News of the Week (September 26-30)

CrowdStrike; The Trade Desk; Meta Platforms; Lululemon; Shopify; SoFi; PayPal; Nanox; Match Group; Macro; My Activity

Today's Newsletter is Brought to You By The Wolf Report:

For a Savvy Trader-powered view of my current portfolio, click here.

1. CrowdStrike (CRWD) -- Channel Checks

Morgan Stanley issued a research note this week on continued cybersecurity demand trends. Unsurprisingly, they, like everyone else, see continued robust security spend while other pieces of enterprise investment falter. Security is mission critical, Slack (for example) is not.

Interestingly, Morgan Stanley also sees agent consolidation as a clear theme in the space. This is advantage CrowdStrike considering its seamless ability to routinely consolidate 5-10 security agents across use cases like endpoint, cloud workload, log management, zero trust identity & more. Other beneficiaries will be Palo Alto and, to a lesser extent, Microsoft within the small-medium business segment predominately.

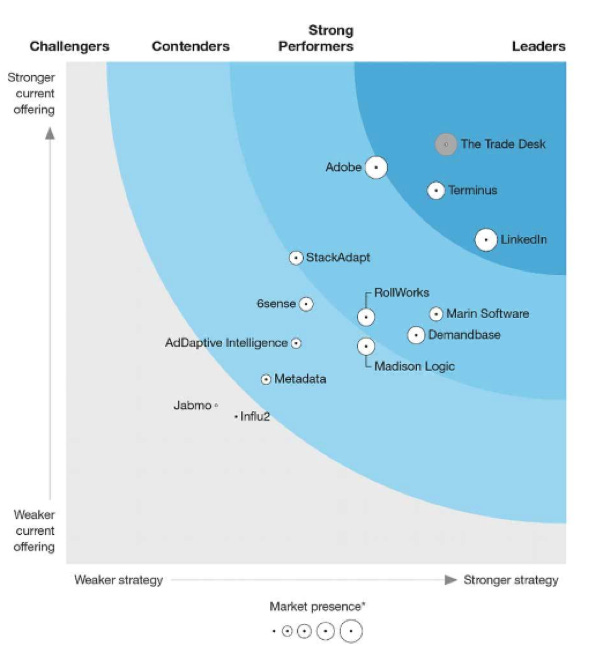

2. The Trade Desk (TTD) -- Forrester

Another week, another convincing accolade for The Trade Desk from an independent, 3rd party research organization. For the 3rd quarter of 2022, The Trade Desk ranked 1st out of 14 in both offering and go to market strategy for business to business (B2B) advertising. It’s far and away the leader in business to consumer (B2C) open internet advertising as well and it’s important to note that B2C is the core company focus here. It intentionally leaves low hanging B2B products to other partners in order to maintain close relationships and no conflicts of interest. This superior score is despite that. Encouragingly, some of the other top scorers like Terminus are fueled by an integration with The Trade Desk.

The report read like a sales pitch for The Trade Desk with language like “the company makes B2B advertising more scalable and targetable” and “it’s leading visionary initiatives to benefit B2B advertising.” Forrester also praised the company for its ability to integrate with agencies that serve demand of all sizes so that the smallest of businesses can access these lucrative tools. When you read through the rest of the company reports, Forrester was not NEARLY as complimentary.

“The Trade Desk is best for B2B advertisers and agencies with large audiences and sophisticated advertising needs.” -- Per the Forrester Report

Click here for my TTD Deep Dive.

If you're interested in entrepreneurship, franchises are a slept on path to own your own business. Everyone thinks of McDonald's when they hear the word franchise, but there's over 4,000+ franchises in the United States, and The Wolf is always breaking down the best ones. His work is perfectly complementary to mine -- and high quality.

He does the research to find brands that show a great return-on-investment, and also how you can become a big time franchise owner (seriously - he gives the playbook for how to be like this guy who owns 140 OrangeTheory franchises). If you want to learn about franchises from the expert - check out The Wolf Report!

