News of the Week (October 31 - November 4)

PayPal; Progyny; Penn Entertainment; JFrog; Revolve; Match; Meta; Shopify; Upstart; Cresco Labs; Macro; My Activity

This piece is powered by my friends at Savvy Trader:

Welcome to the 1,047 new readers who have joined us this week. We’re so happy to have you.

1. PayPal (PYPL) – Q3 2022 Earnings Review

“We are confident that we have turned a corner in our transformation. We will continue to drive cost savings and streamline processes to improve productivity while investing to differentiate our value proposition, drive market share & deliver on our commitments.” – PayPal CEO Dan Schulman

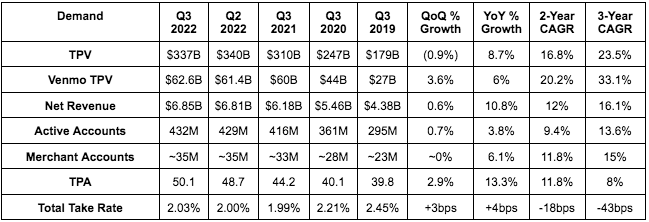

A. Demand

PayPal beat its $6.8B revenue guide by 0.7% and analyst estimates by 0.4%.

More Demand Context:

PayPal’s 3-year sales CAGR of 16.1% compares to 16.5% last quarter & 16.2% 2 quarters ago.

Foreign Exchange (FX) was just a 100bps growth headwind during the quarter vs. 500 bps last quarter. eBay was another 100 bps but its managed payments migration impact on PayPal’s growth is now officially in the past.

More effective currency hedging helped a lot here. Specifically, FX hedging was a $156M benefit vs. a $44M headwind YoY. This benefit counts as international transaction revenue.

That hedging doesn’t benefit volume growth, which is why Total Payment Volume (TPV) experienced a 500 bps FX growth headwind this quarter.

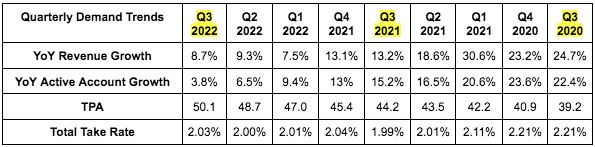

Strong Transaction per Account (TPA) growth is PayPal’s evolution to high engagement users (& use cases to limit churn) working.

Take rate compression is via Bill Pay, Venmo and Braintree growth as well as eBay’s migration. That reversed this quarter thanks to the eBay headwind dissipating and Venmo monetization improvement (its commerce volume grew 150% YoY).

Active account growth includes a large chunk of the churn impact from PayPal halting promotional activity for low engagement, cash burning users as part of its shift to focus on higher value users.

PayPal’s core Daily Active users are up 40% since pre-pandemic.

PayPal continued to outgrow e-commerce this quarter & take or maintain share in all core markets.

Venmo crossed 90 million users during the quarter.

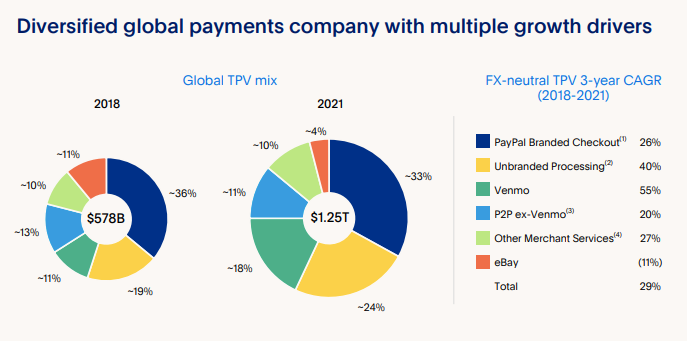

PayPal broke down TPV contribution by product for the first time ever this quarter (THANK YOU) and how that contribution has trended since 2018:

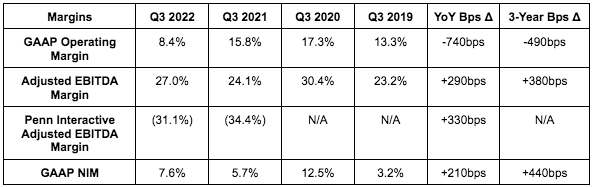

B. Profitability

PayPal’s GAAP EPS beat analyst expectations by 82%.

PayPal beat its EPS guide of $0.95 by 13.6% (analysts expected the same).

This would have been a 25% beat with normalized YoY tax impacts.

PayPal beat analyst EBIT expectations of $1.36B by 12.5%.

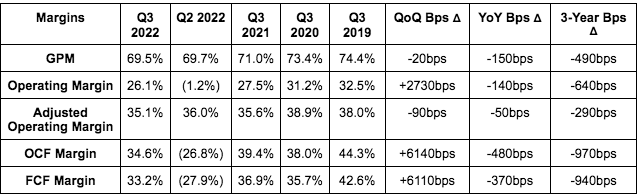

More Context on Margins:

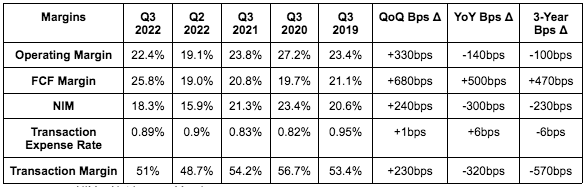

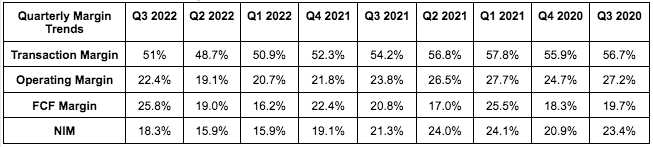

Transaction margin (and so most other margin lines) benefited greatly during the pandemic from stimulus checks temporarily boosting the usage of debit as a % of PayPal’s total volume. Debit comes with lower 3rd party fees vs. credit and has since normalized.

Other things like lapping credit reserve releases, eBay take rate compression, cross border struggles (FX-related) are all currently weighing on YoY margins. Luckily, management expects operating leverage to kick in going forward.

GAAP EPS was boosted by $0.38 in mainly equity investment gains with a bit of credit reserve release help as well. That’s why the GAAP EPS beat was larger than the non-GAAP beat.

This was the first quarter of YoY operating income growth in over a year and a record quarter for cash flow generation.

