News of the Week (April 11-15)

CrowdStrike; Teladoc Health; The Trade Desk; Meta Platforms; PayPay Holdings; SoFi Technologies; Progyny; Match Group; The Boeing Company; CPI; Cannabis News; My Activity

1. CrowdStrike (CRWD) -- Germany, Culture & a Case Study

a) Germany

In another public sector win for CrowdStrike, the company was added to Germany's "Federal Office for Information Security list of qualified response service providers.” This list serves as a curated menu of options for government agencies and the private sector to select heavily vetted security vendors to meet their growing needs. CrowdStrike was able to seamlessly pass an intense, 2-part exam where its technology was tested for compliance and efficacy. I looked into the most recent version of this list and Palo Alto -- a formidable incident response and endpoint protection competitor -- was not on it. SentinelOne isn’t either but they don’t do much in incident response.

Goldman Sachs also issued an upbeat note on CrowdStrike. I don’t really care about price target changes, but I do care about is the institution’s ability to have its finger on the pulse of enterprise-level spend which drives CrowdStrike’s growth. Goldman's findings aren’t surprising but are still encouraging as a reiteration of our current climate: Exploding demand for cybersecurity will continue to be a tide lifting all boats.

b) Culture

CrowdStrike also made Fortune’s list of the 100 Best Companies to work for the second straight year. The three most formidable endpoint and cloud workload protection competitors for CrowdStrike -- I believe -- are Microsoft, Palo Alto and SentinelOne. None of those three made the list. In a world of pressing talent shortages, especially within this space, these small pieces of evidence are good signs pointing to CrowdStrike’s ability to effectively compete for new hires.

c) Case Study

CrowdStrike released a new case study on its success with the century+ old company: Heidelberger Druckmaschinen (a German engineering bellwether with 11,500 employees). The firm beta-tested CrowdStrike’s Falcon platform with just 200 users as Heidelberger was skeptical that the promised scalability and visibility would lead to an inundation of false positives like with other next-gen security alternatives it had tried.

According to the prospective client's Chief Information Security Office (CISO) Dr. Andre Loske, “there were no problems.” CrowdStrike freed this global firm to achieve far better endpoint protection with far less time, energy and resources needed to do so. The German firm has a very small team of security professionals, so CrowdStrike’s asset-light pairing of autonomous & cloud native protection with a managed, human element (when needed) stood out.

“We had a traditional antivirus solution but this led to a real lack of visibility for recognizing threats and reacting in time. We researched many solutions and went with CrowdStrike despite it being in the upper price range as it provides real added value. The integration worked surprisingly well… with Falcon, we have truly achieved a paradigm shift.” — Heidelberger Druckmaschinen CISO Dr. Andre Loske

2. Teladoc Health (TDOC) -- Livongo and India

a) Livongo

Piper Sandler channel checks prompted the institution to raise its Q1 2022 estimates for total Livongo app downloads (owned by Teladoc). This metric rose over 50% sequentially from Q4 to Q1 which represents the service’s best sequential Q4 to Q1 growth since at least 2018. Furthermore, daily downloads consistently ramped higher throughout the entire first three months of the year. These are great signs which should lead to outperforming access fee revenue -- its largest segment by far.

While the last year of owning this name has been brutal from a stock perspective, I continue to see consistent evidence of the company fundamentally executing. As one of the largest pandemic beneficiaries out there, it still expects AT LEAST 25% annual growth for the next three years and its EBITDA margin continues to greatly expand with more cross-selling and economies of scale. Other large Covid-19 beneficiaries have guided to far less impressive forward growth as their own demand fades. The narrative surrounding Teladoc of it being incapable of turning a profit is also just not accurate. Without M&A charges which will end in the 4th quarter of this year, it would already be generating positive net income.

b) India

India launched its first ever telemedicine center “based entirely on Teladoc’s technology.” This center greatly expands a physician’s ability to provide out-patient service in a virtual setting to India’s gigantic population. The center will also make collaboration with doctors in other nations far more seamless while greatly expanding access to medical services for people in India. Telehealth’s ability to free doctors to do “more with less” is especially vital in a world featuring pressing doctor shortages.

