News of the Week (September 12th - 16th)

SoFi; Shopify; PayPal; Duolingo; Revolve; Match Group; Progyny; Upstart; The Trade Desk; Penn Entertainment; CrowdStrike; Meta Platforms; Macro; My Activity

View my current portfolio here

1. SoFi Technologies (SOFI) -- CEO Anthony Noto Interviews with Goldman Sachs

On SoFi Owning its Technology:

“When we wait for a partner to help us innovate, we lose time and the ability to lead our members. We have a very ambitious strategy. Others have talked about being a one-stop shop but are nowhere near getting there… and the reason for that is they don’t own their technology. The tech we need nobody else is building, so we have to build it ourselves.”

On Student Loan Forgiveness:

Student loan refinancing pain still looks to be ending in a few months. As a reminder, Federal Student Loan issuances come at generally high rates for young borrowers without established credit histories. As they age and establish track records, SoFi can easily refinance these loans at lower rates. With the payment moratorium/pause in place for federal student loans, that refinancing motivation went away. This business -- SoFi’s most profitable segment -- is expected to quickly return next year which will only fuel the company’s stellar 2022 results (thus far) further. Rising rates should also add even more refinancing motivation next year as well.

On Home Loans:

Noto went into the ease in finding mortgage partners for refinancing, but more trouble as it has transitions to the purchase market. He’s confident the team is making the changes needed to reduce funding time and raise Net Promotor Score (NPS) mainly with closing partners… but also said “we are not where we need to be yet.”

I’m looking forward to seeing what results look like when student loans are back, home loans are straightened out and personal loans -- where demand rises with rising interest rates -- continue to rock and roll. It has 5.5% market share of its high credit quality demographic and sees ample share gains to come.

“Our loans continue to perform better than they were pre-pandemic.” -- Anthony Noto

On Hedging:

SoFi has been able to maintain variable profit margins per loan (contribution margin) of 40%+ through rate hedging. It locks in gain on sale margins at origination via hedging to remove any margin volatility from rate fluctuations.

On Being a Bank:

Even at 2% yield on checking and savings accounts, the company’s net interest margin is still 100 basis points (1%) better with the bank charter in hand than last year pre-charter and with a yield far below 1%.

On Referral of 70% of unapproved unsecured borrowers:

Noto was asked if weakness in funding supply for referral partners could hurt this business segment. He explained that it can seamlessly shift the credit origination volume to underwriting partners and that he “wasn’t concerned.”

On Technisys:

“Technisys brought to the table all we thought it would. The biggest surprise has been the amount of inbound interest we’ve gotten in Galileo and Technisys together from large financial institutions. That has validated our thesis. The pipeline is rich and we’re deep in conversation with many partners and we hope to have announcements heading into 2023.”

Noto explained that Technisys and SoFi together focused on securing large partners and contracts for proof of concept of the business on its own. Now that it feels it has done that, the focus will more so turn to co-releasing products with Galileo (Pay in 4 will be first) and integrating the tech stack into SoFi’s.

On Consumer Acquisition Cost (CAC):

“CAC continues to be stable to down and relatively stable on a product by product basis.”

On Direct Deposit Momentum:

“Those trends remain positive and on the right trajectory with strong cross-buying rates.”

2. Shopify (SHOP) -- Product Launches

Shopify Markets Pro:

Shopify Markets Pro was launched this week as an extension of Shopify Markets. Upon launch, 175,000 merchants are using Shopify Markets (vs. the last update of “over 100,000”) and are selling in 14 countries. This debut opens merchants immediately up to 150 more nations to seamlessly and vastly expand their geographic reach. Shopify -- through its investment/partnership with Global-E -- will offer automate taxes, duties, shipping (through a partnership with DHL) returns to make the process far easier for merchants and shoppers. It will also, through the click of a button, allow merchants to turn on localized shops and local payment methods in those 150 countries. Talk about easy. These features have been shown to immediately raise merchant GMV by 7%.

Shopify Translate and Adapt are complementary product launches allowing single click auto translate and the engine to localize stores across the globe to drive traffic, conversion and sales. These two features alone raise merchant volumes by another 13%.

