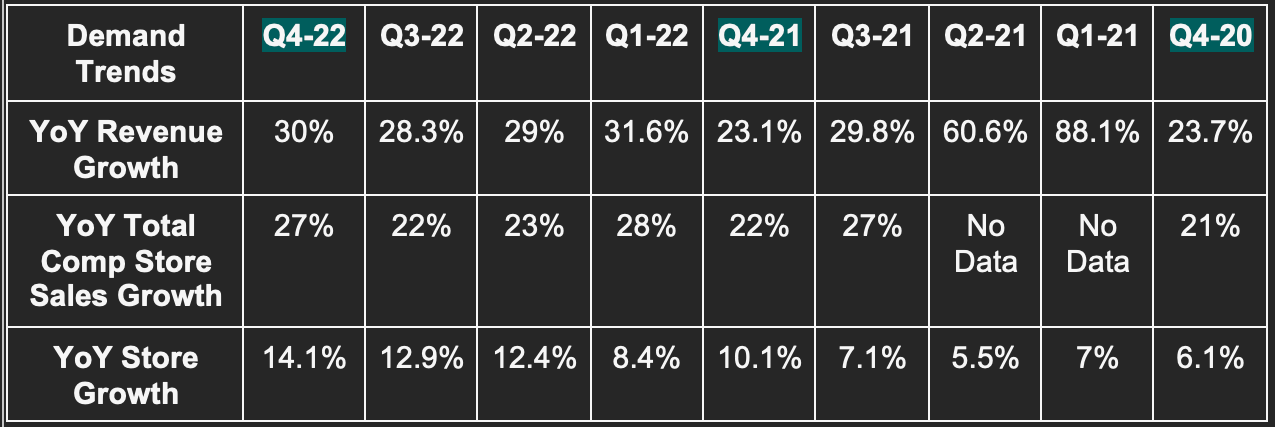

30% YoY growth was 33% currency (FX) neutral.

Revenue rose 29% YoY in North America and 35% internationally.

27% YoY total comp store sales growth was 30% FX neutral.

Direct to consumer (DTC) represented 52% of sales vs. 49% YoY.

More 2022 Demand Context:

Revenue rose 30% YoY for 2022 with total comp store sales rising 25% YoY.

It opened 81 stores during 2022.

Three Year Compounded Annual Growth Rates (CAGRs):

23% for women; 26% for men; 44% for accessories; 46% for e-commerce.

New and existing guest transactions rose in the mid 20% range.

Store productivity is above 2019 levels. Store traffic rose 30% YoY and has compounded at a 3-year rate of 7%.

Digital traffic rose 45% YoY and has compounded at a 3-year rate of 40%.

