News of the Week (October 10th - 14th)

Meta Platforms; CrowdStrike; SoFi; PayPal; The Trade Desk; Penn Entertainment; Lululemon; Olo; Upstart; Green Thumb; Macro; My Activity

Click here for a Savvy Trader-powered view of my current portfolio.

I wanted to take a minute to thank all you readers. Your support from across the globe (50+ countries!!) means the world to me. I am eternally grateful and fully dedicated to offering you as much value as I possibly can. I work for you. I constantly think about giving you more value. That will not change. Onward and upward, friends.

1. Meta Platforms (META) -- 2022 Create Conference

On Microsoft and Accenture:

Perhaps the highlight of the event was a new partnership announced between Meta and Microsoft. Surprisingly, Microsoft CEO Satya Nadella participated in the conference to share the news and express his excitement. Considering Meta sees work and productivity as such massive pieces of Quest’s (the headset hardware’s) future, it needed the tools and apps that consumers know and love to work perfectly in that environment. This new collaboration will make that happen.

“The Metaverse will transform everything, from telehealth to remote maintenance to gaming and the way we work… that’s why we’re bringing together the power of our most popular productivity tools with the new [Quest Pro] device you announced.” -- Nadella

Pieces of the announcement:

Microsoft Teams and “the full power of” 365 (Word, Excel etc.) are being integrated into Quest Pro VR to “give people new ways to connect and collaborate as if you’re in person” per Satya. Meta Avatars will also be usable in Teams Meetings and consumers will be able to hop directly into a Teams meeting from the Metaverse.

Azure’s (Microsoft’s public cloud offering) Active Directory will support Meta Quest and Quest Pro. This -- per Nadella -- means “larger companies wanting to use these devices can be confident that all security and management options available on PC will carry over to VR.”

Microsoft’s X Cloud gaming product will allow users to play Xbox games on Quest with an Xbox controller and a massive virtual screen.

This is a deep partnership.

Accenture -- a global consulting firm readily embracing the Metaverse -- will also join this partnership. Accenture has already deployed 60,000 Quest headsets within its organization which makes it an ideal ambassador for spreading the word to clients. And with that client base representing 75% of the Fortune Global 500, this invariably will open doors to future deployment.

Accenture’s role will be working with Microsoft and Meta to transform this cutting edge tech into countless, real-world use cases that can make enterprises function more smoothly. The next step here is a “Quest for Business” launch next year. This will be a subscription business (including hardware and key apps) model for enterprises to purchase. If the program takes off, it could make the Oculus revenue stream more reliable and recurring.

On Other New Partnerships Announced:

Meta’s VP of Metaverse (Vishal Shan) announced a new “multi-year collaboration” with NBCUniversal. Together, the two will “co-create experiences around The Office, DreamWorks and more” while allowing these experiences to be accessed within Universal’s physical theme parks. Finally, the Peacock app is coming to Quest.

Meta announced a new Epic Games partnership to bring its licensed content to Horizon Worlds.

Autodesk is rolling out their collaborative design review app to Quest this year.

On Product Enhancements:

Meta is building a Web version of Horizon Worlds to allow access to the ecosystem from any computer or mobile device. While iPhone users can’t fully experience the Metaverse, they can now participate passively in it. This should be a strong tool for driving top of funnel adoption as people see firsthand what they’re missing out on.

Developers can create apps without a headset. Previously, this was only possible with the Oculus hardware. Now creators can tap into Meta’s “Crayta” creation software to build Metaverse worlds on Facebook. Crayta will integrate Adobe’s 3D content creation tools to help greatly with graphics. Adobe is also working on a separate suite of apps designed specifically for Horizon (The name of Meta’s Metaverse)

Meta announced its Meta Quest 2 Active Pack this month as a response to rapidly expanding fitness use cases. The pack allows fitness junkies to keep their hardware clean with wipeable gear.

Meta will debut a Fitness API later this year to allow for real-time tracking of performance and progress.

“We started with simple graphics and we’re doing a ton of work to meaningfully improve how Horizon looks and feels in 2023.” -- CTO Andrew Bosworth

On Blossoming Enterprise Metaverse Use Cases:

Logitech uses Quest to design its in-person events.

Puma and New Balance are designing new shoes using Meta’s Gravity Sketch (3D design app).

