This piece is powered by my friends at Savvy Trader:

Welcome to the 342 new readers who have joined us this week. We’re thrilled to have each & every one of you & determined to provide as much free value as possible.

1. Lemonade (LMND) — Investor Day

Please note that the Lemonade team is quite charismatic. Some of these bold claims spoken about below should be taken with a grain of salt. I’m not at all saying they’re being dishonest, I’m just saying that they’re an excited bunch with every incentive to talk up the value proposition of their own company. Keep it in mind throughout this section.

CEO Daniel Schreiber on the Progression of AI:

CEO Daniel Schreiber took us through the progression of AI and how it relates to Lemonade’s tech stack. The field began with a requirement to feed data into an algorithm and to explicitly tell it what to do with it. Today, Generative AI allows for these AI models to self-train and learn things that “nobody even taught them existed.” This generative AI involves intricate neural networks of data sets and connections intimately working hand in hand with one another. If any of those pieces are disparate, none of it will work in an ideal fashion – just like the human brain.

This is why Lemonade thinks it can win: Incumbent insurance competitors are made up of countless disparate data silos and manual processes. Lemonade has entirely avoided this by building its insurance company from the ground up in this generative AI vision.

“It’s not the amount of data that matters, but the interconnectedness of it all… that’s where traditional insurers falter. They have systems pieced together via acquisitions and decades. Their data lakes are a mile wide but just an inch deep.” – Co-Founder/CEO Daniel Schreiber

Schreiber offered us a tangible example of its customer lifetime value (LTV) home insurance model to show how much better its algorithms have gotten just since 2020. These LTV models 2 years ago offered vague recommendations at the zip code level without nearly enough data on most states to offer any estimates at all. Today, that estimate is done at the single address level with Lemonade able to granularly decipher which individual household is actually worth pursuing. These LTV models now direct 86% of Lemonade’s total marketing spend.

“USAA is best in class, but I can say without hesitation that the tools we’re deploying at Lemonade are simply unmatched in the industry. I don’t see a scenario where incumbents will be able to get here from where they are today. It’s a true structural advantage, and we’re just getting started.” – Lemonade Chief Claims Officer & former USAA Chief Claims Officer Sean Burgess

Some examples of How Lemonade’s Technology Manifests in Operational Advantages:

- Customer Delight via using its AI models to automate & expedite manual application & claims processes. Lemonade’s Net Promoter Score (NPS) and Better Business Bureau ratings are in line with Apple and Tesla. No other insurer comes close here.

- JD Power ranked Lemonade #1 for customer service.

- Forbes named it America’s Best Insurance for 2023.

- U.S. News named it the #1 Best Homeowners Insurance for 2022.

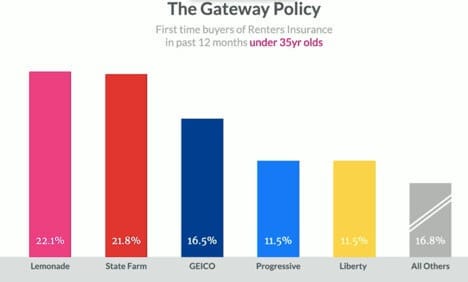

As a reminder, Lemonade’s business model closely relies on this customer delight much more than the competition. Why? Because it uses renters insurance as its main customer acquisition vehicle. Premiums within renters are TINY. So, Lemonade must elate its customers and give them absolutely no reason to leave. That’s the only way it will retain these customers as they graduate to higher value plans (which is also when competition begins to want them more).

- Its internal AI Bot called “Cooper” automates and runs mundane engineering and code writing tasks to save its developer team an estimated 10,000 hours annually. This makes Lemonade inherently more lean and nimble than others in the space.

- Its AI Bot called “Jim” (handles claims) is able to handle first notice of losses at a 98% rate. It can take care of all aspects of an individual claim at a 45% rate with better accuracy and speed than a human agent. This allows Lemonade’s claims team to be quite small relative to its own book vs. competition… and again gives it an efficiency edge.

- Its AI “Maya” Bot sells 98% of Lemonade policies which means no perpetual agent commission. Incumbents sell 95% of their policies through agents fetching a mean commission premium of 15%. Lemonade cuts this inefficiency out of the system.

- Generally speaking, constant upgrades and new layers of automation have helped Lemonade’s % of premiums going to handle claims fall from 36% in Q4 2020 to what is expected to be under 10% next quarter.

