Welcome to the hundreds of new subscribers who have joined us this week. We’re delighted to have you and determined to provide as much value as possible.

1. Airbnb (ABNB) -- Rooms

Airbnb announced a slew of new features including enhanced pricing transparency as it gears up for a busy summer. The highlight of this release is a new product called “Airbnb Rooms.” Rooms can be rented on an individual basis to cut costs for guests vs. needing to rent out an entire home. This emulates a hotel experience in a way that is “more affordable” per Co-Founder/CEO Brian Chesky.

This is a bit more intimate of a booking style, so Airbnb also debuted more detailed host descriptions to allow guests to better match with compatible individuals. The program will start with 1+ million rooms with 80% of them costing less than $100 per day. While Airbnb was once known as the low-cost travel provider, that has stopped being the case in recent years. This is its way to recapture that label and re-appeal to its original niche. Finally, it will add a buy now, pay later (BNPL) feature via a Klarna partnership to create more payment flexibility.

Not only will this lower the bar for guest bookings, but it makes regulatory compliance a bit easier as well. Why? In places like New York City, regulators are pushing to require hosts to be on premise while they rent out space to guests. By letting them rent out a spare bedroom rather than an entire apartment, being there becomes a lot easier.

Mostly metrics is a weekly business newsletter for anyone who cares about company performance. It's written by a tech CFO, CJ Gustafson, and read by +25,000 of your favorite Finance Gurus, Startup Operators and VCs. Subscribe here to get smarter on business metrics, financial operations, and monetization models today. It’s one of the few newsletters that I consistently read.

2. SoFi Technologies (SOFI) -- Capital Markets and Insider Buying

a) Capital Market Liquidity

SoFi reported stellar earnings and subsequently sold off sharply. This led some to concoct reasons to explain that move. The most common reason was concern around its access to capital market funding to sell loans as it didn’t conduct any whole loan sales during the quarter. To us, the SoFi move was related to regional banking concern and turmoil; the price decline was noise considering how strong the numbers were.

Here’s why we don’t see the capital market liquidity risk as valid:

SoFi’s balance sheet building has been telegraphed by leadership since it went public. The decision to get a charter was to create more balance sheet flexibility and a more profitable loan book through lower cost of capital. It can now store loans on its balance sheet to collect net interest income and maximize return on equity (ROE). That’s its goal. Always has been. Always will be.

Some don’t believe the argument that storing loans is to maximize ROE. They think it’s because the loans can’t be sold until being severely marked down. Two rebuttals here. First, SoFi doesn’t mark-to-market these loans itself. It has a 3rd party firm do it every three months with the valuation changes flowing through its income statement. This eliminates conflict of interest and the risk of pent-up unrealized losses surprising investors. Furthermore, it has quite literally gone out and REPURCHASED its previously sold pools back from capital markets. This is because it has excess liquidity needing to earn a yield and sees its loans as the best was to do so. And yes, it continues to enjoy excess liquidity and capital ratios well above regulatory minimums. This is not what a company struggling with liquidity and credit risk looks like.

The rapid growth in loans held is not coinciding with relatively enhanced credit risk. SoFi’s borrowers have an average FICO over 750 and an average income well over $150,000. Its demographic is very affluent and capital market appetite for that kind of credit has held up far better than for more subprime niches. For explicit evidence, it sold nearly $500 million in loans through ABS markets in Q1. The deal was 8x oversubscribed with spreads improving materially vs. its last comparable issuance. While regional banking turmoil has popped up since that deal, the stress is centralized in sub-prime credit and cash burning startups… not middle to upper class individuals. And again, SoFi has excess liquidity with healthy capital ratios, a tiny securities portfolio and significant funding source flexibility.

Finally, management on the call explicitly told us they could sell loans through whole markets easily and expeditiously if they wanted to. They simply see harvesting more net interest income as more attractive. Their words have been consistently accurate and honest since going public.

b) Insider Buying

Anthony Noto doesn’t seem concerned about capital market access. He bought another $250,000 in shares this week. He has purchased over $10 million in stock in the last year for 10% of his total net worth and a larger chunk of liquid net worth. This was in addition to his existing stake.

