News of the Week (May 8 - 12)

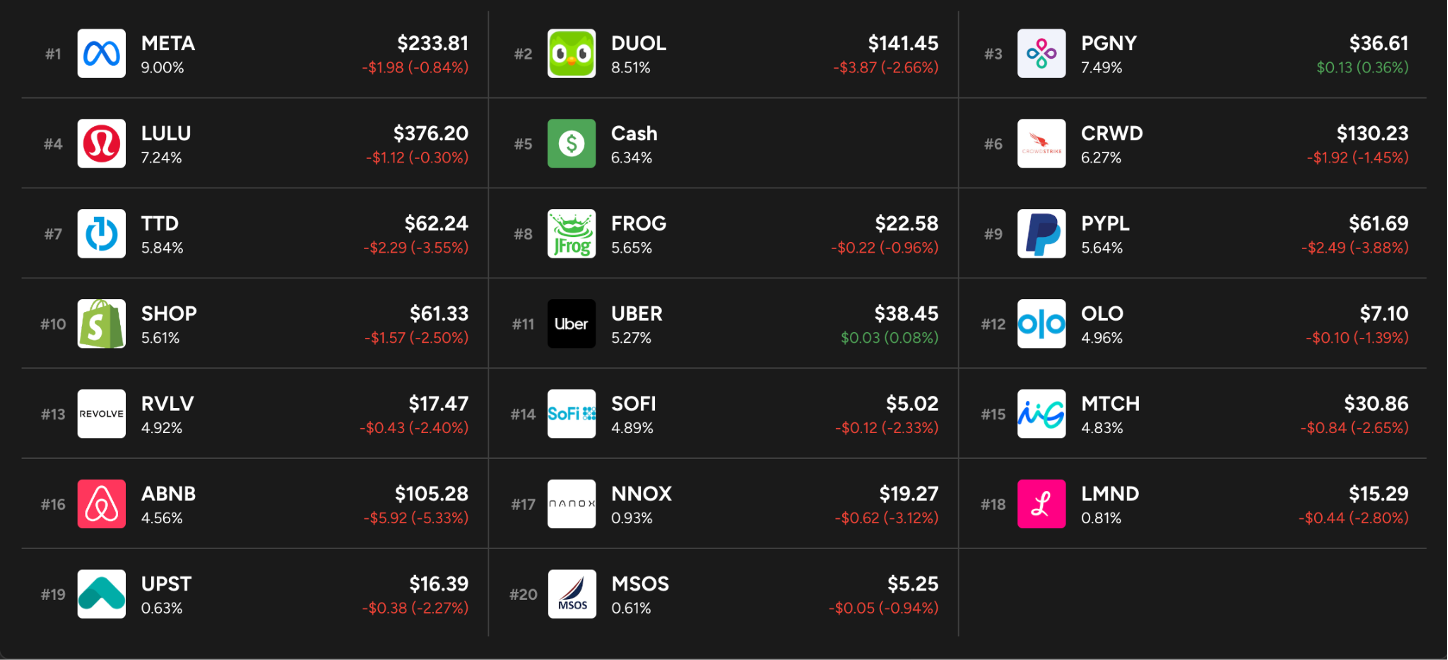

Olo; Revolve; Palantir; Celsius; Hims; Uber; Meta Platforms; PayPal & Match; Nanox; Alphabet; Mastercard; CrowdStrike; Macro; Portfolio

Welcome to the hundreds of new subscribers who have joined us this week. We’re delighted to have you and determined to provide as much value as possible.

1. Olo (OLO) -- Q1 2023 Earnings Review

a. Demand

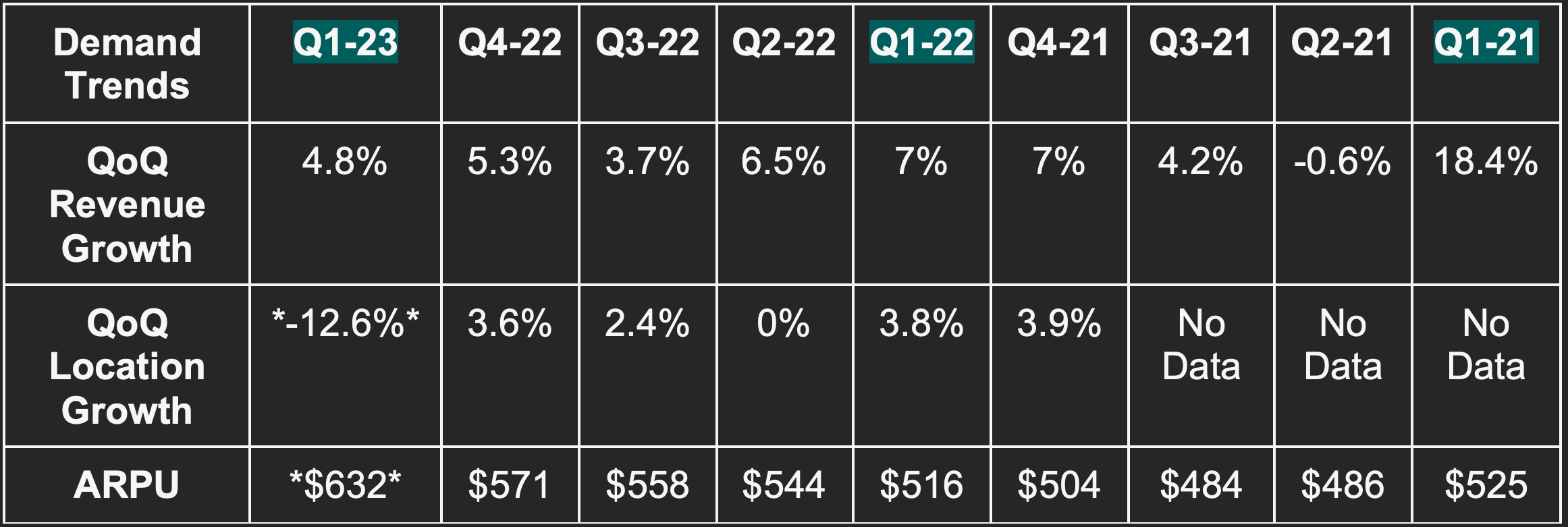

Olo beat revenue estimates & its guidance by 2.8%.

Demand Context:

Net revenue retention was 114% vs. 108% last quarter.

Negative location growth is solely via Subway migrating from the platform last year. It added 1,500 locations QoQ without this hit and added 9,000 YoY. Subway removed 15,000 locations.

