News of the Week (November 22-26)

Upstart; Lemonade; Ayr Wellness; CuriosityStream; Cannabis; A Note on Macro; My Activity

1. Upstart (UPST) — Co-Founders Dave Girouard and Paul Gu Interview with Citi

A. Dave Girouard Notes

On How Upstart improves the car buying process:

“The car buying experience is not all that pleasant or well-constructed. The Upstart auto-retail software is a connecting front-end to present a modern interface to smooth out the process and bring it into the modern era. We like to call it the “Shopify of the Auto-Retail Market”. There’s a lot of areas for us to fix within car buying. The really big win for us here is to suddenly have Upstart’s AI-enabled loans available to consumers to make car buying easier, car loans more affordable and to allow dealerships to move more cars and make more profits. It’s a win-win.”

The company sells into large dealership groups to integrate its software across their entire asset base. This leads to a wildly efficient land and expand model and — based on Upstart adding 1 new dealership per day at this point — is going quite well so far.

“We feel very confident that our value-add within this segment is at least as good as it is in personal lending.”

Considering how remarkably positive the personal loan product’s traction has been, this is notably encouraging.

On auto loan traction:

“A few months back, we could count on 1 hand the number of dealerships using this. I’ve now seen a case where new sales members are closing a 5 dealership deal within weeks of joining Upstart.”

“Everybody in the auto lending ecosystem today is a potential partner of ours. There’s really no competition. Whether it’s helping OEMs use better risk models or helping banks to improve loan approvals and performance — when you have fundamentally better risk models there’s a lot of wins to go around. We don’t have to displace but just upgrade.”

Upstart expects the “hockey-sticking” or positive inflections for its auto product to come sooner than it did for personal loans as it leverages its know-how and training data within personal to support this new endeavor. Auto will become material to its business next year and will eventually carry similar unit economics to its personal product — although that will take some time as the algorithm matures and scales.

Forward revenue estimates for Upstart do not include a large auto contribution. This means that the traction it expects here could provide a powerful and compelling lever for upward revenue revisions going forward.

On Upstart’s value for higher credit individuals:

“We feel very confident that we offer a value proposition everywhere — even when looking at the most prime borrowers. On our journey as a company we believed the real manifestation of our success would come when we could make the very best offers to the right people across the entire spectrum and across all categories of credit. That’s the journey we are on. The model has advantages up and down the spectrum and across all flavors of credit.”

This broader focus is expected to enhance marketing efficiency thanks to Upstart now appealing to a broader audience. This has very recently freed it to participate in Connected TV (CTV) marketing which was not previously productive spend for the company.

On small business lending:

“Small business lending is a difficult area — many have tried and failed. We do see a need for installment loans at reasonable prices with a super-fast and automated process. The risk models are quite different but this is exactly the type of thing that Upstart is good at. We have an opportunity to bring a skillset to the problem that hasn’t been brought to bear yet. It’s a compelling problem that we think we have a unique ability to solve.

B. Paul Gu Notes

I know these are some long quotes, but Paul Gu doesn’t publicly speak very often and all of this information is useful and fascinating.

On understanding the competitive edge of Upstart’s algorithms:

“Our model improvements over the last few years show how we differentiate and why it would be difficult for others to compete. The 3 fundamental building blocks of our algorithm are rows of training data, columns of variables and learning algorithms. You’d think that you can work on one then work on the next and eventually you get there. One of the difficult things about building an artificial intelligence (AI) system and realizing actual benefits is that these 3 things must be worked on in concert. If you just move 1 block — like having ample training data but a weak algorithm — the other blocks become limiting factors and will give you results that are actually worse than a standard model. Institutionally, it becomes difficult to manage improvements at a similar pace across all 3 building blocks without bottlenecking progress and while showing proof points to justify the large financial investments required. That’s why it’s so hard to replicate.”

On Upstart’s maturity/progress:

“In 2016, all that we essentially had was a human-specified rules-based system wrapped around a series of machine learning (ML) models. What’s happened since is that we’ve iteratively gone to each part of the originally human-designed system and transformed it from a rules-based system to first a machine learning (ML) model and then proprietary AI. We replaced each assumption with a model and then supported the model with customized AI…. As an example of what this means, it used to be the case that we had multiple ML models used in the loan decision but we essentially just got outputs from those models and averaged them together. Now what happens is not human-specified logic but is instead models learning from the data to remove any human-specification of weighting. We now have a stack of ML models feeding into each other and each layer of this is powered by a proprietary AI system. We still have a long way to go. I won’t pretend that every corner of the code base is run intelligently but it can be and should be.”

