News of the Week (November 7-11, 2022)

Duolingo; Lemonade; Olo; SoFi; The Trade Desk; Meta Platforms; Shopify; Nanox; FTX Ripple Effect; Cannabis; Macro; My Activity

Welcome to the 509 new readers who have joined us in the last week. We’re thrilled to have each & every one of you and determined to provide as much free value as we can.

1. Duolingo (DUOL) – Q3 2022 Earnings Review

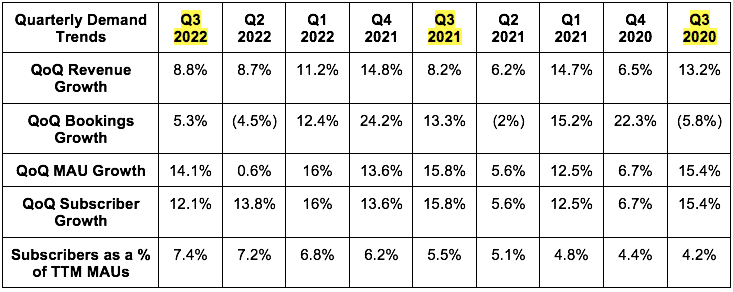

a) Demand

Beat its internal bookings guide by 7.5%.

This is a telling forward looking indicator for growth.

Beat its revenue guide by 1.7% & estimates by 1.8%

More Context on Demand:

7 million sequential MAU adds is Duolingo’s best gross add number to date. And the best part? It was predominantly powered by word-of-mouth growth just like it always has been. Not more external marketing spend.

Conversion rate of this larger cohort of new users to paid subscribers is similar to previous cohorts.

As the vast majority of Duolingo’s revenue is via subscriptions, subscribers as a % of trailing 12-month (TTM) MAUs is the key metric to track.

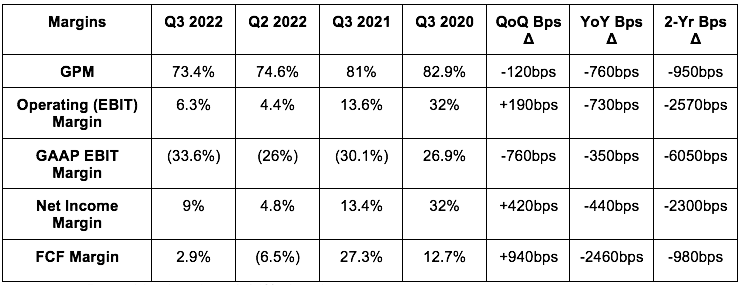

Duolingo’s 45.7% 2-year revenue CAGR compares to 46.6% last Q and 70% 2 Qs ago.

This was the 5th straight quarter of accelerating user growth.

Daily Active Users (DAUs) as a % MAUs rose from 24% to 26% YoY as users became more engaged.

Advertising demand is weak for Duolingo just like for other companies. Luckily, it represents just 11% of its total revenue and still grew 18% YoY.

During the call, CEO Luis von Ahn reiterated that the subscription business (75%+ of sales) has seen ZERO macro-related weakness to date.

FX neutral bookings growth was 50% YoY. That is the demand line that is hit the hardest by dollar strength as it counts annual subscriptions (90%+ of its total subscriptions) as 12 months of business vs. 1 month for revenue. So there’s 12 months of the current FX impact included vs. 1 for revenue.

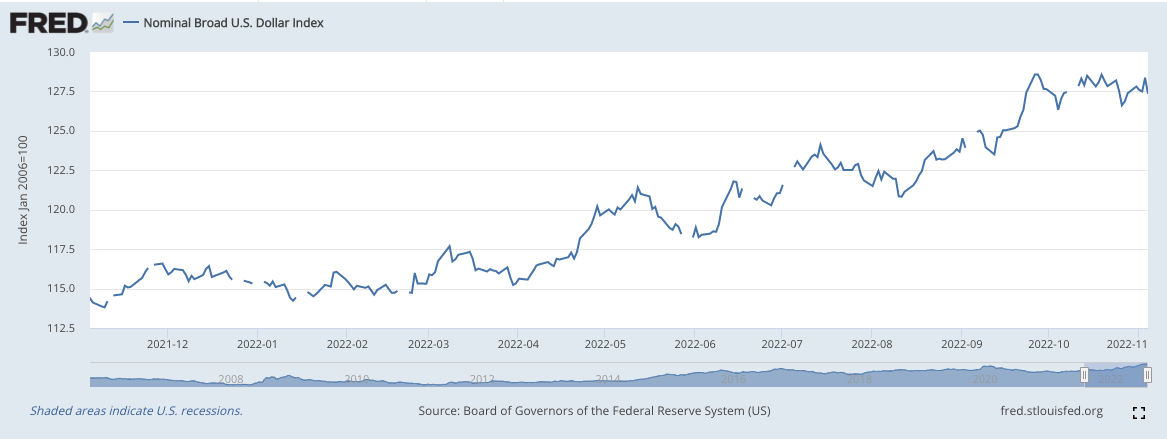

Every 1% rise in the U.S. Dollar vs. major foreign currencies means $500,000 less in bookings. The sharp fall in the U.S. Dollar this week following the cool CPI report is wonderful news for this company and countless others (like Match Group, Meta, PayPal etc. – woot woot!).