3. Meta Platforms (META) -- Hiring & Product Announcements

a) Hiring

Meta is freezing all hiring and restructuring teams in its latest attempt to cut costs. In a Q&A with Meta team members, Zuck said this was to “make sure we’re not adding people to teams that we don’t expect to exist next year” and in light of a persistently poor macro backdrop to “plan conservatively.”

Meta remains in survival mode. The plethora of macro headwinds hitting the industry coincided perfectly with its bumpy monetization transition to Reels -- and its longevity has been questioned as a result. It still has half the planet using its products (Facebook users in North America are still growing), WhatsApp is still in the 1st inning of monetization, commerce is still exploding within the family of apps, and I still fully believe in a future where Metaverse use cases are a daily phenomenon.

Is owning Meta today more speculative than it has been since the IPO? Absolutely. Do I believe in Zuck to right the ship while taking advantage as temporary headwinds abate. Absolutely.

I’ll likely be adding to my position as any semblance of a base begins to form. While I could always be wrong, I wholeheartedly see this as easily a 10%+ revenue compounder going forward with eye-popping margins, a fortress balance sheet, significant optionality and a more than fair multiple.

b) Product Announcements

WhatsApp is debuting sharable links to enter a voice call with the tap of a button. It’s easy to see how this feature could be a relevant enterprise use case going forward.

Meta Platforms is actively testing toggling between Facebook and Instagram in a push to bolster interoperability between the two and to create stickier users.

Meta debuted a new AI algorithm to transform text prompts into video content. To the people who say AI will not turn this world on its head, I think you’re wrong.

