News of the Week (May 15 - 19)

Sea Limited; Alibaba; The Home Depot; Walmart; More Earnings Highlights; PayPal; Progyny; Meta; Shopify; CrowdStrike; SoFi; Amazon; Uber; Macro Data; Portfolio

Welcome to the hundreds of new subscribers who have joined us this week. We’re delighted to have you and determined to provide as much value as possible.

Today’s Article is Powered by Savvy Trader:

1. Global E-Commerce Earnings

a) Sea Limited (SE) Q1 2023 Earnings

Results

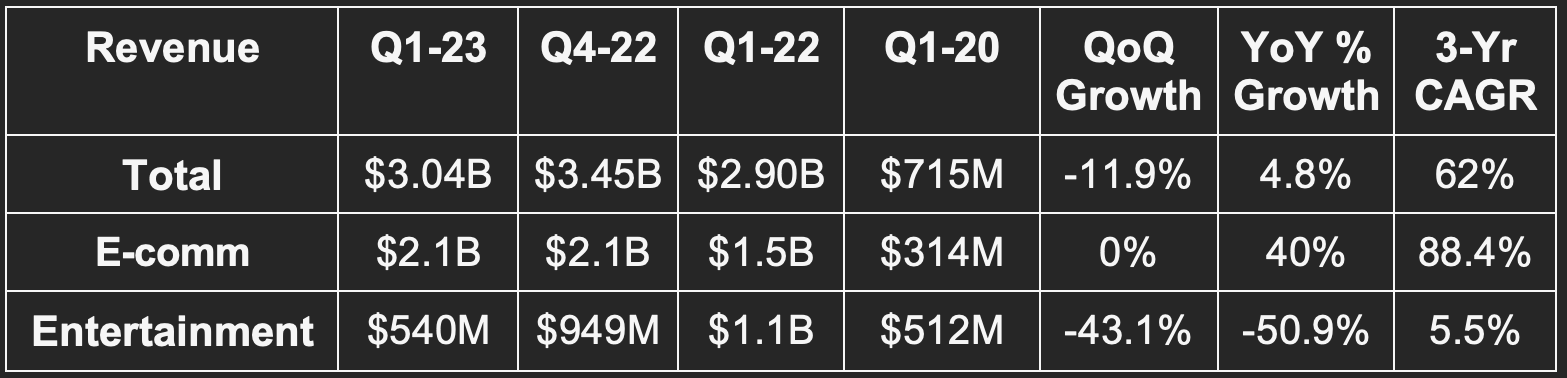

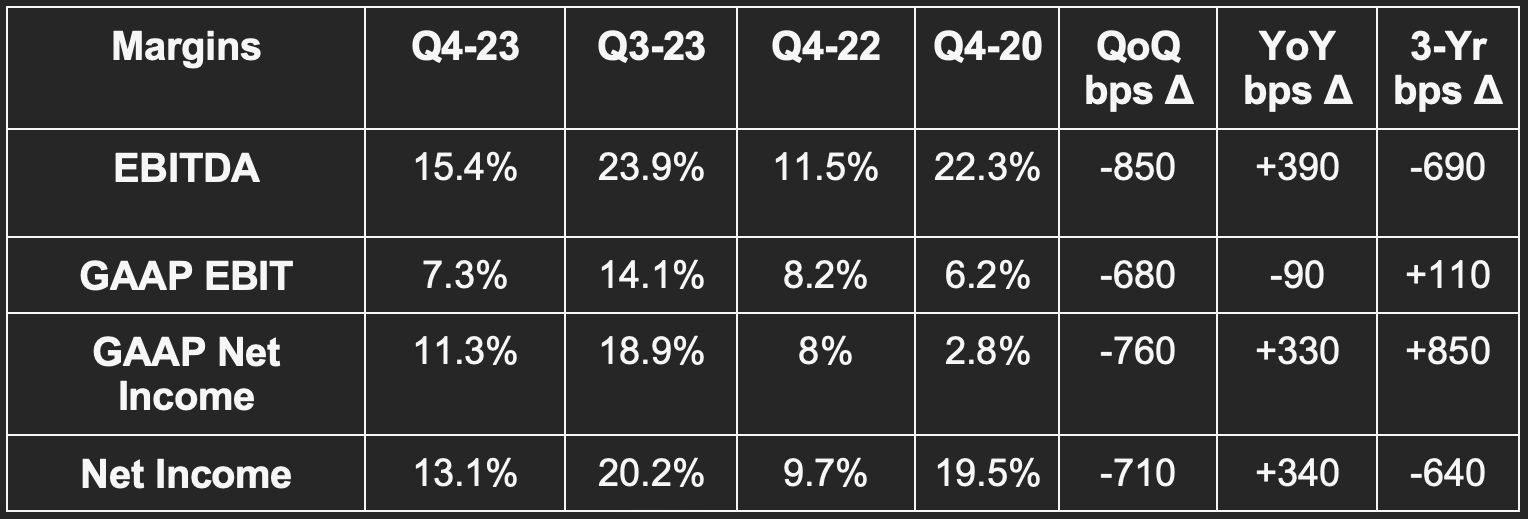

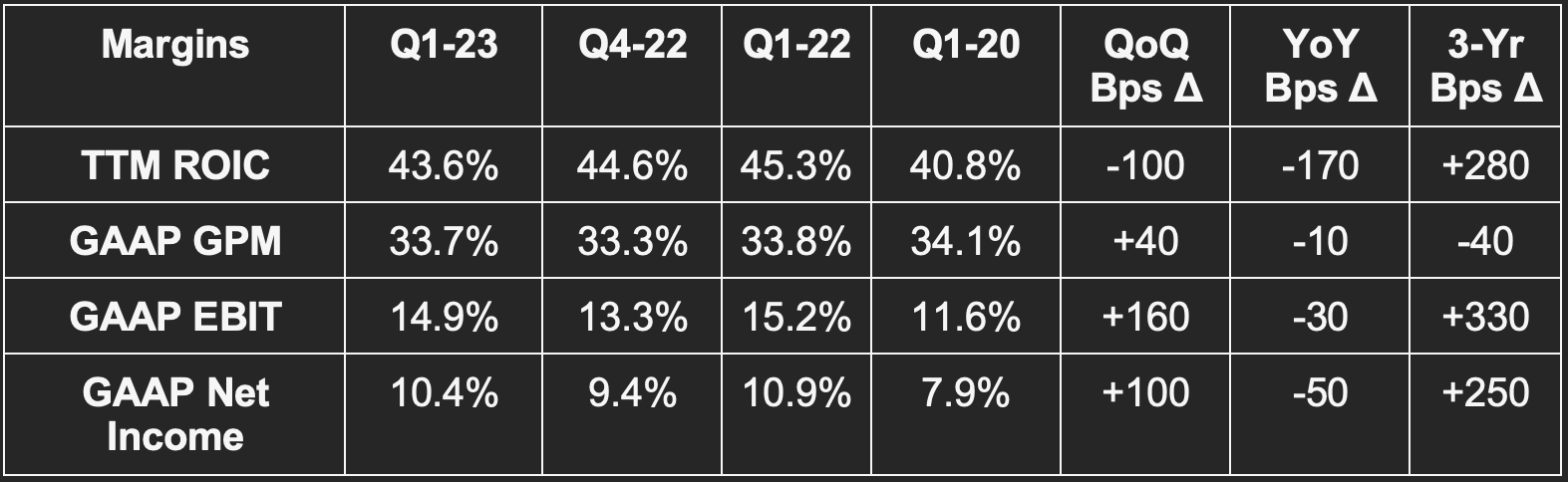

Revenue met estimates.

GAAP gross margin (GPM) missed estimates by 80 basis points (bps).

EBITDA beat estimates by about 30%.

GAAP EBIT missed estimates by about 60%.

Missed $0.41 GAAP EPS estimates by $0.25.

Balance Sheet

$6.1 billion in cash and equivalents with another $1.5 billion in restricted cash. It also has $864 million in short term investments.

$3.33 billion in convertible notes; $100 million in borrowings.

Stock comp was 6.5% of sales vs. 6.2% last quarter and 4.7% of sales Y/Y.

Results context

Sea Limited’s focus has fully shifted from growth to profit. It’s trying to extract maximum value from its existing asset base to juice margins. That’s why it spent $400 million on sales & marketing vs. a little over $1 billion in the Y/Y period. It still grew at a 3-year clip of 62% vs. 73% last quarter, but growth will be muted going forward compared to pandemic periods.

E-Commerce

FX neutral e-commerce revenue rose 42% Y/Y. Revenue growth was driven by transaction fees and advertising.

E-commerce EBITDA margin was 9.9% vs. 9.2% last quarter and -49% Y/Y. The segment is very profitable in Asia and not profitable in newer markets like Brazil.

