News of the Week (August 15-19)

CrowdStrike; Upstart; Shopify; The Trade Desk; Duolingo; SoFi; Penn National Gaming; Meta Platforms; Cresco Labs; Nanox; Macro; Cannabis; My Activity

To view my current portfolio & sign up for my free, real-time transaction alerts, click here.

1. CrowdStrike (CRWD) -- Institutional Channel Checks & An Accolade

a) Channel Checks

Stifel raised their price target on CrowdStrike to $220, and I don’t care about that at all. So what do I care about? The reasoning behind their bullishness. The institution surveyed an extensive cohort of CrowdStrike customers which revealed momentum remaining consistently strong for its services. Great news -- but maybe not all that surprising to those closely following the space. RBC threw in another bullish note this week in response to a strong demand pipeline. Love to hear it. Perhaps that’s why the company has 716 active job openings while countless other public firms pull back on hiring or layoff their talent. CrowdStrike is scooping up this dislocated talent hand over fist.

b) Accolades

CrowdStrike’s indicators of attack (IoA) tool was recognized this week by CRN as one of the 10 most popular new Cybersecurity products for 2022. Another day, another trophy for George Kurtz and his team. Finally, Frost & Sullivan named CrowdStrike a recipient of its Global Technology Innovation Leadership Award in endpoint security. Its frequently relevant and impactful innovation was the deciding factor.

2. Upstart (UPST) -- New Partner & Auto

a) New Partner

Upstart announced Alliant Credit Union as its newest referral network partner. This is the largest credit union win for Upstart to date… by far. Alliant has 650,000 members and over $15 billion in assets making it one of the 10 largest credit unions in the United States. Since the company announced a relationship with the National Association of Federally Insured Credit Unions (NAFCU), it has been able to seamlessly add new partners here -- regardless of a volatile economy.

I’ve seen some take to Twitter to voice their opinion that these pieces of news don’t matter. I think that they are entirely wrong. Upstart’s platform today is severely funding constrained. It is turning down borrowers left and right due to unavailability of capital market or partner funding to originate these loans. As long as record inflation, record low consumer confidence and aggressive monetary tightening persists, this funding will likely remain challenged.

Infusing a massive credit union like this one into the referral fold provides Upstart more funding capacity to place loans AND a lot more data to season its own models. Upstart’s marketing spend also directly floats with its conversion rate which has been hit by these funding issues. Translation? More funding supply raises Upstart’s conversion and justifies more marketing spend from the company to juice growth & traffic.

It’s objectively a significant win. Furthermore -- when loan appetite does return with easing macro concerns -- Upstart leaning back on capital markets and fast money hedge funds for its growth will again make its operations look incredible during fun times, and awful during down times. So? It needs to continue shifting its funding mix to partners like Alliant to build a more sustainable model. These partners can hold loans to maturity, have access to lower cost of capital, and so are innately more sustainable funding partners amid macro deterioration. They still pull back -- especially now while Upstart continues to build out its proof of concept -- but significantly less than capital market investors.

The company is trying to find longer term capital market funding to more reliably conduct loan origination across cycles. But that’s just a transitional Band-Aid. The real prize needs to be partners funding the vast majority of its loans. We’re getting there, but long way to go.

b) Auto

Upstart’s Auto Retail product launched in Ohio and Texas this week.

Click here for my Upstart deep dive.

3. Shopify (SHOP) -- "Collabs"

Shopify debuted “Collabs” this week as its latest product enhancement. Collabs is a unique spin on influencer marketing that companies like Revolve have used to thrive. What it does is allows creators (after approval) to search through a curated list of merchants most relevant to their own brands. They can then use Shopify’s “Linkpop” function to pick and choose individual items from a merchant's site to display on their own shop. When they generate sales, they share revenue with the merchant.

Shopify believes in creators being the future of entrepreneurship. Still, just 4% of these creators are full time due to the severe challenges in identifying marketing opportunities. I can attest to this firsthand. Aside from writing, communicating and pitching sponsors is my most time consuming activity. Shopify is trying to make this search process FAR more targeted and relevant. Creators are helped with monetization while merchants reach new, incremental audiences. This tool plugs directly into Shopify’s social partners like TikTok, YouTube and Instagram through the Shopify Integrations tool.

From the Company Press Release

Today, Collabs is now live for all North American merchants.