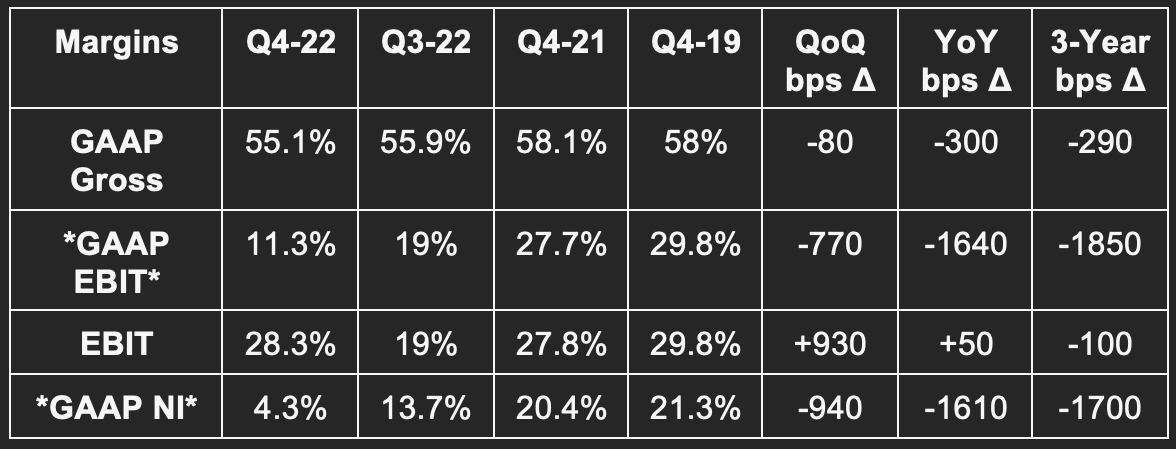

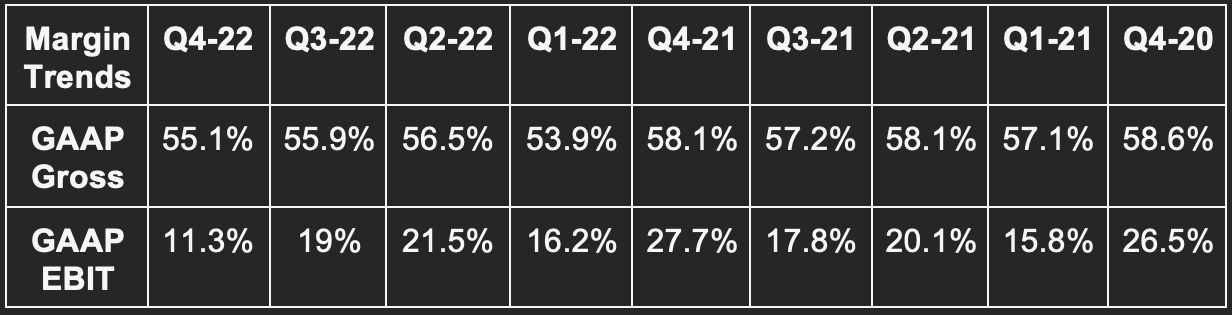

b) Profitability

Lululemon guided to its adjusted gross margin falling by 100 bps as part of its January update. It beat this expectation by 30 bps.

Missed GAAP EBIT estimates by 58.4%. This includes a $408 million Mirror goodwill charge. Non-GAAP EBIT, which excludes this impact, beat estimates by 3.5%.

Missed $4.25 GAAP EPS estimates & its identical guide by $3.31 due to the same Mirror goodwill charge. Non-GAAP EPS, which excludes this charge, beat $4.25 estimates by $0.15.

Beat free cash flow (FCF) estimates by 29.5%.

More Margin Context:

GAAP margins were hard hit by a $442.7 million Mirror goodwill impairment charge. This stemmed from disappointing hardware sales for the segment and a shift in go-to-market strategy explained below.

Adjusted gross margin ex-Mirror impairment was 57.4%. This was hurt by 50 bps of FX headwinds.

SG&A actually enjoyed 50 bps of FX YoY benefits for the quarter.

GAAP Gross margin for 2022 fell from 57.7% to 55.4%.

GAAP EBIT was flat YoY due to the mirror impairment charge. Ex-impairment charge, EBIT rose 30% YoY. Similarly, GAAP EPS fell from $7.49 in 2021 to $6.68 in 2022. This is all related to Mirror. Ex-impairment charge EPS rose 29.2% from $7.79 to $10.07 YoY.

c) Balance Sheet

Lulu generated $838 million in FCF during the quarter. This allowed it to greatly bolster its cash position which now sits at $1.2 billion.

Bought back $69 million in stock this quarter vs. $17 million QoQ & $321 million YoY.

It has about 75% of its $1 billion buyback left.

It has $393.5 million available in credit capacity.

Inventory rose 50% YoY but fell 16.9% QoQ. Q3 2022 was supposed to be the “high water mark” for its inventory position which looks to be the case. Leadership guided to inventory continuing to normalize with YoY growth rates here matching revenue for the 2nd half of the year. It’s encouraging to see Lululemon execute this normalization with quite modest rises in discount rates.

d) Forward Guidance

Q1 2023:

Beat revenue estimates by 3.4%.

Beat $1.65 GAAP EPS estimates by $0.31.

“Significant GPM expansion” via lower air freight charges and promotional normalization. Gross margin estimates sharply rose from 53.9% to 56.8% following the call.

“We continue to see strength and momentum across the business so far in Q1.” -- CEO Calvin MacDonald

2023:

Beat revenue estimates by 2.4%. Its revenue guide implies 15.5% growth which is slightly above its longer-term target despite comping vs. 30% growth in 2022.

Beat $11.30 GAAP EPS estimates by $0.31.

EBIT margin to rise by roughly 30 bps vs. 10 bps of expansion expected.

Will open 45-50 new stores with 30-35 openings happening abroad and most of those being earmarked for China.

Gross margin to expand by 150 bps YoY due to freight benefits and stabilizing markdowns. This implies a 56.9% margin vs. analyst estimates calling for 56.2%. These estimates rose to 57.3% following the report.

CapEx to rise sharply to $670 million YoY in 2023 due to distribution center investments, store openings and remodels. It is building a new facility in LA and expanding capacity in Columbus and Toronto. This will be a temporary margin headwind.

It remains fully on track to execute on its Power of Three x2 plan which calls for 15% compounded revenue growth and modest operating leverage through 2027.

