News of the Week (March 7-11)

Upstart; PayPal Holdings; SoFi Technologies; Revolve Group; GoodRx; JFrog; Teladoc Health; Meta Platforms; CrowdStrike; The Trade Desk; My Activity (With a Portfolio Change)

1. Upstart (UPST) — Investor Conferences, Auto Progress & KBRA Data

a) Co-Founder/CEO Dave Girouard Interviews with JMP Securities and Morgan Stanley

On the differentiation of Upstart’s Lending Model:

“Some either can’t conceive that we can make a smarter credit decision [than FICO and some human-created rules] or think everybody must be doing this. The truth is neither of those things are accurate. It is neither impossible nor easy… the types of teams that can build these models don’t exist in most of the lending industry… the disbelief puts our company in a place where we have a belief adoption curve. We’re proving it month by month.”

“We want to be the first stop for credit access because the consumer trusts us to offer the best rate, best process, best everything. We have to make that a little bit truer every single day.”

On the partner philosophy and partners dropping FICO minimums:

“We have an enormous number of knobs and dials that we can implement to manage partner risk… you can think of our system as having a first pass — which is the partner’s rules — and then a second which is our risk system… we do that because it’s important to meet highly regulated and conservative banks where they are. They have all sorts of reasons not to want to just jump into the future… once they’re on the platform, they start to see how it performs. They start to see that minimum credit score and other rules are unnecessary and not actually predicting risk. The rules actually exclude a bunch of people they could successfully and responsibly lend to.”

On re-thinking Macro:

“Banking and lending tries to watch the tea leaves to react to the changing state of the economy. Ultimately, our system we believe is much more adept at reacting quickly and doing the right things… now 2022 has all these other variables and the bottom line is that there’s no such thing as everything is normal. I think what we’re doing over time is proving to our partners that this is the system you need to deal with a noisy, crazy background economy.”

As a reminder, Upstart has guided to rising default rates into 2022 as the consumer normalizes post-pandemic. According to Girouard, we are now “close to pre-COVID levels” in terms of defaults and he sees it now stabilizing at a rate similar to 2019. Girouard explicitly said this change has “not negatively impacted the business” as the loans have already been priced accordingly (as Kroll Bond Rating Agency (KBRA) data hints at below). Considering Upstart’s loan performance exceeded expectations for partners and investors pre-COVID, re-entering an environment more similar to that one should not impact its ability to continue executing.

“We feel good. We’re in a good position. Our system did the right things and now we’re largely beyond the stimulus impact… as a technology provider in a cyclical industry, it’s vitally important that we are helpful when things get volatile to allow lenders to continue making credit available when it’s needed the most.”

Upstart used the pandemic as a tryout to soar from the 4th largest in its space to 1st, by far. It shined through the hectic times.

On auto refi (older product) and auto purchasing (newer product):

“Last year, we said auto is our next thing. We focused on it and had confidence that the market opportunity is enterable. We came into this year able to say, yep it’s happening. We know the drill for improving the models and scaling up while improving conversion rates and all of that… in the case of auto, we simply offer a better product.”

On Prodigy (acquired by Upstart) giving it the dealer-facing software it needed for auto purchasing:

“We view the auto purchase opportunity as much larger than Refi. With the auto purchase product, we have the same smarter credit and automation built in, but we also have proprietary distribution…. We work a lot with LendingTree and Credit Karma for personal loans. In those cases, they’re the first thing the consumer sees. Now, we are in the car dealership so we are LendingTree, Credit Karma and Upstart all rolled in one. We feel confident that this has the potential to be our largest business by far in a few years… We’re well on our way to being in 15,000 to 20,000 (it’s in a few hundred today) large independent and franchised dealerships. We feel very confident we will continue growing our presence quickly.”

“It is fair to say when we put that $1.5 billion auto origination number out there, we feel very comfortable. Refi has achieved liftoff and hopefully later this year we’ll say the same thing about the auto purchase product.”

Girouard eluded to more dealer integration work left to be done but referred to this as “not remotely risky.”

Until recently, it was not providing its own auto purchase credit offers — now it is:

“In the dealerships where we’re testing our own credit offers, we’re becoming increasingly confident as we start to see that our offers will compete really well across a lot of the spectrum… lenders also are realizing there’s no reason not to work through our system. As usual, we have the same value proposition of approving more people at lower loss rates…. Upstart Auto Retail has no enemies… all 3rd parties can win here.

Upstart Auto Retail refers to the company’s car dealer product. Not refinancing auto loans through Upstart.com or a lending partner. It’s the end-to-end, on and off premise software that dealers use to power the car buying experience. Upstart then uses its auto lending partners to fund the loans.