Contribution loss per order in Brazil improved 77% Y/Y to a loss of $0.34.

It added 50 new hubs in Brazil during the quarter and added new capabilities to service some returns on behalf of 3rd party sellers.

In-house logistics investments led to delivery times falling 12 hours Y/Y on average.

It’s using language learning models (LLMs) to enhance product recommendations which has already begun to raise conversion rates.

The Shoppe affiliate program now has 4 million registered influencers with orders from this program in Indonesia tripling Y/Y.

Entertainment

Digital entertainment EBITDA margin was 42.6% vs. 27.2% last quarter and 39.2% Y/Y.

491.6 million quarterly active users vs. 485.5 million Q/Q and 615.9 million Y/Y.

37.6 million paying users for a 7.7% payer to total ratio vs. 9% Q/Q and 10% Y/Y.

Its hit game Free Fire is seeing “positive user trends and a new MAU peak over the last 8 months.” This positive trend continued into April.

Its Arena of Valor game set new engagement records this quarter a full 6 years after launch.

“Our new game pipeline remains healthy and we will be launching new titles in the coming months.” -- Founder/CEO Forrest Li

Financial Services

Digital financial service revenue rose 75% Y/Y and 8.6% Q/Q to reach $412.8 million.

$2 billion in loan receivables is flat Q/Q. Credit loss allowance rose from $237 million to $281 million Q/Q. Non-performing loans over 90 days rate was flat Q/Q at 2%.

Focused on adding new products like insurance to round out the utility of its digital wallet.

Using AI models here to curb fraud rates.

b) Alibaba (BABA) FY Q4 2023 Earnings

Results

Revenue beat estimates by 1.3%.