“While we are mindful of the ongoing macro uncertainties and we continue to plan the business prudently, we're excited with our sales trends in Q1 and also the benefits we expect to realize in 2023 from lower air freight and our new Lululemon Studio model… We can invest into our growth pillars while delivering operating margin in 2023 slightly ahead of our goal.” -- CFO Meghan Frank

e) Call & Release Highlights

Market Share Gains:

Lululemon took 230 bps of incremental YoY market share within its adult active apparel category. This rapidly rose from 130 bps of share gains last quarter. It was its largest quarterly gain in 3 years which is according to 3rd party research from NPD Group -- not per internal data.

Growing Brand Awareness & International Traction:

Since April 2022, Lululemon raised its brand awareness in the following geographies as follows:

From 19% to 24% in Australia.

From 7% to 9% in China. China revenue rose 30% YoY as the country opened up and so business vastly accelerated into 2023. A tough December due to lockdowns held back results here for the quarter.

From 14% to 16% in the U.K.

Change in Subscription & Mirror Strategy:

Lulu is shifting away from go-to-market Mirror hardware growth investments. It is launching a brand-new digital fitness app this summer, with a lower subscription price, which will become the focal point of this refreshed approach. It’s pivoting away from Mirror investments as falling customer acquisition cost (CAC) has not been meaningful enough to justify continued spend. By removing hardware needs associated with accessing the digital content, it hopes to remove friction associated with becoming a member and to, in turn, accelerate growth.

Its Essentials members tier (which is a free loyalty program) is already seeing “robust new member growth.” This growth is “significantly exceeding expectations with 9 million members in just 9 months.” Lulu does NOT offer discounts through this program… just other perks like early product access. These members engage with the brand more frequently, spend 9% more (all incremental) and retain more reliably.

“Since our acquisition, the at-home fitness space has been challenging. While members love our content, hardware sales did not match expectations. As we continue to invest prudently in this business, we are evolving the model from being focused on hardware-only to offering content through a digital and app-based solution as well. We think the lower cost of entry will allow us to more easily migrate and attract guests into it.” -- CEO Calvin MacDonald

On Mark Downs:

The firm “managed business very well through a highly promotional environment.” Discount rates were just 40 bps higher than 2019 and stable YoY.

Importantly, as it moved through the holiday season, regular price sales “returned to normal levels.”

“We don’t drive top line growth through discounts or promotions and have no intentions to do so. We run a full-price business with markdowns strategically used to clear seasonal and other select products. This will remain our approach.” -- CEO Calvin MacDonald

Footwear:

There was not much color offered on the progress of this product expansion. Leadership told us that they’re “pleased with the performance and guest response.” It will debut its first road to trail running shoe this year while debuting its first men’s shoe in 2024. It’s hard to imagine it would be moving ahead with these plans if this endeavor was not going well.

f) My Take

Besides a one-off Mirror impairment charge due to some ill-advised M&A, this was a flawless quarter for Lululemon. Share gains were robust, margins are set to materially expand and both new and core products and geographies continue to provide ample opportunities. I also love the decision to bite the bullet on Mirror hardware and focus on stickier subscription packages. It’s the right move and shows a willingness and openness from leadership to right previous wrongs.

This is the hottest brand in its category with no slowdown in sight despite being a relatively luxury-goods seller amid hectic macro. This climbed into a top 5 position for me this past week and I’m entirely fine with that.

2. SoFi Technologies (SOFI) -- M&A Rumors

For several months, SoFi leadership has hinted at wanting to fully own its purchase mortgage business and to vertically integrate the back-end processes that it entails. Partners were struggling with timely funding (often taking up to 90 days) which was forcing SoFi to hold off on aggressively investing into the segment.

Well? There are new rumors swirling that SoFi will buy Wyndham Capital to fill the void of this backend cohesion. Three Twitter accounts were all over this news and I wanted to give them credit for their excellent research. To DataDInvesting, Vadim Kotlarov and Trust_In_Noto, wonderful work. Thank you to all three of you.

This has not yet been confirmed by SoFi, but there are multiple pieces of compelling evidence pointing to this being a done deal. There was a SoFi email leak that was passed around Twitter and typing in Wyndham’s web domain directed searchers to SoFi as of Wednesday. Beyond these hints, SoFi merger documents were filed in Wyndham’s home state this week. This means the announcement should be coming sometime in early April.

Wyndham Capital Mortgage is a 22-year-old provider of digital purchase mortgage applications. It calls itself a “Fintech mortgage lender.” The firm has been working tirelessly to make this “clunky, crowded and difficult process” far more seamless, expedient, automated and delightful for customers. Wyndham specializes in “augmented intelligence” or the process of using AI/ML models to support employees instead of replacing them. Every mundane, tedious task is automated by its engineers while customer service talent ensures human touch is available when needed.