On the asset-backed securitization (ABS) market slowing and the impact on Upstart:

“The majority of our institutional buyers don’t securitize, so the market has no impact on them. The rest only securitize if it’s really productive to do so. Otherwise, they happily hold the loans and appreciate the yield they get from them. There’s only a small fraction that could have a lower appetite without the ABS outlet but that’s not all that material to us… In 2021, the ABS market was extraordinary. You had loans bought at par and sold within a month or 2 at 108% of par…. we expect that because ABS markets have cooled down, a lower fraction of 2022 loans from our platform will end up in ABS markets.”

Considering investor worries over Affirm cancelling a debt offering related to an ABS transaction of its own, hearing this from Girouard was both unsurprising and comforting to me.

b) Auto Progress

Upstart launched a mobile-first version of its Upstart Auto Retail platform alongside some new features like custom filters to search for cars. Considering 66% of dealer traffic through the Upstart Auto platform comes from mobile devices, this is key to further removing platform and venue friction while conveniently and actionably meeting the user wherever they’d like. It’s this ability to freely move from on-line to in-store and back that is something many other competing digital products lack. Upstart “bridges these two worlds with a consistent customer experience from start to finish.”

This on-line to in-store toggling capability readily offers salespeople with more timely insight into what a customer is actually looking for to speed time to close. Dealers can pick and choose exactly how they want their purchase flow to be organized so that they can do things like hide steps that have been completed (thanks to a new save and finish later feature). Furthermore, the new product equips Upstart’s dealers with the ability to create a more granular, personalized, targeted buyer experience to raise conversion.

The platform’s broad integrations with brick and mortar dealerships are designed to give buyers the ultimate flexibility within selecting which part of the buying process happens where.

As part of the launch, Volkswagen was announced as the newest of 6 global car manufacturers to support Upstart Auto Retail. Just one day later, Upstart announced that Volkswagen selected the platform as a “preferred digital retail provider.”

“When we started working with Upstart Auto Retail, they were an up-and-coming startup in the digital retail space. We chose them because other platforms simply did not meet our needs. Having worked with them now for so long, it has been nothing but a success story.” — Owner of Volkswagen Platinum Josh Lever

The software costs $599 per month per dealer rooftop.

c) KBRA Data

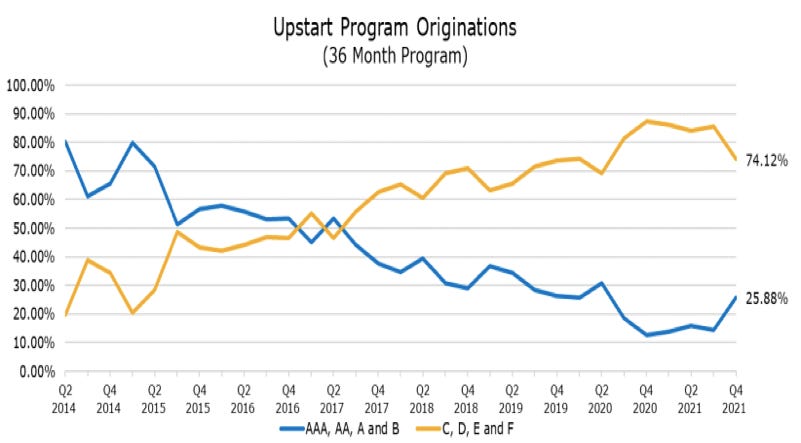

KBRA published new data on Upstart’s 2nd 2022 pass-through transaction. It’s interesting to note that Upstart’s credit mix shift towards lower-graded loans seems to have leveled off:

Still, that mix shift took place throughout 2021 (and before as well) which is why average interest coupon for the latest pass-through transaction is higher (4%) compared to older pass-throughs. This leaves room for more defaults and higher trigger rates — rising credit enhancements within the deal also boost that cushion further.

For every single capital market transaction, KBRA’s current base case loss projection is equal to or below its initial expectation (a good thing).

2. PayPal Holdings (PYPL) — Two Investor Conferences

a) CEO Dan Schulman Interviews with Morgan Stanley

On Russia:

PayPal halted servicing Russian cross-border transactions in light of the war in Ukraine. This was both to take a moral stand and also to ensure safety for the few employees it has in both countries. It does not have a domestic business in Russia and total cross-border transactions from Russia equated to roughly 0.5% of total revenue last year.

On digital wallets at checkout and innovation:

“Clearly, digital wallets are taking share. There are far fewer people entering their credit cards for transactions and we’re seeing all forms of digital wallets take quite a bit of checkout share.”

Considering PayPal’s digital wallet boasts roughly triple the merchant acceptance rate of its next closest competition — Apple Pay — this will be a secular tailwind for PayPal to enjoy for not months, but years to come.

Mote notes on the 6-month-old digital wallet:

It has already been adopted by 50% of PayPal’s active consumers.

Digital Wallet users produce 2X the lifetime value (LTV) vs. checkout-only customers.

Every time PayPal customers add an additional digital wallet service, its LTV rises by 25%

There are many, many new product launches in the works.

