News of the Week (November 1-5)

Progyny; REVOLVE; Penn National Gaming; JFrog; Planet Fitness; CrowdStrike; Nanox; The Trade Desk; SoFi Technologies; Lemonade; Olo; Workplace Awards; Cannabis

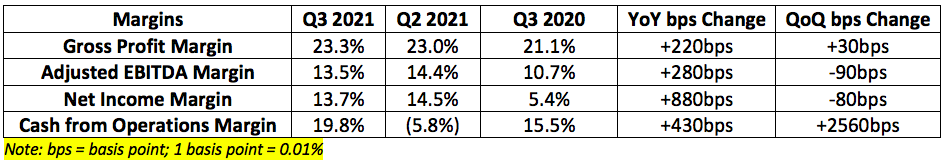

1. Progyny (PGNY) — Earnings Review

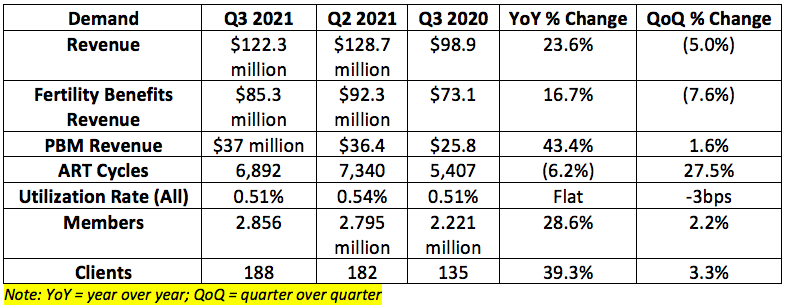

a. Demand

Progyny guided to $121-$130 million in sales for the quarter. It posted $122.3 million in sales missing the midpoint expectation by 2.6% and coming in at the low end of its guidance range.

Like most healthcare service companies, the largest step-up in sequential growth will be between the fourth and first quarters. This is when new clients from the selling season become live.

It’s important to note that revenue growth is expected to briskly accelerate next quarter and in 2022. As the company told us last quarter, utilization rates across the fertility industry dipped to 88% of normal levels before recovering to 90%. Utilization rate continued to improve throughout the 3rd quarter but not to the high end of its utilization rate forecast of 95% of normal levels. Importantly, utilization kept improving into the 4th quarter.

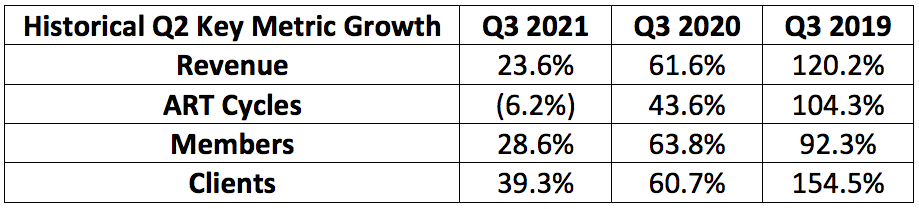

b. Profitability

Progyny was expected to generate roughly $0.05 per share. Without a one-time tax benefit helping its earnings this quarter, Progyny still generated roughly $0.09 per share beating expectations by $0.04. With this benefit it beat expectations by $0.12.

Progyny guided to $14-$16.5 million in adjusted EBITDA. It posted $16.5 million — at the high end of its guide.

The second quarter is a seasonally weak period for the company’s cash flow margins as it spends to support new customers but waits until the following year to collect fees from those new customers. That’s why the sequential boost in cash from operations was so dramatic.

Gross profit margin expansion was due solely to scaling the business. This should continue.

Adjusted EBITDA margin on incremental revenue was 27.5% during the quarter vs. 22.9% sequentially and 22.6% for 2020 as a whole. This offers direct evidence of a long runway for continue margin expansion as the newest business is the most profitable for Progyny — 27.5% represents a 1400 basis point expansion opportunity.

c. Guidance

The company expects $133.9-$140.9 million in next quarter revenue. Analysts had been expecting $141.6 million.

Progyny’s revenue guide represents 48% growth at the midpoint for 2021. Encouragingly, it expects revenue growth to accelerate in 2022 to 50%. That would bring us to north of $770 million in sales which is roughly in line with analyst forecasts. Incoming CEO Peter Anevski told us that this guide assumes the current slightly-depressed utilization rate continues — this rate did not rebound as quickly as it needed to for Progyny to maintain or raise its guide. It does not assume any further improvement meaning any improvement could place upward pressure on that guidance.

d. Notes from Outgoing CEO David Schlanger

On leadership changes:

David Schlanger will step down as CEO next year and stay on as the chairman of the board. Current President and COO Peter Anevski — who has been with the company since Schlanger began his tenure — will assume the CEO position. The 2 have worked together for over 2 decades with WebMD and Progyny.

