News of the Week (October 9 - 13)

Duolingo; Upside Potential; Disney; Amazon; Lululemon; Big Bank Earnings; Macro; My Portfolio

1. Duolingo (DUOL) – Duocon 2023

Duolingo leadership took to the stage to share all of the upgrades and tweaks the company has been making in 2023. Here were the highlights:

Music & Math Apps:

Duolingo app users with iPhones can now request early access to the Duolingo Music App. The app teaches learners through a keyboard/piano. With it, users can learn how to locate notes on the keyboard or on a musical staff as well. At the end of a lesson, students can even play popular songs with the skills they’ve just acquired. Like Duolingo’s other apps, it teaches users via doing to make the content more engaging, entertaining and valuable. Learners master concepts through action and mistakes to sharpen focus and efficacy.

In Duolingo’s quest to teach learners everything, music is another great step. Not only do learners master a new, attractive skill but studies also show that doing so sharpens reading, arithmetic and verbal skills while “delaying cognitive decline associated with aging.”

Speaking of its ultimate goal to make ALL areas of education universally accessible, ubiquitous, fun and effective, its math app is ramping nicely. This app is for both children and adults and provides tools like tip calculation and general brain training. There will be many, many more Duolingo apps debuted in the future.

Animation:

Duolingo took us through its “Rive” product. This is in-house animation software to scale animated lessons with far greater ease and capacity. Manual animating is quite time consuming… Rive helps resolve that bottleneck.

The software allows Duolingo to use its finite animation talent and packages to “mix and match” existing work. This capability creates a “nearly unlimited number of combinations.” That makes subtle signs of repetition within the app less frequent and noticeable without requiring more manual work for Duolingo. Endless animation capabilities pave the way for fun, new use cases like DuoRadio. This offers lessons via animated TV shows with real-world context and education.

With Rive and Duolingo’s AI models, it significantly upgraded character lip-syncing capabilities. Perfecting mouth movements per sound for 40+ languages and hundreds of courses is just not manually feasible. This software can actually match sounds and movements with near perfection. That enhancement makes the app feel more realistic and offers “visual reinforcement of learning.”

AI & OpenAI:

As a reminder, Duolingo and OpenAI have been partners for years. Duolingo is now using the GPT 4 model from OpenAI and its own models for tools like Roleplay and Explain my Answer. Roleplay allows for “free flowing conversation” to drive more advanced, speaking-based learning. Duolingo had struggled there in the past and this addresses that issue. Explain My Answer offers granular explanations for student blunders.

Its Birdbrain model predicts correct answer probabilities to ensure difficulty levels are perfect on a per-learner basis. This algorithm is seasoned with 9 billion weekly exercises from learners to glean personalized patterns for precise lessons. The upgraded Birdbrain model can now make predictions within lessons in real-time vs. by lesson in the past.

Teach More Advanced English:

One of the key headwinds to even more rapid Duolingo growth is its ability to teach more advanced English to students. This is the most popular language on the app and is key to education and economic mobility for countless users around the globe.

Duolingo’s English proficiency framework is based on the Common European Framework of Reference for Languages (CEFR). CEFR is split into categories ranked by how advanced a learner is.

Duolingo in the past has taught up to A2. Now it teaches up to B2. Its upgraded lessons for this higher level drive learners closer to fluency and even offer specialized professional topics to teach students jargon for majors or jobs that they’re pursuing. The company doesn’t need any growth boosts, but this could surely prove to be one. Again… English learning is a not-so-secret weapon for economic mobility for global learners. That is the reality. Duolingo is doing its part to level the playing field.

It also now teaches English in a no translation manner with only minor native tongue support for the most advanced students. This expands use cases for the app but also mightily consolidates its English learning data pool. This pool is no longer dozens of disparate patches split by native language, but one overarching system of record to accelerate Duolingo’s split testing and product perfection. This may not seem significant, but it is for a company that relies on product superiority to drive word-of-mouth growth.

Asian Language Learning:

Over the last 3 years, Japanese and Korean language learners on Duolingo have risen by 120% and 195% respectively while learners of Mandarin are approaching 7 million. Asian language learning is Duolingo’s fastest-growing category. Seeing this play out, Duolingo upgraded its course material for these students. Since learning symbols is the toughest piece, it debuted a tool that accompanies these symbols with Latin lettering to depict sound.

