News of the Week (October 24 - 28)

SoFi; CrowdStrike; Upstart; PayPal; Shopify; Meta Platforms; Olo; Cannabis; Macro; My Activity

This piece is powered by my friends at Savvy Trader:

1. SoFi Technologies (SOFI) -- New Launch

Galileo and Technisys together launched Cyberbank Digital as a managed service. Intuitively, this builds on the Technisys Cyberbank multi-core banking offering. As a reminder, Cyberbank provides a slick, unified UI/UX as well as tech to help accelerate a client’s product launches and operational efficiencies through tools like conversational AI. It can even tweak and tailor the customer experience on a user by user basis to ensure content is most relevant for each person.

SoFi is pairing Technisys’s vast expertise in building a granular, approachable banking app interface with Galileo’s payment processing engine to provide somewhat unmatched breadth in the world of fintech software. It has seamless navigability + deep banking functionality wrapped into 1.

Furthermore, adding a fully managed option will lower the barriers to purchasing and on-boarding for clients by placing the entire operational burden on SoFi. That will allow for more rapid digital evolution by making that transition more seamless.

I’ve been asked: “How can SoFi have access to this cutting edge technology, yet also have an underwhelming consumer app?” That’s a fair question. Priority one for Galileo and Technisys -- considering how much SoFi invested in the two firms -- was to solidify the health of each company as a standalone, independent entity. This news marks a move to stage two: Combining the utility of each software platform. After that’s wrapped up is when SoFi will use all of these tools to improve its own consumer facing app. It’s a process.

2. CrowdStrike (CRWD) -- EY & an Accolade

a) EY

CrowdStrike and global consulting giant Ernst & Young (EY) announced a new cloud security and observability alliance this past week. Over the last few years, CrowdStrike has taken to heart criticism that it isn’t a good enough partner or team player with other parts of its ecosystem. Well, since then it has signed lucrative selling deals with countless Managed Security Service Providers (MSSPs), cloud titans like AWS, bellwethers like Deloitte, and now it is extending its established relationship with EY to more of CrowdStrike’s product categories.

That’s why partner revenue is growing at a triple digit clip -- and relationships like this will work to fuel the fire. EY will now focus more enthusiastically on recommending CrowdStrike’s cloud & observability tech to its clients (some are listed below).

b) Accolade

SE Labs independently published an Enterprise Security Ransomware Test painting CrowdStrike in a very positive light. Not only did CrowdStrike achieve 100% protection, but did so with ZERO false positives. Why is this so important? Security resources are scarce. Inundating already busy teams with false positives diminishes productivity within mission-critical tasks while adding unnecessary cost

“CrowdStrike Falcon performed exceptionally well, providing complete detection and protection coverage against all direct ransomware attacks. It provided thorough insight into the full network breaches that concluded with ransomware deployments… An excellent result in an extremely challenging test.” -- SE Labs CEO Simon Edwards

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Upstart (UPST) -- New Partners

a) Honda

Add Honda to the list of major auto manufacturers embracing Upstart Auto Retail. This week, Upstart secured a Honda Digital Solutions Partner certification. This makes the software is eligible for deployment in all 1,000+ Honda dealers across the U.S.

Whether it’s Kia, Lexus, Toyota etc. iconic car companies are flocking to this platform for the automation-fostered input cost reduction, better customer experience and superior underwriting (subjective at this point). As the fastest growing auto retail software in the United States, this will provide yet another lever of growth for the already thriving segment. Macro will not suck forever. When it doesn’t, I expect Upstart to “magically” morph back into the wildly profitable hyper grower we got so used to -- this time with a more durable lineup of funding partners to combat future downturns. That will not happen tomorrow, next week or next month. But I do believe there will be clear signs of it turning the corner fundamentally sometime next year. We shall see if I’m right or wrong.

“What I love about Upstart Auto Retail is that it combines high-quality digital retail tools with an in-store app to streamline the sales process -- making it a game changer. It’s a UX tool, retention tool, & profit generator wrapped up into one.” -- Buckeye Honda GM Scott Thomas

b) Commonwealth Credit Union

Upstart landed Commonwealth Credit Union as its latest referral network partner. Commonwealth has over $1 billion in assets under management (AUM) and operates predominately in Kentucky. As a reminder, here are the core benefits of adding new partners to the network:

Bank and credit union partners are less sensitive to macroeconomic cycles than fast money hedge funds & other capital market participants. This is a key piece of Upstart building a more durable & smoothly growing book of business cross-cycle.