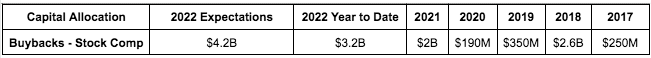

C. Balance Sheet

Accelerating purchases into share price declines is how a buyback program is supposed to look… “cough, cough Meta”

PayPal added $500M to the cash & equivalents pile QoQ to bring the total to $16.1B. It has $10.7B in total debt.

Buybacks this year have represented 78% of PayPal’s total cash flow generation.

D. 2022 Guidance & Preliminary 2023 Notes

Rest of 2022:

PayPal lowered its previous revenue growth guide of 10% (11% FX neutral) to 8.5% (10% FX neutral). This implies revenue of $27.5B which missed analyst estimates by 1.4%. This is actually better than most of its competitors fared during the quarter, believe it or not.

The weakness is because of the early holiday season shopping that occurred in 2021 not recurring this year. That reality has been true across all available 3rd party data -- so not just for PayPal.

PayPal lowered its previous TPV guide of 12% growth (16% FX neutral) to 8.5% growth (12.5% FX neutral).

The larger volume guide down vs. revenue guide down is the hedging effect discussed above. Hedging doesn’t help volume growth like it does revenue growth.

PayPal lowered its Net New Active (NNA) guide from 10 million to 9 million.

PayPal raised its GAAP EPS guide by 35% from $1.57 to $2.12. It also raised its EPS guide by 4.1% from $3.92 to $4.08 for 2022.

PayPal reiterated over $5 billion in 2022 free cash flow.

“Given challenging macro, slowing e-commerce trends and an unpredictable holiday shopping season, we are being appropriately prudent with our Q4 revenue guide.” – CEO Dan Schulman

2023:

PayPal offered EPS growth guidance of AT LEAST 15% for 2023. This equates to at least $4.70 in 2023 EPS vs. expectations of $4.82.

Considering how pessimistic this 2023 guide sounded and the “at least” context, I wouldn’t call this a miss.

This guide does not rely on any improvement in macro or e-commerce trends. Per CEO Dan Schulman, “if the macro picture gets better, these numbers could improve dramatically.” But it’s expecting the terrible macro to persist.

PayPal raised its 2023 operating leverage guide from 50 bps to 100 bps.

PayPal guided to taking more e-commerce market share in 2023.

E. Notes from the Call

PayPal is working with Apple on the Following Initiatives (my favorite part of the call):

Using iPhone “Tap to Pay” to allow U.S. merchants to conduct contactless debit/credit/mobile wallet payments with an iPhone on the PayPal & Venmo apps.

No longer will merchants need a separate piece of hardware to function as an integration bandaid.

In the first half of 2023, Apple Wallet users will be able to add PayPal & Venmo cards. Google did this in Germany and saw a 20% lift in its transaction volume from that move alone. PayPal’s scale & its consumer preference are powerful.

PayPal is adding Apple Pay as a payment option for the Commerce Platform. This is already available for PayPal’s Braintree.

On Upgrading Checkout:

PayPal launched a new software development kit (SDK) enabling 2-click checkout all natively within the merchant’s site. In-line checkout (so never leaving the merchant site to complete a transaction) boosts conversion considerably.

Schulman discussed some upgrades around SMS authentication and biometrics and how they lowered PayPal checkout latency by 40% YoY.

PayPal is beta testing 1 click checkout with select merchants. This is only possible with massive payment vaults and vast quantities of stored consumer information to expedite completion. PayPal has that.

PayPal’s point of sale (POS) software Zettle is now live in the U.S. after successful launches in France and Netherlands this year.

Buy Now, Pay Later (BNPL):

PayPal’s BNPL volume grew 157% YoY to $5B

PayPal now has 280,000 merchants with upstream presentment (showing the PayPal checkout option before a customer checks out) vs. 200,000 QoQ. This raises its share of overall checkout by double digit percentages.

PayPal’s loss rates are “among the lowest in the industry with no observable deterioration” per Schulman. Music to my ears.

PayPal leadership reiterated its plans to secure non-balance sheet funding for this credit product like it did with other U.S. receivables in the past. It wants to remain asset light. Paging Synchrony Bank.

Wall Street Journal ranked PayPal #1 overall for Buy Now, Pay later (BNPL) value prop.

Braintree won several “large new merchants” during the quarter.

F. My Take

It’s hard for me to say this was a good quarter with the small revenue growth miss… but I do think there were many more positives than negatives. Despite all of the chaos, the team is effectively managing costs and continues to take market share in a competitive space. That sets it up well for when the exogenous backdrop improves. Furthermore, I find it extremely heartening to see PayPal and Apple strengthening their relationship as it was the most pressing and formidable competitive threat I saw for PayPal in the U.S. I also appreciated the preliminary 2023 outlook. My position at this point in time is largely full, and I have no interest in selling any shares. This performance was satisfactory in my view.

2. Progyny (PGNY) — Q3 2022 Earnings Review

“We remain the provider of choice for the most successful companies in the world and remain in our strongest and best competitive position given no other benefit provider has built a fully managed solution of our quality & outcomes.” – Progyny CEO Peter Anevski

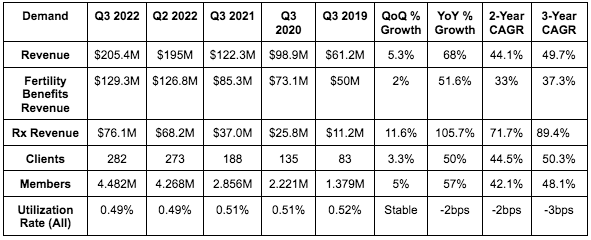

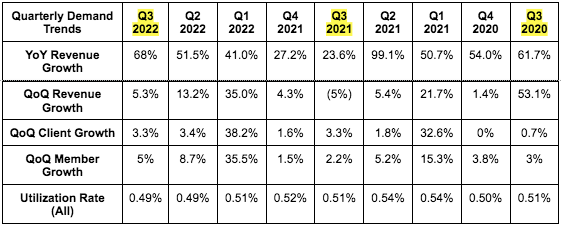

A. Demand

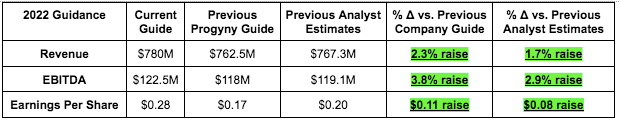

Progyny generated $205.4M in sales, beating its guide 6.1% and analyst estimates by 5.7%.

