News of the Week (October 25-29)

Microsoft; Facebook; Boeing; Upstart; CrowdStrike; The Trade Desk; Tattooed Chef; REVOLVE Group; Nanox; Cannabis News; My Activity

1. Microsoft (MSFT) — Earnings Review

“The case for digital transformation has never been more urgent or clear: Digital technology is a deflationary force in an inflationary economy.” — Microsoft CEO Satya Nadella

a. Demand

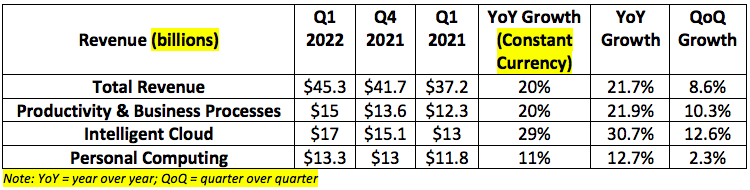

Guidance was for:

$14.5-$14.75 billion in Productivity & Business Processes. It beat expectations by 2.6% at the midpoint.

$16.4-$16.65 billion in Intelligent Cloud. It beat expectations by 2.7% at the midpoint.

$12.4-$12.8 billion in Personal Computing. It beat expectations by 5.6% at the midpoint.

$43.75 billion total revenue using segment midpoints. It beat expectations by 3.5% at the midpoint.

Xbox growth was expected to be in the “low single digit range” — its results were in line. LinkedIn was looking for growth in the high 30% range and posted results at the upper end of that range.

b. profitability

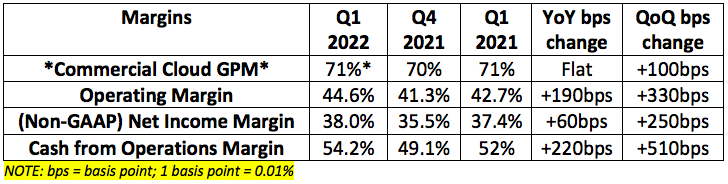

Microsoft was expected to earn $2.07 per share. The company reported $2.27 per share beating expectations by 9.7%. GAAP earnings per share came in at $2.71 thanks to a $3.3 billion tax benefit.

Commercial cloud gross profit margin (GPM) was expected to be 70%. The company generated a 71% cloud GPM beating expectations by roughly 100 basis points (bps).

*Commercial cloud GPM includes a 4% hit from a change in accounting estimates for the useful life of server assets. Without it, commercial cloud GPM would have been roughly 75%. There will be another 4% GPM hit next quarter from this change.*

c. Next Quarter Guidance

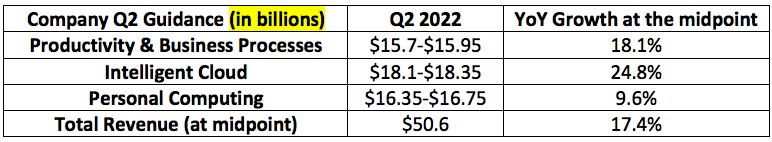

Analysts were hoping Microsoft would guide to roughly $48.9 billion in next quarter revenue. It guided to $50.6 billion (using the midpoints of its segment guidance) which is 3.5% ahead of estimates.

d. Satya Nadella Conference Call Notes

General notes:

78% of the Fortune 500 now uses its cloud offerings vs. 75% QoQ.

GE Healthcare and P&G moved vital workloads to Azure during the period.

Kimberly Clark, The NBA and SoftBank all picked Azure for their SAP workloads.

Microsoft has doubled total developers on GitHub to 73 million since buying it in 2018; GitHub has added 70 enterprise customers with 84% of the Fortune 100 now using it.

Power Platform (low-code tools, robotic process automation (RPA) and business intelligence (BI)) monthly active users grew 76% YoY to 20 million; It’s now used by 91% of the Fortune 500.

Confirmed LinkedIn hires grew 160% YoY and advertising revenue grew 61% YoY; it now has 800 million members.

138 firms have 100K+ Teams users vs. 124 sequentially.

Users with 10K+ employees integrating their 3rd party tech stack pieces into teams (like ServiceNow) grew 82% YoY.

PayPal and Toyota picked Microsoft’s new Viva product to enhance the work-from-anywhere connection and productivity within enterprises.