Upstart’s original set of algorithms led to siloed outputs from various models producing a metric. These metrics were originally assessed by humans and manually fed back into stepped machine learning models to get a result. The issue is, the human touch here invariably leads to assumptions being made that can hurt the purity of the prediction/result. Most companies using AI have these limiting, human-based interactions in place to use their training data. Upstart is actively working to remove all human bias by replacing touch points with ML models.

Upstart is currently at 70% of all loans fully automated. The ceiling for this percentage in Paul Gu’s words is “1 - the percentage of true fraudsters” meaning the proportion has a long, long way to go. As a reminder, consumers experiencing a fully-automated process feature double the conversion rate.

On usage of alternative data:

Gu went into how one can use the basic 6-12 variables in pricing loans and feed that into a machine learning network — but doing so will not lead to that much progress. To unlock the full potential of Upstart’s models it leans on far more granular and flexible variables — education, how you interact with the application, employment tenures — to bring out the best in its models. Gu referred to it as optimizing “depth and breadth” of data and its granularity. This is how learning algorithms create the most differentiation vs. human alternatives. Models can handle and make sense of thousands of variables — people can’t.

Click here for my broad overview of Upstart’s business.

2. Lemonade (LMND) — A Comment on Reinsurance

When I initially invested in Lemonade at the IPO, the most common bear case against the company was that its use of reinsurance proved its risk algorithm was nothing special and would preclude the young company from reaching compelling profitability.

I disagreed and still do. Management has consistently reiterated that reinsurance is a choice the company is making on a temporary basis to allow its risk algorithms to scale, mature and improve. Keep in mind that this company is just 5 years old — it’s a kindergartener.

Fast forward to earlier this year, and Lemonade announced it was lowering its percent of ceded premiums from 75% to 70%. Daniel and Shai told us multiple times that this was a unilateral decision from Lemonade and not a matter of the same reinsurance contract terms being unavailable for the company.

As the company grows up, it will innately become more equipped to endure natural catastrophes like the Texas Freeze and will inherently be better at pricing plans. The company lowering its rate of reinsurance is a direct sign that it’s becoming more confident in its ability to profitably compete without leaning heavily on reinsurance contract commissions to shield risk. Lemonade has room to lower this rate further from 70% to 55% and fully plans to do so in the coming years.

Lowering this ceded premium proportion shifts more risk onto Lemonade and also allows it to keep a larger portion of its in force premium (IFP) as revenue. As Lemonade gains confidence, it makes perfect sense to remove this artificial revenue ceiling from its model. This is not a red flag. It’s an entirely expected (and encouraging) evolution of this very young business model.

It’s ironic that the bear case has shifted from using too much reinsurance to not being able to use enough. This is inaccurate, contradictory noise born from a “stock down = company bad” philosophy. I will continue to tune it out.

Click here for my broad overview of Lemonade’s business.

3. Ayr Wellness (AYRWF) — Earnings Review

“5 of our 8 states have yet to convert to adult use — we see this as a tremendous growth opportunity for years to come.” — Co-COO Jason Griffith

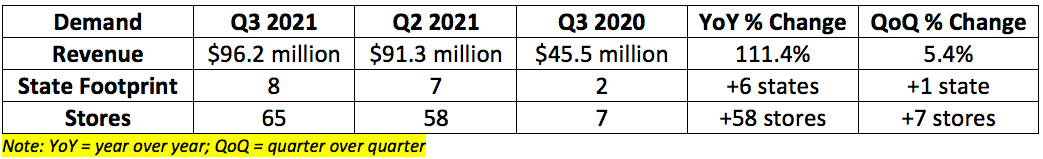

A. Demand

Ayr Wellness guided to $100 million in revenue for the quarter. It posted $96.2 million. This was largely due to its New Jersey acquisition closing later than expected and getting less inorganic contribution from those assets in the period.

Similarly to Cresco Labs and Green Thumb, a historically strong second quarter due to stimulus checks led to flat sequential growth this quarter in both wholesale and retail for the industry as a whole. Ayr grew both wholesale and retail sequentially thus outperforming the industry.

Ayr now sells its products into 350 stores across the nation vs. 100 at the beginning of 2021. It will convert its stores not currently branded as Ayr to Ayr next year.

B. Profitability

Ayr guided to roughly $27.4 million in adjusted EBITDA for the quarter. It posted $26.0 million missing expectations by 5.1%.