Anything Shopify can do to create value for its merchant base is the primary key to its long term success. If merchants don’t get incremental value from being on Shopify, they’ll just go to another solution. The company has done things like leverage its built-in consumer base to create marketing tools for merchants, and Collabs is its latest attempt at differentiation. To me, this seems like a very timely launch, but we’ll have to see what kind of traction it gains.

Click here for my Shopify overview.

4. The Trade Desk (TTD) -- Accolade & a Study

a) Forrester

Forrester named The Trade Desk as the top leader in business to business advertising. That piece of the company does not get much attention, but perhaps it should get more. Not only does The Trade Desk provide the most robust and utility-building ad platform for agencies to tap into relevant consumers, but it does so for enterprise marketing as well.

All of this is vital for The Trade Desk continuing to outperform advertising markets and overall economic growth regardless of where we are in the macro cycle. Amid times of exogenous turmoil, marketing budgets -- regardless of if they’re targeted at consumers or other businesses -- are among the first to be shrunk. This forces CMOs to extract as much return on ad spend (ROAS) as they possibly can with their now more finite resources. Time and time again, The Trade Desk has shown its ability to optimize for ROAS for these clients -- which is why it took more market share this past quarter than at any point in its history and is why its growth continues to accelerate in the face of daunting obstacles. I’ve said it before and I’ll say it again: The Trade Desk is best in breed.

b) Canada Study

The Trade Desk ran a survey with YouGov of 1,000 consumers in Canada. The findings were encouraging and unsurprising:

70% of respondents under age 44 are cutting the cord.

Linear remains the go to for live content -- but that’s now shifting with almost 40% of Canadians watching sports via “nontraditional means.” 9/10 of the most watched shows are live sporting events. This is the final domino to fall.

~50% of viewers have multiple streaming services.

48% prefer to see ads over paying a subscription.

Click here for my TTD Deep Dive.

5. Duolingo (DUOL) -- Math

Duolingo’s lovable founder took to Twitter this week to announce an expansion of a Duolingo beta program. It’s Math App is now available for testing with a large cohort of customers.

Duolingo is clearly the de-facto digital language learning platform. To be an iconically successful investment, I think it needs to establish a significant niche as a go-to platform for all learning. That would expand its already large and growing addressable market more than 10 fold. Early success with its children’s literature product and Duolingo English Test offer concrete evidence of its ability to use the language learning product as a core for building adjacent product lines. We’ll see how this math product does -- I’m optimistic.

Click here for my Duolingo Deep Dive.

6. SoFi -- SoftBank

SoftBank continues to sell off large blocks of its SoFi stake. To me, this troubled institution's liquidity needs or views on SoFi don’t matter much to me. I simply include this because I know readers will ask me why it’s missing if I don’t.

7. Penn National Gaming (PENN) -- Barstool

Penn’s stake in Barstool -- as part of the original deal terms -- rose from 36% to 50% this past week. Penn was able to do that at the original $450 million valuation which represents about 2X 2021 Barstool sales. As part of this maneuver, Penn gained the right the purchase the remaining 50% of Barstool which it announced it chose to do at a $650 million valuation.

Barstool has been a shining star for Penn since it acquired a stake in the polarizing sports media company. With nearly 100 million social media followers across platforms, this company has a wildly passionate base of “Stoolies” eager to support the brand. The effect of this has come in the form of things like more efficient market share gains with less promotional spend in sports gambling and immediate 20-30% traffic boosts from re-branding table games and retail sports books to Barstool. Barstool has also effectively and drastically lowered the median age of a Penn consumer -- thus lengthening the runway for its growth.

Penn’s casinos boast a leading regional market share in the United States, its Score Media is the most popular app and book in Canada, and Barstool is a freight train going full speed ahead. This is a North American entertainment powerhouse in the making -- just my view.

8. Meta Platforms (META) -- Reels

Meta is expanding its Facebook Stars program. As a reminder, this initiative allowed for more direct, fully interactive connections between loyal fans and influencers through Reels. This week, Facebook announced that it will now enable these influencers to generate revenue through their popular content. This is a continuation of Facebook trying to cater to content creators with more favorable revenue sharing agreements.

The program began beta testing a few months ago with some of its most popular creators. The results have been very encouraging to date. Creators can cross-post these Reels to both Instagram and Facebook.