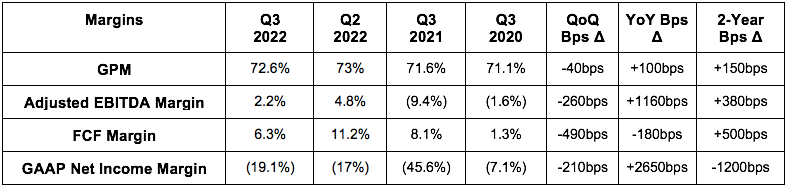

b) Profitability

Beat its ($3M) EBITDA guide & analyst estimates by 170% or $5.1M.

Beat analyst GAAP net income per share estimates of ($0.55) by $0.09 or 16%.

More Context on Margins:

Duolingo is intentionally trying to operate at break-even while investing all excess profits back into more growth. The positive EBITDA is in spite of that philosophy.

Duolingo continues to enjoy brisk sales & marketing (S&M) leverage DESPITE the demand outperformance. GAAP S&M was 18% of revenue vs. 24% YoY.

“We’re going to continue to grow revenue faster than expenses.” – CFO Matthew Skaruppa

c) Balance Sheet

Duolingo has $600 million in cash & equivalents (about $12 per share) and no debt.

Its diluted share count grew by 0.4% sequentially and the company expects 3% total equity dilution for 2022. That’s quite modest compared to other recent IPOs. For now, stock compensation is elevated at 22% of sales (vs. 32% YoY) as IPO-related awards continue. This is why there’s such a large difference between GAAP and non-GAAP margin. Still, it’s slowing mightily as compensation grew by just 2% YoY as compared to the 51% revenue growth.

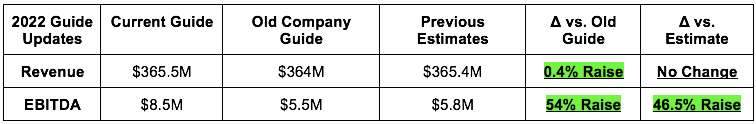

d) 2022 Guidance Updates

The Q4 2022 guide was in-line on revenue and ahead of expectations on EBITDA. Ideally, I would have loved to see a larger revenue raise after the beat this quarter, but I’m being very picky (especially in this environment) and the company has developed a clear trend of under-promise, over-deliver as well.

“We will provide our full year 2023 guidance on the Q4 earnings call. I’d like to remind everyone that we believe we are early in our monetization efforts and growth. We will continue to invest to drive growth and invest in more early stage efforts. Even as we do that, we will stay focused on progressing to our long term profit target of 30-35% EBITDA margins.” – CFO Matthew Skaruppa

e) Notes from the Call and Shareholder Letter

In-App Purchases:

Duolingo is making more progress with monetizing unpaid users via a la carte purchases within its apps. This has been powered by “gem” buying which is its virtual currency that can be used to speed through lessons more rapidly or access more gamified content. Specifically, in-app purchases now represent 5% of bookings vs. 3% YoY. It’s focusing more and more on motivating these types of purchases — especially in developing markets where subscriptions tend to be less appealing.

HBO Partnership:

“This partnership has been our most successful PR campaign to date, generating hundreds of press mentions and millions of social views. We attracted hundreds of thousands of new users to the High Valyrian course and nearly half of these will stick around to learn another language with Duolingo. In total we spent under $150,000 on this entire campaign.” – Co-Founder/CEO Luis von Ahn

This rough outline of how the partnership is going implies a worst case customer acquisition cost of $1.50. For reference, Duolingo collects around $7 in revenue annually per user (including free users) meaning it takes them about 60 days to recover all of these costs. That’ll work.

On Other Products:

Duolingo English test reached adoption of 3,800 Universities (all of the top 25 by volume) vs. 3,700 QoQ.

The Duolingo Math App is Live on the App Store:

2 weeks in, usage and retention is “as expected or better.”

Interestingly, there are more adults using the product for brain training than children.

CEO Luis von Ahn is confident that Duolingo can “monetize the app similarly to language learning.”

As a reminder, Duolingo waits a few years to begin monetizing brand new products. Math will not be a big revenue contributor for a while.

50% of the users so far are also language learning users.

Cross promotion is expected to become a bigger and bigger part of user growth as Duolingo leverages its vast built in user base to support new product launches.