The company generated positive cash flow from operations but did not quantify this metric on a quarterly basis specifically.

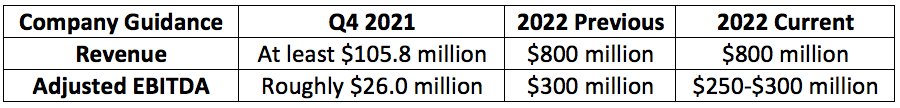

C. Outlook

Analysts were looking for $128.3 million in 4th quarter sales. Ayr guided to “at least” $105.8 million missing expectations by a worst case of 17.6%. This was driven by Ayr actively choosing to hold wholesale supply into the first quarter of next year in some states when its retail shops will come online and it can realize a higher selling price.

Ayr also was expected to generate roughly $40.2 million in adjusted EBITDA for next quarter. It guided to roughly $26.0 million missing expectations by 35.3%.

“We still see a very achievable path to the $300 million in adjusted EBITDA for 2022 but we want to be prudent and reflect changes that we think may have the potential to persist.” — Co-COO Jennifer Drake

The reduction in EBITDA guidance (and no revenue raise) is due to 3 things:

The company plans to more aggressively invest in new markets, brands and capacity to capture opportunities in 2022. For example, Ayr grew its headcount by 20% sequentially (including adding several senior-level employees) and has current projects that will bring its production footprint from 554,000 square feet to 1.2 million and will triple its biomass capacity to 300,000 pounds.

New sites in Massachusetts, New Jersey and Ohio are now likely to be delayed by 1 quarter as labor shortages and port delays persist. This will push Ayr to lean on wholesale suppliers more heavily until the projects are completed which comes with lower incremental EBITDA margin. This is a matter of retail rollouts running ahead of cultivation projects coming online.

Supply in markets like Pennsylvania, New Jersey, Boston and Florida is growing in anticipation of adult use. That is creating a short term mismatch in supply and demand while regulation is rolled out and is creating some pressure (10-20%) on wholesale pricing. Sandelman believes this volatility will benefit Ayr over the longer term. This is related to the aforementioned holding of supply for future retail sales:

“Instead of participating in temporary irrational behavior we are holding supply that we have into the first quarter when we’ll have 9 stores in Pennsylvania and adult-use stores in Massachusetts. We made a business decision. We can irrationally participate or simply take the product and sell it at a major premium 1 month later.” — Founder/CEO Jonathan Sandelman

“We will capitalize on the current market volatility and take the opportunity to expand our footprint as we announced today with 2 new stores in Chicago. Consolidation within the cannabis industry is being pulled forward.” — Founder/CEO Jonathan Sandelman

Ayr expects margins to fall in the next quarter or two as it builds out infrastructure ahead of regulatory program rollouts. Margins are expected to improve thereafter.

It’s encouraging that these delays did not hit its 2022 revenue forecast although some analysts were expecting another raise and this prevented that from happening.

D. Operational Highlights

On Chicago:

Ayr announced plans to acquire Dispensary 33 and its two Chicago dispensaries to bring its total store count in Illinois to 5.

On Florida:

The company has now opened 11 stores in Florida since February (42 in total) and continues to improve the consistency and variety of products in the retail shops it acquired from Liberty. Ayr has plans to open 23 more stores by the end of next year in the state to reach 65. It’s now harvesting 22 strains (more than 2X what Liberty was doing) consistently. Yields, THC content and terpene profiles have all precipitously improved since Ayr took over Liberty’s operations.

On the West:

The company grew market share in Nevada to 13.7%.

On Pennsylvania:

The company is selling its branded products into 77% of dispensaries in the state.

On liquidity:

“Having recently added $200 million in cash to our balance sheet… we feel confident in our ability to continue our growth driven by investments in state footprint, M&A and expansion projects.” — Co-COO Jennifer Drake

On the power of quality:

“We sell our Kynd flower brand through wholesale today at about a 25% premium to the current market. We grow quality and we sell it at a premium.” — CEO Jonathan Sandelman

E. New Brands

Ayr unveiled a new logo and a new categorization of its portfolio of brands. Kynd, Stix, Origyn Extracts and Levia will be its 4 “power brands” which will focus on high quality and will fetch higher price points. Road Tripper, Haze, Entourage, Secret Orchard, Wicked and Canna Punch will be its value-based brands to appeal to a wider range of consumers.