Security customers grew 50% YoY.

“Windows 11 is the biggest update to our operating system in a decade… We are delighted with the early response to Windows 11.” — Nadella

Microsoft enjoyed “record first-quarter gaming monetization and engagement.” I find this encouraging considering we are exiting a pandemic.

On digital transformation:

“We are building Azure as the world’s computer, with more data center regions than any other provider. We’re partnering with mobile operators like AT&T, Verizon and Telefonica as they embrace new business models & bring ultra-low latency, as well as compute and storage power, to the network and edge.”

e. CFO Amy Hood Conference Call Notes

General notes:

Xbox Series X and S consoles as well as PCs all continue to be supply constrained.

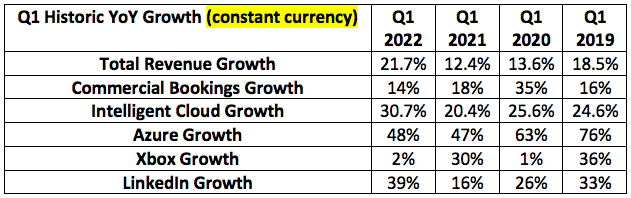

Commercial bookings growth of 14% was impacted by fewer large long-term Azure contracts ; for evidence of this being the case, remaining performance obligations grew 29%. This is a great forward-looking demand metric.

Headcount grew 14% YoY.

F. My take

There’s not much for me to say other than great job Microsoft, again. They endured supply chain issues and tough YoY comparisons to deliver yet another remarkably positive quarter. When every single analyst question begins with something along the lines of “congratulations on the strong results” is when we know things went extremely well.

2. Facebook (FB) — Earnings Review & Facebook Connect

a. Demand

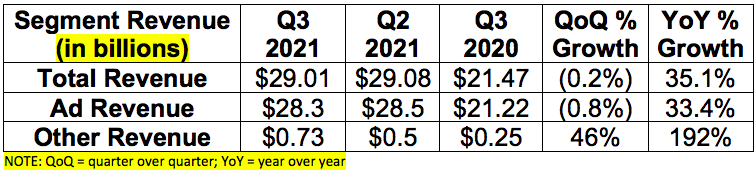

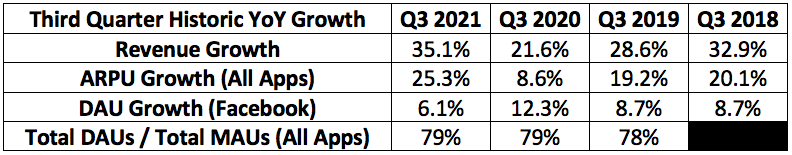

The company was expected to generate $29.58 billion in total revenue. It posted $29.01 billion missing expectations by 1.9%. This miss was despite a $259 million foreign exchange (FX) rate boost during the quarter. Without it, revenue would have missed by 2.7%.

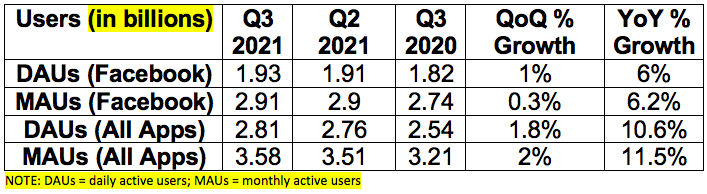

Facebook was expected to report 2.92 billion monthly active users (MAUs) for its entire family of apps and 1.92 billion MAUs for just Facebook. Its results were in line.

Only Facebook daily active users (DAUs) grew in the United States/Canada for the first time in 5 quarters with MAUs growing for the first time in 2 quarters. These users are more lucrative for Facebook’s business vs. the rest of the World.

Ad revenue and average revenue per user (ARPU) shrank sequentially in the United States, Europe and Canada as Apple’s App Tracking Transparency (ATT) and Identifier for Advertisers (IDFA) changes took hold. ARPU grew in the rest of the world where Android is far more prevalent to point to this truly being the case. The impact of these changes on Facebook’s business is expected to peak this quarter.

In total, ad impressions still rose 9% YoY with price per ad rising 22% YoY thanks to comping over a pandemic period featuring weak pricing.