The approach has allowed it to grow to 500+ employees, 100,000 originated loans, $30 billion in volume, and 20% faster close time than the industry average (exactly the metric SoFi was looking to improve). So, what does this acquisition mean? Simply put, it means that post integration, SoFi will finally be able to step on the gas pedal for growing its mortgage business. It should now have the technology, talent, and processes in place to condense 90-day funding windows to 30 days or less. Furthermore, the vertical integration will mean less 3rd party fees to make SoFi a lower cost provider just like Galileo and Technisys help it to do.

The timing of this acquisition is perfect in my view. The tumultuous mortgage backdrop likely means SoFi is getting a good deal. We’ll have to wait for transaction terms to come out to confirm this. But regardless, buying a digital mortgage originator as the Fed Funds rate peaks and likely falls later in the year or early in 2024 offers an ideal macro concoction to make this move.

3. Block (SQ) -- Short Report Response

Block released a compelling response to the Hindenburg short report released last week. It directly refuted what I saw to be the most serious claims brought forth by the research. I am not a shareholder but, in my view, investors should feel very good about this counter. Here were the highlights.

On Multiple Accounts:

Block rightfully reminded investors that multiple accounts per ID is not evidence of fraud, but merely based on Cash App use cases. Customers frequently maintain different accounts for personal and business use and even for different objectives like day-to-day payments and budgeting per the report.

It intentionally discloses transacting active users as a traffic metric to be conservative with its reporting. This format only counts a person as active if they transact through Cash App. Others solely require a customer to log into an app or enter a web page to count them as an active user.

44 million of the 51 million transacting users come with verified IDs. 13% of the remaining 7 million have verified their IDs since December 2022 when this metric was last updated. 97% of cash app inflows come from verified accounts. Of the 44 million verified users, 39 million come with unique social security numbers. Even with this most stringent measure of unique active accounts, a maximum of 24% of its accounts (and surely far less) are fraudulent vs. the 40%-75% estimate that Hindenburg offered.

Lastly, Block’s risk loss rate (associated with illegal activity, fraud and rejected transactions) has been at or below 0.20% of inflows for the last several years and has fallen further to 0.12% as of the end of 2022. This would not be falling if illegal drug and sex rings were running more and more rampant on the platform.

On Compliance:

Block maintains that it is in full compliance with the Anti-Money Laundering (AML) regulation. It has a dedicated team to ensure constant compliance as well as an independent 3rd party review team to audit its practices annually. Because Block runs a highly regulated industrial bank, it would be hard to believe blatant violations of these laws would go un-penalized for several years.

Takeaway:

Unless Block is explicitly lying about these figures (which I don’t at all think is the case and would shock me) this response effectively put to bed most of Hindenburg’s thesis.

4. Uber Technologies (UBER) -- Virtual Restaurants & Gopuff

a) Virtual Restaurants

Uber launched the Certified Virtual Restaurant Program this week in partnership with Virtual Dining Concepts and others. Uber’s clients have long asked for more hands-on service to stand up their own virtual dining concepts. This initiative is how Uber will offer more of an end-to-end structure to remove friction involved in doing so. It allows high quality brand clients to be matched with a partner and Uber sales reps to structure the business model, brand design and operational workflows.

It will help merchants be more successful (which makes Uber more successful) and also create a higher quality roster of virtual dining concepts. Since the pandemic struck, these types of listings on the Uber Eats app quadruped to 40,000. This added clutter led to growing customer complaints around option clutter and decision fatigue. This is Uber’s response to make sure virtual brand listings are relevant and appropriate going forward. As part of this news, Uber will no longer allow restaurants to list their menus under multiple brand names.

“We’re matchmakers with this program. We just try to connect folks who want to grow their business with a virtual restaurant or some experienced, quality brand builders and content creators.” -- Uber Head of Virtual Restaurants and Dark Kitchens John Mullenholz

b) Miscellaneous

Gopuff has been using Uber to fulfill 4% of its orders since Q4 2022.

Uber owns a ride sharing company in the Middle East called Careem. Careem is in the process of raising funding from the Emirates Telecommunications Group to expand into other product categories.

Uber will debut its “Comfort Electric” all-EV ride sharing product to 14 more North American markets.

5. CrowdStrike (CRWD) -- Falcon Fund Investment

CrowdStrike’s venture fund (called Falcon Fund) invested in “Abnormal Security” this week. Abnormal security specializes in email security. The investment includes a tight new partnership to integrate both platforms while Abnormal will become the newest member of CrowdStrike’s extended detection and response (XDR) network. As XDR is the extension of EDR and relies on infusing 3rd party data sources to extend its reach beyond the endpoint -- the more partners, the merrier. According to the press release, when a vulnerability or breach is uncovered by Falcon, Abnormal Security (when relevant) will now be prompted to require more layers of identity verification.