Finally, an account on Twitter (@Fbbagholder) posted a redacted congressional study on the efficacy of Reels vs. TikTok. It revealed what we already knew: Reels has a long way to go to catch up to the appeal of TikTok. And Meta knows that. This was a long report that I plan to cover in detail next week. For now, I wanted to share that overarching takeaway and provide a link for anyone wanting to read it themselves.

9. Cresco Labs (CRLBF) -- Earnings Review

a) Demand

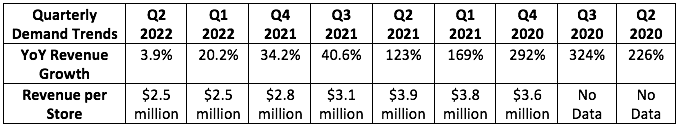

Analysts were expecting Cresco to generate $218.2 million in revenue for the quarter. It generated in line results of $218.2 million.

More Context on Demand:

Same store sales rose 6% YoY & 3% QoQ.

Like its competition, Cresco responded to wholesale pricing pressures by pushing more product through its vertically integrated retail operations.

Cresco remains the top wholesaler of branded flower and concentrates and is number 2 in vaporizers in the nation -- per BDSA. It’s also quickly rising in edibles with a top 5 position today.

This quarter, Cresco took over the top spot for branded market share in Massachusetts while maintaining that position in Illinois and Pennsylvania.

At $2.5 million in revenue per store, Cresco’s retail operations remain the most productive in the business.

Price compression this quarter was as sharp as it has ever been for the industry. Cresco saw consistent 10-30% declines across states.

“We’re holding and growing market share, driving efficiencies across the business to maintain margins and prepping to integrate Columbia Care.” — Founder/CEO Charles Bachtell

Over the next 3 years, flipping from medical only to recreational in New Jersey, New York, Pennsylvania, Ohio, Virginia, Maryland and Florida will drive industry growth. Cresco is primely positioned in all of those states

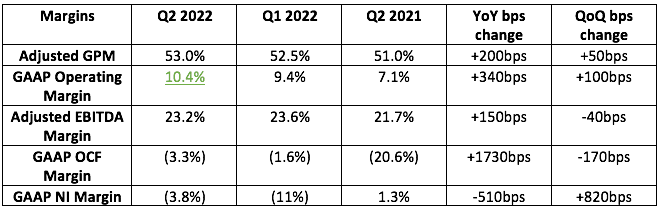

b) Profitability

Analysts were expecting Cresco to earn $51.1 million in EBITDA while Cresco earned $50.6 million, missing expectations by 1.0%.

Note that with the amount of accounting changes that Cresco and the cannabis industry have commenced in the last several quarters, quarterly margin trends are not all that relevant.

More context on margins:

GPM outperformance was credited to exiting California wholesale.

c) Balance sheet & Columbia Care

Cresco has just $90 million in cash with $379 million in senior secured term loan debt. Luckily, its all stock deal to acquire Columbia Care is on track. The M&A will include divestitures of redundant assets to other participants. All of these planned divestitures were met with bidding wars and letters of intent are now signed. This gives Cresco confidence in its original expectation to collect $300 million in gross proceeds from these deals later in the year. That fresh cash infusion from the all stock deal will come WITHOUT the ridiculous interest payments cannabis companies pay on debt today. Just dilution.

“Columbia Care puts us on a path to build what we believe will be the largest engine of value creation in the industry.” — Founder/CEO Charles Bachtell

Fully converted share count grew 6.2% YoY and 0.9% QoQ. This is a byproduct of sky high cost of debt for cannabis companies. It is financing M&A with its equity -- as it should be in this unique situation.

d) Notes from Founder/CEO Charles Bachtell

On Market share:

Cresco gained or maintained share in all of its states except California. It lost about 0.2% of market share there this quarter. As a reminder, Cresco greatly scaled back its 3rd party distribution business in that state in Q3 2021 as it became less attractive for wholesale. This will weigh on top line growth comps for one more quarter.

The cultivation issues it was having in Massachusetts are now fully resolved.

The most aggressive share gains this quarter came in Michigan, Ohio and Florida.

On Wholesale:

The YoY decline in wholesale revenue was entirely exiting California related. YoY growth was flat when adjusting for this. Operators (including Cresco) also continue to focus on selling more of their own product through stores as pricing pressures remain aggressive. That too is challenging wholesale growth today.

