News of the Week (November 21 - 25)

SoFi; Shopify; Lululemon; Revolve; Olo; Cannabis; Macro; My Activity

This piece is powered by my friends at Savvy Trader:

Welcome to the 323 new readers who have joined us this week. We’re thrilled to have each & every one of you & determined to provide as much free value as possible.

1. SoFi Technologies (SOFI) – Crypto and Student Loans

a) Crypto

4 members of the Senate Banking Committee this week requested information from SoFi pertaining to its cryptocurrency practices. Following a string of liquidations and high profile chapter 11s in the digital currency space (which the letter explicitly cited as a reason for the concern), this is not all that surprising. It’s also not concerning to me for the following reasons:

Since Anthony Noto was named CEO in 2018, there has been 0 regulatory drama for this firm. Considering it listed as a SPAC during the height of that craze, this matters. That’s why the company was able to secure a bank charter (January 2021) amid all of the regulatory and bureaucratic headaches. Noto runs a tight ship.

The company immediately responded to this inquiry telling investors it has played entirely by the rules here.

TOTAL brokerage fees equate to less than 1% of SoFi’s revenue. Crypto brokerage fees are just one small piece of that tiny revenue contributor.

SoFi has never had any relation to FTX or other bad actors in the space. Coinbase is its crypto custodian.

I think this will turn out to be irrelevant noise.

“We maintain consistent, constructive dialogue with each of our regulators… We look forward to sharing the requested information with the Senators in a timely fashion.” — SoFi Response

b) Student Loans

Once again, the Biden Administration has announced an extension of the “pandemic era” student loan moratorium through June 2023. The President wants the Supreme Court to review his loan forgiveness policy that was blocked by lower federal courts and this was his move to force that action.

SoFi had been gearing up to finally have all of its business segments enjoying a normal exogenous backdrop in 2023 for the first time in 4 years. It was prepping for a large ramp in December student loan refinance demand in anticipation of the moratorium ending. Now, that will not be the case.

This is undeniably an annoying headwind, but it’s not all gloom and doom for us SoFi shareholders. Why? Two years ago, when the moratorium was first implemented, student loan refi was an astronomically more important part for SoFi’s success than it is today. It didn’t have rapidly proliferating personal loan or technology platform businesses to weather the initial blow. And REGARDLESS, it still met its original 2021 guidance despite this unforeseen obstacle, it still grew rapidly, and it still expanded key margins.

Today, overcoming the same headwind will be easier for the company simply because its operations are more diversified across product categories than in 2020. That’s why Noto was able to confidently tell us this month that SoFi would continue to grow revenue over 35% YoY with a 30%+ incremental EBITDA margin in 2023 even if the moratorium stayed in place. He considered the expiration an if, not a guarantee and had his team preparing for a world of continued extensions. Prepare for the worst, expect the best.

I expect SoFi’s 2023 results to show little evidence of student loan pain, and I expect student loans to turn back on at some point for yet another lucrative growth lever to pull. Student loan refi demand isn’t gone, it’s just trapped in a can being frustratingly kicked down the road. I’ll likely wait for this news to be digested by markets for a few more days, and then add to my stake.

It may sound like I’m cheerleading to some when I shouldn’t be. In response to that, I’d just like to reiterate how remarkably consistent and strong SoFi’s fundamental performance has been since going public: That is why I remain so bullish. If that continues, the stock price will eventually take care of itself. If fundamental performance deteriorates, I’ll be open, candid and prompt about it… as always.

2. Shopify (SHOP) – Black Friday Stats

Shopify released data this morning covering how Black Friday went for its merchant base. Results were quite strong:

Generated $3.36B in sales -- up 17% YoY & 19% constant currency

Peak sales volume reached $3.5M per minute vs. $3.1M YoY.

Cowen reported that Shopify’s peak sales volume only reached $2.1M per minute this year -- so this correction from Shopify was appreciated and encouraging.

Shopify’s point of sale product saw 27% YoY volume growth.

Average cart price rose slightly YoY — behind the rate of inflation.

15% of orders were cross border.