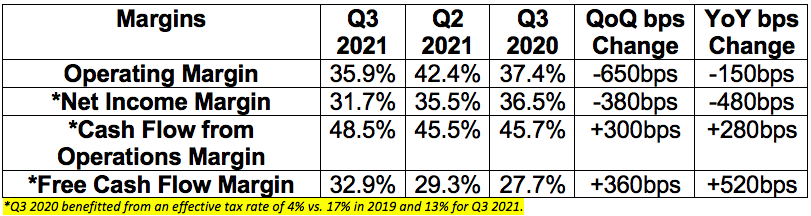

b. Profitability

Facebook was expected to earn $3.19 per share. It earned $3.22 per share beating expectations by 0.9%.

c. Mark Zuckerberg Conference Call Notes

On the whistleblower and recent accusations:

“My view is that what we are seeing is a coordinated effort to selectively use leaked documents to paint a false picture of our company.”

“When we make decisions, we balance competing social equities like privacy while supporting law enforcement. It makes a good soundbite to say we don’t solve these impossible trade-offs because we’re focused on money. In realty, this isn’t primarily about our business but about balancing social values. I repeatedly call for regulation here because I don’t think companies should be making these decisions themselves.”

Zuckerberg highlighted an interesting case study of polarization in the United States to depict Facebook’s independence from this issue. General levels of American polarization have been rising for decades while other countries with similar social media consumption patterns have seen diminished polarization.

The company is set to spend $5 billion on “safety and security” this year — more than any other tech company on both a relative and absolute basis.

On the creator economy and age demographic:

“I am optimistic that Reels will be as important for our products as Stories is. Reels is already the primary driver of engagement profiles.” — Note: Reels is Facebook’s short-form video competitor to TikTok

The company is planning several family of app upgrades to make short-form video a larger part of the focus.

Zuckerberg spoke about a reinvigorated focus for Facebook on attracting young adults (18-29) to their platform rather than just maximizing total users. He called this a “north star” and Reels will be a central piece of this ambition. I found this bit of the call concerning as it depicts Facebook’s opinion that it needs to do a better job competing for young people than it currently is.

On Commerce:

“We have an exciting program planned this holiday season to work with the businesses that have invested the most in Shops to identify what works to find new customers and accelerate growth. Our plan is to then scale those solutions more broadly in 2022.”

On “building the next computing platform” and “bringing the metaverse to life”:

“I view this work as critical to our mission as delivering products like you’re there with another person is the holy grail of online social experience. The metaverse is the successor of the mobile internet. Over the next decade, these platforms will unlock the experiences I’ve wanted to build before I even started Facebook.”

Zuckerberg announced a new goal to help the metaverse reach a billion people and hundreds of billions of dollars in digital commerce.

Facebook views this product diversification as also “reducing dependence on delivering services through competitions” — AKA cutting Apple out of their value chain wherever possible. Zuckerberg reminded us that this endeavor will not be profitable for years.

The company will begin to disclose the revenue and operating profit results of its Facebook Reality Labs independently from the rest of its business. The aim is to provide more transparency into the capex Facebook is spending on the segment. Specifically, the investments will reduce operating profit by $10 billion next year. Zuckerberg expects that $10 billion to grow even more thereafter.

d. COO Sheryl Sandberg:

On iOS 14 privacy/targeting changes:

“We’ve encountered 2 challenges from Apple’s changes. One is the accuracy of our ad targeting decreased thus increasing the cost of driving outcomes for our advertisers. The other is that measuring those outcomes became more difficult.”

Sandberg reiterated Facebook’s belief that the privacy changes have resulted in Facebook underreporting real-world conversions. In reality, these conversions are higher and Facebook’s value to advertisers is greater.

“We think we’ll be able to address more than half of the underreporting by the end of this year and we’ll continue to work on this into 2022.”

The worst is likely behind us for iOS 14 targeting headwinds.

On e-commerce and supply chain issues:

“E-commerce is no longer growing at the pace it was at the height of the pandemic. These factors have been compounded by major supply chain issues and global shortages leaving many with less inventory. This reduced appetite to generate demand and impacted advertising spend.” — Note: Snap Inc. leadership made similar comments on its call.

On new advertiser tools:

“We started rolling out a new conversion leads optimization goal for high-quality leads with advertisers able to integrate their customer resource management (CRM) tools with Facebook via our Conversions API.”

