News of the Week (March 6 – 10)

SoFi; Shopify; Meta; Uber; PayPal; Airbnb; Match; Visa/Mastercard/BofA; Sea Limited; Nanox; Olo; Macro; My Activity

1. SoFi Technologies (SOFI) -- Silicon Valley Bank, Potential Ripple Effects & a Lawsuit

a) Silicon Valley Bank & Bank Customer Impacts

Silicon Valley Bank (SIVB) -- a top 20 U.S. banking institution by assets -- collapsed this week. Here, we’ll explore what happened, why this situation is unique and why SoFi is not in pressing danger of following suit.

So, what happened? The nearly 50 year old bank is a key piece of venture capital and technology banking. It has a dominant presence in Silicon Valley culture and was a big piece of the institutional funding from this most recent boom. Founders of innovative start-ups routinely parked their money at the company, and so deposits soared. These deposits were used the build an $80 billion fortress of mortgage backed securities (MBS) at an average yield of 1.5% while rates were held at 0.

Then rates rose, rose and rose some more. Souring macro led to an abrupt weakening of its banking niche as its customers raced to extract deposits for funding operational cash burn to stay afloat. The bubble uniquely propped up this piece of the economy; the aftermath has uniquely hit it. For context, SIVB’s average client cash burn is double the rate of 2020 -- that hole had needed to be plugged somewhere and was plugged via SIVB withdrawals. Concurrently, mark-to-market valuations of its low yield bond portfolio tanked as interest rates rose. Both issues placed pressure on reserve ratios as the value of fixed debt reserves fell.

So to summarize:

Mark to market bond portfolio valuation cuts.

Rapid client withdrawals.

This recipe pushed SIVB dangerously towards its reserve requirement minimums. It collectively forced it to sell off $21 billion from its treasury bond portfolio in a panic and at a large loss to satisfy liquidity requirements. It took a $1.8 billion loss on this transaction and subsequently tried to sell a little over $2 billion in equity to re-strengthen its balance sheet and cover accelerating withdrawals. This sale failed and so have early attempts to find an outright buyer. Fear surrounding that failure led to a further acceleration in withdrawals to get funds out of an institution perceived to be at risk of blowing up. There were lines outside of SIVB branches throughout yesterday as the bank run took place. As a result, the FDIC shut down SIVB for now and took over its deposits.

Is this bank as important to the national financial plumbing as a Bank of America? Not even close. Is this another Lehman Brothers or Bear Stearns? Absolutely not. But still, to think this massive banking entity exists in a vacuum with no implications for the rest of the economy is not correct. Venture capital and innovation will power future economic production growth. This institution was a core part of providing the liquidity to fund that growth. There will be ripple effects.

Already we’ve seen Bill.com have to come out and assure investors that its banking relationship with SIVB is easily replaceable. Separately, we’ve heard Roku warn that it had roughly $500 million in capital at SIVB with the timeline to recouping those funds unclear. Countless companies including Stock Market Nerd holdings like Duolingo, Shopify, CrowdStrike and others have some exposure. These accounts are clearly in excess of the $250,000 FDIC insurance maximum -- but the firms should be fine. SIVB has over $200 billion in cash, securities and loans. Even with its current liquidity commitments, it could all be used to cover deposit liabilities.

b) SoFi Bank Implications

So what does this mean for SoFi? First, it has drawn $40 million in credit from SIVB. This credit is “unaffected by the FDIC’s receivership of SIVB” per SoFi. It has no other direct ties to the bank. But could SIVB’s issues eventually spell weakness at SoFi? Is SoFi vulnerable? Let’s dig in.

Starting with a high level overview of the balance sheet. The company has $1.42 billion in cash & equivalents. With over $7 billion in deposits, it’s required to maintain a reserve ratio of 10% of deposits -- or about $720 million. As we can see, it has about 200% of this needed funding in its most liquid asset bucket. Not to mention it has another $5 billion in untapped warehouse capacity.

Specifically, SoFi Bank capital ratios are all well in excess of their required minimums. They grant miles of leeway of potential (not certain) mark to market losses on loans and bonds before becoming at all concerning:

Common Equity Tier 1 (CETI) risk-based capital ratio is 14.6% vs. a 7% minimum and a well-capitalized minimum of 6.5%.

Tier 1 risk-based capital ratio overall at 14.6% vs. an 8.5% minimum and an 8% well-capitalized minimum.

Total risk based capital ratio is 15.1% vs. needing to be over 10.5% and a well-capitalized minimum of 10%.

Leverage Ratio is 15.3% vs. needing to be over 4% and a well-capitalized minimum of 5%.

“As of December 31, 2022, our regulatory capital ratios exceeded the thresholds required to be regarded as a well-capitalized institution, and meet all capital adequacy requirements to which we are subject. There have been no events or conditions since December 31, 2022 that management believes would change the categorization.” -- From the 10K dated March 1st 2023

SoFi’s major capital ratios overall (not just SoFi Bank) sit over 20% with over 1000 basis points of wiggle room for all of them. So much flexibility. That’s why CFO Chris LaPointe tells us SoFi has “excess liquidity” every single call.

So what about the bond portfolio? Could mark-to-market losses move the needle enough to force it to allocate more capital to cover reserves? Simply put, no. It has $195 million in debt securities which encompasses its treasury holdings. In the extremely unrealistic scenario where this had to be written down by $100 million, it could easily allocate balance sheet funds to cover this and still comfortably maintain liquidity requirements. Furthermore, this book transaction will only be temporary as eventual interest rate reductions will turn those mark-to-market valuation changes back to positive in the future.

The only possible negative read-through here is rate volatility and rising loan deliquency (associated with systemic credit issues) hitting SoFi’s loan performance. That’s certainly not ideal as it would diminish net interest margin and possibly make ABS markets less open, but it’s miles better than what SIVB is dealing with. Furthermore, SoFi has been able to raise weighted interest rates enough on loans to create more valuable originations. To increase comfort even further, its hedging program has, in a surgical manner, offset volatility associated with rate fluctuations to date. Finally, its life of loan loss rate remains a full 35% below its risk tolerance with delinquencies well below 2019 levels. The book is in great shape several quarters into macro turmoil. This all ensures ample, predictable liquidity continues flowing in and that the loan book stays valuable.