“We’re probably going to be releasing other apps.” – Co-Founder/CEO Luis von Ahn

Discipline, Discipline, Discipline:

“While our headcount continues to grow, we have never gone nuts on hiring. Because of that, we don’t have to implement cost controls like layoffs or hiring freezes to be profitable.” – Co-Founder/CEO Luis von Ahn

f) My Take

This was a solid quarter in every sense. The company continues to demonstrate clear operating leverage while demand growth remains robust. And that’s expected to continue. Its creativity in seeking out efficient customer acquisition via social media or House of the Dragons is admirable to me and its user growth acceleration is wildly encouraging. Some are picking at the beat being smaller than we’re used to. If only that were the largest negative for all reports that I cover. I’m pleased and added to my stake following the price decline.

Based on Friday’s closing, Duolingo trades around 60X what I think it will do in 2023 EBITDA and under ~6X gross profit (which is actually a 25%+ discount to markets today). With all of the margin expansion and consistent growth expected to come, I see this as reasonably expensive.

2. Lemonade (LMND) – Q3 2022 Earnings Review

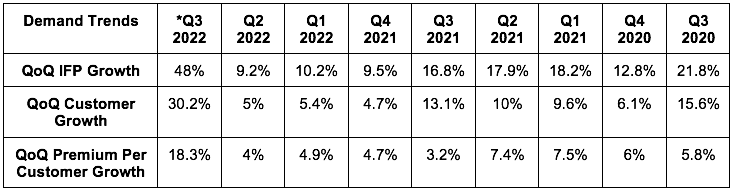

a) Demand

Beat its revenue guide by 15.6% & analyst estimates by 14.2%.

This was aided by its ceded premium rate falling from 75% to 55% YoY. Ceded premiums can’t be recognized as revenue. The ceded premium rate is expected to keep falling over time as Lemonade’s book scales & matures.

Beat its In Force Premium (IFP) guide by 2%.

Beat its Gross Earned Premium (GEP) guide by 6.6%.

More Context on Demand:

*All growth metrics were propped up by the more than $100 million in premiums that Lemonade added from closing the Metromile acquisition this quarter. For more context, IFP growth would have been roughly 45% YoY without this help.

Lemonade is intentionally pulling back on growth spend to ensure it can become profitable before requiring another capital raise. It does not want to have to raise cash from a point of weakness – and I appreciate that. It expects YoY growth to slow to around 23% YoY while it intentionally holds back on customer acquisition spend. It really is in control of its revenue and feels it can economically accelerate growth as soon as conditions improve.

Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio “continued to improve” per CFO Tim Bixby. As of the last update we got here it was pushing 3.0X.

“Given our penchant and track record for rapid growth, we thought it sensible to underline our deliberate, tactical slowdown. We’re chomping at the bit, but we’re comforted in the knowledge that the huge growth opportunity before us isn’t going anywhere… still insurance is a business that thrives at scale, and so ever as we optimize for cash vs. growth, we will continue to see growth.” – CEO Daniel Schreiber

b) Profitability

Lemonade beat its EBITDA loss guide by 9.4% & estimates by 6.3%.

Lemonade met analyst net income per share estimates of ($1.25)

More Context on Margins:

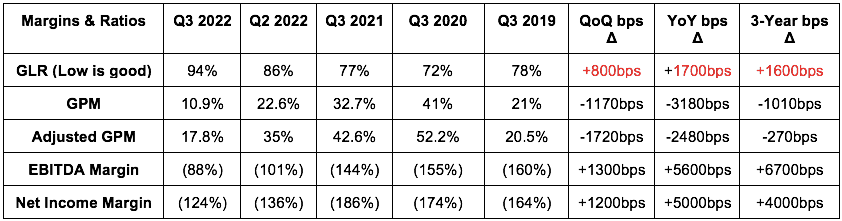

The Metromile acquisition closing added roughly 400bps to Lemonade’s Gross Loss Ratio (GLR). The other source of the worsening is Lemonade’s rate update filings still working their way through approvals. As a reminder, rising inflation immediately impacts claim values, but not premiums paid. This inherently raises loss ratios – especially when your book is still as small as Lemonade’s is.

It has filed the needed rate changes and expects that help to begin taking effect next quarter. It expects the faster pace of its filings to now keep up with rates of inflation going forward.

In my view, this was an operational blunder from the team. It was too slow here compared to its competition. Only 25% of its business has been adjusted for inflation to date. Too slow.

It expects GLR to continue its long run trend lower for each product with the occasional spike like we’ve seen.

The GLR hit directly translates to a GPM hit as well. This manifested in a $53 million loss and loss adjustment expense charge vs. just $17 million YoY. Had the expense simply grown in line with revenue (which is still a very pessimistic long term assumption), GPM would have been 35.7% this quarter.

Operating expenses grew 63% YoY – significantly below revenue growth. That trend is expected to continue.

c) Balance Sheet

Lemonade still has $1.1 billion in cash & equivalents (about $16 per share in cash for the $23 stock) thanks to the $165 million in cash it added from closing the all-equity Metromile deal. This total is stable sequentially.

There’s no debt.

And again, the company reiterated its promise to turn GAAP profitable before it issues another capital raise.