Using this goal and the conversions API together raises lead-to-sale conversion by 20% so far.

e. CFO Dave Wehner:

General notes:

Headcount growth will likely be around 20% next year like it was this year.

2022 margins will be worse than 2021 with all of the planned spending.

f. Guidance

General notes:

Facebook expects revenue between $31.5 billion and $34 billion. Expectations were for $34.9 billion representing a midpoint miss of 6.5%.

Total expense guidance for 2021 was reduced from $70-$73 billion to $70-$71 billion. Total expense guidance of $91-$97 billion was issued for 2022 representing 31.4% growth at the midpoint.

CapEx guidance for 2021 was reduced from $19-$21 billion to $19 billion. 2022 Capex guidance was issued at $29-$34 billion representing 71% growth at the midpoint.

g. My Take

This was the worst quarterly performance Facebook has showcased in a long time — and that’s ok with me. The company is aggressively sinking its teeth into new verticals with fully untapped potential and long growth runways. I view it as being at a similar stage to when Amazon was spending ridiculous amounts of money to build out its courier business. More spend now should hopefully mean larger returns in the very long term and metaverse margins should be far better than shipping packages.

With a fortress balance sheet and an elite free cash flow margin, this spending makes a lot of sense to me. Building the metaverse will take time and tens of billions of dollars. By Facebook spearheading this expenditure, it positions itself to be a core part of a new digital economy that some project to be worth trillions at maturity. I cannot think of another CEO I have more confidence in to spend on these new projects; based on Oculus success to date — so far so very good.

We are through the toughest period for Facebook’s advertising business amid iOS 14 changes and sequential growth rates should begin to normalize going forward. That business will continue to be the stable cash cow feeding this ambitious endeavors. With lofty top line growth, immense optionality and elite margins, I don’t think you can do better than Facebook and its roughly 22X 2021 earnings multiple.

h. Facebook Connect Highlights

Zuckerberg on what the Metaverse is and will do:

“The next platform and medium will be even more immersive. When I send a video of my children to my parents, they’re going to feel like they’re right there with their grandchildren, not just peering through a window. Where you’re in a meeting, it will feel like you’re there together and not just looking at a screen of faces. It will be an embodied internet.”

“I believe high fees and lack of choice stifles innovation and holds back the entire internet economy. We are taking a different approach by working to serve as many people as possible to make our services cost less, not more. We even offer our creator and commerce tools at cost. That’s the approach we will take to build the metaverse.”

“Your device will no longer be the focal point of your attention. Instead of getting in the way, it will give you a sense of presence in the new experiences you’re having. The feeling of presence is the defining quality of the metaverse. You will feel like you’re actually there with other people… In the next 5-10 years, this will become mainstream.”

Meta Horizon product plans (the metaverse platform is called Horizon):

“Horizon Home” — essentially your homepage in the metaverse and the first thing you’ll see with a Quest headset today.

A social version of Home where friends can join you in the space. In beta testing.

“Horizon Worlds” to allow developers to build their own metaverse spaces. In beta testing.

“Horizon Workrooms” for better remote collaboration.

“Horizon marketplace” to allow creators to sell, trade and share digital items. He highlighted that it will be creators and developers that make the metaverse what it will be. Meta wants to support them every step of the way by removing barriers and creating/aggregating demand.

“It will be critical that creators and developers make a good living doing this work.” — Zuckerberg

Some cool use cases highlighted:

A student studying astronomy able to put on their glasses, look into the sky and have an interactive lesson ready to go.

A person going to Ancient Rome to experience it first-hand.

A med student practicing surgery in a stress-free environment until mastering the practice.

A biologist student swimming through the Great Barrier Reef and learning more from David Attenborough in immersive 3D.

Bringing games into the physical life via holograms like playing ping pong in New York City against champions from around the world.

Playing 3-on-3 hoops with people across the planet.

Feeling that we are in the office with our workplace setup with no commute. Better productivity in the remote world.

AR/VR Gaming Updates:

Beat Saber (one of Quest’s games) just passed $100 million in total revenue.

Rockstar and Facebook just announced a Grand Theft Auto video game for the Oculus Quest 2.