Novartis is now using Quest to accelerate its own drug discovery.

On the New Quest Pro for Enterprise (costs $1500 and starts shipping in 2 weeks):

Meta is launching its Quest Pro device geared towards enterprise use cases. The firm expects that productivity will offer the next major batch Metaverse use cases. And so? The new device allows you to do things like suspend a half dozen full size monitors in front of you to mimic your perfect work station in a truly mobile, always available fashion. Zuck thinks this will eventually be the only “monitors” you need. It’s easy to see how he could be right.

Quest Pro also dives further into Mixed Reality (a bridge to Augmented Reality) with uses like overlaying 3D Horizon designs to work on directly through the Metaverse in the physical world for further configuration. This will be called “Magic Room” and is coming soon. The function should facilitate much more productive hybrid meetings as it allows both the remote and present to participate in more actionable, personal ways.

More Quest Pro hardware upgrades:

Simply put, it’s far more comfortable to wear.

Open periphery lenses allow you to see the physical room you’re in while immersed in the Metaverse. This is what actually paves the way for actionable, utility-building Mixed Reality use cases. There are also magnetic light blockers for those wanting the fully immersive VR experience. Your choice!

As a reminder, Mixed reality is a place holder as we move to a world where fully Augmented Reality works perfectly.

Display is 40% thinner than Quest 2 thanks to the new pancake lenses. There are 37% more pixels per inch in the display for better graphics and 75% better contrast as well via new dimming technology.

The new touch controllers -- per Zuck -- are “basically now their own computers re-engineered to track themselves and work as hand extensions.” These can track motion in a 3D space without the headset.

Inward facing cameras pave the way for accurate facial expressions and body language in the virtual environment. This is the most vital piece of making the feeling of social presence attainable in a virtual world. Meta is first to offer it at scale.

The plan is for these upgrades to start with Quest Pro and enterprise and eventually work their way into consumer use cases over time as they become less expensive to implement for Meta.

On Avatars:

Zuckerberg excitedly shared all of the upgrades Meta has made to its Avatar tech. It was rightfully made fun of last year for poor graphics, and it effectively responded. Now, Meta’s new Avatars are the only with fully configurable facial expressions, mannerisms AND LEGS. Believe it or not, legs are very hard to get right considering they’re frequently blocked from our line of site. And if regenerating AI models don’t get spatial positioning perfectly correct with extremities, the experience rapidly worsens for the user.

Avatars are no longer scripted with pre-set movements, but a granular reflection of an individual human being. These avatars will be integrated into Meta’s video services (and Zoom) for a better version of camera off where you don’t have to show your actual self but can be something other than a black box.

And for a sense of what’s next, this is an example of Zuck in Meta’s Codec Avatar form:

No this is not a picture of him, it actually is an Avatar. Meta is now meticulously working through an extensive AI model for the newer Codec Avatars to implement the finishing touches on facial and body recognition and to truly set its Avatar tech apart.

On Perfecting Augmented Reality (AR) -- The Next Frontier:

To make AR hardware smaller and more comfortable, Meta is experimenting with motor neuron and neuro-muscular signals. This allows for the checking of messages, responding and game playing etc. with a small hand movement and no hand controller. These neural interfaces would actually learn the user (vs. us needing to learn how to use it) so that the hand motions most common and comfortable to us are the ones it recognizes for certain actions on a person by person basis. And by using our mind and muscles for commands, the hardware needs are vastly reduced which solves a key AR pain-point. With this new tech, the consumer is the hardware.

This is how we’ll get to a world where sophisticated, cutting-edge smart glasses look identical to a pair of Ray Bans.

On Metaverse’s Tangible, Growing Value Creation:

1 in 3 Quest Store apps are now generating more than a million in annual revenue.

Quest Store apps with over $10 million in revenue are up 50% to 33 in just the last 6 months with apps making $5 million or more per year doubling YoY.

Gaming spend on Quest has now surpassed $1.5 billion to date.

“This is what is looks like when a new platform takes off.” -- CTO Andrew Bosworth

My Take:

I’m really not sure how anyone can walk away from this conference anything but convinced that the Metaverse will be a core part of future human life. Meta already has a large hardware lead in the space, and now new deals with Microsoft and Accenture as well as proliferating Fortune 500 use cases make its ability to take a large piece of this massive pie all the more likely.