“With Shopify Markets Pro, and our partnership with Global-e, we’re empowering merchants to rapidly scale their international sales using a merchant-of-record solution that would typically be inaccessible to independent brands.” -- Shopify Director of Product Rohit Mishra

Click here for my Shopify Overview.

3. PayPal (PYPL) -- CEO Interview & Regulation

a) CEO Dan Schulman Interviews with Goldman Sachs

On eBay:

Schulman reiterated the 100 basis point (1%) revenue growth headwind for this quarter from eBay with virtually no hit in Q4. This was important to me as the migration schedule has previously been changed many times.

On Guidance:

“I would say we are clearly now at a turning point… Revenue is where we expected for the quarter and EPS is a bit stronger than we anticipated. We still have several weeks left, but I think this is going to be the 3rd quarter in a row where we’ve met or exceeded guidance. And that bodes well as we look into Q4. It’s an uncertain environment, but I think we finally got the guidance right.”

Schulman added that the company is on track to save at least $900 million in operating expenses this year and at least $1.3 billion next year. This will pave the way for considerable operating leverage.

On Checkout:

Schulman repeated his recent comments about now being the time for PayPal to take share of checkout most aggressively. Cash burning start-ups have had to pull back… but PayPal -- with its vast cash flow and strong balance sheet -- doesn’t have to.

Checkout with Venmo on Amazon is getting closer to a release (like it has been all year):

“We’re working closely with Amazon to overcome the last of the technical issues to make sure we have a beautiful experience when launched.”

Contracts and Costs:

“The scale we’re at now (double pre-pandemic) enabled us to go back to suppliers and cut our unit costs. Those contracts are done. Some are better than expected and that’s flowing through to our cost structure.”

Final Notes:

Schulman teased a considerable roster of new Braintree client wins soon to be announced.

Venmo Checkout on Amazon is still on track to be released this year.

Digital Wallet user churn is now 33% lower for digital wallet users vs. previously thought to be 25% lower.

CFO Blake Jorgensen is taking a medical leave of absence to take care of a “treatable condition.” Best wishes, Blake!

b) Regulation

The Consumer Financial Protection Bureau (CFPB) is going to begin formally regulating Buy Now, Pay Later (BNPL) players including PayPal. Considering PayPal’s extreme regulatory clout in the United States and across the globe, I actually think this is a good thing for the company. Competitors don’t possess these same relationships or resources and will likely struggle more with compliance. Relative advantage PayPal.

Click here for my PayPal Deep Dive.

4. Duolingo (DUOL) -- Founder/CEO Luis von Ahn Interviews with Piper Sandler

On Macro Resilience:

“So far we’ve seen absolutely no weakness in any of our metrics to date. We continue to look every day as we hear about other competitors seeing weakness, but we are not.”

On the Product:

The company’s AI engines are able to granularly decipher areas of strength and weakness for each learner and can then tailor lesson plans around that. It can also map the probabilities of getting each problem correct so it can offer customized problem sets that are just hard enough to keep people learning most effectively, but not too hard to make them frustrated and give up.

On In-App Purchases:

Today, in-app purchases represent a small single digit percent of revenue (2-3%), but that business has doubled sequentially. von Ahn sees the business’s potential as similar to dating apps where a la carte accounts for about 30% of revenue on average. He thinks Duolingo gets a lot closer to that 30% benchmark than it is today.

It’s going to be rolling out customizations of character avatars but hasn’t “quite nailed it yet.” Luis expects this to be a “material revenue contributor” eventually.

On TikTok:

Duolingo’s views and clicks on TikTok feature a strong, positive correlation with new user growth for Duolingo. And because it pays nothing outside of a social media manager’s salary for this virality, the growth is ideally efficient. Duolingo thinks about 1 in 10 of its new users are now coming from TikTok.

Click here for my Duolingo Deep Dive.

5. Revolve Group (RVLV) -- CFO Jesse Timmermans Interviews with Piper Sandler

On FWRD:

“We’re on chapter 2 of FWRD today. The first phase was building out the assortment and brand relationships which was a multi-year journey. Chapter two is to start to market to new customers outside of the Revolve family and also cross-selling.”

