News of the Week (October 3-7)

The Trade Desk; CrowdStrike; PayPal; Lemonade; Duolingo; Upstart; Shopify; Penn Entertainment; Green Thumb; Meta Platforms; Cannabis; Macro; My Activity

Click here for a SavvyTrader-powered view of my current portfolio.

1. The Trade Desk (TTD) -- Investor Day

a. Notes from Co-Founder/CEO Jeff Green:

On a look back at 2020’s investor day:

Green took the first chunk of his talk to essentially take a victory lap. He was laughed at in 2020 when saying the company’s login ID footprint would be one of the largest in the world. Well? Today, its new Unified ID 2.0 (UID2) creation has 3 billion registered devices on it. Not bad. He also predicted that its nascent CTV category would grow to become the company’s largest. And? You guessed it. That happened.

On Why Buy Side is and Always Will Be in the Driver’s Seat:

Green spoke on poor results posted from supply-oriented firms like Snap and how people incorrectly extrapolate that to mean The Trade Desk will suffer. Beyond the superior targeting, measurement and channel optionality, Green explained The Trade Desk’s outperformance as the overarching dynamic of advertising being permanently demand constrained -- and it’s the market leader in servicing that piece of the ecosystem. If demand were approaching supply, publishers would just seamlessly create more. Conversely, creating more demand is far more problematic.

The supply side needs The Trade Desk’s demand aggregation to fetch cost per mille (CPM) rates that make their models work. The demand side needs The Trade Desk to reach the right people at the right time with the right frequency to deliver better return on ad spend (ROAS) despite the higher CPMs -- otherwise, buyers would just seek out the cheaper options. The Trade Desk does both of these things very well and has established itself as the de-facto open internet advertising platform as a result… with a focus on the demand side but with direct plug-ins to the supply side.

With Netflix, HBOMax and Disney all deciding to embrace ads in the last year, The Trade Desk expects the demand imbalance to become even more favorable for it in 2023. This simply shifts the power dynamic further to its niche.

On Macro and Secular Headwinds:

The Trade Desk has not slowed down its hiring cadence in 2022… at all.

It continues to see brisker share gains as macro worsens and advertisers are increasingly forced to seek out ROAS optimization. Some brands still aren’t fully comfortable with embracing a shift to programmatic, but a poor macro backdrop forces their hands and accelerates the evolution.

The Trade Desk is not immune to macro. Shocks like the pandemic did temporarily slow its growth. But that impact was very short-lived as advertising came back with a vengeance and with The Trade Desk possessing larger market share. That’s generally what happens: When markets slow, it simply takes a larger piece of the pie and positions itself to capitalize on the next phase of the cycle.

On Google:

Green thinks a Google targeting/advertising federal lawsuit is coming “any minute now.” He’s always right.

He acknowledged that Google is a competitor… but that it competes with the giant on its “37th priority which doesn’t move the Google P&L needle.” To him, The Trade Desk’s combination of openness, objectivity, superior outcomes and Google having 36 more things to focus on first has forced Google to try and compete by creating a market that unfairly favors them. Green thinks this approach is far from worth it for the company’s financials, and that we’ll eventually get to a point where Google concedes and the playing field levels.

It’s important to point out that advertising’s demand constrained reality isn’t unique to the open internet. It extends to walled gardens like Google’s YouTube as well. So? That product would greatly benefit from allowing open internet bidding to free all possible demand to place their offers. These offers are routinely better than what walled gardens can fetch alone, meaning they’re leaving significant revenue on the table.

“If we’ve done this well in an unfair market, imagine what we can do in a fair one.” -- Jeff Green

On Connected TV:

Connected TV (CTV) is very fragmented. This blocks any single participant from assuming the market power that Google enjoys in search. These participants will need competitive bidding processes to fund expensive content creation and sustain their businesses. As an aside, that’s why 3rd party cookies are such an outdated internet identifier: It only works in web and none of the other rapidly proliferating advertising channels.

CTV has now matured to a point where it’s enjoying the “first dollar of ad budgets” with other players like walled gardens enjoying the leftovers. It used to be the polar opposite.