Schlanger will now focus on the areas of the business where he feels he can have the greatest impact on Progyny’s future: developing new markets, products and relationships. He’ll continue to be a “sounding board” for Anevski as well.

Michael Sturmer will be the new Progyny President. Sturmer previously was the Chief Growth and Strategy Officer and SVP of Health Services at Livongo. Sturmer was a driving force behind the successful selling season this year.

“I believe this is an opportune time to implement this transition given that we are now concluding the most successful selling season in our history.” – Schlanger

While leadership transitions can be worrisome when the outgoing CEO has been so successful, it’s comforting to see all of the roles being filled internally by company veterans.

On the selling season:

Progyny received commitments from 85+ clients with an estimated 1.2 million covered lives for the selling season to get to 265 clients and 4 million covered lives. This would mean at least 45.2% growth and 42.0% growth respectively. This represents briskly accelerating growth between 2021 and 2022 as Progyny takes advantage of a full normal selling season under its belt post-pandemic. These marks exceeded extremely high expectations for the company. Most new clients will be live in Q1 with the rest live by Q2 of 2022.

Progyny maintained its “near 100%” client retention for the 5th consecutive year.

33% of existing clients increased their benefits coverage for next year — upsell activity exceeded all expectations.

e. Notes from Future CEO Peter Anevski

“To put our latest selling season into perspective, we added more new clients in one year as we had when we went public 2 years ago.” — Incoming CEO Pete Anevski

On the selling season:

Average covered lives per client of roughly 14,000 recovered off of the 2020 dip to levels in line with pre-pandemic periods. They also signed new clients with over 100,000 covered lives.

92% of new clients are going with the pharmacy benefit — Progyny believes it can get this number to 100%. The 92% metric is vs. 84% in 2020 and 73% in 2018 when it went public. Cross-selling is gaining more and more momentum.

48% of Progyny’s new clients this year previously had no existing fertility benefit (creating new TAM) vs. usual levels of around 35%-40% as fertility benefit adoption among large employers grows.

The 2022 selling season pipeline is larger than the 2021 pipeline was at this time last year.

Anevski on new product launches:

“We are continuing to explore the possibility of broadening our portfolio of services or adding new markets where we believe expansion makes sense.”

f. Notes from CFO Mark Livingston

The sequential assisted reproductive treatment (Art) cycle decline was due to the temporary blip in utilization. Female utilization remained strong, but the proportion of lower-priced fertility services was higher during the period due to (again temporary) lower IVF utilization. People returned to fertility treatment pursuits, but the first step of this return is lower-value consultations for Progyny with IVFs and other more costly procedures taking place thereafter. This has largely normalized into the 4th quarter.

4th quarter margins are seasonally weak for Progyny as it on-boards new employees to service new clients that will go live in the following quarters.

g. My Take

The slight top line miss and the second straight 2021 revenue guide down is not good. Utilization rate recovering more slowly for the sector than some thought was to blame for this but that rate continued to improve into this quarter.

Everything else in the quarter was fantastic. Selling season went extremely well, margins continue to rapidly improve and the 2022 revenue guide calls for strong, accelerating growth. This was not perfect, but it was good enough and keeps my long term thesis entirely intact.

Click here for my Progyny deep dive.

2. REVOLVE Group (RVLV) — Earnings Review

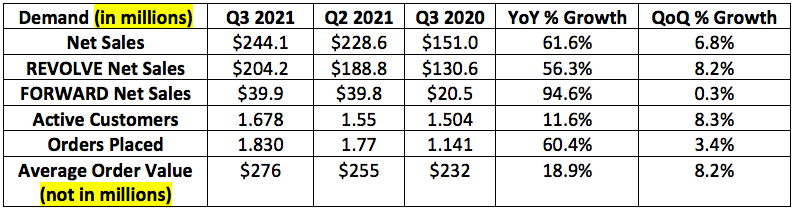

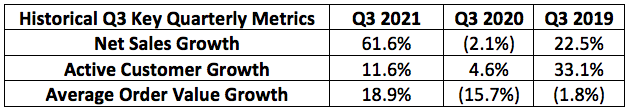

a. Demand

REVOLVE was expected to generate $214.4 in quarterly sales. It posted $244.1 million beating expectations by 13.8%.