More Context on Demand:

This large beat and raise is DESPITE a $10M unexpected revenue hit from the industry-wide Menopur medication shortage due to supplier issues. There has been no recall and the issue is expected to be resolved swiftly… but Progyny’s 2022 guide assumes it to be permanent. The company sharply beat demand forecasts anyway and there could be even more upside if it’s resolved as expected.

Progyny maintained near-100% gross client retention for the 7th straight year following the 2022 selling season.

Progyny’s member interest and engagement has fully returned to pre-pandemic levels.

Progyny enjoyed a record number of early deployments this quarter. This pulled some growth forward, but strong 2022 and 2023 selling season commentary (discussed below) is a sign of more of the same rapid growth we expect to come.

New clients boasted a Progyny Rx adoption rate of 97% vs. a previous company record of 92%. With this progress, Progyny expects total Rx adoption to rise from 84% to 90% next year.

Progyny’s 3-year revenue growth CAGR of 49.7% compares to 51.4% last quarter and 53.9% 2 quarters ago.

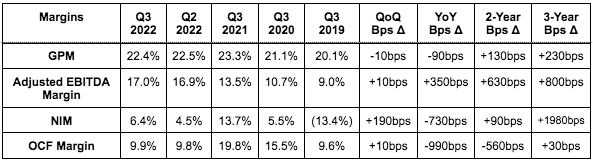

B. Profitability

Progyny generated $35 million in adjusted EBITDA, beating analyst estimates and its own guidance by 14.2%.

Progyny earned $0.13 per share, beating analyst estimates and its own guidance by $0.10 and more than quadrupling net income estimates as well.

Note that Progyny’s guidance does not include income tax benefits which it continued to enjoy this quarter

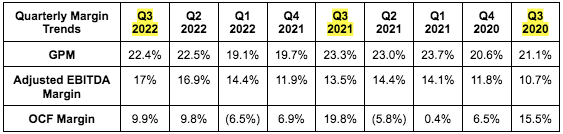

More Context on Margins:

A stock grant that Progyny paid out to hire and retain talent was the source of the falling margins YoY. That’s why adjusted EBITDA margin conversely expanded.

For NIM specifically, the decline YoY was due to the stock comp and also $5 million less in income tax benefits YoY. It would have grown with just the stock comp headwind and the same YoY tax benefit.

Cash flow margins are also being impacted by Progyny lengthening the cash collection cycle as part of renegotiated Progyny Rx contracts. This allows Progyny to collect more total cash flow over time, but the payment now takes 6 months to begin ramping. So? Rapid Rx growth like its enjoying now doesn’t equate to more cash flow in the near term, but will eventually.

Progyny’s incremental EBITDA margin was 22.2% vs. 21.7% QoQ and 27.5% YoY. This points to 500+ bps of more operating leverage ahead.

C. Balance Sheet

Progyny’s balance sheet is ideal. It has $141M in cash & equivalents vs. $122.4M QoQ. It is deeply cash flow positive and has no debt. Diluted share count shrank slightly YoY & QoQ.

D. Guidance

Progyny’s Q4 2022 guide was ahead on revenue and earnings, but slightly below on EBITDA. This isn’t concerning to me considering the full year EBITDA guide rose materially. It expects margins to fall QoQ (normal seasonality).

None of Progyny’s clients have conducted large scale layoffs to date. But it does not expect existing client headcount to grow in 2023. That’s usually a ~100-500 bps contributor to growth.

E. Call Notes

On a Strong 2022 Selling Season:

“The results we achieved in our 2021 selling season had been favorably impacted by pandemic demand carryover. This set a high bar for 2022 success and we are pleased that our selling season this year resulted in a record 105 new client commitments and 1.2 million covered lives…. This demonstrates strong conviction that employers have to add fertility to health plans given its increasing relevance to the workforce.” -- CEO Peter Anevski

This 2022 client growth equates to nearly 40% YoY expansion which beat Progyny’s previously implied expectations of at least 32% YoY growth.

25% of Progyny’s existing clients expanded their benefit for 2023.

Progyny is starting to enjoy more 5-year renewals (vs. all 3 year before) from some of its largest clients as a sign of faith in the company.

Progyny now represents 40 industries vs. 30 YoY. Once it enters a new field, that generally serves as a domino for close competitors of the client to follow suit to more effectively compete for talent. The tight labor market today merely adds to that tailwind.

50% of Progyny’s client wins were from clients without any existing coverage and it still serves less than 5% of its target market. The runway is long and the greenfield opportunities remain robust.

“Given the strong sales season, as well as our expected near 100% client retention rate, we’re enthusiastic about the year ahead.” CEO Peter Anevski

On the 2023 Selling Season:

“[Macro weakness] pushed some accounts to delay deployment. Many are eager to revisit in January which sets us up with a larger and healthier pipeline than what we had this time last year.” – CEO Peter Anevski

On the Competitive Environment:

Progyny leadership was asked about competition winning some big clients. That was because of Progyny’s unwillingness to cut corners on its coverage like those employers were asking by doing things like implementing dollar maximums or excluding services. So those employers looked to other providers to cut the corners for them.

F. My Take

Wonderful quarter. Wonderful guide. Wonderful company. Enough said.

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

3. Penn Entertainment (PENN) — Q3 2022 Earnings Review

A. Demand

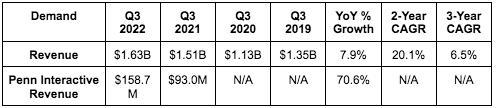

Penn generated $1.63B in sales, beating analyst estimates of $1.58B by 3.2%.

More Context on Demand:

Penn’s 6.5% 3 Year revenue CAGR compares to 7.2% last quarter & 7.0% the quarter before.

Penn Interactive is Barstool and Score Media. This was not disclosed as a separate revenue stream until 2021.

Growth here includes an inorganic Score Media contribution.

YoY Interactive growth was 95% YoY when normalizing the YoY impact of gaming tax reimbursements.

The pandemic hit Penn’s regional casino business hard. That’s why the 2-Year CAGR was so strong. This is a 5%-8% revenue growth business. Don’t expect 20% with normal comps.

Multi-channel guests are up 25% YoY as Penn Interactive begins to work its magic.

Penn’s mywallet (contactless digital wallet) is now at 92,000 users vs. 70,000 QoQ.

Penn’s regional casino handle share ex-Nevada FELL from 19% to 18% QoQ.

