News of the Week (September 13-17)

GoodRx; Progyny; Olo; SoFi Technologies; JFrog; Tattooed Chef; Lemonade; Microsoft; Apple App Store; REVOLVE; Green Thumb Industries; My Activity

1. GoodRx (GDRX) — CEO Doug Hirsch & CFO Karsten Voermann Interview with Citi

There was a lot of overlap between the themes covered in this interview and the topics of conversation in GoodRx’s last investment conference less than a week ago. Click here to access those notes.

a. Voermann on the GoodRx opportunity:

“We are still in the very low single digit percentage penetration of our market as the biggest player. We feel like we have a long runway ahead of us with still 70% of consumers not aware that prescription prices vary.”

“Our most significant source of traffic remains unpaid word-of-mouth referrals from consumers and providers. It’s in our DNA to grow fast and to maintain attractive margins — we intend to do that going forward as well.”

b. Voermann on the importance of partnering with 95% of the top 20 branded manufacturers:

“The top 20 manufacturers in the United States represent 50% of the $30 billion advertising TAM. The top 20 are viewed by other manufacturers as indicative of the best ways to spend money and also allow us to expand horizontally with more medications from the same manufacturers.”

GoodRx is in just 4% of the medications that these top 20 manufacturers sell. There are also about 500 smaller branded manufacturers and GoodRx merely works with 35 of them. It’s the top of the first inning for this rapidly growing and immensely profitable segment.

“A top ten manufacturer recently concluded that GoodRx delivered them with an 8X ROI across a portfolio of 5 branded medications. The net revenue retention with that customer is 170% year to date.”

c. Hirsch on why telehealth:

“This serves as another entry point for consumers to experience GoodRx. We want to be there at every critical point in the healthcare journey.”

“We identified early on that consumers were coming to GoodRx looking for savings but without a prescription in hand.” GoodRx care (a piece of its telehealth platform from the HeyDoctor acquisition) plugs this gap of prescribing and adherence.”

d. Hirsch of GoodRx Gold:

Hirsch believes there are more partnerships like the KrogerRx tie-up coming for GoodRx Gold. While he wouldn’t offer any specific names, he did tease that there is more news coming.

e. Voermann updating the impact of the pandemic on GoodRx’s business:

“We haven’t yet seen a return to normal prescription volumes but we have seen sequential month over month growth. We think the care backlog has now leveled off — so it’s no longer growing. There is still a coiled spring that will drive future growth but the timing is uncertain.”

f. Hirsch on GoodRx’s B2B presence beyond USAA and DoorDash:

Hirsch explained that while GoodRx’s primary focus has been on the consumer, enterprises have approached GoodRx asking for benefits help thus pulling GoodRx into the B2B space.

“We are just getting started with business development efforts and you will see a lot more really exciting partnerships.”

g. Hirsch on Amazon:

“Amazon is focused on driving its mail-order business but even in a pandemic mail-order did not significantly grow and is now receding. We will always worry about everything pertaining to growing our business but that is not a threat we worry too much about today.”

“GoodRx is tremendously lower-priced in retail and by mail vs. Amazon but it’s not an either or for us… Our competition is the old way of doing things. Too many Americans don’t understand the price variation in healthcare.”

Click here for my broad overview of GoodRx’s business.

2. Progyny (PGNY) — Amazon hiring news & CEO David Schlanger Interviews with Bank of America

a. Amazon news

Amazon announced that it will hire another 125,000 employees in the coming months. Because Amazon is a Progyny client and because Progyny generates more revenue as its clients require more treatment cycles, this should be a positive revenue driver for it going forward. Progyny is automatically included in its client’s benefits packages for new employees if that employee gets its benefits through their employer.

Treatment utilization rates remain constant as new employees are on-boarded so hiring for a client is directly correlated to Progyny revenue growth.

b. Schlanger on the selling season:

Progyny also interviewed with Bank of America last month. Click here for the notes.

As a reminder, Progyny’s core selling season runs from August 15th to October 15th — we are roughly half way through the season.