Ok but what about withdrawals draining balance sheet liquidity like we’ve witnessed at SIVB? Consider who SoFi’s direct deposit customers are. They boast an average annual income in excess of $150,000 and a FICO well over 740. Its deposits don’t come from cash burning start-ups, but instead affluent individuals less prone to macro cycles.

As a sign of insider confidence, CEO Anthony Noto bought another $1 million in stock. I reached out to leadership for their take on the matter and will update you all with anything I learn.

c) Lawsuit

SoFi is suing the Federal Government to block its Student Loan payment pause. I don’t like this decision. It puts a regulatory target on its back and likely won’t result in any kind of positive resolution. Just a distraction. The company should continue to focus on controlling what it can control and powering the growth and operating leverage that markets will eventually reward. Even if the student loan industry vanishes for good, there is still so much growth and leverage to be enjoyed here. Executing will take full focus.

I understand that some believe this could create bad publicity for loan customers and hamper growth there when student loans finally return. I don’t really agree. This will be a loud headline for the next few days before the public moves on to the next topic and puts this out of mind. Remember when the misinformation policy at PayPal was going to lead to their accounts vacating the platform? Yeah, me neither. That lasted for a news cycle and was gone. This reminds me of that.

2. Shopify (SHOP) -- CFO Jeff Hoffmeister and President Harley Finkelstein Interview with Morgan Stanley

On 2023 Guidance, Year to Date Performance & Profits:

“The guide was mindful of the environment we’re in… I would say explicitly, we’re not seeing what caused us to be more cautious on the overall economy [play out] in our business. Our business is doing very well. The guide was out of an abundance of caution as it relates to some of the news out there.” -- CFO Jeff Hoffmeister

The company took more market share in Q4 2022 than it did in Q3 2022 and that has continued for both offline and online commerce in 2023. Hoffmeister reminded us that the 10%+ share of e-commerce figure floated around frequently is now 15 months old. The current Shopify market share is materially higher. Hoffmeister was also directly asked about his profit philosophy vs. the old CFO who aimed to “invest all gross profit dollars into more growth.” He assured investors that Shopify will take a more balanced approach to profitable growth going forward.

“We were being prudent with guidance. The business is rocking.” -- COO/President Harley Finkelstein

On Commerce Components by Shopify (CCS):

Shopify Plus was borne to allow smaller merchants to endlessly scale into large enterprises on the Shopify platform. The product later morphed into a lead generator for winning larger brands outright by displacing alternative vendors and home-grown solutions.

Commerce Components by Shopify is the extension of this subscription package that is more geared towards the largest of enterprises. As a reminder, this allows merchants to pick and choose pieces of Shopify’s platform to integrate with the pieces of their legacy tech stack they’d like to preserve. Shopify ensures these integrations can take place without sacrificing latency, shopping experience, data sharing and operational excellence. It shied away from these integrations in the past, but now sees its infrastructure as capable of handling it as its suite of APIs continues to be upgraded and things like headless commerce take hold.

This product has been over 2 years in the making and is expected to “take a much larger chunk of the larger enterprise market” per Fintenstein. Mattel, Spanx and Black & Decker were just the first dominos to fall.

Unlike Plus and its more basic subscriptions, which lean on partner referrals and some organic word of mouth for growth, CCS takes a different go-to-market approach. Because most massive enterprises prefer embarking on platform overhauls through system integrators (SIs), Shopify established partnerships with several of the largest in tandem with developing CCS. Shopify was missing out on these opportunities because SI selling partners weren’t trained on selling Shopify products and also not incentivized to do so. Now they are. When pairing this with its enterprise resource planning (ERP) program which ensures all data sets can be queried into the Shopify Admin, it can now sell itself as a better giant brand partner than it has in the past.

Interestingly, its go-to-market for CCS also includes request for proposals (RFPs) which it had refused to partake in, in the past. With these tools, it now sees RFPs as worth its time.

On Shopify Fulfillment Network (SFN) & Re-Thinking CapEx Post Deliverr M&A:

Like he did on the Q4 call, Hoffmeister all but told investors that once Deliverr integration work is done, Shopify will be updating its SFN total CapEx investment projections. Deliverr’s team, tech, partners and industry understanding “accelerated thoughts related to how Shopify can do this in a more CapEx-light way.” It sounds like Shopify is again re-thinking how much warehouse capacity it needs to self-operate and thinks it can use the Atlanta facility and perhaps one more as models for partner proof of concept to integrate its fulfillment software.

“We can do this in a much more thoughtful way than we were before.” -- CFO Jeff Hoffmeister

The team was asked yet again if SFN will make money on its own or if it’s just a “cost of doing business” and a service merchants expect. The company adamantly responded (again) that it will make money on its own.

On Price Hikes:

There was “virtually no pushback from merchants on price hikes.”

Price hikes were the result of benchmarking vs. all available competition and seeing room to raise while still being “by far the best value out there” per Hoffmeister

It is considering hiking Shopify Plus pricing but is not yet ready to do so.

On The Shop App:

Shopify just added a new ChatGPT integration to the Shop App. This enables AI-powered directing to available goods based on conversational product searches.

3. Meta Platforms (META) -- Layoffs, CFO Susan Li & COO Javier Olivan Interview with Morgan Stanley & Twitter Competition

a) Layoffs

Meta will fire another 13% of its staff in a move to trim costs further. As I said on Twitter, this is the byproduct of over-hiring for the last 2 years. That over-hiring is why we see videos of employees enjoying days of lavish perks, relaxation and 0 productivity. This is the necessary normalization of that excess. It stinks for those impacted, but luckily they’ll be entering a labor market that remains impressively strong outside of tech.

b) Executive Interview

Efficiency or some variation of word was used 21 times during the short interview.