- It does this via initiatives like building models to automate the review of 60+ page inspection reports to free underwriting associates to work elsewhere.

On Why this Advantage is Still Coinciding with High Cash Burn & Loss Ratios:

Lemonade disclosed its updated lifetime loss ratio for new business written last quarter. This has fallen from 79.1% to 60.6% YoY. BUT, this is not yet showing up in its bloated gross loss ratio for a few reasons:

- Gross loss ratios (GLRs) peak during year 1 of a customer’s policy and improve from there. These GLRs fall below predicted lifetime loss ratios typically between year 2 and 3. Because such a large portion of Lemonade’s book is new business, a large chunk of its business is still year 1 customers with peaking loss ratios.

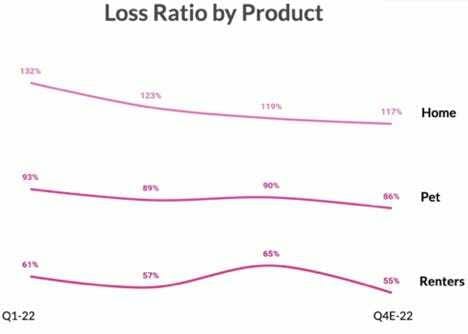

- It continues to launch new products and new geographies rapidly. Like new customers, loss ratios in new countries and with new product lines peak right at the beginning. Loss ratios by individual product continue to improve consistently:

- Finally, only 4.5% of Lemonade’s rate change filings in the wake of rampant inflation have been implemented with existing policies. Inflation raises claim values immediately, but not premiums until these filings can be implemented. This is hitting all product line loss ratios today, but especially home insurance where the regulatory process takes a bit longer.

Lemonade also explained (again) why its margins are so poor if it’s supposedly so good at underwriting:

It built out all of the tech, regulatory licensing, underwriting capabilities and full vertical integration from scratch and up-front. Costs were severely front-loaded while the business was much smaller than it is today.

So when combining this with underwriting models that still need some seasoning, margins have stunk… a lot. But the good news is that Lemonade’s dollar losses have now peaked while the business will continue to rapidly grow. So margin expansion is coming with the bulk of these costs now having been incurred. Some small evidence of this began to pop up last quarter as its expense ratio fell from 103% of premiums to 80% YoY (yes I know there’s a long, long way to go here).

“We are on a path to having a fabulous expense ratio, it’s just going to take the business time to grow into all of what we’ve built.” – Co-Founder/CEO Daniel Schreiber

You may be rightfully wondering how a young company that has never been close to profitable knows its losses have peaked? It’s a fair question. But it’s also good to keep in mind Lemonade’s peak loss performance this past quarter was guided to not a few months ago, but a few years ago. This company has been impressively precise in terms of its loss schedule. Those losses are just bloated because of the paragraph above.

On Market Share per a Google Survey – Lemonade has now taken a market share lead of first-time renters under the age of 35. While this is only step one of getting customers in the door, delighting them and thus motivating them to buy higher value home policies, it’s still a CLEAR sign that the model is working. That retention also seems to be going well with more than 22% of Lemonade home policy holders being former renters vs. 11% at its 2020 IPO (and 33% of pet policies vs. 0% at the IPO). Cross-sold policies mean more LTV and no added customer acquisition cost (CAC).

On Cross-Selling Progress:

Lemonade is now up to 3.7% of users with multi-line plans. Encouragingly in Illinois, where it has had a car product for the longest, that rate is 5.9%. Car is the peanut butter to home’s jelly when it comes to insurance bundles. Lemonade finally will be able to offer both pieces of that bundle in all 50 states as its new Lemonade Car product expeditiously rolls out thanks to the Metromile acquisition.

On Product Stat Disclosures:

Renters:

- $223M in premiums & 9% total market share.

- 3.15X LTV/CAC ratio; 65% Q3 2022 loss ratio.

- Procured $42 million in cross sale premiums vs. $36M QoQ & $22M YoY.

Pet:

- $110M in premiums (up over 100% YoY).

- 3.8X LTV/CAC.

- The strong ratio here is thanks to the innate frequency (and low severity) of pet claims. This seasons the underwriting model far more quickly than for a product line like home.

Home:

- $149M in premiums.

- 1.6X LTV/CAC; 119% Q3 2022 loss ratio.

- Unlike Pet, Home claims are infrequent. It will take longer for Lemonade’s underwriting here to be good enough.