CTV is still just 6.4% of the TV advertising market. But when looking at solely data-driven, auction-based programmatic advertising (The Trade Desk’s model) it’s just 1.6%. The segment is rapidly growing and still in the early innings of its maturity. Great combo.

On OpenPass:

Green announced a new company product called OpenPass (different from OpenPath) that is currently in private beta testing. This is a next-generation single sign on (SSO) product like Google’s with a convenience and privacy upgrade. It’s an “open internet wide pass that enables publishers to join their user bases.” Considering that less than 5% of impressions for sectors like journalism are from logged-in users, cookie degradation makes it so that the other 95% are not AT ALL targetable.

So, The Trade Desk is making up for this degradation in its own way. How? Like other SSOs, this feature allows consumers to forgo account creation and login for all participating publishers. But here, consumers can opt in on a per site basis to customize who gets access to what data. Today, other SSOs are opt out, meaning you’re automatically opted-in unless you explicitly say otherwise. Most of us have countless sites that we don’t even use leveraging our data for profit. Not consumer friendly. OpenPass’s opt in process is also done with the click of a button, thus marrying responsibility and convenience.

On The Trade Desk’s Budding Data Marketplace and UID2 (AKA its identity tokens):

The Trade Desk’s data marketplace transforms the manual process of sifting through thousands of data sources to guess at which will increase ad spend returns. Now, The Trade Desk organizes, contextualizes and recommends which data sources are actually utility building in a fully automated fashion. It offers “Multi-Element Bidding” which frees buyers to layer on new pieces of data with a full understanding of value creation -- while paying based on the data’s performance instead of quantity used.

Green talked through several data marketplace issues. Data scrolling, matching and efficacy he sees as solved with this new product. This next year, the focus will be on fostering efficient price discovery vs. a legacy buying process that is almost entirely lacking it.

This data marketplace closely relies on The Trade Desk’s UID2 open internet identifier. Why? Without it, coverage overlap between the publisher, The Trade Desk and 3rd party data providers was routinely below 5%. This means advertisers have no sense of how to apply data to successfully promote to the other 95%. Quite the issue. This leads to things like generalized, less effective targeting. Using UID2 as the common currency of the open internet vs. the already sparingly available 3rd party cookies allows stakeholders to move from 5% coverage to 100%.

The company is using a pricing model here to “align costs with results.” Rather than charging a flat fee, it will charge a percentage with more revenue earned by data efficacy and performance.

On Shopper Marketing:

The Trade Desk’s ability to connect shopper marketing dollars to brick and mortar sales has unlocked yet another channel with a vast runway, little formidable competition and ample low hanging fruit. 2020’s Investor Day was about the incredible opportunity that CTV represented. This year, CTV still received a lot of deserved love, but Shopper Marketing took a larger piece of the conversation as it continues to shatter all internal company expectations. It sees the iconic logos such as Walmart and Home Depot serving as dominos pushing other retailers to follow suit to keep up with the competition -- and that’s already playing out:

b) Notes from Co-Founder/CTO Dave Pickles

On Solimar (its ad-buying platform):

One year into The Trade Desk’s brand new platform (Solimar) going live, here are the results:

50% mean increase in client channel usage

100% increase in data elements used per impression.

100% adoption rate after just 1 year despite the brand new, unfamiliar user interface (UI).

A key part of Solimar is its cross-channel graph which offers a holistic visualization of granular identity. This is how The Trade Desk alone makes sense of ID while UID2 is leveraged for the whole industry. The company created the “Identity Alliance” to incorporate other ID vendors like LiveRamp into Solimar to raise cross-device usage by 150% vs. the old identity graph The Trade Desk had been using (via its 2017 acquisition of AdBrain).

On Koa (its AI engine):

“Several prominent ad agencies have now made Koa a core part of their processes this year.” -- Pickles

On The Planned Next-Gen Forward Market Product:

The Trade Desk -- after about a decade of talking about it -- is now creating a dedicated, data-driven forward market product to transform the archaic up-front buying process. This will function as a bridge for clients as they move from spending marketing dollars on linear to streaming. The Trade Desk wants to be a big piece of that transition to increase its chances of winning streaming dollars in the future.