Subway migration is helping ARPU a lot as it was a 1 module client.

Multiple module adoption from enterprise and emerging enterprise clients continues to nicely ramp.

b. Profitability

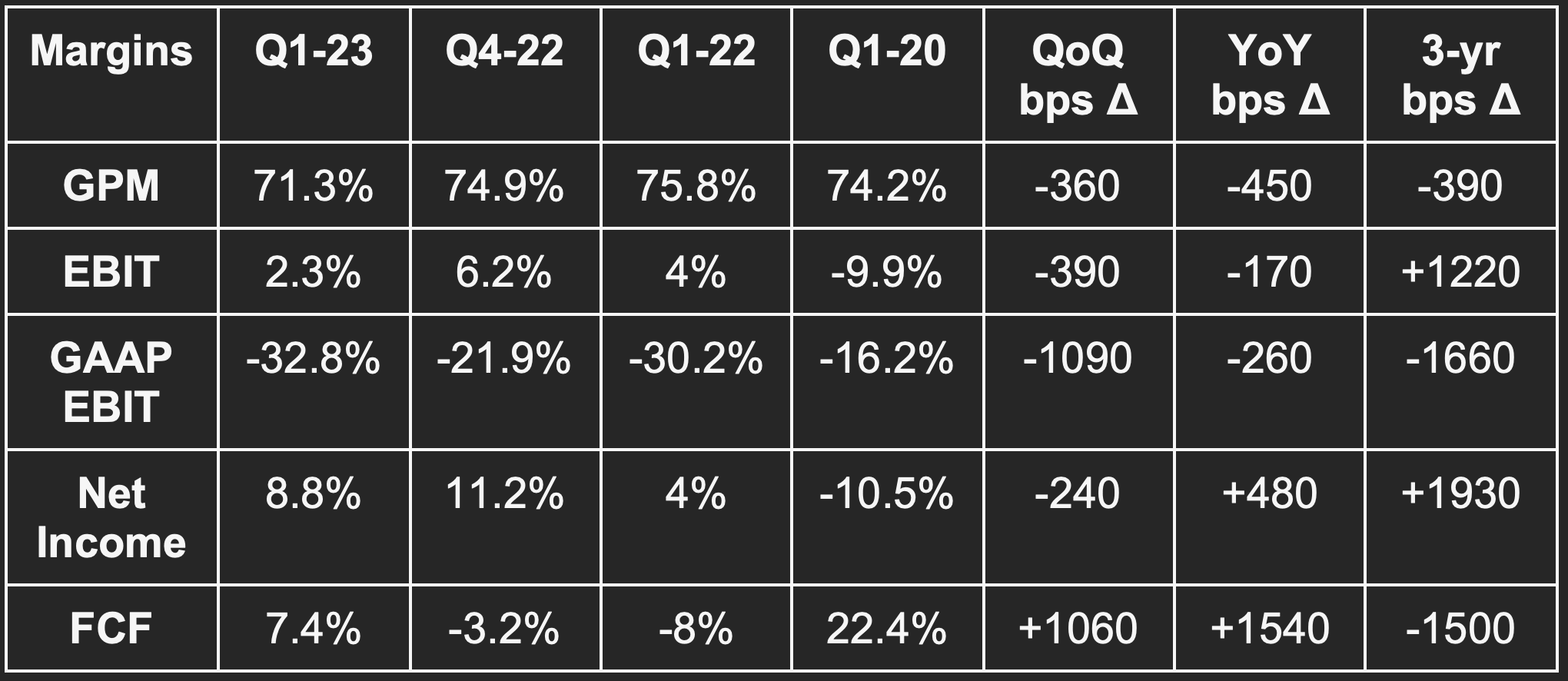

Beat $800,000 EBIT estimates & its guide by $400,000 or 50%.

Beat -$1.6 million FCF estimates by $5.5 million.

Missed gross margin (GPM) estimates by 160 basis points (bps).

Met ($0.08) GAAP EPS estimates.

Beat $0.01 EPS estimates by 2 pennies.

More Margin Context:

Its previous Wisely and Omnivore acquisitions continue to hit gross margin for now as it invests into those newer opportunities. Higher compensation to support location onboarding and Olo Pay processing costs not present in the YoY period also hit gross margin.

The EBIT margin contraction was related to timing of its Beyond 4 conference. That conference took place in Q1 2023 vs. Q2 last year. So? It added about 500 bps to sales and marketing as a percent of revenue. That’s why the EBIT margin didn’t materially expand YoY with G&A falling to 20% of sales vs. 26% YoY (thanks to scale). Not operating profitability. Not demand. Just timing of the spend. No issues here. R&D spend was stable at 30% of sales with leverage expected to kick in for the rest of the year.

c. Balance Sheet

$438 million in cash and equivalents.

No debt.

Stock compensation was 26.9% of sales but buybacks represented 143% of stock compensation for the quarter. It has $60 million left on the current buyback program.

The buyback is a necessary offset to somewhat hefty dilution. Share count rose by 1.5% YoY as it controls share count growth much more effectively. It doesn’t see these buyback dollars as replacing investment dollars, but as excess cash.

d. Guidance

Q2:

Beat revenue estimates by 3.3%.

Met EBIT estimates.

2023:

Raised its revenue guidance by 1.2% and beat estimates by 1.2%

Raised its EBIT guidance by 3.3% and beat estimates by 3.3%.

e. Call & Release Highlights

Customer Wins:

Noodles and Co expanded with Olo Pay across its 300+ locations. This is Olo Pay’s largest win to date. Leadership called the Olo Pay pipeline rock solid. Up-selling to its existing client base will be a 5-year cycle as payment contracts are typically signed in 5 year increments.

Denny’s launched with Olo’s Engage modules in a key up-sell win.

Added Shipley Do-Nuts and its 300+ locations. It’s launching with 5 Olo modules including Pay.

Olo Connect:

As an extension of Olo’s thriving partner ecosystem of 300+ tech vendors, it’s launching Olo Connect. The program ranks partners based on service quality and usage to guide customers on their tech stack building journeys. This sounds like it could upset some partners ranked in a less favorable light, but Founder/CEO Noah Glass told us that the “partner response has been positive.” Perhaps the net benefit of painting more important partners in a more concretely positive way outweighs the con of pushing less important partners down the cue.