Users of the crypto services are 25% less likely to churn.

Checkout upgrades highlighted:

PayPal lowered checkout latency by several seconds in 2021.

It now proactively updates expired cards so “you never have a transaction turned down due to expiration.” This raised authorization by 0.01-0.02%.

The organization worked to make a larger part of the PayPal order flow native to its application… “so you don’t have to bounce from merchant to PayPal and back as one-click checkout makes that much quicker.”

On Buy Now, Pay Later (BNPL):

“We could have bought a BNPL player for $10+ billion but we opted to do it organically. Exiting Q4, depending on what metric you look at, we’re either the number 2, 3 or 4 player in countries globally where we offer BNPL.”

It did buy Paidy in Japan for roughly $2.7 billion but that was to expand into the country and for its deep integrations with Japanese convenience stores more so than to get its BNPL assets.

PayPal believes its value proposition in BNPL is “best in class” as it charges no added merchant fees and fosters a 21% spike in their sales volume which is 90% incremental margin. This is why I find it imperative for BNPL to be a tool and not the main value creator: PayPal is merely using BNPL to feed the Total Payment Volume (TPV) and checkout share of its core business — it does not need to overcharge merchants for these services as it generates the needed variable profit elsewhere.

“BNPL is a really good service… it’s not an end in and of itself. It’s not a company by itself.”

More BNPL notes:

PayPal enjoys a double digit percentage rise in checkout share when its BNPL option is presented upstream during the shopping and discovery processes.

The product is fully integrated into PayPal’s digital wallet.

Its max payment is $1500 for BNPL which it’s looking to uncap.

“We’ve been doing credit inside PayPal for 10 years. We know when to responsibly lend and when not to… As best we can tell, we have the lowest BNPL loss rates in the industry. When you have 400 million consumers, it gives you another big advantage via familiarity. When you know the consumer, your approval rates are 90%+, when you don’t, the rate is 75%+. Using PayPal BNPL gives them a much better consumer experience than anyone else.”

On the brand:

“There are a couple of studies that have us as the #2 most trusted brand in the world. 54% of consumers will shop more at a merchant if PayPal is present.”

Braintree:

“Braintree is growing at leaps and bounds. We brought on some of the world’s largest merchants like DoorDash and Live Nation. If you look at Uber and Airbnb, we are either the primary or exclusive provider for the full stack.”

“Braintree is the only full stack processing platform where you can fully integrate in both PayPal and Venmo. If you think about one of the big advantages here, the competitors to Braintree supply just 1 side of our 2-sided network for full stack processing. We provide a full set of services and the ability to tap into our consumer bases.”

On missed Q4 2021 estimates and underwhelming guidance for 2022:

“We clearly got a little ahead of ourselves in looking at what was happening early on in the pandemic. But if you look at the underlying strength of our business ex-eBay… we have really strong underlying growth… everything I see now points to core business strength. So far, the first quarter is shaping up about as we expected.”

On changing customer focus:

Schulman told us that while the focus has shifted away from quantity and to quality, they should return to 30 million+ annual account adds as we lap tough pandemic comps. PayPal’s 11% YoY growth (18% ex-eBay) in transactions per account was one the fastest rates it has posted in 3 years — a sign that the quality approach is working.

“The top of the funnel remains very strong… Are we running out of room to grow active users in our core markets? Absolutely not. We’re 1/3 penetrated in our core markets.”

“Low engaged customers using us 1 time per year leaving us has basically no material impact on revenue. It allows us to shed the costs associated with keeping that customer without impacting our future revenue potential.”

On China:

“We’re very focused on the opportunity in China now that we have our licensing there and now that we’ve finally got our infrastructure in place that is fully compliant and legal inside the country.”

On Crypto:

“We put out an easy-to-use crypto product to buy and sell and use with merchants as well. That was step 1 of a multi-part road map around digital assets.”

On Venmo:

“Venmo TPV is approaching 0.25 trillion growing at 44%. To put that in context, in 2017 PayPal was at TPV of $0.20 trillion growing at 25%... PayPal was a P2P service starting off… and then it went into every merchant (85% in the U.S.). Venmo is going to follow that same track.”

Venmo Pay on Amazon will launch in 2022.

On Walmart and presentment:

“2 years ago, we were buried in pages of checkout options at Walmart. We’ve worked with them on a number of different things post eBay operating agreement so now we’re front and center. As a result, checkout percentage is up substantially. The reason a company like Walmart will work with PayPal like this is because we drive incremental sales and our conversion rates are higher.”