6. Microsoft (MSFT) & Google (GOOGL) -- AI-Powered Search:

Microsoft is threatening enterprise customers of its Bing search engine that it will restrict access to the service if they use it to build search engine AI models. Companies that could be impacted include Yahoo and DuckDuckGo. The AI-powered search race and competition is in full swing. Google’s Bard, Microsoft’s/OpenAI’s ChatGPT and incoming language and visualization models from Baidu, Meta and Amazon are all rapidly coming to market.

Because AI models fully rely on an effective scale of data for seasoning, Google’s Bard is clearly in the poll position to win this race. BUT… Google has enjoyed that poll position in a somewhat monopolistic manner for decades. Now, there are formidable competitors seriously investing to take a piece of this pie. It’s hard to see Google ceding its share and becoming extinct. It’s easier to see it potentially losing a percent or two of its market position which still would be needle moving for its overall results.

7. Meta Platforms (META) -- Miscellaneous

Credit Suisse was the latest institution to turn positive on Meta stock. The decision is due to the thriving click to message ad business now more than offsetting revenue losses from Apple’s cross app data sharing restrictions. Whether it’s ample opportunity to enhance ad load here or more ad placements coming for Instagram in areas like search, there are multiple high-margin growth levers for Meta to pull as it also cuts costs to bolster profitability.

Meta will permit European consumers to opt out of some ad formats. This is an attempt to appease EU regulators not wanting to allow Meta to force users into enabling ad targeting as part of the terms of service agreement that none of us read. It also follows large fines issued by Ireland regulators for what it saw as unlawful targeting. Users will have to manually submit a request to block more precise and personal targeting which will likely deter a large chunk from doing so.

This is still an opt in system vs. opt out with open internet platforms like The Trade Desk. It will be interesting to see if this is enough to satisfy lawmakers.

Meta plans to slash bonus payments.

8. Visa (V) -- M&A Attempt

Visa made another offer to buy Brazilian-based Pismo for $1.4 billion. Pismo offers an end to end, cloud-native processing platform in Latin America and calls several large financial institutions in that region its clients. It offers application programming interfaces (APIs) to allow B2B clients to extend into digital banking, wallets and card issuance with an asset-light, software-first approach.

9. Amazon (AMZN) -- AMC

Amazon is rumored to be considering an acquisition of AMC in what would be a clear evolution in its content creation and streaming strategy. Amazon has and will continue to ramp content spend to amplify the appeal of its Prime subscription. This offers it yet another avenue to monetize that content and grants it the ability to tie in more value to its overall bundle with things like special access to early viewings. It also gives it another brick-and-mortar chain to test its checkout biometrics technology.

10. Apple (AAPL) -- BNPL

Apple is launching its own version of a buy now, pay later (BNPL) product. It had some financing partnerships in place with competitors like Affirm in the past, but it’s now ready to do all of this on its own. It’s hard to see how standalone BNPL players can compete with this offering. Apple will make it a core part of its pay suite and so iPhone utility. And furthermore, it has exponentially more training data to sharpen underwriting models than any alternative.

This is why I’ve always said BNPL needs to be a tool in the toolkit and not the entire suite. There’s nothing special about offering this installment product alone and nothing difficult about deep pocketed entrants competing. What makes it more difficult to replace is when the service is tied into several other, value creating products and an aggregate scale of data that can more closely match Apple’s. This is why later entrants like PayPal have been able to take such rapid share in this space. I expect that Apple will too.

The product closely mirrors others on the market. It allows users to split transactions into 4 separate charges in a 0 interest and 0 fee manner. Other alternatives like Square’s Afterpay have hefty late fees. For now, the credit product is only for purchases up to $1,000 in size.

11. Progyny (PGNY) -- Short Report

Hedgeye announced a new Progyny short. The report spoke through many of the same issues addressed in the first two short reports that I covered with a few additions that I’ll discuss here. The overall takeaway was that its business will be hurt if fertility treatment trends slow. Obviously, they’re right. Every business will be hurt if their industry slows. Here are all of the reasons why I think that slowing will not happen:

a) Runway

The United States lags every comparable developed nation in terms of proportion of births via fertility treatments. We sit between 2% and 3% today while every other comparable geography is between 4% and 10%. This gap is solely related to fertility treatment in the U.S. requiring far more out of pocket expense vs. these other nations. It has nothing to do with different population characteristics as 12.5% of couples in the U.S. have some sort of fertility issue which is consistent with comparable markets. That’s the essence of Progyny’s business model: To carve out a covered, carrier integrated, customizable fertility treatment solution to boost efficacy, lower cost and boost access. Within this untapped opportunity, Progyny is the carve-out market share leader, yet calls well under 5% of its total addressable market (TAM) clients.