Conclusion:

The event gave me everything I wanted just like the team and quarterly earnings reports consistently have as well. The company is rapidly expanding into new categories while uplifting how advanced a learner can become on the app. It’s ensuring organic virality can continue powering its wonderfully efficient growth with the continued, singular focus on creating the best, most accessible product. This is no external marketing machine… it’s a free attention machine through its award-winning apps and social media engine. That’s how you get featured on the Barbie movie for free. That’s how you briskly grow without rapidly increasing sales & marketing costs. That’s how you win.

2. Sell-Side Analysts (Includes ABNB; UBER; META; AMZN; SHOP)

There are many, many talented sell-side analysts. They frequently post original research that helps all of us understand trends and business models. Still, they’re not perfect like none of us are perfect.

When companies embark on large overhauls of their operational philosophy, estimate trends are usually slow to follow suit. Airbnb in 2021 shut off all product marketing and saw a free cash flow explosion. Uber in 2022 shifted from a growth at all costs mentality to one that prioritized incremental margins to see its own free cash flow explosion. Meta also tweaked its own approach to cost incurrence and is enjoying its own free cash flow explosion beyond what the analyst community has modeled.

These companies existed for years in a zero-interest rate world where money was free and investors demanded maximum revenue first and foremost. So? That’s what the firms sought to deliver. Preferences obviously changed on a dime, but adjusting takes longer for massive enterprises.

For several quarters (and several years with Airbnb and Uber), the firms mentioned prioritized demand and thought of profit growth in a secondary manner. This was especially true for Airbnb and Uber, but it was still the case for Meta as it raced full speed ahead on its cash burning Metaverse vision. The coinciding underwhelming profit growth led many to assume the profit potential in these models was just miniscule. That was not the case.

The firms have since pivoted all with a similar asset recipe. They all had large revenue bases, they all had unique competitive differentiators driving user stickiness and they all had several easy opportunities to get more efficient. The firms embarked on cost-cutting initiatives which didn’t really translate into any material revenue hits. That’s the luxury of the aforementioned competitive moats, strong word-of-mouth growth and loyal customers.

Net income and free cash flow proceeded to explode higher as margins soared. That process has largely played out for Airbnb and is in the process of doing so for both Uber and Meta. While one may find it frustrating that analysts are so slow to adjust forward estimates, that frustration should be excitement. The delays foster inefficiency and opportunity for stock pickers to thrive if they pay close enough attention to the fundamental investment cases. To those of us tracking the bull cases, the profit explosions were not a shock, but an obvious byproduct of the changes implemented.

While this is interesting, Monday morning quarterbacking is not super helpful. So let’s look ahead to who could potentially be next to offer large profit upside potential. Which companies have massive revenue bases, loyal user bases, clear product differentiation and obvious opportunity to cut redundant and/or unnecessary costs?

When I look across my coverage network, two candidates emerge: Amazon and Shopify. We’ve covered Amazon’s margin levers extensively. We’ve also covered how it has kicked the profit can down the road for decades yet is no longer doing so. I see Shopify in a similar light which is why I’m willing to hold it at admittedly lofty valuations. I don’t think the estimates forming those valuations are at all accurate.

Shopify has sold off its negative gross margin fulfillment business and now has a CFO that is committed to flat sequential OpEx growth while revenue briskly compounds. He has single-handedly made free cash flow growth priority 1b alongside revenue compounding at 1a. It has cross-border and marketing products that are now enjoying fading macro headwinds. It has a fiercely loyal merchant base which sustained no material churn after it hiked pricing this year. This churn was so immaterial that it’s already now considering more price hikes in wake of its strong elasticity of demand. Last quarter saw a forward free cash flow guide several factors higher than was expected. Still, analyst profit estimates moved less aggressively than I think they should have. So? I expect more lofty beats this quarter and into 2024.

Amazon and Shopify are the two firms I see as the next earnings darlings to emerge. I could be wrong, but that is what I fully expect as we enter earnings season.