Spark AR:

Spark AR is the company’s augmented reality (AR) branch to build tools allowing creators to place digital objects into the physical world. Facebook is creating a Spark certification process for developers with Coursera and EdX.

3. The Boeing Company (BA) — Earnings Review

“As expected, the recovery has been uneven. However, it continues to gain broader momentum that gives us confidence in the resilience of our market.” — CEO Dave Calhoun

a. Demand and Backlogs

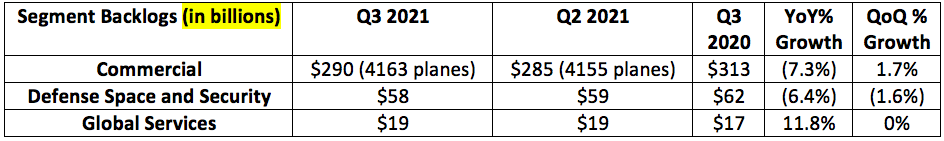

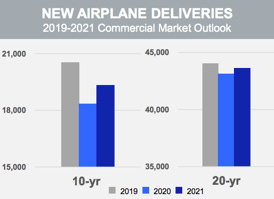

Boeing reiterated that it expects commercial passenger traffic to return to pre-pandemic 2019 levels during 2023 while returning to its normal growth trend thereafter.

Its next-decade market outlook stood at $8.7 Trillion pre-pandemic. That has actually now risen to $9 trillion to highlight recovering trends.

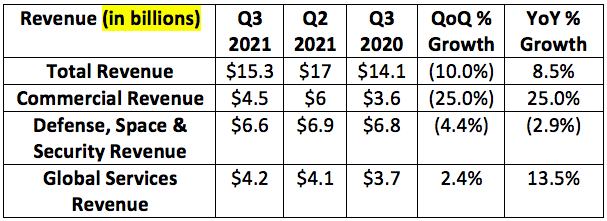

The company was expected to generate $17.2 billion in sales during the quarter. It reported $15.3 billion missing expectations by 11%.

b. Deliveries, The Recovery & Future

Deliveries:

Boeing was expected to deliver 96 commercial airplanes during the quarter. It delivered 85 missing expectations by 11.4%. 85 deliveries represents 7.6% sequential growth. It delivered 28 total planes in the YoY period that was severally impacted by the pandemic and the 737 MAX still being grounded at the time.

Most of this disappointment is 787 Dreamliner related. The company is producing just 2 per month until it fixes the issues it uncovered with the fuselage and resumes deliveries. As a reminder, this is NOT a flight risk and not a part that Boeing manufactures itself. Still, it will lead to roughly $1 billion in total incremental costs to fix the issue. On the heels of their 737 MAX debacle, this is not what I want to see.

For evidence of this being 787-related, Boeing delivered 62 737 MAX planes during the quarter which represents 32% sequential growth and the most deliveries since Q1 2019. Before this report, the company had only been expecting to reach a run rate of 50 MAX deliveries by 2022 — it’s well ahead of schedule.

The company has delivered 195 out of the 450 MAX planes it had in storage due to the grounding. There are 255 remaining which conservatively represents $12.75 billion in sales using a price per plane of 50% off of its list price (my estimation).

The Recovery & Future:

Global departures rose from 59% of pre-pandemic levels to 67% quarter over quarter.

Due to strong demand, Boeing raised its 737 MAX production rate to 19 airplanes per month and expects to get to 31 per month by next year. It’s working towards approval in China by the end of the year which will dictate when it returns to 31 planes per month. A test flight was successfully completed during the quarter.

Higher oil prices are accelerating fleet modernization which benefits Boeing greatly.

It also delivered 24 freighter planes as freighter demand remains 70% above pre-pandemic levels. The company is raising its 777 freighter production capacity to meet near term demand.

“We see strong bipartisan support for strategic investments in Boeing products and services as Congress works through its annual budget for fiscal 2022.” — Calhoun

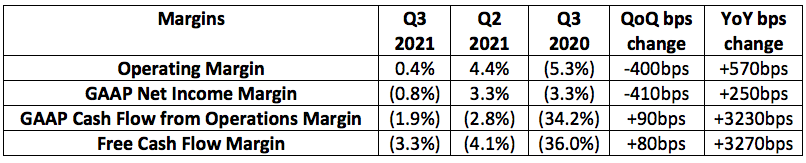

c. Profitability

Boeing was expected to lose $0.15 per share and lost $0.19 per share. This missed expectations by 26.7%.