On Macro:

Inflation, consumer confidence and recreational delays all continue to weigh on the industry. Encouragingly, new shopper growth and volume growth remains robust -- so when macro pressures abate, we could see some real tailwinds. For example, Cresco’s new shopper growth in Chicago during Lollapalooza grew 30% YoY.

“While pricing dynamics are muting this impact today, this data point during the highest inflationary period in 40 years is incredibly important for underwriting the durability of cannabis and our overall thesis.” — Founder/CEO Charles Bachtell

On Growth:

Cresco doesn’t have access to the New Jersey market today. That market was responsible for essentially all of the top line outperformance from competition like Green Thumb. Cresco gains access to this state with the Columbia Care purchase.

Retail growth continues to be held back by store opening delays. It has taken steps to “resolve these issues and replenish the growth pipeline.” New store openings will re-accelerate going forward.

The top ¼ of its Illinois customers shopped 17% more YoY. Selling objectives like a loyalty program, basket building promotions and cross-selling promotions drove this growth.

More On Columbia Care:

The purchase will make Cresco the largest RETAILER in 5 markets.

“Do brands matter? Absolutely. Consumers choose our brands more than any other, even though we have less on the shelves for the most part.” — Founder/CEO Charles Bachtell

e) Notes from CFO Dennis Olis

On growth:

“With several new store openings planned, we will see organic growth return to the wholesale channel and top line overall.” — CFO Dennis Olis

On costs:

Cresco expects to keep GPM over 50% going forward. It will offset any price compression with operational efficiencies and retail shifting.

SG&A grew by 8.7% YoY -- ahead of revenue growth unfortunately. But it expects this growth to be flat to slightly down 2H as it adjusts expense to address macro challenges.

Cresco expects to maintain these EBITDA margins through 2022.

On Regulation:

“The institutional capital pool truly is sitting right on the sidelines and ready to jump in when they can.” — CFO Dennis Olis

The Senate held its first committee hearing on cannabis legalization ever this Q.

Cresco made $89 million in total tax payments during the quarter. Olis followed that up by saying “it is going to be really good when 280E goes away.” I agree Dennis… I agree.

f) My Take

The cannabis industry remains economically challenged with some much needed growth levers still in the future. For now, overall results won’t look good. But still, Cresco is thriving on a relative basis with market share gains, expanding GAAP operating margins and the most efficient retail operations in the business. I’m confident that if the cannabis growth story plays out like I think it will, Cresco will be poised to succeed. For now, patience is needed.

10. Nano-X Imaging (NNOX) -- Earnings Review

a) Results

Nanox generated $2.2 million in revenue -- up 22% vs. $1.8 million last quarter.

Teleradiology Revenue was $2.1 million -- up 15% QoQ due to client wins.

Nanox AI generated $100,000 in revenue

Nanox generated gross profit of $800,000 for a 36.4% margin.

Nanox lost $19.6 million for the quarter in GAAP net loss vs. $21.7 million sequentially and $13.6 million YoY. It pulled back on marketing in the quarter but incurred large, incremental integration costs from all of the 2021 M&A.

R&D grew 51% YoY to $6.5 million.

The company has $126.7 million in cash, equivalents and marketable securities vs. $140 million QoQ. This gives it 6 quarters of liquid assets at the current burn rate. There could absolutely be a dilutive capital raise coming.

Share count has grown by 0.7% since the start of 2022.

Nanox issued equity awards to Nanox AI due to meeting performance goals as part of the purchase agreement.

b) Notes from CEO Erez Meltzer

On Regulatory progress:

Nanox just finished its final pre-sub meeting with the FDA. Its next step will be submitting the Multi-Source 510(K) clearance application in the coming weeks.

Nanox has submitted all needed paperwork to commence the CE (Europe) approval process.

On Deployment progress:

Nanox has stationed a team in Nigeria to prep for Arc deployment there. It sent a commercial unit for training and education and partnered with BIO Ventures (a Seattle NGO) to develop training programs in that nation.

Nanox signed a new 350 unit contract with an entity in Ghana. It hopes to begin shipping units there in Q4 2022 but would not commit to that timeframe.

It’s developing an R&D and manufacturing center in Israel to complement the Korea and Japan facilities.

On Teleradiology and the AI Segment:

Nanox AI launched with Northwell Health -- the largest Healthcare provider (HCP) in New York -- in July. Today, it’s in 6 facilities and will be deployed in many more through 2022.

Nanox AI launched with Spectrum Health -- a large Michigan-based HCP -- to deploy its population health solutions.