This is why I am confident that the eBay operating agreement ending will be a net long term tailwind for PayPal. It’s free to participate in more intimate relationships with countless other merchants; it had previously been restricted from or entirely prevented from doing so. The eBay business abruptly halting has been a pain, but it’s now just 3% of PayPal’s TPV.

b) CFO John Rainey Interviews with Wolfe

On guidance and the stock price:

“It has been and likely will continue to be a more difficult environment to predict. We were conservative in assuming only 2 interest rate increases in our forecast for the year… given that we earn interest on customer balances, that is one area for potential upside. The other area of conservatism is credit loss rates returning to the mean because of the impact of stimulus. Neither are huge drivers of our business… I would not characterize our guide as overly conservative.”

“We are a show-me story. We clearly need to demonstrate that we can produce the results we talked about. I’m disappointed that we are in that positions… some of it is self-inflicted and we all recognize that. We are focused on generating results that get back to demonstrating the true value of our franchise and opportunity.”

On checkout:

“You can look at 3rd party independent survey after survey that would suggest the preferences for PayPal for checkout going head-to-head with the others… for conversion, completion, engagement and everything else, studies suggest we fare much better than others.”

“Moving further up into the payments flow is where the PayPal value proposition shines. They can have the one-click checkout with no information needed. It’s also where merchants see much higher conversion.”

On directly integrating Honey Rewards into PayPal and Venmo:

“We recognize that the capabilities we got with Honey can unlock many more relevant experiences for our consumers. We are in the early stages around what we’re doing with Honey… We’re seeing strong (7x) increases in discoverability and first-time usage of new features that we’ll build upon to create more utility in the digital wallet.”

It has used some of Honey’s shopper and discovery tools in the new digital wallet which are all working, but there’s much more to do here.

On the super-app journey:

PayPal’s high yield savings product is now in a live beta stage for 20% of its users. The investing products it has planned could be live by the end of the year or early next year. PayPal digital wallet users can now buy and sell crypto and use the balances for purchases at participating merchants.

“We want to provide this digital app where our users can access a suite of different services and then re-spend that money within the PayPal ecosystem.”

On international:

“International focus has become more targeted over the last few years. The 3 that really stand out are Japan, China and Mexico.”

“China has incumbents that dominate the digital payments market. We’re not delusional to think people are going to start using PayPal in Shanghai vs. the other options. What’s exciting is that Chinese nationals can use PayPal to shop at our network of 30 million+ merchants where those Chinese payment options aren’t available. That’s a huge business for us.”

On Venmo:

“The focus has very much so turned to generating more volume linked to commerce. We want to diversify beyond P2P type applications. This includes buying things on or offline. We’re moving more into areas like Pay with Venmo. Most of Venmo’s monetization is around instant cash withdrawal and so Pay with Venmo is really like the prize here.”

“Our Venmo credit card strategy is to bridge to that point in time when we all checkout with a mobile device.”

On operating leverage:

“We have tremendous opportunity because of our scale to grow at a low marginal cost and see our margins go up over time… we are very focused on the non-volume related expenses in the business becoming more efficient. We expect to get back down to mid-to-high single digit growth in operating expenses.”

Considering revenue should compound going forward at 15-20%, this would mean much more margin expansion to come.

On Braintree:

“There are other payment processors that have come out in the last year that people were quite excited about. Side by side, our Braintree platform compares just as well as those others… so we need to provide more disclosure on that and we’re discussing internally more disclosures to give a better sense of tremendous merchant side progress.”

3. SoFi Technologies (SOFI) — CFO Chris Lapointe Interviews with JMP Securities and UBS

On vertical integration:

“We’ve built end-to-end processes and solutions within lending which enable us to have the lowest cost of operations. This in turn allows us to provide the best experience for our members.”

The term “vertical integration” was used a few dozen times in the 26 minute chat. SoFi is obsessed with cutting operating costs wherever possible to pass on differentiating savings to consumers in a commoditized banking world.

On competition and macro:

“We’ve shown an ability to execute with constant headwinds and I don’t think 2022 will be any different. In 2022, we’re finally in a position where all of our products are largely in place. I’m excited to continue executing and delivering on our long term plan we’ve given to shareholders.”

On financial services monetization:

“If you look at total revenue per financial services product, that rose 30% sequentially when looking at annualized revenue per product.”

On Galileo and Technisys combined:

“I don’t think anyone has the capabilities to offer a multi-product, cloud native core with experience in lending and building out every other product. This will certainly be a differentiator.”

“The assumptions for organic growth and the synergies within the forecasts are relatively conservative.”

4. Revolve Group (RVLV) — VP of Investor Relations Erik Randerson Interviews with Bank of America and Raymond James

On inflation impacting Revolve’s customers:

Randerson reiterated management’s confidence in being in a relatively better position to endure high levels of inflation vs. many of its peers due to Revolve’s higher price point and its deep brand loyalty.

“I know there are other companies with lower price points talking about consumers being impacted. I don’t want to suggest we’re immune to what’s happening… but I think our luxury segment customer has the ability to withstand inflation better than others… Our customers come to us for what’s on trend and not so much to price compare.”

