News of the Week (July 18 - 22)

The Trade Desk; Shopify; CrowdStrike; Meta; Lululemon; PayPal; Upstart; Match; Duolingo; GoodRx; Macro; Cannabis; My Activity

1. The Trade Desk (TTD) -- The EU, a Case Study, an Accolade, Disney & Snapchat

a) EU

This past week, EU lawmakers signed the Digital Markets Act (DMA) and the Digital Services Act (DSA) into law. Both are structured to erode the monopoly-type power of internet players like Google and to create a responsibly open environment for data sharing. Each Act complements the previously passed GDPR legislation. The Wall Street Journal is calling this the strictest attempt to control walled gardens yet and is expected to have global ripple effects.

Stricter regulation and tighter controls on data syphoning is a net positive for The Trade Desk. Its inherent open-internet approach has found seamless compliance with GDPR -- unlike other tech giants -- and this should be more of the same. Anything that creates a more level playing field (and a more regulated one) with bigger, richer tech-giants is good for The Trade Desk.

b) ViewSonic

The electronics company wanted to grow its global businesses in a cost efficient manner. It went with The Trade Desk’s Koa engine and data marketplace to help run its media buying campaigns. ViewSonic also utilized The Trade Desk’s “Wootag” integration to further customize local solutions for ViewSonic in Asia. Here were the results:

Koa boosted video completion rate from 59% to 81%

The Trade Desk delivered a 47% lower average cost per completed view vs. benchmarks.

Click through rates are 24X industry benchmarks in Germany and 11X in The UK.

That’ll do.

“Their team was instrumental in bringing our campaign to life in a timely, cost-effective manner. Without The Trade Desk’s network of partners and expertise, we would not have been able to pull off such a complex activation to this degree of efficient success.” — Global Digital Campaign Manager @ ViewSonic Billy Choi

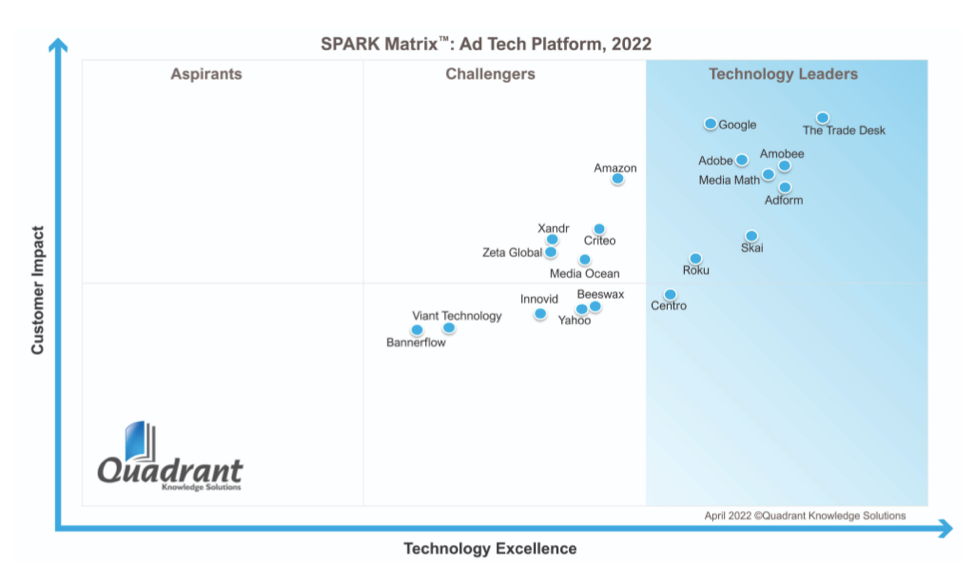

c) Accolade

SPARK Matrix released its first competitive landscape graphic of the Ad Tech sector this week. The Trade Desk, unsurprisingly, ranked first in customer impact and technological excellence -- the two ranking variables.

d) Snapchat

Once again, poor results from Snapchat led many to conclude that the entire ad-tech sector would be challenged for the quarter. Last quarter, the company blamed macro-economically-induced ad-weakness while several others in the space posted strong results. I think this could likely be more of the same. And as a reminder, The Trade Desk re-affirmed its strong guidance several weeks ago, I'm really not concerned.

e) Disney

Disney set a new company record with $9 billion in upfront advertising sales for the year. So I guess it's not seeing the same terrible ad market that Snapchat is. Interesting. Notably, 40% of these sales (so $3.6 billion) were for streaming impressions. Considering the tight relationship that Disney and The Trade Desk have and the fact that Connected TV (CTV) is The Trade Desk's largest revenue segment, this is encouraging.