“As we said in August, we are having a very active selling season — that continues to be the case.”

c. Schlanger on the threat of traditional carriers potentially improving their own fertility offerings:

“Our primary competition is the legacy carriers, and they have largely adopted the status quo approach to utility.”

“Carriers have shown no effort to try and improve their fertility programs other than maybe coming up with a new brand name. From a substantive perspective they haven’t done anything and there are a lot of structural issues making it difficult for them to do so. The things we do they are not set up to do. They’d have to do a lot of re-tooling their operations and have many other priorities. I don’t envy the carriers.”

“Doctors (providers) don’t view us in the same boat that they view large commercial carriers and think working with us is easier and more beneficial to their practices.”

“Our competitive environment has been largely the same for a handful of years now. Even with direct competitors, we hardly ever see them in a competitive situation and lose business to them even more rarely — almost never.”

d. Schlanger on the ability to expand into other service offerings like post-birth care services:

“We do believe those opportunities exist and are actively assessing these opportunities.”

“We have found that it’s ill-advised to try to create something with questionable value that merely sits on top of our existing benefits program. Maybe you can get the sale but renewals are tough. With Progyny, renewals are not tough because we create real value. That’s the lens that we will look at other adjacencies through.”

e. Schlanger on utilization rate:

As a reminder, the company experienced a sudden dip in its utilization rate in recent months. That dip was felt sector-wide and was attributed to pent-up summer travel demand — not pandemic variants. The dip was referred to as an anomaly and the trend is recovering.

Schlanger reiterated his comments from his last talk with Bank of America.

My Progyny deep dive will be published next month.

3. Olo (Olo) — CEO Noah Glass/CFO Peter Benevides Interview with Piper Sandler

a. Glass & Benevides on Olo’s long term ambitions:

“Olo already touches the full commerce stack directly and through our partner ecosystem. We will go deeper with new digital use cases for on-premise and drive-thru in the years to come. We are seeing a lot of interest in these 2 areas. Olo’s new ambition is digital entirety: To touch, add value to and derive revenue from every restaurant transaction. Now it’s all on the table for Olo.” — Glass

“The QSR segment is something that gets us very excited. This segment has grown through franchising leading to fragmentation within a brand’s tech stack. That’s an area where we can add a lot of value.” — Benevides

b. Glass on how Olo can improve the drive-thru process:

“Our customers are interested in creating fly-thru lanes rather than drive-thru lanes. This will convert drive-thru lanes to a lane where consumers who have ordered and paid ahead can go to collect their order for a faster experience. We can enable this so a consumer can have the order run out to them while being able to pull out without being gated in by another car.”

c. Benevides on how Olo is so quickly growing AND profitable:

Because a brand wants that homogenized digital experience across all locations, Olo is able to sign exclusive deals with entire corporations to deploy its software brand-wide. Olo allows for the unified digital experience regardless of how fragmented a specific brand’s tech stack is.

The network effect in action:

“A benefit we are witnessing is the momentum associated with being a leader in a vertical market. As we sign large brands in a segment and as we are successful with service, other restaurants in that segment tend to follow.”

d. Glass on why brands don’t build this solution themselves:

“There are certainly brands that have built a platform themselves. What we typically see is the brands that have made that investment generally tire of the ongoing OpEx required to maintain that platform.”

e. Glass on the “5&5” partnership:

5&5 is a software consulting firm that helps large enterprises select and onboard new products to their technology stacks.

5&5 calls mammoth brands like Carl’s Jr. and Friday’s customers while Olo does not yet. This could be a powerful gateway into new client wins.

“5&5 gives our clients that ability to leverage a consultant to implement Olo’s software. It’s about deployment at scale. This helps brands launch Olo faster and any brands reluctant to sign with Olo because we don’t have in-house resources to support their launch might now consider doing so.”

f. Glass on M&A philosophy with $600 million in the bank:

“While we don’t have anything specific in mind, we are thinking about tuck-in opportunities to help broaden a product’s features or to accelerate development timelines.”