On REVOLVE and FWRD brand overlap:

As a reminder, Revolve’s REVOLVE segment has a lower average price per order of around $250 vs. FWRD’s $650. They also sell different categories of apparel and accessories, making the two very complementary.

“The percentage of REVOLVE active customers spending on FWRD is in the single digits. But what’s encouraging is that the percentage has increased every month since we introduced the FWRD loyalty program… We believe it can go much, much higher.”

On supply-chains, inventory and Apple-related marketing challenges:

“The data-driven nature of our technology allowed us to automate many merchandising processes and to utilize data to move more quickly than we believe other companies have in a very accurate way. We’ve been able to get access to the right inventory while others have struggled… one of the things that we use is up to 60 attributes on each item to help us gather data on what trends are working. This allows us to see more than just a style and helps to guide reordering.”

“A lot of companies have talked about headwinds to marketing efficiency. By comparison, in Q4 we delivered over 1% of incremental marketing efficiency. It’s really the strength of our brand and the diversity of our marketing channels that has helped us…. 5 of our top 10 selling brands in 2021 were owned-brands.”

Revolve was able to raise its total SKUs offered from 50,000 to 70,000 throughout its sites in 2021. It uses 3rd parties to create broad selection that doesn’t coincide with large inventory needs. Revolve uses its first party data to quickly drive re-ordering and so stays quite financially nimble throughout the process. This was immensely important over the last two years with consumer preferences changing so rapidly as a result of pandemic waves.

On strong retention and performance:

“Our customers have been loyal over our 19 year history. From the beginning of our history, we offered free shipping and returns to allow customers to turn their homes into dressing rooms. Our shipping and returns speed is un-paralleled in the markets we serve.”

Revolve’s net revenue retention set new record-highs in 2021 and eclipsed 100% for the first time in its history. The firm believes this outperformance is related to the successful launch of its two loyalty programs.

Revolve has not even had access to its largest event (Revolve Festival) for driving new demand in 3 years. It will host its first since the pandemic began next month.

The brand ambassador program — incentivizing its army of influencers to promote their love for Revolve via kick-back commissions — was also given a lot of credit for Revolve’s performance being so strong. Ambassadors can choose to be paid in cash or Revolve clothing. Impressively, more choose clothing than the cash which “really speaks to the love for the brand.” It will launch a similar program for FWRD in the future.

Active customer growth for the first quarter should be “higher” than this past quarter’s 25% growth rate.

On FWRD:

The company now sees this segment at large enough scale to begin investing meaningful external marketing dollars into it. Revolve sees this as a go-to destination for luxury exploration while other competition caters to customers knowing exactly which popular brand and item they’re looking for.

On the men’s segment:

The vast majority of its sales remain to women but it does carry some items for men. It sees this as a long term growth opportunity somewhat similar to how Lulu Lemon began with women, established the brand and expanded from there.

“This is still not the focus as we just see so much opportunity in female. Longer term, we see it as a real opportunity with men.”

On Revolve’s long term 20%+ revenue growth target:

“We’re very confident that even after 54% growth last year, we should be right back at that 20% or better revenue growth — with an emphasis on we are hoping to do better. We’re excited for 2022 as we see it as when our market will truly re-open and our events will return.”

“When we look at the underlying metrics of the business like how many owned-brand styles we create that are re-ordered and how many are selling at full price, we are seeing results that are as good as ever.”

Net sales exposure from Russia and Ukraine is well under 1% for Revolve.

5. GoodRx (GDRX) — M&A & Investor Conferences

a) M&A

GoodRx announced its intent to acquire VitaCare Prescription Services from TherapeuticsMD for $150 million in cash plus another $7 million in incentive-based considerations. VitaCare offers a technology platform to streamline access to branded medications while past GoodRx purchases like HealthiNation focused more so on awareness. Somewhat similarly to GoodRx’s price comparison tool for generics, VitaCare helps patients uncover savings opportunities while offering a direct means of communication between physician and patient. It also comes with a large network of 3rd party pharmacies to fill these prescriptions.

The selling parent company — TherapeuticsMD — is predominately a pharmaceutical manufacturer and mainly used VitaCare internally for its own products. This means there’s ample low hanging opportunity to sell the solution to the rest of GoodRx’s clients and the industry.

“You can think about this as extending what we do more to direct patient care. Essentially, a doctor will write a script to VitaCare and they coordinate between health plans, pharmacies, patients and doctors to get the patient on therapy regardless of insurance.” — SVP of Corporate Strategy Justin Fengler

Manufacturers also benefit from the following:

VitaCare conducts benefits investigations to uncover and promote savings offerings.

VitaCare manages all time-consuming prior authorizations (which most prescriptions have at this point).

Just 50% of branded prescriptions written every year are filled and just 3% of Americans know about available branded savings plans. Of the scripts that do get filled, roughly 30% come with significant, administrative-based delays. There’s much to solve here.