$244.1 million represents 58% growth vs. the most recent pre-pandemic period which accelerated from 41% sequentially. The company has been able to maintain a 26% 2-year compounded annual growth rate (CAGR) through the heat of the pandemic. The strength was led by domestic sales growth of 65% with international growing by 49%.

As a reminder, the pandemic was a severe headwind for this e-commerce company specifically for the following 2 reasons:

The company predominately sells dresses and clothing people wear when going out or to the workplace.

The company spends a large chunk of its marketing dollars on live events like music festivals and fashion shows.

Note that Average order value (AOV) is getting a boost from FORWARD’s proliferation — FORWARD is one of REVOLVE’s core, luxury owned-brands.

b. Profitability

The company’s profit guidance was as follows:

Revolve was expected to earn $0.14 per share for the quarter. It earned $0.22 beating expectations by $0.08.

The company was expected to generate $17.05 million in adjusted EBITDA. It earned $21.7 million beating expectations by 27.3%.

Margins were expected to compress this quarter as management previously highlighted that marketing spend would greatly accelerate and normalize during the period and going forward. For context, marketing spend was nearly 20% of sales this quarter which is 25% above its projected 2021 spend. It also more than doubled its inventory year over year which had been severely restricted and capped during the pandemic — this hit YoY cash flow and net income margins hard.

While these margins fell annually and sequentially, they still handsomely beat expectations with gross profit margin (GPM) previously supposed to be just 54% for the full year. Now it expects 54.5% GPM for 2021. FORWARD gross margin actually rose roughly 600 basis points year over year.

c. Balance Sheet

$222 million in cash on hand

$0 debt

Wonderfully clean.

d. Co-CEO Mike Karanikolas Conference Call Notes

“We are thrilled with the early returns of our heavy marketing and brand-building investment initiatives.”

Karanikolas general notes:

Traffic is well above pre-pandemic levels with higher conversion rates as well.

A majority of newly added customers are buying from both REVOLVE and FORWARD.

FORWARD segment growth is handsomely outpacing the luxury fashion segment as a whole.

Cross-selling activity between REVOLVE and FWRD continues to grow “every month” yet the overlap remains in the “very low percentage” range pointing to a long runway. It was 5% as of last quarter yes that 5% already translated into 10% of FRWD’s total sales.

The company is seeing 0 impact from Apple’s IDFA changes.

Karanikolas on supply chain issues:

Supply chain impacts like lower on-time delivery rates and rising freight costs have been prevalent but manageable. REVOLVE’s high-end goods paired with low discounting activity helps offset this issues. This is massive considering how many companies have blamed poor results on supply chain issues. Net promoter score (NPS) continued to rise during the year regardless of some delayed shipments.

e. Co-CEO Michael Mente Conference Call Notes

On Kendall Jenner’s Impact:

Kendall Jenner (new FORWARD creative director with nearly 200 million social media followers) hosted several events during New York’s fashion week. A video following her around New York for a look inside her day as the new creative director got 5 million views. She’s an icon… and now an icon working for REVOLVE.

The announcement to hire her led to a spike in FORWARD traffic that has not yet normalized with downloads of the app more than doubling year over year last month and social media followers 10Xing.

f. CFO Jesse Timmermans Conference Call Notes

“Strong top line trends continued through the month of October with the growth rate broadly in the range of our 3rd quarter growth rate.

Revolve now expects a 54.5% gross profit margin for 2021 vs. 54% last quarter and 53.5-54% 2 quarters ago.

The company continues to expect run rate growth of 20-25% and 14% EBITDA margins.

g. My Take

Fantastic quarter. The company is admirably managing supply chain issues better than most have been able to and is finding its recovering marketing spend met with exceedingly strong demand. Margins continue to remain elevated with its data-driven approach to inventory. I’ve said it before and I’ll say it again: hiring Jenner as the new creative director for FORWARD was nothing short of monumental for the company’s future. Great job, REVOLVE.

3. Penn National Gaming (PENN) — Earnings Review

“What really sets Penn Interactive (its online business) apart from the competition is our strategy to buy and build — whether it's brands, experiences, loyal customers, products, tech stack — versus the renting of eyeballs via aggressive traditional marketing tactics. We expect that this approach is the right long-term strategy and will result in a best-in-class margin profile and loyalty and retention.” — CEO Jay Snowden

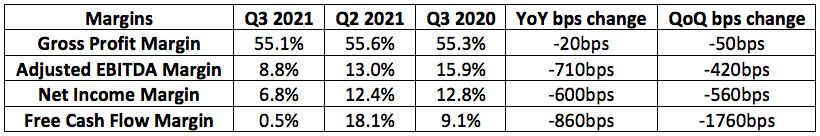

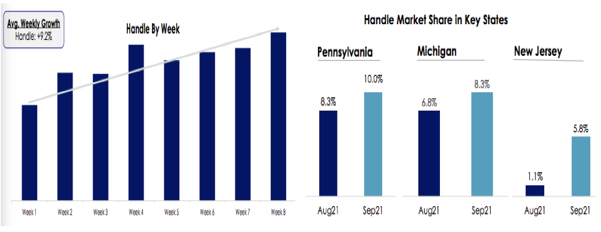

a. Key Metrics

Expectations for Penn’s results were as follows:

Penn was expected to generate $1.51 billion in sales. Results were in-line.