On Key 2023 Priorities:

Leadership continued its 2023 theme of calling this the year of efficiency. Specifically, COO Javier Olivan identified a few specific areas of cost controls that have been most powerful including:

Consolidating measurement, creative and recommendation marketing teams into one group and doing the same with its business and user integrity teams along with its various department level AI teams.

Matching cost per project with accurate shared costs of things like memory. This has allowed project teams to become more disciplined & precise with matching cost to value creation.

“And what we're finding, though, is by focusing on these things, you start finding ways to actually drive incremental revenue in much more efficient ways.” -- COO Javier Olivan

On Cost Controls & the Quarter so Far:

CFO Susan Lee told us that the Q3 macro overhang lightened a tad into Q4 and into 2023. Recovery in Europe has disappointed while recoveries in LatAm and APAC have exceeded expectations. In North America, things are about as expected.

“The Q4 expense guide considered this was a year of efficiency and reflected the cost-saving measures we had identified. But that work has been ongoing… When I look at all the work we’re doing right now, I expect some of these efforts will translate into further cost savings. We’ll update investors as we make those decisions.” -- CFO Susan Li

The layoff program announced yesterday will surely help.

In terms of CapEx, the company is still hyper-focused on long term cost structure rationalization. This will mean automation and scale-building investments for a short term margin drag and higher margins at maturity. The data center 2.0 footprint with more flexible scaling is a great example of this. The overhaul of its footprint costs money. But it makes META a more efficient company for the long haul (There was also a large gap in AI-powered computing capacity between META and its competition that it needed to address to stay as competitive as possible). All of this established data center capacity is being used for ads and app content -- not Oculus. The net impact of all of this will be falling 2023 expense growth. I just included the long term tidbit to show that Meta is still investing in its future and not cutting as aggressively as it could be.

“CapEx as a percentage of revenue we expect to bring down over time.” -- CFO Susan Li

On AI Investments:

AI is greatly enhancing campaign automation (and so ease of use) through products like Advantage+ which lets you “test 150 different combinations of targeting and ranking to optimize campaigns.”

The company continues to fixate on bringing conversions on-site rather than re-directing ad clicks to external sites and losing reporting/measurement control. Apple’s cross-app data restrictions necessitated this change. Commerce, Reels and click to message ads are all helping mightily here with more work to do. Within commerce specifically, it now has the ability to conduct real-time decisioning on whether to send clicks externally (if external reporting will allow) or to keep them on-site to maximize conversion.

Admittedly, it’s very hard to track the efficacy and return of these investments. The evidence is in things like +20% YoY ad conversions, lengthened accurate attribution windows and bolstered return metrics for the demand side. These factors mean the investments are working with Oppenheimer this week specifically raising ad revenue estimates by 2% for 2023 due to the new tools driving improvements.

On Reels Monetization Progress:

Most (not all) ad formats for stories and feed are now available for Reels.

Monetization still has a lot of catch up to do. And this could take longer than it did for Stories considering there’s “not as much opportunity to introduce ads per time between content.”

40% of Family of App (FOA) advertisers are using Reels.

It’s incremental to overall engagement. Should be revenue neutral by Q1 2024 at the latest.

WhatsApp:

Olivan spoke about a General Motors ad campaign in Brazil through WhatsApp. 60% of their car sales in the country were attributed to WhatsApp conversions.

“It's hard for people here in the United States to understand what is it to live in a country that really communicates on WhatsApp. But even for me, it was hard to understand what is really happening with people communicating with businesses in places like Latin America and Southeast Asia.” -- COO Javier Olivan

c) Twitter Competition

Meta is building a social media platform for text-based updates. It will integrate with ActivityPub which is used by Mastodon and it will be a direct competitor to Twitter if it can find any traction.

4. Uber (UBER) -- CEO Dara Khosrowshahi Interviews with Morgan Stanley & Freight

a) CEO Interview

On Macro & Competition:

Uber being “ahead of the curve” on cost discipline positions it to avoid pulling back on operating expenses further like its competition is now compelled to do. This has helped it secure a top market share position in 80% of its largest mobility markets and 70% for delivery. And it has established this domination while its margins have exploded higher -- even in the wildly competitive delivery space where it continues to outperform its EBITDA as a percent of gross bookings targets. This was credited to Uber’s R&D teams implementing “cost-saving process efficiencies” to cut cost per delivery by 20% YoY last quarter. The higher margin advertising business outperforming growth expectations is helping too.

Dara talked up Uber’s scale advantage creating an inherent data advantage. This allows it to do things like run more extensive split testing to uncover rider and driver preferences and perfect its offering and promotional offer timing. This is the Duolingo playbook being exercised in a different market.

“It’s the small improvements that compound and are difficult for competition to match… The output from this that you’re seeing now is our delivering on both the top and bottom lines and our category position.” -- CEO Dara Khosrowshahi

On Lyft Shifting its Insurance Structure & Pricing to Reflect Uber:

“There have been no changes in competitive intensity at this point. The Insurance team has done a great job in reducing incidents. Any adjustments they’re making -- on a relative basis we haven’t had to make. This is a bigger headwind for Lyft than for us… it seems like they’re taking the necessary steps to adjust to the realities of the marketplace going forward.” -- CEO Dara Khosrowshahi

On a Change in Cost Structure:

Uber is currently decommissioning its own data center footprint to migrate to the cloud with Google and Oracle. The added cloud usage will show up in operating expenses while maintaining its own footprint was largely capital expenses-related. This will lead to “much better free cash flow” generation and its EBITDA and free cash flow margins converging over time. This change will allow “allow engineers to focus on value-add work vs. recreating what has already been built by the cloud providers” per Dara.

In a savvy move by the team, the team structured these cloud contracts in a way that allows easy shifting of volume between the cloud operators. This will offer it more powerful negotiating leverage when these contracts come up for renewal due to lower Uber switching costs.

On Mobility Growth Levers:

Uber continues to see “the deciding 5 year mobility success factor being how many drivers it can add to the platform, how engaged they are and how many it can hang on to.” This will be the cause of its mobility success while riders will follow suit due to faster time to service and scale allowing it to be the lowest cost provider.