2. Shopify (SHOP) -- YouTube

Note that this is still just a watch list item.

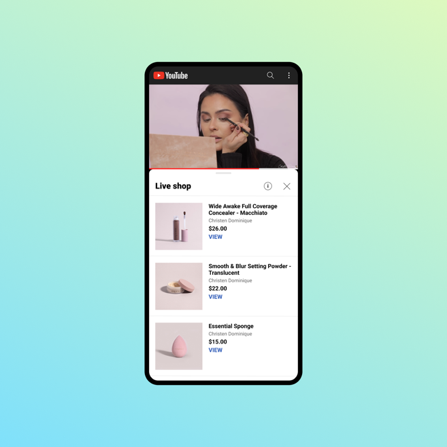

Shopify announced a deepening partnership with Google which frees a direct integration between its merchants and YouTube. With this new relationship, businesses will be able to embed their product catalogues directly into the ubiquitous site. Whether it’s live steams, on-demand videos, or the dedicated store tab, YouTube is now fully open for Shopify merchant business.

This unlocks yet another channel for merchants to sell into and further enhances the scope of Shopify’s vast integration roster. And that’s really what sets it apart in a competitive, rapidly growing field: An ability to seamlessly & intuitively connect its merchants to a greater number of key selling channels than others can. The real-time plug-in will allow for accurate product inventory displays, pricing and performance tracking. Some merchants are even eligible for Shopify-powered in-line checkout through YouTube. In-line simply means a shopper never leaves YouTube while checking out (which raises conversion rates).

Click here for my Shopify Overview.

3. CrowdStrike (CRWD) -- Accolade & Macro Tailwinds

Fortune Magazine named CrowdStrike as one of its best places to work for Millennials in 2022. While this may not sound relevant, considering how fierce the battle for new talent is within security, it certainly is.

Gartner released an update on the state of cybersecurity trends in 2022. The conclusions were uniformly clear -- breach intensity is only growing. Vendors dedicated to helping companies stay safe will continue to be in high demand.

4. Meta Platforms (META) -- Miscellaneous

Meta is shifting resources from its news and newsletter features (Bulletin) to focus more on other pieces of the creator economy.

Instagram is debuting in-app (in-line) shopping within direct messaging.

Meta’s Family of Apps is fully leaning into Reels. It's turning all video content into that format.

Instagram is ending its affiliate influencer marketing program.

Credit Suisse thinks Meta is on the verge of “improving news flow” while cutting its targets due to macro pressures. Morgan Stanley, Deutsche Bank and MoffettNathanson all issued similar notes of still optimistic, but more cautious outlooks.