Penn was expected to earn $0.89 per share and earned $0.52. This missed expectations by 41.6%.

EBITDA took a $30 million (or 0.85%) hit due to the Delta variant and Hurricane Ida. The company is seeing demand trends normalize into this quarter. That paired with recovering operational spend, M&A and Barstool product launches all led to the margin decreases. Margins largely improved vs. the pre-pandemic period.

b. Balance sheet

Lease-adjusted net leverage down to 3.9X vs. 4.0X sequentially (despite the M&A).

$2.73 billion in cash with $3.4 billion in total liquidity.

$2.77 billion in total traditional debt.

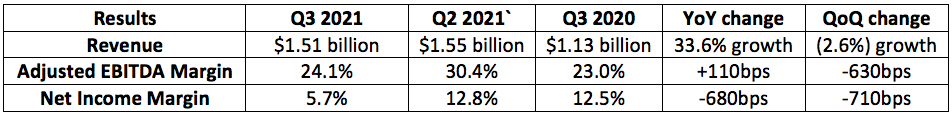

c. Barstool Updates

“Overall, Barstool is benefitting from increased scale and driving higher handle and revenue market share across the board while remaining disciplined with our marketing spend.” — CEO Jay Snowden

This improvement taking place in more mature states such as Michigan and Pennsylvania hints at Barstool and Penn being in an ideal position to capture incremental share as larger promotional spend from competitors slows down over time.

General performance notes on Barstool and Score Media:

Barstool Sportsbook app was launched in 6 new states during the quarter bringing its footprint to 10 states overall.

MAUs have 6Xed year over year.

Customer acquisition cost has remained below $100.

Early gambler retention data from its original users is “very encouraging.”

Average age of users of the sportsbook is 28.5 years old — younger than any other competitor.

The Score Media acquisition closed which will integrate with the Barstool sportsbook app to create a “one stop shop” for sports betters.

Score is the number 1 sports app in Canada and number 3 in the USA

Ontario is set to launch sports wagering early next year and was originally set to launch in December. This delay was a demand headwind.

50% the sportsbook app users bet with Barstool exclusives.

Barstool Sportsbook is tied for the highest-rated sports betting app in North American with a 4.8 star rating with 13,000 reviews.

Barstool has now signed 135,000 collegiate athletes since the NCAA changed compensation rules.

One Bite pizza launched in Walmart with “sales exceeding expectations”

“One of the highest selling frozen food products at Walmart”

The first 2 Barstool-branded sports bars will open in Philly and Chicago in the coming months.

The Barstool Block party in Illinois brought in 10,000 new customers — they were expecting around 1,000.

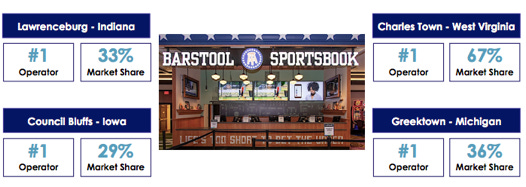

Barstool retail rebrands are thriving:

The interactive segment (including Barstool and Score Media) is projected to lose $20 million next quarter. The sportsbook is far closer to breakeven than the competition. Penn Interactive is still expected to lose roughly $80 million next year due to investments in vertically integrating the tech stack with The Score.

d. Legacy business updates

General notes:

Penn’s VIP gambler segment is 33% larger than it was pre-pandemic.

Penn’s brick and mortar consumer base is getting younger thanks to the Barstool-branded retail sportsbook concepts.

e. My Take

This was an average quarter for Penn National Gaming. The company was likely prepping for a revenue beat before the macro-factors I mentioned hit their business and it’s encouraging to see demand already normalize as of last month.

The best part of the report was seeing Barstool Sportsbook handle rise in the largest states that it operates in. This — along with all of the other projects it’s working on — will be key to long term growth for the combined entity.