3. Meta Platforms (META) -- FTC

The Federal Trade Commission accused Meta of violating previous privacy rulings. It wants to ban the company from monetizing teen data and to block it from releasing products not blessed by the FTC. This ain’t happening. Every few years, an intimidating headline like this drops and turns out to be far more bark than bite.

Meta responded by calling this a baseless political stunt. It pointed out the irony in the FTC wanting to more tightly regulate this company vs. Chinese Government-affiliated TikTok. The social media giant doesn’t see the FTC as having anywhere near the authority or rationale to implement the rules and will take all of these claims to court. Zuck must have not invited Lina Khan (FTC Chair) to his last barbecue.

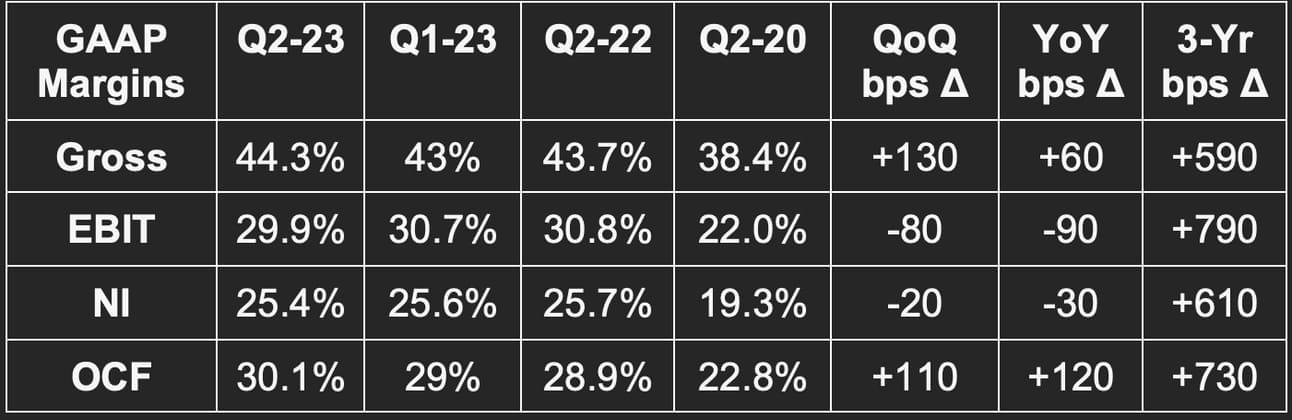

4. Apple (AAPL) -- FY Q2 2023 Earnings Review

a. Results

- Beat revenue estimates by 2.2%.

- Beat EBIT estimates by 4%.

- Beat $1.43 EPS estimates by $0.10; Beat OCF estimates by 16%.

- Beat gross margin (GPM) estimates by 20 bps.

b. Balance Sheet

- New $90 billion buyback announced.

- $39B in buybacks YTD vs. $43B YoY; $7.4B in dividends YTD vs. 7.3B YoY.

- Inventory rose 51% YoY; $110B in debt ($10.6B is current).

- $55B in current cash & equivalents; Another $110B in marketable securities.

c. Guidance

- Apple guided to YoY revenue growth similar to this quarter. That implies 3% constant currency growth and -1% growth overall given an expected 400 basis point (bps) foreign exchange (FX) headwind. This slightly beat estimates of -1.7% YoY growth.

- Gross margin guidance of 44.3% met estimates.

- EBIT guidance roughly met expectations (slightly ahead).

d. Call & Release Highlights

Demand Context:

- 17.6% 3-yr revenue CAGR vs. 8.5% last quarter & 12.1% 2 quarters ago. This quarter enjoyed uniquely easy 3 year pandemic comps.

- 975 million paid subscribers across all of its services vs. 825 million YoY for 18.1% growth.

- FX was a 500 bps revenue growth headwind.