Some point to falling birth rates as evidence of Progyny’s business growing out of favor. To those people (not Hedgeye), I would recommend a biology course. The largest reason for falling birth rates is women thankfully enjoying more career-based opportunities than previous generations -- and so deciding to have children later in life. The older a woman gets, the more likely it is that they’ll need treatment. So? Falling birth rates are actually a net AMPLIFIER of demand for Progyny as they’re largely the result of falling fertility rates. Yes, less births overall will hit its growth opportunity somewhat, but the net benefit is positive.

b) Utilization & Demand

There have been concerns presented about Progyny’s utilization rate. It was as follows by year:

1.23% in 2022

1.30% in 2021

1.16% in 2020

1.30% in 2019

While the trend looks somewhat lower, there are a few items that must be called out. First, 2020 was impacted by a temporary, pandemic-related halting of new fertility treatments. Variants continued hitting demand throughout 2020 and pent-up demand unleashed in 2021 which led to the sharp recovery.

So what happened in 2022? Progyny thrived in 2022, that’s what happened. Its new clients ALWAYS start at utilization rate troughs with that metric gradually rising as they mature (it has 99%+ client retention). It vastly outperformed guidance and street expectations on new clients in 2022. This -- per leadership -- was the source of the utilization rate dip. Importantly, its guidance assumes no improvement to this rate which has been called pessimistic by leadership.

Furthermore, its utilization rate closely correlates with overall revenue. It would not have been able to offer such a robust 2023 guidance if utilization was suddenly tanking. Based on the last several years of public market data, the company has a strong track record of effectively modeling forward results largely thanks to the high level of visibility and predictability in its business model. And there’s no slowdown in view. The 2023 selling season has been called a great success thus far by leadership with most of these wins impacting 2024 results. It gave nearly identical commentary on how the selling season is shaping up as it did in 2020-2022 when that process went so overwhelmingly swimmingly.

As an aside, its brand-new male-facing extension of the fertility bundle should gradually lift overall utilization over time.

c) Efficiency Force Multiplier Amid Poor Macro

Fertility treatment demand was relatively resilient during the Great Financial Crisis. Progyny leadership frequently talks about how growth slowed, but remained positive throughout. This is during a time when fertility was largely client cash pay while Progyny frees its treatment cycles to be covered by large enterprises. Amazon is more reliable when it comes to repayment than an individual.

Progyny’s outcome-based advantages have consistently grown in all relevant fertility categories over the last 6 years. This includes boasting more successful treatment and healthier live birth rates. Because treatment plans routinely cost $60,000 a pop, less cycles per pregnancy are a real cost saver. Furthermore, less NICU usage and less twins (AKA “million-dollar babies”) also greatly lower costs. Specifically, Progyny saves clients 25%-30% vs. alternatives on average. So? Amid hectic macro, Progyny’s sector remains in high demand while its specific offering saves clients money due to better outcomes. This becomes more sought out when the economy turns sour -- especially as fertility treatment becomes more and more table stakes for hiring coveted talent.

Finally, some of the recent short research sounds the alarm on un-billed accounts receivable (AR) as well as bad debt expense. On bad debt expense, it’s very stable and consistently low so I don’t know where that argument came from. On un-billed AR, that issue stemmed from the same thing as utilization -- rapid new client additions. There’s a time lag between Progyny authorizing treatments for new clients and starting to collect cash. Thankfully, its EBITDA to cash conversion soared higher in Q4 2022 as un-billed AR normalized.

d) Don’t Fear Layoffs and Follow the Numbers

Tech layoffs are a weekly headline at this point. Nearly 20% of Progyny’s clients preside in tech. So? Some have rightfully worried that this will weigh on its covered lives growth. My response:

Progyny’s robust 2023 guidance assumes 0 organic existing client employee growth. It has called this assumption pessimistic just like with utilization.

Progyny has clients across 40 industries. Member growth in every industry besides tech is positive and more than offsetting this hit.

Leadership has explicitly told us this is a “non-event” for its business. It’s pushing 5 million covered lives and the U.S. has had roughly 100,000 tech layoffs total. Some of these were contractors that didn’t have access to Progyny’s benefits in the first place and many were also not Progyny clients.

I’m candidly tired of wasting my time reading reports from firms that have not taken the time to master the business model. This report wasn’t offensive, inflammatory, or blatantly inaccurate like the first two, but it was still underwhelming and offered nothing that I find remotely concerning. That’s why these firms resort to condescension and personal jabs on social media: They know the quality and completeness of their arguments are lacking. My arguments are complete because I obsessively take the time to make sure that they are and keep my mouth shut if they aren’t. I will continue to read/watch/listen to all legitimate opinions with an open mind. Like with the first two reports, this does not change my views on the company in the least. Time will tell if I’m right to have that opinion.

