News of the Week (October 17-21)

The Trade Desk; SoFi; PayPal; Meta Platforms; Upstart; Progyny; Lemonade; JFrog; Penn Entertainment; Nanox; Match; Market News; Macro; My Activity

This piece is powered by my friends at Savvy Trader:

1. The Trade Desk (TTD) -- Netflix, Fubo, Snapchat & Secular Growth

a) Netflix (NFLX)

Please note that Netflix is not a holding. As such, I’m not concerned about the company’s earnings so much as its planned ad product and how The Trade Desk will benefit. So that is the main focus here. This is not meant to emulate earnings reviews that I publish for each holding.

On the Planned Advertising Product:

Netflix is debuting a $6.99 per month plan with 5 minutes of ads per hour. This is far less ad load than linear, and that’s entirely thanks to the fully targetable nature of connected TV (CTV) vs. linear. The added efficacy that this fosters means advertisers can achieve target returns with fewer annoying breaks in the content. This ad supported tier will roll out next month.

Netflix thinks the ad plan will be immediately neutral or accretive to margins. So? Considering how the cheaper price should create new demand, the company should be incentivized to promote its ad-supported products more than the full-priced subscriptions. Ads grow the addressable market while improving unit economics. A win-win. As an added bonus, advertisements also mean profile sharers are still monetized even if they’re not paying for their own plan. So? Monetization mirrors total hours watched more closely.

Netflix’s ad inventory is oversubscribed. It still expects its Cost Per Mille (CPM) rate to be roughly 2-3X the competition. And how will that be? The only way this is remotely possible is by enabling open internet auctioning/bidding. When that happens (not if), The Trade Desk will be the player representing most of the available demand.

Quickly on the results:

Netflix beat its earnings expectations by a roughly 50%. Conversely, its forward earnings guide sharply missed expectations. This, to me, seems to be a matter of timing more than anything as the company discussed shifting some OpEx from Q3 to Q4.

The strong U.S. dollar is impacting its margins with an operating margin guide of 4% which would have been 10% on a FX neutral basis.

Netflix beat revenue expectations slightly and missed revenue guidance slightly. Some called out Netflix’s revenue guide implying its slowest growth ever. That’s mainly related to a strong dollar.

The highlight of the report was its 2.4 million net subscriber adds which more than doubled depressed expectations of 1.0 million adds. It reversed a 6 month trend of negative subscriber growth in North America as it distances itself from the positive pandemic shock.

“We’re excited to work with partners and advertisers to think about the ads experience… over the next couple of years, we’ll better understand the right native format for premium CTV ads.” -- Chief Product Officer Greg Peters

b) Fubo

Fubo pre-announced revenue ahead of its guidance and reiterated its path to free cash flow while ending its sports gambling business to get there. Why does this matter? Fubo was one of the first publishers to plug into Unified ID 2.0. And this past year, that integration has allowed its pricing per impression to FAR outpace impression growth while its peers haven’t enjoyed the same -- thus paving the way for the revenue beat. This is a small, anecdotal, yet still encouraging piece of news to pressure remaining publishers to embrace this new open internet identifier and The Trade Desk’s platform more broadly. Furthermore, this also hints at CTV remaining durable which is The Trade Desk’s largest and more promising (along with retail media) revenue channel.

c) Snapchat

This section functions to remind everyone how irrelevant Snap’s results are as a hint for The Trade Desk’s. Fubo and Netflix were the signals to focus on this past week. Next.

d) New Data

The Trade Desk released some encouraging data this week reiterating how compelling its niche truly is. Here were the highlights:

43% of Americans are embracing more ad-supported content this year vs. last. This is why HBO Max, Netflix and Disney are all now more openly embracing ad models than they have in the past.

Using The Trade Desk’s data driven ad buying platform, advertisers can precisely control ad frequency to effectively cut 38% of low return impressions with frequency control. By re-investing those savings through The Trade Desk, advertisers efficiently expand reach by 24% on average.

2. SoFi Technologies (SOFI) -- Galileo and Insurance

a) Galileo

SoFi’s Galileo unit and its client -- T. Rowe Price -- debuted a new app this week. Together, the two will offer “Waysaver” through T. Row Price’s platform. Waysaver is a “smart savings app providing easy, secure and automatic ways to create emergency savings funds.” T. Rowe built most of the front end while Galileo is running most of the backend. This marks a deepening of an already tight relationship where the two worked together on SoFi’s bread and butter student loan offering.