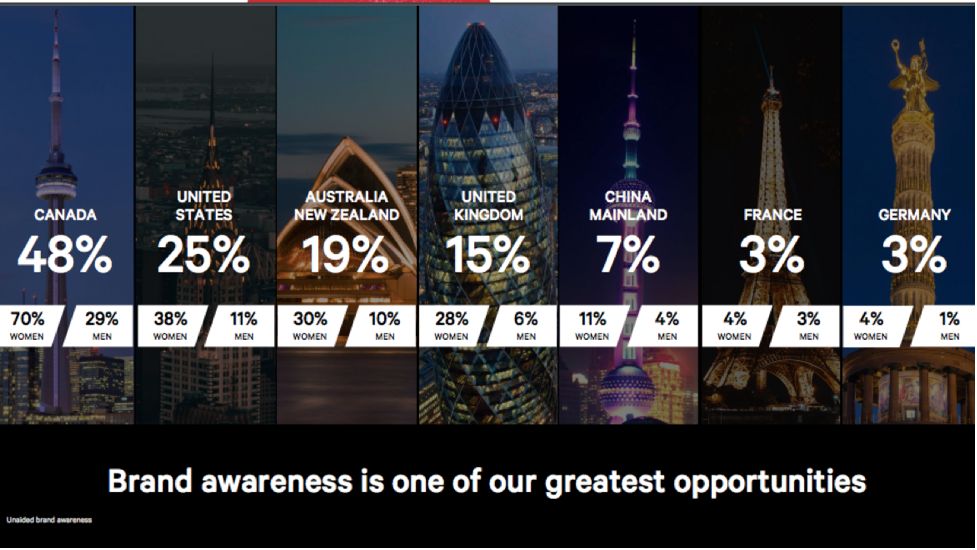

5. Lululemon Athletica -- International, Analyst Notes & Unions

a) International

Lululemon launched in China through JD.com’s marketplace this past week. With the Chinese Giant’s hundreds of millions of users, this could be a very important launch. It’s full speed ahead for Lulu’s international expansion as it expects to quadruple that business over the next 5 years. If previous long term targets are any indication -- and that’s far from certain -- it could reach the target more expeditiously.

“The popularity of Lululemon indicates that the Chinese market acknowledges the product quality and the connection it creates between community and brand.” — JD Spokesperson

b) Analyst Notes

Stifel, BTIG and Goldman all slashed price targets but remain upbeat on the company’s prospects

KeyBank initiated it with an overweight rating.

c) Unions?

Some Lulu staff are petitioning for unionization in Washington D.C. This surprised me as the company hasn’t dealt with it before, but it’s extremely preliminary. We’ll see where this news goes.

Click here for my Lululemon Overview.

6. PayPal Holdings (PYPL) -- Activists, Analyst Notes and a Lawsuit

a) Activists?

There are rumors swirling that PayPal is attracting activist attention. As a note, this refers to minority shareholders (or potential shareholders) rounding up voting shares to secure board seats and influence change. This makes sense to me considering how poorly the team guided expectations through the last few years (like countless other firms) -- but I don’t think it’s necessary.

I still wholeheartedly believe in CEO Dan Schulman as his track record speaks for itself. Furthermore, I see PayPal’s “dinosaur” label as a product of our current world, not its own value proposition. Like many others, it is suffering from inflation stretching consumer budgets, consumer confidence tanking and the lapping of stimulus and e-commerce shocks. It is also dealing with a several hundred basis point headwind from its eBay operating agreement ending

All of these issues are mostly lapped after the company reports 2nd quarter earnings in a few weeks. Growth will re-accelerate regardless of macro headwinds and I think the narrative surrounding PayPal will sharply turn for the better. And with the eBay contract gone, it has been free to secure deeper relationships with Amazon, Walmart, Live Nation and several other clients. Ask yourselves, would you rather have more eBay checkout share? Or less, but while being free to work with all of these other, faster-growing marketplaces. I think the choice is clear.

b) Wells Fargo

Wells Fargo sees a weak PayPal Q2 due to all of the macro pressures we frequently discuss. They’re not wrong -- Q2 is not going to be blue skies for PayPal. But again, starting in Q3, comps get easier and momentum should get much stronger. If it doesn’t, I’ll have to re-evaluate my position.

c) Lawsuit

Card issuers (in association with Affinity Credit Union) have filed a class action lawsuit against Apple and its “Tap to Pay” functions. The complaints are quite similar to the App Store monopoly issues raised for both Apple and Google. Issuers claim that Apple is unlawfully blocking them from accessing other payment providers and thus forcing them to use its Tap to Pay. Many other vendors don’t even charge for this, but Apple’s scale forces the hand of issuers conceding hefty fees for an identical product. Again, somewhat similar to the app store complaints. The lawsuit frequently points out that Android offers far more optionality for issuers, while Apple automatically links its phones to the Apple wallet, and sets it as the exclusive default option to shutter rivals.

Issuers are suing for retroactive damages of $1 billion annually. If they succeed in forcing a more level playing field, that's certainly advantage PayPal. There’s already rampant speculation that a Venmo and PayPal integration with Apple Pay is an obvious “when and not if." This makes that even more probable if lawmakers force Apple to be a team player.

It should be noted that Apple has earned a certain amount of market power. Many of us spend our days with our heads buried in our iPhones (at least in North America) and Apple should absolutely leverage that the best it can. With this is mind, it’s likely (in my opinion) that the company will continue to push walled garden policies a bit too far and have them subsequently reined in by regulation. The pros of doing so outweigh the cons.