VitaCare CEO John Milligan will stay on with the combined GoodRx team. The closing of the deal will contribute less than 1% of GoodRx’s total 2022 sales and will reduce its adjusted EBITDA margin by 2% this year. This implies around $18 million in annual revenue and a loss of roughly $35 million for the purchased entity. GoodRx expects growth for the offering to be similar to the rapid growth it enjoys within the rest of its pharmaceutical manufacturers business with margins for the product “at or better than the rest of the business as a whole” in the long haul.

Per TherapeuticsMD’s most recent quarterly report, VitaCare has 3 existing contracts in place with 30 more in the pipeline.

“The early success with selling this into our existing customer base has been very strong relative to our internal expectations.” — SVP of Corporate Strategy Justin Fengler

b) Investor Conferences

On a bad quarter and how GoodRx knows the money it’s spending on marketing is money well spent:

“We continue to see marketing payback consistent with what we’ve seen in the past. It’s consistently below 8 months for all cohorts. Our Consumer Acquisition Cost (CAC) has remained very consistent as we don’t do a lot of marketing on social where prices have inflected.” — CFO Karsten Voermann

Voermann spoke at length about GoodRx’s 80%+ recurring transaction rate leading to an adverse impact over the last 2 years as there have been smaller script start cohorts since March 2020. This has led to smaller recurring contributions over the last several quarters and has been far more sustainable of a headwind than management told us it would be. Script volumes have largely recovered but GoodRx’s business hasn’t for this precise reason. Click here to learn more about this phenomena.

There is no longer any undiagnosed backlog unwind tailwind assumed in the company’s forward guide — so if the unwind does occur there should be upside to demand. GoodRx managed to nearly meet the low point of its 2021 revenue guide thanks to strength from its non-core segments.

“I think these backlog unwinding benefits could still materialize. We are ready for when this [unwind] happens but we are not assuming it will in our guide.” — CFO Karsten Voermann

On competition:

“We continue to see ourselves as by far the market share leader. We continue to grow that market share lead and grow the market overall. There has been noise around Amazon and Mark Cuban and Optum but we see no traction with any of those… our pricing is by far the best. We are the place to go and see no material change from competition.” — SVP of Corporate Strategy Justin Fengler

GoodRx’s savings rate leads vs. others continue to rise.

On nearly doubling the subscription price:

“We tested very heavily to gauge the price elasticity of demand of our subscribers. What we found is that the pricing is highly inelastic due to the savings consumers get relative to what they’re paying. $5.99 per month for thousands of dollars in annual savings is pretty low.” — CFO Karsten Voermann

“We rolled out the price hike to new users already and it hasn’t attenuated our gross subscriber adds which gave us confidence. We’ve seen little churn from the existing cohorts we’ve tested on thus far… we’ve assumed heavier churn in our guidance than our testing currently supports.”

GoodRx could see users simply move from subscriber to free user — but it’s not counting on that in its forward guidance. If that happens, the company could get a “lift.”

On the pharmaceutical manufacturers momentum:

GoodRx’s guide for 70% growth vs. tripling YoY is a factor of the base getting much larger and also aggressive spend from partners last quarter (revenue 4Xed in Q4 2021 YoY). GoodRx is not sure how much of the spend was due to structural changes in pharmaceutical marketing vs. how much is just temporary. The company is taking an extremely conservative approach to guidance in this segment as well.

Solutions per manufacturer roughly doubled year over year.

On GoodRx for Providers vs. other pharmaceutical manufacturers competition like Medscape and Doximity:

“The unique thing about us is that we provide a combination of providers and consumers allowing us to be an unparalleled digital healthcare platform and coordinate activity.” — SVP of Corporate Strategy Justin Fengler

GoodRx for providers has already generated two new pharmaceutical manufacturer contracts. This product should be a larger revenue contributor starting in 2023 after GoodRx can take advantage of a full 2022 selling season.

“This product will quickly put us on a path to becoming one of the largest provider platforms in the country.” — CFO Karsten Voermann

On the 40% long term EBITDA margin target (it was there already in the past):

“We’ve now largely built out our technology and product teams. You saw us hiring very aggressively from 2020 to 2021 and will pick up a significant amount of new expense from that in 2022… leverage in cost lines and mix shift to pharma manufacturers is how to get to the 40% range in the years to come.” — CFO Karsten Voermann

The tone of this call was one of encouraging caution. GoodRx is assuming no acceleration, no improvement and no upside in its 2022 guide — this past quarter appeared to be the kitchen sink and I’m somewhat optimistic forecasts will improve going forward. I could always be wrong. They were overly optimistic in modeling 2021 and I am hoping they learned their lesson and are being overly pessimistic for this year.