EBITDA beat estimates by 5.1%.

GAAP EBIT beat estimates by 21.9%.

Beat $1.35 EPS estimates by $0.21: nearly doubled GAAP EPS estimates.

For the full year, revenue rose 2%, net income rose 17% and non-GAAP net income rose 4%. Note that China is now exiting its latest pandemic lockdowns and Alibaba has an established brick and mortar presence there.

Balance Sheet

$28 billion in cash and equivalents with another $47.5 billion in short term investments.

$14 billion in senior notes.

$7.5 billion in long term debt; $1.1 billion in current debt.

$1.9B in buybacks during the quarter with $19.4B left on program.

Restructuring

Alibaba is considering and executing several initiatives to reorganize the firm’s structure and unlock shareholder value. It will spin off its cloud group via a special stock dividend in the coming quarters which will function as an independent public company. The board of directors is also exploring an IPO of its logistics group called Cainiao and an IPO of Freshippo (grocery delivery). It formed a new capital management committee to explore more possibilities.

China Commerce

Debuted a new interface for its shopping app Taobao. The aims of this upgrade are to infuse more media content to boost engagement, to become more price competitive and to get better at high frequency everyday deliveries.

Taobao and TMall gross merchandise value (GMV) fell by about 5% Y/Y. That decline improved throughout the quarter and turned positive in March.

Local consumer service order growth was over 20% Y/Y for the quarter.

International Commerce & Logistics

AliExpress (cross-border) enjoyed double digit order growth. It debuted a new product called “Choice” which is really just a program to bolster selection and fulfillment service.

72% of its logistics revenue was from external customers vs. 69% Y/Y.

Named the first Chinese logistics company to partner with the United Nations on its World Food Program.

Cloud

Revenue fell 3% Y/Y and 2% Y/Y ex-intercompany eliminations. The decline was blamed on cloud project delays due to the pandemic, content distribution demand normalization and a large customer churning from the platform.

Alibaba Cloud debuted its latest LLM which it plans to infuse across its entire business. The segment is also cutting pricing by up to 50% for its core products to bolster adoption and is debuting a more price conscious product bundle as well.

2. North American Commerce Earnings

a) The Home Depot (HD) Q1 2023 Earnings

Results

Missed revenue estimates by 2.7%.

Roughly met EBIT estimates and beat EBIT margin estimates by 50 bps.

Beat $3.80 GAAP EPS estimates by $0.02.

Met GAAP GPM estimates.

Balance Sheet

$1.26 billion in cash and equivalents vs. $2.84 billion Y/Y.

$25.4 billion in inventory is roughly flat Y/Y and rose slightly Q/Q.

$40.9 billion in long term debt; $1.3 billion in current debt.

Repurchased $2.9 billion stock vs. $2.3 billion Y/Y.

Quarterly dividend payment rose 8% Y/Y.

Inventory turns fell from 4.4x to 3.9x Y/Y (higher = better here)

Guidance

The company lowered its Y/Y comparable sales and revenue growth guidance from 0% to negative 3.5% for 2023. It also lowered its EBIT margin guidance by 25 bps and now expects EPS to fall 10% Y/Y vs. previously expected a mid-single digit decline.

“We are confident in continued share gains.” -- Press Release

Results Context

“Over the past 3 years, we grew our business by 43%. After this period of unprecedented growth, we expect the demand to moderate in fiscal 2023, which our first quarter results reflect… This is a year of moderation for the sector.” -- CEO Edward Decker

U.S. comp sales fell 4.6% Y/Y. In February they fell 2.8% Y/Y; in March they fell 7.5% Y/Y and in April they fell 3.7% Y/Y.

Overall comp sales fell 4.5% Y/Y.

EPS of $3.82 compares to $4.09 Y/Y.

The company’s external surveys show professional backlogs are elevated vs. historical norms but diminished Y/Y.

Out of Home Depot’s 14 merchandise departments, 4 delivered positive Y/Y comps (building materials; hardware; plumbing; millwork)

Factors Blamed for Soft Results

The company blamed soft results and the guidance reduction on a few factors. Lumber disinflation was the main reason cited. That alone shaved 2.2% off of its comparable sales growth with more commodity disinflation hitting its growth by a bit over 1% incrementally. For context, framing lumber sold for $420 per 1,000 board ft. vs. $1,170 Y/Y. The benefits from an input cost standpoint were less noticeable than the hit to revenue as seen from the Y/Y margin declines.

Extreme weather in California was also partially blamed. The validity of this is evidenced by regions experiencing normal weather seeing more resilience vs. the Western U.S. This relative strength was more concentrated in smaller ticket items with large, discretionary purchases a notable weak spot. Large tickets over $1,000 in size shrank over 6% Y/Y across the book of business. Finally, consumer weakening beyond what Home Depot expected as of last quarter added pressure to its results. This pressure amplified as the quarter progressed.

Wage Investment Update

Home Depot announced a new billion-dollar investment in front line hourly workers last quarter. Early on, the investments are delivering on the firm’s goals. Application growth is healthy and it’s finding a more seamless ability to hire. March 2023 yielded the firm’s lowest employee attrition rate in “some time.” As an aside, this investment is why operating expenses slightly rose Y/Y.