Developments like this one make me more excited than positive developments from the consumer facing app. Yes, SoFi’s annual percent yield (APY) is a fantastic top-of-funnel differentiator to juice direct deposit and member growth. But aside from that, there are countless FinTech apps featuring most (not all) of what SoFi provides. Many have a comparable APY at this point as well.

So? If it’s also powering FinTech’s backend through Galileo and Technisys, that makes a successful investment case less reliant on picking a winning brand (hard to do) vs. picking a rapidly growing sector like FinTech (easier to do). Furthermore, nearly 100-year-old firms with $1 trillion+ in assets trusting their businesses and customer relationships to Galileo is a positive reputation signal to say the least.

Business to business (B2B) traction has been brisk thanks to the sleek nature of SoFi’s application programming interface (API) suite and its ability to do things like act as a sponsor bank for non-chartered FinTech’s. That role saves Galileo clients a bit on 3rd party fees while SoFi enjoys more revenue and profit from the unique cross-sale.

b) Insurance

SoFi and Bindable Technology are partnering to offer SoFi members branded insurance products as the one-stop shop continues to round out its offering. SoFi has dabbled in things like crypto insurance for investors, but this marks a more pronounced focus here -- as we’ve been told to expect the last two quarters.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. PayPal Holdings (PYPL) -- Rewards Program

PayPal debuted a new rewards program this week. The offering adds tracking, saving and redeeming of rewards capabilities directly to the new PayPal digital wallet to join all of the newer shopping features. And thanks to PayPal’s ubiquitous scale, this means the app will function as a true hub for saving on commerce by brining together tens of millions of merchant rewards plans. Perks of the new program include:

Combination of rewards from various purchases from different merchants.

A seamless Honey integration (which is its smart shopping tool with an automated coupon finder and tracker).

No category restrictions or rewards minimums for redeeming points.

Easy transferal of points to linked bank accounts to quickly turn rewards into cash.

People always care about savings. But the motivation to seek out savings becomes more and more pressing as the economic backdrop grows more precarious. That’s what is happening now, which is why products like Honey have been standouts for PayPal as of late.

4. Meta Platforms (META) -- UFC, ROAS & Branded Content

a) UFC

Last week, The UFC and Meta Quest announced a new fully-immersive content experience. Fans will now be able to throw on their Quest headset for a front row seat to the most popular fights.

Whether it’s a more convenient work set-up, risk-free medical training, design, fitness or entertainment, VR use cases are proliferating at a rapid clip.

As an aside, I saw some concerns circulating around Meta Horizon currently having less users than the company originally anticipated. To focus on if Meta has 200,000 or 300,000 or 400,000 monthly active users (MAUs) today, in my opinion, is failing to see the forest through the trees. The near future is about hardware enhancement, more software integrations with firms like Microsoft, more enterprise use cases with organizations such as Puma, and more selling partners like Accenture to drive adoption. The total users on Version 2 of this product is simply irrelevant to me. What this product looks like even 12 months from now will be astronomically different than it is today.

b) Channel Checks

RBC channel checks continue to show advertising green shoots for Meta’s Family of Apps. Its new Advertising+ product (to help with measurement and addressability) is bearing fruit and “advertiser forward commentary favors Meta vs. Google” per the institution. When pairing this with last week’s news that I shared on Meta’s Return on Ad Spend (ROAS) metrics trending well above 2021 levels, it appears that the Family of Apps (FOA) may be seeing a performance trough. That would be extremely welcome news and -- if FOA can evolve back into a wildly stable growth and cash flow machine -- would likely make the investment community more tolerant of the speculative Metaverse investment.

c) Branded Reels Content

Meta is debuting its own branded Reels content on the Family of Apps.

d) TikTok

Forbes reported that TikTok employees were attempting to track locations for various America citizens using the app. I still think a TikTok ban in the United States is a “when not if” event. I just don’t have a clue when it will happen.

e) Giphy

Microsoft can buy Activision Blizzard, but apparently the UK won’t let Meta buy Giphy for well under a billion dollars. Ridiculous, but at the same time, concerning. Zuck needs to do better in massaging relationships with regulators and his stand-offish tone at times certainly is not the way to do it. Microsoft’s Satya Nadella is simply more likable to the general public, and Zuck could learn a thing or two from his leadership style in my view. No reason to create a path of greater resistance.