6. Teladoc Health (TDOC) — CEO Jason Gorevic and CFO Mala Murthy Interview with Cowen

On Amazon Offering Teladoc through Alexa:

“I think the Amazon relationship demonstrates our ability to partner with the overall ecosystem in a way that very few can, based on integration, scale and delivery. Teladoc is the default provider in the event that someone asks Alexa to talk to a doctor. We take care of checking eligibility and what is appropriate to charge them. This is really a distribution partnership.” — CEO Jason Gorevic

“I won’t comment on Amazon’s internal decision making. What I will say is that when they approached us, it was clear they needed someone who could deliver at scale across geographies in a way that meets Amazon’s user experience expectations.” — CEO Jason Gorevic

Teladoc does not have to share revenue with Amazon within this Alexa arrangement.

On Better Help’s outperformance (the business to consumer mental health product):

“We should not underestimate the amount of innovation we are driving here. For example, we recently launched a group therapy service which boosts provider utilization and efficiency which is all part of the segment’s superior execution. If you think about CAC, we are managing it very well unlike others in the marketplace.” — CFO Mala Murthy

“We are seeing no pressure on the wage side for behavioral health. I think it’s because we have so much demand on the consumer side that it really is the preferred place for a therapist to come to deliver care and grow their panel. I spent time with the Better Help team yesterday and we don’t see an end in sight to these trends. All past programs have been coach-oriented but stopped at the point of treatment. Going further enables us to have a bigger impact on outcomes and to reduce cost of care. We’ve made it an integrated part of the whole-person care strategy. ” — CEO Jason Gorevic

On Chronic Care:

“The pipeline for chronic care services is very strong. Last year’s pipeline was larger than 2 years ago but it was really early stage. This year, the pipeline is again larger but twice as much is later-stage deals.” — CEO Jason Gorevic

‘This product is us delivering on the proof points we talked about when we merged with Livongo. It’s about the full continuum of capabilities. We are the only ones who do this thanks to scaled data that connects all of it.’ — CFO Mala Murthy

7. Meta Platforms (FB) — CFO David Wehner Interviews with Morgan Stanley

On 2022:

“We’ve got a set of near-term headwinds, but at the same time we think we’ve got great long term opportunities…

“In the U.S. it looks like we have reverted back to the pre-pandemic trend line in terms of e-commerce gradually increasing as a percentage of total retail. It was this softness that was really notable as we went through the end of Q4… as we start to see the pandemic period normalize, we’ll get back to the secular trend of e-commerce growth.”

Wehner also reminded us that Meta laps Apple’s app tracking change and the headwind that has been for the ad business after Q2 of this year.

“Historically, we’ve done a great job of optimizing our advertising tools to leverage 3rd party data. We’re clearly best in class at that so we were more impacted by Apple’s changes. We weren’t moving slower or failing at getting advertisers to adopt solutions. In fact, we were out in front of these changes before our peers.”

Finally, we were reminded about the content shift to Reels weighing on ad monetization. Facebook takes a slow, calculated approach to ramping up ad load for new content forms as it prioritizes experience over revenue early on — so this headwind will eventually fade. This is mainly why impressions fell 6% YoY last quarter. Facebook is following the same playbook as its web-to-mobile and feed-to-stories content transitions in the past that both turned out to be overwhelmingly successful.

More on Apple’s changes and Facebook’s evolution as a result:

“Our ability to use off-site conversion data at the user level was impacted by Apple and we’ve had to pivot as a result to helping businesses measure their campaigns with aggregated events management (AEM) data tools. We expect to continue to make measurement progress over time through improvements here. And on targeting, anything that impacts measurement will impact targeting as well.”

“We’re moving to get the conversion to happen on-site for our e-commerce clients through click-to-messaging ad formats and also Shops.”

Wehner told us that some of the $10 billion impact from Apple’s changes were incurred in 2021 and that the cost for 2022 will be lower. Most assumed they meant a $10 billion charge in 2022 when they mentioned it in the last earnings call so this is a positive.

On Russia blocking Facebook:

This accounted for 1.5% of Facebook’s 2021 advertising revenue. Facebook is also experiencing related “softness” in Europe due to this as well with advertisers (not users).

On Reels:

62% of U.S. MAUs are engaging with Reels so far in 2022 vs. 53% earlier in 2021.

“We believe short-form video provides a big opportunity for incremental time-spent growth… we are not pulling time away from our other services but adding to overall engagement… Reels is growing faster than Stories was at a comparable time in 2018.”

“While Reels is now a headwind for impression and revenue growth, longer term we think it’s going to be a tailwind.”

8. JFrog (FROG) — CFO Jacob Shulman Interviews with Morgan Stanley

On the 30%+ medium term revenue growth target:

Shulman attributed this bold goal to JFrog’s full platform only being used by 5% of its customers today. The 5% already represents 35% of JFrog’s sales meaning more conversion (which is fully expected) should strongly bolster demand growth even within its existing customer cohort. It also plans to expand upon the 30% of the Global 2000 it currently serves to grew via new logo wins. Nothing crazy here.