Segment operating margins:

Commercial: (15.5%) vs. (38.1%) YoY. This margin benefited via a $1.3 billion tax refund.

Defense, Space and Security: 6.6% vs. 9.2% YoY. The margin hit was driven by an added $185 million Starliner charge from having to repeat the test flight next year. Boeing and NASA have identified the most likely cause of its Starliner valve malfunction and expects another test flight next year.

Global Services: 15.3% vs. 7.3% YoY.

d. Balance sheet

Summary:

Boeing has $20 billion in cash & marketable securities vs. $21.3 billion sequentially.

Boeing has $60.9 billion in long term debt vs. $62.1 billion sequentially.

Boeing has $14.7 billion in undrawn credit facility capacity.

“We expect to turn cash flow positive in 2022.” — CFO Brian West

e. My Take

Boeing’s recovery remains intact. This was far from a perfect quarter, but as a global, supply-constrained duopoly, the odds are more stacked in its favor than the vast majority of companies. A return to free cash flow and normal 737 MAX production rates next year will be very welcome developments. I’m sticking with Boeing.

4. Upstart (UPST) — New Banking Partner

Upstart announced a deepening of its partnership with Four Corners Community Bank this week. The two organizations had been working together in some capacity since July. Now, the bank’s customers will be able to access Upstart loans (and the more compelling risk quantification) directly through the Four Corners website. With less than a billion in assets under management (AUM), this New-Mexico based company is among the smallest partner wins for Upstart to data. But a win is a win is a win.

This is Upstart’s 31st partner since it went public less than a year ago with 10. Upstart often doesn’t announce new partners until several months after the relationship has begun. Considering this, the partner roster is likely larger than 31 today.

Click here for my broad overview of Upstart’s business.

Click here for my broad overview of Upstart’s risks.

5. CrowdStrike (CRWD) — Intensifying AWS Partnership & Humio Case Studies

a. AWS

CrowdStrike unveiled new add-on features on top of its Falcon platform that directly integrate with Amazon Web Services (AWS). The objective is to further protect endpoints and workloads from consistently rising ransomware attacks.

“Security teams have turned to the cloud for protection. However, they must consider how their applications communicate with each other and devise an effective strategy to ensure connectivity between the cloud and the rest of the security stack. Falcon unifies security and breach protection for cloud workloads and containers on AWS in a single platform. — CrowdStrike Chief Product Officer Amol Kulkarni

Specific new features include:

CrowdStrike Cloud Security Assessment: Identifies security anomalies and misconfigurations and meets them with actionable insights and protocols from CrowdStrike and other cloud security players.

CrowdStrike CloudEndure Disaster Recovery: Speeds time to application restoration and minimizes productivity and operational hits.

CrowdStrike IAM Analyzer for AWS: Predicts account activity to prevent identity-based threats. This relies heavily on CrowdStrike’s new Extended Detection and Response (XDR) module to pull data from all pieces of the security stack, connect these disparate data points and to offer an easier path to remediation.

CrowdStrike is now fully compatible with AWS Distributor. This allows software packages featuring CrowdStrike software to be managed within a single, intuitive interface.

None of these upgrades are all that new for CrowdStrike, they’re just specifically designed for AWS. The 2 entities have been working together for quite some time now. This merely marks an extension of this relationship — and a welcomed extension for sure.

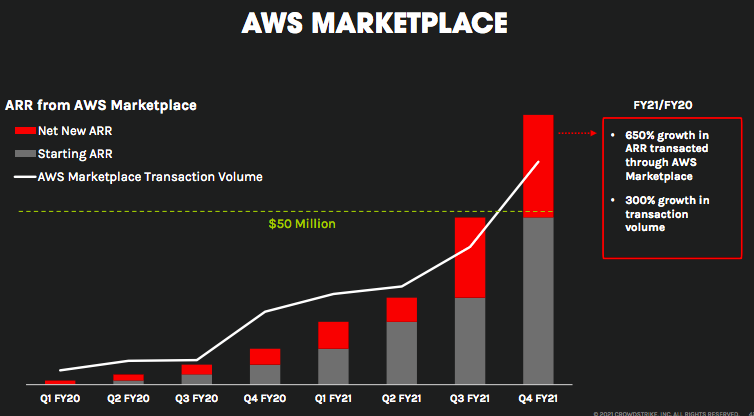

Below depicts the rapid growth CrowdStrike had enjoyed with AWS (before this announcement) as of an old CrowdStrike investor day from a few quarters ago:

b. Humio

CrowdStrike also published a product overview slide deck this month. The most interesting highlight from the presentation was 3 case studies highlighting the benefits of Humio — the log management company it purchased earlier in the year.