Overlap between FWRD and Revolve shoppers is now at nearly 5% and continues to rise every single month with the new loyalty program helping to bolster that. It will launch a FWRD ambassador program later this year.

On Men’s:

“We’re excited about the men’s opportunity… it’s still a very low single digit percent of the business, but it’s a little heavier on the FWRD side… our Revolve customer is very loyal. We have a lot of research showing she’s doing shopping for him as well. We think there’s a very natural benefit to having a men’s selection.”

6. Match Group (MTCH) -- CFO Gary Swidler Interviews with Goldman Sachs

This conversation was extremely similar to the chat Gary gave last week.

On Tinder:

“The new Tinder team continues to gel well and they’re on a good track. They need some time, but we’re very optimistic that they will change the trajectory of that business. We were under-executing and Brian Kim (BK) rightly and bravely made the changes… Tinder has to push itself harder and I expect to see that over the coming quarters.”

The Tinder Team’s focus for 2022 has aggressively shifted to the female monetization package and away from things like virtual coins (for now).

On Hinge:

Swidler expects Hinge to add as much incremental revenue in 2023 as 2022 (so $100 million or 33% growth) with plenty of room for further upside if international expansion succeeds.

Final Notes:

Match is working on a few new targeted apps similar to Stir for a different specific use case. He didn’t offer specifics.

The hiring environment for Match has greatly improved with competition laying off workers. It’s leaning more aggressively into hiring new talent as a result.

7. Progyny (PGNY) -- CEO Pete Anevski Interviews with Bank of America

On Utilization:

Utilization rates have been and continue to be normal since early in Q1 2022. No macro pressures are impacting utilization. The passion and time sensitivity associated with pregnancy makes Progyny largely immune to recessionary pain.

On The Selling Season:

The selling season is going well and the company is in a “good place vs. last year in terms of overall activity.”

CFO Mark Livingston added that retention and client expansion have both been very positive as well. Layoffs have not hit its clients (largely massive, blue chip enterprises) nearly as hard as other parts of the labor force.

On Competition:

All other disruptors continue to struggle to secure relationships with national carriers and so continue to pay out benefits post tax vs. Progyny’s pre-tax edge (which equates to $14,000 on average for a middle income individual).

All disruptors continue to use limited lifetime dollar maximums greatly limiting the flexibility and efficacy of treatment. Nobody is emulating the granular, flexible customization of Progyny’s offerings and so nobody is delivering its level of outcomes.

Of Progyny’s 900 providers in its network, 180 of them don’t even accept any other benefits manager.

Click here for my Progyny Deep Dive.

8. Upstart (UPST) -- Management Interviews and NAFCU

a) Founder/CEO Dave Girouard Interviews with Goldman Sachs

On Macro:

Girouard spoke on the disproportionate impact this latest cycle has had on “blue collar America” both on the way up and down. He sees this volatility as “mostly behind us.” I found this to be a bit bold considering the treacherous times we find ourselves in and the uncertainty of when hawkishness wanes and macro improves. We were burned by his optimism in 2021… let’s wait and see how things play out before we get excited.

He also again talked up the need for longer term capital market funding. “Longer term” here simply means committed capital for loans that investors will hold to maturity vs. needing to flip for a quick profit. That won’t be the cure for finding more near term growth, but will (along with more partner retention) make its business more durable across future credit downturns. Over the next 18 months, Girouard expects at least 10% of its capital to be from committed capital institutional investors.

On credit Quality:

Girouard talked up the company’s aggregate outperformance for lenders across credit cycles overall. That outperformance also includes periods of underperformance like we’ve seen briefly this year, but the total return has been above expectations for the company’s partners AND capital market investors since inception.

b) CFO Sanjay Datta Interviews with Piper Sandler

On How AI Actually Helps the Lending Process:

Datta explained that AI is about maximizing computer power to remove the linear assumptions common in credit underwriting. Variables do not correlate in a linear fashion in the real world. These models allow it to “relax the rigid rules and assumptions of linearity” while the majority of the industry “still leans on these linear regression functions."