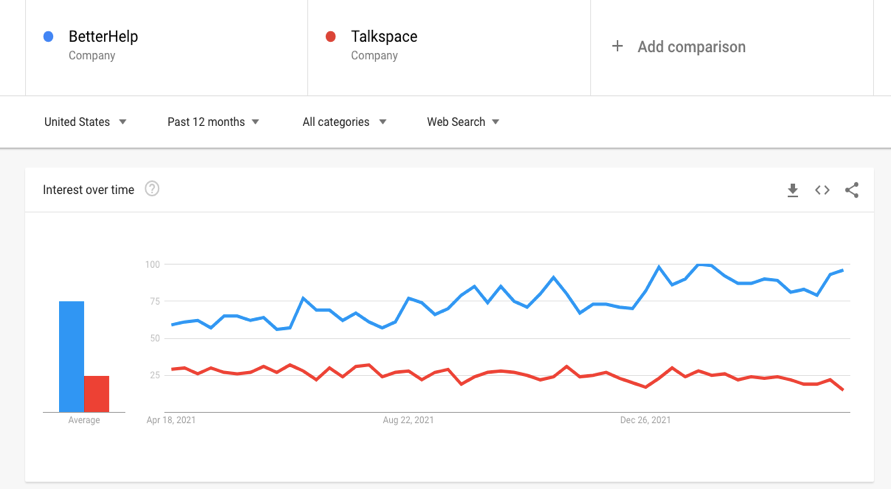

c) BetterHelp

Twitter conversations this week inspired me to check on BetterHelp’s (Teladoc’s B2C mental health product) traffic trends. They were strong. Per Data.Ai, BetterHelp has steadily climbed from the 79th overall Health and Fitness App in the USA to 46th -- in just 90 days! It’s now a top-100 app in 14 nations across the globe vs. 10 earlier in the year. Google Trends data is just as notably strong (TalkSpace is the most formidable & direct competitor):

3. The Trade Desk (TTD) -- Solimar Tailwinds & Proxy Statement

a) Solimar Tailwinds

Solimar -- The Trade Desk’s new ad platform -- paved the way for the company to build dedicated ad-platforms for giant retailers like Walmart and Home Depot. These behemoths revere Solimar as it provides them with a far more effective and lucrative means to use, contextualize and eventually profit from their 1st and 3rd party retail sales data.

The enhanced utility appears to be in high demand as research out of Ad-Week indicates that marketers will seek to use this retail sales data at nearly triple the rate in 2022 vs. 2021. Not only does this make The Trade Desk’s service even more valuable for established retail brand clients to extract value from their data, but it motivates more retailers to sign on. According to Co-Founder/CEO Jeff Green from an earnings call in 2021, the organization was working on arrangements with “dozens” of other large retailers which are the companies that "investors would expect The Trade Desk to be working with." We should learn a lot more about that this year.

Click here for my TTD Deep Dive.

b) Proxy Statement

Highlights from The Trade Desk’s newly released proxy statement:

Jeff Green’s total compensation in 2021 was a whopping $828 million as he received a handsome options package for clearing large performance benchmarks.

Other executives also got nearly $45 million in bonuses for clearing these benchmarks.

Baillie Gifford owns 12.1% of The Trade Desk's class A shares vs. 6.8% YoY and now controls 6% of its voting power vs. 4.3% YoY.

Morgan Stanley showed up as a 5%+ shareholder for the first time with 6.4% of The Trade Desk's class A shares and 3.2% of the voting power.

Prudential is no longer on that 5%+ list.

Vanguard grew its stake from 8.9% to 9.0% YoY.

Jeff Green owns 97.7% of the class B shares vs. 97.9% YoY and now owns 1.1% of class A shares vs. close to 0% YoY (equity awards).

