News of the Week (September 20-24)

CrowdStrike; Upstart; The Trade Desk; Facebook; GoodRx; American Cannabis; Cresco Labs; Ayr Wellness; Butterfly Networks; JFrog

1. CrowdStrike (CRWD) — 2021 Threat Hunting Report Summary

a. CrowdStrike released the results of its annual threat hunting report. Here are the highlights:

OverWatch (CrowdStrike’s human-managed threat hunting service) has seen a 60% rise in intrusion activity since last year. OverWatch analysts blocked 65,000 additional attacks providing direct evidence of how it bolsters and augments the success of CrowdStrike’s autonomous threat graph.

68% of alerts/detections within CrowdStrike’s threat graph did not use any malware.

E-Crime (financially motivated) makes up 75% of all intrusion activity with established black markets in place for hackers to actually sell their programs to people as a service as well as connect hackers to each other like a broker. No longer does someone need to be an expert to wreak havoc.

E-Crime adversaries are now capable of moving horizontally throughout a victim’s platform in just 92 minutes. 36% of these adversaries are also able to laterally move into new hosts in less than 30 minutes. This is why Zero Trust and the Preempt acquisition was so important. This prevents a hacker from breaching a vulnerable piece of an ecosystem while then navigating freely throughout it without any further authorization controls in place.

OverWatch observed a 100% rise in crypto-related intrusions year over year.

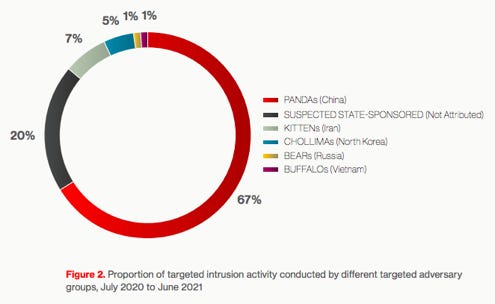

Breakdown of targeted intrusions by which County this adversary came from:

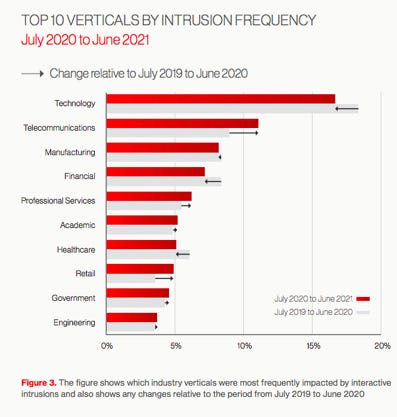

Breakdown of attack trends by industry:

b. My take:

Rising instances of cybercrime will continue to be a tide that lifts all boats in the space — and I think CrowdStrike is the best-positioned to benefit in its end-point/workload niche. It’s important to note that competition such as SentinelOne places more of an emphasis on stopping malware vs. CrowdStrike’s focus on preventing breaches more broadly. Based on 68% of threat attempts not even using malware anymore, CrowdStrike’s north star seems to be better-placed.

2. Upstart (UPST) — A New Partner

Upstart announced a new partnership with WSFS Bank to bring its AI-powered lending capabilities to one of the oldest banks in the United States. With roughly $27 billion in assets under management (AUM) and a public market cap of $2 billion, this is a solid get for Upstart.

When Upstart went public less than one year ago, it was working with 10 credit unions and banks. Today, that number is now approaching 30 thanks to strong momentum since its listing. Clearly, its solution is gaining traction.

3. The Trade Desk (TTD) — A Campbell’s Soup Case Study

Linda Lee — Campbell’s Chief Marketing Officer — sat down with The Trade Desk’s “The Current” to talk about how a data driven approach to marketing allowed the company to weather the toughest of storms.

Campbell’s pivoted to aggregating and leveraging its data wherever possible to embrace a programmatic approach to ad-buying. And it’s working: Since the beginning of the pandemic, 13 million new households have purchased Campbell brand products and roughly 4.3 million of these households are counted as millennials. This growth handsomely outpaced its direct competition.

According to Lee, the company is drowning in insightful data but limited in how it can organize this data to confidently act. That’s exactly where The Trade Desk helps the demand side of the advertising space — connecting data to tangible marketing results and efficacy.

Click here for my deep dive into The Trade Desk’s business.

4. Facebook (FB) — Advertising Warning

Facebook’s Vice President of Marketing — Graham Mudd — published a blog post warning investors about the challenges associated with Apple’s ad-tracking practices.

