News of the Week (October 4-8)

Upstart; CrowdStrike; SoFi Technologies; Teladoc Health; Butterfly Network; Facebook; Penn National Gaming; JFrog; Cannabis; Microsoft; Progyny; My Activity

1. Upstart (UPST) — A Hiring Spree, Product Launch & CEO Interview

a. Hiring Spree

Upstart plans to hire 508 additional workers in its Columbus headquarters through the remainder of the year making it larger than the company’s (previously-largest) Silicon Valley office. As of the beginning of this year, the company had just 554 full-time employees pointing to the significant scale of this decision. The hiring will be directed to operations and engineering roles and has already begun. Columbus is expected to award Upstart with a $3.6 million tax credit for all of the new jobs.

The announcement continues an annual trend of rapid headcount growth for the company with 257 people hired in Columbus in 2018 and 250 more hired in 2020. This depicts direct evidence of leadership envisioning a long growth runway.

b. Product Launch

In other Upstart news, the company officially launched Upstart Auto Retail — the resulting product from its Prodigy Software acquisition. The product merges the slick user car-buying experience featured by Prodigy’s software with Upstart’s AI-powered loan algorithm.

Upstart had already been offering superior car-buying software and this merely upgrades that product while incorporating its financing know-how to maximize consumer utility. With this new product launch, buyers will be able to enjoy a digital or in-store Upstart experience from shopping to purchasing.

There are already signs of Upstart finding success in the auto-world even before this financing integration: The company announced a tripling of its car dealership footprint 2020 as of the product launch. This compares to a “doubling” of the footprint just 2 months ago which illustrates ongoing adoption momentum.

Upstart estimates its total addressable market (TAM) in personal loan origination to be $84 billion — the addition of auto loan originations multiples that addressable market by roughly 7.5X. With less than 1% of car buyers happy with the buying process, there is a large void of consumer satisfaction and access for Upstart to fill. I think it’s in the perfect position to do so.

c. CEO Interview

Patrick O’Shaughnessy interviewed Upstart co-founder and CEO Dave Girouard. The conversation was fascinating and the highlights are below:

Girouard on the company’s focus and optionality:

“Our mission is to build models that are learning as quickly as possible and always improving. Then we can take sidesteps to learn new tricks where suddenly almost any type of lending in the world -- and potentially domains beyond lending -- we have significant advantages in… we’re in a couple sectors today and we’re going to expand to some more. We are building a company with ambitions to plant flags everywhere.”

Girouard clearly stated that lending would be the main focus of the company going forward. It’s important to keep in mind that lending is an extremely broad segment with multiple verticals for seamless expansion. He hinted at mortgages, different types of unsecured loans and even insurance as being on the table but followed that up by stating he has no interest in building a super app.

Girouard on crypto:

“The attraction to crypto in the world is so strong that we do feel like it can be a liability that we’re not a crypto company today. We are crypto believers and we will look and understand things more over time.”

Click here for access to the full interview.

Click here for my broad overview of Upstart’s business and here for my overview of Upstart’s main risks.

2. CrowdStrike (CRWD) — A New Partner and a Telling Chart

a. A new Partner

CrowdStrike is partnering with UiPath and its 9,100 customers to enhance the security of UiPath’s Robotic Process Automation (RPA) platform. UiPath’s RPA niche enables the automation of mundane work-flow tasks to enhance productivity -- this naturally includes a large cohort of end-points and workflows for CrowdStrike to protect.

UiPath’s work-flow transformation requires better security solutions capable of stopping attacks on the endpoints it serves while scaling with all the future growth UiPath is expecting. That’s what CrowdStrike brings to the table — a seamlessly scalable and effective solution for stopping breaches.

Mergers often highlight revenue and profit synergies. This partnership — conversely — will create efficiency and efficacy synergies by reducing time to uncover and remediate threats. Both customer cohorts will benefit.