He has 49.3% of all voting power vs. 50.6% YoY.

Co-Founder/CTO Dave Pickles continues to hold 2.8% of all voting power.

All executives and directors own 51.5% of the company's voting power vs. 52.7% YoY.

4. Meta Platforms (FB) -- India, Beta-Testing, WhatsApp Upgrade & Channel Checks

a) India

The National Payments Corporation of India raised its user cap on WhatsApp’s Unified Payments Interface (UPI) from 40 million to 100 million just months after raising it from 20 million to 40 million. This will allow Meta to greatly expand its peer-to-peer and peer-to-merchant money transfers in that quickly growing, quickly digitizing nation.

b) Metaverse Beta-Testing

Meta is beta-testing new tools with some of its creators to help them more seamlessly monetize their virtual products and services. The product launches are mostly surrounding in-world commerce and include:

A more defined, accessible process via a “commerce tab” for selling items and “effects” in the worlds that creators build -- Facebook will take up to 47.5% as a commission on these transitions. Not a typo. Wow.

A new Horizon Worlds “Creator Bonus program” in the U.S. with monthly, commission-less payments based on usage goals.

New tools to help creators build new worlds.

New templates to build off of its popular Arena Clash game.

A new analytics platform for creators to gauge engagement and growth.

Meta is also setting up large funds to subsidize and compensate creators and to motivate them to build worlds within Horizon’s ecosystem. Zuckerberg hosted an event with three popular creators which functioned as a means for them to tell him how the service can improve. Creators will be a core part of building out this new endeavor -- and rightfully so as Horizon's success will rely on their participation.

c) New WhatsApp Features

WhatsApp is testing a new tool that allows for the creation of larger groups to cater to schools and big companies. The current group cap of 256 people will be raised to the “thousands” to make things like email blasts a far simpler process. This is somewhat of a competitor to Slack and Teams but doesn’t offer nearly the same range of service (yet). It will likely be free of charge. WhatsApp also debuted a new tool allowing group leaders to unilaterally delete abusive messages and raised the voice call cap to 32 people.

d) Channel Checks

Advertising activity from this past quarter hints at Facebook reporting underwhelming results later in the month. We already knew this as the company has been preparing us for a rocky first 6 months of 2022 for the last several quarters. In my view, we will lap tough Apple privacy-changes, e-commerce growth will recover, Reels ad-loads and efficacy will grow, on-site monetization and targeting will ramp and I believe the idea that Meta is “dead” will, over time, disappear.

5. PayPal Holdings (PYPL) -- Leadership Shake-Up & Case Studies

a) PayPal CFO John Rainey Exit

After 7 years of serving as CFO at PayPal, John Rainey is leaving to become CFO at Walmart. PayPal’s SVP of Corporate Finance and Investor Relations -- Gabrielle Rabinovitch -- will serve as the interim CFO while PayPal searches for a new candidate to fill the void. A key executive leaving is clearly not a positive, but I wanted to add a few notes as to why I’m not concerned about this:

Walmart is an iconic, $460 billion company. If PayPal is a borderline blue chip firm, Walmart is a blue chip on steroids. This is clear promotion for Rainey.

Rainey was the driving force behind the long-term guidance PayPal offered at its last investor day. The company has since had to greatly tone-down those forecasts while the stock has been absolutely punished for doing so.

Rainey played a key role in orchestrating the TIO Networks acquisition in 2017 which PayPal had to soon after shut down due to data privacy issues.

My point? Rainey was far from a superstar for PayPal. While I wish him the best of luck in his new role, I’m even more excited to see who PayPal picks to replace him. I think the new hire has a great chance to turn out to be an upgrade.