On Capital Markets:

Datta thinks capital market investors are eagerly waiting for macro improvement to return to originating Upstart loans. He also thinks the company’s decision to use its balance sheet to plug some funding gaps for now is making these investors more confident. Skin in the game.

“Under the hood, our model is systematically improving. When the world snaps back to something more normal, I believe we’ll come out of it looking quite good… longer term absolutely there continues to market share gain opportunities.”

He also reminded us that conduits like Cross River and Finwise are “very replaceable.” And I think he’s right. There are a long series of originators that would line up for a small fee and no balance sheet risk… these conduits sell the originated loans immediately.

C) Upstart also won The National Association of Federally Insured Credit Union’s (NAFCU’s) Services Innovation Award for this year.

Click here for my Upstart Deep Dive.

9. The Trade Desk (TTD) -- Retail Media Progress

The Trade Desk revealed this week that 80% of major retailers are using The Trade Desk’s software. Since Walmart and The Trade Desk announced a partnership last year, it has found rapid, rapid traction in the space. This merely marks another untapped, long-tail opportunity that the company is admirably taking advantage of.

Other Interesting stats that came from the news report:

71% of consumers prefer tailored ads over paying to avoid ads (bodes very well for streaming’s shift to ad supported video on demand (AVoD).

53% of consumers recognize sponsored products on retail sites.

42% of consumers claim to frequently click to buy from these ads.

Click here for the TTD Deep Dive.

10. Penn Entertainment (PENN) -- Barstool

Barstool leadership hosted an up-front event for advertisers in a renewed focus on reeling in blue chip brands. Its theme was simple: “we move product better than others do.” Along with this message and push, Barstool made the following product announcements:

Barstool will host its first college basketball tourney that it will “exclusively produce and broadcast” in November. Mississippi State is a power 5 school participating in the event.

Lakers star Patrick Beverly will launch a podcast with Barstool personality Rone in October.

Barstool is launching 7 new reality TV shows this year following historic success in 2022 so far. Its 4 shows have already enjoyed 25 million views this year.

Barstool launched “TwoYay” -- a Name, Image and Likeness (NIL) platform and marketplace to help college athletes get paid. They will not take a cut but are simply trying to deepen an already tight relationship with younger generations. Barstool’s College athlete network and its 150,000 members will be leveraged to make this an immediate success.

To wow advertisers, Barstool disclosed the following stats:

58% of its listeners have purchased a product after hearing it on a Barstool podcast per internal surveying

Barstool sees its fanbase at over 100 million strong across all platforms. This is vs. 68 million 2 years ago representing at least a 21.2% compounded annual growth rate (CAGR).

92% of advertisers have renewed this year while spending 27% more YoY.

It’s a top 5 publisher overall on TikTok

As an aside, Matt Berger -- Barstool’s new head of sales -- was instrumental in landing blue chip advertisers like Coke to a previous taboo brand he led called College Humor. He knows the playbook to repeat.

“If advertisers care about moving product, they should care about both top and bottom of funnel. Barstool provides both. That’s why during times of turbulence, brands should and do give their money to Barstool because you know we’re going to work.” -- Barstool Head of Sales Matt Berger

There are two ways to juice return on ad spend (ROAS): Targeting more efficiency (like The Trade Desk does for example) or having an especially passionate following. I would describe Barstool’s as cult-like.

“We have cornered the market on crazy, creative people.” -- Barstool Founder Dave Portnoy

11. CrowdStrike Holdings (CRWD) -- 2022 Falcon OverWatch (managed threat hunting) Report Highlights

CrowdStrike saw a 50% rise in interactive intrusions YoY.

71% of attacks were malware free while other competitors continue to predominately focus on malware.

Targeted attacks (often state-level) rose from 14% of intrusion campaigns in 2021 to 18% in 2022.

Renting ransomware as a service continues to proliferate. This lowers the barriers to hacking by limiting resources and knowledge required.

12. Meta Platforms (META) -- Miscellaneous

Instagram launched a feature for businesses to be paid within app messaging.

WhatsApp is releasing a short film based on Giannis Antetokounmpo’s life.