4. Lululemon Athletica (LULU) -- Lululemon Studio & Nike

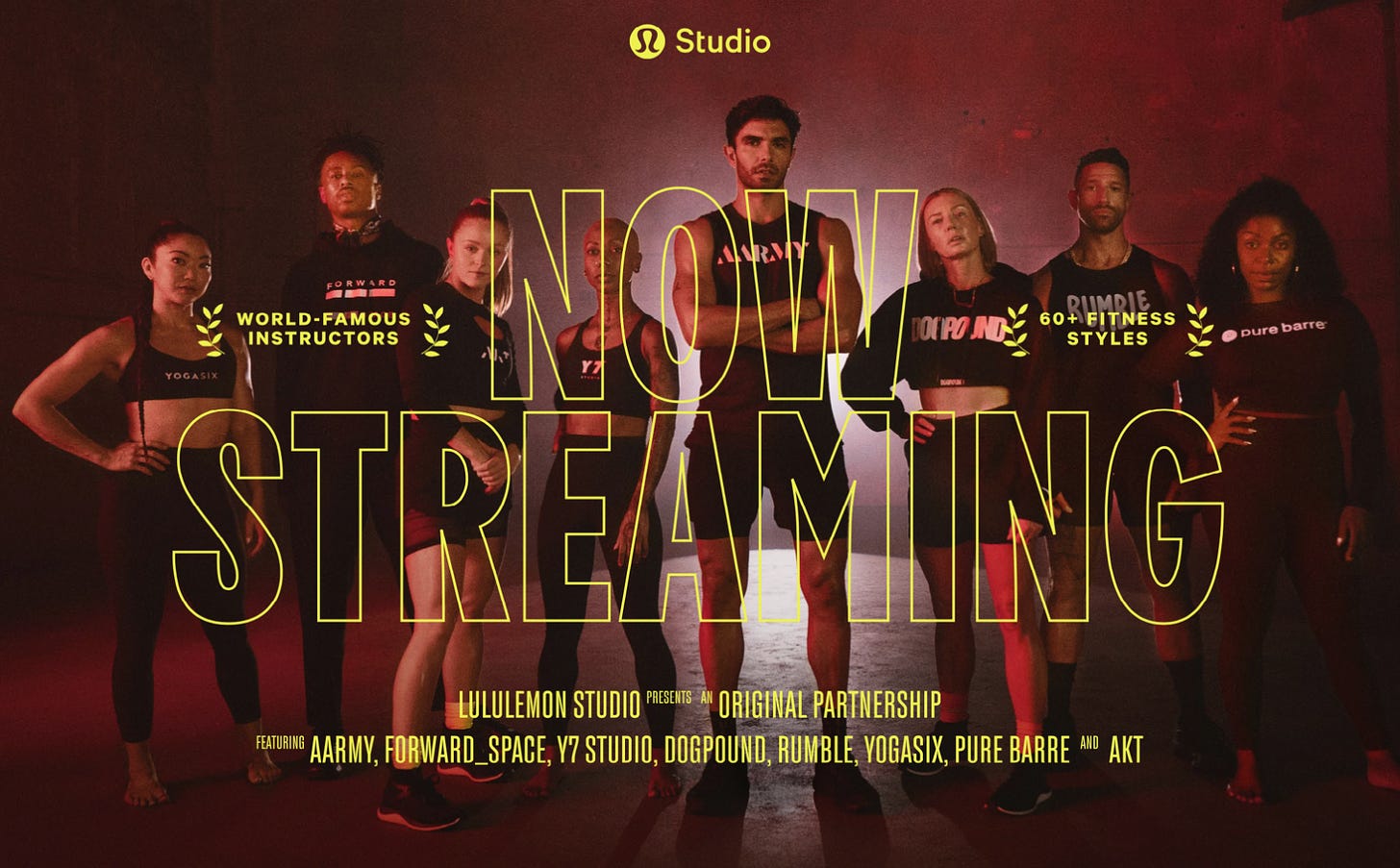

a) Lululemon Studio

The Athleisure behemoth announced Lululemon Studio this week which will debut October 5th. The membership will cost $39 per month and can only be purchased with the Mirror. The Studio will “connect members to the most dynamic fitness content, community and products.” It will offer the same at-home workout capabilities that made Peloton so popular over the years, but will also offer in-person studio workouts as well. This is sort of like a business model merger between Peloton and Soul Cycle -- without Lulu directly maintaining all of the real estate.

This launch stems from the principle that the more you can keep loyal shoppers in your ecosystem, the more (in general) they will spend and the less (in general) they will churn. This gives those shopper more opportunity to engage and spend.

The product will use and add to Mirror Studio’s 10,000 classes leveraging Lulu’s deep fitness and wellness partner relationships. Content partners to start will include Pure Barre, Rumble, YogaSix, AARMY and many more. At discounted prices, users will be able to access the content and buy Lulu gear if taking the classes in person.

Considering Lulu’s massive, passionate following in the Athleisure space, success here seems like a probable outcome. I still don’t like the Mirror purchase, but traction here could change my mind on that in a hurry. And conversely, I love the way Lulu is going about this omni-channel studio make-over: In an asset-light way that leans on already established infrastructure of what would have been entrenched competition.

“No longer will you have to choose between going to your favorite studio or streaming a class a home -- you can have both.” -- Lululemon Chief Brand Officer Nikki Neuburger

As part of this announcement, Lululemon is launching the Lululemon Essential Membership program. All existing North American guests will receive free access. This is essentially a loyalty program refresh with rewards and early product access to create more recurring, loyal revenue streams. This launch will be intimately intertwined with the Lululemon Studio membership as Studio includes all of the same perks as the Essential Membership with a few unique features (like another 10% off lulu purchases).

b) Nike’s Quarter

Nike is struggling with inventory gluts amid a weakening economy and will have to mark down apparel more aggressively to work through it. Margins and growth will be tough to find for this consumer discretionary icon in the near term. While Lulu shares fell on this news with all other retailers, I don’t see this as a relevant read-through to Lulu’s future results, and here is why:

Lulu’s management has a wonderful track record of effectively guiding through tumultuous times. It has already guided to a strong end to the year with zero plans to enhance discounting. It sees ZERO evidence of macro pressure hurting its customer while that’s largely what Nike is blaming. How could this be? It’s a combination of serving the slice of our world that is less sensitive to Macro pressure and the brand also firing on all cylinders. I think a rock star management team helps too -- but I’m clearly biased. Yes, Lulu’s inventory spiked last quarter, but it’s having no trouble moving the gear as it was a reaction to (NOT A FORECAST OF) demand and being under-inventoried last year.