Adyen:

As recently announced, Olo announced a new partnership with Adyen. This enables Olo to add card-present transactions into the Olo Pay fold with new “embedded financial services coming in the future.” This will help Olo Pay customers fully unify digital and on-premise payments while creating an overarching means of gleaning and utilizing the data from all of these interactions. This also “eliminates the need to use multiple tools for reconciliation, refunds, fraud and chargebacks” for a consolidated view of financial performance. As an aside, this more precise demand data will inherently help the two partners offer more affordable access to capital. Another perk of brands tapping into network level scale on the Olo platform. This will launch in 2023 and represents a 6x revenue expansion opportunity for Olo pay.

Product Updates:

Launched AI-driven kitchen capacity management to enhance customer throughput on-premise.

Launched open check to allow customers to continuously add items to a ticket to be consolidated upon checkout on their mobile device for payment.

Also launched a pay at table function to allow guests to control when they pay a bill and leave.

On Demand Resilience:

“End market restaurants are reporting a lot of resilience and growth. This supports the positive signs we’re seeing from sales and deployment. As we look ahead through the year, we want to remain prudent in terms of how we think about the potential for upside in the model given we’re early in the year. There are a lot of encouraging signs but still quite a bit of time in the year.” -- CFO Peter Benevides

f. Take

What a wonderfully boring quarter. Olo Pay seems to be a shining star in the making for the company. Resilience in the restaurant industry paired with some trading down to less expensive brands (which Olo predominantly serves) is helping. Growth should accelerate after 2023 when comps get easy and macro gets more favorable. That should coincide with steady margin expansion as M&A integration work wraps up, product investments bear fruit, and module up-selling continues. Expensive names with no GAAP net income are not in vogue at the moment. But growth will eventually get a bid and that bid should favor highly recurring revenue models with strong unit economics -- like Olo’s. It’s a de-facto technology layer for enterprise restaurant brands and that only became truer this quarter.

2. Revolve Group (RVLV) -- Q1 2023 Earnings Review

a. Demand

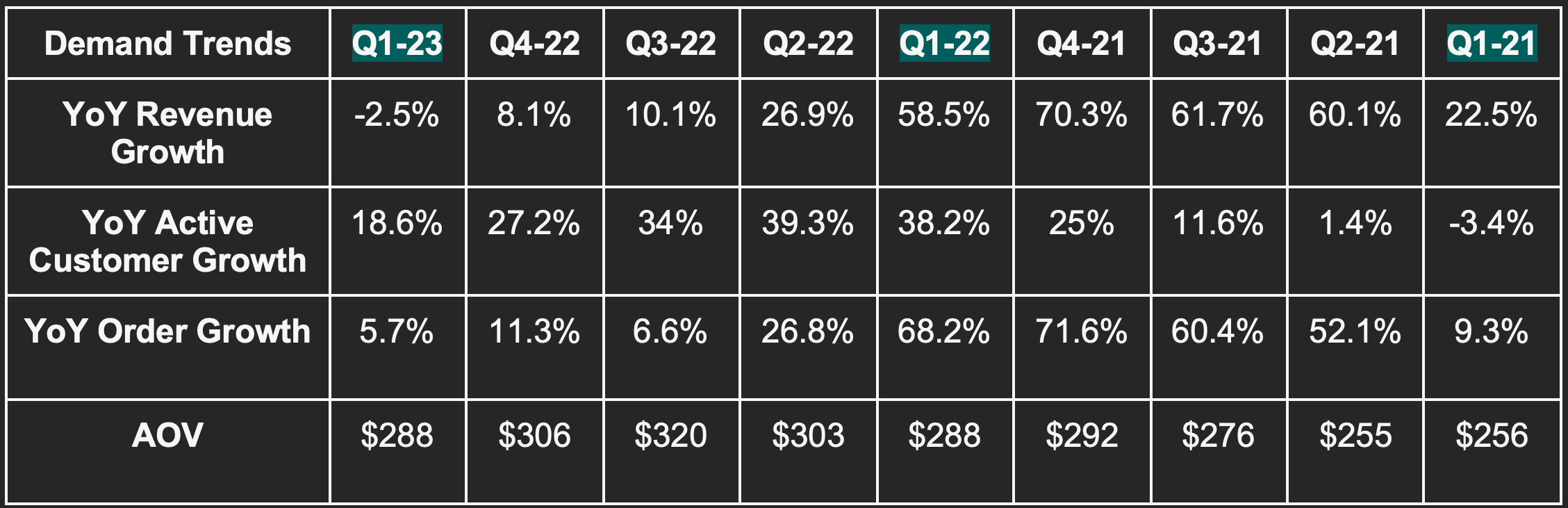

Revolve missed Q1 revenue estimates by 3.6%. It does not provide quarterly revenue guidance.

More Demand Context:

U.S. sales fell 5% YoY; international sales rose 16% YoY. Global growth was notably strong in China as that country reopened as well as in Mexico and India. It was notably weak in Europe.