“When you compare Apple Pay to Google and Samsung, they’re essentially identical… and yet the same service on Android that card issuers pay nothing for costs them $1 billion annually through Apple Pay.” — Hagens Berman Co-founder Steve Berman

My PayPal Deep Dive will be published this month, I promise.

7. Upstart Holdings (UPST) -- New Partner

Upstart announced partner number 61 (at least) this week in Financial Partners Credit Union (FPCU). FPCU predominately operates in California and boasts $2.1 billion in assets with 86,000 members. This is a sizable get.

While Upstart’s institutional funding sources remain timid and constrained, its partner retention roster continues to grow virtually churn-free. As I’ve spoken about in several previous issues, partner retention is how Upstart builds a more profitable and durable business in light of violent credit cycle shifts. These partners don’t need to flip the loans immediately for profit and generally hold to maturity with the lowest cost of capital in the industry. They pull back amid worsening macro far less aggressively than hedge funds needing to immediately flip loan pools for several hundred basis points in profits. And with Upstart continuing to target 10%+ loan returns for its partners through all of this -- they’ve been happy to hold.

Capital market usage as markets cycle will continue to drive great volatility and cyclicality in Upstart’s results. But, that becomes less true as its sourced loans are retained by partners like FPCU at a higher proportional clip. It’s moving in the right direction, but there’s a long way to go.

Click here for my Upstart Deep Dive.

8. Match Group (MTCH) -- Analyst Note

J.P. Morgan issued a cautious note surrounding online dating amid macro stresses, but continues to like Match Group as a stock. I think Match Group is much more recession resistant than analysts like to give them credit for. The company thrived amid the Great Financial Crisis with no material impacts to traffic growth or propensity to spend. In terms of luxuries, spending $10-$20 a month for romantic and platonic attention is a bargain compared to other discretionary expenditures.

Click here for my Match Group Overview.

9. Duolingo (DUOL) -- HBO Max

Duolingo has officially partnered with HBO Max for its upcoming Game of Thrones Spin-off: “House of the Dragon.” In preparation, Duolingo will launch a High Valyrian course to teach the fantasy language to its super fans.

From HBO MAX's Website

In typically-quirky Duolingo fashion, it debuted national billboards across major cities with phrases to strike interest in the language. Duolingo’s Duo mascot will also make co-branded appearances at Comic-Con this year. To motivate learning, HBO Max is launching an app where Duolingo learners can “hatch personalized, visual dragon eggs and raise them in augmented reality.” These dragons only speak High Valyrian.

I guess I'm now rooting for this show to succeed.

“Our data shows a direct correlation between user growth and what’s happening in the cultural zeitgeist, from K-Pop to Eurovision and more.”

Duolingo Head of Business Development George Audi

Click here for my Duolingo Deep Dive.

10. GoodRx (GRDX) -- Traffic & Analyst Notes

a) Traffic

Forbes released an interesting study this week. It searched through 5 years of Google search data revealing that GoodRx has the most searched coupons in 8 states. It’s the most sought-after deal-hunter in its category by a wide margin.

Despite that, there has been a hurricane of headwinds hitting the company simultaneously, largely the fault of leadership. I think that management has since appropriately adjusted how it handles guidance -- which has been the main issue. To me, this company is down, but far from out. While my leash is getting shorter, the un-paralleled consumer & physician value it provides across healthcare is desperately needed and immensely valuable. Management just needs to get out of its own way and also needs Kroger and PBMs to play nice.

That dispute between Kroger and the PBMs is something I’m keeping a sharp eye on. A negative resolution could force me out of this position. GoodRx’s value comes from its leading PBM scale gives it the best drug pricing many more times that not. That needs to remain the case for this investment to work. We’ll see.

b) Analyst Notes

Both Barclays and Guggenheim -- likely as a reaction to the share price -- lowered their price targets and maintained bullish views on the company.

Click here for my GoodRx Deep Dive.

11. Macro:

a) Recent Developments

The signs of macroeconomic strain continue to intensify:

The Philadelphia Fed Manufacturing Outlook is the worst in nearly 50 years and vastly disappointed with a reading of -12.3 vs. -2.5 expected. Yuck.

Bank of America fund managers expect a recession at the highest clip since 2020 (and 2009 before that). Thanks to Jay and Special Situations for sharing that this week.

The Services PMI came in at 47.0 vs. 52.6 expected. This represents a deep contraction in the wake of an expansionary outlook. Yuck again.