Adobe reported just ~4% YoY growth in online Black Friday sales & we’ve gotten several reports pointing to underwhelming brick & mortar sales as well. Considering these factors, the performance was reason for optimism.

It’s also good to see the company find more brick & mortar traction as it pushes deeper into that large piece of global commerce. Physical shopping has clearly come back with a vengeance (Walmart search volume re-surpassed Amazon’s yesterday for evidence), and it’s good to know Shopify continues to command a sizable chunk of that opportunity.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Lululemon Athletica (LULU) – Black Friday Channel Checks

According to Bloomberg News channel checks, Lululemon stores saw notably strong traffic during Black Friday with long lines and big crowds. The company -- as per usual -- conducted far less discounting than most of its peers, so it’s good to hear it still had comparatively strong store attendance.

4. Revolve Group (RVLV) – Needham Conference with Mike Karanikolas

On the market and share gain opportunity:

“The total addressable market (TAM) is huge at $300 billion in the U.S. and much more internationally. We’re less than 3% penetrated & we’ve been gaining more share from players like Nordstrom.” -- Co-Founder/Co-CEO Mike Karanikolas

On the Customer Niche:

While Revolve sells higher end gear, its consumer is quite average in terms of actual annual income. Specifically, its average household income per customer is $60,000. Per Karanikolas (just like others), Revolve is seeing more macro-related weakness from its less affluent customers vs. the wealthier ones.

A few months back, I offered the opinion that both Revolve and Lululemon would outperform consumer discretionary peers because of their affluent niches. That happened with Lulu, but I was wrong on Revolve. This is likely why. I’m still very excited to hold this company, but I wanted to point out my blunder.

On FWRD (Revolve’s other site that complements Revolve.com):

Revolve launched the FWRD Brand Ambassador program this past week. According to Karanikolas, Revolve’s influencers had been “begging them” to enable working with FWRD like they do in the Revolve Brand Ambassador program.

“I think this is going to be a smashing success.” – Co-Founder/Co-CEO Mike Karanikolas

Karanikolas reiterated that Revolve and FWRD continue to see shopper overlap grow each and every month. It’s pushing closer to 10% and leadership sees a clear path to that surpassing 50% over time. Every 1% rise is another $10 million in annual company revenue.

On the New Fashion Game Revolve is Developing with Muus Collective:

Revolve announced the development of a metaverse fashion game being developed in partnership with Muus Collective on its last earnings call. I really did not like this news as it felt like a clear distraction at a time when strong focus is all the more vital. Karanikolas assured us this week that virtually all of the expenses incurred to build the game will be from Muus, not Revolve. Revolve is merely lending its brand clout to the partnership with close to zero capital outlays and what Karanikolas sees as vast potential long term project upside. That made me like this development much, much more.

Other Interesting Notes:

Revolve is beginning to push into winter product categories for the first time.

Revolve is getting close to the scale needed to justify an international fulfillment center.

As Revolve leans on free returns and “allowing people to turn their homes into dressing rooms” as its value prop, this could help a lot with fulfillment/return costs.

The company isn’t feeling the need to match the currently intense promotional environment as Revolve shoppers don’t “come to the site looking for a deal.”

It also helps that most of Revolve 3rd party brands are emerging and not yet ubiquitous. This makes price comparison more difficult. FWRD doesn’t enjoy this edge as it mainly carries the biggest luxury brands.

The company is “pleased with inventory progress” and still thinks growth there will turn negative in the first half of next year. It’s dealing with gluts like everyone else.

Mike expects to stay profitable no matter how tough times get. He reminded us that he and Michael Mente founded the company with no external capital and remain the 2 largest shareholders.

I made an Instagram account where I’ve begun posting video content and some other material. You can follow along here.

5. Olo (OLO) – New Brand & an Accolade

a) New Brand

Olo announced Bakehouse 46 -- a small chain with 5 locations -- as its newest brand client. While this won’t be monumentally important to Olo’s near term results, the news is encouraging for a few reasons:

Bakehouse 46 is landing with 4 modules initially (vs. a tad over 2 on average) as Olo’s platform outside of core products gains more traction.

The deployment includes Olo’s new Olo Pay module.