It’s obvious to me that Meta is trailblazing and shipping innovation at a far more rapid pace than its most fierce rival today: Apple. Compare this Create event with Apple’s developer events where they debut a Phone with 3 cameras instead of 2. Groundbreaking stuff. While I’m in the minority, I view Meta as capable of developing the next computing platform beyond the mobile phone. It’s coming from a place of desperation vs. what I see as complacency out of Apple. That desperation paired with the capable leadership team and fortress balance sheet should bear considerable fruit in my biased view. The stock is utterly broken. I still wholeheartedly believe in the company.

2. CrowdStrike (CRWD) -- IBM

CrowdStrike’s Falcon platform received “Red Hat OpenShift Certification.” According to the release, this will give shared clients broader breach protection within IBM’s OpenShift cloud environment. Like Deloitte and other large selling partners, this merely offers CrowdStrike another powerful referral channel in the world of technology to accelerate its already brisk market share gains. The new relationship marries Red Hat’s DevOps bread and butter (so developing new software packages and deploying them to runtime) with CrowdStrike’s unmatched ability to protect endpoints, workloads, containers, cloud environments etc.

Red Hat customers will benefit from broader, centralized visibility of an environment, better breach prevention and faster software builds. CrowdStrike will likely benefit from new customer opportunities.

3. SoFi Technologies (SOFI) -- Galileo

SoFi’s Galileo secured Visa Ready Certification this past week as an issuer processor for its payment processing software. The news gives Galileo access to a whole host of advantages:

It’s a positive reputation signal to the rest of the industry. It screams legitimacy just as Galileo’s Mastercard partnership does.

The certification frees Galileo to develop its product roadmap hand in hand with Visa’s partner network (500+ strong) and integration ecosystem to ensure broader interoperability and product-market fit -- and so traction.

The Visa Ready certification also trailblazes a direct line of communication between Galileo’s and Visa’s product development teams. This will make global compliance easier (Visa is a pro with this) and will speed Galileo’s product launch cadence within the worlds of checking/savings, payments, card issuing, lending “and future products.”

This is a good piece of news… but we’ve gotten used to that as SoFi shareholders since it went public. I’m confident that the stock success will come eventually if it keeps executing like it has on an enterprise level. We’ll see if it does.

4. PayPal Holdings (PYPL) -- SMBs and Drama

a) SMBs

PayPal’s Zettle launched its new point of sale (POS) system geared towards small and medium businesses (SMBs) in the USA this week. The product (called PayPal Zettle Terminal) requires no other hardware pairing and is fully mobile. The POS system, (just like with competitors such as Shopify) has been transformed from a static, plugged in system to one that can be taken across the store or on-the-go to help customers shop anywhere. Just like Venmo’s POS terminal stickers, this launch oozes merchant flexibility. It features the ability for shoppers to redeem digital rewards in store, buy now and pay later, or even use crypto funds for transactions. The hardware costs $199 dollars.

Aside from a few perks like crypto usage, POS systems are commoditized at this point in time. Winning here is about how you can lace in other value creating services and integrations to motivate the merchant to pick the most convenient options in a sea of similarity. I think PayPal effectively does this.

b) Drama

PayPal published a new policy last weekend giving it the ability to claw back funds from merchants for “spreading misinformation” or conducting other illegal activity through the platform. This freaked some people out, and rightfully so considering how subjective “misinformation” ironically is. I wanted to offer a few notes on this:

PayPal is financially liable for its merchant’s illegal behavior… not the actual merchants. So? The company constantly tests new ways to dis-incentivize merchants to break laws. This was one of countless attempts at doing that. Other players like Shopify and Block routinely create policy to fine merchants for wrong-doing.

The company immediately rescinded the policy and added that it was inadvertently sent out. Was this rescinded via public backlash and not actually a mistake? Maybe, but I don’t really care. Some argued that if it was written out as policy, it already made it through all necessary legal teams. That’s not accurate. We have very little color on how far it actually got or how rough of a draft this was. It was a paragraph in a document; we can only guess.