The case studies are as follows:

Raised terabyte ingestion rates by 6.5X (from 20TB to 130TB) for a large financial services company.

Raised terabyte ingestion rates by 7X (from 10TB to 70TB) for a global technology company.

Raised terabyte ingestion rates by 8X (from 1TB to 8TB) for a global consumer goods company.

Humio’s index-less log management allows for a tangible data compression edge over competition including Datadog (according to a Hewlett-Packard Enterprise executive at Fal.Con). More efficient data ingesting allows for more organized and connected data, a smaller server footprint, more expedient insights and less cost and headache for all parties.

6. The Trade Desk (TTD) — Gartner Recognition & A New Partner in India

a. Gartner

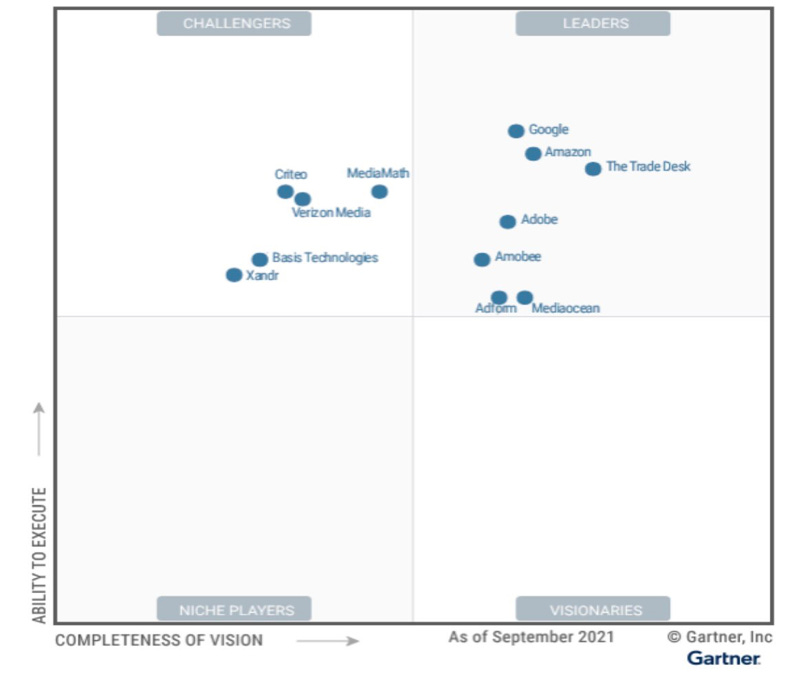

For the 3rd consecutive year, The Trade Desk was named a leader in ad-tech by Gartner. Gartner is a world-renowned research firm that aggregates insights and data from countless expert industry sources to arrive at these calculations. Companies often highlight Gartner achievement awards in their earnings press releases to give an idea of the importance of this.

Specifically, Gartner named The Trade Desk as the best positioned in terms of completeness of vision and barely behind only Google and Amazon in terms of ability to execute. Gartner also recognized The Trade Desk as the top ranked company for Media Plan Creation, Campaign Piloting and Campaign Result Analysis Use Cases.

b. New Partner

The Trade Desk announced a new partnership with Lifesight to enable more precise measurement, conversion and outcome data within advertising campaigns in India. Lifesight specializes in customer intelligence.

This partnership is not nearly as notable vs. others it has announced like with Home Depot and Walmart. Still, it does represent another foothold into the wildly compelling Indian economy enjoying 30%+ connected TV (CTV) growth and a rapid digital transformation.

Click here for my deep dive into The Trade Desk’s business.

7. Tattooed Chef (TTCF) — M&A

Tattooed Chef purchased Belmont Confections for $18 million in a mixture of cash and stock.