- It opened its first 2 stores in India during the quarter.

- Apple’s install base continued to grow beyond the 2 billion benchmark it reached in January.

- Macro is weighing on mobile gaming and advertising services. The rest of its services continue to perform well.

- Services revenue set all-time highs in all geographies besides North America.

Margin Context:

- Intentional cost savings drove the GPM improvement and its operating expenses coming in at the low end of its guidance. This helped margins while less demand hurt margins.

- Product GPM was 36.7% vs. 37% QoQ and 36.4% YoY.

- Services GPM was 71% vs. 70.8% QoQ and 72.6% YoY.

Mac & iPad, and Apple Watch:

- Most of Apple’s hardware segments are being held back by poor macro conditions per the company.

- Mac and iPad growth were both greatly pressured by tough macro conditions. Furthermore, growth was hit by the YoY period comping vs. a Q2 2022 period when the M1 chip very successfully debuted.

- Mac fell 31% YoY and iPad fell 13% YoY -- both in line with internal expectations.

- 2 out of 3 Apple Watch purchases came from new customers this quarter.

iPhone:

iPhone revenue fared a bit better with slow YoY growth. Interestingly, emerging market strength carried the success here as demand was a bit softer in North America. This isn’t surprising considering North American carriers have cited weak upgrade cycles during the quarter. Apple believes it took more smartphone share in China during the quarter along with other key emerging and international markets. The new iPhone has a 99% customer satisfaction rate per 451 Research.

Apple Card & BNPL:

Apple got a few questions on its newer financial services push. It declined to offer detail on the segment’s trajectory, but told investors the high yield savings account was off to a great start. Forbes already told us that Apple racked up $1 billion in deposits in just 4 days, so this was not surprising.

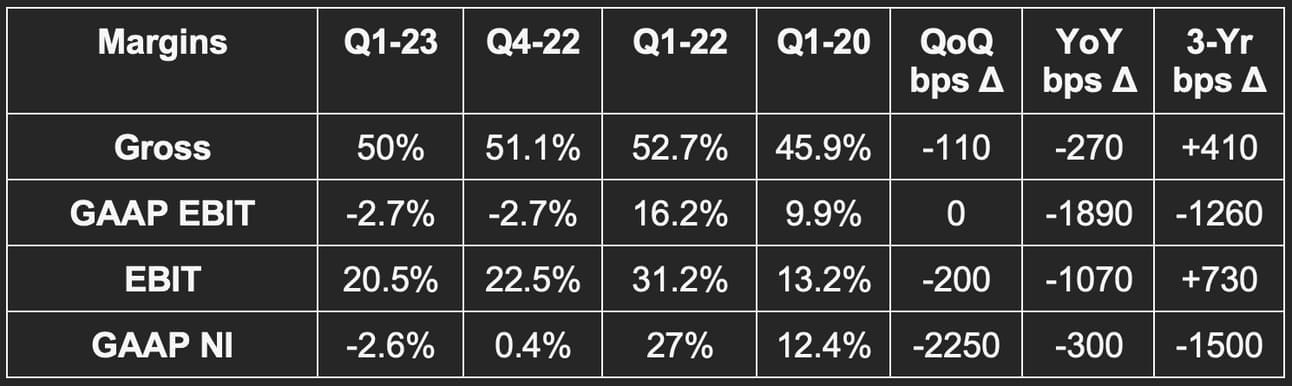

5. AMD (AMD) -- Q1 2023 Earnings Review

a. Results

- Roughly met revenue estimates & beat its guide by 1%.

- Met GPM estimates & met GPM guide.

- Beat EBIT estimates by 4.3% & beat EBIT guide by 4.6%.

- Missed $0.03 GAAP EPS estimates by $0.12.

b. Balance Sheet

- $5.9B in cash & equivalents; $2.5B in debt.

- Bought back $241 million in stock with $6.3 billion remaining on its current program.

- Inventory rose 12.5% QoQ and 74% YoY.

c. Guidance

- Missed Q1 2023 revenue estimates by 3.8%.