3. Disney (DIS) – India & Activist Investor

a) India

More potential bidders have emerged for Disney’s streaming and linear TV assets in India. Last week, we covered two billionaire media moguls in Gautam Adani and Kalanithi Maran along with unnamed private equity firms that are in the fold. This week, Blackrock surfaced as another potential buyer. I don’t know who will buy these assets and I don’t really care. All I know is that more bidders are always a good thing. Drive that price up as much as possible and sell this business. The segment doesn’t contribute to anything but cash burn and doesn’t support the Disney intellectual property flywheel. Get that cash infusion.

b) Activist Investor

Nelson Peltz and Trian nearly 5Xed their stake in Disney to well over $2 billion in total. Trian’s listed portfolio value on Whale Wisdom is just $3.9 billion, which would make this a massive investment for the company.

Q1 2023 is when Trian initially took a smaller activist stake. Their concerns then were based on the 21st Century Fox acquisition, streaming cash burn, neglecting the parks and experiences business and its negative view of the current board. Following conversions with Iger and the management team, Trian lost its bid for multiple board seats and went somewhat quiet on Disney. Now, as one of Disney’s largest stakeholders, it will reportedly renew this push.

I’m entirely fine with Trian winning board seats. Peltz is a world-class investor and Trian is a world-class fund. These board members will likely have a keen focus on shareholder value creation which is good news for investors. Other than that, I’m not really sure what Trian is trying to accomplish here. Iger has already gone public with decisions to address every major issue that the company has. Disney has already made significant steps to reduce streaming cash burn while focusing on the aspects of that business that drive lower churn and differentiation. It’s already fielding offers to sell ABC, its other linear assets and its India business to build the cash pile. It’s already on track to beat its $5.5 billion cost savings goal and will use the pocketed costs to reinvest in its higher return parks business. Perhaps Peltz and Trian are making this move because they concur with Disney’s decision making which very closely mirrors what they wanted in the first place.

c) More News

Disney hiked Disneyland ticket prices by as much as 9% for some time slots.

Contract negotiations with Hollywood actors are on pause.

4. Amazon (AMZN) -- October Prime Day

Amazon’s October Prime Day was unsurprisingly record-breaking like it always is. The company cited apparel, beauty, home and toy categories as the standouts. 3rd party data from Numerator depicted a boost to Y/Y average order value but also less big-ticket purchases as consumers simply stocked up on a larger number of essentials. This year, Prime Day extended outside of Amazon’s marketplace to merchant sites utilizing its white-labeled Buy with Prime product.

For this event specifically, third party sellers on the marketplace were a clear winner. These merchants enjoyed 150 million orders vs. roughly 100 million Y/Y. 3rd party seller volume in particular comes with strong Amazon margins. Along those same margin lines, 13% of its goods fulfilled during the event required no additional Amazon packaging as another cost efficiency (and sustainability) boost.

5. Lululemon (LULU) -- S&P 500

Lululemon is set to join the S&P 500 on October 18th. This will mean more passive investing demand and should be an overall (small) positive for the stock and its multiple over the long term.