Composite business confidence fell to multi-year lows.

While the manufacturing PMI was ahead of expectations at 52.3 vs. 52.0 expected, the leading new orders indicator was the worst since the depths of the pandemic.

Once-thriving companies like TikTok are slowing hiring and laying off workers.

Despite all of that, we’re still left with an extremely tight labor market and low levels of unemployment. Considering that employment is one of two Federal Reserve objectives, it can focus wholeheartedly on the other, which is fighting inflation. A combination of a 9%+ CPI and a still relatively healthy labor force give the Fed permission to continue aggressively hiking rates and passively shrinking its balance sheet.

That will almost surely continue for now, but with vocabulary such as “pausing” and “re-assessing” and “data-dependent” creeping into Fed Official speeches, we seem to be getting there. And if large-scaled layoffs continue, we could get to the coveted dovish pivot everyone is waiting for sooner rather than later. That's the small silver lining of unfortunate firings: Eventual monetary easing comes more quickly. As a reminder, this means lower discount rates, and so more value awarded to longer duration assets like structural growth stocks.

Hopefully commodity inflation will continue to ease and distancing from stimulus-driven demand means inflationary readings have peaked. That's the less painful way to get the Fed to become less hawkish. But even if that’s the case, there’s a long way to go to get back to 2-3%.

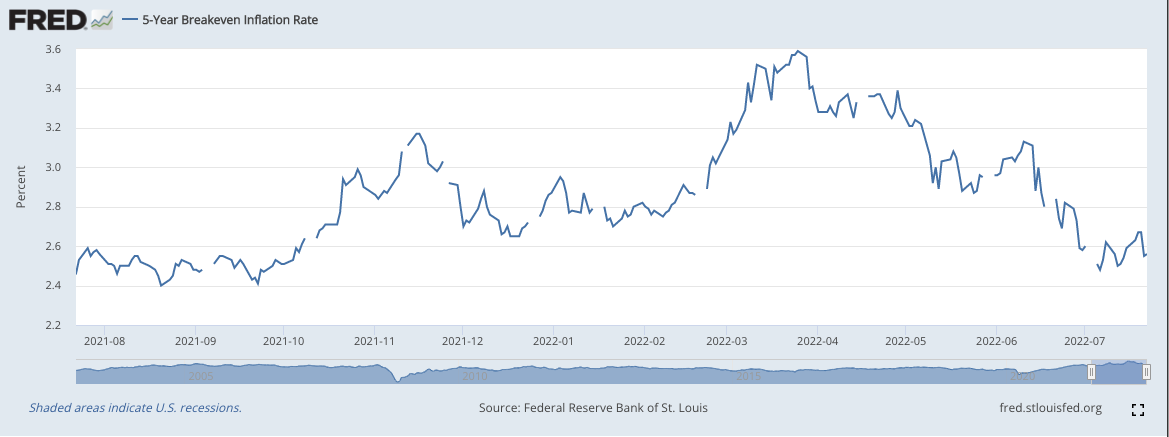

It is easy to see a scenario where inflation falls precipitously from the 9% range to the ~5% range, equity market victory is declared, then inflation remains sticky at 5% and the Fed continues to tighten until a recession is severe. This does not have to play out in a straight line, in fact, it rarely does. Still, breakeven inflation expectations looking out 5 years are beginning to re-anchor around 2% which is a pre-requisite for any Fed pause.

Again, we’re getting through this, but there’s still likely more turbulence ahead (in my opinion).

