News of the Week (July 11-15)

The Trade Desk; CrowdStrike; Match; Duolingo; Olo; Penn; SoFi; Lululemon; JFrog; Lemonade; Plaid; Macro; Cannabis; My Activity

1. The Trade Desk (TTD) -- Disney & Microsoft

a) Disney

The Trade Desk signed a new deal with Disney to deepen its clients' abilities to programmatically target within the iconic content library. Disney’s vast data ecosystem will now be infused into “Unified ID 2.0” (UID2) which will free advertisers to merge their unique 1st party data with The Trade Desk's data scale Disney’s value-added insights. Together, the two will now allow advertisers to leverage all available data through The Trade Desk’s platform which augments targeting efficacy and precision.

Not only does this allow The Trade Desk to gain a more intimate and valuable partnership with arguably the most relevant content company on planet earth, but it gives them another foothold into the world of live sports. While linear TV cord cutting in favor of streaming is in full swing, live sports is perhaps the final domino to fall in the value equation. The vast majority of the most-watched shows in the United States are live sporting events. Now, with The Trade Desk securing the Disney partnership (which includes ESPN+ and all of its rights), the company continues to find itself in an ideal spot to be the primary demand-side beneficiary in the streaming revolution. Disney wants 50% of all its ad impressions placed programmatically in the near future and will use The Trade Desk to make that happen.

b) Microsoft

Netflix announced a new partnership with Microsoft to help power their advertising platform. Just like potential relationships with NBC and Roku will not prevent The Trade Desk from profiting off of Netflix's pivot, Microsoft won’t either. To create the most competitive bidding environment, Netflix will need to collect the maximum number of bids. The Trade Desk represents virtually all of the companies placing these bids as it instructs them on pricing, timing etc.

The partnership utilizes Microsoft’s "Xandr" ad-platform for Netflix’s planned ad-supported infrastructure. Per the Current (The Trade Desk’s Blog), this was a natural choice considering that other options like Google have inherent conflicts of interest. Xandr will help marry more data sources with Netflix’s built-in scale to allow for more effective programmatic targeting. Importantly, this does not mean The Trade Desk is getting shut out of Netflix’s ad-tier. It is something that The Trade Desk is openly excited about as the Microsoft agreement is a clear sign that Netflix is embracing the open internet approach to advertising. With Xandr being among the first adopters of UID2, this is not something to be feared by TTD shareholders. Xandr will funnel demand through its programmatic ecosystem and The Trade Desk is a prominent piece of that.

2. CrowdStrike Holdings (CRWD) -- Case Studies

a) Tuesday Morning

Tuesday Morning -- a national discount retailer -- transitioned its legacy tech stack to CrowdStrike’s Falcon platform in recent months. The company’s IT Director -- Tom Sipes -- praised the platform for seamlessly locating and nixing potential vulnerabilities with no developer or operational down time. Here were the other highlights:

Eased the burden on its small security team via enhanced automation.

Reduced costs by well over $1 million with no staff cuts.

“Increased visibility and streamlined operations.”

“In terms of improved productivity and adding business value, the difference with CrowdStrike is night and day.” — Tuesday Morning IT Director Tom Sipes

b) InfoCepts

InfoCepts is a global data analytics firm that needed to re-vamp its security stack. It chose to do so with CrowdStrike and these were the highlights:

No worsening of device performance post Falcon implementation (unlike with substitutes).

Limited false positives.

Reduced incident response time from hours to minutes.

“The pre-purchase pilot was so good, we feel in love with it. It showed us that CrowdStrike was the right partner… CrowdStrike is bulletproof and our users love it…. CrowdStrike improved our security by 100%.” — InfoCepts CIO Rajendra Jodhpurkar

3. Match Group (MTCH) -- The League, Google & Garbo

a) The League

Match Group’s new CEO, Bernard Kim, has made his first M&A splash at the dating and social discovery company. Match is buying an exclusive dating app called The League for terms not yet disclosed. The League’s exclusive niche uses an admission-based model requiring user applications and a thorough vetting process. It seeks out highly-motivated users and matches individuals based on career-goals and ambitions. There is a free tier, but also a subscription where users can double their match frequency. It has around 250,000 users today.