“I am leaving knowing PayPal is well-positioned for the future.” — Outgoing PayPal CFO John Rainey

b) New Case Studies

In the wildly competitive field that is financial services, merchant and consumer vendors (PayPal is both) must stand out by providing incremental utility on comparable products. The following two new case studies offer small pieces of evidence pointing to PayPal being able to do just that:

Pressed -- a maker of plant-based foods and drinks went with PayPal's Commerce Platform and Braintree

Digital sales as a percentage of revenue rose from 2% pre-pandemic to 65% (and rising) in large part thanks to PayPal’s channel and funding source flexibilities.

It used Braintree’s (PayPal’s payment processing specialist) credit card vaulting capabilities to lower friction and raise conversion. Specifically, conversion rate spiked by 69% immediately after implementing Braintree’s software.

After 1 week of on-boarding PayPal’s merchant commerce and payment platforms, 50% of Pressed transactions were via PayPal or Venmo.

Average Order Value (AOV) is 40% higher with PayPal’s internal options like Venmo used for funding vs. traditional cards and 2% higher than Apple Pay. Venmo reached Apple Pay volume one week after Pressed added it as an option.

Younique -- a digital sales company dedicated to empowering female entrepreneurship on-boarded PayPal’s Pay in 4 (BNPL) Option

The integration prompted an immediate 209% spike to its overall BNPL transactions with 56% of Younique’s BNPL checkout now via PayPal.

It also yielded a positive impact on order values and conversions via PayPal’s upstream presentment product.

Presentment results “exceeded all of Younique’s expectations.”

Younique is so excited about PayPal’s contribution that it “wants to let the field know about this option and why it is such an important tool for engagement, volume, AOV and flexibility.”

When you delight the customer, that customer often feels inspired to go organically market your platform via word-of-mouth. This is that in action for PayPal.

“We looked at other subscription providers and Braintree helped simplify the process without adding customer friction… We had huge problems with our existing processor. Braintree was one of the best decisions we’ve made… everything from PayPal is easy to implement thanks to their developer mindset. I no longer need to worry about the future of payments thanks to this partnership.” — Pressed VP of Digital Commerce and Technology Blaine LaBron

“With PayPal, we feel like we hit the jackpot. We launched Pay in 4 just nine months ago and have already seen massive results…. compared to other payment-related options, implementing this was the easiest.” — Younique Director of Finance David J. Serpa

My PayPal Deep Dive will likely be published early next month!

6. SoFi Technologies (SOFI) -- Technisys

SoFi’s newly acquired Technisys signed a new deal to provide its digital multi-core banking platform to "Crediclub." This new customer -- which specializes in micro-financing and investment products -- is a small win for the SoFi team as it does less than $100 million in annual revenue. Still, it serves as evidence for the synergies generated via the Technisys acquisition as this is a player in the Mexican FinTech market where Galileo has a strong foothold. Considering that new research out of HTF Market Intelligence forecasted a 53% global digital banking CAGR through 2028, international momentum will likely be a lucrative revenue driver for SoFi.

“For us, the merger of Technisys with SoFi and Galileo was important and impactful." — Crediclub Co-Founder Juan Francisco Fernandez

7. Progyny (PGNY) -- Fertility Rates

U.S. fertility rates continue to decline with the nation’s population growing at the slowest pace ever in 2021 after it set a new record in that category for 2020. While this could be a potential concern for a fertility benefits firm like Progyny, it’s actually quite the opposite when we dive deeper. Fortunately, the decline in birth rate is being driven by a sharp drop in teen births due to things like better access to contraception and also improving career opportunities for females.

The result of this shift has been delaying family building for longer than our population ever has. This is why birth rates for women over 35 years old are actually rising. For Progyny, this inherently lends itself to more demand for its services as fertility declines with age. So this is actually a tailwind. With just 2% of pregnancies in the U.S. via Assisted Reproductive Treatment (ART) cycles vs. 10% in other developed nations, there’s a long runway for Progyny to tap into. Its dominant market share and growing clinical outcome leads make me confident it will be able to take advantage.

Click here for my Progyny Deep Dive.