f) Snapchat

Conversely to The Trade Desk, Snapchat results are a slightly more reliable indicator for what to expect from Meta. Still, the key part of that sentence is slightly more. Snap doesn’t have Meta’s scale, doesn’t have its unit economics, doesn’t have its balance sheet and doesn’t have a capable leadership team (in my view). While the two will deal with similar macro headwinds, Meta is easily more capable of handling them -- even with the unique current headwind of ramping Reels monetization. I’m not saying its results will be amazing. I am saying Snap’s shortcomings should not be automatically extrapolated to Meta.

5. Upstart (UPST) -- New Case Study

Upstart’s newest (publicly announced) credit union partner is certainly enjoying the relationship thus far. In a new Atlantic Federal Credit Union (AFCU) case study released, the financial institution (FI) was praised for its willingness to lean into credit origination amid deteriorating macro and growing consumer needs. Rather than turning away from innovation like others have, AFCU instead obsessively dug into researching and vetting FinTech options as potential partners and eventually arrived at Upstart for its underwriting and interface superiority.

And AFCU is being rewarded for this small leap of faith with a diminished loss ratio from Upstart-sourced loans of under 1% vs. a mean expectation of 4% according to AFCU’s COO -- not Upstart leadership. This vast outperformance is coinciding with volumes also greatly exceeding expectations. So it’s not a matter of AFCU simply being overly picky about loan candidates. Furthermore, all of this strong data is from a period of tumultuous macroeconomics… not from when credit markets were historically easy and the tide was lifting all boats.

Interestingly, AFCU also called out Upstart’s verification process which has cut its fraud rates and paved the way for more seamless National Credit Union Administration (NCUA) compliance. Based on all of the success, AFCU is now actively borrowing Upstart’s white-labeled interface for its own website and aggressively raising its program originations. Love to hear it.

“Upstart has done a phenomenal job of meeting our aggressive goals and requirements… we’ve worked with other vendors in the past, but because of Upstart’s eagerness and willingness to help tailor the program to our needs, it’s been incredible. Our CEO and board couldn’t be happier with the results.” -- AFCU COO Jason Reed

Continuing to deliver overachieving loan pools to its partner retention network is the only way that network will sustainably grow across business cycles. Upstart seems to be doing just that. There have been some underperforming Upstart loan vintages sold through capital markets in the last 12 months (many more outperformed vs. underperformed), but the consistent trend of outperforming bank and credit union partner originations remains true through all of the chaos.

6. Progyny (PGNY) -- Accolade

For the 4th consecutive year, Crain’s New York Business named Progyny to its Fast 50 list. For 6 years, this company has grown all relevant key performance indicator leads over the rest of the field while rapidly and profitably compounding. That’s why it’s my largest holding. What an easy company to own -- in my biased view.

7. Lemonade (LMND) -- Chewy Partnership

Chewy’s “Care Plus” insurance and pet wellness offering is adding Lemonade pet polices to its network. This isn’t an exclusive arrangement, as players like Trupanion are also part of the network. Chewy could even be trying to piece together an insurance marketplace to tuck into its product which would dilute the meaningfulness of this news. But I’m speculating.

And still, it does open Lemonade up to millions of high intent buyers for its budding pet product. And this channel of demand should theoretically come without the company having to work so hard on marketing and customer acquisition -- so it could be more profitable growth. Chewy fetches (pun intended) the brand awareness and Lemonade provides a lucrative cross-selling opportunity to make Chewy’s telehealth and Rx offerings more compelling. As part of the program, Lemonade Pet plan owners will be eligible for these telehealth and Rx services as well to add true breadth to the offering.

Based on the release, automation and AI-driven ease of use seemed to be the deciding factor for inviting Lemonade into the fold -- along with a similar culture of charitable ties. Why is that important? Because Lemonade’s differentiation solely comes from those two factors. If it is winning business because of these strengths, the model is working (at least from a top line perspective). The partnership will go live next spring.

I’d love to see Lemonade have a sharper focus on building a partner roster of firms like these, but also realtors for business segments like home insurance. That seems to be in the plans -- according to CFO Tim Bixby last quarter -- but is more of a longer term project.