Share count grew nearly 9% in the last 12 months with a chunk of that due to the all equity Metromile deal. Stock comp was 21% of revenue vs. 36% of revenue YoY.

“A more accelerated rate of growth would, we continue to believe, maximize the Net Present Value (NPV) of Lemonade. Nevertheless, given today’s high cost of capital, we are decelerating spend towards optimal cash burn velocity which we estimate is in the 20-25% annual revenue growth range.” – CEO Daniel Schreiber

d) Guidance

Raised its 2022 IFP guide by 0.2%.

Reiterated its GEP guide.

Raised its revenue guide by 3.8% & beat estimates by 3.3%.

Lowered its EBITDA guide by 1.7% but beat analyst estimates by 2.7%

Raised its capital expenditure guide by 10% (from $10 million to $11 million).

Reiterated its stock based compensation guide of $60 million.

Lemonade began enjoying outperforming marketing efficiency in the third quarter. So? It pulled forward some planned Q4 marketing expenses into Q3. That’s why the quarterly beat was material, but there’s not much of a 2022 guidance raise. The “beat” on the top line was mainly a matter of timing and so demand was largely in line with expectations. The EBITDA outperformance, however, was encouraging considering it coincided with that accelerated spend.

e) Shareholder Letter

Chewy Partnership:

As a reminder, Lemonade will be integrating its pet insurance interface into Chewy’s platform to offer the product to the pet supply company’s 20 million users. Interestingly, on the call we learned that most of the compensation Lemonade pays to Chewy will be via equity awards for sourcing new business. To the team, this serves as a compelling “vote of confidence” in the Lemonade offering and its longevity. It also helps with Lemonade’s current mission of cash preservation while it turns profitable. It could, however, turn out to be (hopefully) more expensive than just paying them in cash. Pros and cons.

This will go live in 2023 and is expected to significantly enhance Lemonade’s unit economics thanks to the lower expected CAC for these Chewy-related customers. Candidly, I’m excited for this to launch and hope to see more deals like this one in the future.

f) My Take

This was a good quarter for Lemonade. I’m disappointed in its slowness with updating policy rates compared to its established competition. I will be even more disappointed if the issue recurs in the future after leadership told us filing cadence is now appropriate. Aside from that issue, it’s effectively controlling costs while still finding strong growth – and I appreciated its reiteration of no capital raises until turning profitable. Thumbs up from me.

Based on Friday’s close, Lemonade still trades at a nearly 50% premium to markets in terms of its enterprise value to gross profit multiple. There’s no EBITDA, so I have to use this metric. I’d likely wait for the 11.6X gross profit multiple to fall closer to the market rate of 8X (probably not all the way) before adding to my stake again.

3. Olo (OLO) – Q3 2022 Earnings Review

“We’re built to help customers do more with less… As operator conversations increasingly focus on sales & margin maintenance due to inflation, supply chain issues & labor dynamics, we believe Olo is best positioned to meet restaurant needs. This quarter’s deployments & new partnerships support the belief that technology is instrumental to enabling operationally efficient restaurants.” – Founder/CEO Noah Glass

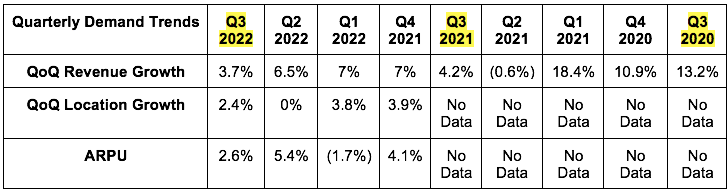

a) Demand

Olo beat its $46.7M revenue guide & analyst estimates by 1.3%.

More Context On Demand:

Olo’s other professional service revenue stream is from on-boarding & maintaining client deployments. This is a small portion of total business and much lower margin. It’s not important to me – platform revenue is.

Olo has more than 600 Brands as clients vs. 400+ as of the end of 2020.

YoY active location growth includes a 2,500 location hit from Subway leaving. YoY growth would have been 13.8% YoY without the unique hit. Subway is also still impacting the company's DBNRR.

As a reminder, we were promised last quarter that there were no other brands like Subway that Olo was expecting to leave its platform. That was true this quarter and needs to continue being true.

This means there are about 10,000 remaining Subway locations to be rolled off at the same pace over the next 12 months. Olo expects to continue growing net locations during this period regardless as its pipeline of new customers remains “robust.”

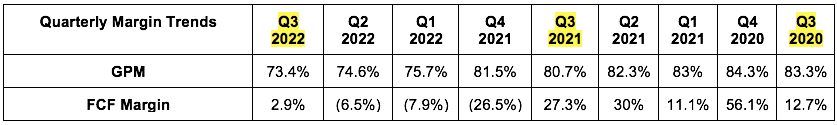

b) Profitability

Olo beat its $2M EBIT guide & analyst estimates by 50% or $1M.