- Missed Q1 2023 EBIT estimates by 9.5%.

- Missed GPM estimates by 40 bps.

- Reiterated vague 2023 guidance. Nothing concrete was offered for the full year.

d. Call & Release Highlights

Demand Context:

- 44% 3-yr CAGR vs. 38% last quarter and 45.7% 2 quarters ago.

- Data center revenue was $1.30 billion vs. $1.66 billion QoQ and $1.29 billion YoY.

- Gaming revenue was $1.76 billion vs. $1.64 billion QoQ and $1.88 billion YoY.

- Embedded revenue was $1.56 billion vs. $1.4 billion QoQ and $595 million YoY.

- Client revenue fell from $2.12 billion to $740 million YoY. The Client segment shipped “well below consumption to work through inventory.” AMD thinks Q1 was the bottom for the segment’s demand.

- Signed a new multi-year Samsung contract for its graphics suite.

Margin Context:

- Xilinx is weighing down GAAP margins; GAAP NI margin was 12.8% ex-amortization charges.

- Data center EBIT margin was 11.4% vs. 26.8% QoQ & 33.0% YoY.

- Gaming EBIT margin was 17.8% vs. 16.2% QoQ & 19.1% YoY.

- 6.1% FCF margin vs. 7.9% QoQ and 15.7% YoY.

Macro:

“In the near term, we continue to see a mixed demand environment based on the uncertainties in the macro environment. Based on customer demand signals, we expect second quarter revenue will be flattish sequentially with growth in our client and data center segments, offset by modest declines in our Gaming and Embedded segments. We remain confident in our ability to grow in the second half of the year.” -- CEO Lisa Su

- Enterprise sales are “falling due to end customer demand softening with near term macro uncertainty” per Su.

- It expects server demand to stay mixed in Q2 and grow in Q3-Q4.

Program Highlights:

- Azure, Google Cloud and Oracle all expanded AMD deployments for their infrastructure.

- Closed multiple new Fortune 500 contracts during the quarter.

- Its new Pensando Data Center chip is delivering 10x more connections per second vs. the old model for Azure.

- Expects PC chip revenue to ramp throughout the year.

AI:

- Customer interest is “increasing significantly” in AMD’s training and inference AI chips.

- Its newer MI300 silicon chip for AI will launch this year.

- Combined all AI teams into one unit during the quarter (just like Google did).

- AMD is seen as a challenger in this space with Nvidia the tech and share leader at this time.

“We are in the very early stages of the AI computing era, and the rate of adoption and growth is faster than any other technology in recent history.” -- CEO Lisa Su

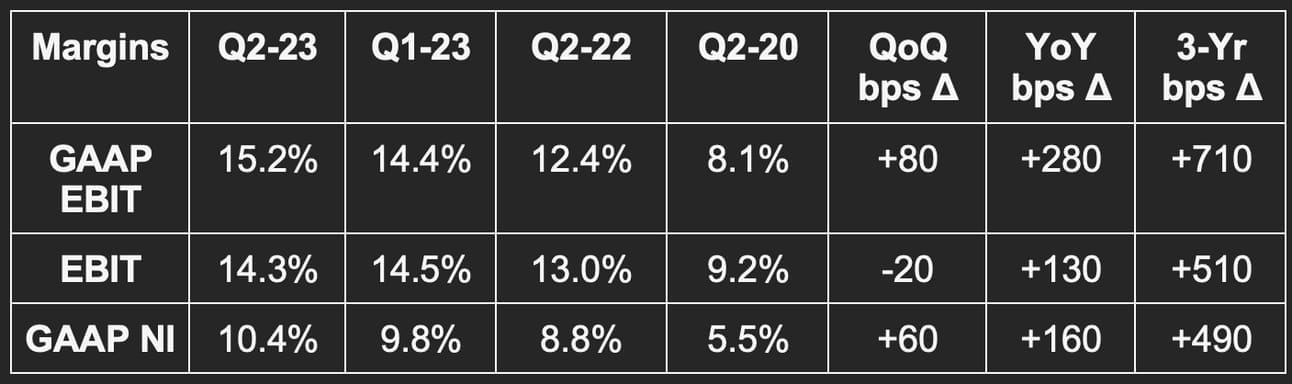

6. Starbucks (SBUX) -- FY Q2 2023 Earnings

a. Results

- Beat revenue estimate by 3.4%.