- Still, there is some progress coming with new customer cohort predicted home loss ratios of 81% in October vs. 93% just 6 months ago. Continued implementation of rate change filings is expected to drop that 81% metric further going forward.

“We are confident that home loss ratio improvements will start to show in the next few quarters.” – Chief Business Officer Maya Proser

Car – 300,000 customers are now on the waitlist. This will slowly roll out to more states throughout 2023.

Life – Lemonade continues to allocate resources elsewhere as it doesn’t feel comfortable enough in its ability to write life policies in this environment.

On 5 Year Scenarios – CFO Tim Bixby laid out the following paths to profitability and reiterated no cash raises until turning profitable:

Please keep in mind that all of the growth assumptions provided by leadership assume the current challenging environment and intentional growth slowdown (via mightily pulling back on OpEx growth) lasts for the next 5 years. I’d call that pretty darn pessimistic, but let’s roll with it.

- Scenario 1:

- 20% 5-Year premiums CAGR.

- 70% gross loss ratio.

- 25% of customers are multi-line.

- Profitable in 2026 with a minimum unrestricted cash balance of $100M.

- Scenario 2:

- 20% 5-year premiums CAGR.

- 65% gross loss ratio.

- 35% of customers are multi-line

- Profitable in 2025 with a minimum unrestricted cash balance of $175M.

“In this case, we would likely accelerate growth beyond the 20% with our additional cash cushion.” — CFO Tim Bixby

- Scenario 3 — overly pessimistic:

- 20% 5-year premiums CAGR.

- 78% gross loss ratio.

- 20% of customers are multi-line.

- This would burn through its cash balance before turning profitable. In this scenario, Lemonade would pull back on spend to an estimated 12% 5-year premiums CAGR to get to profitability in 2026 with a minimum $100M unrestricted cash balance.

“The takeaway to leave you with is that we have ample capital to control our destiny because of what we’ve done to quickly raise capital when the market was conducive.” – CFO Tim Bixby

My Take:

To be candid, I was very close to selling Lemonade earlier in the year. But management has shown a maturity and market sympathy that has been pleasantly surprising to me. They’re doing what they need to do to avoid costly near term dilution, and they continue to take more and more market share while showing clear signs of underwriting improvements. This was a strong showing with a lot to be encouraged by.

2. SoFi Technologies (SOFI) – CEO Anthony Noto Interviews with Citi

On the loan book:

“We’ve been able to manage our unsecured personal life of loan losses below 8% since 2018. We’re below that still today… we expect it to normalize up to that level… if we get into a tough recession next year with our forecasts of (1%)-(3%) GDP we think we can still operate well.”

- Noto sees “a few hundred billion” in outstanding loans that a SoFi student refi can create material savings for. He still thinks the moratorium ending January 1st is an if and not a guarantee... But if it does end, there should be a large volume ramp of refinancers next month.

- SoFi’s personal loan market share for 680+ FICO users rose from 4.5% in 2021 to 6% this year.

- Noto continued to complain about back-end partners for its home loan purchase business and their funding delays. He hinted at wanting to own the back-end and exploring smaller acquisition targets. He sees 2023 as a year of “rebuilding” the product.

On 2023:

“As we go into 2023, we couldn’t be more optimistic about our position in the market and the opportunities ahead. Whether the moratorium continues to be extended or not, we’re going to have really strong growth if we’re in an economy that’s what we expect which is more dour than today but not overly dour.”

- Noto expects a 30% incremental EBITDA margin and 35%+ revenue growth (for the next several years) in 2023.

- SoFi is debuting more products like SoFi Travel to turn its app into a daily destination. This product offers direct deposit customers material discounts and other perks like rewards points for booking travel plans.

On the Technology platform:

- Noto continues to expect the same synergies estimated at the time of the Technisys deal closing.

- Noto sees SoFi as being in a “pole position” to win the largest banks in the world as clients thanks to the combination of Technisys and Galileo. He thinks it’s just a “matter of when they decide to make that transition.”

- Noto alluded to using the tech platform to expand into small/medium business (SMB) banking eventually.

In other news, the Biden Administration has formally asked the Supreme Court to allow their student loan forgiveness program to continue. I’ve said it before and I’ll say it again: Getting officially past this blip is the most important thing. 86% of federal student loan balances outstanding becoming immediately more incentivized to seek refinancing is more important than if the remaining 14% is forgiven.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.