The cream of the crop often like to partner with the cream of the crop. Based on CrowdStrike’s relationships with CloudFlare, Zscaler, Okta, UiPath and more it is safe to say that is how CrowdStrike is viewed.

b. A Telling Chart

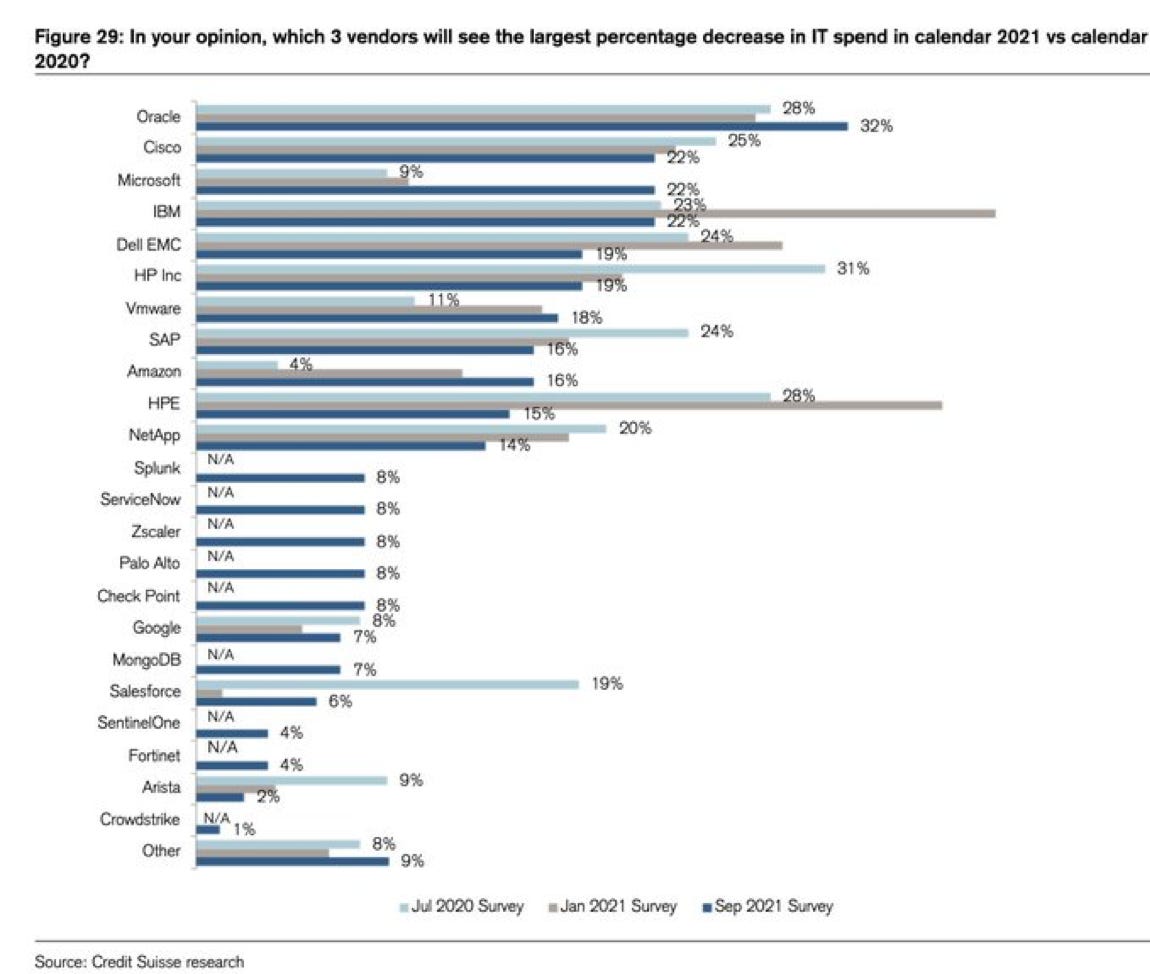

In other news, the twitter account @Soumyazen shared a Credit Suisse CIO survey on which companies these CIOs expect to see the largest percent decrease in IT spend during 2021.

The results were quite favorable for CrowdStrike and are illustrated below:

3. SoFi Technologies (SOFI) — A Marketing Machine

Across its social media accounts, SoFi has been running a promotion it calls #SoFiMoneyMoves. The marketing tool asks consumers to post their SoFi Money Moves Dance and to download the SoFi app. 50 selected winners will get $1,000 with the overall winner receiving $25,000.