This, to me, will be a blip on the radar. I don’t expect the public blow-back to materially impact its results as… just a few days later… we’re already on to the next story. Jefferies came out with a note along those same lines this past week. Far less than 0.1% of PayPal accounts interacted with the “delete PayPal” hash tag this week across social media and surely only a small portion of those actually deleted accounts. No large brands left the platform or even announced they were considering doing so. Noise. This was a misstep for sure, but not one that makes me all that concerned.

5. The Trade Desk (TTD) -- New Hire

The Trade Desk named Dr. Bill Simmons as its new VP of product. Simmons was a co-founder at Dataxu, which was purchased by Roku. Following that sale, he worked in a similar role with Roku for a couple of years. This change can be seen as a somewhat horizontal career movement, meaning Simmons perhaps saw The Trade Desk as a more compelling company to be part of for the longer term. I’m speculating… maybe it just paid him a lot more.

6. Penn Entertainment (PENN) -- Growth

Penn announced the following new projects this past week:

Moving its two Illinois riverboat casinos (quite old and dated facilities) to land-based locations. One of these facilities will be in Aurora Illinois and that city will fund $50 million of the project. Penn will lease both facilities as part of a new agreement with Gaming and Leisure Properties.

Building a new hotel at its Hollywood Columbus casino in Ohio.

Building a 2nd hotel tower at its M Resort in Nevada to accommodate supply shortages.

Penn has up to $550 million in liquidity to tap into from Gaming and Leisure Properties for property improvements at a 7.75% interest rate.

Penn expects these new projects to cost $850 million total. Out of pocket costs for Penn will be around $300 million.

It’s strange to see a casino operator aggressively expanding in this economy. But the expansions are a direct response to continued robust demand. It needs the capacity -- even today as consumer confidence worsens and economic cracks deepen. And if it needs it today, surely it will when the backdrop doesn’t suck so much. Barstool re-brandings are turbo-charging its brick and mortar operations (which were already doing fine pre-Barstool) and Penn Entertainment, in my mind, is rightfully leaning in.

7. Lululemon Athletica (LULU) -- Upgrade

Raymond James came out with some very nice things to say about Lululemon and its stock. As always, I’ll focus on the fundamental reasoning behind the note, and not the $345 price target. The institution sees a combination of Lulu’s core segment strength, success in product and geographic expansion and best in class leadership and margins as the reasoning behind its optimism. In other words: It’s a great business. The firm sees the loyalty of Lulu’s consumer base and the higher price point insulating it from the brunt of this macro cycle’s pain. This sounds eerily similar to what I’ve been saying for the last several months.

8. Olo (OLO) -- New Client & Jack in the Box

a) New Client

Olo announced Cameron Mitchell Restaurants and its 40+ locations as its newest brand client. The chain is a bit more up-scale than most of Olo’s customers, meaning this news serves as a sign of the firm’s ambition to expand into finer dining finding traction. The brand is landing with 3 Olo modules out of the gate (vs. less than 2 on average for the company): Ordering, Rails and Dispatch. It’s good to see news like this continuing to come following the company’s last quarter where it cited a lengthened sales cycle as the reason for underwhelming results and guidance.

b) Jack in the Box

The other worry stemming from Olo’s last call was its loss of Subway as a client. This was its largest customer by total locations (but not close to largest by Olo revenue contribution as it used just 1 module). This led some, including me, to fear a weakening in Olo’s competitive positioning. After talking to CEO Noah Glass, I was confident this would not be a trend. We got a good (anecdotal) piece of news pointing to that being the case this week. A year into Olo’s partnership with Jack in the Box (2,000+ locations), the large chain is adding its second Olo module (Ordering) to join the Dispatch module. Clearly, they’re happy.

Either last quarter was the beginning of a trend in worsening fundamentals, or it was a culmination of all pandemic shocks hitting it at the same time. I think it’s the latter, and so also think this company’s performance will sharply bounce back over the coming quarters. We’ll see if I’m wrong or right.

9. Upstart (UPST) -- Leadership

Upstart’s General Counsel Alison Nicoll is retiring in November. Scott Darling is being promoted to Chief Legal Officer to be her successor.

10. Green Thumb (GTBIF) -- An Unfortunate, and Ideally Temporary Goodbye

In the past week, the majority of Green Thumb’s audit committee and independent directors resigned while its top lawyer subsequently followed suit. Apparently, this news stemmed from personal conduct disagreements and not financial controls, but it’s still an immediate red flag in my mind. Considering how fundamentally similar Green Thumb is to other large players in the space, it does not make sense to me to continue holding this name today with the corporate governance risk that others don’t feature.