Match Group has made M&A a central part of its success for years and years. Apps like Hinge and Plenty of Fish -- both inorganically acquired -- have become integral pieces of its operations. And with its strong balance sheet and cash flows, there’s no reason not to remain acquisitive for the right price. This is why I was so encouraged that Bernard Kim was brought on to replace Shar. His track-record of explosive growth and successful M&A integration at Zynga makes him a perfect candidate to conduct a thoughtful M&A path here. This is step 1.

b) Google

Google responded to Match Group’s Google Play lawsuit calling it a “cynical attempt” to use Google’s scale while side-stepping fees. Despite this, the other recently announced settlement between the two allowing Match to plug in to 3rd party payment systems (and thus to sidestep the app store fees) remains in place. But clearly this relationship is far from amicable.

c) Garbo

Match Group is expanding its successful background check program to more of its apps. Through its Garbo partnership, where Match is also an investor, the company allows users to seamlessly search a user’s public records; now that will be doable through Match.com and Stir. Subscribers to these two apps will get 4 of these searches per month with free users getting 2. The feature is also available on Tinder for a few dollars per search. As in-person meeting comes back with full force, this is how Match plans to keep its users feeling safe and secure while also collecting more revenue.

4. Duolingo (DUOL) -- Accolade & Analyst Notes

a) Accolade

AdAge named Duolingo as one of its hottest and most successful brands in creative, social marketing. This is encouraging, but not all that surprising considering Duolingo’s impressive Twitter and TikTok engagement that I frequently discuss.

Social media is a key driver of Duolingo’s word-of-mouth growth engine, accounting for 90%+ of its new users. Happy customers are frequently nudged to share their experiences with friends, and this fuels user growth via the personal endorsements. Friends posting their experiences with a product is inherently more valuable marketing than a 3rd party, “take-my-word-for-it” approach. Perhaps this is why we’ve seen the company drastically cut marketing expense as a percentage of revenue while still outperforming on top line growth.

Economically efficient expansion like this is only possible with beautiful, compelling products; that has been the central Duolingo focus since day 1. It’s more interested in spending that next dollar on R&D to create a better product vs. on advertising. If the company has its way, users will be so delighted with the product that they’ll organically spread the word for free. That’s the goal. It uses its leading scale to effect data-driven split testing to craft the best product vs. guessing at it.

b) 2 Analyst Notes

KeyBanc downgraded Duolingo during the week on valuation concerns. At 126X 2023 EBITDA, this is a fair and valid worry -- but I would remind everyone that Duolingo has shattered estimates in each quarter since its public debut. Still, expensive is an accurate classification as it has held up remarkably well over the last several months. That’s why I trimmed the position last month and would be glad to add that piece back at lower multiples. Conversely, Raymond James channel checks suggest more upside to 2022 Duolingo forecasts via robust traffic.

5. Olo (OLO) -- Case Study

One of Olo’s modules is called Olo Network. This allows menu items to be displayed across a large roster of 3rd party partners and marketplaces and includes “Order with Google through Olo.” It does this while allowing brands to stay in full control of their customer experience and data -- which is an exception to the rule in this industry.

The module was the central focus for a new Olo case study involving Uncle Julio’s and its 34 U.S. locations. It had successfully built a digital order business, but struggled with high 3rd party fees, no user experience control and limited consumer data. The results of Uncle Julio’s Order with Google case study were as follows:

+2.5% rise in total direct digital sales

+8% average check size vs. other marketplace orders

+74.3% new guests who hadn’t ordered online from the restaurant directly until this launch.

“Order with Google through Olo was a no-brainer… we’ve gotten better control of the off-premise experience, built stronger guest relationships and loyalty and gained additional sales.” — VP of Off-Premise at Uncle Julio’s Mary Batson

6. Penn National Gaming (PENN) -- Macau

Renewed Macau lockdowns will surely place added pressure on global casino operators like Wynn. Fortunately, Penn is not one of those operators. Its casino portfolio is entirely U.S-based and regional. This is a non-issue for Penn. Next.

7. SoFi Technologies (SOFI) -- Shelf Offering

SoFi filed a $1 billion mixed shelf offering during the week giving them the ability to issue a mixture of debt and equity in the future. I’d like to point out that the company just became eligible to do this and it’s common practice for qualified public companies to maintain a shelf for flexibility and good corporate governance. I'm sure most of your holdings have the same thing in place. This is not concerning or even notable to me, but considering how much attention Twitter paid to it, I thought I’d discuss.