Click here for my Lululemon Introduction.

5. Shopify (SHOP) -- Brick and Mortar

It’s no secret: Shopify and countless other e-commerce companies got too excited with pandemic trends and assumed them to be far more permanent than they turned out to be. Brick and mortar retail is instead back with a vengeance, growing 60% YoY over the first 6 months of 2022. So? Shopify is sinking more resources into carving out its brick and mortar niche. This week, the company announced its new point-of-sale (POS) hardware called Shopify POS Go to “power a new kind of retail.”

Rather than tell you how large of a hardware upgrade this is vs. the previous model, I think it’s better to just show you. Here’s a comparison with the old model on the left and the new on the right:

The hardware is no longer a standalone tablet, but instead a simple case-like attachment to a smartphone to make taking commerce on the go far more convenient. The new hardware comes with the same built in barcode, chip-reader, tap to pay capabilities and omni-channel inventory management that the old version showcased. It also seamlessly integrates into the Shopify admin dashboard so that any changes there are immediately reflected across all channels to unify business visibility.

But now -- with this new hardware -- merchants will also be able to accept transactions in any environment and collect, organize and leverage individual customer profiles to raise conversion with targeted deals and promotions. Furthermore, the new product frees merchants to build a cart for a shopper and email it to them to complete later on. To me, that seems like an immense value add considering this unlocks stationary POS systems to be used around store. It’s intuitive to think some merchants will transform brick and mortar centers into shopping consulting centers to feed digital sales -- but I’m speculating here. We’ll see.

Click here for my Shopify Introduction.

6. SoFi Technologies (SOFI) -- Galileo & SoFi Plus

a) Juniper Research

SoFi’s Galileo and Juniper (a 3rd party research organization) conducted an extensive study revealing rapidly growing demand for finance products embedded into enterprise tech stacks (“embedded finance”). This trend is helping financial institutions drive growth, retention and visibility of their businesses. As this is Galileo’s core-competency for clients (white labeled, integrated financial services), it is a clear sign that SoFi and Galileo are skating where the puck is going. And considering Technisys adds another layer of products to be embedded into existing infrastructure, there’s ample low hanging fruit here to be devoured.

The study surveyed 450 executives of various businesses in the U.S. and here were the highlights:

65% of respondents that are not using embedded finance solutions want to use them.

68% of respondents want to offer embedded finance services from a “non-bank provider.” This is why it was so important for Galileo to stay a stand-alone, independent organization.

While the majority of respondents used embedded finance, 78% of them use 2 or more disparate providers (enter Technisys and its multi-core, unifying banking platform).

“The market has evolved at lightning speed and this new research confirms that forward-thinking B2B executives are embracing embedded finance solutions as a key part of their strategies.” -- CRO of Galileo Seth McGuire

b) New Website

Galileo’s new website is beautiful. Candidly, SoFi’s website is not beautiful. Dear Galileo, please build SoFi a new website. I am confident that is in the plans.

c) SoFi Plus & an APY Boost

Why do I love Twitter? Because the slightest of developments on any of my holdings are posted in real time. This week, that golden nugget was SoFi’s planned “SoFi Plus” subscription seemingly going live on the app. The program comes with SoFi’s newly announced 2.5% APY of checking/savings accounts, but offers larger card rewards, loan discounts and preferred IPO access among other things. This is SoFi’s attempt to create a more visible and recurring book of business, and I wholeheartedly support it. Let’s see how the launch does and what management has to say about it on the next call.

Speaking of the 2.5% APY news, some have rightfully asked about the impact this will have on SoFi Bank’s net interest margin (NIM). To that I would say: SoFi is 50 basis points more profitable with a 2.5% yield and a banking charter vs. its pre-charter yield when it was using warehouse facilities to fund loans. Furthermore, in SoFi Bank’s first quarter of operations, it generated significant GAAP net income. Unit economics there are strong and this is a necessary cost to bolster top of funnel growth and feed the rest of the business.

d) Student Loans

The Federal Government is blocking 770,000 thought-to-be eligible borrowers from student loan forgiveness. Now, if loans are not directly held with the Department of Education, those borrowers cannot have their debt forgiven.