8. JFrog (FROG) -- Launch

JFrog is debuting “JFrog Advanced Security” to unify software package protection across the entire DevOps cycle -- from developer source code all the way to binaries released in run time to the endpoint. This module will be operable in any environment and intimately integrated into Artifactory (its binary repository) and Xray (software composition analysis and security -- AKA a bill of materials to track the health of binaries).

Open Source Code often functions as the vulnerable kink in the armor for companies as scalable protection of this source code with all of an enterprise’s customization built on top is difficult. What’s easier? Transcribing all of that source code into 0s and 1s (binaries) for a holistic, easily scalable and easily organizable single true source/language of infrastructure health. JFrog can aggregate and contextualize more data than other DevOps players thanks to its binaries niche, so it can protect customers more holistically. That’s why JFrog’s binary repository thrived amid the Log4J hack as its software automated remediation of this code in minutes vs. others taking months.

This product lets developers focus on building code, and takes the pressure off of enterprises in their pursuit of securing that code and ensuring its consistent quality. Enterprises can access and track JFrog’s performance through a single dashboard which is set to “reduce overhead and more quickly identify malicious code” that is commonly missed.

To me, this product is somewhat similar to its Xray module with more use cases and eligible environments tied in. It’s not a transformative release, but more of a broad upgrade.

According to the company, these will be some of the key incremental (paraphrased) benefits:

Exposed Secrets Detection: Uncover unwanted permissions and leaked identification info to prevent painful leaks of APIs, tokens and passwords etc.

Container Contextual Analysis: Rapidly scan any container for malicious software packages and vulnerable open source code while ranking these vulnerabilities by priority.

Insecure Use of Libraries and Services: Makes which open source code to avoid in building applications more obvious to developers.

9. Penn Entertainment (PENN) -- Gambling Data

Recession? What recession? I’m kidding, but by the looks of current sports gambling data, consumers (perhaps somewhat unfortunately) do not seem to be giving up their vices. The State of New York reeled in over $1 billion in total bets with data from multiple other states looking “very strong” according to Jefferies. Growth remains robust. Out of the market share leaders, DraftKings and FanDuel are still a clear 1 and 2 with MGM and Penn’s Barstool in the 3rd and 4th position for market share. It’s important to keep in mind that this is bet market share. Barstool’s revenue market share has consistently outpaced its handle share across its footprint because the company spends much less on marketing and customer acquisition than the field. Why? Because Barstool is a passionate cult of nearly 100 million fans. Sports gambling is a commodity. Branding will win eventually. That’s advantage Barstool.

All of this data prompted Jefferies to maintain buy recommendations on the 4 aforementioned companies to their clients.

10. Nano-X Imaging (NNOX) -- ARC Day

Nanox will host an investor event next month to show off the 3D imaging capabilities of its ARC machine. The most interesting part of this announcement is that this year there will be a live audience. Last year the only attendees were Nanox employees. That decision exudes confidence in the hardware.

11. Match Group (MTCH) -- Plenty of Fish App

Plenty of Fish -- one of Match Group’s legacy, lower growth dating apps -- is debuting a playful new way to break the ice. Starting now, the app will launch “Cue’d Up” which is an in-app card game to help singles less awkwardly dive into conversations.

The card games include groups of up to 6 people where participants are prompted with a cue and then asked to respond within a short period of time. Players then anonymously share responses and vote on their favorite answers. These rounds build a sense of compatibility between players so that the app can ultimately match individuals.

Match Group generally tests new features like this one in its less important apps (no offense to Plenty of Fish) in a sort of split-testing fashion. If the change shows to effectively juice engagement and payers, it ends up extending the product enhancements to its prized apps: Tinder and Hinge.

With the majority of Plenty of Fish’s users worried about how to respond to messages and how to break the ice, I could easily see this launch taking off. But success likely won’t impact results all that much until it’s launched across its other, more material app contributors.

Match Group continues to set new 52-week lows and I’m waiting for a bit of a breather from the selling or a base to form before getting more aggressive with building out the rest of my position. I still believe in the new CEO wholeheartedly (his track record makes that very easy) and see his leadership paired with Match’s 50% global market share of a 10%+ CAGR space as extremely attractive. The multiple also prices in very little success at this point. I have no interest in selling any shares.