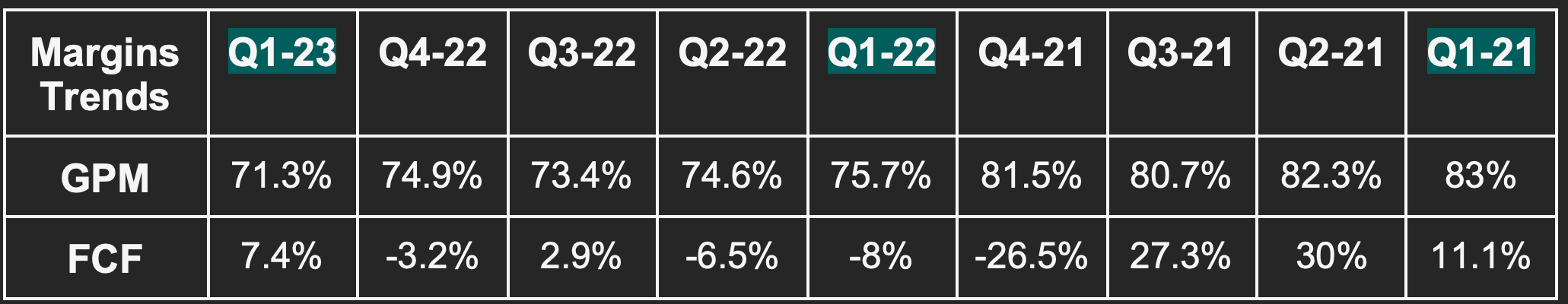

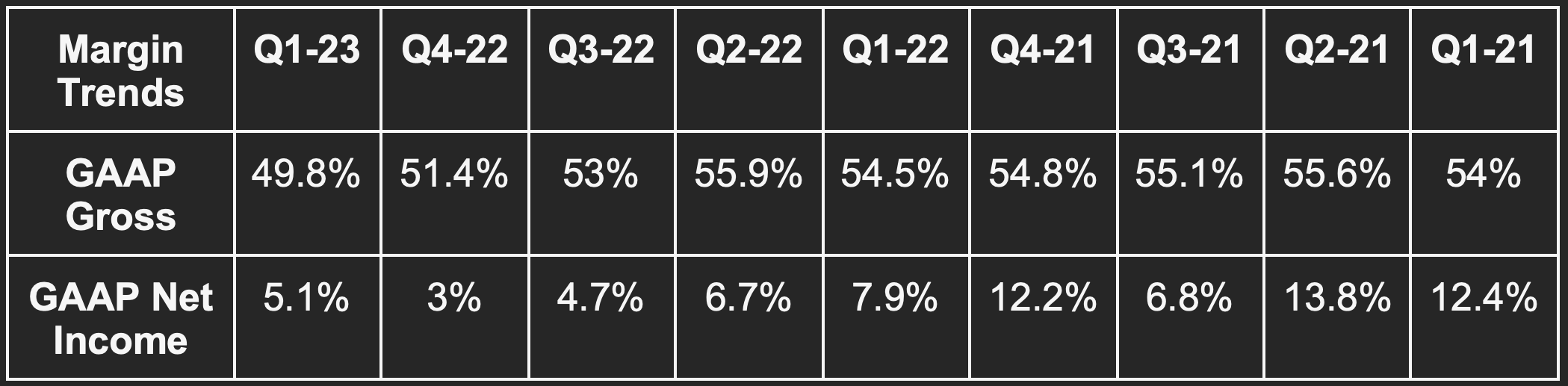

b. Margins

Revolve missed EBITDA estimates by 13.3% and missed GAAP EBIT estimates by 17.1%. Conversely, it beat $0.14 GAAP EPS estimates by $0.05. This was materially helped by $6.6 million in other income for the quarter vs. $516,000 in the YoY period. It also ever so slightly beat GAAP gross margin estimates by 10 bps. This beat its own gross margin guide by 30 bps.

More Margin Context:

Free cash flow was aided by intentional inventory reductions. The company still expects inventory to be fully re-balanced by the end of Q2. It’s balanced for Revolve.com with still more work to do on Fwrd (its other site).

Fulfillment costs as a percent of revenue rose 70 bps YoY via higher return rates while selling and distribution costs as a percent of revenue rose 200 bps YoY. Marketing conversely fell as a percent of revenue by over 200 bps.

An insurance reimbursement helped net income a bit this quarter.

c. Guidance

Revolve doesn’t offer formal revenue guidance. It did tell us that sales for the month of April fell 7% YoY which is materially worse than consensus Q2 estimates. Still, it acknowledged that comps begin to get easier in May and June and so expects a more modest fall in YoY revenue next quarter or perhaps slight growth.

Gross margin is expected to significantly improve QoQ to reach 53.3% thanks to less mark downs and a healthier inventory position. It reiterated a 52.5% GPM for the year. It also sees fuel surcharges slowing and fulfillment costs easing as its new East Coast facility ramps.

“Some pressure points on our P&L in recent periods should begin to ease in the coming quarters.” -- Co-CEO Mike Karanikolas

Still, it now sees selling & distribution costs higher than it previously expected due to product return rates above its expectations. It attributed that to poor macro.

d. Balance Sheet

$283 million in cash and equivalents.

$0 in debt.

Stock comp was less than 1% of revenue.

Inventory fell nearly 12% QoQ and rose 6% YoY.

e. Call & Release Highlights

Macro:

Revolve blamed the miss on poor macro hitting discretionary spend paired with a difficult YoY growth comp. The 58.5% growth it posted in Q1 2022 compares to its run rate growth of around 20% for context. Over a 4-year period, its CAGR sits right around 20%. It pointed out that its worsening sales growth trend throughout Q1 was consistent with U.S. Department of Commerce retail sales data.

It will keep investing in its business, team and growth as it sees now as the opportunity for the strongest in its space to “separate from the competition.” Its liquidity and cash flows allow it to stay aggressive.

Efficiency:

Revolve ramped investments in streamlining shipping and logistics and enjoyed some “early wins in optimizing costs in some regions.” It expects more improvement over the coming quarters.

Like everyone else, it’s now using generative AI models to expedite design and marketing campaign creation. It’s also using these models to enhance search results and product discovery.

Customer acquisition cost was better vs. previous periods.

“We are very focused on reducing the significant negative impact on our profitability from these increased shipping costs with several initiatives in place. More are being developed and tested.” -- CFO Jesse Timmermanns

Fwrd:

The company debuted new Fwrd product navigation on Revolve.com and is also now sharing inventory space for mutual brands between its two sites. It launched a new upgrade to improve web response time in its international stores to enhance localization and conversion. It will also expand Fwrd’s loyalty program to international markets this year.

The Fwrd re-selling program is thriving amid the poor macro environment that is pushing consumers to embrace their thrifty side. Growth here was 50% QoQ and the program was credited for its customer growth -- a highlight from the otherwise mixed report.

Growth Vectors:

Its men’s and beauty segments will be prominently displayed at this year’s REVOLVE Gallery event for the first time. It just hired a new lead for its men’s business.

f. Take

For a company serving a young, aspiring buyer and selling expensive, discretionary goods… macro hits it about as hard as any other retailer. The results were therefore understandably bad. Looking ahead, this is a probable 20% compounder in normal times with excellent margins, robust cash generation and a very hip brand. All of this weakness is macro driven. Revolve will be just fine when the tide begins to turn. The inventory progress this quarter was better than what I expected and the continued rapid customer growth gears them up to thrive in future quarters. Will that happen in Q2? No, it will not. But performance should improve as macro brightens into the end of the year while comps get FAR easier. Focus on the 4-year CAGR here, not the YoY growth comp vs. a period when it grew at triple its normal pace.

I was very tempted to add to my large stake and will likely do so if price action stays this negative. It trades for 28x earnings with EPS set to shrink this year. While that looks unappealing, it becomes a lot more attractive when considering 2023-2025 EPS CAGR expectations of over 40%. No hurry to add here as performance will be challenged for a while longer… but I want more shares this year.

3. Palantir (PLTR) -- Q1 Earnings Snapshot

a. Results

Beat revenue estimates by 3.8% & beat its guidance by 4%.

Beat EBIT estimates by 33.8% & beat guide by 34.5%.