The large sell-off this week is more related to the hit piece published on Dave Portnoy. The piece made some pretty disgusting allegations but was grossly inaccurate (at least according to Portnoy). The video he responded with offered actual text exchanges featuring real, contradictory evidence — but the article was still published and some will still assume he’s guilty regardless of any tangible evidence. As a Penn shareholder, we have to accept that Portnoy fetches a great deal of attention and that will not always be positive. I added to my stake this week.

Click here or here for some of my broad coverage of Penn’s business.

4. JFrog (FROG) — Earnings Review

a. Demand

“Team JFrog, you delivered a strong quarter which exceeded our commitments to the market. This success belongs to you.” — Founder/CEO Shlomi Ben Haim

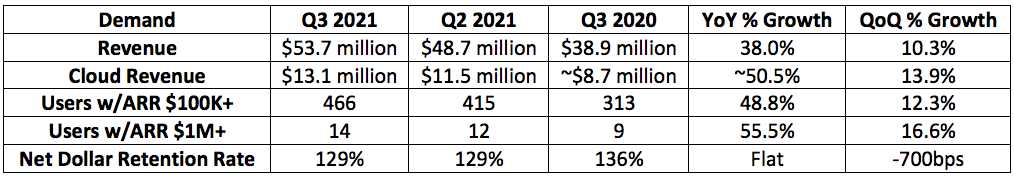

JFrog guided to $52-$53 million in revenue. It posted $53.7 million beating expectations by 2.3% at the midpoint.

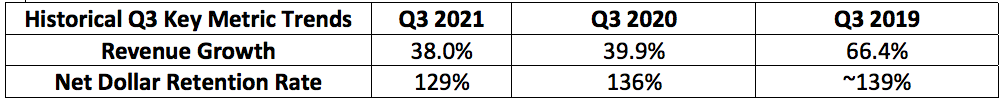

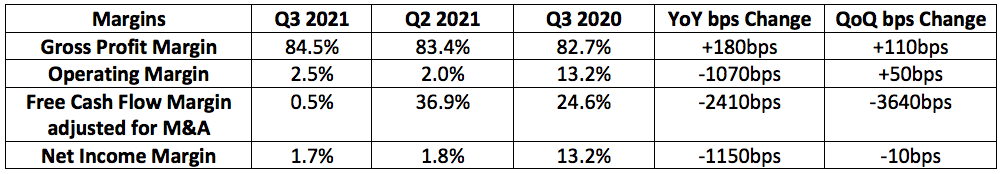

Cloud revenue growth accelerated from 47% YoY growth to 50% YoY growth from last quarter to this one. Revenue growth as a whole similarly accelerated from 33.8% to 38.0%. Sequential growth meaningfully accelerated from 7.9% to 10.3% from last quarter to this quarter.

Accelerating large customer growth is due to the investments it has made in its sales team to broaden the awareness for its offering.

JFrog guided to:

Non-GAAP operating loss of $2.6-$3.6 million. It actually earned $1.3 million thanks to lofty demand.

Non-GAAP loss per share of between 3 & 4 cents. It ended up earning $0.01 per share.

c. Guidance Updates

JFrog expects $57.5-$58.5 million in revenue next quarter vs. analyst expectations of $57.5 million.

d. CEO Shlomi Ben Haim Conference Call Notes

On M&A Success and Customer Wins:

Its most recent acquisition — Upswift — has already led to the 2nd largest car maker in Europe partnering with both JFrog and Upswift. The new client plans to “use Upswift in the future more and more to monitor fleets.”

A brief summary of Upswift can be found here.

Its other acquisition — Vdoo — continues to accelerate JFrog Xray cross-selling activity with Vdoo’s security intelligence know-how tools used in roughly 200 public software repositories. Vdoo led to JFrog signing the largest industrial automation company in North America during the quarter. Vdoo also enabled JFrog to uncover a vulnerability in 23andMe’s data storage and operations during the quarter

“Highly publicized findings like this one [with Vdoo] are only the beginning… this amplifies our position as thought leaders in the security community.” — Ben Haim

A brief summary of Vdoo can be found here.

JFrog displaced 2 vendors to win over one of the world’s largest consulting firms during the quarter. JFrog will now run and facilitate its software repository and software security solutions.

On new products:

JFrog launched its Architect Storage (cold storage product) module during the quarter. This makes long term storage of software packages far easier and drives down cold storage costs. it also helps facilitate easier regulatory compliance for industries with file maintenance requirements. The National Australia Bank is already a client.

JFrog extended open source integrations for its developer community with observability and collaboration organizations. This follows its philosophy of focus on what you do best and partner with the best for the rest. Integrations like this prompted one of the world’s largest retailers to migrate more of their software processes to JFrog with a 200% net revenue retention rate here in 2021. It also helped pave the way for its new SoftBank partnership to extend further into Japan.