Newer products like Uber Hailables (allows for calling a taxi through the Uber app in markets like London) have been a wonderful new rider growth lever for the company. Despite it being just a low single digit percent of bookings, it’s the source of 15% of its new customers. 33% of Hailables users convert to using other products. Uber will continue to lace new use cases into its app and subscription to enhance retention and lifetime value (LTV) while introducing new cross-selling promotional opportunities to appeal to users.

Uber’s growth contribution from price per transaction over the last couple of years will revert back to growth via transaction volume in 2023 to a certain extent. Still, Uber sees overall pricing per delivery & ride rising overall due to a mix shift towards higher cost products like Uber Reserve which lets you pre-book.

Despite Uber being a verb, just 30% of adults in its most developed markets have used the service. The runway remains long.

Uber’s driver engagement continues to be better than competition.

Driver retention is “improving.”

Better driver earnings and easier on-boarding led to drivers growing 35% globally YoY last quarter and 30% in the U.S.

On Driver Supply:

“The labor environment feels a lot looser to us even though it’s not showing up in unemployment rates. 70% of drivers are now coming to the platform because of some of the macro effects.” -- CEO Dara Khosrowshahi

Upfront Fares and Destinations has been a real value-add for its drivers. It has allowed Uber to “price products more algorithmically” rather than solely based on time & distance. Now it can factor in variables like other rides available to service at a given destination. This has led to more accurate value to price matching and a 4% rise in trip throughput on the same supply and demand dynamic. It’s rolling this tool out to international markets as we speak.

Regulation:

It will appeal California’s Prop 22 decision regardless of what it is. Dara “hopes the courts retain the will of the people with most wanting to be independent contractors.”

New York City minimum wage regulation for delivery drivers is something Uber can adjust to, to make it “neutral from an EBITDA standpoint.” In a piece of good news, the proposed minimum wage was lowered by the city this past week.

Advertising:

Its advertising business is delivering 7-9x returns for participating brands. There’s a virtually 100% untapped opportunity in grocery delivery to introduce ad impressions to offset the lower margin nature of that business.

On Tampa Bay Airport:

Uber Eats is partnering with the Tampa Bay Airport to allow travelers to order online from restaurants in the terminals while they’re waiting in check-in or security lines or getting off of a plane.

b) Uber Freight

Uber is rumored to be considering a spin-off or outright sale of its freight division. There are two ways of looking at this.

The glass half empty view: We are just 15 months removed from closing its Transplace acquisition for over $2 billion to expand further into Freight. This hints at that acquisition being ill-advised if the spin-off or sale price disappoints. It calls into question leadership’s capital allocation philosophy.

The glass half full view is the view I take. Uber needs to solely focus on its consumer business. Mobility and delivery are both hyper competitive and both absolutely gigantic opportunities. It should be allocating all time, dollars and attention on fortifying its consumer-facing differentiation. This means combining value-add products into its app where possible to create stickier users via cross-product promotions, lower marketing intensity, higher LTV and more visible revenue creation.

It is in a pole position to win the majority of these lucrative growth vectors and if its focus is spread too thinly, that could jeopardize this most important piece of the investment case. Building freight doesn’t help its other businesses like building its other businesses all help each other. And furthermore, because freight has been a drag on margins, this could be yet another move to bolster earnings growth and appeal to investors who have been waiting on compelling profit compounding for over a decade.

5. PayPal (PYPL) -- CEO Dan Schulman Interviews with Morgan Stanley & Leadership

a) Schulman Interview

On 2023 So Far:

“I said a month ago that the quarter was off to a good start. A month later, I would reiterate that again. Across our business, we’re seeing strength beyond what we expected. Branded continues to accelerate. Unbranded is doing quite well. We could be beginning to see a turn of e-commerce. Inflation is cooling slightly and discretionary spend is coming back.” -- CEO Dan Schulman

Cost structure is now “exactly where PayPal wants it to be.”

Schulman is confident in “meeting or exceeding” 18% EPS growth in 2023. The exceeding piece of that statement was a new and very positive addition.

Reiterated that branded checkout share is rising with merchants who have implemented its latest checkout integrations and new, fully-native mobile checkout kit. In these cases, it’s seeing share strength while “competitors are weakening.” When these updates aren’t in place, shoppers must bounce in and out of the site to complete payment with more clicks, more pages and lower conversion.

Overall branded checkout market share continues to be “stable or rising.”

It’s taking significant share in the BNPL market as “competition is having a tough time and pulling back to desperately try to figure out how to make money.”

“2023 has the potential to be a very strong year and for us to exit with a lot of momentum… We thought e-commerce was going to be flat to up slightly. It’s going to be higher in the short term and likely for the full year. We’re seeing that across the businesses… China is clearly opening up and seeing exports. Europe is much better than feared. The U.S. if we do go into a recession will be shallower than we anticipated. We are beginning to see people spend more on discretionary items, at least through our platform.” -- CEO Dan Schulman

On Rate Hikes:

More rate hikes would be a net help to PayPal’s financials considering its large consumer deposit and cash balances. It would incrementally hit discretionary spending a bit, but be a net tailwind according to Schulman.

On Venmo:

While Dan pounded his chest on PayPal and white label checkout performance, he was a bit more critical of Venmo. He made sure to say things were going well, but added that there’s “so much more to be done” and that “its monetization is not what I expected at this time.” He thinks the new Apple partnership enabling tap to pay through Venmo will be a big help along with new Amazon, Starbucks and CVS integrations.

On Apple:

Schulman thinks PayPal is holding its conversion and loss rate leads over the competition including Apple.

Schulman continues to think consumer preference for PayPal’s checkout products is “2-3x higher” than the closest competitor which I would think is Apple.

He thinks there’s too big of a gap between PayPal and Apple on PayPal’s abilities around authentication which is why password-less login has been a key recent focus.

He thinks Apple’s clear edge is within its full access to NFC chips through its tap to pay platform that PayPal partners with through Stripe. He sees this being a regulatory issue over time for Apple. We’ll see.