According to Mudd, the impact of Apple’s new policies on advertising efficacy has been “larger than expected” as targeting and measurement has gotten more difficult. This is due to the impact that Apple’s iOS privacy changes have had on Facebook’s ability to report iOS web conversions. The social media behemoth estimates that it’s now underreporting these conversions by an average of 15%. Furthermore, it believes the true conversion rates are in reality higher than what Facebook reports to its advertisers. Facebook had already warned investors of tougher 2nd half growth as Apple’s ad-targeting headwinds persisted — this is merely a reiteration of that previous warning.

The company is actively promoting its Conversions API — the vehicle actually connecting marketing data with marketing channels — to help advertisers steer through this new, uncertain world of selling. Facebook has also dedicated resources to improving the accuracy of its conversion rate reporting on a 1-day basis and to building a new tool to help advertisers track conversion even on 3rd party sites like independent marketplaces.

The company issues warnings about the fragility of its advertising business every few months — and then proceeds to continue seeing its advertising business thrive and crush expectations each quarter. To me, this is just another one of those warnings that will eventually end in yet another fantastic quarter for the company. Warnings are never good, but with Facebook they tend to be all bark with no bite. And in the world of advertising — thanks to Facebook’s unparalleled scale — whatever hurts Facebook hurts the rest of its industry more.

In other news, the company’s CTO — Mike Schroepfer — will step down from his role with the company and will become a part-time advisor. Andrew Bosworth — currently an engineering executive with Facebook — will assume Mike’s role.

5. GoodRX (GDRX) — CEO Doug Hirsch and CFO Karsten Voermann Interview with Goldman Sachs + a New Product

a. Hirsch on the competitive Landscape

“In our entire history, no competitor has been able to impact our growth trajectory. Companies have tried to copy the GoodRx model but none of them have actually had an impact. Amazon has been trying to grow a pharmacy delivery service and has not been successful to date. We’ve seen no evidence from any third party data of traction [for Amazon] here — there’s virtually no usage.”

“Ultimately our brand, scale and volume give us better pricing and more consumer savings. I remain constantly paranoid and always working to make sure we have the best product out there. I believe very strongly that we are in a great position with a deep competitive moat.”

b. Voermann on pharmacy benefits manufacturers (PBMs)

“We’ve never had a PBM leave the GoodRx platform.”

c. Voermann on the pandemic-induced demand backlog

“The backlog has begun to level off but we haven’t yet benefited from the backlog shrinking and the additional demand that will bring. The timing of back to normal is a little uncertain but we are getting closer with things like schools and healthcare broadly remaining open. The headwinds will become tailwinds moving forward and the backlog will take time to unwind.”

d. Voermann on GoodRx Gold

“We haven’t had to spend a lot to get subscribers on board and yet we still get this nice return (2X the LTV of non-subscribers) due to higher order frequency.”

Hirsch also reiterated his comments from GoodRx’s last investment bank conference that more business to business deals like with USAA and DoorDash will be coming soon.

e. Hirsch on the GoHealth Insurance relationship

“Insurance is something that we haven’t really addressed before but the reality is that 75% of GoodRx users have insurance and 30% have Medicare. The GoHealth agreement opens up a whole new acquisition channel for us within Medicare. Now a Medicare eligible consumer can find and enroll in the best Medicare plan on GoodRx and we can now give those members access to the affordable services we offer. This is just one of many platform extensions you should expect from us in the future.”

e. GoodRx Health debut

GoodRx debuted GoodRx Health — an online resource for all thing’s healthcare education-related. The product sounds a lot like a search engine but only for thoroughly researched, verified answers. It also comes with “Health Wizard Tools” to help consumers through tough care decisions while featuring thousands of videos to be guided through even our most delicate issues. It even tells us when consensus research from world-renowned experts is still uncertain so we remain fully in the loop. The company is leveraging its HealthiNation purchase from earlier this year to bolster its library of video content.

Furthermore, the product will actively fight against the spread of fake information by including a “Health Debunked” segment to educate the public on things such as women’s care and vaccines.

A team of doctors, pharmacists and industry experts have been enlisted to build this curated education feed — thus ensuring the information can always be counted on by consumers. This team is entrusted with “literature reviews” of existing materials to ensure no misleading information falls through the cracks — within healthcare this is imperative.

There are hubs on GoodRx Health dedicated to common ailments like heart disease with actionable advice on how to save on medications and care.