Click here for my Olo deep dive.

4. SoFi Technologies (SOFI) — An Encouraging New Hire

Roughly one year ago, SoFi secured conditional approval for its banking charter. This week, SoFi named Chad Borton as the new President of SoFi bank depicting real confidence in approval being a done deal at this point.

Borton previously served as USAA’s Bank President and has held leadership roles with JPMorgan Chase and Fifth Third Bank as well.

Click here to read how CEO Anthony Noto views the impact of a banking license on SoFi’s business.

Click here for my broad overview of SoFi's business.

5. JFrog (FROG) — CEO Shlomi Ben-Haim & CFO Jacob Shulman Interview with Jefferies + M&A

a. JFrog M&A

JFrog announced the acquisition of Upswift — a creator of “connected device management software for developers.”

The combination will unify the disparity between development and connected device by creating one, single company with the ability to bring the processes of software management and distribution together. Customers will now be ensured that all of the end points in their internet of things (IoT) ecosystem will be fully plugged into timely, secure software updates. This unification will reduce time to deployment and operational bloat.

“When a software package is deployed to a data center, Upswift takes this package and seamlessly delivers it to the end point device. Upswift brings to our platform a continuous [software package] deployment ability not just to the edge, but all the way to the device while it can manage the device’s updates.” — Haim

According to JFrog, this creates the “first solution for secure, 360-degree management of connected devices throughout the DevOps lifecycle.”

The IoT TAM is set to reach $16 billion by 2026 as 5G proliferates and makes connectivity far more seamless.

“As more intelligent applications and data collection move to the edge, the marriage of DevOps and device management is unstoppable. We’re thrilled to join JFrog. — Upswift Founder/CEO Amit Ezer

The details of the transaction have NOT been disclosed at this time.

b. A reminder on JFrog’s Reach from the new investor presentation

c. Jacob Shulman on the Pandemic’s Impact on JFrog’s Business

The overwhelming impact of COVID-19 has been a negative one on JFrog’s business as large enterprises pulled back on total spend. Its net dollar retention rate fell from roughly 140% to 129% as a result and its revenue growth is expected to dip from 44% in 2020 to 34.9% this year as well.

“We see that the business environment is improving which is why we guided for a slight revenue growth acceleration for the second half of the year.”

6. Tattooed Chef (TTCF) — Leadership Interviews with Cowen

a. CEO Sam Galletti on the importance of vertical integration:

“The more we can produce our own products the more profitable we will be. By having our own production plants we can control our own destiny. We’ve been able to take advantage of growth presented to us which would have been very difficult with a co-packer.”

b. On why Tattooed Chef bought Foods of New Mexico:

Capacity expansion was the main reason but it runs deeper than that. Foods of New Mexico already had 300 trained workers preparing food — in an extremely tight labor market. This acquisition allowed for more efficient expansion — as well as it being more economical considering Tattooed Chef paid a co-packer multiple rather than the premium multiple it would have paid if it wanted another brand.

c. CEO Sam Galletti on new products winning:

Its new plant-based burrito bowl is now its 2nd best-selling stock keeping unit (SKU).

“We are excited to get into the broader part of the store with shelf-stable products. There will be a lot of things coming in the future there.”

d. CFO/COO Stephanie Dieckmann On why it has a plant in Italy:

“The facility gives us access to some of the best produce in the world. We can contract with local farmers and can turn it into finished goods in the same day it was harvested. We are all about locking in flavor and providing the best quality we can.”

Other perks:

Less cost variance between organic and non-organic in Italy vs. The U.S.

Cheaper labor costs

Container shipment from Italy to the East Coast is cheaper (yes, even today) than freight costs from the West Coast to the East Coast

Sets Tattooed Chef up for future international expansion into Europe (which is still a few years away based on the domestic opportunity being so strong)

e. Notes on marketing

Tattooed Chef debuted its very first marketing campaign this year. It reached over 80% of all plant based food intenders (their core addressable market) while raising brand awareness from 6% to 15%.