B. Profitability

Penn earned $472M in adjusted EBITDA, beating analyst estimates of $466M by 1.3%.

Penn earned $0.72 in EPS, beating analyst estimates of $0.49 by 47%.

More Context on Margins:

Penn Interactive turned profitable in October & Penn reiterated that it will be profitable next year. That compares quite nicely to DraftKing’s and its $500M+ EBITDA loss guide for 2023.

Property level revenue boasted a 37.3% adjusted EBITDA(R) margin vs. 37.1% QoQ & roughly 35.2% YoY.

Margins were hit all by $20 million in California lobbying expenses and a processing fee adjustment.

C. Balance Sheet

Penn has $1.7B in cash & equivalents and nearly $1B in net debt. The net debt position rose slightly due to $168M in buybacks during the quarter. $211M remains on Penn’s $750M buyback plan.

The debt is 85% fixed rate which is important in our rising rate environment.

Penn’s lease adjusted net leverage ratio is 4.3X vs. 4.1X start of year (also due to buybacks).

Penn drew a lot of criticism last month for the timing of its new brick and mortar expansion/upgrade projects. Out of the $850M in planned cost, $575M is being covered by a low interest rate credit revolver from Gaming and Leisure Properties with a $50 million grant from Aurora Illinois to further minimize cash outlay needs.

D. Guidance – Penn Reiterated its top and bottom line guidance for 2022. In this environment, that’s great news.

E. Notes from the Call

On Penn Interactive:

Ontario has now become Penn’s largest sports betting and iCasino market via Score Media’s dominate presence there

Penn is on track to integrate the full Barstool Sportsbook into Score Media’s tech platform by the middle of next year. This will lead to substantial 3rd party licensing fee savings.

Score’s iCasino product is thriving and that tech will be infused into the Barstool product next year as well.

Barstool’s college football tour is breaking attendance records.

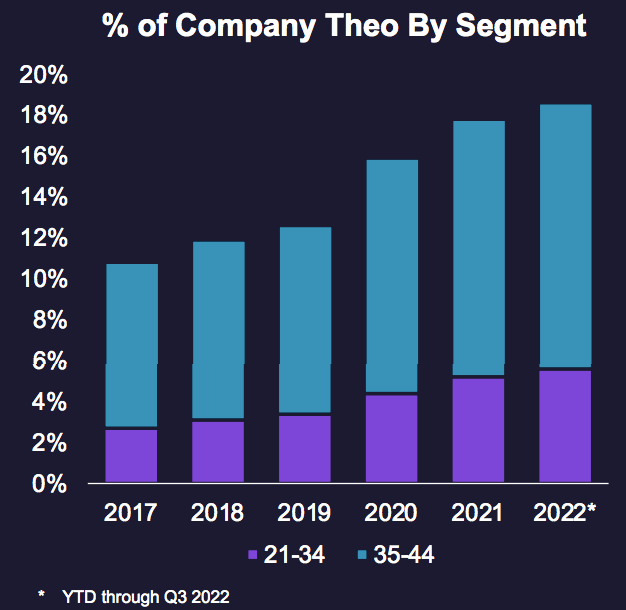

Barstool and Score are working extremely well on making Penn’s customer base younger:

On Brick and Mortar:

After 2 years, Penn has finished its Greektown Detroit casino renovation to fix water damage. A large chunk of the rooms had been closed since 2020.

On Current Trends:

Penn sees engagement and spending trends remaining healthy into today. Love it! On the last earnings call, it illustrated the relative durability of regional casinos vs. the Las Vegas strip across economic cycles. That is playing out before our eyes.

F. My Take

This was a good and boring quarter. The only surprises I saw as probable were to the downside, so it was good to see the 2022 guide reiterated. With the cost of capital rising, liquidity shrinking and the ad market faltering, I think this is Barstool’s time to take incremental market share for its sportsbook and I expect that to play out in 2023. Barstool has a cult following. It does not rely on irrational spend to attract market share like its competition. That irrational spend is no longer acceptable in the current macro environment. Time to shine.

4. JFrog (FROG) — Q3 2022 Earnings Review

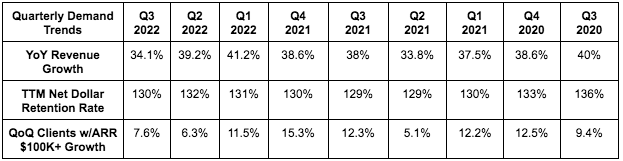

A. Demand

JFrog generated $72 million in sales, beating its guide by 1.4% and analyst estimates by 1.8%

JFrog beat its mid 50% range cloud revenue growth with 60% YoY growth.

More Demand Context:

JFrog Complete (its full suite of products) is now 39% of sales vs. 35% QoQ & 34% YoY.

JFrog’s 37.3% 3-year growth CAGR compares to 39.6% last quarter and 44.3% 2 quarters ago.

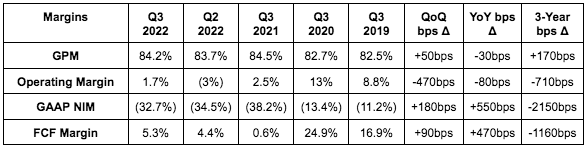

B. Profitability

JFrog beat its breakeven EBITDA estimate with positive EBITDA of $1.2M. This also more than tripled analyst expectations.

JFrog beat its breakeven net income estimate by $0.02 (analysts expected the same).

More Margin Context:

GAAP NIM has been greatly impacted by the IPO and associated stock awards.

JFrog leaned into investment in 2020 to build out its product suite via R&D and a lot of M&A. That’s the reason for the margin contraction. It has been trying to operate at breakeven all year. Next year is when profit growth will begin to ramp.

The company expected operating, cash flow and net margins to bottom for good last quarter. The sequential rises are a good start.

All of JFrog’s revenue is charged in U.S. dollars which makes foreign exchange headwinds irrelevant for it. Quite convenient in 2022.

C. Balance Sheet

JFrog has $434M in cash & equivalents vs. $430.2M QoQ.

JFrog has no debt.

JFrog’s diluted share count grew 4.1% YoY & 0.7% QoQ.

YoY growth needs to slow, and will as we move further away from the IPO.