- Beat EBIT estimate by 12.1%.

- Beat $0.65 GAAP EPS estimate by $0.10.

b. Guidance

Starbucks reiterated its guidance of 11% revenue growth and 17.5% EPS growth -- both at the midpoint. This compares to estimates of 12.1% revenue growth and 16% EPS growth.

“We expect Q2 demand to continue as we push the envelope with innovation.” -- CEO Laxman Narasimhan

c. Balance Sheet

- $3.4 billion in cash & equivalents.

- $13.5 billion in total debt.

- Repurchased $480 million year to date (YTD) vs. $4 billion YTD YoY.

- Dividends YTD are up 6.8%.

d. Call & Release Highlights

Demand Context:

- 13.2% 3-yr revenue CAGR vs. 7.1% last Q & 7.6% 2 Qs ago (easy pandemic comps).

- Global comp sales rose 11% YoY vs. 5% last Q.

- Revenue growth was impacted by a 200 bps FX headwind.

- Its egg bites and other foods saw record revenue during the quarter.

- Mobile Order + drive-thru + delivery = 74% of U.S. company owned revenue.

- Mobile orders = 47% of sales vs. 43% YoY.

- Rewards members = 57% of U.S. company owned revenue vs. 54% YoY.

- Starbucks took more ready-to-drink category share to grow its leading position for a 2nd straight quarter.

- International revenue rose 9% (19% FX neutral (FXN)) while North American revenue rose 17% YoY.

Priorities for new CEO Laxman Narasimhan:

- Will try to morph store deliveries from a “one size fits all model with frequent out of stocks” to a lower cost, higher quality process over time.

- Will streamline vendor purchasing to do things like condense its 1,500 cup and lid combos in the network.

- He spoke on going “back to basics” for the company to streamline operations and become more efficient in several areas. This sounded a lot like Chipotle’s current initiatives.

- New beverages like Oleato (olive oil infused coffee) is a top 5 product launch for Starbucks in the last 5 years.

- To Narasimhan, evidence of his plan working can be seen in things like company margins and improved barista turnover. Its margins expanded materially YoY while barista turnover fell 9% YoY.

China:

Starbucks outperformance was attributed largely to China recovering “faster than expected.” This was Starbucks’ first positive comp sales quarter in that country since 2021. Comp sales growth was 3% there for the quarter and accelerated to 30% YoY in March. It reiterated 2023 China store opening plans and sees its decision to keep opening stores there during COVID as finally paying off.