On Public Sector Ambitions:

The company is pursuing a FedRAMP certification to broaden its public sector opportunity. It previously announced its Iron Bank certification for the public sector. When Shlomi was asked what differentiates JFrog from other public cloud vendors, he highlighted the 30 different technologies that it integrates with (more than the competition) and a more seamless ability to scale the development, management and security of packages.

He also highlighted that “all of the other cloud repositories are just container registries supporting old docker images… JFrog supports everything you have around software and binaries.”

On the competitive environment:

“Our tools coexist one next to the other to support our customers. When we look at the customer specific names, we have customers using JFrog’s [complete] enterprise platform together with other tools to fulfill their DevOps initiatives.”

e. CFO Jacob Shulman Conference Call Notes

General notes:

Cloud is now 24% of total revenue which is stable sequentially.

JFrog’s margins (aside from gross) were supposed to be negative this quarter. Positive operating/cash flow/net income margins came from stronger than expected demand and better than expected synergies from the M&A.

The company expects net dollar retention to remain around 130%.

This quarter marked the largest sequential increase of customers with more than $100,000 in annual recurring revenue (ARR) in the company’s history.

This is partially due to enterprise + adoption coming with minimum spend of $115,000.

R&D spend rose from 23% of revenue to 30% year over year.

R&D spend is my favorite kind of cost as it depicts companies exploring new ways to bolster and expand their operations.

This large customer growth has been driven by adoption of higher subscription tiers.

34% of its revenue now comes from enterprise plus subscribers (comes with the full product suite) vs. just 19% year over year.

f. My take

This was JFrog’s best quarter as a public company to date. Stronger than expected demand is my favorite cause for better than expected margins — that’s what JFrog delivered. Integration of its Vdoo and Upswift appears to be going very well and gross profit margin expanding from its already lofty and elite level is another notable positive. As Shlomi likes to say, “may the frog be with you.” Great job JFrog.

Click here for my broad overview of JFrog’s business.

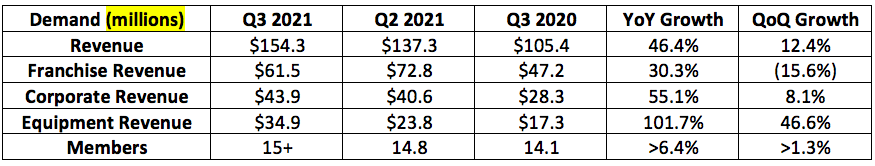

5. Planet Fitness (PLNT) — Earnings Review

a. Demand

“I hope you can feel the enthusiasm as I truly believe that we are on the verge of a fitness boom.”— CEO Chris Rondeau

Planet Fitness was expected to generate $135.2 million in revenue. It posted $154.3 million which beat expectations by 14.1%.

Notes on demand:

The company returned to organization-wide same store sales growth with brisk 7.2% growth.

Posted the highest sequential net member growth of any 3rd quarter for the company. Sequential growth always declines from the second quarter to the third — that did not happen this year.

Franchisee revenue is now above pre-pandemic levels.

24 new stores were opened in the quarter to reach 2,193 stores in total.

No stores closed during the pandemic despite 22% of all fitness/health clubs permanently closing.

Membership back to 97% of all-time-highs.

Usage for new members is above pre-pandemic levels.

40% of its paid app users that aren’t members are signing up for new brick and mortar memberships.

60% of its 15 million members are now using one of its apps

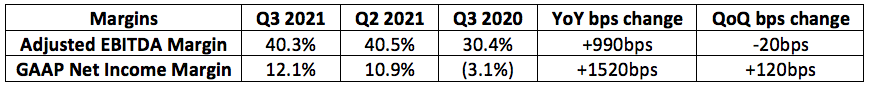

b. Profitability

Planet Fitness was expected to earn $0.18 per share. It earned $0.25 beating expectations by $0.07.

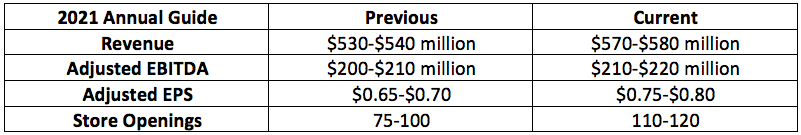

c. Guidance

The favorable real estate environment for franchisees and strong demand is what prompted Planet Fitness to raise its guidance so aggressively across the board. 2022 guidance will be provided next quarter.

d. CEO Chris Rondeau Conference Call Notes

The company will complete its consolidation from 16 different local and national marketing agencies to just one servicing the entire organization. This should boost the consistency of the company’s messaging and the efficacy/ROI thanks to the more centralized database.

e. CFO Tom Fitzgerald Conference Call Notes

“We’ve been confident in our ability to come out of the pandemic even stronger, but the pace of the rebound is even faster than we expected.”

f. My Take

Fantastic quarter for Planet Fitness. The company has endured the toughest of times and leaned on its lowest cost, lightest-asset, highest profit approach to survive. Now that its survival is all but imminent, it’s time to thrive. I said in March of this year that I felt Planet Fitness was a better long term investment than Peloton. While I was laughed at back then, this does seem to be the case.