8. Match Group (MTCH) -- My Interview with 7Investing

This week, I sat down with my friends at 7Investing to lay out exactly why I own Match Group. We covered a broad range of topics related to the company’s bull case and had a ton of fun (I know I’m a nerd) in doing so. The link to the video can be found here.

9. The Boeing Company (BA) -- Various News

India banned nearly 100 pilots from flying 737 MAX jets until they complete adequate re-training.

141 of Boeing’s jet orders are no longer expected to be delivered due to the war in Ukraine. It delivered 41 jets vs. 29 YoY in March including 34 MAX jets. Boeing added 38 net new plane orders in March.

The company’s order backlog sits at 4,231 planes.

10. A Note on the Elevated Consumer Price Index (CPI)

The CPI came in at the highest level in decades (8.4%) and I wanted to highlight a few notes to add context:

The March reading includes the vast ramp up in oil pricing due to geopolitical tension outbreaks. That ramp has since moderated.

Supply chains continue to show signs of recovery and normalization as things like freight availability and inventory levels rise.

Starting this month, YoY inflation comps become much “tougher” (or more apples to apples/normal) as we begin to lap wildly strange pandemic-era comps.

That was the peak, in my view, especially considering the price give-backs we’ve seen across many commodities (not just oil). I could always be wrong.

The long term viability of an investment case will be based on the pace and durability of sales and free cash flow compounding, not monetary cycles.

I’ll continue to focus predominately on micro (company-specific performance) while using macro headlines to slowly add into fear and multiple compression.

11. Cannabis News

a) Company Specific

Green Thumb opened a new RISE Dispensary in Minnesota which is perhaps the most underserved, regulated market in the nation.

It now has 6 stores in the state, but this is its first in Southern Minnesota.

Cresco Labs launched its popular FloraCal Farms brand in Illinois.

b) Industry Specific -- Mainly per Marijuana Moment

Senate Majority Leader Chuck Schumer delayed his plans for a broad-reaching cannabis bill set to be released this month to August. The left wing ran in 2020 using cannabis reform as a key differentiator and vote-getter. They’ve since done absolutely nothing pertaining to reform and they’re running out of time before midterms.

Hopefully that winding clock will put pressure on our politicians to finally get something done. Most democrats (and a large chunk of republicans) consider it a real priority for their representatives to pass cannabis reform. Until then, the biggest and strongest cannabis companies will simply get bigger and stronger with this restrictive regulatory moat in place.

There’s some optimism that cannabis banking could be receiving some much needed momentum as well with dealmakers now in place to negotiate.

There was even some bi-partisan movement surrounding cannabis reform that would mirror alcohol rules -- which would likely mean lower taxes than some of the other proposals out there.

Research from Emerson College and other partners revealed that 68% of North Carolina voters support medical cannabis. North Carolina lawmakers continue to struggle to pass any kind of meaningful reform while their voters overwhelmingly support said reform.

New Jersey recreational cannabis sales will begin this month!

58% of voters in the deeply conservative state of Louisiana support an end to cannabis prohibition per a study out of the University of New Orleans. This is vs. 36% just 3 years ago!

New York approved 52 recreational cannabis licenses in preparation for legal cannabis sales beginning in the state this year.

Pennsylvania passed their own version of a cannabis banking bill allowing for ordinary business expenses to be deducted from state (not federal) tax bills. New York is working on similar legislation.

55% of Europeans across countries including Italy and Spain support legal cannabis.

Colorado cannabis sales continue to fall in 2022 as the state distances itself from the large boost that stimulus checks offered and as that market continues to mature.

Kentucky’s Governor would consider executive action if his fellow lawmakers cannot pass cannabis reform.

Click here for my broad overview of American Cannabis Regulation.

12. My Activity

My cash position is roughly 10.0% of holdings after I added to the following names during the week:

Upstart

GoodRx

Duolingo

Match Group

Progyny

I am anticipating a handful of material cash deposits into my account throughout 2022. I will allow those infusions to sit in cash unless the position builds up beyond where I want it. At that point I would do some version of dollar cost averaging .