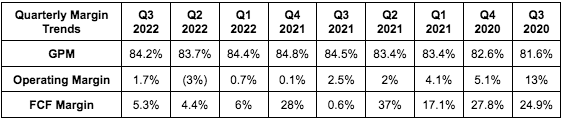

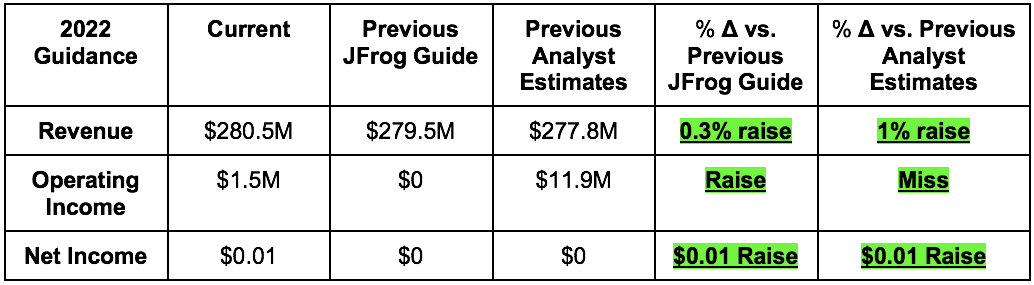

D. Guidance

Similarly to the 2022 guidance, JFrog’s Q4 2022 guide was ahead on the top line, behind on operating income, and in line on net income.

JFrog is not seeing much pain from worsening macro. It is still seeing some lengthening in the sales cycle like last quarter, but nothing all that major. Its retention, win and usage growth patterns remain very healthy. It has implemented some cost savings programs, but continues to spend aggressively and intentionally on key growth areas.

JFrog expects Q4 gross margin somewhere around 83%-84%.

E. Notes from the Call

Slides 5-18 of the investor presentation offers an awesomely intuitive, concise and basic introduction of JFrog’s binary niche. If you’re not aware of what this company does or how it interacts with the GitLab’s of the world, I’d recommend looking it over here.

On Quarter Highlights:

JFrog signed one of the 3 largest auto manufacturers in the world to a multi-million dollar, multi-year deal. This company saw the value in JFrog’s hybrid offering to make its on-premise transition more seamless. It left Sonatype Nexus to standardize on the JFrog platform.

This deal was via JFrog’s public cloud partnerships which means the revenue will be higher margin than if it were a direct sales win.

JFrog has 85% of the Fortune 100 as clients. Wow.

Traction for the new advanced security product is exceeding expectations.

Secured a $500K ARR contract with one of the largest heavy manufacturing equipment firms in the U.S.

JFrog signed its first large deal for JFrog Connect with an international defense electronics firm.

“The list of global enterprises making JFrog part of their DevOps backbone continues to grow.” – Founder/CEO Shlomi Ben Haim

On Customer Case Studies:

Box enjoyed a 90X acceleration in software package release cadence with JFrog’s Enterprise suite of products.

Nokia enjoyed a 52 day decrease in software update time at the edge with JFrog’s Enterprise Plus Platform.

Morgan Stanley recently standardized on the JFrog Complete platform after being pleased with its initial product deployments. Its head of enterprise tech says JFrog’s “focus and vision uniquely addresses Morgan Stanley’s needs.”

JFrog reiterated its long term target of 30%+ revenue growth, mid 50% cloud revenue growth, an 80% gross margin, 23% operating margin and 30% free cash flow margin. It has not lowered a single guidance metric since its IPO.

On a Binary-Centric Approach to Security:

“Any security tool that attempts to provide a software supply chain tool will either need to deeply integrate with Artifactory or build a binary repository… we are positive that more security solutions like Google (a JFrog client) will follow JFrog and acknowledge binaries as the primary assets to secure modern software delivery flow.” – Shlomi Ben Haim

Why is he so confident? Aside from the strong results to date, it’s intuitively easier to track a software ecosystem with a single language of 0s and 1s (binaries) vs. dozens of disparate source code languages. All of that source code can be seamlessly converted into Binaries by JFrog to store, deliver and protect. No longer is JFrog merely a software composition (AKA software bill of materials) tool. It performs vital tasks like malicious package scanning as well.

F. My Take

JFrog has quickly turned itself into a remarkably consistent performer. Do not be put off by their deliberate decision to invest all earnings in more growth. I’m excited to see how investor appetite for this company improves as its margin expansion kicks into high gear and it continues growing over 30% annually. I’ve made JFrog one of my largest holdings over the last few months following consistent execution, successful category expansion and what I see as a reasonable multiple of 5.6X forward gross profit & somewhere around 40X free cash flow.

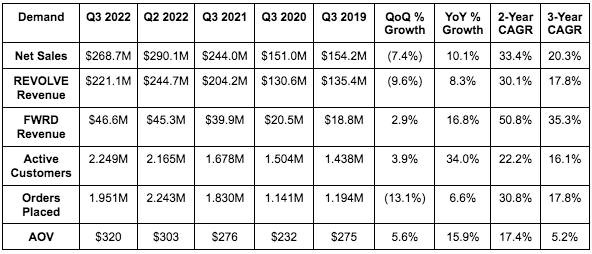

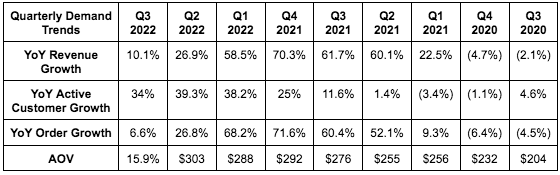

5. Revolve Group (RVLV) — Q3 2022 Earnings Review

A. Demand

Revolve offered rough guidance of growth slowing to 10% YoY early in Q3. It added that continued slowing was entirely possible. Considering this, 10% YoY revenue growth to me was a strong result.

Revolve beat analyst estimates of $257.7M in revenue by 4.2%.

More Context on Demand:

Revolve’s e-commerce business experienced a unique impact from the pandemic. Its “going out” niche and reliance on live event marketing made the pandemic a large headwind for the company. As a result, the second half of 2021 saw some of its best growth ever as it lapped those easy comps. We are now lapping that strong growth from the second half of 2021.

This was Revolve’s first quarter in a while with under 100,000 net customer adds. it added 80,000.

Revolve’s 3-year revenue growth CAGR of 20.3% compares to 21.5% last quarter and 27.3% 2 quarters ago.

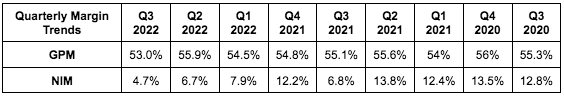

B. Profitability

Revolve earned $17.7M in adjusted EBITDA, beating analyst estimates by 68.5%

Revolve earned doubled EPS estimates of $0.16.