On Profit Growth Beyond 2023:

The key concern around PayPal is what growth will look like after it finishes cost controls. Will it be able to find more profit dollars via expanding revenues, or not? Dan had some interesting things to say on this:

“Leverage and expanding revenues is not a 2023 thing. This is '23, '24, '25. There is so much that we're going to be able to do to reduce costs, but not just reduce costs because that's never your way towards greatness. It's important to be as efficient as you can be… I think as we grow our revenues, and I feel good about our momentum on that front, you will see a lot of that drop down to the bottom line. And that's why we're highly confident of our 18% EPS growth and highly confident of operating margin leverage in the years ahead.” -- CEO Dan Schulman

b) Leadership

CFO Blake Jorgenson will not return to the company. He unfortunately had health issues creep up just 3 weeks into the job and needs to focus on that. I wish him the best. In Schulman’s Morgan Stanley interview, it sounded like interim CFO Gabrielle Rabinovitch could potentially shed that interim label and become the permanent CFO. Even if that were to happen, the new CEO coming in next year could always want to shake things up again.

6. Airbnb (ABNB) -- Co-Founder/CEO Brian Chesky Interviews with Morgan Stanley & Layoffs

a) Morgan Stanley Interview

On Making Hosting Mainstream:

Chesky spoke on Airbnb hosting now getting to a point where it can be taken mainstream. Previously, lack of uniform regulation made hosting a “legal gray area” and made most avoid it altogether. With uniform regulation being established across most of Airbnb’s core markets, it can now begin to promote this income-supplementing activity to the masses. AirCover -- its insurance policy -- is a big part of host confidence as well. Specifically, it raised Airbnb’s net promoter score (NPS) on home damage claims by a full 70 points. Chesky pointed out how wonderfully weird it is that damaged homes are now a source of brand promotion for Airbnb. That’s what it gets for taking care of stakeholders.

As an aside, this is one of the more subtle advantages to stricter regulation. Along with Airbnb being bigger with a stronger balance sheet and deeper global relationships than smaller competitors, it encourages hosts to list their properties.

On take rate:

Airbnb’s take rate policy hasn’t changed in 10 years while it has continued to provide more and more value to its ecosystem. Chesky’s philosophy is to “give away more value than charged for to make the moat deeper year after year.” He spoke on more tie-in services that Airbnb will likely charge for. The most interesting item is sponsored host listings or the idea of hosts paying for better placement. This alone could “easily add a few percentage points to take rate over time” once introduced. But the team is in no hurry to do so:

“Advertising is now a big part of the largest markets in the world like Amazon, Alibaba or even Booking. But my CFO -- from Amazon -- has a quote on this that I love: You want to focus on the most perishable opportunities first. Sponsor listings are not perishable. The bigger the platform gets actually the more interesting monetization gets. Monetization is great at scale. So you want to get as much scale as possible. So we still feel like we're still in land grab mode. So that is not the #1 most perishable opportunity, but it's absolutely on the horizon.” -- Co-Founder/CEO Brian Chesky

On Loyalty Program Plans:

The company thinks about loyalty programs a bit differently than others. Chesky believes the “best loyalty program is people loving your products.” He doesn’t want to pay for that loyalty. He prefers to approach it like Amazon did with Prime as more of a membership program. This would allow them to extend the perks and services beyond what they offer today with positive unit economics.

b) Layoffs

Well… this is awkward. Founder/CEO Brian Chesky celebrated no recent layoffs in the company’s last earnings call. This week, Airbnb fired 30% of its recruiting department and announced that it will slow hiring. Given the elite execution from the company over the last 3 years, I’ll give him a pass here -- but the timing of this was still a bit “icky.” For some fair context, 30% of its recruiting staff represents well under 1% of its overall staff and it is not planning more layoffs. Headcount should still grow very modestly in 2023 but may now end up being flat. In my view, considering how robust the forward guidance was, this is likely a move to become more efficient and profitable -- they’re not struggling to find demand as of now.

7. Match Group (MTCH) -- Hinge Founder Justin McLeod Interviews with Morgan Stanley

Hinge’s Global Progress:

Hinge was #1 in the U.K. in terms of January 2023 dating app downloads. It’s “vying for #1” in Australia as well. These were its first two international markets of product localization.

It remains #3 in Germany, #2 in the Nordics and has “really good” early momentum in France. It’s now generating revenue in these European markets.

Hinge is not gaining this traction with heavy marketing spend, but instead organically. That’s why it’s staying at the top of these lists rather than jumping to the top amid the debut and quickly fizzling out.

It sounded like Latin America will be the next area of expansion as the app has already been translated to Spanish.

It has a “lot of natural organic momentum” in India as well.

Thriving in North America:

Hinge has been the #2 dating app in the U.S. on the App Store since January.

MAUs rose 25% YoY in the U.S. with 35% growth in GenZ female users. Its gender balance continues to be better than its competition including Match’s Tinder.

Hinge enjoyed 50% growth in LGBTQ+ users. Big considering ⅕ GenZ adults identify as LGBTQ+.

“Hinge’s international push is off to a better start than I imagined. I think the EU excluding the U.K. will be 20% of Hinge revenue over time” -- Hinge Founder Justin McLeod

On the New $50/Month Hinge X Subscription:

“This has delivered in line with expectations and gives us confidence in our $400 million revenue number for the year.” -- Hinge Founder Justin McLeod

Hinge X users are getting 4x more dates vs. non-subscribers vs. 2x more for its cheaper subscription called Hinge Preferred ($30 per month).

On the Long Term Potential:

McLeod elaborated on how early on Hinge is in its monetization journey -- even in the U.S. The app’s revenue per user is much lower than swipe apps, largely because this is a new focus. Internationally, it hasn’t even localized subscription pricing to give an idea of how far it has to go here. That work should be lucrative. The progress it has made here to date has been with a “marketing budget a fraction of the size of the competition” showing just how efficient it has been thus far.

On AI:

Like for everyone else, AI came up in this conversation. McLeod told us that Hinge will use capabilities here to enhance matching and coach users on interactions. He thinks it will reach a point when the apps can function as a “personal match-maker” to directly pair you with your most compatible mate. A bit creepy, but maybe I won’t have to go on as many awkward first dates to find Mrs. Right? Fingers crossed.