This product will allow for the reservation of inventory just like with traditional up-front markets. But now, advertisers will be able to do so while unleashing The Trade Desk’s platform to intelligently and actionably forecast where and when your target audience will be. This new precision will motivate buyers to pay a premium for having more relevant impressions reserved. In the past, up-front buying was like throwing darts at a board; The Trade Desk is fixing that.

c) Notes from Chief Strategy Officer Samantha Jacobson

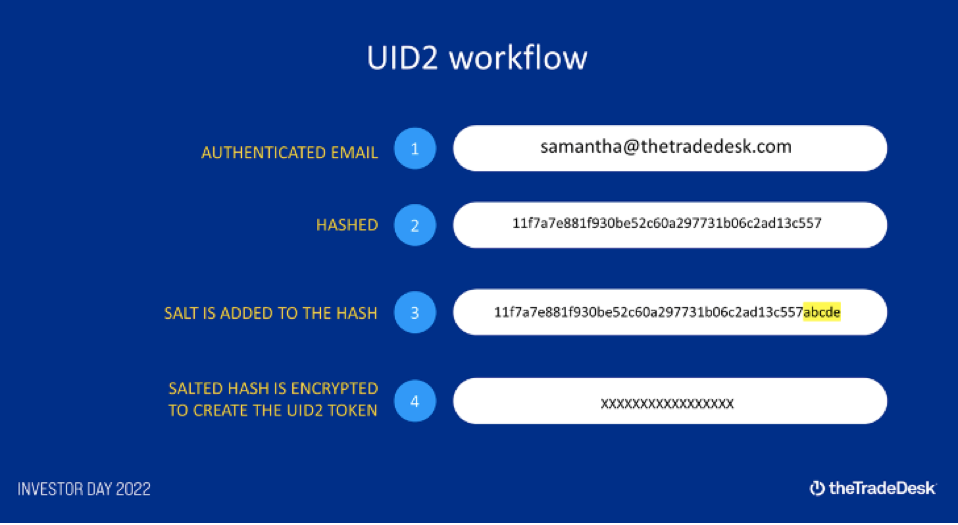

On UID2 Open Identifiers (Tokens) and How They’re Created:

Jacobson talked us through a valuable breakdown of how UID2 goes about anonymizing an identifier like an email address. Here’s the process in her paraphrased words:

Interact with a brand online like Lululemon.

It collects an email or phone number for a more personalized customer experience.

Via key integrations with data firms like Snowflake and Salesforce, the brand can overlay the UID2 algorithm within their own ecosystem or can also send it externally to the UID operator if that’s preferred.

UID2 then hashes the email address which just means turning it into a randomized group of numbers and letters.

Next, UID2 “salts” the hashed address. This means adding a uniform code specific to UID2 (which is “ABCDE”) to the end of each address. This makes the code unique to UID2’s environment.

Finally, it encrypts this hashed, salted address. This turns it into a series of X’s.

It also allows firms to use double encryption protection. That lets companies take their list of UID2 tokens and add another layer of encryption specific to themselves. The firm can then transfer it to their end clients which always need a decryption key from that publisher for access.

The Trade Desk’s platform can then use this token and layer in all relevant data on it (without risking ID exposure) to ensure unique, responsible targeting.

Keep in mind:

UID2 (its ID product) is how advertisers know who they’re talking to, data is how they know who they want to talk to & what to say.

The Trade Desk built BUT DOES NOT OWN UID2. It vested ownership to remove potential conflicts of interest which is why countless competitors have adopted it.

On Case Studies

For Fubo, UID2 delivered:

A 62% rise in ad spend year over year DESPITE just a 25% rise in ad impressions YoY.

A 14% rise in ROAS for Fubo ad buyers. So The Trade Desk is getting buyers to spend more and enjoy more success while making Fubo more money.

For Mercedes-Benz, The Trade Desk’s CTV Platform facilitated:

A 5% rise in brand awareness.

An 11% rise in key demographic brand awareness.