12. Market News -- Apple News, Bank of America Earnings, & the Coinciding Consumer Hints

Like Netflix, Bank of America and Apple are not holdings and will probably not be in the future. But they are massive consumer-oriented bellwethers and so I find their comments to be a reliable gauge for other companies. There’s one important caveat to mention: Bank of America and Apple cater to a generally affluent crowd. So? This data is a more reliable read-through for a company like SoFi vs. one like Upstart.

a) Apple’s Production Cut:

Just two weeks after beginning production on its mid-tier iPhone 14 Plus model, Apple is cutting production targets and has asked a manufacturer in China to halt manufacturing. Yet another sign of a weakening consumer for the largest tech company in the world. There was no announcement like this for its most expensive model.

b) Bank of America Earnings Highlights

On Bank of America Results:

Bank of America sharply beat expectations across the board with ample operating leverage as its loan book enjoys expanded net interest margin (NIM). It offered upbeat forward guidance.

If you’re picking on shrinking net income year over year, this is a function of building credit reserves this year vs. releasing them last year. Nothing to see here.

Digital sales were the strongest driver of its top line beat.

On Consumer Health per Bank of America

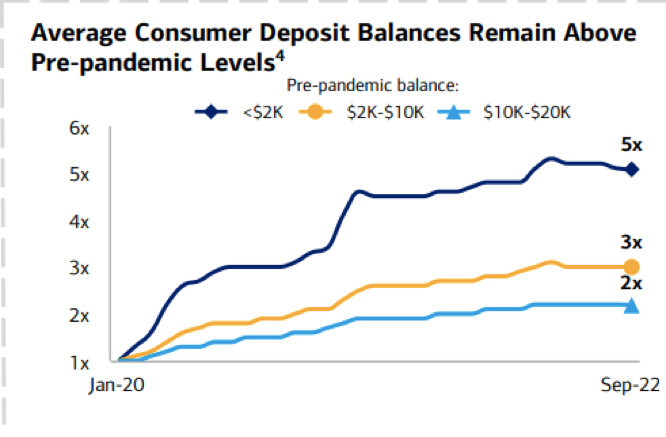

The successful quarter was powered by “good organic customer activity” according to CEO Brian Moynihan. Consumers are “spending at strong levels” and average deposit levels are multiples higher than pre-pandemic.

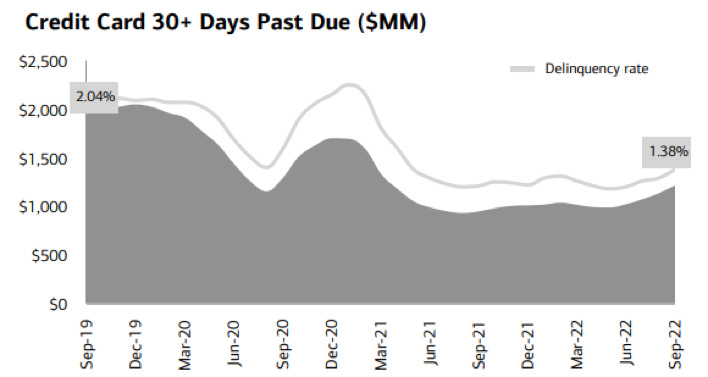

Card re-payment rates are a robust 1,000 basis points above pre-pandemic levels.

Early and late stage card delinquencies remain well below pre-pandemic levels and near decade lows. They’re now gradually rising but can rise another 30% before approaching the 5 year average.

“We just don’t see inflationary and recessionary pressures slowing consumer spend at Bank of America. Consumer spend is up 12% YoY and up 10% so far in October… This isn’t just inflation driving spending as transaction growth is outpacing the rate of inflation.” -- CEO Brian Moynihan

On the brief takeaway:

This is just another sign of the affluent consumer holding up far better in the current inflationary and hawkish environment vs. the less affluent consumer. The pattern is crystal clear. This is why companies like Lululemon are hanging in there more gracefully than others.

13. Macro:

a) Key News from the Week

Wall Street Journal’s Chief Economics Correspondent -- Nick Timiraos -- had some very interesting Federal Reserve hints to share this week. According to him, there’s a growing divide between officials on what to do after a likely 75 basis point hike at the next meeting. Apparently, there’s building support for slowing rate hikes and pausing them entirely early in 2023 if data continues to trend in the right direction. Mary Daly (not a voting member of the Fed) added commentary this week pointing to her concern over continued large rate hikes. Step 1 of a hawkish pause is commentary like this beginning to pop up.