On Tinder’s Turnaround:

Match is pausing Tinder’s CEO search and keeping Bernard Kim in the interim role for now. Either they couldn’t find a compelling candidate or the team is clicking.

They continue to be confident in re-accelerating growth in 2023 which is a necessity for this investment to work.

It will raise pricing on its subscription in some markets this month.

Product update cadence continues to accelerate. Things like weekly subscription offerings are working while rebranding its incognito mode led to 4% more cash collection from female subscribers. Other products like à la carte pricing internationally haven't worked. More shots on goal will mean more misses too. That’s ok if some shots hit.

It sees price hikes and discount eliminations as leading to negative user growth until Q2 when it should turn positive once more.

M&A:

Match group is interested in some smaller “private market” dating apps with immediate synergies. It’s not interested in buying another Hyperconnect… thankfully.

8. Visa (V), Mastercard (MA) & Bank of America (BAC) -- Consumer Strength

a) Visa Investor Conference

Last week, Visa published February spend volume data. This week, its CFO spoke with Morgan Stanley to elaborate on just how pleasantly surprised the team has been with this spending resilience. And it’s not just across credit or a matter of consumers borrowing more to fund their lifestyles. Debit has been almost shockingly robust as well. Encouragingly, it’s also seeing a faster than hoped for cross-border recovery. This is wonderful news for the entire e-commerce market considering cross-border transactions -- which skew to discretionary e-commerce -- are some of the highest margin transactions that these entities conduct.

Still, goods volume growth is unsurprisingly slower than services growth as our consumption patterns normalize. The mix is back to roughly 50-50 vs. a slight majority in favor of pre-pandemic services. Visa CFO Vasant Prabhu added that goods growth remains strong vs. pre-pandemic levels, but this current shift could be a YoY comp headwind for some discretionary e-commerce in 2023. Puts and takes. For other buckets like travel booking (cough, cough Airbnb), it should be an accelerant.

“We focus on what our data tells us. If you listen to talking heads, you’d be manic depressive. Our data is remarkably stable. Shockingly stable.” -- Visa CFO Vasant Prabhu

b) Mastercard February SpendingPulse Data

SpendingPulse measures nominal omni-channel retail sales growth. The data meshed very well with Visa’s data and commentary. Here were the highlights for the February data release:

U.S. retail ex-auto rose 6.9% YoY.

E-commerce sales rose 13.2% YoY.

In-store sales rose 5.5% YoY.

Service spending growth unsurprisingly led the way. Restaurant spend rose 14.2% YoY, Airlines rose 15.6% YoY and lodging rose 43% YoY. Goods growth was slower with things like apparel rising 3.9% YoY.

“Following a dynamic holiday season, consumer spending returned to a familiar and healthy balance in February. Consumers have remained resilient, prioritizing discounts where possible to counteract inflationary pressures." -- Mastercard Senior Advisor Steve Sadove

c) Bank of America Spending Data

Trailing 3 month growth for February remained above the rate of inflation. This “suggests that consumer spending remains resilient as the rate of spending growth moderates.” Still growth for February specifically slowed to 2.7% YoY vs. 5.1% growth YoY in January which enjoyed easier Omicron variant comps. Annualized spend per household as of February sat at a still robust 4.8%.

Inflows into money accounts vs. outflows remain “in fairly good share” with bank balances relatively elevated.

Tech layoffs are not really impacting spend growth. Labor market strength in most other sectors is “allowing U.S. consumers to largely ride through inflationary pressures.

It’s strange. All of this data points to the consumer being in very good shape. Other anecdotes from Uber point to labor slack lengthening and so employment weakening. This data is more complete, but I don’t think we can just disregard Uber’s sentiment considering its massive scale and global presence. Strange times we live in which is understandable considering our last 3 years of stimulus checks, payment holidays and lock downs. There’s no financial history book chapter for this cycle.

9. Sea Limited (SE) -- Earnings Review

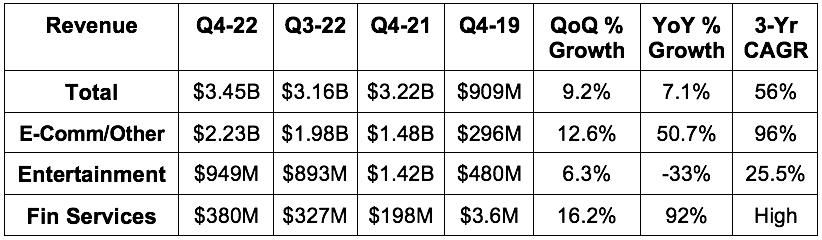

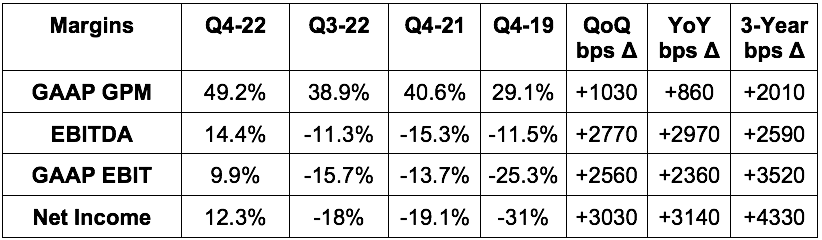

a) Results vs. Expectations

Beat revenue estimates by 13.1%.

Beat -$226.6 million EBITDA estimate by $722 million.

Beat -$344 million GAAP EBIT estimate by $688 million.

Beat -$0.66 EPS estimate by $1.38; beat GPM estimate by 1040 bps.

There was no forward guidance offered.

b) Balance Sheet

$6.9 billion in cash & equivalents with another $1.2 billion in long term investments and $1.5 billion in restricted cash.

$3.3 billion in convertible notes.

Stock compensation was 5.5% of sales vs. 6.2% last quarter and 4.1% YoY.

c) Call & Release Highlights

Results Context:

Net income was aided by $330M in accrual reversals & debt extinguishment.