A 1.5 million unique household reach.

d) Notes from Chief Revenue Officer Tim Sims

On Why the Future of CTV is Decisioned and Biddable:

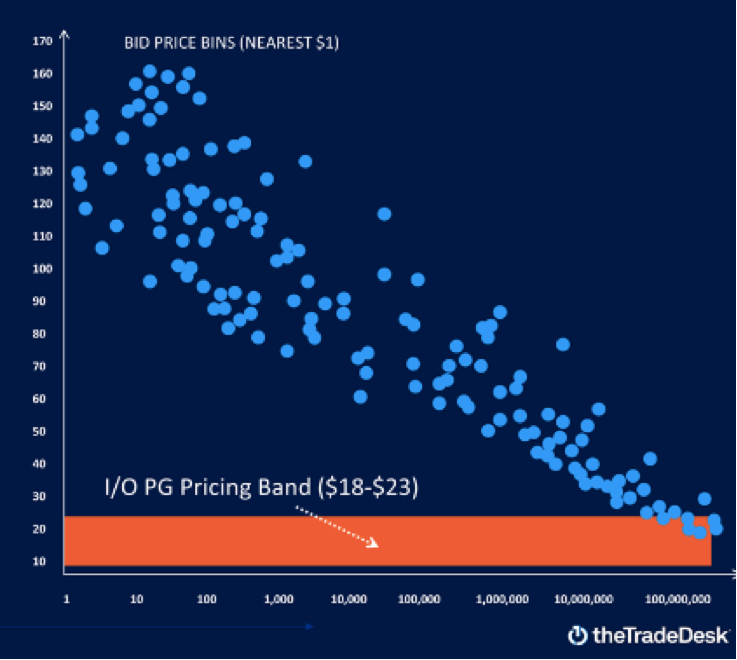

Sims worked through a striking example of CPMs for streaming-based advertising that isn’t data driven (decisioned) or biddable -- so very similar to linear up-front buying with a little more timing flexibility. Generally, CPMs under that dated format range from $18-$23 for publishers. Amazingly, when opening these same placements up for bids and connecting them to The Trade Desk’s decisioned impression engine, millions of incremental offers flowed in at CPMs astronomically higher. This is because The Trade Desk’s data infusions uncovered the wants and likes of the audiences and removed the guessing from ad buying while freeing more demand to flood in. So? Without using The Trade Desk’s decisioned, biddable programmatic advertising platform on the demand side, publishers leave a fortune on the table:

On ad frequency:

Sims dove into the power of programmatic, decisioned, biddable advertising. Linear (or even non-biddable CTV) adverting features networks that don’t communicate with each other and so create what Sims called “frequency silos.” This leads to inundating consumers with too many identical ads, thus fostering diminishing returns and annoyed viewers. One of the wonderful things about The Trade Desk’s platform is that it allows for complete control of ad frequency which innately optimizes performance. This fosters immense cost savings which coincidingly makes publisher impressions worth more -- thus also making them happier and richer.

As an aside, this is one of the many examples of The Trade Desk trail-blazing efficiencies in what has been a wildly inefficient advertising world. And this is why it has commanded a consistent take rate of around 20% for the better part of a decade -- with that expected to be maintained going forward. When you’re more than doubling ad efficiency for your constituents, 20% is an easy price to command.

“I get a lot of questions about our ability to maintain take rate with scale over time. Our take rate has been very consistent for 8 years ranging right around 20% every year… We continue to add more value than we extract. We provide a stakeholder surplus… since 2016 we’ve added so much functionality while maintaining the same take rate. Why? Because it spins our flywheel. As we provide more value, our customers come back and spend more and use more campaigns.” -- CFO Blake Grayson

e) Notes from CFO Blake Grayson

Long term Targets:

The Trade Desk guided to a long term adjusted EBITDA margin of 40% (it’s already there) with consistent growth and share gains to come. Grayson added that the EBITDA guide could easily be surpassed (like all of the company’s other guidance is) if it focused more there today. But it remains fixated on striking the right balance of growth and still fantastic margins. I still think 40% is too pessimistic as it assumes no operating leverage left in the business. I find that extremely hard to believe.