Upstart’s platform today is severely funding constrained. It needs all of the funding supply it can get -- and this helps.

Step 1 is signing on more partners to join the network. Step 2 is providing them with outperforming returns. And Step 3 is seeing those partners originate more and more volume once proof of concept has been established. Its consistently outperforming loan pools for partners through all of the turmoil should mean it can continue getting to step 3 (like the Atlantic case study last week indicates). That ability needs to be strong and consistent.

4. PayPal Holdings (PYPL) -- Amazon, Passkeys & More

a) Amazon

After over a year of building and planning, Venmo is launching its checkout product on Amazon’s marketplace. Starting this week, the option is available for a small cohort of consumers and will roll-out to all of Amazon by Black Friday. Amazon has been historically protective of its checkout flow in terms of preferring to support its own option at every turn vs. opening it up to the field. That makes this move even more interesting as it marks Amazon’s awareness of just how much incremental value Venmo’s nearly 90 million U.S. consumers can provide.

Venmo is actively transitioning its operations from peer-to-peer (P2P) revenue reliance to a reliance on higher margin (and more sustainable) commerce. Considering how quickly the Federal Reserve’s own P2P products are expected to come, this is vital for the longevity of the platform. Evidence of the transition’s success is already clear with rapidly growing commerce volume and Venmo business profiles -- which are directly bolstering the product’s unit economics. That’s why Venmo recently inflected to positive operating profit.

There is no better partner to add to this commerce momentum than Amazon with its dominant stranglehold on American e-commerce. Institutions like Morgan Stanley also think this will serve as a domino for other large merchants to follow suit… that’s already beginning to play out with the Venmo checkout offering briskly growing its merchant adoption to 4% in the last few quarters.

This should be exciting.

b) Misinformation Policy

The policy allowing PayPal to claw back $2,500 in merchant revenue for promoting misinformation has been reinstated. I know many will disagree with me on this (and that’s ok!), but this is the correct move in my view. PayPal is financially liable for any illegal activity conducted by a merchant on its platform. Affording itself more flexibility in recovering losses associated with that law breaking limits the risk of dealing with the inevitable bad actor in a sea of 30+ million merchants. If it abuses this policy, the public will likely hold it accountable by moving on to the plethora of other financial service substitutes. That’s the beauty of Capitalism and competitive markets.

Furthermore, at the peak of the blow back when this was first announced, there was zero merchant attrition. Despite all of the noise, a microscopic portion of PayPal users even interacted with the trending headline at the time of its release. Surely only a small portion of that microscopic piece actually deleted their accounts.

c) Happy Returns

PayPal and research firm TRC surveyed 2,000 U.S. consumers about their return preferences for online purchases. Out of this sample, the favorite return method among consumers is in-person, box-less returns with 79% of respondents saying they AVOID mail-in returns intentionally. Surprising to me.

Not only is this the preferred method for the majority, but it also reduces cost per return for the merchant by up to 40%. Quite the material win-win considering half of those surveyed expect to return an e-commerce purchase this year with the majority saying free returns are a deciding factor in their decision making. For icing on the merchant cake, 62% of these respondents claim to have used their cash refunds to shop with the merchant and so to allow it to recover some of the lost revenue. All of this meshes perfectly with PayPal’s “Happy Returns” offering and simply emphasizes the product’s relevancy today.

d) Passwords

PayPal added passkeys -- cryptographic key pairs -- as a substitute for passwords this week. Considering a forgotten password is by far the leading cause of customer churn, this project should meaningfully improve PayPal’s checkout business. And it’s not just a PayPal problem: 44% of U.S. consumers have abandoned an online cart because they couldn’t remember a password. This is a big pain point to be solved. When you’re serving 400 million customers, limiting churn by even 5% or 10% can make all the difference in the world for user growth. PayPal’s top of funnel remains robust… it’s all about limiting reasons for an existing user to churn. Furthermore, passwords are routinely available for purchase on the dark web. They’re no longer a reliable indicator of identity AND they’re a large consumer headache. Adios.