Not to sound arrogant, but that’s exactly what I’ve been saying all year: That a hawkish pause will not happen in 2022, but as we approach yearend aggressive increases would slow to a halt before pausing sometime in the first half of 2023.

New York’s Empire State Manufacturing Index sharply missed expectations at a reading of -9.1 vs. -4.0 expected. Conversely, overall industrial production grew 0.4% month over month which beat expectations of 0.1% growth.

Housing starts missed expectations while building permits (more of a leading indicator) beat expectations.

The 30 year fixed mortgage set a new 22nd century high this week.

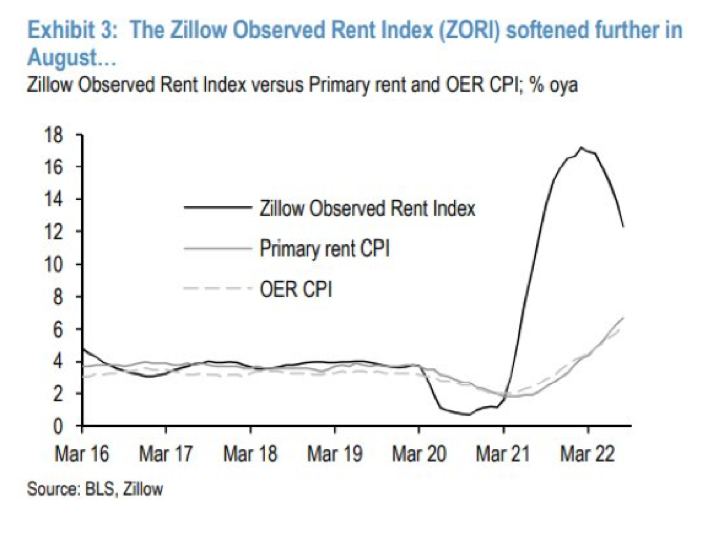

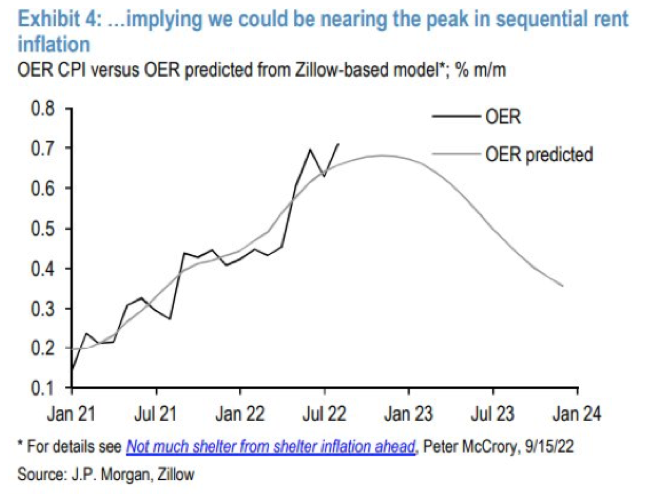

@Qcapital2020 on Twitter shared an awesome visual of owner equivalent rent (OER) (a very lagging indicator) and Zillow’s Observed Rent Index (a more forward-looking indicator). The takeaway is obvious: Rent inflation is easing and OER -- which is what the Fed is monitoring -- has not begun to reflect that. It will eventually.