6. Big Bank Earnings

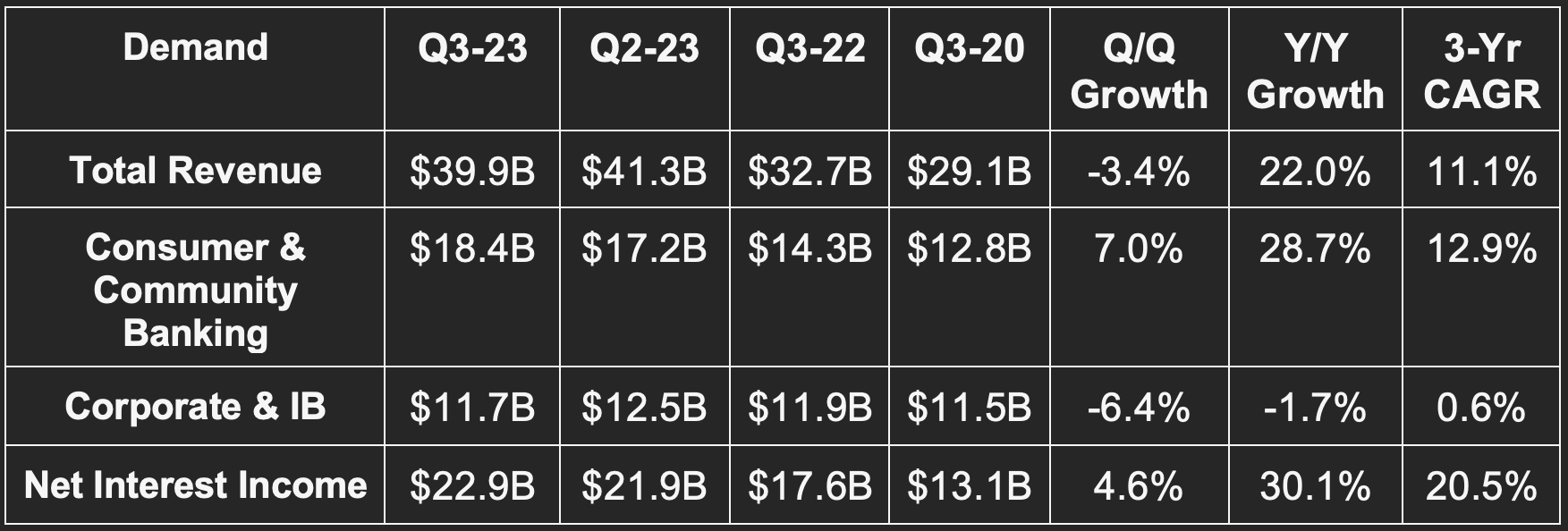

a) JP Morgan (JPM)

Results vs. Expectations:

Beat revenue estimate by 1.3%.

Beat $3.94 GAAP EPS estimate by $0.39.

Beat return on equity (ROE) estimate by 200 basis points (bps).

Beat return on asset (ROA) estimate by 12 bps.

Annual Guide:

Raised net interest income guide by 1.7%.

Lowered expense guide by 0.6%.

Lowered card net charge off (NCO) rate guide by 10 bps.

Key Context:

Revenue +15% Y//Y ex-FRC; Net interest income (NII) +21% Y/Y ex-FRC.

EPS +38.8% Y/Y.

Loans up 17% Y/Y & deposits down 4% Y/Y.

Dividends rose 3.3% Y/Y.

#1 for Investment-banking share.

Mobile users +9% Y/Y.

$1.5B in net charge offs vs. $727M Y/Y.

$113M in reserve releases vs. $800M in reserves built Y/Y. Releases mean more net income and vice versa.

“U.S. Consumers remain healthy but are spending cash buffers. Tight labor markets & large fiscal deficits raise the risk that inflation stays elevated & rates rise from here.” -- CEO Jamie Dimon