If you think this seems silly, I completely agree. But it’s still finding eye-opening attention. Just in the weeks since this promotion began, the hashtag has had over 4.7 billion total views on TikTok alone — there’s nothing silly about that. The company has also been running promotions in SoFi Stadium (home of the Rams and Chargers) where consumers downloading the SoFi app can skip lines and save on concessions. Furthermore, if you watch TV, I’m sure you’ve also seen dozens of the company’s catchy commercials to “get your money right.”

SoFi’s one-stop-shop for digital banking is the core enabler of the company’s aggressive marketing philosophy. By cross-selling multiple products, SoFi enhances its consumer lifetime value (LTV) without materially raising consumer acquisition cost (CAC). This efficient expansion allows it to sink its teeth into growth more aggressively than its competition can. These are 3 (of many) direct examples.

Click here for my broad overview of SoFi’s business.

4. Teladoc Health (TDOC) — Primary360 Launch

Teladoc Health officially launched its Primary360 product for commercial insurers, employers and other organizations 2 years after the pilot program began. This product launch attempts to virtually emulate (as closely as possible) the service of an in-person primary care physician by tapping into Teladoc’s whole-person care capabilities.

Mental health, chronic care and infectious disease will all be categories covered by this new product launch among others. It also further personalizes the virtual care experience by crafting individual care plans to do things like nudge a consumer towards a healthier outcome. Primary360 plugs directly into Livongo’s remote-monitoring capabilities to allow for more actionable virtual diagnosis.

The vastly enhanced access to more services has been the most common benefit cited by pilot program members throughout the beta testing. Considering J.D. power published a telehealth survey last week revealing the primary consumer telehealth complaint was limited services, this makes perfect sense.

Better access inherently leads to earlier detection thus cutting down on hospital system/emergency room strain and reducing costs for all involved parties. According to data published by GoodRx, 30% of emergency room (ER) visits could have been avoided by preventative care. This new tool is a powerful ally in making that preventative care attainable and -- because ER visits are so costly -- this is a meaningful cost savings tool as well.

Some notable early statistics pointing to the need and want of this product:

2 out of 3 Primary360 pilot program members lacked access to adequate primary care before Primary360.

50% of Primary360 pilot program members used 2+ Teladoc services with 30% using 3+ services.

Teladoc Primary360 physicians are available for new appointments within 1 week vs. roughly 1 month without the product.

25% of chronic condition diagnosis for Primary360 members have been brand new.

“Several Fortune 1000 employers are live today with other large employers like Aetna launching early next year.”

The most common bear case against Teladoc Health is that its product offering is largely a commodity. While single point solutions in telehealth have been commoditized, Teladoc’s whole-person care approach goes several steps further in integrating service offerings and boosting the actionable utility of virtual care. This is far from single point.

Teladoc’s ability to help with more ailments remotely paired with its patient monitoring technology is what sets this company apart from the competition. Primary360 is its latest attempt at fortifying this whole-person care advantage. So far, so very good.

5. Butterfly Network (BFLY) — Product Launch

Butterfly launched a new iteration of its full-body, hand-held IQ+ specifically for animals called iQ+ Vet. The ultrasound probe is able to examine any species of animal.

Some of the upgraded features include:

Deeper maximum screening of up to 30 cm.

Clearer mid-depth resolution.

Enhanced abdomen imaging for kidney measurement on even the smallest of animals.

Visualization of full animal organs via a wider lens.

Bladder assessment and Cystocentesis capability using the IQ+’s NeddleViz and bladder settings. Cystocentesis definition: The Process of a vet placing a needle into the bladder through the abdomen for a urine sample.

Sharper bone imaging.

Probe designed to maximize animal comfort.

Longer battery life.

Click here for my broad overview of Butterfly Network’s business.

6. Facebook (FB) — A Personal Note

Whistler-blower noise has been loud for Facebook this week — but I don’t really care all that much. The company continues to enjoy unparalleled scale with loyal users regardless of what headline surfaced today. This continues a years-long pattern of seemingly devastating news stories being published on Facebook with the company simply continuing the thrive thereafter.

Facebook is a core tool for small business success globally and for connection in general. That is not changing despite the juicy congressional hearings and inherently-biased interviews.