5 Year Breakeven Inflation has looked consistently worse over the last few weeks… reversing a consistent positive trend:

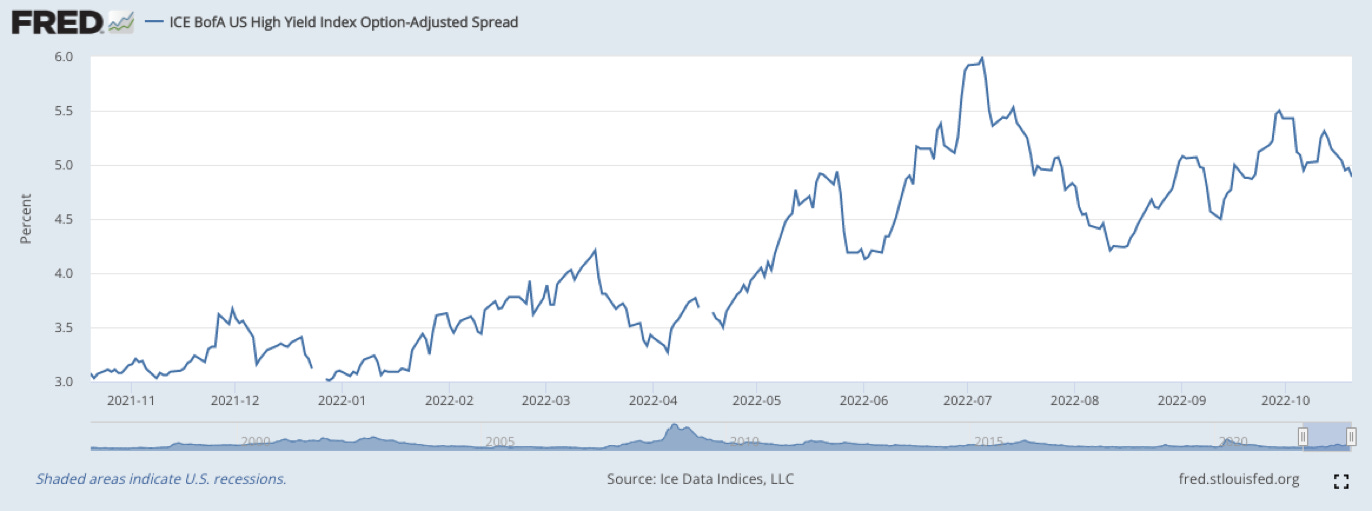

High Yield Option Adjusted Corporate Credit Spreads have continued to look better and better in recent weeks… reversing a consistent negative trend:

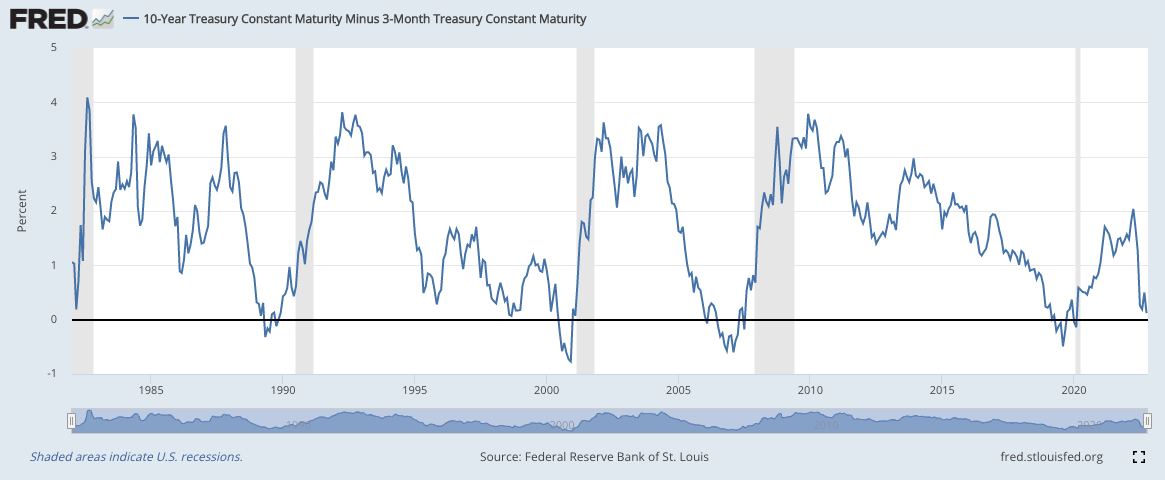

The 10 Year - 3 Month Yield Curve (which is a cleaner signal for deep recessions than other pieces of the yield curve) is unfortunately again creeping back to inversion:

The Dollar vs. British Pound continues to show a bit of a breather for U.S. Dollar strength (good news):

b) Level-setting the data

This was a relatively quiet week in macro land. Not much has changed from the last few articles, so to avoid redundancy, I would invite anyone interested in reading about my current take on the macro backdrop to check out the last few issues. My base case remains the same: No pause until early 2023, and gradually slowing hawkish aggression as we approach that time.

15. My Activity

I did not transact this week. My cash position is 16.8% of holdings.