On Capital Allocation:

“M&A is not something we talk about, but we have an active program. Valuations have come in and we are looking deliberately. We’re very good at saying no, but if it’s the right choice, we’ll say yes… buybacks are on the table and it’s too early for dividends.” -- CFO Blake Grayson

2. CrowdStrike (CRWD) -- Buffalo & More

a) Buffalo

CrowdStrike and the City of Buffalo inked a new cyber security partnership this week. The relationship will be focused on protecting Information Technology (IT) systems from “ransomware and digital viruses.”

There are a few things I wanted to point out in conjunction with this release:

This is merely another public sector domino to fall for CrowdStrike since it secured Impact level 4 (IL4) status from the Department of Defense. The Federal agencies that signed with CrowdStrike as a result of that rare classification are used as best practice signals for more local public entities. Momentum here is wonderfully strong and the market is even less tapped than CrowdStrike’s large enterprise bread and butter.

The deal is focused on protecting Buffalo’s IT systems. So? This is just more evidence of cyber security and IT segments continuing to converge. That’s great news for CrowdStrike’s addressable market expansion.

Buffalo expects to enjoy $75,000 in annual cost savings thanks to CrowdStrike’s automation and agent consolidation. These pieces of info are important indicators of CrowdStrike’s sustained ability to fetch a per-endpoint premium vs. competition. It can charge more if it’s providing enough value to foster net savings/value creation… and that’s what it does.

b) Miscellaneous

Evercore & SMBC initiated bullish CrowdStrike coverage this week. They -- like everyone else -- think cyber security will hold up better than other pieces of enterprise spend and that companies like CrowdStrike will continue to outperform as a result. This wasn’t surprising, but it’s always nice to hear an institution confirm optimistic opinions.

CrowdStrike and Optiv were named the overall incident response solutions of the year by Cybersecurity Breakthrough Awards.

3. PayPal Holdings (PYPL) -- Case Study & Venmo

a) Case Study

Kiramoon -- a skincare company -- was having trouble scaling the business. It went with PayPal as a payments provider (including payouts and business accounts) and here were the results:

22% of transactions on Kiramoon.com are via PayPal

PayPal creates a 6.5% higher average order value (AOV) vs. other checkout option.

b) Venmo

Venmo launched Charity Profiles on its app this past week. The profiles allow charities to field donations in-app.

4. Lemonade -- Going Global & the Give Back

Lemonade launched its software platform in the United Kingdom this past week. The same lightning fast on-boarding and claims management is now available to its roughly 70 million residents alongside the USA, France, Germany and the Netherlands. UK residents will now be able to cover individual belongings (including rentals) with add-ons available for an extra layer of coverage.

As part of the go-to-market, Lemonade is partnering with Aviva -- the 2nd largest insurance brand in that nation and the 13th largest in the world. The release hinted at more insurance products to come in that market from the two companies which I fully expect to be the case.

Just like Lemonade’s other markets, insurance in the UK is both massive and quite fragmented -- meaning it doesn’t really need to disrupt the market to find success… but that’s still the goal.

“Insurance as we know it hails from the UK, as do I. So both professionally and personally this is a homecoming of sorts. We believe the millions of local renters will appreciate what Lemonade has to offer. After all, who doesn’t want instant, transparent, personalized and mission-driven insurance.” -- Co-CEO and Co-Founder Daniel Schreiber

The same giveback program that the firm is known for in its other markets will also be available there as well. As an aside, this give back program is often misunderstood by investors. Yes, it’s to build goodwill and to meet the “B-Corp” label. But it goes deeper than that. Lemonade’s business model is based on extensive academic research on human psychology and incentives. People are motivated to lie about claims if extra profits line the pockets of insurance companies. By donating those excess profits to charity and locking in Lemonade’s margin ceiling, it makes consumers hesitate about exaggerating those claims which creates a net positive for the insurer. After all, a few bucks going to my favorite charity sounds a lot better than into State Farm’s balance sheet. Wouldn’t you agree?

5. Duolingo (DUOL) -- Gunner

Duolingo made an acquisition this past week. It bought Gunner: a Detroit-Based design and animation studio. For years, the two have partnered on animation projects that Duolingo has embedded into its apps and marketing programs to optimize engagement and efficacy. These animation projects have explicitly shown to augment Duolingo’s key performance indicators (KPIs) and so it will lean into extracting more value here. It’s a very similar concept to the extensive split testing it runs to try out new features: As things work, Duolingo gets more aggressive… not vice versa like we see with other app-based companies such as Match Group.