Efficiency Investments

The firm tweaked order fulfillment operating procedures to allocate work more efficiently and to batch fulfillment orders to help employees be more productive. Its “Sidekick” app is helping to direct fulfillment employees to designated assignments to reduce down-time. Shelf availability customer service scores (internal metric) rose 3% as a result.

b) Walmart (WMT) FY Q1 2024 Earnings

Results

Beat revenue estimates by 3.0%. Beat its 4.8% FX neutral growth guide by 290 basis points (bps).

Walmart’s EBIT grew by 17.3% Y/Y vs. analyst estimates calling for 1.6% Y/Y growth. Its EBIT dollars were about 13% ahead of expectations.

Beat $1.32 EPS estimates by $0.15 and beat its guide by $0.19.

Sharply missed $1.32 GAAP EPS estimates by $0.70. This was due to equity investment valuation volatility which makes GAAP EPS a useless metric in many cases (like this one).

Beat 23.8% GAAP gross margin estimates by 50 bps.

Trailing 12 month (TTM) return on assets was 4.5% vs. 5.5% Y/Y. TTM return on invested capital was 12.7% vs. 13.9% Y/Y. Both metrics were hit by “discrete charges” (opioid legal fees). Without this impact, ROA would have been 5.9% and ROIC would have been 14.1%. The company expects return metrics to positively inflect this year.

Balance Sheet

$10.6 billion in cash & equivalents.

Total debt of $49.5 billion.

Bought back $686 million in stock vs. $2.41 billion in the Y/Y quarter.

Dividend payments were flat Y/Y.

Inventory rose slightly Q/Q and fell by 6.9% Y/Y.

“In terms of inventory, we're in good shape. In stock is improving and excess inventory keeps coming down. We see it in the numbers, and I'm seeing it on store and club visits.” -- CEO Doug McMillon

Fiscal Year 2024 Guidance

Expects 3.5% FX neutral revenue growth vs. previous guidance of 2.8% growth.

Expects 4.2% FX neutral EBIT growth vs. previous guidance of 3% FX neutral growth.

Expects $6.15 in adjusted EPS vs. previous guidance of $6.02 and estimates calling for $6.14.

Its Q2 guidance was a bit light on revenue, EBIT and EPS.

Results Context

Sales growth moderated throughout the quarter like for The Home Depot.

eCommerce sales rose 26% overall and 27% in the U.S.

Generated $200 million in free cash vs. -$7.3 billion Y/Y as it gets its inventory position in a much better spot.

Advertising revenue rose 30% Y/Y.

U.S. comparable sales rose 7.4% Y/Y while comparable sales in key international markets like Mexico, India and China rose well in excess of that metric. In China, economic reopening powered over 20% comparable store sales growth.

Macro Mix Shift

Walmart is seeing an aggressive shift from general merchandise to less discretionary grocery purchases as macro worsens. This revenue mix shift was larger in Q1 than the entire calendar 2022 period. That was the reasoning for the gross margin contraction Y/Y. Supply chain and freight costs were actually both gross margin tailwinds to offset this impact.

Interestingly, Walmart took grocery share this quarter overall, but also with more affluent cohorts as consumers became increasingly price conscious. That is advantage-Walmart as the low-price vendor in commerce. Macro weakness is also leading to private brand share gains as a percent of total revenue. This helps margins a bit vs. 3rd party brand sales.

General merchandise prices for consumers fell Y/Y, but Walmart is still struggling with some dry grocery inflation that it is dealing with. This is leading the company to take a more cautious approach to annual guidance as necessary good inflation hits its discretionary revenue growth. Budgets are finite.

“Consumer spending proving resilient… below the surface see signs that customers remain careful with discretionary categories.” -- CFO John Rainey

Sam’s Club

This business enjoyed its largest quarterly membership growth on record. While pricing power was responsible for some of the revenue growth here, unit sales growth was also positive. Plus member penetration as a percent of total membership set a record high. Encouragingly, Sam’s Club is having more success with younger and more affluent cohorts – just like Walmart.

Margin Drivers -- Marketplace and Fulfillment and Ads:

Marketplace seller count in the USA rose 40% Y/Y.

Sellers using Walmart fulfillment services doubled Y/Y.

Connected ads in the U.S. rose 40% Y/Y.

3rd party sellers using ad capabilities doubled Y/Y.

Sam’s Club active advertisers rose 50% Y/Y as advertisers embrace its reporting and measurement precision thanks to Walmart’s budding partnership with The Trade Desk.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Final Earnings Highlights from the Week

a) Brief Applied Materials (AMAT) Earnings Summary

Applied Materials makes hardware to support the semiconductor industry. With semis among the most correlated industries to economic cyclicality, its results and commentary are a decent reflection of general economic health. The somewhat upbeat results were as follows:

Revenue beat estimates by 4.2% and beat its guidance by 3.6%.

EPS beat $1.83 estimates by $0.17 and beat its $1.84 guide by $0.16. EPS grew by 7.4% Y/Y.

GAAP EPS beat $1.84 estimates by $0.02. GAAP EBIT missed estimates by 2.3%.

Operating cash flow roughly met estimates.