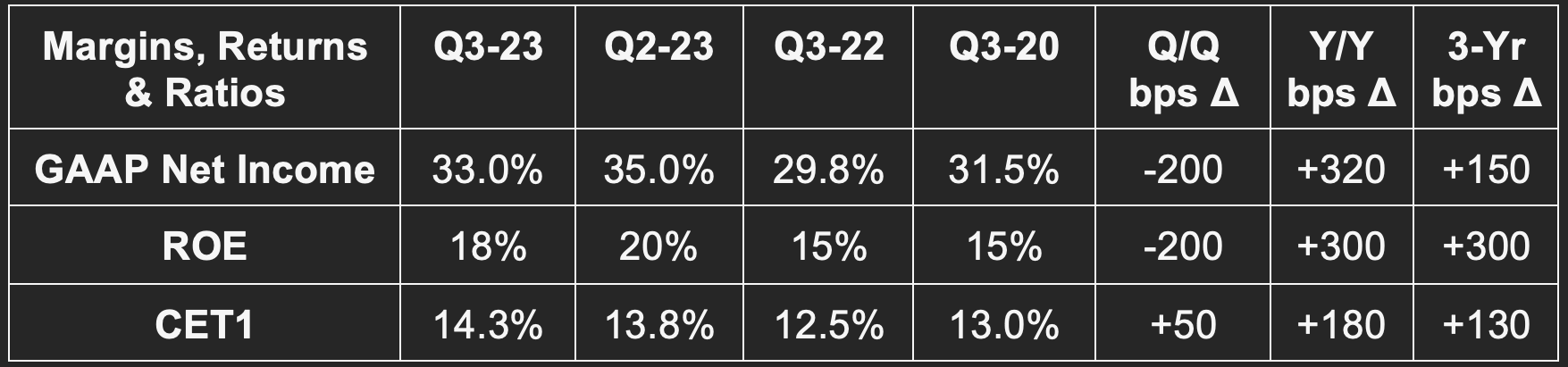

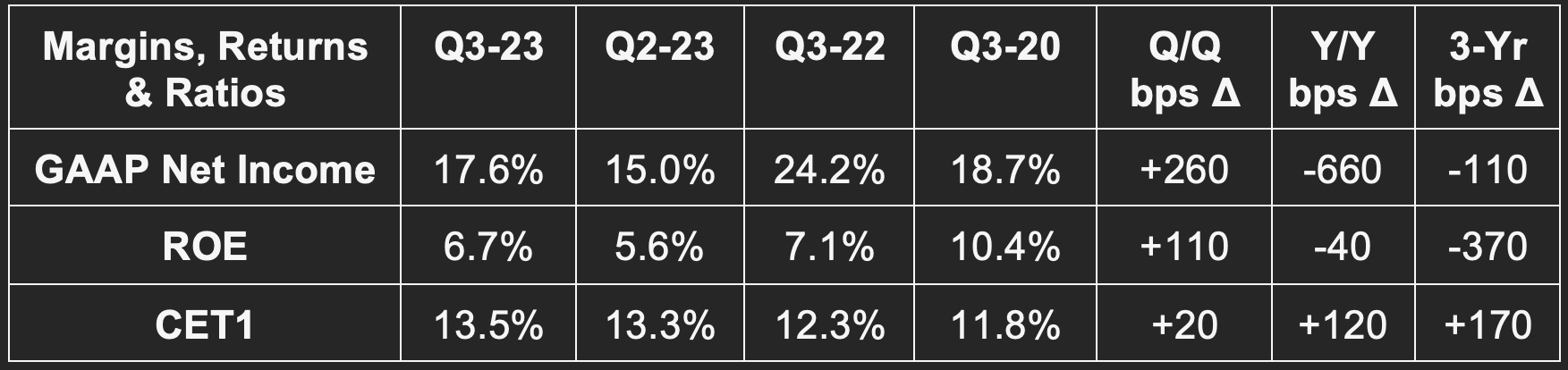

b) Citibank (C)

Results vs. Expectations:

Beat revenue estimate by 4.1%.

Beat $1.25 GAAP EPS estimate by $0.38.

Beat ROE estimate by 130bps.

Beat ROA estimate by 13bps.

Full Year Guidance:

Reiterated annual revenue guide.

Raised annual net interest income guide by 2.2%.

Reiterated annual expense guide.

Key Context:

EPS flat Y/Y.

Loans up 3% Y/Y.

Deposits down 3% Y/Y.

$179M in credit reserves built vs. $441M Y/Y.

Dividends up 3.7% Y/Y.

“U.S. Personal Banking grew double-digits. Continued deceleration in spending indicates increasingly cautious consumer.” -- CEO Jane Fraser

7. Macro Data

Inflation Data:

Not a great week of inflation data following a very positive core PCE. Shelter and specifically “other lodging away from home including hotels” drove the slightly above consensus monthly CPI.

Producer Price Index (PPI) rose 0.5% M/M vs. 0.3% expected and 0.7% last month.

Core PPI rose 0.3% M/M vs. 0.2% expected and 0.2% last month.

Consumer Price Index (CPI) rose 0.4% M/M vs. 0.3% expected and 0.6% last month.

CPI rose 3.7% Y/Y vs. 3.6% expected and 3.7% last month.

Core CPI rose 4.1% Y/Y this month as expected and vs. 4.3% last month.

Core CPI rose 0.3% M/M as expected and vs. 0.3% last month.

Export Price Index rose 0.7% M/M for September vs. 0.5% expected and 1.1% last month.

Import Price Index rose 0.1% M/M for September vs. 0.5% expected and 0.6% last month.

Michigan 1-year Inflation Expectations for October are 3.8% vs. 3.2% expected and 3.2% last month.

Michigan 5-year Inflation Expectations for October are 3% vs. 2.8% expected and 2.8% last month.