More Context on Margins:

Revolve’s net income was hit by a 26% effective tax rate vs. 14% YoY. Without this, net income would have growth slightly and the margin would have been 5.2%.

Gross margin (and so other margin) pain was from a lower mix of net sales at full price as dresses return as a normal % of sales (higher return rate) and as it works through inventory (not what I want to hear).

FWRD’s GPM fell sharply YoY from 48.6% to 40.2%. It’s still 890 bps ahead of its Q3 2018 GPM.

Revolve’s GPM was 55.7% vs. 56.4% YoY

Continued fuel surcharges are also impacting 2022 margins.

“We have taken swift action to balance inventory given the moderation of discretionary spend in the current environment.” – CFO Jesse Timermanns

C. Balance Sheet

Revolve has $244M in cash & equivalents on the balance sheet, is consistently cash flow positive and has no debt. Its cash position has nearly 5Xed since 2019 from $51M to $244 with no capital raises.

Revolve’s stock based compensation remained ideal at under 1% of quarterly sales.

Inventory levels rose 2% QoQ after the large spike last quarter to take advantage of demand.

D. Guidance

Revolve avoided formal revenue guidance. It did say that quarterly growth to date was 3%. Analysts were only expecting 1.5% YoY growth next quarter, so this was ahead of expectations. BUT, the team told us to expect further slowing throughout the period. So I’d call this guidance roughly in line.

Q4 2021 and Q1 2022 were its best quarters ever, with pandemic tailwinds driving 50%+ YoY growth. The next quarters therefore will be its toughest YoY comps in company history.

Revolve guided to a 52.8% gross margin for the quarter.

Revolve expects fulfillment costs to be 3% of Q4 sales, selling and distribution costs to be 17.3% of Q4 sales and marketing to be 16.3% of Q4 sales.

E. Guidance

Revolve continued to avoid formal guidance, but did tell us that sales growth quarter to date was about 3% YoY. This was actually better than analyst expectations of around 1.5% YoY growth.

F. Notes from the call

Revolve Gallery at NY Fashion week saw 50% YoY growth in attendance.

Revolve’s TikTok impressions are up 10X YoY.

Revolve’s new plus-size brand (launched with Remi Bader) sold out immediately with ⅓ of the shoppers brand new to Revolve. Its other new brand launch “was one of the most successful to date”

On the Metaverse – Revolve announced a new initiative to build a fashion centered mobile game and eCommerce experience. I think this is a silly distraction and I hope it’s not devoting much time or attention to it.

“With our profitable business model and balance sheet, we are excited about our continued brand and tech investments that we believe will enable more market share capture.” – Co-Founder/Co-CEO Michael Mente

E. My Take

The company is running into inventory glut issues like everyone else. This is a tad disappointing to me considering how much it talks about its data driven inventory systems. Still, the quarter was fine and I understand its consumer discretionary niche remains severely challenged. My thumb is pointed firmly sideways. Nothing to get excited or upset about.

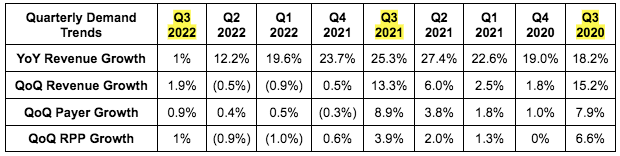

6. Match Group (MTCH) – Q3 2022 Earnings Review

A. Demand

Match Group generated $809.5M in sales, beating its guidance and analyst estimates of $795 million by 1.8%

This was not a surprise. Management has told us several times over the last few weeks that guidance would be met or exceeded.

More Context on Demand:

Foreign Exchange (FX) was a 900 bps growth headwind this quarter which was 100bps more than expected. It still beat expectations, but would have posted closer to $817 million in sales if the FX hit was in line.

The FX headwind in Europe and APAC is well over 1500 bps as the dollar strength weighs on Match’s growth.

Match’s 14.3% 3-Year CAGR compares to 16.8% last quarter and 19.8% 2 quarters ago.

Match continues to be impacted by poor macro, continued residual lockdown impacts in countries like Japan, the strong dollar AND poor Tinder execution. The new CEO has his hands full for sure.

It was good to see sequential Revenue Per Payer (RPP) growth turn positive after the better part of a year. The League is likely helping a lot here.

Q3 2021 was Match Group’s and Tinder’s strongest quarter ever. This led to a tough YoY comp.

Emerging apps grew 36% YoY while established apps shrank 5% YoY.

B. Profitability

Match earned $284.2M in adjusted operating income, beating its $257.5 million guide by 10.4% and analyst estimates of $261 million by 8.9%.

Again, we were explicitly told guidance would be met or beaten.

Match beat earnings per share estimates of $0.41 by $0.03 or 7.3%.

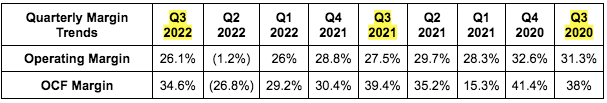

More Context on Margins:

Q2 2022 GAAP margins were hard hit by a $441 million charge in legal fees resulting from Tinder Founder lawsuits. Adjusted operating margin accounts for this. Importantly, these legal matters are now completely behind Match

Gross margin compression was largely driven by the $8 million escrow fund Match had to set up in connection with the Google settlement.

Tinder continues to operate at best in class operating margins over 50% with Hinge over 30%.

C. Balance Sheet

Last Q net leverage ratio was back to 3X so it added a $1 billion buyback program.

Match spent $267 million on buybacks during the quarter and paid out $52 million (6.4% of sales) in stock based compensation.

Match has $400 million in cash, equivalents and short term investments.

Match has $3.9 billion in long term debt.

Match has a $750 credit revolver that remains totally untapped.

Match’s TTM net leverage ratio is 3.1X vs. 3.0X QoQ.

D. Guidance

Q4 2022:

Match guided to $785 million in revenue, missing expectations of $811.5 million by 3.3%. This includes a 900bps FX headwind. Revenue guidance would have been $799 million if FX headwinds didn’t recently worsen QoQ for the company.

Match expects subscription growth to remain robust with A La Carte growth the source of the weakness.

Match guided to $272.5 million in adjusted operating income, missing expectations of $273.2M by 0.3%.