The company bought back $800 million in stock vs. $1.8 billion in the Y/Y quarter. Dividend payments grew 3.8% Y/Y. It has $4.6 billion in cash and equivalents with another $500 million in short-term investments. The firm carries $5.5 billion in debt on its balance sheet with $200 million in current debt. Share count fell by nearly 4% Y/Y. Gross margin was 46.8% vs. 46% Q/Q and 47.3% Y/Y.

For next quarter, the company’s revenue guidance was 1.7% ahead of consensus and its non-GAAP EPS guidance was $0.10 ahead of $1.64 consensus. It expects to keep taking market share across all of its categories and remains optimistic on the long-term future of its industry despite continued short term cyclicality.

Demand and margins by segment

Semiconductor system revenue grew 11.6% Y/Y. Foundry logic and other represented 84% of that segment’s revenue vs. 65% Y/Y as Flash memory demand weakened significantly. The segment’s operating margin was 35.6% vs. 37.1% Y/Y

Applied Global Services revenue grew 3.3% Y/Y. The operating margin was 29% vs. 30.5% Y/Y.

Display and adjacent markets revenue fell nearly 50% Y/Y to $168 million with the EBIT margin coming in at 12.5% vs. 21.5% Y/Y. This segment is being impacted the most harshly by poor macro and budget tightening.

Brief Call highlights

“Despite macro headwinds, our outlook remains favorable, and we expect to outperform our markets in 2023, thanks to our balanced market exposure, our strong position at key technology inflections… and our growing service business, which is increasingly subscription-based.” -- CEO Gary Dickerson

Demand driven by consumer endpoint use cases is notably weak.

Demand driven by “technology inflections (AI, clean energy etc.) and strategic regional supply chain investments remains robust.” $400 billion in government incentives deployed through 2028 will be a real tailwind for this supply chain “regionalization” which is expected to support this firm’s growth. Geopolitical tensions actually help it.

Memory spending (tied to consumer electronics) is at its lowest point in over a decade.

For foundry logic, it is enduring customer spend delays but truly sees these as delays and not eliminations.

IoT, automotive, power and sensor markets (ICAPS) were demand standouts for the quarter. It revised its demand forecasts here higher for the calendar year.

b) Brief Doximity (DOCS) Earnings Summary

Doximity is a digital platform for healthcare-based collaboration and use cases like e-signatures, streamlined medical consultation and telehealth. It calls all 20 of the largest hospitals and all 20 largest pharma companies in the U.S. its clients. The results were somewhat strong:

Revenue beat estimates by 0.8% and its guidance by 0.8%.

EBITDA beat estimates by 7.0% and its guidance by 7.0%. EBITDA margin was 44.1% vs. 42.0% Y/Y.

Free cash flow generation was roughly flat Y/Y and EPS fell by a few pennies Y/Y.

For the full year, revenue rose 22% Y/Y, net income margin fell from 45.1% to 26.9%, EBITDA margin rose from 43.7% to 43.9% and cash flow grew by 42% Y/Y.

The company bought back $85 million in stock vs. about $3 million Y/Y. Buybacks represented nearly double the company’s stock compensation. It has a cash & equivalents balance of about $840 million and no debt. Share count fell 1% Y/Y.

Q1 guidance was weak on revenue and EBITDA. This, however, seems to be a matter of timing as full-year revenue guidance was largely in line on revenue (0.2% beat vs. estimates). EBITDA was 1.6% ahead of estimates. Revenue growth guidance for the year is 20% at the midpoint. EBITDA growth guidance for the year is 19% at the midpoint. It trades for 26x calendar 2023 EBITDA, 27x EBIT and 41x EPS (51x GAAP EPS).

Brief operational highlights

Amion.com (purchased for its physician scheduling) has rapidly become a “cornerstone of daily engagement.”

65% of the revenue in its full year guide is under contract which is above historical norm. It expects a “tough upselling year as macro belt tightening continues.”

New engagement and quarterly active user records as you’d expect for a growth company.

Announced a new MEDITECH integration (3rd largest electronic health record provider in the USA).

Launched DocsGPT.com which has “proven to be a hit” with its ability to expedite doctor writing. This paired with its product suite cuts half of their paperwork time needs per the American Medical Association (AMA).

4. PayPal Holdings (PYPL) -- Investor Conferences & Xoom

a) Investor Conferences – Global Head of Sales Peggy Alford and CFO Gabrielle Rabinovitch

Braintree (Unbranded Processing)

Peggy Alford discussed a key Braintree benefit that leadership has talked up in the past: Bringing merchants to its latest and greatest checkout flow to juice branded market share and merchant/customer delight. That inherently makes for easier cross-selling as the latest flow requires a simple click of a button to add Hyperwallet, pay later features, new payment methods and more. There’s no manual labor involved in adding products anymore. Most of PayPal’s products were added via acquisition. This meant painfully stitching together manual integrations any time a merchant wanted a new product. That meant immense friction and less cross-selling. Braintree fixes this as the integration vehicle for every single PayPal tool.

Alford used TikTok as a recent example of landing with Braintree as a backup processor. That paved the way for it adding PayPal Hyperwallet and giving Braintree more and more processing volume as it proved to have better authorization rates, stability and uptime vs. all substitutes. That edge is born from PayPal’s decades of experience in processing complex transactions at scale. TikTok was also enamored with Braintree’s willingness to plug into all other payment providers as a unifying layer of transaction orchestration. Global firms constantly use several processors and gateways. Braintree unites them all.