So what does this mean for SoFi? Its Student Loan business relies on expensive Federal Loans being originated and serviced to motivate people to refinance to lower rates as their credit improves. If payments aren’t happening, that motivation vanishes.

This means the end of the moratorium really is by far the biggest piece of this segment’s recovery. But still, this does add another group of borrowers who now feasibly will be motivated to refinance.

Starting this month, I’ll be offering 1 on 1 Zoom calls to chat through whichever topic you’d like.

We can dig through risks and prospects for individual firms/sectors, dive into the macroeconomic picture and how it’s developing, talk about overall process etc. The sign-up sheet will go live soon to reserve 15+ minute chunks of time and I’m excited to speak with you all. While all written content will remain 100% free to read, this will be a paid feature.

7. PayPal Holdings (PYPL) -- Amazon and Margins

Canaccord came out with an interesting note about Venmo Checkout on Amazon being a margin tailwind for PayPal. I agree, but there was not much reasoning offered. I wanted to add context about that and PayPal’s margin profile going forward more broadly. Venmo first:

Venmo was born as a peer to peer payments system. It built a U.S. only user base of over 80 million through the wonderfully organic word of mouth growth that Venmo’s virality facilitated. But P2P comes with putrid margins. Non-instant transfers are free of charge and instant transfers fetch a take rate that should shrink over time with free P2P payment rails being stood up by the Federal Reserve. The good news? This has been the base case for years, and PayPal has calculatedly accepted poor Venmo margins to fuel the top of funnel. P2P will not be the driver of Venmo’s demand and profit growth in future years… and PayPal is fully aware of that.

That philosophy of top-of-funnel focus has begun to change with higher margin products like Venmo Business Profiles quickly growing as a piece of the pie. PayPal fully expects commerce to be Venmo’s future -- not P2P. And there’s no other company on this planet more capable of supporting that commerce ambition than Amazon: Venmo Checkout on Amazon is going live this year should be a wonderful growth AND margin driver.

If PayPal is right about commerce being the future, that will mean continued operating leverage for Venmo on its own. Considering it just achieved operating profit breakeven this past year, progress seems to be strong.

Moving past Venmo, investors also readily point out Braintree and Bill Pay’s lower take rates as reason to be concerned with margin maintenance. It’s important to note that the lower take rate DOES NOT MEAN lower margins. Operating costs for those products vs. things like branded checkout are much lower and PayPal expects operating leverage for those segments going forward via economies of scale. Finally, the eBay migration and credit reserve margin headwinds are now both behind us.

I say all of this to argue that PayPal’s margins have bottomed out. We’ve seen consistent pressure on its unit economics since the peak of the pandemic. I expect that to end in the coming quarters (and so does the company).

Click here for my PayPal Deep Dive.

8. Nano-X Imaging (NNOX) -- FDA Submission

After months of “it’s coming soon,” Nanox’s multi-source 510(K) application for the commercial X-ray machine has FINALLY been submitted to the FDA. I’m actually cautiously optimistic about this application being cleared. Why? The company has been in direct communication with the FDA all year via what’s called a pre-submission (AKA “Q-sub”) process. This allowed Nanox to receive consistent feedback on any future application shortcomings to address before finally submitting. So this should be a strong application -- but we’ll have to see.

If this company can ever get to scaled distribution, its Arc contracts worth roughly $500 million in annualized revenue paired with the X-ray tube/chip licensing business should provide nice shareholder upside. The issue? The probability of that successfully playing out is candidly somewhat low. So? It remains a tiny position (my smallest) for me today.

We should hear back from the FDA on the application within the next 6 months.