Green Thumb has been consistently stellar with fundamental execution, and so my decision to exit this week was quite frustrating… but also necessary. The ambiguity of the news releases leave us investors in the dark for now, and I’m not willing to hold shares while that remains the case.

Some pointed out that leadership cannot explain the developments during the company’s blackout period. That rule should only extend to material financial disclosures and should not cover discussing this now publicly available news. In a perfect world, CEO Ben Kovler addresses this head on and offers an explanation making me comfortable to re-enter.

Today, the Green Thumb equity I sold went straight into MSOS (a cannabis ETF) as a temporary placeholder. So my total cannabis industry exposure did not change. Either Green Thumb eases my concerns, or I buy my next favorite in the space -- Trulieve -- to join Cresco Labs in my portfolio.

11. Macro

a) Key Data from the Week:

Economic:

The Producer Price Index (PPI) Data this week was negative:

The PPI was +0.4% month over month vs. expectations of +0.2%.

YoY, the PPI was +8.5% vs. +8.4% expected and +8.7% last month.

The core PPI (strips food and energy) was in-line with expectations at +0.3%.

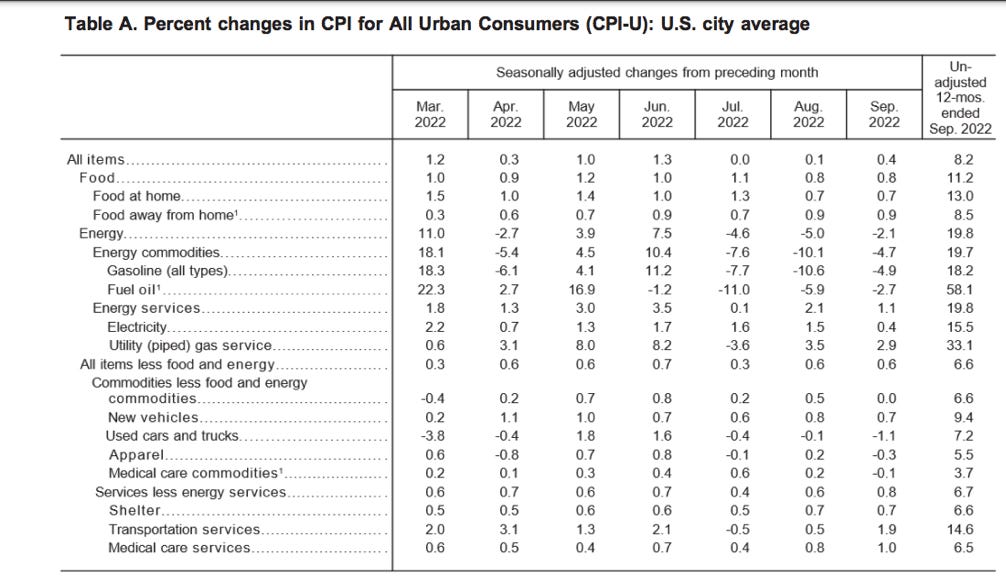

The Consumer Price Index (CPI) Data this week was also negative:

The CPI was +0.4% month over month vs. expectations of +0.2% and +0.1% last month. Not good.

YoY, the CPI was +8.2% vs. +8.1% expected and +8.3% last month. The peak CPI narrative is still in place, but the downward pressure has been too slow to declare victory.

The Core CPI grew +0.6% month over month vs. expectations of +0.5% and +0.6% last month as well.

Initial Jobless Claims came in at 228,000 vs. 225,000 expected

Core Retail Sales came in ahead of expectations at +0.1% vs. -0.1%.

Retail sales were flat this month vs. 0.2% growth expected.

Michigan Consumer Expectations missed expectations while Michigan Consumer Sentiment beat.

The Fed Minutes did not have many surprises. Hawkish policy will continue and the pace of that continuation will (hopefully) depend on new data.