Now after logging in once, a customer will have the option to create this passkey and to store it on Apple’s iCloud.

5. Shopify (SHOP) -- Update

Shopify added a new layer of granularity to its marketing tools this week. Merchants are now able to split customers by small cohorts to see which cohort is an especially strong or weak contributor to revenue and profit. With that information, Shopify offers merchants recommendations on how to tailor marketing efforts to the highest return customers. Whether it’s the consumer facing Shop App, Collabs, Shopify email etc. the company is working hard to create new tools and experiences for merchants to know their consumers on an even deeper level, and yes, to sell them more.

In case you missed it, on Thursday, I also published a review of Shopify’s mainly positive quarterly report from this past week.

6. Olo (OLO) -- Products & Clients

a) Fall Release

Olo debuted several new platform features this past week as part of its fall release event. These were the highlights.

Borderless Pay:

Olo broadly released its borderless pay tool within the Olo Pay module this week. This is essentially a payment gateway and vault that allows for card and fulfillment information to be saved and stored for rapid checkout. Importantly, this is one of the places where Olo’s large network of 600+ enterprise clients shines. Why? Because any opted-in restaurant can offer this speedy checkout to any guest that has ever shopped at any other opted in Olo restaurant -- creating a truly compelling network of convenience. This is unique in the world of restaurants unless those restaurants want to ship off their data and margin to a marketplace.

No longer will guests have maintain an account and a password (which is a large source of churn) with borderless pay. All a user has to do is opt in to Borderless Pay and enter a mobile phone verification code each time to check out.

The product launched in soft beta last quarter. So far, the consumer opt-in rate is 2.5X the average rate of traditional checkout. More generally speaking, it’s expected to boost conversion, basket size and so restaurant revenue (and it already has for the initial customers).

It also will give restaurants access to relevant data on a larger portion of orders to better steer and customize the guest experience in an actually informed manner. Specifically, 70% of a restaurant’s digital orders today on average are anonymous -- meaning the brand gets access to no lucrative data at all despite securing the sale. Olo’s Borderless offering will reduce that 70% almost down to 0%.

Multi-Concept Ordering:

This new tool allows for single ticket ordering across a brand’s family of restaurant concepts. Now, for chains like Wingstop, with virtual and in-person operations, consumers will be able to order from multiple concepts under the same checkout flow and ticket. This is set to boost ordering convenience, cross-selling, average order value and experimentation for clients. It also allows for the consolidation of marketing efforts across concepts.

Marketing Push Notifications:

Olo added automated push notifications to its suite of marketing services. This new tool is outperforming traditional efforts like email across the board with a +50% open rate lead, a 7X click through rate and a 3-10X app retention rate. Not bad… not bad at all.

More Upgrades:

Olo updated its Google menu syndication tool called Olo Network to ensure more real-time accuracy -- which also means better search placement on the Google page.

Eliminated its “View Locations” link (now assigns locations with an ability to manually change it) which raised conversion rates significantly.

Extended tracking features to secure pages like checkout for brands to gain more holistic access to data.

New open plug-in to ALL preferred coupon providers. This had been a more cumbersome process with custom APIs needed for any non-integrated provider. This was a key piece of Jack in the Box’s ability to work with both Olo and Punchh on its new app (more later).

New automated ability for restaurants to file late delivery tickets without large call teams to seamlessly recover losses from delivery service provider errors.

b) Client Momentum

Jack in the Box:

Jack in the Box and its 2,200 locations launched its new website and app this week. That launch comes with off-premise ordering, fulfillment, a loyalty program and so much more. Olo is powering a large chunk of this software with Punchh running the loyalty program.

Grimaldi’s:

Grimaldi’s is Olo’s newest client. The pizza chain and its 43 locations purchased 4 modules from the company: Ordering, Rails, Dispatch, and its newest module, Pay.

7. Meta Platforms (META) -- Update

For those of you who missed the earnings review, I decided to pause my accumulation of Meta shares after another disappointing quarter. I need to see the company show even the slightest effort to curtail expenses, need to see operating margin stabilization within the Family of Apps, and need to see more progress in Reels monetization (which has been fine to date). I’m hoping all of that happens and I can resume adding in the future. I’m not selling any shares. The world is tough for it right now, but others are more gracefully enduring than Meta at this moment.