8. Lululemon Athletica (LULU) -- Analyst Note

Jefferies downgraded Lululemon this week in light of the pandemic finally fading away. Lululemon’s “Athleisure” niche got an aggressive boost from stay at home orders. Employees no longer had to wear a suit to work and Lulu’s comfortable line of apparel got a lift. Jefferies thinks this will challenge the company’s growth due to difficult comps for the next few quarters. If that weighs on the stock, I’d likely be a buyer.

9. JFrog (FROG) -- Microsoft Teams

JFrog added new interoperability between its binary repository (Artifactory) as well as its security scanner (Xray) and Microsoft Teams. The new integration features a JFrog App for Teams which offers the same overarching visibility and security of all software packages within the Teams ecosystem. With a newfound birds-eye-view and communication channel between developer and enterprise, blunders such as failed builds and vulnerabilities will be viewable and quickly fixable. With as omni-present as Teams is becoming, this is a needed, timely and relevant integration.

This announcement is encouraging for another reason: It clearly siphons source code and binary management niches into separate components. Microsoft owns GitHub -- a highly capable source code player in the dev-ops space. While source code and binaries operate in complementary worlds, JFrog’s quarterly earnings Q&As still center on analyst worries about their competitive positioning vs. the source code players. It doesn’t make sense, but it’s the reality. This is clear evidence that the two products are largely complementary -- just like JFrog’s leadership constantly reminds us.

10. Lemonade (LMND) -- Give Back

Lemonade’s Give Back program recently wrapped up for 2022. Partners like Teach for America took to social media to pound their chests about the charitable donations they gave through this program. While the event isn’t a direct growth driver for the company, it is surely good press and a boost to unaided brand awareness. With as similar as insurance offerings are, maybe some will see this as a difference-maker within an otherwise un-important decision.

11. Plaid -- FinTech Effect

Plaid interviewed 4,000 individuals across the globe about their experiences with using financial technology to improve their lives. Here were the key findings:

93% reported that FinTech is a time-saver while 78% reported that it reduces financial distress.

GenZ trusts FinTech vendors with their data at a 66% clip vs. 63% for traditional Financial Institutions (FIs).

95% of Hispanic respondents use FinTech in some capacity.

48% of respondents are daily active users of fintech.

From 2020 to 2021, the proportion of U.S. consumers using FinTech spiked from 58% to 88% with most planning to continue usage post pandemic.

More respondents (88%) frequently engage with FinTech than social media (72%).

None of this is surprising, but with industry multiples as depressed as they are, I think it’s a timely study from an independent 3rd party. FinTech is not going anywhere. Usage curves are up and to the right via the time, access and cost efficiency force multipliers that it provides. I’m excited to own SoFi, PayPal, and yes, Upstart going forward when the world is not such a dreadful place for these firms to operate. That excitement could always change, but for now it hasn’t. Thanks for the research, Plaid!

12. Macro:

a) Beige Book Highlights

Overall economic activity continued to expand at a modest pace while some districts saw material growth slowdowns via soaring energy/food prices weighing on discretionary spend.

5 districts called out rising recession probabilities.

Most districts cited continued supply chain and labor shortage challenges. Labor conditions remain tight but availability is now beginning to improve.

Price increases were broad and nearly uniform across districts. Moderation did begin to pop up in construction as lumber prices cool off.

Food, commodity and energy cost increases remained significant BUT most districts reported slowing vs. previous months.

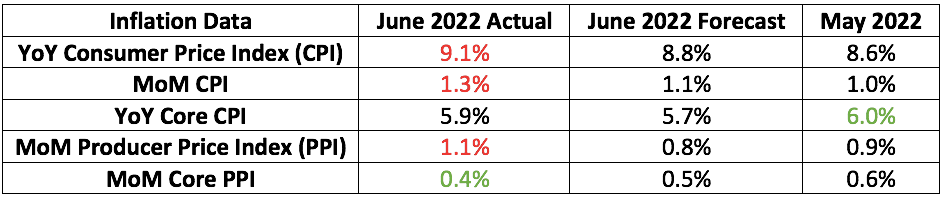

b) Inflation Update

The green shoots that I had been discussing in recent weeks (cooling PCE, breakeven 5 and 10 year inflation normalizing) dulled a bit this past week with the CPI and PPI.