The company cut its sales & marketing expense from $1.2 billion to $473 million YoY in a move of aggressive cost cutting/belt trimming. This is part of its previous pivot to prioritizing profitability.

R&D fell slightly while G&A rose slightly. The operating leverage was from S&M cuts and then revenue outperformance as well.

The 56% 3-year revenue CAGR compares to 73% last quarter and 63.3% 2 quarters ago.

Sea Limited’s core Asian markets performed in line with its internal expectations. Developing markets like Malaysia underperformed.

It’s still determined to turn its popular Free Fire game into an “evergreen franchise.” The tanking digital entertainment growth is not changing plans there.

Financial Services continue to support more transaction volume & higher transaction margins on Shopee (its marketplace) in a “highly synergistic” manner. This segment also generated positive EBITDA for the first time. It grew 16.2% sequentially despite shuttering most marketing efforts.

What to Make of this Report in my non-shareholder opinion:

It’s not often you see a company report a 10% GAAP EBIT margin when that margin was supposed to be closer to -10%. This was an incredible bottom line beat. While it was powered mainly by S&M cuts, it still generated sales a full 10% above depressed consensus estimates. And it still found YoY growth despite halting most external marketing efforts.

It will be interesting to see how reliant its revenue is on advertising going forward. The benefits of its performance marketing surely leaked into this period. As we distance ourselves further from these cuts, will it continue to briskly compound on the top line? I’m not sure. I don’t think we’ll ever see revenue growth creep back above 50% again. I also don’t think it’s unrealistic to expect 15%-20% compounding for this company like we see with other players around the globe like Coupang. This investment could work in that scenario. If revenue is more closely reliant on more marketing dollars for long term sustainability, this investment likely won’t work.

10. Nano-X Imaging (NNOX) -- Earnings Review

a) Results

Generated $2.1 million in revenue vs. $1.3 million YoY. None of this revenue is from ARC distribution and none of this revenue is at all relevant to my investment thesis. It’s entirely dependent on the ARC system being cleared and distributed across the globe. Rejection of the system is a very real possibility and Nanox will be essentially worthless in that outcome. So, this is a pie in the sky investment. That’s why it only gets 0.2% of my overall funds. If they execute that’s all we’ll need. If they don’t, that’s all we’ll want.

Its Teleradiology services segment generated $2 million in revenue at a 15% gross margin. Its AI solutions business generated $100,000 in revenue with a gross loss of $2 million. Net loss worsened from $22 million to $44.8 million YoY due to $36.5 million in non-cash goodwill impairment increase via delays in revenue generation from these tiny business segments.

It has $77.7 million in cash and equivalents. This gives it 1.5 years of operating cash burn at its current burn rate. It paid out $18 million in stock comp which was flat YoY and down from $25 million in 2020.

b) ARC Regulatory Updates

It continues to respond to FDA requests for more information for the 510(k) multi-source clearance application it submitted in September. We won’t have a final verdict until it completes all of these requests.

EU clearance is being delayed by changing regulation there which is leading to a backlog in updated applications for their regulatory body.

Sent an ARC system to the University of Ghana for “training and demonstration” purposes. It’s pending local approval. Upon approval, Nanox would begin shipment of the 350 ARC systems it has under contract there.

Sent an ARC system to Nigeria for review by its FDA equivalent.

It continues to conduct clinical trials in Israel and has now scanned a few dozen “healthy volunteers.” It’s hoping to be granted permission to expand these clinical trials to a 2nd hospital in the near future.

c) Business Updates

It’s consolidating R&D facilities into a main Israeli facility. It thinks it largely wrapped up the establishment of needed enterprise processes and manufacturing capacity in 2022.

Adding new 3rd party agreements with tube and X-ray chip manufacturers to control costs and ensure sufficient supply as deployment hopefully finally ramps.

New Nuance Precision Imaging Network partnership for its AI solutions to make them eligible for purchase on its market that sells to “thousands of healthcare facilities and providers.” This sounds exciting, but again, the investment case is all about ARC.

d) My Take

Nothing about this quarter changes my approach to the investment. I will not add until real ARC revenue starts to be generated. I will not liquidate my currently tiny position due to the massive upside I see associated with global ARC clearance -- which is very far from a certainty. Brian Feroldi said it best: This is a lottery ticket.

11. Olo (OLO) -- Accolade

Fast Company named Olo the most innovative company in its dining category for the year. This continues a string of industry accolades awarded to this software disruptor.

12. Macro

a) Data from the Week

Notes from Powell Pressers:

Powell doesn’t think the Fed has overtightened but also acknowledged the effect of previous hikes hasn’t been fully felt… so how would he know?

Risk of not taming inflation is higher than the risk over over-tightening.

Could potentially accelerate the pace of rate hikes but hasn’t made that decision.

January data interrupted the trends of softening that Powell had been seeing.

Employment Data:

ADP Non-farm employment rose 242,000 vs. 200,000 expected and 119,000 last month.

Jolts Job openings for January closed at 10.824 million vs. 10.5 million expected.

Initial Jobless Claims came in at 211,000 vs. 195,000 expected and 190,000 last month.

February earnings rose 0.2% month over month (MoM) vs. 0.3% expected and 0.3% last month.

Non-farm Payrolls for February rose by 311,000 vs. 205,000 expected and 504,000 last month. Note this is the data point where calculation was sharply changed last month.

Labor Force Participation Rate encouragingly ticked up from 62.4% to 62.5% MoM in February.

Private Non-farm payroll for February rose 265,000 vs. 210,000 expected and 386,000 last month.

The unemployment rate rose from 3.4% to 3.6% MoM vs. 3.4% expected.

Salesforce fired 10% of its employee base.