“In Q4, we’re seeing a significant deterioration in trends. Over the last few weeks, macro has gotten much more challenging and we’re nervous about it for Q4 and beyond. That’s why the guide is perhaps lower than you would have thought because we think caution is warranted.” – CEO Gary Swidler

Preliminary 2023 Guidance:

Match guided to 7.5% revenue growth for 2023 vs. expectations of 10% growth. This guidance assumes a 300bps FX headwind and no macro improvement.

Hinge will grow by AT LEAST 35% YoY.

Match Group will manage costs to deliver AT LEAST stable margins for 2023. This assumes no app store fee relief.

E. Shareholder Letter and Call Notes

Tinder continues to struggle with green shoots forming:

Product execution and release velocity has noticeably improved BUT momentum will take a few quarters to build so results are still underwhelming for now.

The new weekly subscriptions that rolled out are exceeding expectations. This is good to hear after many product releases from Tinder in 2021 and 2022 have failed miserably.

Match Group has seen a recent weakening in A La Carte spend with Tinder in the last few weeks. This was factored into its forward guidance with no expectations of any improvement.

No team members have left Tinder since the new team was put in place.

The 4 key focuses for Tinder going forward are:

Improving the female experience with more curation and intentioned matching.

GenZ brand campaigns.

Virtual goods and coins.

Advertising. 85% of Tinder’s users pay it nothing. Kim wants them contributing ad revenue.

Tinder is rolling out a new brand campaign in Q4 as new CEO Bernard Kim feels the “narrative has been set for Tinder for too long” and that “Tinder as a category leader has been too quiet for too long.” To me, this is a pivot to making Tinder a tad more classy feeling.

It’s adding a relationship intent tab to help address this issue.

Bernard Kim told us that Tinder is tracking to return to high teens revenue growth in the coming years… whatever that means.

Tinder remains the top app for GenZ and Millennials in all of its core markets… with still just 15% of its core demographic using the app in its most developed U.S. markets.

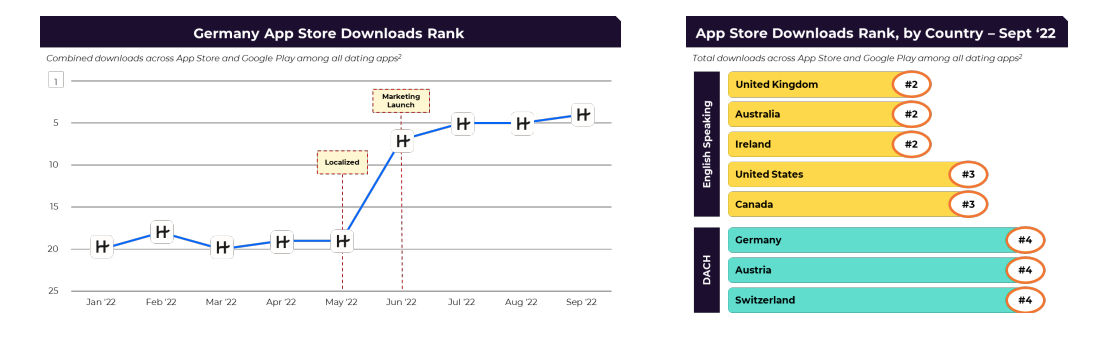

Hinge Remains Match Group’s Shining Star:

Hinge is off to a “great start” in Germany after it debuted a localized product there. Specifically it has climbed from 20th to 4th in the dating category in 2022.

Hinge debuted a localized offering in Sweden recently and is working on a Q4 debut in France, Italy and Spain. Things have greatly accelerated here.

“With strong initial traction seen in new markets and the halo effects we’ve seen across other European countries, we’re as confident as ever in Hinge’s long-term international growth potential. We’ll continue to accelerate expansion efforts.” – Shareholder letter

Hinge will debut its new premium subscription in Q1 2023. This has been delayed a quarter to make sure the team gets it right.

Hinge still has just 55% AIDED brand awareness in the U.S. – there’s a lot more success to be realized.

Global and U.S. downloads of Hinge in October set new records.

Match will accelerate marketing spend here amid the success going forward.

Hyperconnect needs help:

Hyperconnect’s main Azar app returned to 10%+ growth after seeing negative growth throughout 2022. BUT… Hakuna (its other app) is not seeing the same recovery.

On 2023:

Hinge is working on more apps to meet the needs of underserved demographics.

Bernard Kim’s new Tinder CEO must “work with the team and strategy put in place” to ensure the transition is as smooth as it can be.

Match expects sales and marketing expenses overall to FALL in 2023 vs. 2022 as it focuses on key, higher ROI areas and sharpens its focus.

F. My Take

This was an OK quarter. It’s hard to call it good with the guidance miss, but the turnaround will not happen overnight. It will take some time, and the green shoots we got this quarter (along with Kim’s sterling resume) make me confident in Match’s ability to right the ship. It operates in a global duopoly with 50% share. The odds are stacked in its favor and I now view the team as capable of taking advantage of that. the Turnaround won’t happen tomorrow, but I absolutely think it will happen as macro pain eases sometime in 2023.

When I look at Tinder’s struggles, the investment becomes immensely more speculative and risky. The balance sheet is also somewhat fragile. The team needs to prove it can turn things around there before I add more shares. And I actually trimmed this week to add to holdings that have already reported fantastic quarters. That’s where I’ll focus. Earn it, Match.

7. Meta Platforms (META) – TikTok & Layoffs

A. TikTok

The Federal Communications Commissioner was vocal in multiple interviews this week about wanting to see TikTok banned in the United States. While this would be amazing news for Meta shareholders, it’s all noise until formal legislation actually happens. There’s no reason to pay this any time or energy until it becomes more real.

B. Layoffs

Rumors that Meta has hired help to conduct large scale layoffs have continued to proliferate.

8. Shopify (SHOP) – Insider Buying

Founder Tobi Lutke bought $10 million in stock this week. It’s a tiny fraction of his net worth but still a good sign. While I guess this could be purely for show like some have hinted at, wealthy people don’t willingly light $10 million on fire.

9. Upstart (UPST) – Layoffs

Upstart laid off 140 hourly loan application processing employees this week. That’s around 8% of its labor force. The reason for the move was cited as tough macro and loan demand. As these were hourly workers, I don’t think there will be material severance package costs to endure. Upstart has committed to staying cash flow positive this year and this is one of the unfortunate steps it has to take to get there amid the daunting backdrop. As Upstart’s loans will ideally be 100% fully automated in the future, these workers will no longer be needed anyway. But the company is not close to that point and is doing this to cut costs and meet its shareholder promises.