Olo beat analyst net income per share estimates of $0.01 by $0.01.

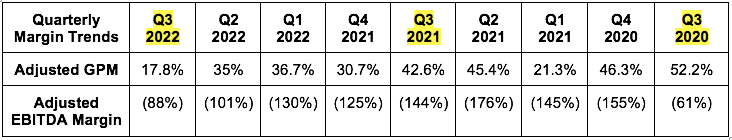

More Context on Margins:

Net income margin is better than operating margin because of $1.5 million in interest (other) income.

Mainly $12.1 million in stock based compensation, but also a charitable donation of common stock, a $3.2 million impairment charge from subleasing its old headquarters and amortization all resulted in the wide difference between GAAP and non-GAAP margins.

The Wisely and Omnivore continue to weigh on margins (and again, stock comp).

Sales & marketing de-leveraged from 11% of sales to 13% of sales YoY. This will continue near term to support all the new product releases Olo has had in 2022.

R&D is stable at 32% of sales YoY & general and administrative (G&A) improved from 24% of sales to 22% of sales YoY.

c) Balance Sheet

Olo has $467 million in cash and equivalents (about $3 per share) and no debt.

Dilution (impacted by multiple M&A deals this year):

Olo’s share count grew roughly 1% QoQ and 9% YoY.

Stock based compensation was 26% of sales vs. 21% of sales YoY.

The company did not buy back any shares this quarter.

d) 2022 Guidance Updates

Raised its revenue guide by 0.3% & beat estimates by 0.6%.

Raised its EBIT guide by 19% & beat estimates by 22%.

Olo expects to add 2,000 locations next quarter (4,500 ex-Subway).

Olo’s guidance now assumes a $5 million 2022 Olo Pay contribution vs. “a few million” as of last quarter as momentum there exceeds initial expectations. It contributed $2 million to Q3 2022 revenue. Traction here will be a vast growth tailwind considering adoption boosts Olo’s revenue per order by 4X alone.

e) Notes from the Call & Investor Materials

On ARPU:

More new client multi-module adoption & accelerated cross-selling is driving the ARPU outperformance.

A “growing portion of emerging enterprises are landing with multiple modules” per Glass.

Olo sees an overall opportunity to 25X its ARPU over time and thinks that will be the most powerful source of its long term growth. This goal will be realized through things like on-premise dining and what Glass calls “digital entirety” (or 100% of order being processed digitally vs. 15% today).

Olo now has 50 brand clients processing orders with its software on-premise.

Customer Wins:

Jack in the Box replaced its homegrown ordering module with Olo’s Ordering module. It’s already an Olo Dispatch customer.

Added new modules with the following notable existing clients:

BJ’s, IHOP, Wetzel’s Pretzels and Broken Egg Cafe

Notable new client wins:

Smashburger, Ruby Tuesday & Zaxby’s all replaced their legacy tech stack in favor of Olo’s Ordering, Dispatch and Rails modules.

2 large convenience store chains representing 600 total locations became Olo clients during the quarter.

Noodles & Company gave Olo a Vendor of the Year award. I guess they’re happy.

And speaking of Noodles & Co, this Olo client will be one of the first to beta test Olo’s new order management upgrade allowing for full on-premise integration of order management and prioritization.

New Partners:

Olo added 3 new partners (now 300+ in the ecosystem) within autonomous delivery. Now, Olo customers can use piloted delivery robots to cut last mile delivery costs that often equate to 40% of input expenses per order. This is currently only in a few markets.

Olo also added some new AI voice partners to automate the receiving of drive-thru orders and to cut down line sizes.

Elongated Sales Times:

Glass alluded to some relief in the elongated customer win and deployment times thanks to falling wholesale food prices and improving labor dynamics. Still, forward guidance assumes these issues will not improve, so any continued green shoots here could mean another beat next quarter. We’ll see.

f) My Take

This was a fine quarter. The company continues to add impressive brands to its client list and traction for the new Olo Pay product is quite promising. We’ve been told to expect more operating leverage in 2023 and that growth will accelerate throughout the period as well. I expect that to happen – we’ll see if it does. I added to my stake after the positive report.

Based on Friday’s closing price, Olo trades for roughly 6.5X 2023 gross profit and somewhere around 50X EBITDA with a lot of room for that to fall if it continues to effectively control costs like it did this quarter. I see this as compelling enough considering its fundamental performance, and I added to my stake after the report.

4. SoFi – Student Loans

A Federal Judge has ruled the Biden Administration’s student loan forgiveness plan as unlawful. The executive order has been blocked for now and applications for relief have closed. SoFi relies on a motivation for federal borrowers to seek out lower rates as they build a credit history over time. That motivation goes away if payments aren’t required as they weren’t during the moratorium.

The relief equated to just 14% of debt owed by new borrowers looking to refinance with SoFi. But it’s still clearly good news as that 14% can now be serviced by vendors like this one with borrowers also now actually having reason to refinance. The current administration has already appealed the ruling, but it looks as though pushing this relief through is becoming a steepening battle.