6. CrowdStrike (CRWD) — M&A, Efficacy and Google Cloud Progress

CrowdStrike announced its intent to purchase SecureCircle in an all cash transaction with the amount not yet disclosed. SecureCircle was founded in 2016 and calls companies like ForeScout, Avalon Healthcare and Inspirage customers to name just a few.

This purchase is aimed to expand CrowdStrike’s zero trust capabilities that it had already been building (with the help of previous the Preempt acquisition). Now these capabilities will extend all the way to the endpoint device (as well as the rest of the security stack).

The combination will allow for a more granular approach to zero trust identity security thanks to superior data protection vs. what CrowdStrike can currently provide. The remote workforces our world is evolving towards make these capabilities all the more vital.

“By joining forces and leveraging SecureCircle’s innovative capabilities, CrowdStrike plans to solve a complex problem vexing all organization: data protection. — Press Release

This further opens CrowdStrike up to the $3 billion spent in data loss prevention (DLP) in 2021. DLP solutions merely encrypt data as it leaves the endpoint and is triggered by a fixed workflow pattern leaving no room for discretion or flexibility — this is the main reason behind the shortcomings of substitutes; hackers are fully aware of this shortcoming and exploit is frequently.

The 2 companies together will establish several encryption layers for each data point’s life cycle and journey through the cloud. Highlighted use cases on the SecureCircle website specifically include source code security, IP protection and of course Zero Trust.

“Despite the critical need for data protection to be part of any security strategy today, legacy data loss prevention tools fail to rise to the challenge. ” — CrowdStrike CTO Michael Sentonas

“CrowdStrike will set a new standard for endpoint-based data protection by connecting Zero Trust enforcement to the device, user identity and data.” — CrowdStrike Founder/CEO George Kurtz

In other CrowdStrike news, AV-Comparatives’ 3rd party testing reported that CrowdStrike reached 99.7% success in its “real-world protection test” with zero false positive. It also was named the best malware protector last month by AV-Comparatives. As a reminder, one of security teams’ main issues is being overwhelmed with false positives and thus distracted from actual breaches with higher costs incurred. This is a good sign of CrowdStrike further fixing this challenge.

Finally, CrowdStrike’s Falcon Horizon product announced new support and integrations with Google Cloud during the week. It now directly integrates its cloud security posture management (CSPM) into all 3 major clouds.

7. Nanox (NNOX) — Zebra Medical Vision Name Change

There was some skepticism as to whether the Nanox deal to purchase Zebra Medical Vision would actually close. With Zebra changing its name to “Nanox AI” this week I think it’s safe to say it will indeed close.

Zebra comes with 8 FDA-cleared patents covering various use cases of artificial intelligence (AI) modules aiding the diagnostic process for radiologists. With a global radiologist shortage this is key to enabling our doctors to do more with less. The deal adds to Nanox’s regulatory credibility while also giving it a larger piece of the estimated $40 charged per scan globally — it had been planning to pay AI partners like Zebra a fraction of that fee.

Zebra already calls bellwethers like Johnson & Johnson, NHS and the University of Oxford clients along with several other formidable brands in healthcare. This should provide an immediate revenue stream for Nanox which is still pre-revenue as it works to multi-source clearance and Xray tube licensing deals. I’m encouraged to see an established company like Zebra willing to sell itself to Nanox. Clearly they don’t think it’s fraudulent, and neither do I.

Click here for my broad overview of Nanox.

8. The Trade Desk (TTD) — UID2 Case Study

The Trade Desk published a case study on the impact its UID2 is having on the brand: “Made In”. Made In is 3 years old and sells equipment to world-class restaurants.

Here were the highlights:

20% cost per action improvement.

33% faster user conversion.

22% higher user conversion

“In a world where privacy is the ultimate focus, UID2 feels clean.” — Made In CEO

Click here for my deep dive into The Trade Desk’s business.