As an aside, I think it’s safe to say that Upstart’s quarter next week will be bad. Its demographic and funding supply both remain severely challenged… but everyone knows this. The evaluation will be about if the quarter is “less bad” or “more bad” than expected.

10. Cresco Labs (CRLBF) – Asset Sales

Cresco and Columbia Care divested their redundant state cannabis licenses in New York, Illinois and Massachusetts to Sean Diddy Combs for $185M in fresh funding. There will be more assets sales coming in the near future to meet regulatory restrictions which should raise another $100M-$150M in 0 interest cash.

11. Macro

A. Highlights from the FOMC Statement and Powell’s Prepared Remarks:

The Fed hiked its benchmark rate by 75 bps to 3.75%-4% today.

There was new language hinting at more focus on the cumulative impact of hawkish policy and the time delay of that policy working.

“Significant” balance sheet reduction and more hikes will continue for now, but this language hints at the cadence of that hawkish policy soon slowing.

Powell still thinks the Fed needs to move beyond neutral to restrictive policy.

Longer term inflation expectations remain convincingly anchored around 2%.

The Neutral rate is somewhere around 4.5%-5% – higher than previously thought.

Powell called it premature to pivot now and said we have a ways to go on hiking. That’s not surprising.

Future markets are now pricing in a terminal rate slightly above 5%.

There remains a large labor market imbalance with demand still outpacing supply.

Economic growth, financial conditions, consumer spending & production are all slowing.

“It will take time for the full effect of our policy on inflation to be realized. This is why determining the pace of future increases will account for the cumulative impact & the time delay of policy… at some point it will be appropriate to slow the pace of increases… but we will stay the course until the job is done.” -- Powell

B. Key Data from the Week

Purchasing Managers Index (PMI) & ISM Data

The manufacturing PMI was 50.4, beating expectations of 49.9.

Chicago’s PMI was 45.2, missing expectations of 47.0.

The ISM Manufacturing Employment Index was 50, missing expectations of 53.

The ISM Manufacturing PMI was 50.2, beating expectations of 50.

The ISM non-manufacturing PMI was 54.4, missing expectations of 55.5.

Job market:

Job Openings came in ahead of expectations.

ADP Non-farm Employment crushed expectations by over 22% (good is bad here)

Jobless claims came in slightly below expectations.

Non-farm Payrolls came in well ahead of expectations.

The labor participation rate fell from 62.3% to 62.2% this Month.

Apple is freezing hiring while Morgan Stanley, Lyft, Twitter and Opendoor all announced large scaled layoffs.

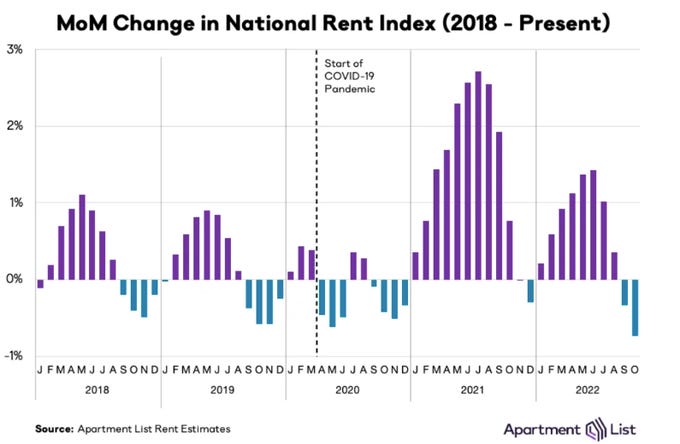

Forward Looking Rent Inflation continues to cool off:

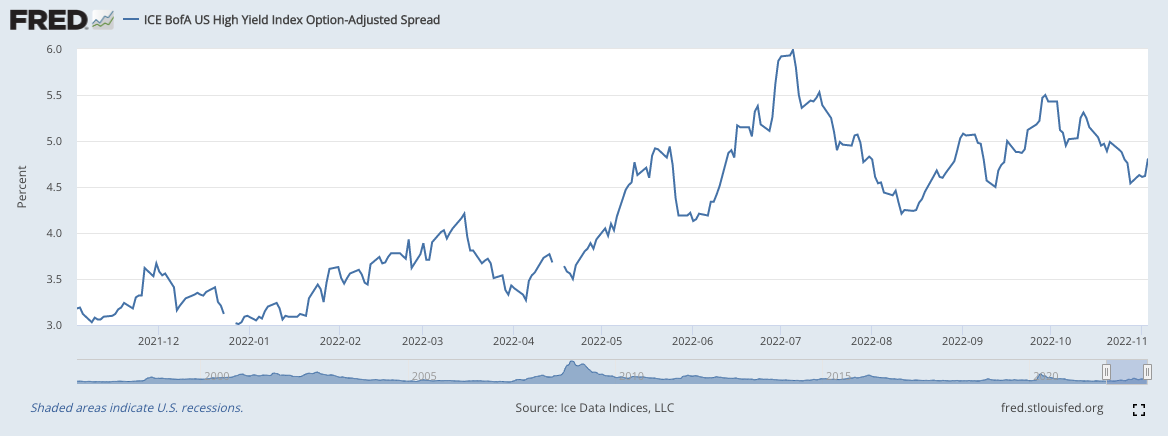

High Yield Option Adjusted Corporate Credit Spreads widened (worsened) slightly this week:

The 5-Year Breakeven Inflation Rate rose (worsened) slightly this week:

C. Level Setting the Fed Talk and Data

This new language makes a dovish pause in the first half of 2023 more likely. Leading deflationary signs like spot freight rates, commodities, rent (see below) and rising corporate inventory levels keep popping up. Still, with inflationary readings where they are today, as well as robust labor data this week, continued hawkish aggression will likely remain through 2022. But the cracks in the economy are obviously deepening and that cannot be ignored for long. That’s why I see a pause coming in the first 6 months of 2023.

If the trends in data continue to confirm that opinion, I’ll likely look to deploy my cash position sometime around the New Year. This was still a hawkish release, but less so than in previous meetings. There’s no reason to delay and accelerate my plans after this week.

12. My Activity

I sold 25% of my position in Match Group and used most of the proceeds to add to Progyny and JFrog following stellar quarters. My cash position is currently 17% of holdings.