Today's Piece is Presented by Commonstock:

1. The Trade Desk (TTD) -- Netflix

Since Netflix’s inception and its wildly successful journey as an entertainment disruptor, it had been entirely opposed to selling advertisements. The company thought it would cloud the high quality nature of the platform -- but that no longer seems to be the case.

Perhaps in light of subscription growth challenges, Co-CEO Reed Hastings explicitly said on the company's earnings call this week that Netflix would launch lower-priced and ad-supported products in the next 2 years. Furthermore -- in perhaps the most ideal news possible for The Trade Desk -- Hastings said that Netflix would continue to wholeheartedly focus on being the publisher and have “other people do all the fancy ad-matching.” This means Netflix will readily tap into the expertise of the programmatic advertising world rather than trying to build it all internally on their own.

“Those of you who have followed Netflix know I’ve been against the complexity of advertising and a fan of subscription simplicity. As much as I’m a fan of that, I’m a bigger fan of consumer choice.” — Netflix Co-Founder/Chairman/Co-CEO Reed Hastings

Why does this matter? Connected TV (CTV) supply is more data driven and so generally more accurate and lucrative than other channels of marketing like linear TV. With Netflix’s 6%+ share of streaming hours, this means there will be more of this data-driven supply to be auctioned to advertisers and agencies which work with The Trade Desk at a far more frequent clip than any other player in the open internet category. All of this new supply will find demand and The Trade Desk will play a large role in connected impressions to buyers based on Hastings comments of not wanting Netflix to be responsible for doing so.

Not only will this be a demand tailwind for The Trade Desk, but one that occurs in a targeting environment that cannot be hurt by Apple’s ATT/IDFA changes or by Google’s removal of 3rd party cookies. So with the news, The Trade Desk should enjoy a top line tailwind and even less reliance on walled garden giants.

Fun fact: The Trade Desk’s co-Founder/CEO Jeff Green predicted this would happen 4 years ago.

Click here for my TTD Deep Dive.

2. Upstart (UPST) -- Berkshire Hills Bancorp & Bloomberg Loan Data

a) Berkshire Hills

An analyst downgraded Berkshire Hills Bancorp this week citing the company’s usage of Upstart as a source of loan volume. In response, the bank (thank you to their team) published data on how its Upstart loans were actually performing. Berkshire Hills is collecting an average loan yield of 11.5% with a 5% annual net charge-off rate from Upstart-sourced loans -- meaning there’s plenty of room for adequate cash flowing.

Additionally, it stated that “while the program is relatively new, annual net charge-off rates are well below model expectations.” This is a very positive piece of news. The bank also expects the proportion of its loan book via fintech partners (mainly Upstart) to triple from 1% to 3% this year. This serves as an encouraging hint at the growing willingness of bank partners to retain loans and grow their business with Upstart.