13. Olo (OLO) — Smashburger

Olo announced Smashburger as its a latest brand client. This chain features over 200 locations and is starting with three Olo modules: Ordering, Rails and Dispatch.

14. Macro

a) Key Data from the Week

The Consumer Price Index (CPI) came in at 0.1% month over month vs. 0% last month and -0.1% expected. Year over year it rose 8.3% vs. 8.1% expected. This fell ever so slightly from last month’s 8.5% reading.

The Core CPI (strips out food and energy) came in at 0.6% month over month vs. 0.3% last month and 0.3% expected. This was an objectively bad number.

The Producer Price Index (PPI) came in at -0.1% vs. -0.4% last month and in line with expectations.

Core Retail sales came in quite lightly at -0.3% month over month vs. 0.1% expected but retail sales overall beat expectations at 0.3% month over month vs. 0.2% expected.

Jobless Claims came in slightly below expectations at 213,000 and fell month over month from 218,000.

The Philadelphia Fed Manufacturing Index reading came in at -9.9 vs. 2.8 expected and 6.2 last month. Yikes.

Michigan Consumer Expectations slightly beat expectations while Michigan Consumer Sentiment slightly missed expectations.

FedEx sharply disappointed on earnings and withdrew annual guidance amid uncertain macro.

b) Level-setting the data

The economy is clearly weakening with another terrible Philly Fed number, a poor Core Retail Sales number and the Atlanta Fed’s Real GDPNow forecast again flirting with negative territory. But still, jobless claims continue to fall and inflationary readings were quite bad this week for the first time in a while. So? What we already knew would happen is going to happen: The Fed is going to continue raising rates and eroding its balance sheet. I think that process will finish playing out sometime next year, but we’ll have to see how the data comes in. I’m going to keep slowly deploying cash and will wait to get more aggressive until inflationary metrics cool a lot more: That’s when I’ll really sink my teeth into accumulation.

What I will say is that rent is a big part of the poor CPI reading this week. That makes up about 30% of the datapoint. The Personal Consumption Expenditures (PCE) number only has a 15% rent contribution and is something the Fed focuses on more closely. That data will come on September 30th and could look more encouraging also considering slightly cooling commodity prices this past month. But still, our Federal Reserve cannot pivot with CPI and PPI readings even remotely close to where they are today. 2022 continues to be a year of slow nibbling and patience for me.

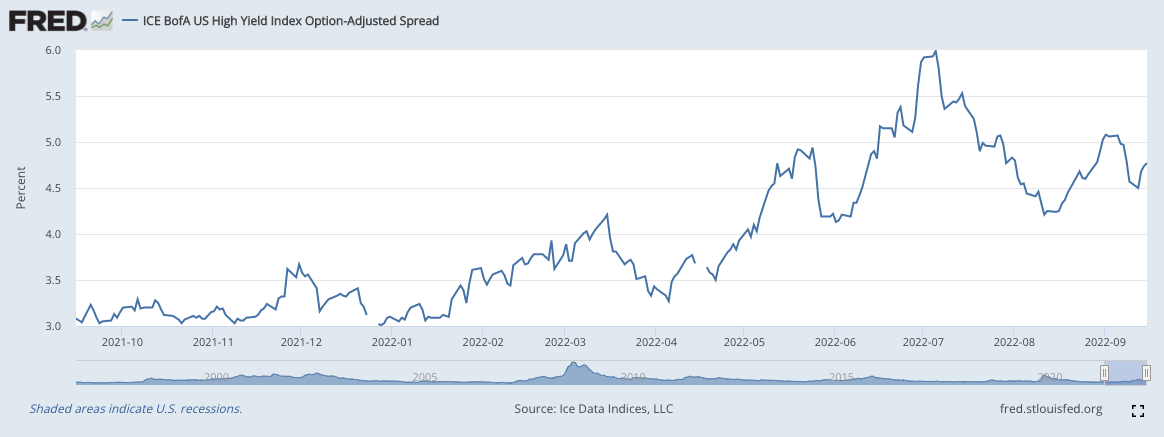

High Yield Corporate Credit Spreads are unfortunately rising once more:

The Ten Year, Two Month Yield Curve interestingly continues to base and has not inverted:

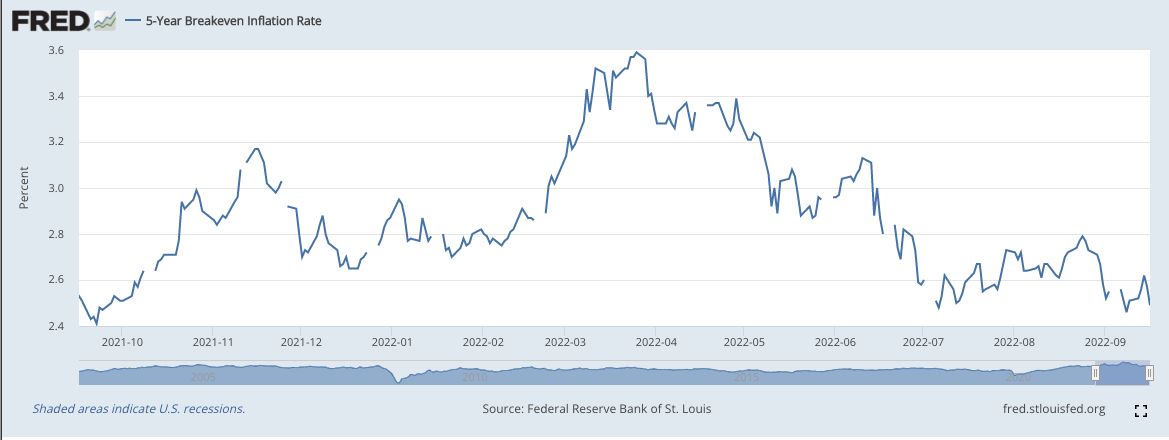

5 Year Breakeven Inflation expectations luckily continue to fall:

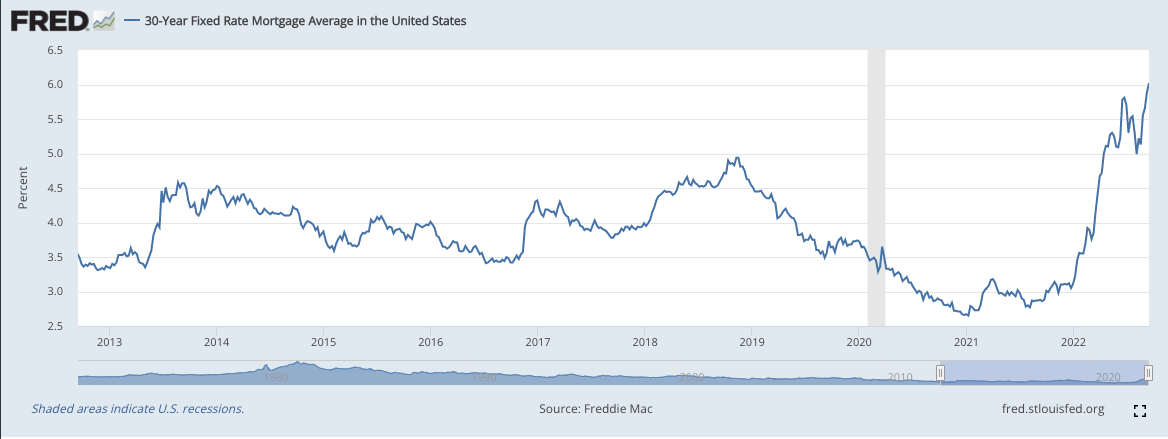

The 30-Year Fixed Mortgage rate keeps setting new cycle highs (this complicates rent inflation further):

The Dollar continues to set new decade highs vs. the Euro:

15. My Activity

I didn’t transact this week.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that the MSOS position is a placeholder for my positions in Green Thumb and Cresco Labs while OTC stocks are added to the platform. You can also re-create your very own portfolio through Savvy Trader here.

Have a wonderful weekend!

I agree that SOFI is interesting because they own their platform and can innovate quicker. However their lopsided balance sheet and severely negative cashflows are a huge concern...especially given how competitive the financial services industry is.

Thanks for your fabulous weekly write ups. Weekend must read in my book.