The teleradiology segment signed 14 new clients this past quarter.

“We continue to see accelerated revenue growth in our teleradiology services driven by new client additions and growth from existing clients… this strengthens our belief that these applications & services will add value within our multi-source system.” — CEO Erez Meltzer

c) My Take

I continue to have no interest in adding to my stake until Nanox.ARC commercial deployment begins. The success in its ancillary businesses is a small positive, but ARC is the real value creator here. Until then, I’ll continue to sit on my tiny stake in the company.

11. Macro

a) Key Data from the Week

The NY Empire State Manufacturing Index sharply contracted in August vs. expectations on modest expansion. Conversely, the Philadelphia Fed Manufacturing Index for August sharply beat expectations with brisk expansion vs. expectations of contraction. Interesting dichotomy.

Month over month industrial production growth overall came in at 0.6% vs. 0.3% expected. (leading indicator)

Building permits for July came in slightly ahead of expectations. (leading indicator)

Core Retail Sales for July came in at +0.4% monthly growth vs. expectations of (0.1%) growth.

Initial Jobless Claims came in slightly below expectations at 250,000 vs. 265,000 expected. (leading indicator)

Cisco cited easing supply chain issues and robust global demand for its outperforming quarterly results this past week. That’s a decent (not great, but decent) bellwether for economic growth.

The Atlanta Fed GDPNow estimate fell back below 2% for this current quarter.

Fed Minutes Highlights:

Fed Minutes from the July meeting came with little surprise. Members want to see more sustained evidence of easing inflation -- duh. More rate hikes are invariably coming, although the pace of those rate hikes could soon slow from the current 75bps clip. The tone seemed less concretely committed to aggressively hawkish policy and more flexible and open to the idea of data improving to warrant a less hawkish tone. Still, that data needs to be positive (like it more so has been recently) for that evolution in tool usage to occur. Metrics like month over month PPI turning negative last week are encouraging examples of how the data needs to evolve for monetary policy to get easier.

Finally, most Fed officials prefer overshooting in terms of tightness vs. undershooting in pursuit of the rare “soft landing.” They’re more motivated to hike into a recession than to allow inflation to continue running rampant.

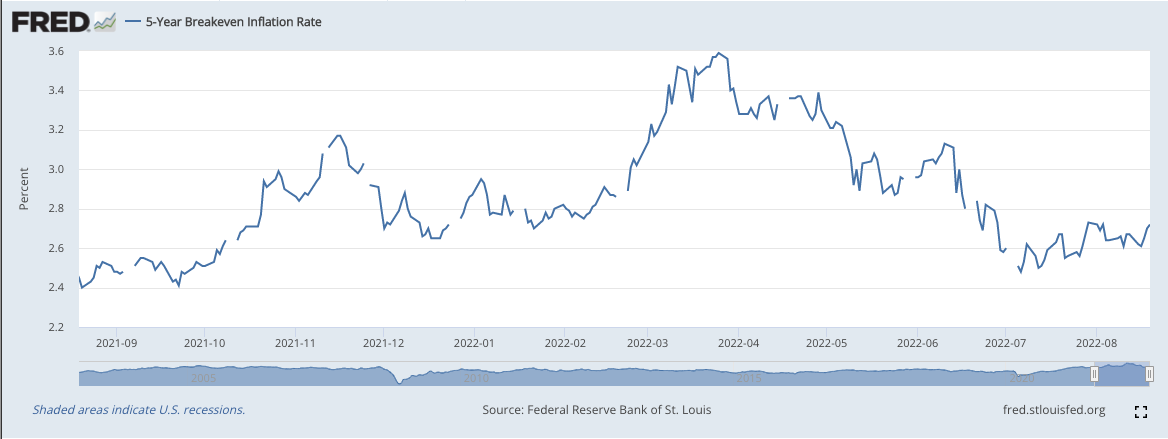

5-Year Breakeven Inflation ticked slightly higher this week:

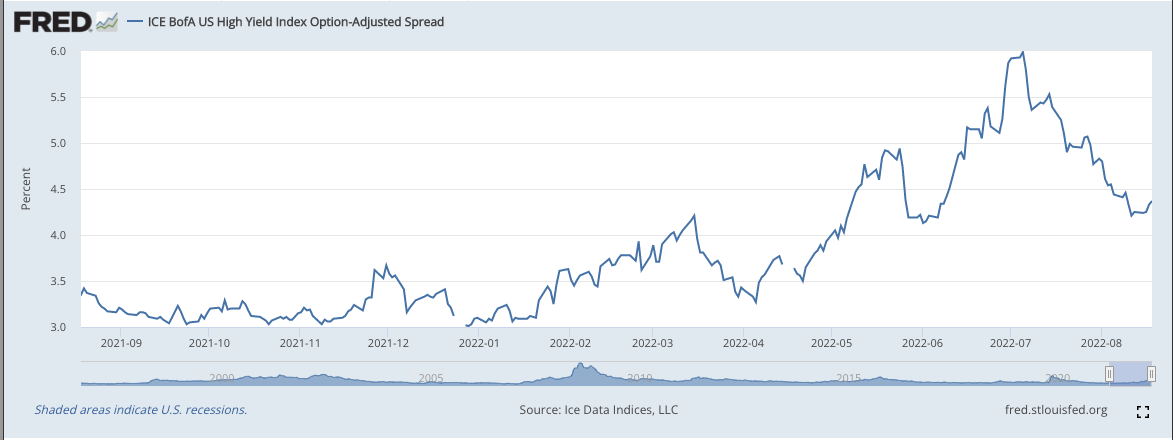

Option Adjusted U.S. High Yield Corporate Credit Spreads ticked slightly higher this week:

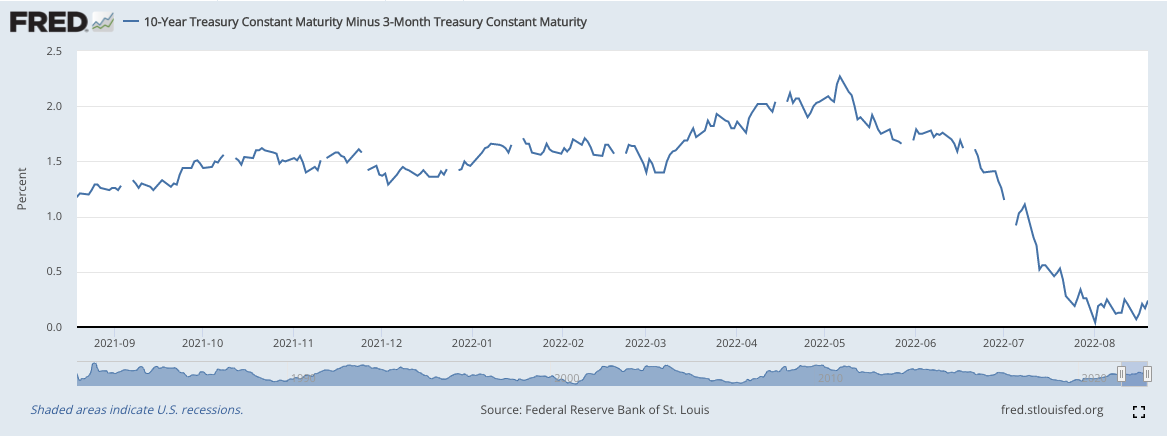

The 10-year, 3-month yield curve (better recession indicator than 10-year, 2-year curve) widened a bit this week. It continues to flirt with inversion:

b) Level-Setting the Data

Economic data-points from this week weren’t as uniformly positive as last week, but they were still mostly positive in my mind. For now, I remain more eager to accumulate into severe multiple compression than I have been over the last several months. Still, a worsening of macro data could push me right back into a timid frame of mind. That worsening did not come this week -- we’ll see what the rest of the month brings.

12. Cannabis -- Mainly Per Marijuana Moment:

NY approved its first batch of cannabis adult user processor licenses.

D.C's medical patient requests spiked in July following an easing of restrictions there.

Missouri Lawmakers are prepping cannabis regulation with the expectation of medical legalization passing in November.

A U.S. Court of Appeals decision this past week could provide needed loopholes to allow for interstate commerce (gross margin headwind).

Idaho is working towards getting cannabis legalization on its 2024 ballot.

69% of Wisconsin voters support cannabis legalization -- per Marquette Law School. This includes 51% of republican voters.

Arizona continues to see strong month over month recreational sales growth.

13. My Activity

I made 0 transactions during the week.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that the MSOS position is a placeholder for my positions in Green Thumb and Cresco Labs while OTC stocks are added to the platform:

Have a wonderful weekend!