5. The Trade Desk – Addressing Two Concerns

The Trade Desk reported another solid quarter this week and my review can be found here.

a) Take Rate

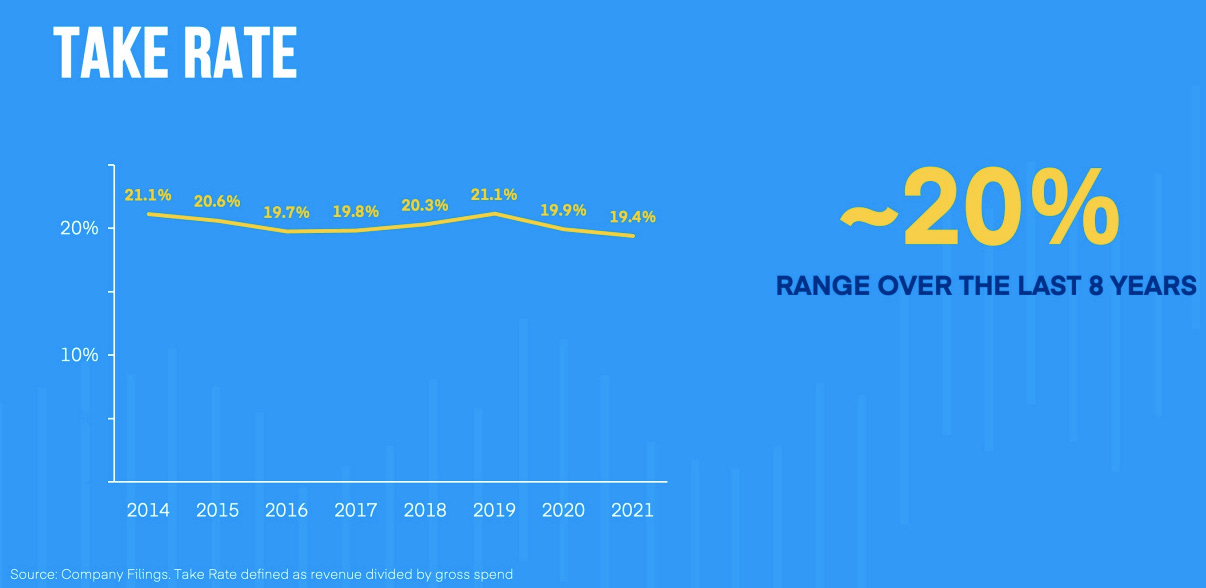

I read some mumblings about The Trade Desk’s take rate being a robust 20%+ on Twitter. That take rate was called ridiculous and I wanted to address that idea with a few notes:

The Trade Desk cuts booking costs in half for its buyers and routinely delivers a return on ad spend spike (often in the triple digit percent range) vs. all of the other channels they purchase media through. It delivers more value than it commands, which is why this take rate has been largely stable over the better part of a decade.

This company serves all of the largest media conglomerates and ad agencies in the world. I guess those poking fun at the take rate know more about the value TTD provides than every single one of the the brightest media executives in the world. Clearly, these executives don’t know how to buy placements, but Twitter’s hecklers do (sarcasm).

b) Stock Compensation – A more valid qualm

Stock compensation is too elevated today. There’s no way around it. BUT, this compensation is not in the form of recurring equity grants. It’s part of a roughly $600 million package awarded to CEO Jeff Green for meeting all of his performance targets ahead of schedule. This founder has been among the most consistent performers in public markets for several years and he deserves to be paid like one in my biased view.

But more objectively speaking, the vesting of these options will start to slow next quarter when management told us that absolute stock compensation will FALL YoY while revenue will briskly grow. The rest of the package will mainly vest throughout next year when the GAAP margin headwind will fully abate. Context is key.

6. Meta Platforms (META) – A Painfully Necessary Move, TikTok & More

Meta fired 11,000 employees this week which equates to 13% of its workforce. This allowed the company to lower its operating expense guide by about 1.5% from $98.5 billion to $97 billion for 2023 with its CapEx guide falling slightly too. It will “continue to refine its investment plans and update its guidance as appropriate throughout the year” according to the 8K filing. Zuck finally seems to be listening to investor desires.

Meta is ending its smartwatch development projects.

More and more politicians (Marco Rubio this week) are calling for a TikTok ban. Yes please.

TikTok cut its advertising revenue outlook from $12 billion for the year to $10 billion. Nobody is immune.

7. Shopify (SHOP) – Fulfillment

The Wall Street Journal is reporting an interesting shift in delivery trends this holiday season. To combat freight, supply chain and more input inflation headache, merchants are leaning away from optimizing for fastest possible delivery. Instead, they’re settling for 1-2 days rather than the same day to bolster unit economics amid tough times. They think consumers will be fine with the less tight, but guaranteed window concession.