Beat ($0.01) GAAP EPS guide by 2 pennies. This was its 2nd positive GAAP net income quarter which was primarily due to interest income. Interest income was $20.8 million vs. $550,000 in the YoY period.

b. Balance Sheet

$2.9 billion in cash and equivalents.

Stock comp was 21.8% of sales vs. 25.6% QoQ and 33.4% YoY. Stock compensation will “trend higher” throughout 2023.

$950 million in undrawn credit capacity.

c. Guidance

Raised 2023 revenue guide by 0.3% & beat estimates by 0.5%.

Raised 2023 EBIT guide by 4.9% & beat estimates by 7.1%.

Q2 2023 revenue guidance slightly missed & met on EBIT.

Guided to positive GAAP net income for Q2 and in every quarter for 2023. This is vs. less specific guidance of positive GAAP net income for 2023 offered last quarter.

“We remain committed to sustained GAAP profitability.” -- CFO David Glazer

d. Call & Presentation Highlights

Demand Context:

Commercial revenue grew by 15% YoY and at a 2-year CAGR of 33.2%.

Government revenue grew 20% YoY and at a 2-year CAGR of 17.8%.

Growth was powered by U.S. demand with international struggling a bit more via macro.

U.S. revenue rose 23% YoY overall and 26% YoY for commercial specifically. That was the standout.

Billings rose 25% YoY.

It closed 64 $1 million+ deals vs. 55 last quarter. 8 of these deals were worth $10 million+ vs. 5 last quarter.

Apollo (its platform for guided software deployment) closed its first $1 million+ deal this quarter.

Margin Context:

While interest income helped GAAP net income, this was Palantir’s first positive GAAP EBIT quarter which points to operating profitability also powering the net income improvement.

Adjusted GPM of 81% vs. 82% QoQ and 81% YoY

New Artificial Intelligence Platform (AIP) for Defense and Business:

The main focus of the call was Palantir’s new AI platform to “unleash the power of language learning models (LLMs) for networks.” The demand for this new launch has been “nothing ever seen in 20 years of Palantir” according to CEO Alex Karp. This demand is prompting Palantir to shift more resources to LLM and generative AI investments.

Palantir sees operationally scaled tech deployment, data matching relevance and the limitations of smaller LLMs as being true hurdles for competition… and points of differentiation for Palantir. It does not see alternative vendors creating the design quality to deploy models in a secure, scalable and utility-building manner. For these reasons, Karp sees Palantir as “well ahead of the curve.” It has been dealing in scaled, leveraged data deployments for decades, this is simply a tweaked application of its core prowess.

The team now sees Chat GPT models as “table stakes” with points of differentiation for mega cap tech companies vanishing due to “a handful of open-source developers.” Palantir’s models are intricate extensions of commoditized models to deepen the use cases and to plug into the rest of its product suite.

Karp took this time to rip apart Silicon Valley culture like he so often does. He criticized business models for harvesting and monetizing personal data for their own interests instead of for the good of humanity. Palantir takes the public utility approach which it sees as another edge -- albeit quite an abstract edge.

Customer Wins:

Large expansion deals with Hertz and Jacobs Engineering.

Another expansion deal with the largest U.S. Healthcare system.

BP used Palantir’s Foundry to cut production cost per oil barrel from $14 to $6.

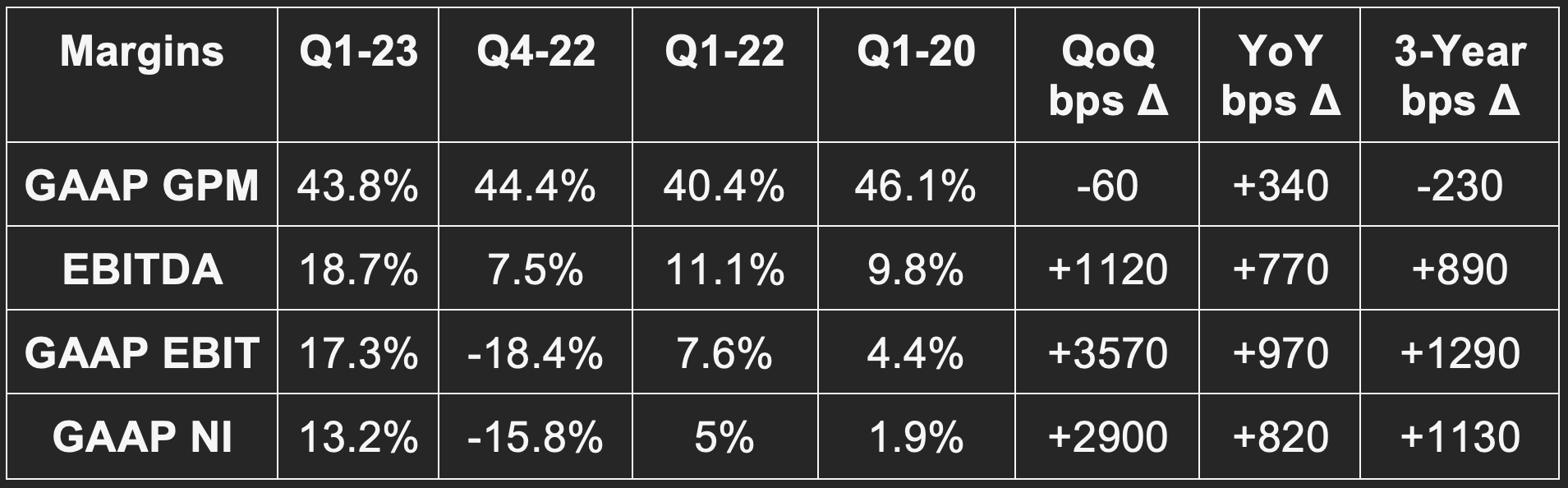

4. Celsius Holdings (CELH) -- Q1 Earnings Review

a. Results

Beat revenue estimate by 18.4%.

Beat EBITDA estimate by 65%.

Beat GAAP EBIT estimate by 84%.

Beat $0.21 GAAP EPS estimate by $0.19.

Missed GAAP GPM estimate by 60 bps.

b. Balance Sheet

$634 million in cash and equivalents.

No debt but $825 million in convertible preferred shares with a 5% cumulative yield.

Inventory levels fell 11% YoY.