It seems like Meta may be starting to finally embrace frugality with growing rumors of a 15-20% cut in headcount. Its 2023 OpEx guide assumes flat headcount growth for the next 15 months, so this could provide some expense relief after the initial severance packages are paid out. Not to sound insensitive, but with all of the videos we’ve seen recently about mega cap tech employees working 20 hour weeks with little effort and large salaries, this is necessary. Trim the fat.

8. Cannabis News

After closing its Canadian retail operations last month, Canopy Growth Company is consolidating its U.S-owned brands into a single holding company to be named Canopy USA. Doing so is expected to allow it to complete acquisitions of its American assets including Jetty, Wana Brands and Acreage Holdings.

Unsurprisingly, the Nasdaq is not ok with this and the move will likely cost Canopy its ability to list on U.S. exchanges. They could always change their mind, but I really don’t see that happening. Interestingly, the Toronto Stock Exchange’s (TSX’s) CEO seems publicly fine with the move and even happy with it. Why is that important? Because American growers are still listed on junior exchanges in Canada.

If Canopy can create a U.S. holding company and list on the major Canadian exchange, I see no reason why Cresco Labs etc. can’t as well. And this would mean more liquidity and likely some (not a lot of) cost of capital relief. In an interview with BNN, TSX’s CEO even seemingly invited other American cannabis companies to follow the Canopy blueprint for an eventual listing. TSX wouldn’t be nearly as meaningful as a U.S. listing, but it’s likely a prerequisite before getting there.

9. Macro

a) Key Economic Data

Purchasing Manager’s Index (PMI) Data -- quite forward looking indicators -- were weak and worsening across the board:

The Manufacturing PMI missed expansionary expectations of 51.0 with a reading of 49.9 -- marking slight contraction.

S&P Global’s Composite PMI also missed estimates with a 47.3 reading vs. 49.3 expected.

The Services PMI missed estimates of 49.2 with a reading of 46.6

Consumer Data:

The Conference Board Consumer Confidence metric came in at 102.5 vs. 106.5 expected.

Personal spending grew 0.6% month over month (MoM) vs. 0.4% expected.

New Home Sales were slightly better than expected at 603,000 vs. estimates of 585,000.

Pending home sales sharply missed as prospective buyers react to rising mortgage rate. The 30 Year Fixed Mortgage rate continues to set new 22nd century highs.

Jobless Claims were roughly in line with estimates.

The University of Michigan’s Consumer Sentiment reading came in roughly in line at 59.9 vs. 59.8 expected.

Credit card debt of $930 billion in the USA is at record highs as consumers borrow more to handle inflationary pressures & maintain their quality of life.

Core Durable Goods Orders (also a leading indicator) sharply missed +0.2% MoM expectations with a reading of -0.5%. Durable Goods Orders similarly missed.

Personal Consumption Expenditures (PCE) data (which is the Fed’s favorite inflation metric):

The Core PCE YoY came in at 5.1% vs. 5.2% expected -- slightly better than feared. MoM growth was in line with estimates.

The PCE was identical to last month at 6.2% YoY growth and 0.3% MoM growth. This was largely in-line.

Q3 GDP came in at 2.6% vs. 2.4% expected.