Why is this important? Shopify’s Fulfillment ambitions involve the Shop Promise. This guarantees delivery within a certain day and is exactly what these merchants are now looking for. It’s nice to know merchants are prioritizing something that Shopify can actually provide rather than same day delivery. It can’t provide this same day delivery service on a consistent basis unlike Amazon.

A small piece of good news.

8. Nano-X Imaging (NNOX) – Q3 2022 Earnings Review

a) Results

Nanox generated $2.4 million in quarterly revenue. This is up 9.1% sequentially & 33% from 6 months ago.

Note that the multi-source Nanox.Arc cold cathode Xray machine (where all of the potential is) still has not been approved and has not begun generating revenue. This is all from teleradiology and AI imaging services.

Teleradiology generated $2.4 million in revenue & signed 9 client service agreements during the quarter.

Nanox.AI generated about $100,000 in revenue.

Gross margin progress:

Nanox’s GAAP GPM was (62%) vs. (82%) sequentially.

Nanox’s non-GAAP GPM was around 45% vs. around 36% sequentially.

Net loss increased from $13.5 million to $19.1 million YoY via M&A integration costs and growing R&D costs.

Balance sheet:

It has $117 million in cash & equivalents vs. $127 million sequentially.

$29 million of the $117 million in liquidity is long term investments and not actually all that liquid.

Diluted share count was stable sequentially. Love it.

b) Regulatory Updates

Submitted its 510(k) multi-source application to the FDA in September following a lengthy pre-submission process. The application is under review.

Gained a “Helsinki Permit” for trials in an Israeli hospital which just allows them to test the multi-source device on people. Sample images are expected this quarter. A step in the right direction.

Gave a vague update on the CE marking in Europe but nothing exciting.

“It remains our goal to begin to deploy the multi-source Nanox.ARC this year. We continue to advance the process in Nigeria & have received an import license. We intend to ship the first system and begin training soon as we aim to secure regulatory approval.” – CEO Erez Meltzer

c) My Take

I will not touch this position (add or trim) until commercial deployment of the ARC system begins. That may never happen. We’ll see. This remains my smallest holding and my most speculative bet by far. There was nothing to be alarmed by or excited about in this report.

9. Cannabis

Midterms brought several cannabis reform decisions this year. Maryland passed recreational cannabis convincingly with 66% of the vote. Wow. The conservative state of Missouri narrowly passed recreational cannabis narrowly with 53% of the vote. Still, it wasn’t all positives. North Dakota, South Dakota and Arkansas all rejected cannabis reform.

I’ve also come to the decision that I will not be re-entering Green Thumb. Regulatory purity will be wildly important as the cannabis industry continues to mature. Political clout matters here. Considering there are a few companies that I see as quite fundamentally similar, it makes no sense for me to assume this potential risk instead of searching elsewhere. The issues could turn out to be meaningless, but considering they haven’t been concretely described (and won’t ever be), I have no choice but to avoid this compelling investment. For now, the old Green Thumb equity will stay in the ETF MSOS. I am considering Verano, Trulieve or just adding it into my existing Cresco Labs stake. I’ll keep you posted as always.

10. FTX Ripple Effects

I’d like to point out the FTX situation that unfolded this week. For those of you who weren’t following, its valuation shriveled from $18 billion to $0 in about a day as its company filed for chapter 11 and rumors of its founder going to jail grew. He did some shady stuff that I’m sure will be shared in a Hollywood film in the future. FTX is (was) one of the largest crypto exchanges in the world. This leaves a significant amount of share up for grabs and I’m interested to see who will take it. SoFi & PayPal (& Block, Coinbase etc.)… the ball is in your court to go and steal lucrative volume share. Make this count.

11. Macro (Hallelujah)

a) Key Economic Data from the Week

CPI data this week was more encouraging than we’ve gotten in a long time:

YoY CPI rose 7.7% vs. 8% expected and 8.2% last month.

YoY Core CPI (strips out food & energy) was 6.3% vs. 6.5% expected and 6.6% last month.

Month over month (MoM) CPI rose 0.4% vs. 0.6% expected and 0.4% last month.

MoM Core CPI rose 0.3% (YES!) vs. 0.5% expected and 0.6% last month.

Medical services and commodities minus food and energy turned negative MoM while nearly every other category meaningfully slowed.

Initial jobless claims came in slightly ahead of expectations for a small sign of the labor market weakening.

University of Michigan (Go Blue) Data was weak across the board:

Its Consumer Expectations Index came in at 52.7 vs. 56 expected and 56.2 last month.

Its Consumer Sentiment Index came in at 54.7 vs. 59.5 expected and 59.9 last month.