Also, the vast processing volume that Braintree fetches feeds PayPal’s data chest to inform better branded checkout flows and marketing placements. These two businesses work quite cohesively. Alford ended this section of the discussion by telling us the pipeline of new Braintree merchants is “rich.”

More Margin Headwinds

More transaction margin headwinds led to profit concerns culminating from PayPal’s report. These included more buy now pay later (BNPL) loss provisions as that business has exploded in size and some PayPal Business Loan Portfolio deterioration. These factors hit transaction margin by 130 basis points in total. It will sell its BNPL portfolio this year (first the Europe receivables) which will remove the provision headwind from its margin profile.

Unbranded Margin Tailwinds

Braintree’s rapid growth has weighed heavily on PayPal transaction margin as those transactions are more frequently credit card-funded than its branded growth. Credit card-funded means higher interchange fees and less profits. While this has created new concerns for the stock, leadership has a clear, confident line of sight to margin expansion here to get the profile in line with Adyen and Stripe. How? A few items:

Launching PayPal Commerce Platform (PPCP) as a Braintree suite tweaked for SMBs. This replaces PayPal Pro which leadership will readily tell you is antiquated. For context, Pro only allows for payouts into PayPal accounts while PPCP will tap into Hyperwallet to power payouts to all relevant destinations.

Going global. International merchants come with higher transaction margins vs. domestic via added FX fees and transaction complexity.

Adding more value-added services like Hyperwallet, Buyer Protection, Pay Later and more.

The slowing of a shift back from debit to credit funded transactions post-stimulus leading to normalizing Y/Y comps.

Braintree’s success has largely come from Fortune 500 brands in the USA. These types of clients come with the worst margins in the space for a processor. It’s now ready to expand into more lucrative categories using Airbnb, Uber, LiveNation and countless others as successful proof of concepts. It thinks these margin levers will begin taking effect this year.

Branded Checkout

When Alford was asked if PayPal branded checkout will realistically get back to double digit revenue growth, she quickly and enthusiastically replied “absolutely, absolutely.” A big part of this branded strengthening will actually come from Braintree traction. The latest and greatest integration that Braintree offers comes with the branded PayPal and Venmo checkout flows. These flows have proven to stabilize branded share losses and reverse them in some cases. PayPal still wholeheartedly considers branded checkout perfection a core mission and a lucrative growth vector.

In terms of branded PayPal BNPL, it expects to keep taking share. It is going to large merchants that signed exclusive deals with venture-backed substitutes to steal those contracts away as they expire. Its offering -- including no balance sheet risk for merchants and immediate access to funds with better authorization and fraud rates -- is gaining rapid traction.

On Active Accounts

The other main concern stemming from PayPal’s report was the Q/Q decline in active accounts. This decline was as expected and was well-telegraphed by leadership. It is coming from last year’s pivot in focus to prioritizing engagement over account additions. Monthly active users (MAUs) are about 25x more valuable to PayPal than its average account. That is where its money is made and where the focus is. MAUs grew last quarter with that expected to continue.

“Adding low-quality, minimally engaged accounts in markets is actually quite easy to do? Marketing dollars can take us wherever we'd like to be if active accounts were really what we were managing for. So what we're really focused on is continuing to grow our monthly active unique user base.” -- CFO Gabrielle Rabinovitch

Take Rate

Take rate fell due to a shift in the sales mix to larger merchants. Apples to apples take rates across its business are stable.

b) Xoom

PayPal is reportedly exploring a sale of its cross-border money remittance product called Xoom. This is its 3rd product in that area in addition to PayPal P2P and Venmo. To be frank, this is an irrelevant part of the investment case and has been a struggling entity. Like Lulu liquidating Mirror and moving on, any proceeds PayPal can get from this would be a net positive. Focus on the core. Move on from distractions like this one.

5. Progyny (PGNY) -- Investor Conference

Utilization

Progyny leadership spoke on positive utilization trends continuing through the first half of 2023. One may wonder how macro and inflation isn’t weighing on this. That is because of the inherently finite timeline of family building, the passion of parents, the growing prevalence of infertility overall and the rising rate of 35+ year old births. Fertility needs grow with age. The structural tailwind for Progyny continues to blow and macro softness is not having any slowing impact.

“Your fertility odds fall every year even with the help of assisted reproductive technology. So when you're a couple and you realize that you're infertile and you need help, the last thing you do is worry about the current price of beans.” -- CEO Peter Anevski

While consumer demand remains robust, employer demand does too. Employer clients continue to liberally expand their treatment and Progyny continues to win an abundant supply of new logos. That success is supported by industry leading outcomes and an average savings rate of 25% delivered by Progyny vs. alternatives to its clients. That edge is more coveted amid poor macro… not less.

Interestingly, this utilization rebound is happening at the same time as rapid new client growth. As frequently discussed, new clients always debut at utilization troughs and grow from there. So? There should be even more room for utilization rates to rise as new clients mature. Even a single basis point of improvement is needle-moving to results. One may wonder if clients are ok with this utilization spike, and rightfully so. After all, they pay for a large portion of these treatments. Well? Leadership spoke on this being a good thing in their eyes vs. bad. It is serving as a powerful talent recruiting tool, leading to less maternity leave time (via healthier mothers) and, again, vastly cutting NICU costs vs. any other alternative they can find. And today, employees increasingly expect a managed fertility benefit. It’s becoming table stakes.