The company’s $3 million boost in forecasted 2H 2021 marketing spend is to test new methods. It’s in trial and error mode currently on marketing and is expecting 2022 to be the year it perfects this marketing objective. I will say, it’s impressive how quickly Tattooed Chef has been able to grow branded sales to date with virtually 0 external marketing.

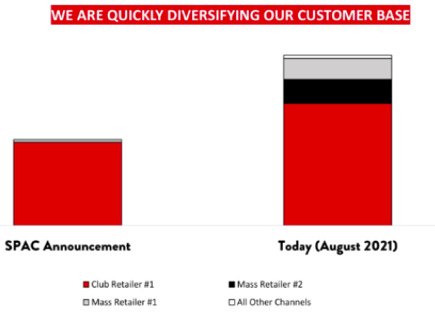

f. Illustrating broadening customer concentration from the new investor presentation

g. Case Studies

Tattooed Chef has the top 2 plant based frozen food SKUs in Target and 3 of the top 10

Tattooed Chef’s retail sales velocity is 60% or more above its nearest 10 competitors like Amy’s and Stouffer’s

It started with 2 SKUs in Target less than a year ago and will have 25 SKUs nationally distributed starting next month

h. More color on last quarter’s margin disappointment

Tattooed Chef expects gross margin to rise over the long term from here — and I would hope so considering it sits at 13.4%.

7. Lemonade (LMND) — Product Addition

Lemonade launched a new pet insurance plan designed for puppies and kittens. The plan takes a preventative — not reactive — approach to make sure our beloved pets are staying in tip-top shape throughout their lives.

During 2020, roughly 3.7 million American households became pet owners for the first time with now 7 out of 10 households being counted as pet owners today. Furthermore, younger generations are more likely to consider a pet part of the family while having a higher propensity to spend on a pet’s wellbeing. This product is in the right place at the right time.

With Lemonade’s existing pet insurance already making up 13% of its premiums, it will be interesting to see what kind of impact this upgrade/addition to the product has on the segment. Lemonade attempts to build loyalty at the very beginning of a consumer’s insurance life cycle with its renter product. This product designed for kittens and puppies seems to have the same ambition in mind within the world of pets.

Click here for my broad overview of Lemonade’s business.

8. Microsoft (MSFT) — Shareholder Capital Return Updates

Microsoft raised its quarterly dividend by 11% sequentially to $0.62 per share. This represents a roughly 0.9% annual dividend. Microsoft’s board of directors also approved a $60 billion share repurchase program representing nearly 3% of its enterprise value.

9. Apple (AAPL) — Tear Down Those App Store Walls, Mr. Cook

This past weekend, a federal judge ruled that Apple must allow developers to link to outside payment methods. This transaction — when conducted internally — fetches 15%-30% of sales for Apple so this change could have a significant impact on its App Store business. Apple was not told to lower its fees, but this does make it far easier for developers to side-step its hefty take-rate.

Earlier in the month, Apple made a similar announcement on its own — but this only pertained to what it called “reader apps” like Spotify or Netflix for example.

This ruling appears to be far broader in nature and does not come with that reader app specification. Every single company selling an app or in-app items through Apple stands to meaningfully benefit from this move. The primary example for my portfolio is Duolingo, although holdings such as CuriosityStream, Lemonade, REVOLVE, and Penn’s Barstool Sportsbook all should theoretically enjoy a meaningful boost to margins.

10. REVOLVE (RVLV) — Mastercard Holiday Spending Data

Mastercard announced that it expects to see 7.4% year over year growth in consumer spending this holiday season. Savings rates and stimulus checks are expected to drive the strongest growth in luxury segments. This is great news for REVOLVE specifically and high-end retailers more generally.

11. Green Thumb Industries (GTBIF) — Retail Footprint Expansion

Green Thumb opened its 3rd dispensary in New Jersey during to week to reach 65 dispensaries across the United States.

12. My Activity

I added to Teladoc Health during the week.

Thank you for reading!