b) Bloomberg Data

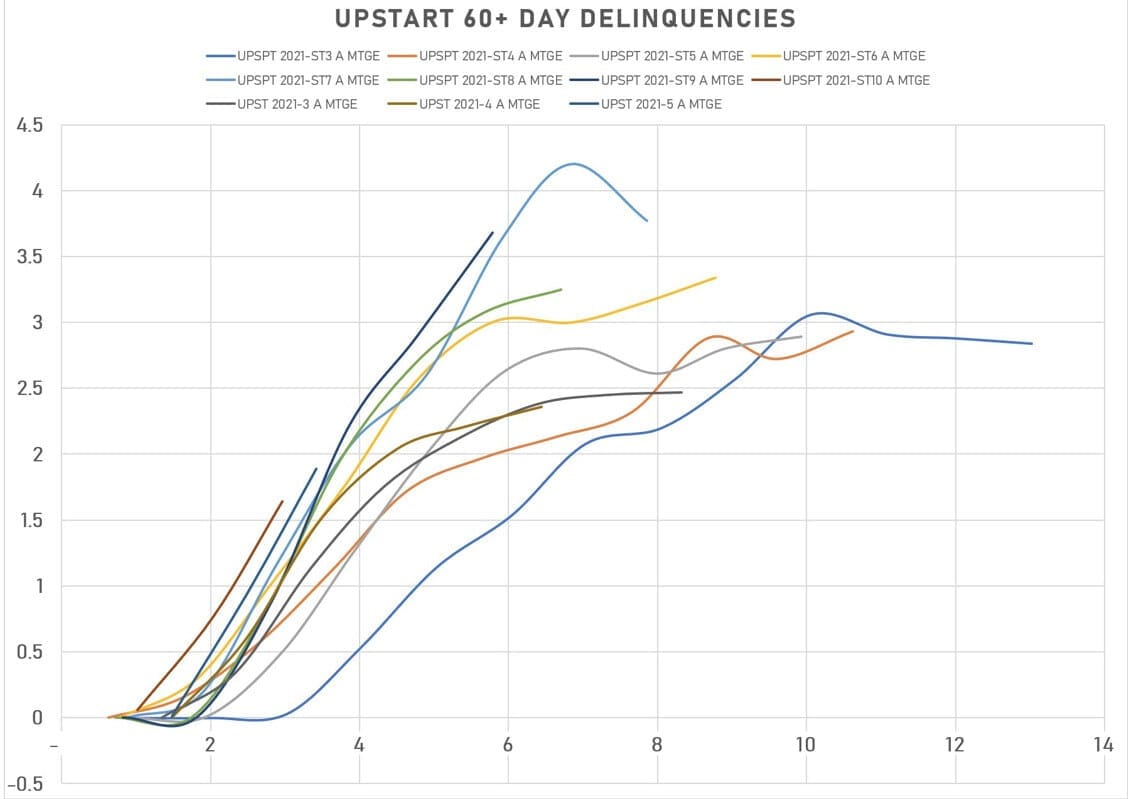

Concerns have risen surrounding rising delinquency rates associated with Upstart’s loan pools sold through capital markets. My friend -- Marcelo Lima -- was kind enough to share updated Bloomberg delinquency data with me and it was a positive surprise:

The company had guided to rising delinquencies throughout 2022, so it was encouraging to me to see delinquencies for the problematic ST-7 deal sharply invert down (a good thing) and other deals with concave-up shapes turn concave-down (a good thing). While it was a pleasant surprise to see this playing out, I’d like to remind everyone why I wasn’t panicking over rising delinquencies:

- Delinquencies were artificially held down by government intervention in the forms of payment holidays and stimulus checks during the pandemic. The YoY comp here is one of a rapidly normalizing world (today) vs. a uniquely easy environment for delinquency -- so of course delinquencies will rise as the world has dramatically changed over the last 12 months.

- The company has assumed normalizing (rising) levels of delinquency and a normalizing of the American consumer overall in its wildly positive 2022 guidance.

- Rising delinquency is also a factor of loan pool mix shift to less traditionally-worthy borrowers. The rising default rates that coincide are offset by the higher levels of interest payments that partners and investors receive from the current, higher risk loans.

I’m eager to see Upstart’s first quarter results. Spikes in capital market volume for the company hint at strong sequential demand, but I’ll be more focused on the tone surrounding the updated 2022 guide. This year is when the tailwinds Upstart has enjoyed turn to headwinds and when it will be most important for the company to continue delivering relative outperformance on its loan pools and building partner trust. While the price action has been brutal, the company’s operating results have been fantastic and I continue to accumulate more shares.

Click here for my Upstart Deep Dive.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I'm a daily active user.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.

3. Progyny (PGNY) -- Infertility Week

Progyny is again partnering with the fertility benefits non-profit RESOLVE to run national infertility awareness week. While this may not sound all that significant, I think it is. Why? Despite infertility impacting more than 12% of American couples, the American Medical Association had not recognized it as an actual disease until 2017. The result is wildly unequal and broadly inadequate infertility coverage that I extensively cover in my deep dive (linked below).