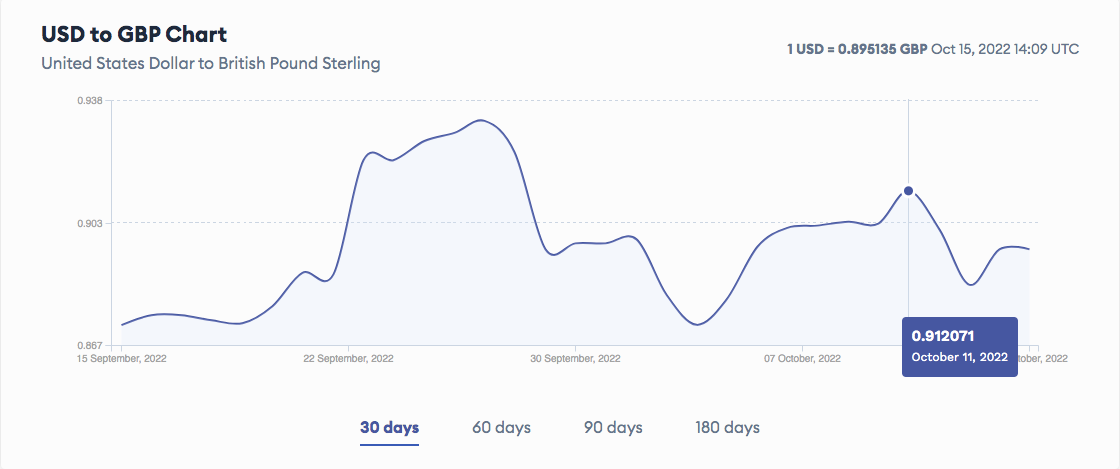

The United Kingdom reversed a previous tax cutting decision this past week. This led to a strengthening Pound and so easing pressure on the red hot U.S. dollar. Markets loved this -- regardless of the how inflation data.

5 Year Breakeven Inflation unfortunately continues to tick back up. The University of Michigan’s longer term inflation expectations also unfortunately ticked up this past month. Conversely, The New York Fed released data pointing to 1, 3 and 5 year inflation expectations falling.

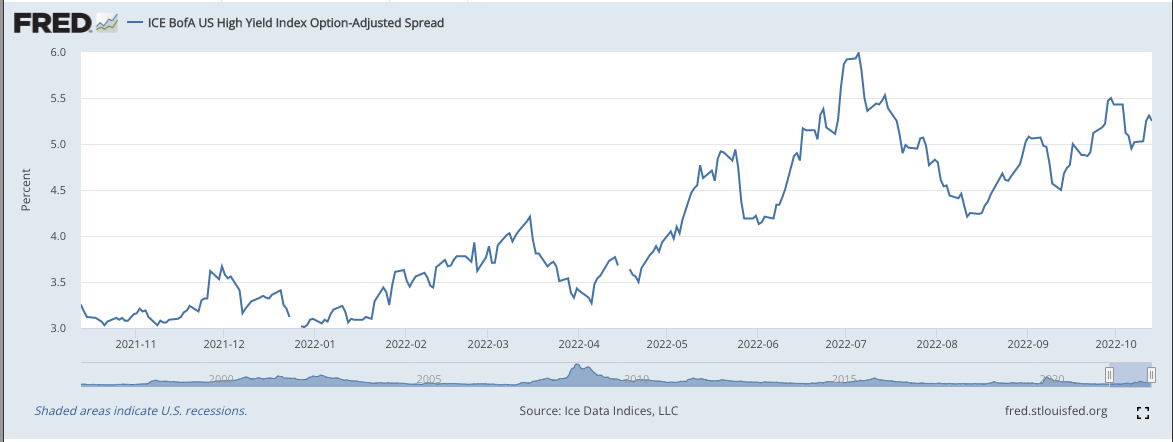

High Yield Option Adjusted Corporate Credit Spread Chart (higher points to worsening risk tolerance and liquidity):