The company also released mock-ups of what its re-branded Ayr dispensaries will look like. Here’s a peak:

F. My take

This was an underwhelming quarter for Ayr as delays and strategic retail initiatives held results back in the short term. From a long term point of view, the company is doing exactly what it needs to do. I have 0 interest in selling any shares and will continue to add into extreme volatility.

Click here for my broad overview of Ayr’s business.

4. CuriosityStream — Black Friday Deal

CuriosityStream is offering 40% discounts on its direct to consumer subscription this holiday which is leading some to infer that the company is struggling to meet demand. This is not the case. CuriosityStream’s factual content costs it around 5% the expenses to produce an episode of a show like Game of Thrones.

This affordability allows CuriosityStream to bundle its offering with global distributors like Tata Sky Binge in India and SPIEGEL TV in Europe at small fractions of a dollar. This means that CuriosityStream collecting roughly $1 per subscription per month on the discount it’s running still results in far more profitable direct subscribers vs. bundled.

It also ran the exact same promotion last year on its way to delivering on its revenue and subscriber targets. The 2020 promotion encouragingly did not result in higher user churn as the company posted its best 12-month churn rate in the months following the sale. More evidence like CuriosityStream’s 2021 revenue guide being 100% committed points to demand for the company’s offering being perfectly healthy.

Just like with Lemonade, the bear cases surfacing at this point in time seem to me to be predominately due to a “stock down = company bad” mentality. The organization is executing.

Click here for my broad overview of CuriosityStream’s Business.

5. Cannabis — Industry News

SAFE Banking remains part of the National Defense Authorization Act (NDAA) for the time being. This provision would allow American cannabis growers to access banking, credit and insurance services not currently available to them. It would inherently lower the sector’s cost of capital — by a lot — and would also free institutional dollars to flood into the space to greatly prop up depressed valuation multiples.

There is no guarantee that this will remain a piece of the NDAA when it’s all said and done. Left wing politicians like Cory Booker are adamant to keep this from happening as he feels it doesn’t go far enough to address social equity concerns — he’s not alone. Still, bipartisan support is quickly growing to remedy our currently antiquated cannabis monetary system with republican lawmakers introducing another legalization bill last week.

There have been and will continue to be countless false starts and pump fakes on our way to cannabis reform. I have no clue when it will come, but I’m as confident as ever that it’s a matter of when not if. It’s time to give roughly 70% of America what they want.

Click here for my broad overview of the American Cannabis regulatory landscape.

6. A note on Macro

Turbulence has hit growth stock land hard and — naturally — people began reaching for reasons to explain the decline. The most popular explanations are based around a perceived tilt towards more hawkish monetary policy in 2022 and beyond. Higher rates will absolutely lead to more heavily discounted future cash flows which could feasibly cap near-term multiples especially for speculative companies like many that I own. And furthermore, less liquidity sloshing around in our economy will likely lead to some short-term demand erosion for risk assets.

Despite all of this, I’m continuing to add to my growth stocks as the thriving companies are met with stock declines and multiple compression. Why?

First, policy will remain extremely accommodative. I do not believe the United States government can afford a 4% 10-year treasury yield with the mountain of debt we continue to add to. A 2-2.5% 10-year would lead to the aforementioned heavier cash flow discounting — but that would remain an immensely accommodative environment, historically speaking. Furthermore, the Federal Reserve has already raised monetary supply by ~30% and printing will continue — albeit at a slower rate — in the months to come. We won’t have less dollars, it’s just that the rate of increase will (thankfully) decline.

Secondly — and most importantly — macro-conditions will not be the primary determinant of our very long term returns — far from it. Whether GoodRx or Olo (two random examples) succeed in terms of delivering alpha for my portfolio depends on how successfully and how profitably the companies can compound. My returns will have far more to do with if GoodRx is generating $2 billion in cash flow or $5 billion in cash flow several years from now. Yes, whether that cash flow receives a 15X or 18X multiple will impact my returns as well, but not nearly as much.

Similarly, new pandemic variants pushing back tapering and rate hiking schedules will not make me more bullish on these long duration assets. I am laser-focused on whether my companies are doing what they need to do to continue delivering sustainable success from both a demand and margin point of view. The rate of the 10 year yield has very little to do with this success — the ball is much more in the court of each individual company. As multiple compression continues, I will continue to slowly deploy more of my 15.72% cash position.

7. My Activity

I added to my stake in Duolingo during the week to bring my cash position from 15.87% to 15.72%.

Click here for my Duolingo deep dive.

Awesome work Brad 🤓🥳🤩

Thanks for a great read as always Brad! I love and am envious of your cash discipline. Congrats on the win Saturday :-)