12. Lemonade (LMND) -- Car Insurance

Lemonade debuted its car insurance offering in Oregon this past week. This is the final piece of the puzzle for bringing its bundle up to par with most incumbents. As management has told us in the past, it had been “operating with a hand tied behind its back” by not being able to combine and discount home/renters and car offerings.

This newfound ability in Illinois raised its retention rate from 83% to 93% immediately to give an idea of how powerful this bundle truly is. Now, Lemonade has the needed products to marry with its more automated, slicker, and more delightful on-boarding and claims processes. The company remains utterly hated by investors as macro headwinds rage, inflation rates temporarily hit its loss rates and its losses improve slower than I expected. That last nugget is why I paused adding a few months ago, but I have no plans to exit my position. I still believe that this company can turn into a wildly successful business and investment. We’ll see. Today, it does not deserve more than a tiny portion of any portfolio.

13. Macro

a) Data from the Week

February Personal Consumption Expenditures (PCE) Data:

YoY core rose 4.6% vs. 4.7% expected and 4.7% last month.

Month over Month (MoM) core rose 0.3% vs. 0.4% expected and 0.5% last month.

YoY rose 5% vs. 5.1% expected and 5.3% last month.

MoM PCE rose 0.3% vs. 0.5% expected and 0.6% last month.

Fed Auctions:

2-yr note auction closed at a 3.954% yield vs. 4.673% at the previous auction.

5-yr auction closed at a 3.665% yield vs. 4.109% at the previous auction.

Consumer and Employment Data:

Conference Board Consumer Confidence for March was 104.2 vs. 101 expected and 103.4 last month.

Initial Jobless Claims were 198,000 vs. 196,000 expected and 191,000 last month.

Pending Home Sales rose 0.8% month over month (MoM) for February vs. -2.3% expected and 8.1% last month.

Personal Spending rose 0.2% MoM in February vs. 0.3% expected and 0.2% last month.

Michigan Consumer Expectations reading was 59.2 vs. 61.5 expected and 64.7 last month.

Michigan Consumer Sentiment reading was 62 vs. 63.2 expected and 63.4 last month.

Economic Output data:

Q4 GDP rose 2.6% vs. 2.7% expected and 3.2% last month.

Chicago Purchasing Managers Index (PMI) was 43.8 vs. 43.4 expected and 43.6 last month.