This shows continued success for Olo expanding into the “emerging enterprise” segment (5-100 locations). Its bread & butter is larger enterprises, but this is a new focus and one that seems to be working.

Olo sees this type of client as ideal for location expansion and so revenue per client growth.

Bakehouse 46 continues to open new locations.

b) Accolade

Speaking of signs that Olo’s push to an end to end restaurant platform is working, Digiday crowned it with an award this week. According to this digital marketing company, Olo is the best Customer Data Platform (CDP) in its business.

One of the key value propositions Olo provides its clients is its ability to tear down data silos and allow an entire organization to work cross-channel in one, cohesive manner. But Olo goes even further than that by tapping into its 600+ enterprise clients to create a broader pool of relevant, lucrative data for every customer in the ecosystem to leverage. All of this unlocks capabilities like uncovering granular lifetime value (LTV) for each customer to truly understand where to best deploy marketing dollars. According to Digiday, Olo does this better than anyone else can.

This stock is broken. I continue to be excited about the long term prospects of the company, and the multiple is finally compelling.

6. Cannabis News

There’s supposedly a renewed sense of urgency to pass SAFE banking through congress before 2023 following midterm results. As a reminder, this would significantly reduce cost of capital and potentially effective tax rates for growers. The boost to earnings would be immediate and massive. Still, to be candid, I don’t have it in me to get the slightest bit excited until legislation actually passes. This is all meaningless political theatrics until then. All talk, no action. Do something.

Other News:

Nevada will soon conduct a lottery for cannabis consumption lounge licenses.

Iowa is attempting to allow cannabis growers to side-step 280E. This would allow for normal business expense deductions from tax bills at the state level (not federal).

Idaho voters are rounding up signatures to put medical cannabis on the 2024 ballot.

Data out of Pew research now shows that just 10% of Americans don’t support any cannabis legalization.

Rhode Island recreational cannabis sales will begin next week.

78% of voters in the conservative state of South Carolina support cannabis legalization in some capacity according to a Winthrop Poll.

New York moved ahead in its awarding of recreational cannabis dispensary licenses.

7. Macro

a) Key Data from the Week

Purchasing Managers Index (PMI) Data (anything under 50.0 means contraction):

Services PMI for November was 46.1 vs. 47.9 expected.

Manufacturing PMI for November was 47.6 vs. 50.0 expected.

Consumer Data:

The University of Michigan’s (UofM’s) Consumer Expectations reading was 55.6 vs. 52.7 expected.

UofM’s Consumer Sentiment Reading was 56.7 vs. 55 expected.

New Home Sales for October of 632,000 sharply beat 570,000 estimates.

Initial Jobless claims of 240,000 beat 225,000 person estimates.

Hewlett Packard is firing 6,000 people.

More Economic Data:

Core Durable and Durable Goods Orders beat expectations.

According to Freightos CEO Craig Fuller, the Southern California cargo ship backlog is now 0 vs. 109 at the beginning of the year. Supply chains are normalizing and the economy is cooling -- a significantly deflationary combo.