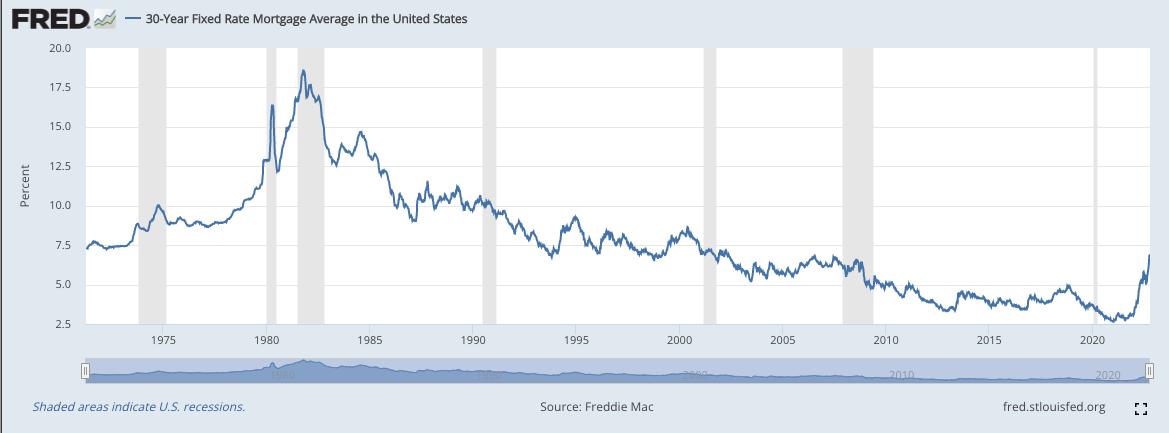

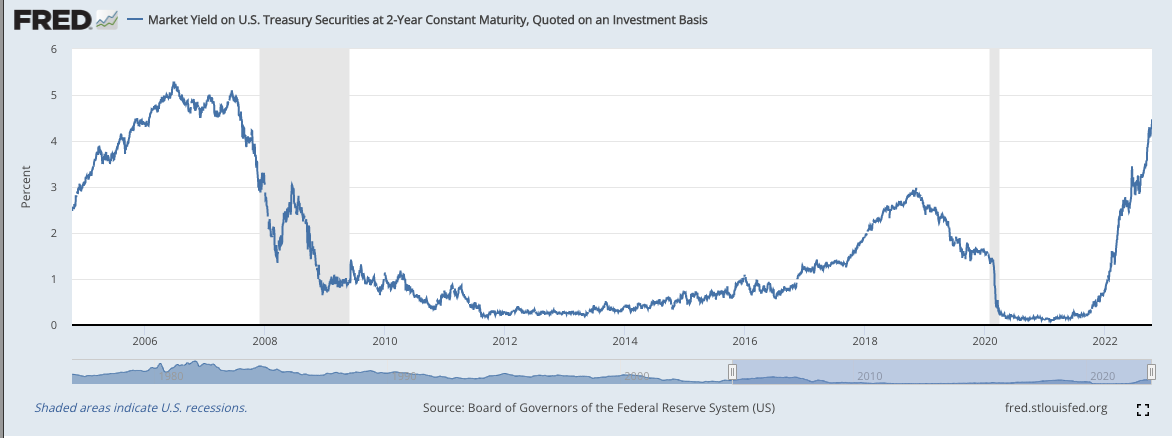

The 30-Year Fixed Rate Mortgage rate and the 2 year Treasury Yield both continue to set multi-decade highs:

Company Specific:

J.P. Morgan is telling clients needing cash to raise it now with expectations of further credit market deterioration.

Intel is cutting thousands of jobs.

b) Level-setting the data:

Data from the week was largely negative in terms of getting to a hawkish pause. The developments confirm what we already knew to be true: rates will keep rising and the balance sheet will keep shrinking. That won’t change in 2022.

Still, it’s vital to keep in mind that this poor inflationary data is backward looking and that the fear of runaway inflation is easing.

More current indications of freight, auto, food, lumber, energy and rent prices are all seeing meaningful contractions. And with previous rate hikes yet to take effect on the economy as well as supply shortage news being replaced with frequent inventory gluts, I still think 2023 will offer a much more encouraging macro backdrop for a stock picker like me. All this week did was push me to exercise perhaps a tad more caution and slowness in my accumulation pace for now.

12. My Activity

I moved my Green Thumb equity into MSOS this week and added to Duolingo, Match Group, Revolve, Olo and Shopify. My cash position is 17.9% of holdings.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that roughly 50% of the MSOS position is a placeholder for my position in Cresco Labs while OTC stocks are added to the platform. You can also re-create your very own portfolio through Savvy Trader here.