Clearly, Duolingo was impressed with the capabilities and wanted to bring Gunner’s team of 15 in-house. While the company is quite small, its reach isn’t as it has designed art for Amazon, Spotify and Google among others.

Interestingly, when I took to Twitter to break this news, there were several prominent designers that responded with a celebratory tone. Anecdotally speaking, Gunner seems to have a pristine reputation within that community. Always a good sign to be loved by your sector.

Final notes on the deal:

No deal terms were provided.

Duolingo will open a brand new Detroit office.

The firm has sparingly used M&A in its brief company history but has now established a sizable team with that focus and expects to make more splashes going forward.

“We know the hardest thing about learning is staying motivated… Art and animation is foundational to making Duolingo a beloved daily habit.” -- Luis von Ahn

“We have been fortunate to collaborate with so many great brands, but Duolingo has stolen our hearts… it feels right to be at a company that invests in art and has a mission that we believe in.” -- Co-Founder Ian Sigmon

6. Upstart (UPST) -- New Partner

Upstart added another partner -- Atlantic Federal Credit Union and its roughly $1 billion in assets under management (AUM) -- to its referral network this week. The two ran a successful pilot program and are now ready to take the next step. Throughout all of the macro pain that has been inflicted especially hard on Upstart, it’s sector and core demographic, the company has continued to rapidly add new partners to its lending program. Some call that irrelevant unless these new partners are actually originating more and more volume through Upstart. That’s correct, and considering the recent trend away from capital market funded volume to partner retained, that seems to be happening. Furthermore, it’s important for the following additional reasons:

Bank and credit union partners are less sensitive to macroeconomic cycles than fast money hedge funds and other capital market participants. This is a key piece of Upstart building a more durable and smoothly growing book of business cross-cycle.

Upstart’s platform today is severely funding constrained. It needs all of the funding supply it can get -- and this helps.

So this is a short term and long term positive.

Partner adds are objectively good pieces of news. It feels odd to have to say that -- yet here we are.

7. Shopify (SHOP) -- Europe

Shopify has made changes to its shopping platform following discussions (more like negotiations) with European regulators. Some Shopify merchants had been engaging in unscrupulous and unlawful selling activities while using Shopify software -- and the company has been asked to address that issue. As a result, it’s adding new consumer protection layers to its merchant operating system to appease the European Commission.

This is always a risk when you’re serving millions of mainly smaller merchants from all over the planet. Shopify is liable for all of its merchants’ wrongdoing. Fortunately, this issue seems to have been resolved with little company headache.

8. Penn Entertainment (PENN) -- Bullish Note & Barstool

a) Bullish Note

Cannacord Genuity initiated coverage on Penn Entertainment this week. The price target was positive ($50), but I wanted to focus (as I always do) on the reasoning behind the news. The firm is enamored with Penn’s omni-channel approach. Its Barstool and Score assets pave the way for more efficient customer acquisition while the brands also re-invigorate Penn’s legacy brick and mortar business. In a world where competition has to spend wild amounts of money to win business with a high propensity of churn, Penn wins with stickier brand loyalty. That’s why Barstool Sportbook is the most profitable in the space and why its revenue market share far outpaces its bet market share -- it works less hard and spends less to acquire new business.

b) Barstool

Penn Entertainment is opening a Barstool-themed restaurant and bar in Nashville next year. Penn continues to find success in other cities like Philadelphia and Chicago with similar concepts -- so it’s full speed ahead.

9. Meta Platforms (META) -- Miscellaneous

Common Thread Collective shared a great graphic on Facebook ROAS for 2022 greatly outpace 2021 levels. This is explicit evidence of its ad-tech stack investments in measurement and targeting bearing considerable fruit.

Meta is actively shrinking its real estate footprint including the closure of a New York office. I greatly prefer this over layoffs. Keep the talent in-house.

Facebook is debuting feed customization tools to more granularly pick and choose content feeds. This includes more control over actively selecting what type of content to see more or less of.