On Benefits Manager Traction Perks

A main theme of this interview was success within managed care and benefits companies like Northwell. Northwell had been building their own fertility benefit, but recently decided to partner with Progyny on it instead as yet another meaningful vote of confidence.

Northwell and healthcare networks like Children’s Hospital Association (CHA) are among the most respected buyers of healthcare in the world. They both spent years vetting Progyny’s offering and elected to partner with them after all of that work. Not only does this shrink the sales cycle for members of the networks seeing their umbrella organization embrace the company, but it also creates a standard process for administrative work to shrink onboarding time.

“I think the Evernorth partnership is a good start to what we hope to see, which is more partnerships with managed care.” -- CEO Peter Anevski

For partners like CHA, nurse shortages are also leading member hospitals to seek out talent retention tools like this one.

Clients won through these channels will carry the same profit profile as direct selling wins.

Early Selling Season Progress

CEO Pete Anevski reiterated what we’ve been hearing from the team. The selling season is going well in every way, shape and form. Full speed ahead.

6. Meta Platforms (META) -- Chips & Twitter

a) Chips & AI

Meta’s Mark Zuckerberg this week revealed a new line of internally developed semiconductors to support its AI computing push. Like Amazon, Apple and others, Meta sees itself as creating training and inference capabilities more compellingly and more affordably than what it can find on the market today. I’m sure Nvidia would disagree. It calls its training and inference product MTIA (Meta Training and Inference Accelerator) which will be used for more effective product recommendation algorithms and content discovery. With discovery becoming a more important piece of its app engagement, this is quite relevant. Rumors are swirling that Taiwan Semi will manufacture the chip. It has started and canceled projects like this in the past, so we’ll have to see if this attempt has more legs. The chips mesh perfectly with Meta’s PyTorch offering which has rapidly become a standard software tool for AI app development.

This news comes as it revamps its data center infrastructure to more flexibly support the scaling up of AI and non AI-based workloads. Other use cases for these chips include energy efficient video sharing which Meta struggled to find externally.

Other Zuck announcements this week in the world of AI, computing, data centers and language learning models (LLMs):

The second phase of its research supercluster (RSC) project is now done. This Supercomputer is one of the “fastest in the world” and will be used to train its LLMs and the “world’s first AI translation system for oral languages.”

Meta also released its version of Microsoft’s AI-powered coding assistant called Copilot.

b) Twitter

Instagram is reportedly debuting a text-based app competitor to Twitter this summer. Supposedly, the app will openly integrate with Mastodon and other similar tools to craft a more open internet-type experience vs. Twitter’s walled garden. Two things here: Now is the perfect time to try this out with Twitter’s new leadership turning off a decently sized cohort of advertisers. Furthermore, this is very low risk with significantly less upfront spend than other projects like the Metaverse. Meta will simply recycle and tweak some of its infrastructure to create this simplistic app. If it doesn’t work… it’ll move on with very little lost in costs. If it works… great. It effectively ripped off Snap stories, BeReal, TikTok’s bread and butter and more. Now it’s turning its attention to the Bird App.

This app will be a standalone product and also tightly integrated into Instagram. Instagram users will automatically get access to their handle on the new platform with all followers prompted to go check out creators on their new pages. In leaked images, the app looks very similar to Twitter.

Maybe this is why Elon Musk attacked WhatsApp last week and why Twitter is debuting features that overlap with Instagram.

7. Shopify (SHOP) -- New Study

Shopify released an upbeat study on the value of its web and checkout offering vs. alternatives. According to the results, Shopify-powered sites convert buyers at a rate 15% better than average. It’s 36% better than the Salesforce Commerce Cloud and 12% better than BigCommerce. Shop Pay accelerated checkout lifts shopper conversion by another 10%-50% and raises bottom of funnel conversion (very important revenue driver) by 5%. 1-2 click native checkout is a powerful thing. The firm attributes these edges to its scale (so massive data vault to avoid manual data entry), brand and innovation.

Luckily, this data does not come from Shopify internally. Instead, it comes from a Big 3 consulting firm. That makes the results a bit less biased and a bit more legitimate.

8. CrowdStrike (CRWD) -- Forrester MDR

Forrester again ranked CrowdStrike as a managed detection and response (MDR) leader with the best market presence in the space. Interestingly, it thinks Secureworks, Red Canary and Expel have better offerings for this use case than CrowdStrike. The company received top scores in 12 of 23 categories.

MDR is a lower margin business than the rest of its suite… so why should we care about this? While MDR is low margin, it’s a powerful lead generator for new business. This is where CrowdStrike showcases its abilities to clean up constant messes from Microsoft Defender and others. Doing so often wins the hearts and minds of new customers and lets CrowdStrike routinely cross-sell higher profit tools. Specifically, $1 of spending by a client within MDR yields over $5 in cross-selling revenue for the firm.