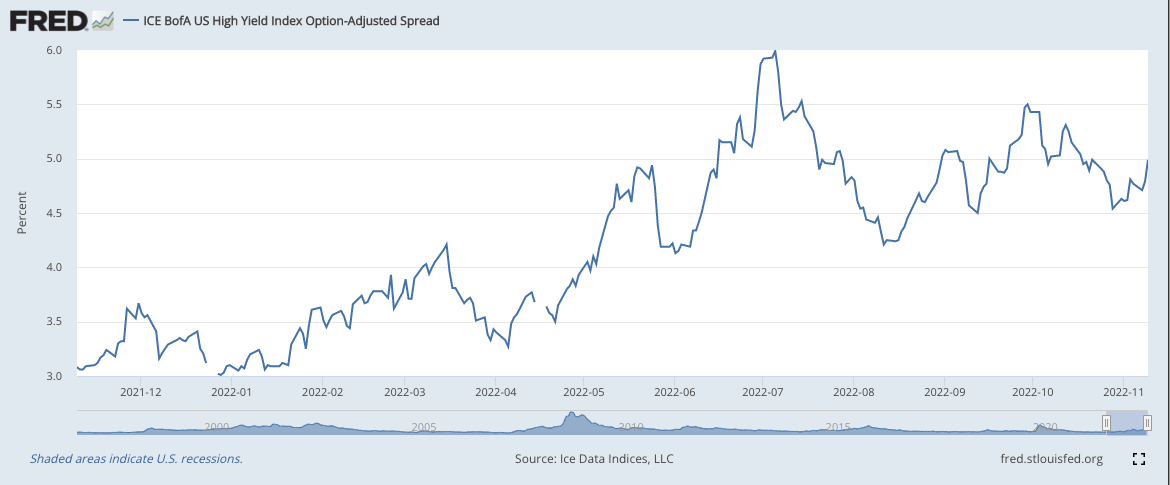

High Yield Corporate Credit Spreads continued to look more fragile this week as liquidity conditions and risk appetite worsen:

The U.S. Dollar sharply fell following the CPI report (again, wonderful news for countless globally oriented firms):

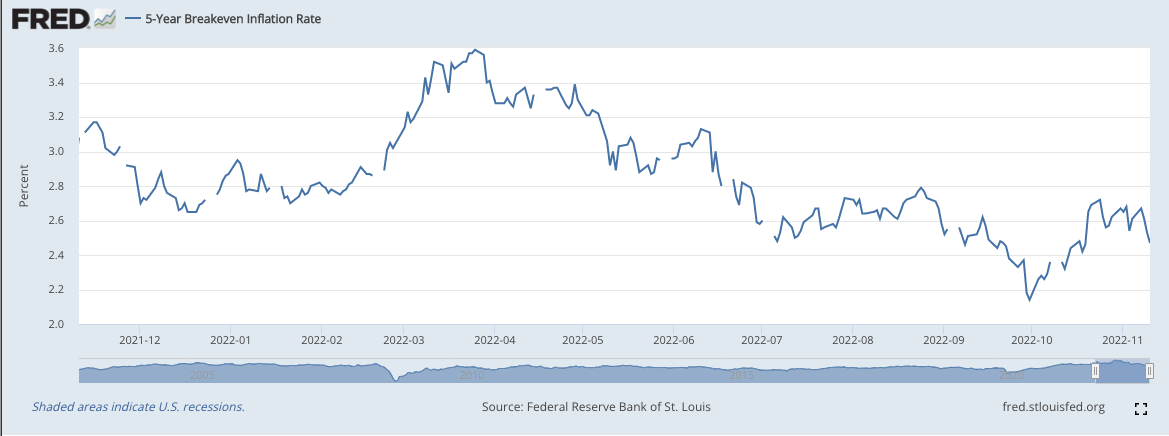

5-Year Breakeven Inflation expectations continue to fall:

b) Level-Setting the Data

We’ve had a few weeks of somewhat encouraging glimmers of hope in macro land recently, but nothing like what we just saw. While one data point doesn’t mark a trend (I’ll keep saying it), this CPI print was very encouraging and very important. And furthermore, the single metric is being consistently confirmed in real time with several coinciding forward looking deflationary indicators that I’ve discussed at length (freight, raw materials, rent etc.). Still, this is not a victory in the pursuit of a hawkish pause. It is simply a large step in the right direction. The trend must continue briskly lower considering we’re still at 7.7% YoY growth.

We’re getting there, and the progress we made this week was beyond what I was hoping for. If the data trends continue to look encouraging, I’m weeks away from deploying my cash pile. I still see early 2023 as the time when employment will become a more fragile Fed mandate than inflation, which is when I expect the pause (not a pivot) to take place. Another positive CPI print could go a long way in reiterating that opinion with a negative print likely delaying my accumulation timeline. For now, I’m not ready to take one encouraging data point as a sign to go all in… but I’m excited and pleased with how this week shaped up to say the least.

11. My Activity

I added to Duolingo and Olo this week after the earnings reports. After a 30%+ run up in Shopify since I started the position recently, I was tempted to trim a little bit. I decided against it as the position still is far from built out and it felt a little too cute to take profits – especially after a strong quarter and a very long runway.

Excellent coverage Brad! I always enjoy reading your posts.