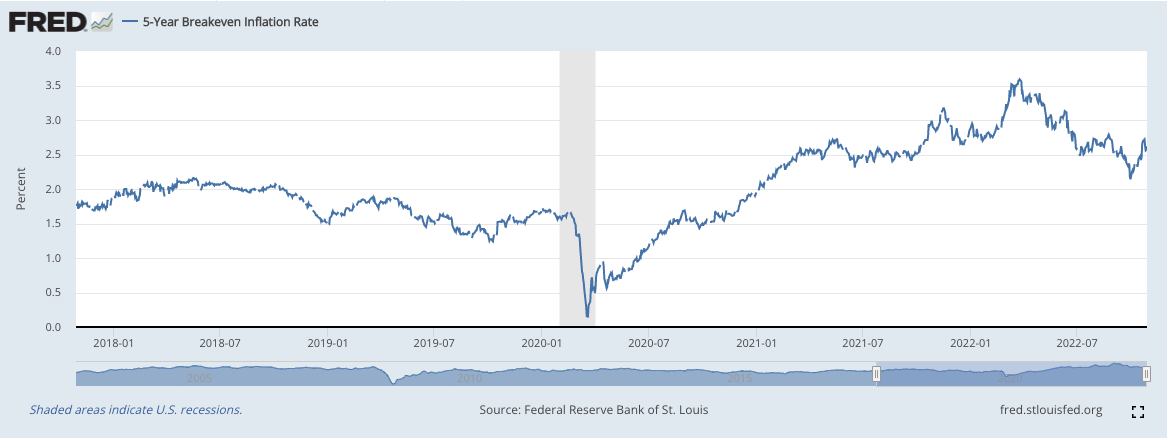

The 5 Year Breakeven Inflation rate showed some encouraging relief this week:

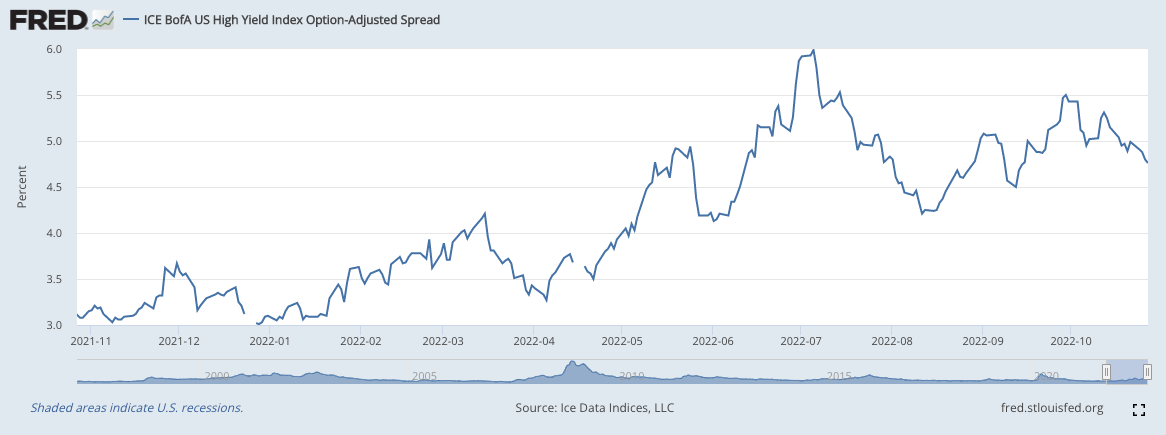

High Yield Option Adjusted Corporate Credit Spreads also continue to look better as liquidity & risk tolerance perhaps slightly improve:

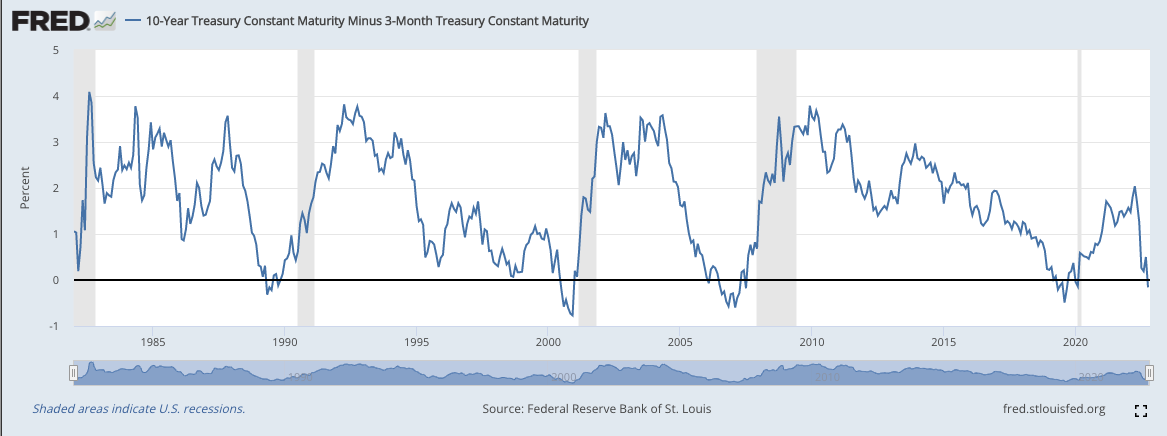

The 10 Year, 3 Month Yield Curve -- a more accurate, less noisy recession indicator than other parts of the yield curve -- inverted for the first time this cycle during the week. As you can see below, this has generally meant that a recession is near:

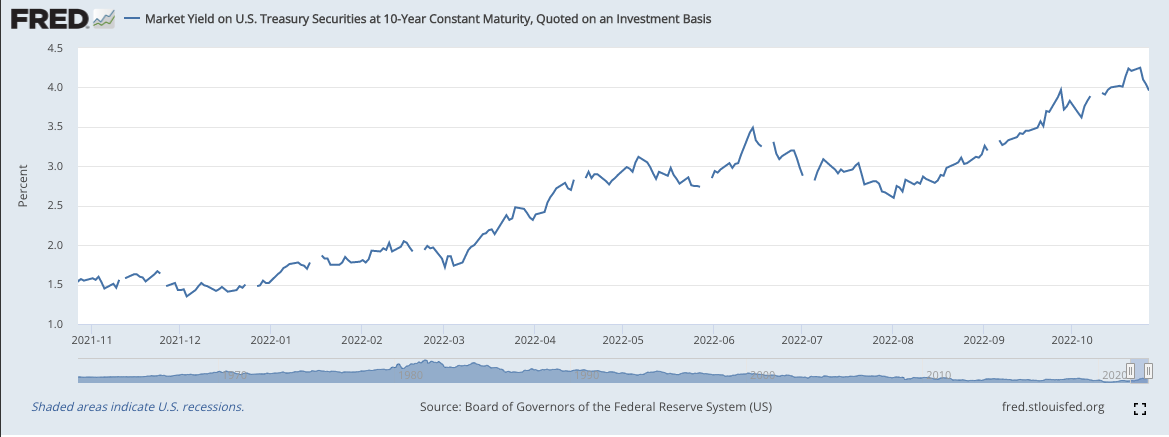

The 10 Year Treasury Yield fortunately cooled off this week:

The U.S Dollar has cooled considerably vs. British Pound. A weakening dollar would be amazing news for globally oriented firms with challenged international growth -- like Match Group for example:

b) Key Market Data

Mega Cap Earnings Highlights:

Apple’s quarter was strong for the most part with some weakness in its higher margin services category and other areas like digital advertising. As an aside, Pinterest actually posted quite upbeat results as it navigates a tough ad market. Back to Apple: Apple again did not provide any guidance aside from telling us YoY revenue growth would slow from the 8% metric this quarter. Interestingly, silicon, Apple’s most pressing supply chain concern, seems to be mainly resolved at this point. Good news. This was the best report of the season among mega caps -- but the large caveat there is the lack of formal guidance.

Amazon’s quarter was mixed, but the forward guidance was quite poor with revenue expectations coming in nearly 10% below consensus. Its cloud segment (AWS) showed more aggressive signs of deceleration vs. Microsoft’s Azure and it even announced a freezing of hiring within that star revenue channel. Similarly, Microsoft’s and Google’s quarters weren’t awful, but the guidance was significantly below consensus. Times are tough… even for the best companies on planet earth. And the Fed must take this into consideration.

BlackRock is telling its clients to expect pivot language to enter the Fed’s vocabulary after an expected 75bps hike at the next meeting. That would be great.

c) Level-Setting the Data

The pattern this week was wonderfully clear to me: The economy is weakening and we are nearing an end to this tightening cycle. Mega cap earnings have been awful, more layoffs are unfortunately coming, forward manufacturing and order data looks horrible, and inflationary data was actually slightly better than dreaded.

So? Broken record alert: We are not getting a hawkish pause with inflationary and employment data where it is. But at the same time, these cracks can only deepen for so long before employment becomes the more pressingly fragile Fed mandate. These weakening trends will eventually force the Fed to pause -- and my confidence in that happening 1H of 2023 grows by the week. Barring an abrupt change to the incoming data, I still expect to deploy most of my remaining cash position sometime in the next few months.

10. My Activity

I added to Shopify and Olo this week. My cash position is roughly 16% of holdings.

https://mobile.twitter.com/LuoshengPeng/status/1587137386688880641

Brad any thoughts on this? Thx… Bearish?