9. SoFi Technologies (SOFI) -- Galileo

SoFi’s Galileo payment processing and risk prevention tools are now available for purchase on the AWS Marketplace. When I look across my portfolio, software names like JFrog, CrowdStrike, The Trade Desk and virtually all others have leaned on channel partnerships to augment growth. Galileo really hasn’t as aggressively explored these partnerships, but now it seems to be doing so. This could be a meaningful product awareness lever for the slowing SoFi branch and could be a key contributor to its expected re-acceleration. Key word here is could.

10. Amazon (AMZN) -- New Position & Various News

a) New Position

I started a brand-new position in Amazon this week. On Monday, we will publish a standalone article detailing the thought process and the plan going forward. I’ve started the position at about half full with plenty of room to average in. Candidly, I was torn between using my finite cash pile to start Amazon or Google. Over time, it’s likely that I will raise or deposit additional cash to start a Google position as well. For now, I slightly prefer Amazon which will be explained in 48 hours.

b) Various News

Amazon Games is partnering with Middle-Earth Enterprises to create a new Lord of the Rings multiplayer video game. This announcement marks continued momentum for the segment. Previously debuted games like New World received warm introductions from gamers pushing it up to the top of charts.

Amazon is also looking to emulate ChatGPT features to build its own AI-powered marketplace search. It has been long at work on chip sets for AI use cases and continues to perfect its Bedrock foundational LLM model. This appears to be one of the first consumer-facing use cases to come from these investments. Not only could this lead to better search results and higher conversion, but it’s yet another compelling tool for sponsored product placements to grow its budding advertising business. Jungle Scout released an interesting survey this year on consumer product searches in the USA beginning on Amazon more frequently than Google. By connecting these searches to more desired and granular product results, Amazon can retain a larger piece of its massive traffic base. It had been losing some of this traffic to vendors such as Google due to search processes that have fallen behind competition in recent months.

Amazon also unveiled a new set of hardware products from its Echo line of smart speakers:

The Echo Pop will cost $40 and serve as a basic speaker for books, lights, appliances and more – powered by Alexa voice commands.

The Echo Show will cost $90 and features all of the same Echo Pop perks with a higher quality sound system and a Ring doorbell integration.

It’s also launching Echo headphones for $50.

This line of hardware is ripe for generative AI integration and the launches mark a continued focus on building Alexa. With generative AI now entering the fold, Alexa can finally morph into Amazon’s vision of equipping every household with a personal assistant. Google showcased use cases like calling a hair salon with its alternative system to book an appointment. It’s easy to see Amazon getting to this point with Alexa very soon.

Finally, Amazon will invest $12.7 billion into cloud infrastructure in India to fortify AWS’s presence in that increasingly important market. Every mega cap tech is meaningfully investing into the country for good reason. The population is massive, the government is business friendly and the country is earlier on in technological evolution than UCAN and Western Europe.

11. Uber Technologies (UBER) -- 2023 Product Showcase

Uber announced a slew of new products at its 2023 product showcase to round out its suite and to motivate cross-selling, retention and best-in-class unit economics. If you are a consistent reader, you know how important this effective product expansion is to our investment case. It’s how to side-step endless marketing intensity and how to create a more valuable, stable network with heftier margins. The Uber One subscription is its way to tie together all of these perks with deeper discounts to manifest that vision.

This week, it debuted the ability to call a ride from a toll-free number without using the app. This is expected to be popular for older individuals that don’t want to use a smartphone.

More interestingly, it also debuted teen accounts. The tier will feature more heavily vetted drivers, more safety layers and the ability for parents to communicate with drivers directly. Added privacy perks include “Verify My Ride” which serves as another verification tool to ensure a person is getting in the right car. This functions similarly to duo authentication products. It’s easy to see how this could gain rapid traction. Parents are busy and kids partake in extra-curricular activities. It’s more comforting to let a stranger drive your teen to school or to practice when you can vet the individual more thoroughly and can directly call them. These teen accounts can be linked to overarching family profiles to pay for services from a singular card. The product will start with rides and soon expand to Uber Eats.

Other product announcements

Uber Car Seat to order a car with a safe car seat in it.

Group grocery orders. This lets people add individuals to a grocery delivery to include what they want in it. It has automated features to help customers divvy up bills.

Group rides to invite others to join you on a trip. Uber automatically optimizes the route to minimize time spent on extra stops.

In Greece, Uber customers can now order a boat service.

Uber Central is an extension of Uber Reserve to pre-order and plan out rides when you’re vacationing or on the go several days out.

12. Macro

a) Data from the Week

Output Data

NY Empire State Manufacturing Index for May was -31.8 vs. -3.7 estimates and 10.8 last month.

Philadelphia Fed Manufacturing Index for May was -10.4 vs. -19.8 expected and -31.3 last month.

Industrial Production M/M for April rose 0.5% vs. -0.1% estimates and 0% last month.

1.416 million building permits for April vs. 1.437 million expected and 1.437 million last month.

Housing starts for April were 1.401 million which met estimates and compares to 1.371 million last month.

Consumer Data

Core Retail Sales month over month (M/M) for April rose 0.4% vs. 0.4% estimates and -0.5% last month.

Retail Sales M/M for April rose 0.4% vs. 0.8% estimates and -0.7% last month.

242,000 initial jobless claims vs. 254,000 expected and 264,000 last report.

4.28 million existing home sales for April which vs. 4.3 million expected and 4.43 million last month.