Stock comp was roughly 2% of sales.

c. Guidance

Celsius does not offer concrete guidance. It did offer vague commentary on operating leverage slowing in Q2 and Q3 via debuting new marketing campaigns to take advantage of clear growth opportunities. It expects leverage to re-ramp in Q4 thanks to supply chain synergies being enjoyed with its Pepsi distribution partnership.

d. Call & Release Highlights

Demand Context:

North American growth was driven by rapid distribution traction across all channels. Celsius is now the “established #3 energy drink brand” in the space with its market share (per SPINs data) DOUBLING in March from 3.7% to 7.5% YoY. That is not a typo. Holy moly. It’s also now #2 on Amazon with 19.1% share vs. Monster’s 22.3% and ahead of Red Bull at 12.8%. Celsius thinks retailer inventory resets this spring will further bolster its share gains which are currently taking place at the most rapid clip in the firm’s history.

International growth is still not the priority. It has spent the last several quarters beefing up its supply chain with Pepsi’s best practices in North America. That has taken the bulk of its time and attention. It is now gearing up for international expansion and thinks this will be kick-started in Q1 2024. For now, it’s doing logistics and distribution prep work to ensure it’s ready to hit the ground running.

Margin Context:

Gross margin was helped by thriving demand and cost savings initiatives (partially thanks to Pepsi supply chain synergies).

Gross margin was hurt by more inventory write-offs and hefty freight charges.

Timing of summer launch events helped EBITDA margin and net income a bit this quarter.

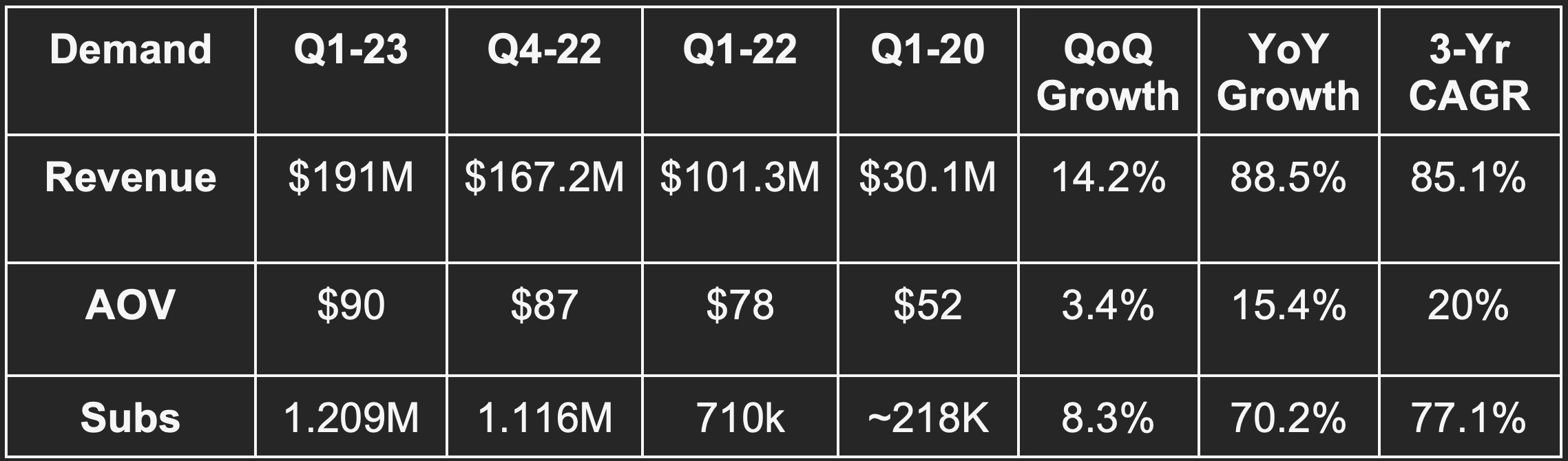

5. Hims & Hers (HIMS) -- Q1 2023 Earnings

a. Results

Beat revenue estimate by 6.6%; beat guide by 7.6%.

Beat $4.3M EBITDA estimate by $2.3M & beat $4.5M EBITDA guide by $2.1M.

Beat GAAP EBIT estimate by 9.1%.

Met ($0.05) GAAP EPS estimate; Beat GPM estimate by 230 bps.

b. Balance Sheet

$190 million in cash and equivalents and no debt.

Stock compensation was 7.3% of sales vs. 7.3% QoQ and 8.7% YoY.

c. Guidance

Raised 2023 revenue guide by 10% & beat estimates by 8.6%.

Raised 2023 EBITDA guide by 10% & beat estimates by 1.4%.

Q2 was well ahead on revenue & slightly ahead on EBITDA.

d. Final Notes

GAAP net income is higher than GAAP EBIT due to other income. Still, with 90% of its revenue recurring and a sub 1 year marketing payback period, the recipe for operating leverage is firmly in place… as these results show. The firm’s revenue continues to get more and more visible with 75% of its subscribers now being multi-month vs. 68% You. This is why 90% of its revenue is recurring.

Finally, it’s expanding deeper into women’s health with new hair growth products launching this quarter. It also signed Kristen Bell as its new mental health ambassador on the women’s side of the business.

6. Uber Technologies (UBER) -- U.K. & Competition

Uber added the ability to book a flight from its app in the United Kingdom. This is merely another step in its journey to building super-apps throughout the globe. Consumers can already book train tickets from the app there along with enjoying the standard services that Uber offers in its other core markets. It will offer this new feature in partnership with online travel vendor Hopper.

Lyft is also playing a bit of catch-up with Uber’s recent product innovations. In a warranted copy-cat move, it will allow users to book rides from airports upon landing with walking ETAs to avoid wait times. Uber has been offering this for a few quarters now. Still, Lyft continues to play defense while Uber remains aggressive. For example, Lyft recently announced the end of its shared-ride program which Uber is calling its next billion-dollar volume product. Lyft is doing this to be more profitable and to focus on the core business while Uber’s scale, product breadth, and healthier unit economics allow this offering to be successful. That’s why it’s liberally launching new products like flight booking in the UK while others retreat. As I’ve said all along, scale and a larger roster of valued products is how companies in this space will motivate retention, sidestep endless marketing needs and win. Uber’s offering and leading supply and demand scale (by a large margin) puts it in the best position to win.

New Lyft leadership continues to entertain the idea of a sale without directly seeking one out. Uber would be the perfect takeover candidate if regulation permitted the purchase. It would morph Uber into a ride-sharing monopoly in the USA.

7. Meta Platforms (META) – Chips & Show Me The Money

a. Chips

Amazon is building its own chips… Apple is building its own chips… Tesla is building its own chips… Meta is building its own chips… Everyone is building chips.