9. Lemonade (LMND) — Car Launch

Lemonade officially launched its car insurance product in Illinois. It will next launch in Tennessee and to more states thereafter as quickly as regulatory approvals allow. This launch greatly enhances Lemonade’s bundling ability as Co-CEO Daniel Schreiber recently described offering home insurance without auto as “operating with one hand tied behind our back.” That tie has now been cut.

Lemonade’s car product measures driver frequency and safety using telematics (essentially leveraging the sensors in your smartphone). This approach will also give it 24/7 roadside assistance with “real time crash detection and dispatch services.”

“This will use technology in a way that the industry doesn’t today to get much fairer prices reflective of driving in a way that incumbents like Geico and Progressive have struggled to do.” — Co-CEO Daniel Schreiber

When Warren Buffett was asked about telematics and Geico at his last shareholder meeting, his comments were that “Geico entirely missed the bus.” Insurance companies are hesitant to deploy this technology as — according to Schreiber — it would reveal that 2 in 3 users are paying too much in premiums. For the 1 in 3 users paying too little, it’s a tough sell to quickly raise their rates to off-set the lower premiums — retention would surely take a hit.

Interestingly, environmentally friendly cars will be rewarded with lower rates. Lemonade even plans to calculate the carbon footprint from the cars within its plans and to plant trees to offset these emissions. That makes for quite good press.

Just like other Lemonade products, claims can be filed in minutes with its insurance operating system (Blender) able to handle claims more expediently (with human support when requested). This automation fosters lower costs that Lemonade seems to be passing on to its consumers: A friend of mine received a $49/month rate (half of his current premium) when requesting a quote in Illinois. I’ll be requesting a quote as soon as it debuts in Michigan. Lemonade hasn’t specifically told us if it plans to compete on price here like it does with renters but this example points to that being the case.

“Providing a best-in-class car claims experience means being there for your customers 100% of the time with fast service and empathy.” — Co-CEO Shai Wininger

Lemonade has had more of its team members working on this product for the last 12+ months than any existing branch of its operations. It will be fascinating to see what kind of traction this can enjoy in a fiercely competitive space. Car insurance revenue is not part of Lemonade’s forward looking guidance at this time which could lead to positive revenue revisions if the product succeeds like all of its others have so far.

Click here for my broad overview of Lemonade.

10. Olo (OLO) — Uber Good News

Olo announced that Uber Direct (its on-demand commerce delivery solution) has been integrated into Olo’s delivery model Dispatch. Uber partnered with Olo in 2019 to integrate its Uber Eats platform into Olo’s channel management module Rails — this marks a deepening of that relationship.

The partnership also points to a more formal entrance into the billion dollar alcohol delivery industry for Olo. This space is growing at a rapid compounded clip of 24% through 2024 to reach nearly $2 billion. CEO Noah Glass has frequently reiterated that Olo is not solely a food business but an on-demand commerce business. That sentiment becomes more accurate every day.

“We are excited to work more closely with Olo as we expand our footprint and serve new use cases.” — Head of Uber Direct Pooja Daftary

Click here for my Olo deep dive.

11. SoFi Technologies (SOFI) — A Differentiator

SoFi was able to secure 0.5% of the immensely popular upcoming Rivian IPO to offer to shareholders on a pre-listing basis. Interestingly, Robinhood — which offers a similar product — was not able to claim any portion of the deal. This could be a nice short-term driver of user growth for SoFi as it allows them to stand out in a largely commoditized space.

Click here for my broad overview of SoFi’s business (podcast form).

12. Workplace Culture Hints

Inc. published its 1st annual list of the 250 best-led companies. My following holdings made the list:

CrowdStrike (ranked 4th)

JFrog

Duolingo

Cresco Labs

Lemonade

Progyny

REVOLVE

Ayr Wellness

13. Cannabis News

a. Industry News:

Republicans are working on a bill to federally legalize cannabis as a substitute for previous attempts from democrats like the MORE Act. It’s called the States Reform Act.

The bill seems to be a compelling compromise that would grandfather state operators into the new federal system.

8 lawmakers proposed a law to legalize medical cannabis for veterans.

People in Arkansas have filed medical cannabis reform that will ideally end up on the 2022 state ballot.

Gallup released a new poll showing 68% of Americans support cannabis legalization. This stood at 33% at the turn of the century.

Voters in Philadelphia voted in favor of a referendum to put state-wide legalization on its next ballot.

b. Position-Specific News:

Ayr Wellness expanded its senior secured credit facility during the week. It added $150 million to this facility at an interest rate of 12.5%. The notes mature in 2024 and the funds will be used to support company growth.

14. My Activity

I added to Penn National Gaming after its earnings report this week.

This is why I enjoy my Saturday morning. Thank you🙏