High Yield Option Adjusted Corporate Credit Spreads Rose Following the SIVB News this Week:

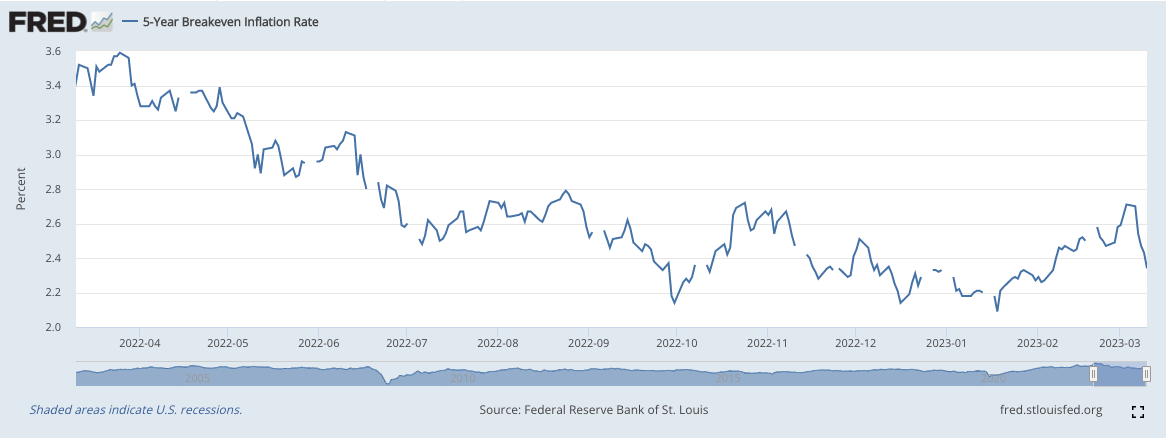

5 Year Breakeven Inflation Rate Encouragingly Fell Sharply this Week:

b) Level-Setting the Data

What a weird week. Things started off with Powell telling us the Fed could accelerate rate hikes. The SIVB bank run quickly took care of that with market expectations rapidly falling back to a 25bps hike this month. Markets also started to price in a rate cut at the end of 2023 after pushing that assumption to early 2024 in recent weeks. Who knows if that cut comes Q4 2023 or early 2024 -- but also who cares besides shorter term traders? Not me.

What’s important is that peak inflation has clearly come with real-time indicators pointing to more disinflation. We’ve already endured one of the most aggressive hiking cycles ever and we’ve already seen quality firms pivot to prioritizing profit to appease markets while this hawkishness persists. They’ll continue to do so if need be.

The progress we’ve made on inflation allows the Fed to pause hikes and QT after we enter a mild recession. If inflation continued raging at that point, we’d have to keep hiking into a more severe downturn which is an outcome we’ve thankfully likely avoided. It’s still possible but not at all probable.

The labor market remains resilient -- although it did show some kinks in the armor this week with the surprise rise in unemployment (ignore non-farm payroll as I don’t think the estimate is apples to apples).

All of this is to say that I will continue to approach cash management with balance. My bias will continue to be slightly skewed towards accumulation, but I will use periods of relief and market exhaling to trim more aggressively than I normally do into margin expansion. That will continue as long as we still need this much more progress on inflation to get it back to 2%. Balance, balance, balance.

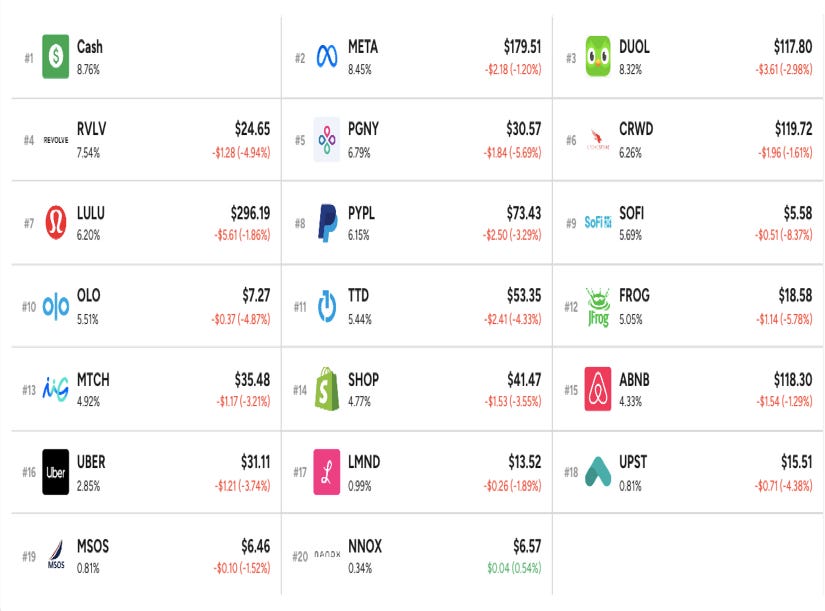

13. My Activity

I published a CrowdStrike Earnings review this week which can be found here.

I trimmed a little bit of Duolingo this week. It had spiked 100%+ in just 90 days and became my largest position by a wide margin. I wasn’t comfortable with that considering it’s less profitable and more speculative than my other largest holdings. So I trimmed. Still, the sheer mastery that was its last 2 quarters led me to make that trim small and to keep Duolingo as my second largest holding behind Meta. I don’t plan to trim it again.

I liquidated 50% of my Cresco Labs stake. The company is well run and well-positioned in American Cannabis -- the regulatory delays and uncertainty just pose too much risk. Even for the stronger growers like this one (and especially if Columbia Care doesn’t close) delays to regulation could mean an expensive capital raise. While 280E reform alone would turn these companies into cash printers over night, when that comes is anyone’s best guess. And until that and other regulatory wins come, regardless of how well Cresco has executed within the hand it has been dealt, profits will be severely artificially held back. I had a bit more to say about it on Savvy Trader which can be found here.

I added to my Uber stake as part of a plan to build out the new position. I added a sizable chunk to my SoFi stake for the reasons mentioned in the SoFi section of this article.

One last note. I will consider Nanox, Upstart and Lemonade sources of cash if Mr. Market becomes overly fearful once more and if I’ve already taken my cash position below 4%. Those are my lowest conviction holdings and I will consolidate into higher conviction names if panic strikes once more to maximize my accumulation fire power in these higher quality names. For now, the three will remain tiny pieces of my portfolio.