This week, news broke that Meta Platforms added 10 semiconductor engineers to its infrastructure team. The new talent will play a pivotal role in developing AI systems and language learning models that Meta will require for its apps and VR investments. The team most recently worked for Graphcore until the end of 2022.

b. App Monetization

WhatsApp business payments are now live in Singapore through a Stripe partnership. Merchants can accept transactions from directly in the app as this chat feature blossoms into a money-making commerce machine… finally. This follows similar news from Brazil and recent pilot projects with Uber in India to call a ride from the app. These new use cases will continue to rapidly be announced; the low hanging fruit for WhatsApp monetization is abundant.

In a move to win the time of more creators and bolster net Reels monetization, Meta is tweaking its ad revenue share model. The payouts will now be decided based on the engagement on the actual content and no longer based on the ad revenue the content generates for Meta.

8. PayPal (PYPL) & Match Group (MTCH) -- Value Traps?

I added to PayPal this week following what I saw as an upbeat quarter. Volume growth accelerated across the entire business, Venmo added Microsoft and McDonald’s as two new commerce partners, revenue and earnings guidance was raised and Braintree continued to take more market share. The company trades at 5 year lows in terms of its 12x 2023 earnings multiple. It expects to compound earnings around 15% for the next few years and will surely get a growth boost from e-commerce growth normalizing. Its demand is intimately tied to that macro indicator.

It continues to work more closely with Apple just like it did with Visa and Mastercard ten years ago when those card rails were going to kill its business. We think the Apple dynamic will play out very similarly. PayPal app penetration continues to rise and generate the expected engagement lift that the firm needed. For Braintree, new projects and global expansion should erode the margin headwind it represents over time. Braintree continues to boast authorization and fraud rate edges over the competitive landscape and is now on par with Adyen and Stripe in terms of apples to apples volume per leadership. In a brand-new case study, Braintree boosted WeSki approval rates by 5.4% vs. its old vendor. This tangible advantage is a cliche for customers switching to Braintree.

All of this is to say that regardless of how ugly the PayPal chart looks today, I don’t see this as the dinosaur others have assumed it to be. I’m willing to slowly catch the falling knife while acknowledging doing so must be very gradual. I love the investment case for the long term. For this year, poor macro, awful fintech sentiment, a scary looking chart, tough comps and a somewhat hated CEO (who is on the way out) will likely hold this back to a certain extent. When they head into 2024 with near double digit revenue growth (in our view), continued net income leverage and a fresh team, this should morph into a loved name once more just like Meta did recently. As always, I could be wrong and those calling it a value trap could be right. There’s no rush to add shares right now, but I’m motivated to do so at a responsible pace.

I view Match Group in a nearly identical light to PayPal and added to it this week too. It owns more than a 50% share of the global online dating market poised for brisk annual growth going forward. Foreign exchange headwinds which have crushed its growth should be starting to wind down and the new team is starting to show signs of righting the ship at Tinder in April. This is happening while Hinge continues to dominate, it continues to rationalize spending on legacy apps and as new subscription packages kick in to boost monetization. The Asia recovery is entirely ahead of the company and the pain from the poor Hyperconnect M&A decision is (in our view) now baked in. Match’s Pairs in Japan is best positioned to enjoy that Asia recovery. It will also buy back 12% of its current market cap under the current program. Mega caps like Meta have tried and failed to compete in this space. Match (and to a lesser extent Bumble) own the industry. We ask ourselves a simple question in this specific scenario: “Will folks magically start meeting in person again and stop swiping on apps over the next 5 years.” No… no they will not”. Match will be fine IF the new team continues to execute. That execution risk is real, but I remain somewhat optimistic.

I will continue to fixate on fundamental health, trim into excessive multiple expansion and add into excessive multiple contraction. As said on Twitter, “Greedy when others are Fearful” never feels comfortable in real time. It often coincides with fair weather fans and Monday morning quarterbacks offering noisy, context-less opinions with no work done to back up their thoughts. It often results in name calling and aggression. We’re ok with that as the singular goal we have is long term alpha. Let them talk. When sentiment turns this negative is when alpha is created. We see the risk reward with these two names as very compelling and invite anyone to disagree.

9. Nano-X Imaging (NNOX) -- Johnson & Johnson

Keep the good news coming. A week after Nanox secured FDA clearance, a 13F dropped showing Johnson & Johnson raising its Nanox stake by over 60% during the quarter. The needed caveat here is that it still owns less than 1% of the firm and it represents a microscopic piece of its balance sheet. But it’s still an interesting development.

Nanox will need manufacturing muscle from partners like Foxconn to globally distribute this complex, multi-source machine. Johnson & Johnson certainly has its fair share of resources and is a welcome addition to the fold.

10. Alphabet (GOOG) -- I/O 2023 Product Highlights

Alphabet announced its first foldable phone in Pixel Fold. This will cost about $1,800 with a cheaper model also available. It also announced that its new Pixel Tablet will be available for purchase in June. The tablet comes with cool perks like a wireless charging station that doubles as an external speaker.

In search, Google is debuting AI-sourced, synopsized text to be displayed above search result links. This could upset some companies reliant on site traffic for revenue. Still, it can also streamline search which would be ideal for some kinds of merchants that instead rely on product sales for revenue.

For Android, attention was paid to “wallpapers” allowing for customization of photos and backgrounds. This seems sort of gimmicky, but other generative AI announcements were more interesting. It’s infusing its Bard LLM into its productive apps to automate sheet building like with Bing and Microsoft Excel. These models will build more immersive Google Maps experiences with detailed visualizations of the entire route. As a nature lover who takes long drives frequently, I found this cool.

Over the next several years, mega cap tech names will pour billions into building generative AI models. This was understandably a core focus of the event as Google’s search monopoly has grown slightly more vulnerable due to competing models. It’s still the data share leader in search by a mile which puts it in an ideal spot to build the most relevant search models… but it does needs to execute and is playing a bit of catch up at this time. Especially with Microsoft reportedly committed to bidding for default search contracts with players like Apple and Firefox. Even amid all of this, Oppenheimer came out with a note calling out stable search share for Google this quarter. Good news for the company.