While this will likely have little direct impact on GoodRx’s growth, it does serve as another entry point for consumers to learn about GoodRx’s brand and eye-popping value proposition. The product will directly plug into GoodRx Care (its telehealth platform) as well as its prescription marketplace to enhance up-selling opportunities while producing a better-informed public. GoodRx expects this up-selling activity to be the strongest within its manufacturers solutions business as GoodRx Health gives them another new platform to market products to a high-intent audience.

Click here for my broad overview of GoodRx.

6. American Cannabis — Regulation Momentum Builds (Again)

The House of Representatives again passed a cannabis bill that would amend the National Defense Authorization Act and pave the way for American Cannabis growers to access safe and reasonable banking practices. The bill has been passed by the House 4 times before and there’s zero guarantee that it will be passed by the Senate. Still, it does point to continued (albeit ridiculously slow) movement towards cannabis reform.

Tom Angell of Marijuana Moment interviewed one of the SAFE Banking sponsors — Ed Perlmutter of Colorado — who said he thinks “the fifth time is the charm.” Key members in the Senate have voiced a desire to pass cannabis legalization more broadly (not just banking reform) — so I will believe it when I see it, Ed.

In other news, Mississippi legislators reached an agreement to replace the bill the state passed late last year which was blocked by its supreme court. Another deeply conservative state is moving towards cannabis reform.

Finally, Amazon’s Senior Vice President of Human Resources — Beth Galetti — published a blog post on the company’s stance towards cannabis reform. A few months back, the behemoth made headlines when announcing it would exclude cannabis from its drug screening program — but its support runs deeper than that. Now, Amazon is “actively lobbying” on the Marijuana Opportunity Reinvestment and Expungement Act of 2021 (MORE Act) which — if passed — would federally legalize the plant.

Click here for my overview of what SAFE Banking or the MORE Act would mean for American cannabis growers and the regulatory landscape overall.

7. Cresco Labs (CRLBF) — M&A

Cresco Labs bought “Cure Penn” — the owner of 3 dispensaries in Pennsylvania — for $90 million total. Cresco Labs expects Cure to be “immediately accretive” to its operations. Importantly, this 3 dispensary footprint does not overlap with Cresco’s existing 4 stores in the state. Just like Cresco’s best-in-class Sunnyside operational efficiency, Cure enjoys revenues per store that outperforms Pennsylvania as a whole — this is a great match for Cresco’s model.

The company did not break down which portion of the deal will be funded by cash, shares or debt but does expect the transaction to close next quarter.

8. Ayr Wellness (AYRWF) — New Dispensary

Ayr opened its 41st dispensary in the state of Florida in West Pensacola (population 500,000). All of Ayr’s core brands will be available for sale here. With medical patients in Florida growing 47% year over year several years into its program, this expansion is very well placed.

Click here for my broad overview of Ayr Wellness.

9. Butterfly Networks (BFLY) — New Subscription Offering

Butterfly introduced a new Pro Custom membership for its IQ+ software. Now — regardless of if you’re a cardiologist, orthopedist or OB/GYN — a specialist will be able to hand-pick which pieces of Butterfly’s platform they actually need and want to purchase.

This new plan evolves Butterfly’s subscription offering from a one-size-fits-all approach to something that can optimize utility regardless of what ultrasound functions a professional uses. This should theoretically remove some buyer friction and raise sales conversion rates.

Click here for my broad overview of Butterfly Networks.

10. JFrog (FROG) — Department of Defense certification

JFrog’s Artifactory and Xray products have been accredited by Iron Bank for use within the Department of Defense’s (DoD) Platform One DevSecOps Software Initiative. Platform One is a network of trusted software providers to guarantee government entities have partners in their DevSecOps endeavors.

DevSecOps Definition = development, security and operations. The process marries and integrates security within software development and deployment.

Iron Bank serves as the DoD Centralized Artifacts Repository (DCAR) for binary containers and this program has Continuous Authority to Operate (cATO) which will quicken the time to deployment for JFrog’s clients. Now JFrog will be able to serve all of the public sector’s software packaging needs — from source code servicing to end point deployment.

“Knowing JFrog’s Platform is Iron Bank-certified makes it easy to recommend them for use by public and private organization that need software delivery solutions including security.” — Head of U.S. Commercial Unit at Oteemo Lou Doerr

Click here for my broad overview of JFrog.

jfrog news is great.