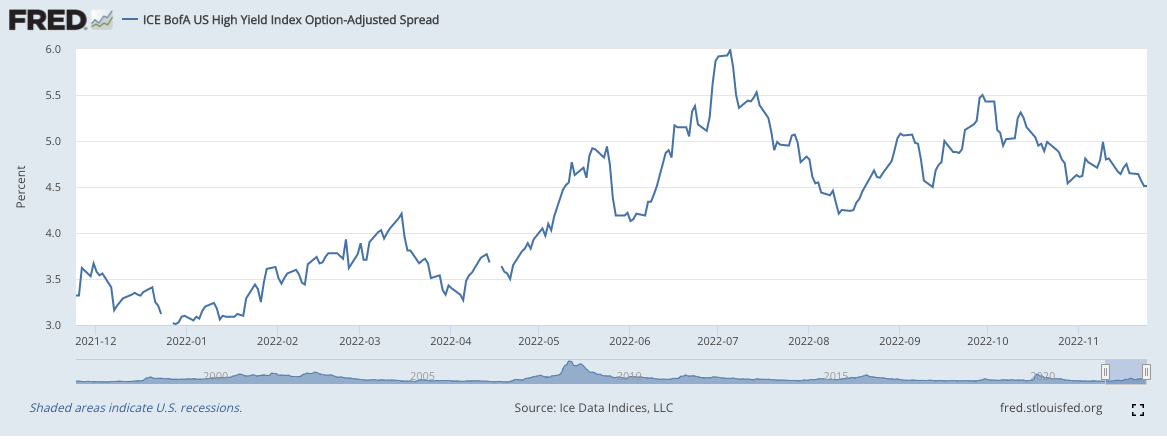

High Yield Option Adjusted Corporate Credit Spreads were stable this week:

5-year Breakeven Inflation Expectations were also largely stable this week:

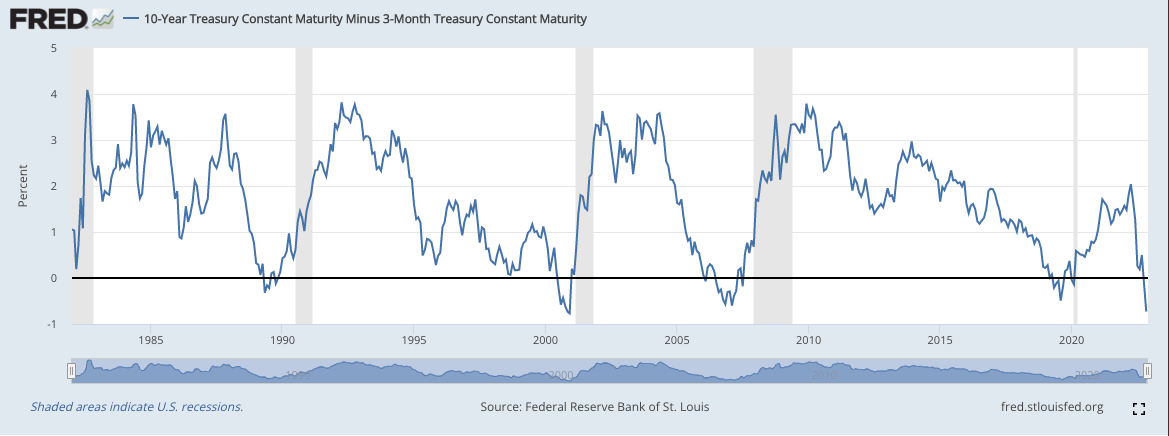

The 10 year, 3 month yield curve (a strong recession indicator) is more inverted than at any time during the Great Recession:

b) Fed Minutes & Level-Setting the Data

In the Fed minutes, we were told to expect a slowing rate hike pace but with the peak rate now estimated to be higher than before. To me, those two ideas are directly contradictory. Today, we have a recipe of frequent large-scale layoffs, cooling forward inflation indicators across the board, supply chain normalization, encouraging CPI & PPI prints this month & deepening economic cracks.

So? That concoction is strong evidence of employment becoming the most pressing Fed mandate at some point in 1H 2023. When this happens, hawkish policy will be forced to slow as long as it doesn’t coincide with runaway inflation -- which is looking increasingly likely by the week. Nothing changed this week in terms of my view on the macro backdrop. I still plan to deploy my remaining cash pile next month if inflation data is again positive.

One more note:

I constantly see people take to social media to point to weak economic data points as a reason to sell growth stocks. That is irrational. A weak economy/recession is exactly what will get us to a point where the Fed can pause and discount rates can once again fall. If this coincides with a slow economy like it often does, scarcity of structural, profitable, durable growth will be all the more coveted. I’ve said it before and I guess I need to continue saying it: Growth investors should NOT fear a recession. They should fear runaway inflation forcing yields endlessly higher.

8. My Activity

I decided what to do with my Green Thumb proceeds in the wake of its entire audit committee abruptly resigning. I moved half of the equity into my existing Cresco Labs stake and left the rest in cash. This means Cresco is now my only cannabis holding -- something I’m comfortable with.

Following the move and this week’s negative price action, my cash position is 12.3% of holdings.

Hi Brad, how about upstart? What’s the impact to the business with falling bond yield? Hope to get your view.