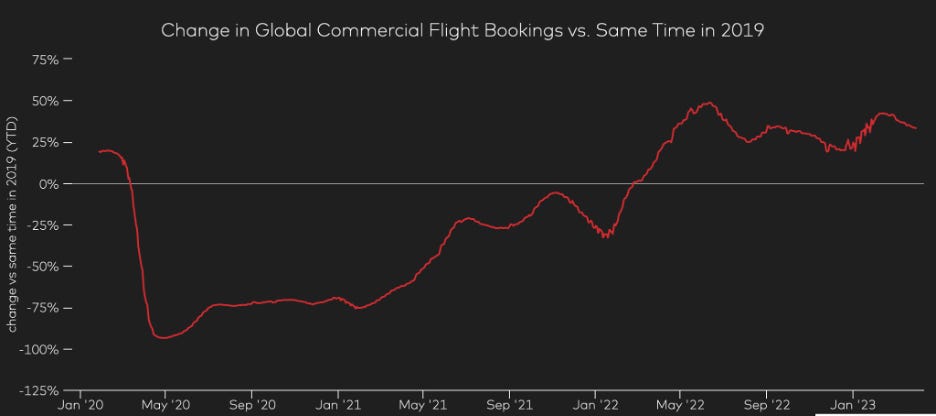

11. Mastercard (MA) -- 2023 Travel Trends

The 30,000 ft view from this report is that travel demand remains robust despite poor macro. People are spending here more than they’ve been able to throughout the pandemic era. Demand overall rose 25% YoY and 31% in March 2023 vs. March 2019. To add fuel to the fire, China’s reopening will increase momentum further. China outbound travel spend is now re-approaching pre-pandemic levels. This meshes very well with service spend growing much more strongly than goods spend. Mastercard sees a chance that this growth could continue and buck historical economic cycle trends. Why? A combination of pent-up demand from the pandemic, low unemployment and recovering consumer savings levels.

By segment, business and commercial travel is coming back with vengeance. These bookings caught back up to leisure bookings in the back half of 2022 and are now growing at a more robust clip.

By region, APAC is leading the way with commercial travel growth of over 60% YoY with every other region enjoying 20%+ growth between January 2023 and March 2023.

12. CrowdStrike (CRWD) -- Zscaler

Zscaler pre-announced robust quarterly results and raised its revenue and profit guide by a few percent each for the year. Why does this matter for CrowdStrike? These two offer somewhat complementary product offerings. CrowdStrike comes at cybersecurity from an endpoint approach with Zscaler protecting the network. The two routinely pull each other into large deals and work in a quite collaborative manner. It’s not 100% friendly, but close to it. Zscaler seeing robust demand is a decent hint that CrowdStrike will too when it reports in a few weeks. Cybersecurity is not discretionary spend… it’s the least discretionary bucket in enterprise tech spend.

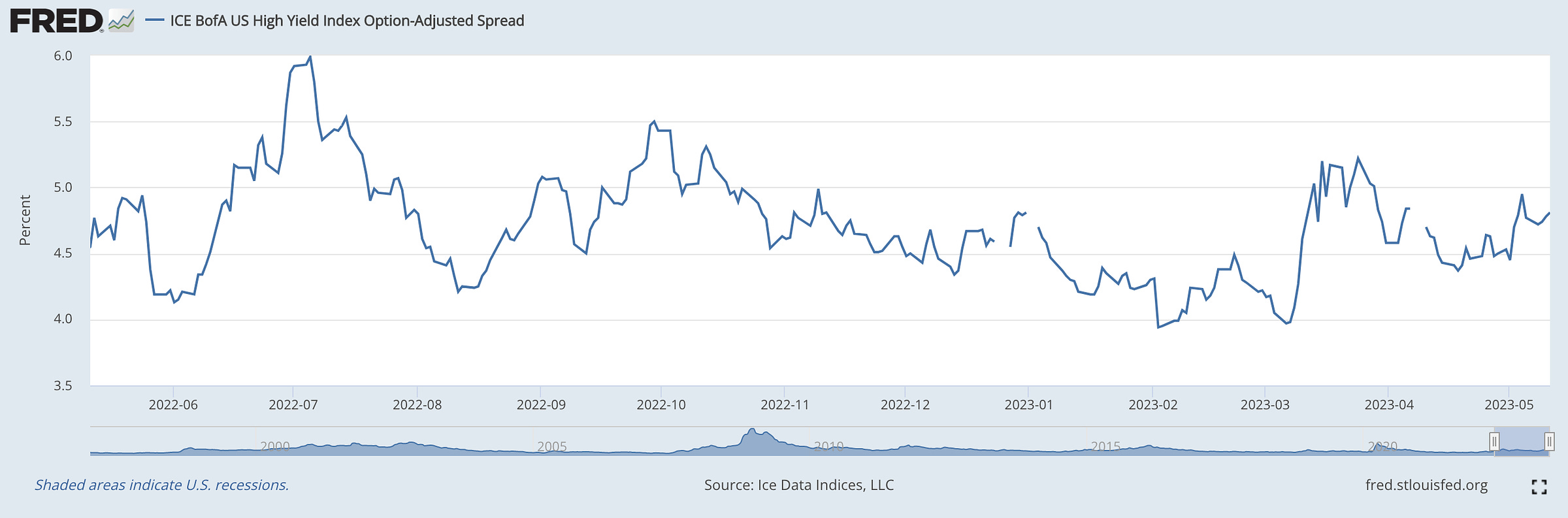

14. Macro

The consumer price index (CPI) for April was roughly in line with consensus or maybe a bit better. It marked a continuation in brisk disinflation with more progress needed.

YoY CPI rose 4.9% YoY vs. 5% expected and 5% last month.

YoY core CPI (strips out food and energy) rose 5.5% vs. 5.5% expected and 5.6% last month.

Month over month (MoM) CPI was 0.4% vs. 0.4% expected and 0.1% last month.

Core MoM CPI was 0.4% vs. 0.4% expected and 0.4% last month.

The producer price index (PPI) was roughly in line as well:

MoM core PPI was 0.2% vs. 0.2% expected and 0% last month.

MoM PPI was 0.2% vs. 0.3% expected and -0.4% last month.

Following this news, betting markets began to price in a 50% chance of a rate cut in July. Those projections are one hot inflation reading away from abruptly changing, but still interesting to note. The Fed’s base case remains zero cuts in 2023 and more quantitative tightening. It will likely pause hikes at the next meeting and we expect that pause to be somewhat lengthy.

In other news, jobless claims were a bit higher than expected at 264,000 vs. 245,000 estimates. This marks gradually improving supply side dynamics which should help wage inflation ease. Finally, Michigan’s Consumer Expectations May survey was 53.4 vs. 59.8 expected and 60.5 last month. Michigan’s Consumer Sentiment May survey was 57.7 vs. 63 expected and 63.5 last month. This marks sharp worsening for both metrics as consumers grow increasingly timid.