“When a customer partners with JFrog, they typically more than double spend over the first 3 years as a result of subscription upgrades and adopting more capabilities… it’s rare that we see customers start on the full platform… It’s a typical journey that the customer will grow into the platform over time.”

Fortune 500 customer growth accelerated from 26% in 2020 to 38% in 2021 thanks to JFrog’s new enterprise sales team finding success. It continues to be a beneficiary of the end of the pandemic as its enterprise selling activity normalizes and infrastructure spend rebounds.

JFrog did raise its pricing during 2021, but that was a “very small” contributor to revenue growth in 2021.

On security and acquiring Vdoo:

“Xray was developed to help automate, but it was not an end-to-end software security solution. It focused on composition analysis to break a software bill of materials down into parts to see if these parts were vulnerable by comparing them to the known vulnerability database. Vdoo (acquired last year) is truly a binary security company… The majority of DecSecOps focus is on source code today. But the hacker will attack binaries as they are the component facing the external world. Nobody attacks source code… therefore securing binaries is vital and Vdoo is the company focused here. It’s completely changed our approach.”

“Since the acquisition, JFrog has discovered twice as many 0 day vulnerabilities (new vulnerabilities) as the rest of the industry… This is the holy grail of security.”

On Profit:

Shulman was asked about balancing growth and profitability in this hawkish macroeconomic environment. He reminded us that JFrog has been profitable for years and that the company would continue to operate near break-even this year to focus more heavily on growing.

9. CrowdStrike (CRWD) — Humio Milestone & Ping Identity

CrowdStrike reported great earnings this week and my review of the report can be found here.

In 2019, Humio was the first log management company to reach a data clearing capacity of 100 terabytes per day. This month, it reached 1 petabyte of data ingestion per day with sub-second latency — and at infrastructure costs of 20% and operating costs of 25% of traditional management vendors. Humio also offers fixed licensing fees that don’t penalizing overconsumption.

Interestingly, the 10X-ing of ingestion capabilities coincided with just a 2.7X rise in processing node requirements, showcasing the growing scalability of the platform and feeding what CrowdStrike calls “Humio’s industry-leading total cost of ownership.” George Kurtz was right, Humio appears to be a shining star.

Ping Identity also announced a new infrastructure defense project for hospitals and utilities alongside CrowdStrike and CloudFlare (who CrowdStrike just named as a new customer).

10. The Trade Desk (TTD) — Netflix and Disney

In an interview this week, Netflix CFO Spencer Neumann said “it’s not like we have a religion against advertising” and hinted at potentially considering advertising in the future. Considering The Trade Desk serves agencies and advertisers trying to connect marketing spend to the most lucrative ad impressions, the amount of those impressions sky-rocketing (like this would lead to) would be a nice tailwind for the company’s connected TV (CTV) business. Disney+ also announced earlier in the month that it would launch an ad-supported version of the streaming service in 2022. Jeff Green has long predicted that advertising video on demand (AVoD) would overtake subscription video on demand (SVoD) and these are more hints at that process rapidly playing out.

As an added bonus, the larger CTV gets as a percentage of overall company revenue, the less Google and Apple tracking drama can impact The Trade Desk — CTV as a segment is not impacted by these moves. The Trade Desk is already more immune to these changes than any other open internet player thanks to vast scale and channel diversification, but this would surely help even more.

11. My Activity (Portfolio Change)

I exited Ark’s Genomics ETF yesterday. This was a small position, so raised my cash position only from 8.3% to 9.5%. I have great respect for Cathie Wood and the research her and her team consistently put out. They’re immensely bright people and genomics remains an industry with fantastic upside. At the same time, when I look across my portfolio, I have higher conviction in the potential long term alpha of my other holdings. I also don’t like the idea of holding an ETF containing predominately cash burners in this tightening and hectic macro environment, and I don’t like how Ark’s ETF structure forces them to make transactions every single day.

As another note, I am getting close to exiting CuriosityStream, Nanox and also Tattooed Chef. If the upcoming quarters don’t show real signs of improvement — I will sell.

Tattooed Chef’s recently re-stated 2021 financials adding $4 million in new, stock-based comp-related net loss does not inspire confidence. It’s far from the firm’s first accounting misstep and I’m running out of patience.

I added to the following positions during the week:

CrowdStrike

GoodRx

PayPal

Teladoc Health (position now full)

SoFi Technologies

Upstart

I will continue to focus my adding solely on fundamentally thriving holdings. While the last several months have been brutal, if the last century+ is any indication, the companies showing clear signs of brisk and sustainable cash flow and revenue compounding will eventually be rewarded. Until then, I will keep slowly accumulating more shares of healthy firms at attractive prices enduring incremental multiple compression. For now, the forward return potential for companies that can continue to execute through all of this noise is simply building.

Really excellent write up and summary of the key drivers. Thanks a ton for putting it together.

Hi Brad, What do you consider a full position?