One scenario people often worry about is regulators forcing Facebook to split up its operations. Instagram or WhatsApp being spun-off from the overall company would be a wildly positive event for shareholders. The sum of the parts is worth far more than the whole in this case. It’s a win-win really: Either the status quo remains or we cash out from a forced break-up. I’m not fretting.

7. Penn National Gaming (PENN) — More Launches with Evolution Gaming

Penn and Evolution launched a live online casino studio in New Jersey for Penn Interactive. The casino is branded as Barstool Sportsbook Casino and follows the debut of Barstool’s live casinos in Michigan and Pennsylvania using Evolution’s live casino studio.

The partnership began in 2019 when Evolution embarked on building a customized suite of casino games for Penn. The relationship has only grown from there.

“We’re delighted to build on our strong relationship with Penn. We look forward to rolling out our live games and slots to Penn players in more states.” — Commercial Director of N. America at Evolution Jeff Millar

Click here for a quick look at how I view what Barstool Sports means to Penn National Gaming.

8. JFrog (FROG) — Another Certification

JFrog received a new certification from The Countering Violent Extremism Task Force (CVE). CVE has designated JFrog as a CVE Numbering Authority (CNA). This designation allows JFrog to assign CVE identification numbers to newly uncovered breaches and to publish the findings within CVE records. There are 180 organizations authorized within the CNA and JFrog is among the only DevSecOps companies in the cohort. Other notable members include Google, Microsoft and IBM.

The designation allows JFrog to join “an elite group of public and private organizations… for collaborating with the global security community while providing our customers with the latest vulnerability and remediation information from Xray.” The enhanced resources for collaboration should secure JFrog’s customer binaries from potential threats in an even more effective manner.

A few weeks back, JFrog received accreditation by Iron Bank for its Artifactory and Xray modules to be used by programs within the Department of Defense (DoD). Public entity adoption momentum for JFrog’s product suite is picking up steam.

Click here for my broad overview of JFrog’s business.

9. Cannabis news

There were a few interesting highlights coming out of the world of cannabis regulation this week:

The NBA — for the 2nd consecutive year — will not test players for THC.

Mexico’s Senate majority leader is calling for the federal legalization of cannabis in the country.

New York’s Cannabis Control Board approved raw, unprocessed flower as a medical product. This expands its medical allowance beyond solely cannabis extracts like waxes and oils.

Philadelphia will have a referendum on its next ballot to vote on recreational cannabis across Pennsylvania. (This is more symbolic than anything)

The total American cannabis labor force grew by 32% year over year (+77,000 jobs) in 2020 despite unemployment sky-rocketing amid the pandemic.

Click here for my detailed look inside American cannabis regulation and the implications.

10. Microsoft (MSFT) — M&A

Microsoft bought Ally.io — an objectives and key results (OKR) company — to improve the remote/hybrid work experience it provides to its employees and clients.

The technology giant will use the 4 modules Ally.io has created — connections, insights, topics and learning — to create a new module within Microsoft Viva — the name of its employee experience platform (EXP). This module will be designed to multiply “actionable insights” within the remote work world while improving Viva’s user interface (UI).

“The OKR category is a fast-growing and emerging space. Ally.io is leading the way as one of the most loved tools on the market. Since its launch in 2018, Ally.io has been adopted by over 1,000 leading high-tech, manufacturing… and healthcare businesses across 80 countries.” — Microsoft COO Kirk Koenigsbauer

The move hints at Microsoft seeing remote/hybrid work as more of a permanent fixture in our society than some other enterprises do. The terms of the deal were not disclosed.

11. Progyny (PGNY) — Deep Dive On the Way

I will publish my Progyny deep dive on Wednesday next week. GoodRx (GDRX) will be the subject of my next deep dive.

12. My activity

I added to Lemonade, Olo and Duolingo during the week. I also added to Teladoc Health, Olo and CuriosityStream last week but neglected to include it in my write-up. The additions took my cash position from 16.1% of total capital to 15.7%. I plan to continue deploying capital into these names and others amid any incremental stock price pain as long as fundamental performance remains strong. A thriving company and a struggling stock is a gift for the long term investor. I like gifts.

Love these weekly summaries! Thank you!