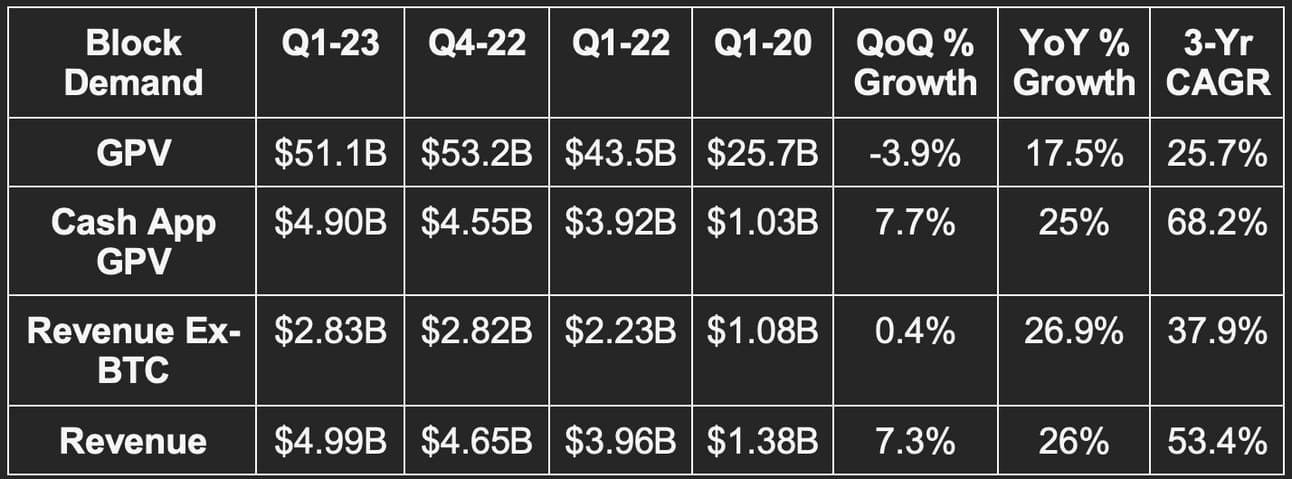

7. Block (SQ) -- Earnings Review

a. Results

- Beat revenue estimates by 8.5%.

- Beat EBITDA estimates by 38.8%.

- Crushed -$124.5 million GAAP EBIT estimate by $118 million.

- Beat $0.34 EPS estimates by $0.06.

- Beat $0.18 GAAP EPS estimates by $0.15.

b. Balance Sheet

- $6.1 billion in cash & equivalents and $7.6 billion in total liquidity.

- $4.6 billion in debt with $600 million in revolver capacity.

- Stock comp was 7% of sales vs. 6% of 2022 revenue and 7% of revenue in the YoY quarter.

- Share count grew 11% YoY. This is being impacted by Afterpay M&A which closed in Q1 2022.

c. Guidance

Block raised its EBITDA guide by 4.6% which beat estimates by 1.5%. It also improved its adjusted operating loss guide from $150 million to $115 million. This non-GAAP metric is not comparable to consensus EBIT estimates.

It also told us that gross profit growth slowed from 32% YoY to 24% YoY as of April and that OpEx will grow by 12.7% QoQ next quarter.

d. Letter Highlights

Demand Context:

Block reported 53 million transacting monthly actives vs. 51 million QoQ and 46 million YoY. Unless this is a fraudulent metric (which we do not believe is the case), this further contradicts the arguments presented by the recent short report on Block.

- Block enjoyed 34% YoY growth in cash app card actives to reach 20 million. Average spend for these users continues to rise. Cash app monthly actives now equate to 38% of total actives vs. 33% YoY.

- Inflows per transaction active rose 8% QoQ. 27% YoY inflow growth was its fastest rate in over a year.

- 2 million direct deposit actives with paycheck deposit volume -- up 69% YoY.

- Its savings account has 3 million actives just 3 months into launch.

- 38% of Squares sellers are mid-market or larger vs. 35% YoY.

- Transaction revenue rose 15% YoY; subscription and services revenue rose 42% YoY.

- Cash app revenue rose 33% YoY and 52% YoY when excluding Bitcoin.

Margin and Profit Context:

Gross profit is the key focus for Block. Cash app gross profit rose 49% YoY, Square gross profit was 16% YoY and overall gross profit rose 32% YoY. Ex-paycheck protection program profits, Square gross profit growth would have been 26% YoY.

- 16% of Square gross profit is now from international sellers vs. 13% YoY. International gross profit for Square rose 43% YoY as it launched products in Japan and extended global traction.

- A shift from debit funded to credit funded transactions is hurting transaction margins like it has for every other payments company as we exit the stimulus era.

- OpEx rose 22% YoY partially due to Afterpay. R&D continued to rapidly grow YoY while sales and marketing (S&M) fell slightly and general and administration (G&A) was roughly flat.

Generative AI:

Block talked about investing more heavily in generative AI. It launched suggested actions for Square sellers to guide them through orders and workflows. This follows its launch of suggested product descriptions which are being used with no manual edits 75% of the time.