9. Match Group (MTCH) -- Leadership

Match Group named Linda Kim as the newest COO of its Korean Hyperconnect brand. Since acquiring Hyperconnect, issues ranging from its ability to evolve with Apple’s tracking changes, macro headwinds and poor execution have all weighed on its results. Hopefully Kim can help turn things around.

Prior to joining Match, Kim was the COO of Lady Gaga’s personal brand, a VP at The Honest Company and a manager at Apple and Nokia. She also worked as a Senior Director of Operations at Zynga where Bernard Kim (Match CEO) was CEO.

Click here for my Match Group Introduction.

10. Macro

In a year where macro headlines have been wildly volatile, this week may have taken first prize in the 2022 crazy contest.

a) Inflation News:

The Core Personal Consumption Expenditure Price Index (PCE) rose 0.6% month over month vs. 0.5% expected and 0.1% last month..

The PCE overall (including food and energy) rose 0.3% month over month.

Two major European gas pipelines were attacked and severely damaged this past week. That will take years to repair. A former European politician took to Twitter to blame the USA for this attack. That was incredibly irresponsible and inaccurate. (Come on, man).

When pairing this with China’s coming re-opening and the U.S.’s upcoming cessation of the strategic petroleum reserve outflows, renewed energy inflation could unfortunately become a more pressing issue regardless of economic weakness.

The UK’s bond and currency markets entered full panic mode this week with price charts that resemble a speculative growth stock after a disappointing earnings report. In response, The UK renewed quantitative easing despite its currently sky-high inflation data.

This should (all else equal) place added upward pressure on the U.S. dollar, unfortunately.

Mortgage rates continue to soar to multi-decade highs. While this has eroded home buying demand (deflationary), it offers another inflationary headache in the form of rising demand for rentals pushing prices there much higher.

Rent is among the stickiest pieces of inflationary data and makes up around 1/3 of the infamous consumer price index (CPI).

The Bloomberg Commodity Index is at year to date lows and racing closer to 52 week lows. This offers a great proxy for volatile pieces of inflationary readings and continues to look better.

We’ll see what increasing energy demand does to that trend.

“I’ve never seen freight rates drop as fast as they are on the ocean market right now.” -- CEO of FreightWaves Craig Fuller

b) Economic Data:

Chicago’s PMI sharply missed expectations of 51.8 with a 45.7 reading -- marking sharp contraction in the wake of expansionary forecasts. That’s a directly forward looking data point. Yikes.

Conversely, Core Durable Goods Orders rose 0.2% month over month -- in line with expectations and a solid leading indicator of future economic activity. Durable goods slightly beat expectations.

Michigan Consumer Sentiment also missed expectations at 58.6 vs. 59.5 expected.

Conference Board (CB) Consumer Confidence for September beat expectations at 108.0 vs. 104.5 expected and 103.6 last month. Consumers may be racking up more credit card debt (a lot more), but their confidence is interestingly growing. The same can be seen in the University of Michigan’s confidence readings.

New Home Sales shattered expectations at 685,000 for August vs. 500,000 expected. We’ll see how that continues to hold up as mortgage rates set fresh highs. Pending home sales conversely disappointed at -2.0% vs. -1.4% expected.

Initial jobless claims sharply beat expectations at 193,000 vs. 215,000 forecasted and 209,000 last month. While there are certainly nicks forming, the labor market remains strong in aggregate.

Q2 GDP fell 0.6% sequentially which was in line with expectation.

The Atlanta Fed GDPNow estimate spiked above 2% this past week. That’s certainly an outlier vs. the rest of the data discussed.

c) Company-Specific Data

Apple is reversing previous efforts to raise iPhone supply in light of abruptly worsening demand. Clearly, economic cracks have formed and begun to deepen.

Nike is struggling with gluts and won’t offer guidance. As the economy weakens, it now thinks it got too aggressive with inventory and expects to have to discount more deeply to work its way through it. This is an eerily similar issue as Target is dealing with among others.

Goldman Sachs is firing team members in light of a weak deal market.