Notes:

Core readings strip out volatile food and energy costs and is the preferred Fed metric

PPI typically leads CPI

While this wasn’t an overly encouraging series of data-points, there are a few things I’d like to note. First, the data is backward looking and from a month in which record-setting gas and commodity prices dominated the headlines. Americans have gotten significant commodity inflation relief in the last couple weeks which wasn’t captured in this release. Stickier pieces of inflation like soaring rent will take longer (at least 12 months) to work through inflation data, but price increase tailwinds now seem to be peaking.

Two things are true: I think that June was peak inflation and I also don’t think that it matters. Who cares if we see inflation fall from here, but stubbornly settle in at 6% or 7%? We need inflation to peak AND inflation to briskly return to the Fed’s target range of 2%-2.5%. Still, to get there, we do need to start with a climax which this likely represented.

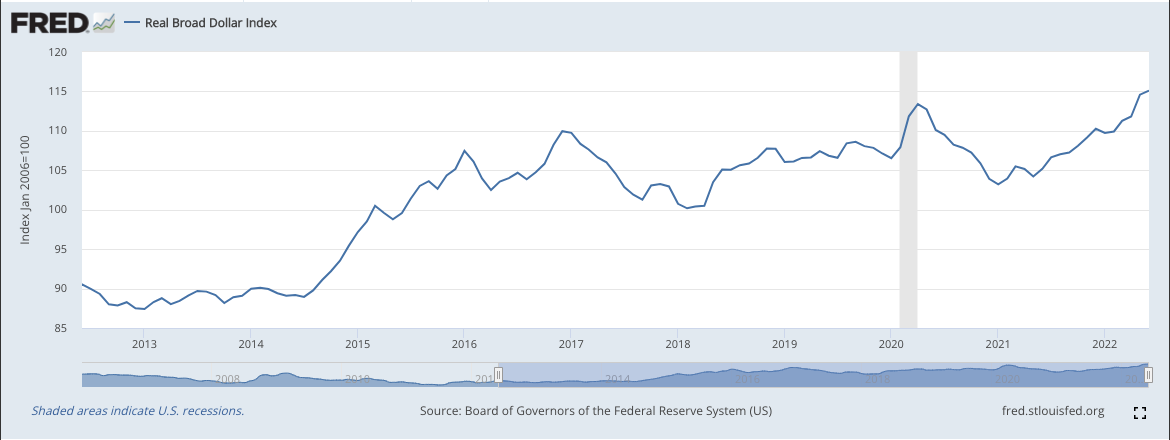

In other important news, the dollar continued its historically rapid strengthening this week. It even rose to parity (equal value) with the Euro for the first time in a couple decades.

As we’ve covered a few times in the past, this makes revenue earned in currencies abroad worth less in dollars when converting. For Match Group, this will be a 500 basis point growth headwind, while other global holdings such as PayPal, Meta, Duolingo and Revolve Group will also experience a growth headwind from the strength. Firms can hedge this to a certain extent, but not perfectly.

Other economic headlines:

The University of Michigan’s Consumer Sentiment reading unexpectedly rose from 50.0 in the last reading to 51.1 in this reading. It was expected to fall further from record lows of 50.0 to 49.9. This is a nice surprise depicting the resilience of the consumer (which is 70% of U.S. GDP), but also gives the Federal Reserve more reason to tighten more aggressively. Similarly, Core Retail and Retail sales both rose faster than expected -- leading me to the same takeaway. Economic cracks have surely formed, but this provides evidence that there’s more slack to take advantage of before the Fed goes too far.