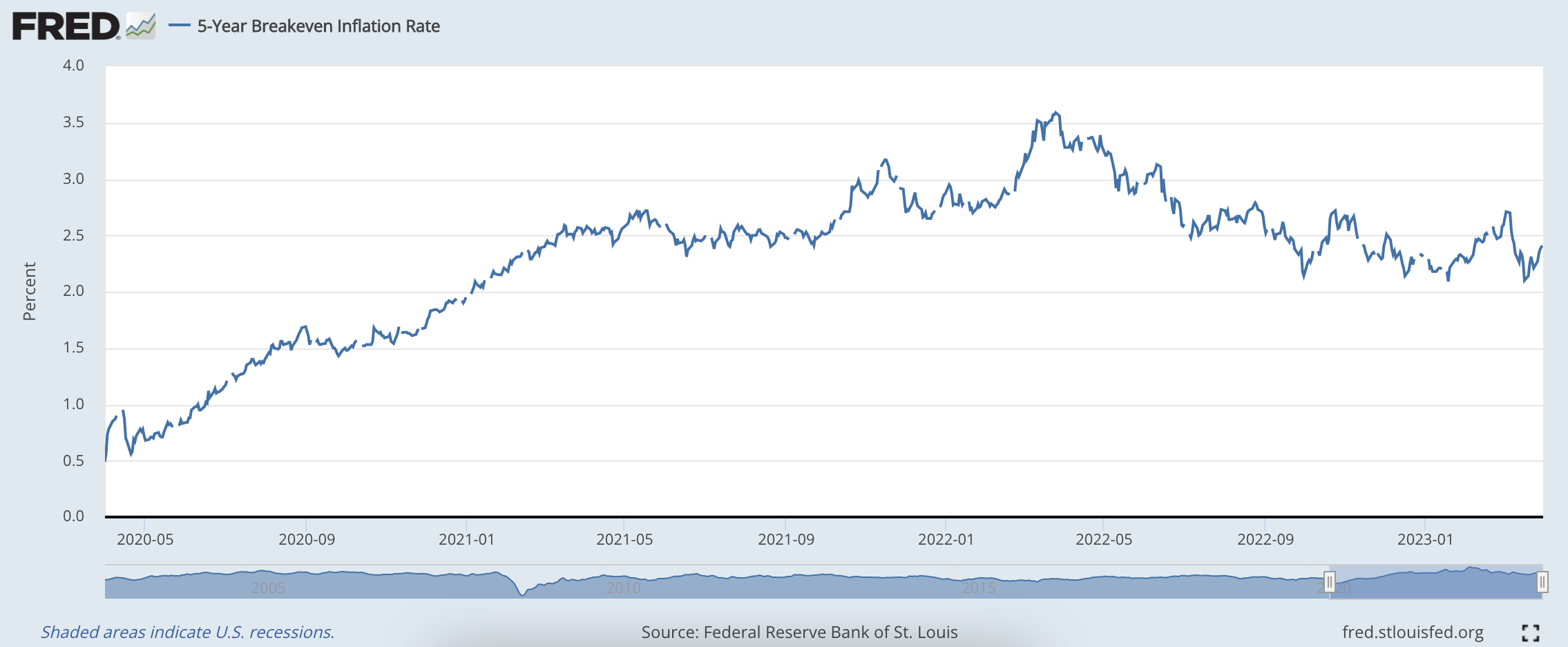

5 year breakeven inflation has risen a bit over the last 2 weeks but remains in a longer term downtrend:

High Yield Option Adjusted Corporate Credit Spreads fell this week as liquidity conditions improved following the banking sector issues & Fed intervention:

b) Level Setting the Data

Nothing changed from this week and my macro-outlook over the last few issues. This week’s PCE fortified that reality. Inflationary data continues to improve at a faster clip than employment and output data weakens. This makes a mild recession the most likely outcome in my mind and creates a somewhat ideal setup for long duration risk assets.

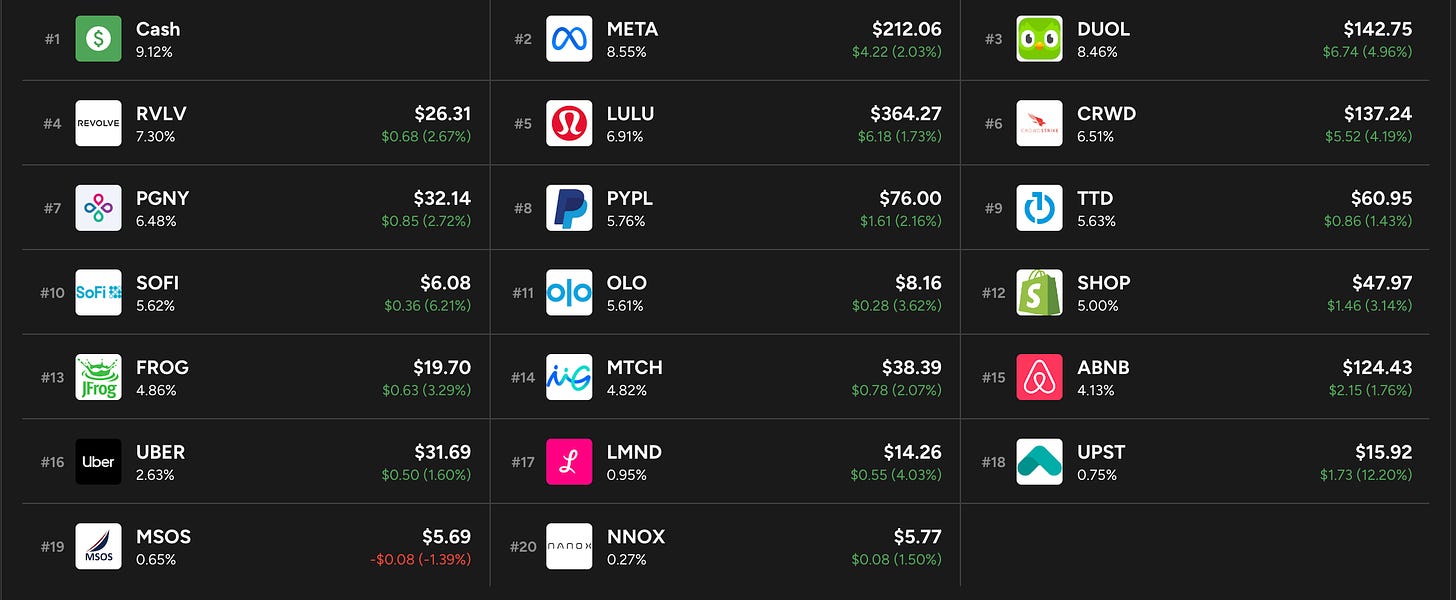

14. My Activity

I made small trims to Duolingo and Meta Platforms this past week.

You think maybe "POLE position" (instead of "poll position")?