Consumer & Employment Data:

Michigan Consumer Expectations for October are 60.7 vs. 65.5 expected and 66 last month.

Michigan Consumer Sentiment for October is 63 vs. 67.2 expected and 68.1 last month.

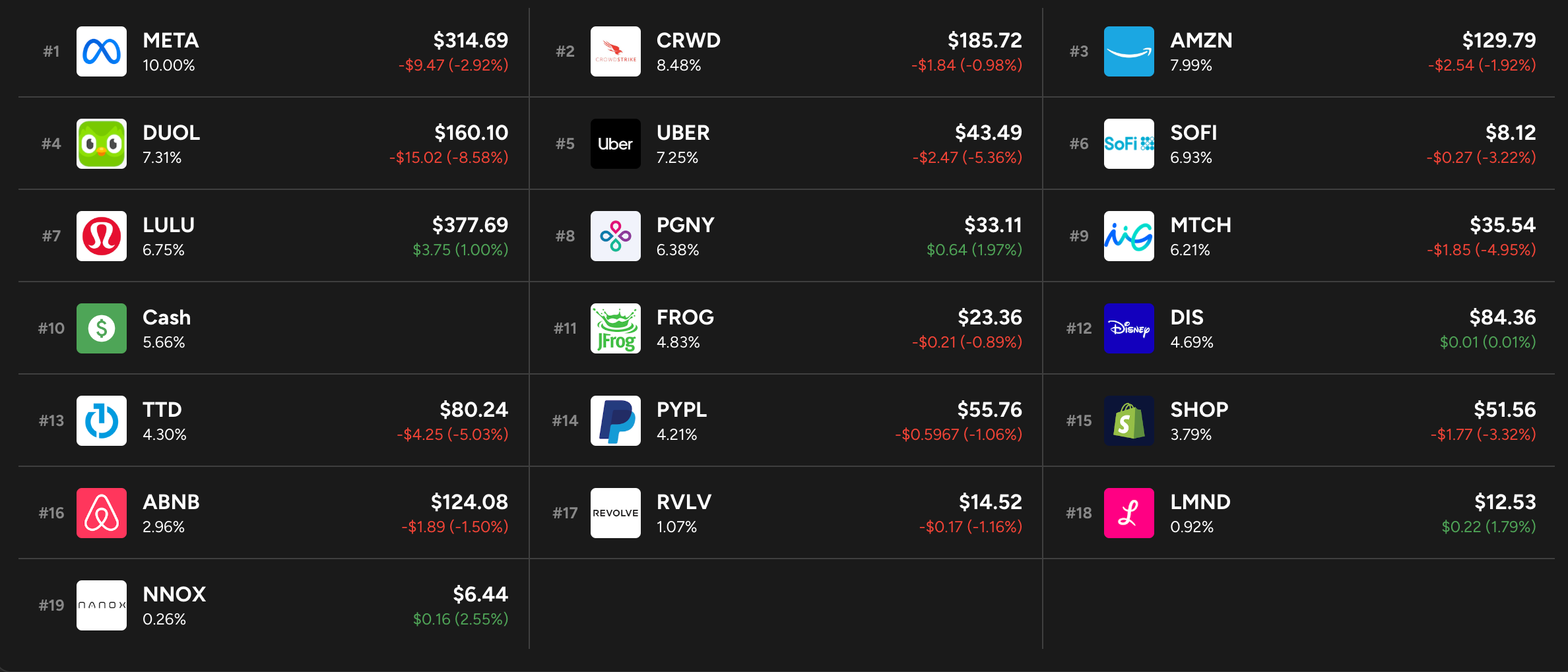

8. My Portfolio

I trimmed 7% of my TTD position this week purely due to valuation. I raised my Uber stake by about 10% and my Shopify stake by 19% during the week.

I love fresh stock news from you on a Sat morning. Always jives well with my morning coffee.

And with earnings season starting up, hope you are ready to do again.

Specifically, I am not a big investor in consumer facing stocks. That's why I read your writings carefully to keep myself informed on those sectors and to get a balanced POV.

Thanks, Stock Market Nerd for your insightful work!

Excellent coverage as usual BF, looking forward to the next one my friend. Kiwi