Belmont manufactures snack and protein bars, meaning this purchase marks a further (and expected) push into ambient foods for the company. The plant-based nutritional bar segment features a total addressable market (TAM) of $10 billion. This combination could also open Tattooed Chef to other types of distribution partners like convenience stores and vending machines. Furthermore, Belmont helps to give Tattooed Chef broader overall control of its supply chain and therefore margins.

Tattooed Chef gains an additional 47,000 square feet of manufacturing capacity in centrally located Ohio with equipment already in place. The new capacity can contribute an additional $100 million in annual revenue eventually bringing Tattooed Chef’s overall manufacturing capacity to $600 million in sales at capacity. Tattooed Chef will likely continue making small acquisitions like this one to economically expand its manufacturing footprint and stock keeping unit (SKU) capabilities.

In my view, this was a great move by the Galletti’s.

8. REVOLVE Group (RVLV) — Earnings Hint

Piper Sandler raised its quarterly revenue forecast for Revolve after speaking privately with management this week. Revolve reports earnings next week and should be gearing up to continue a trend of large expectation beats and guidance raises.

9. Nanox (NNOX) — New Partner & A Presentation

Nanox signed a new medical screening as a service (MSaaS) agreement with International Clinics Group (ICG) in South America. ICG serves a broad range of healthcare systems across Chile, Bolivia and Peru. ICG will deploy both Nanox’s ARC hardware as well as its cloud software designed to enhance access to radiologists, help in the diagnosis process (with the help of Zebra imaging) and seamlessly store consumer files.

Specifically, the agreement is for the deployment of 350 ARC multi-source (multiple x-ray tube) units and brings Nanox’s order book to 6500 machines in total. As a reminder, Nanox does not sell these units but instead distributes them for free and collects a usage fee. It frequently compares its business model to Xerox’s.

So then what’s this worth? When assuming extremely pessimistic usage outcomes across the globe, 6500 units would translate into roughly $160 million in annual revenue for the company. This revenue does not consider potential licensing agreements or tube sales outside of the healthcare industry.

I made the following assumptions to arrive at this number:

Nanox collects $10 per scan (some agreements allow it to collect $14 with some at $7 so I averaged these & rounded down).

7 scans per day (the contractual minimum) are conducted.

The machines are in use for 250 days per year.

In reality, scans could be closer to 10-20 per day based on these generally being deployed in areas of extremely high need and low supply.

Nanox also hosted a presentation to discuss some of the plans and capabilities for Zebra Imaging — an AI imaging company it recently announced plans to purchase — and AI as a whole. There was nothing especially notable to highlight from the event. If you’d like to view the slide deck click here.

Click here for my broad overview of Nanox’s business.

10. Cannabis Stock News

a. Industry News

The Cato Institute published a study that found cannabis legalization lowered suicide rates in males aged 40-49 by 6.3%. There were no negative impacts on community health to report.

The Federal Substance Abuse and Mental Health Services Administration published a survey on teen cannabis usage actually dropping in 2020 despite more and more states legalizing.

A record-high 6/10 voters in Pennsylvania now support recreational cannabis.

Signatures are being collected in Italy to put a referendum on the next ballot to legalize cannabis (and psilocybin).

The new Director of National Drug Control Policy — Rahul Gupta — is the first person named to that position with direct experience working in the legal cannabis industry.

SAFE Banking remains in the National Defense Authorization Act (NDAA) — for now.

b. News on my cannabis holdings

Cresco Labs opened its 40th dispensary nationwide in Oakland Park, Florida. Just one day earlier, Cresco announced the opening of a new Sunnyside dispensary in Tallahassee Florida. The 2 stores bring its Florida dispensary count to 11. Tallahassee is home to roughly 200,000 people. As a reminder, the Sunnyside retail brand is among the most efficient in the space.

Ayr Wellness launched its Kynd Flower brand in Arizona. This continues a planned rollout of the brand (and some of its others like Sun Gems) across its entire state footprint.

Click here for my broad overview of the American cannabis regulatory environment.

11. My activity

I added to Olo and Butterfly Network during the week.

Click here for my deep dive into Olo’s business.

Click here for my broad overview of Butterfly Network’s business.

Thank you for reading!

Like always Brad. High quality, informative, and to the point... 👍

Simply one of best writers.