Citi Bank sees clear sings of Reels monetization beginning to season. Yes please.

Supposedly, there was leaked footage of the new Quest Pro which can be found here.

10. Green Thumb Industries (GTBIF) -- Board Shake-Up

In a both vague and worrisome press release, Green Thumb announced the departure of three of its board members. The reasoning was called out as “disagreements on personal misconduct and not finding a resolution satisfactory to all parties.” Yuck.

I need to learn more about this and expect it to be addressed on the firm’s upcoming call. I view Kovler and his team as best in class in the space, but this clear sign of cultural fragility concerns me to say the least. I have unfortunately paused accumulating shares of this company in light of the news. The decision is frustrating to say the least as Green Thumb continues to fundamentally thrive, but this is too odd for me to ignore. That pause could prove to be very temporary if we get more needed information and context on this issue.

11. Cannabis News

The Biden Administration announced the pardoning of previous cannabis possession offenses this week. In addition, it is looking closely into cannabis scheduling and regulation -- which has led many to hope more announcements will be coming soon. This is the first time we’ve gotten news like that from the Executive Branch. Any movement on taxation, up-listing, insurance and basic banking would be extremely welcomed news -- and cannabis executives as well as institutions like Stifel think this development makes expedient progress far more likely. I think it’s too early to get excited, but hopefully this is just the first announcement of many.

Some have pointed out that things like federal legalization would mean interstate commerce and so the eroding of gross margins in higher price point states as product from California floods in. That’s true. But this headwind only would come after the more meaningful profit tailwinds associated with reform (tax and interest rates vastly diminished, for example). It’s easily a net positive in my view.

Furthermore, others have asked me if I think this is simply a ploy for midterm votes. To that I say: I don’t care. Politics have never interested me… I just want to see cannabis reform. My political ideology is alpha.

12. Macro

a) Key Economic Data from the Week

The Manufacturing Purchasing Manager’s Index (PMI) came in ahead of expectations at 52.0 vs. 51.8 expected. Conversely, The Institute for Supply Management (ISM) reported their manufacturing employment metric at 48.7, sharply missing expansionary expectations of 53.0.

YoY Average Hourly Earnings Inflation came in at 5.0% vs. 5.1% expected and 5.2% last month. Slow progress.

JOLTs Job Openings came in below expectations at 10.05 million vs. 10.78 million expected while initial jobless claims came in ahead of expectations at 219,000 vs. 203,000 expected. These are 2 pieces of evidence pointing to the labor market beginning to worsen which would place pressure on the Federal Reserve to slow hawkish policy.

Conversely, the ADP’s Non-farm employment change and Non-farm Payroll slightly beat expectations this week. Interesting to juxtapose.

OPEC+ announced a sharp production cut which -- along with things like China again re-opening and adding to energy demand -- prompted The Biden Administration to pivot on renewed SPR releases to combat the inflationary pressure.

Freight rates continue to rapidly plummet from previous highs.

The Bloomberg Commodity Index began to rise once more, but remains near year-to-date lows.

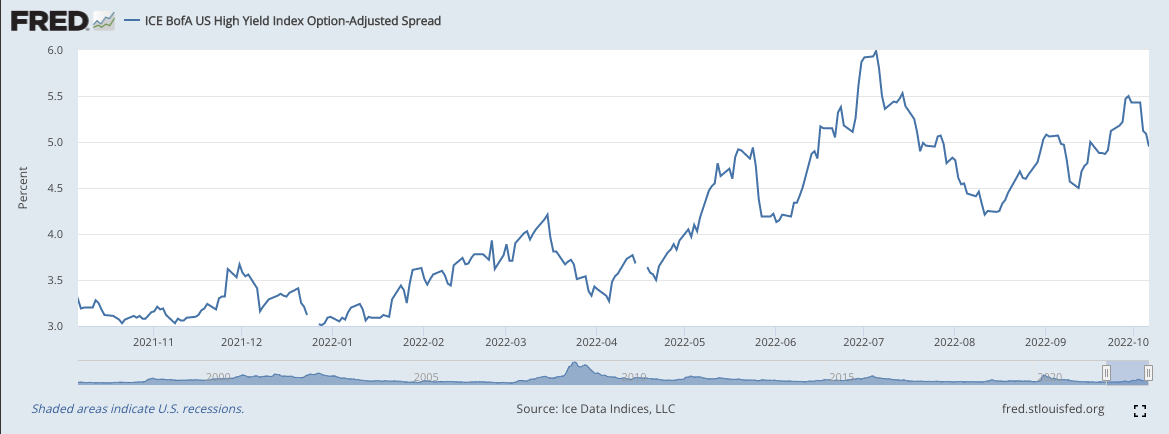

Bank of America’s U.S. High Yield Index Option-Adjusted Spread sharply improved this week:

The 30 Year Fixed Mortgage Rate shockingly (I’m being sarcastic) did not set another cycle high:

The 5-Year Breakeven Inflation Rate unfortunately rose materially this week:

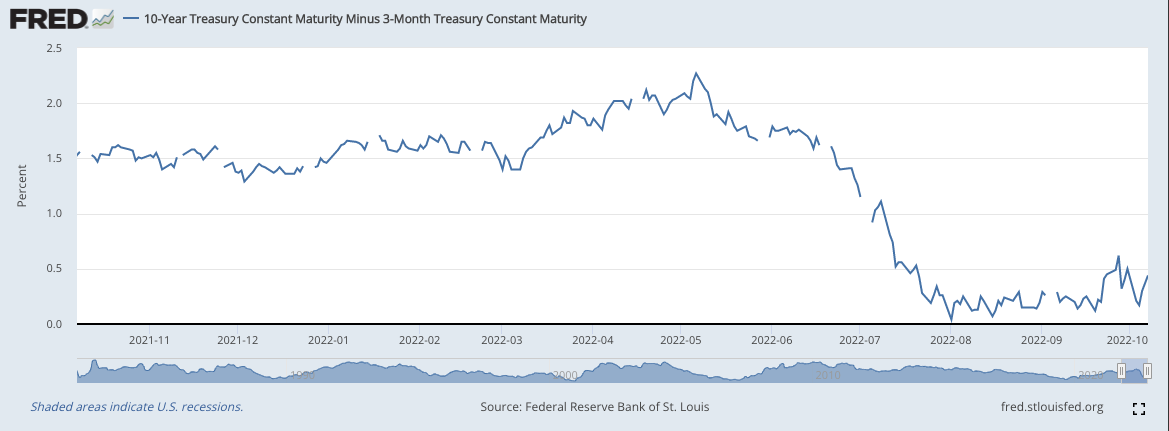

The 10 Year- 3 Month Yield Curve has not inverted. This is the curve with inversions having the tightest correlation to recession (not 10 year-2 year):

b) Key Market Data from the Week

Amazon is freezing hiring while Peloton conducts another round of layoffs as it contemplates the viability of its future as a standalone business.

Tesla expects to deliver its first semi-trucks to Pepsi in December.

AMD pre-announced quarterly results sharply below previous guidance. Chip demand is certainly feeling macro pressures.

c) Level setting the data

There wasn’t a clear trend in new data from the week. Some economic data was impressively strong, some not so much. The same thing can be said for employment and inflationary data. So? Nothing much about my macro point of view changed. Hawkish policy will invariably continue through the course of the year. As we move through 2023, I expect inflation to continue looking better -- especially now with early signs of rent inflation cooling off joining positive commodity news -- while employment and output data looks worse and worse. I don’t know when that will force the hand of the fed to pivot, but I do think that will happen sometime in 2023. Obviously, new data could readily change my opinion.

As markets are always trading on expectations of events 6-12 months out, if data continues confirming my thesis, I will likely look to lean into accumulation as the calendar year turns. If this sounds eerily similar to previous explanations of my plans, it should. Have a consistent plan. Be open-minded enough to tweak that plan if the exogenous backdrop warrants it.

13. My Activity

I did not transact this week. My cash position is currently 18% of holdings.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that the MSOS position is a placeholder for my positions in Green Thumb and Cresco Labs while OTC stocks are added to the platform. You can also re-create your very own portfolio through Savvy Trader here.

Have a wonderful weekend!

Loved the company updates this week, especially the insight into TTD.