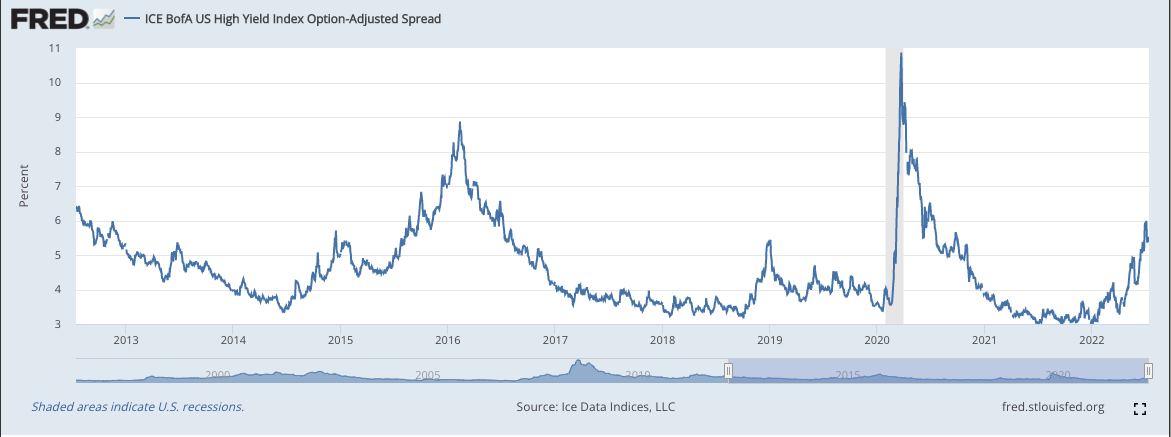

The ICE Bank of America High Yield Index Option-Adjusted Spread continues to look quite fragile:

10-year Breakeven Inflation Rate continues to encouragingly but slowly normalize:

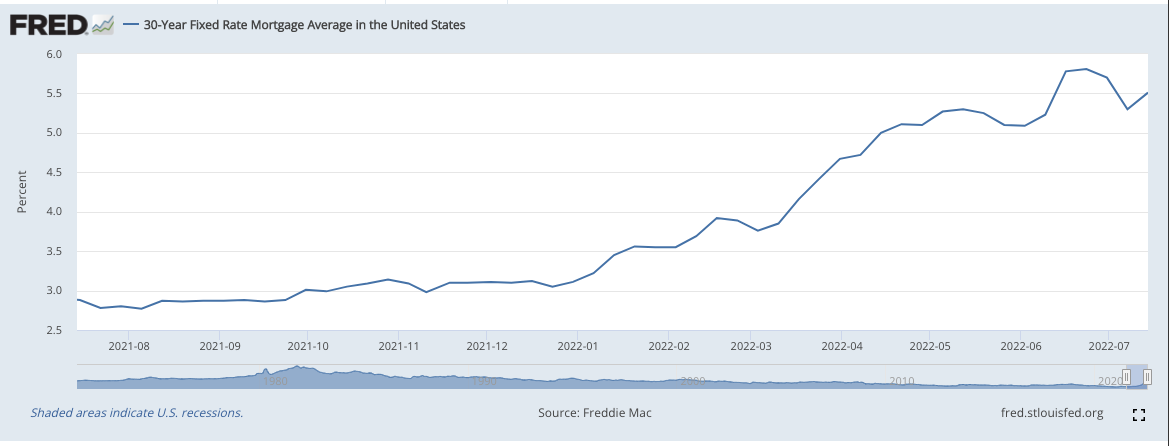

30-year Fixed Mortgage Rate:

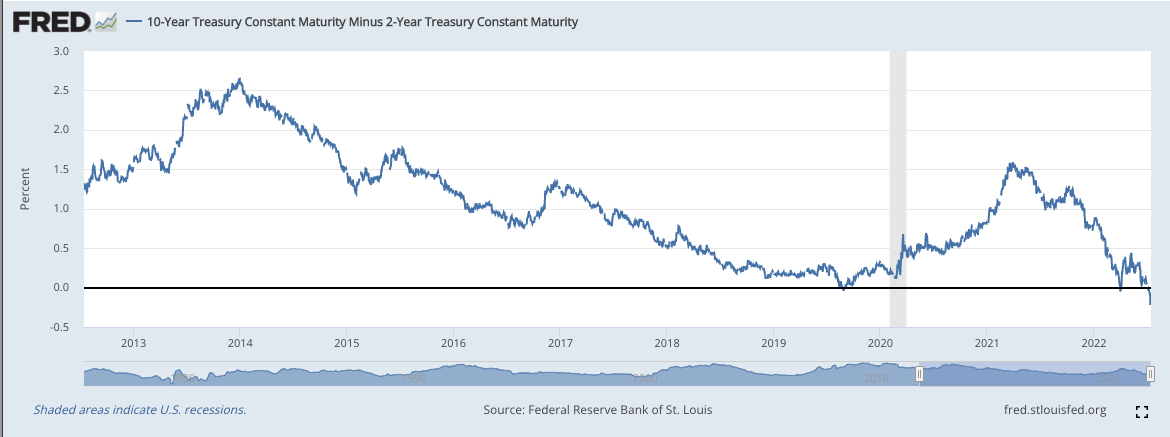

The 10 Year - 2 Year Yield Curve continues to invert more deeply than it has since the Great Financial Crisis:

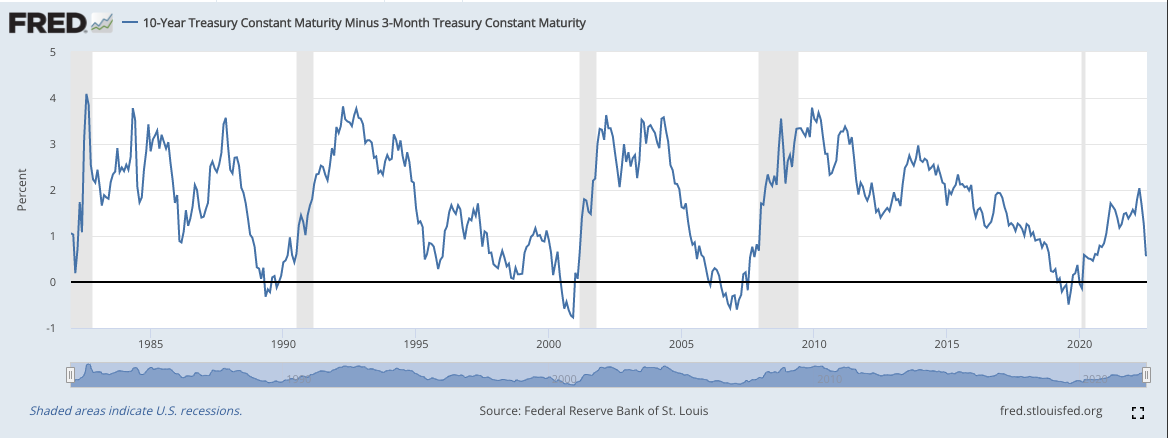

The 10 Year - 3 Month Yield Curve -- which is an even more accurate recession indicator -- is flirting with inversion:

We’ve spoken at length in previous macro sections about why an eventual recession should not be feared by growth investors. To avoid redundancy, I’ll skip that same spiel today and just point out that these yield curves paired with blown out corporate credit spreads, tanking commodity prices and constant layoff news is a common recipe for recession.

Final Economic and Market Notes:

The National Federation of Independent Businesses (NFIB) reported its small business confidence index is at 9+ year lows.

Probabilities for a 100 basis point rate hike spiked from near 0% to nearly 80% after the CPI reading came out.

Google is slowing hiring.

Unity is buying IronSource. Bold.

Bank of America is now assuming a mild 2022 recession in its base case.

With all of this considered, I think the hurricane-like storm that equity markets have dealt with is beginning to run out of stream. It’s still pouring, winds are still howling, but the light at the end of the tunnel is growing more and more bright.

13. Cannabis:

Momentum is again swirling with new cannabis banking reform attempts passing the House, The Senate working to pass de-criminalization and cannabis items still part of the current National Defense Authorization Act. Several banking associations around the nation sent in their own requests for more sensible laws as well. We’ve been through these hopeful headlines several times before. I’d like to see at least 280E reform or up-listing regulation signed, sealed and delivered before I get excited. There have been too many false starts and pump fakes to get our hopes up today.

Green Thumb exercised its right to delay the maturity on its 7% debt from April 2024 to April 2025.

14. My Activity:

I added to Match Group during the week. In the coming days, you'll be able to sign up for real-time text or email alerts to see my live transactions through my partner: Savvy Trader. I'll post the link to Twitter and here when it's officially ready.

I’m also hoping to be able to add some cash to my account in the coming weeks. Ideally, that would equate to about 4% of my total portfolio, but it may end up being a bit lower if other expenses are larger than expected.