5-Year Breakeven Inflation expectations continue to race to 2% despite some poor inflationary data these past several months. This is very positive and very important… well-anchored long term inflation expectations are a pre-requisite for any hawkish pause:

The U.S. Dollar vs. the British Pound (yikes):

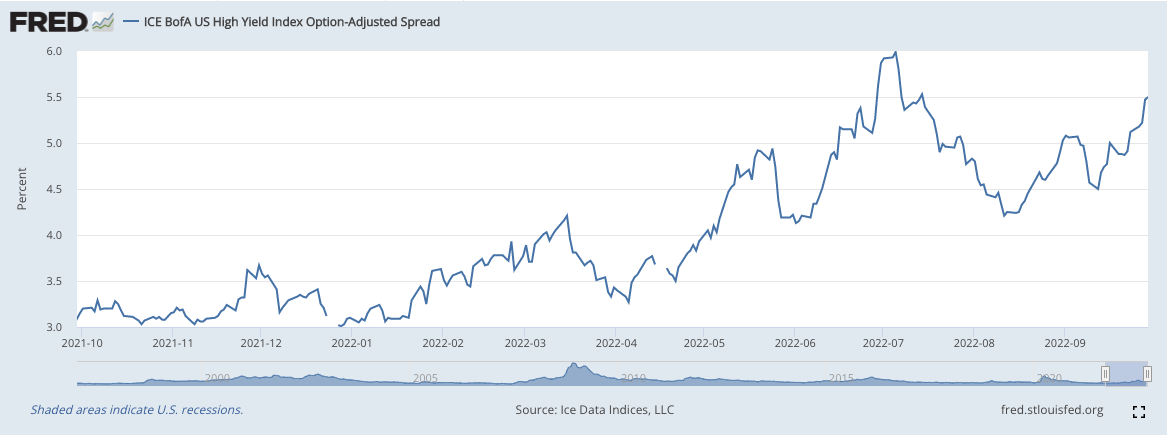

High Yield Corporate Credit Spreads are looking worse and worse as the economy becomes less liquid and more fragile:

d) Level-Setting the Crazy Week:

Here’s where I see things: Inflationary readings are far too hot for the Fed to pivot or even pause in the near term. When pairing that with still strong initial jobless claims (despite things like rising multiple job rates) and surprisingly durable consumer confidence, the Fed has permission to wholeheartedly focus on taming inflation -- for now. And it has done that quite consistently this year. So? Rates are going to keep moving higher, the balance sheet is going to keep shrinking and I think you’d be hard-pressed to find anyone that sees things differently near term.

It’s vital to keep in mind that the Fed is almost always late in terms of conducting monetary policy. It’s tightening into what is clearly a weakening economy when looking at company announcements and overall data. At some point, that tightening will likely break what continues to become a more fragile backdrop -- and at that point the Fed will pause and eventually turn dovish once more.

The less sticky pieces of inflation are rapidly working their way out of our system, long term inflation expectations are re-anchoring, supply chain backlogs have eased, previous rate hikes are beginning to take effect (there’s a ~6 month delay there) and markets continue to assume a pause to hikes at some point next year. Fed Member Mester can say they won’t cut in 2023 all she wants to, but these were the same people telling us there were absolutely no hikes coming until 2024. If they’re data dependent like they say they are, they don’t know. It’s just jawboning.

When taking this all into account, I still think the macro picture will look much brighter as we enter the New Year. That hasn’t changed. Still, I’ll continue to wait for macro trends to show more consistent improvement before I act on that opinion via accumulation. Poor data could absolutely delay this flexible cash deployment schedule. There has been some subtle progress… I need to see more.

11. My Activity

I added to SoFi, PayPal, Shopify and Lululemon this week. They were all small adds (in aggregate far smaller than last week’s cash infusion) as I remain skewed to cash preservation mode. My cash position sits at 18.4% of holdings.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that the MSOS position is a placeholder for my positions in Green Thumb and Cresco Labs while OTC stocks are added to the platform. You can also re-create your very own portfolio through Savvy Trader here.

The demand or interest in embedded financial services / solutions is intriguing. The 450 executives that were surveyed...did they belong to a particular industry vertical? Thanks