b) The Dollar

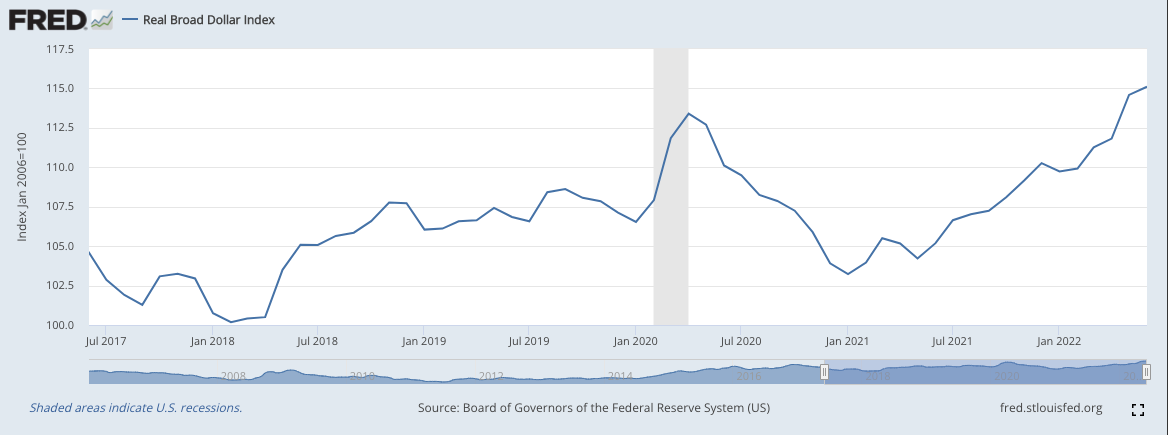

This week, IBM reported a 600 basis point foreign currency headwind to its growth rate -- that will likely be the norm for global companies this quarter (and probably next). Several of my holdings will see dampened growth as a result and investors should be aware of this. With the EU FINALLY raising rates, perhaps we could finally get some near-term relief here. We'll see.

Real Dollar Chart:

c) Other Key Charts:

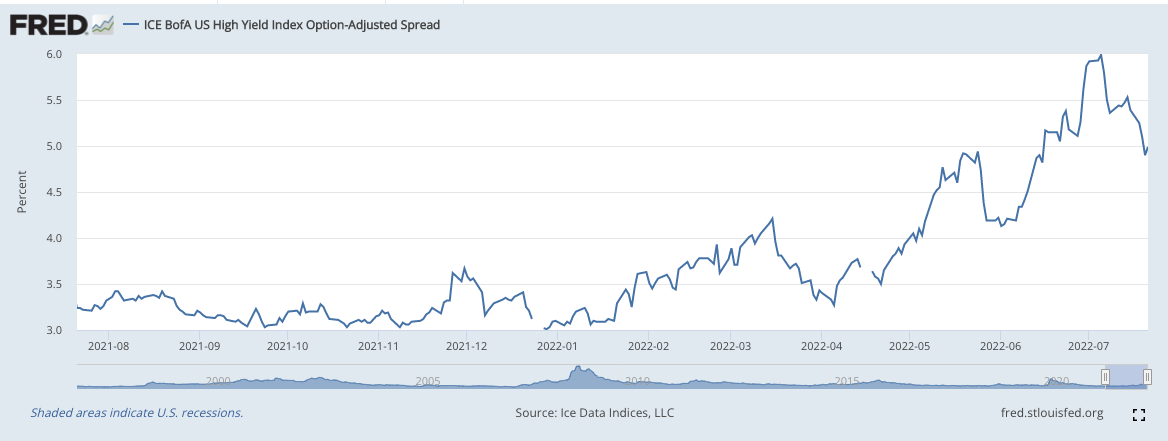

The ICE Bank of America US High Yield Index Option-Adjusted Spread has been improving:

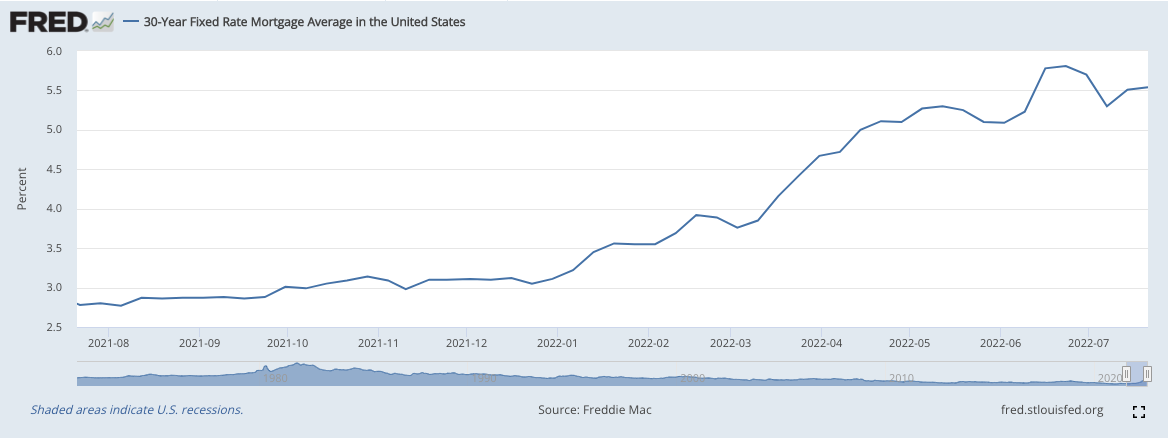

30-year fixed mortgage:

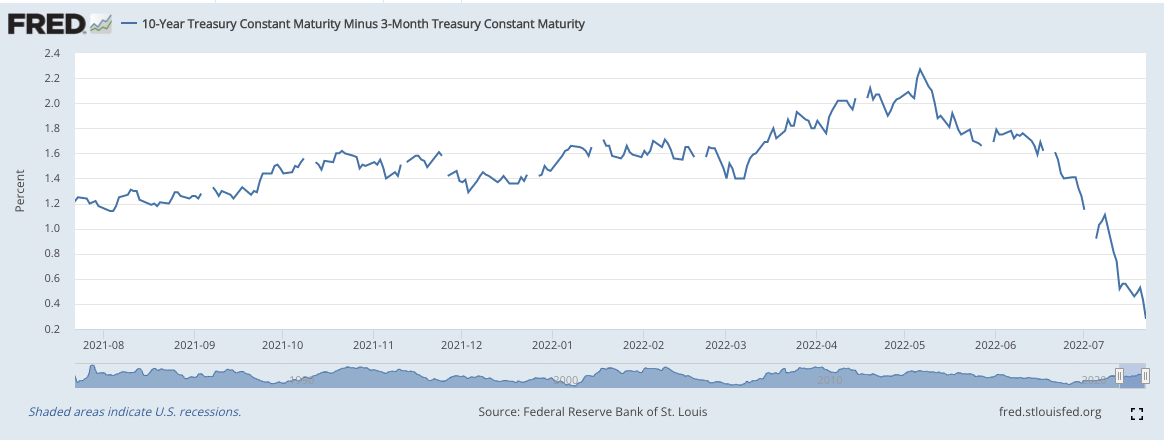

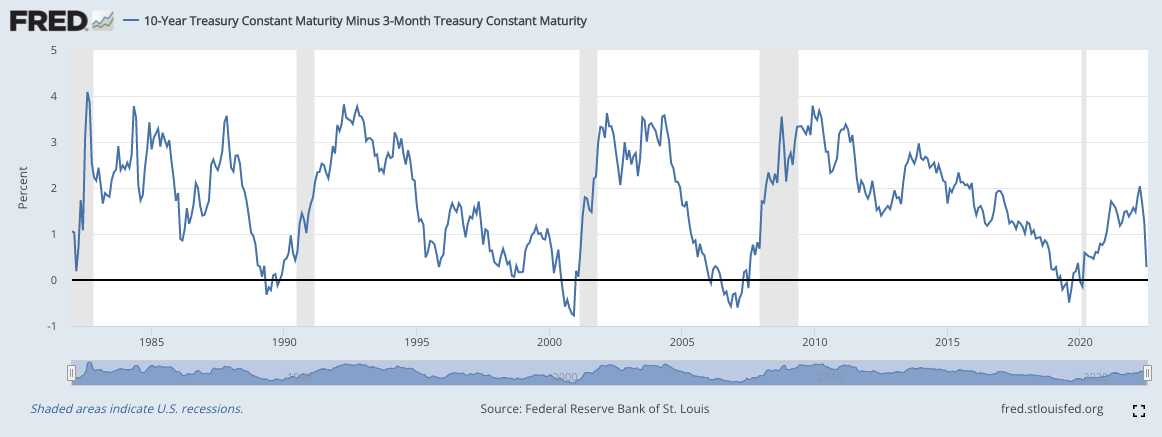

The 10 year-3 month yield curve continues to push closer to inversion. Note that this curve's inversion is more strongly correlated to recessions than the more frequently cited 10 year-2 year yield curve:

12. Cannabis News -- Mainly Per Marijuana Moment

Standardized cannabis guidelines have been added to the National Institute of Standards and Technology’s Federal Handbook. This is a very small baby step towards federal reform, but it’s a step. If conservative law makers simply embrace more social justice provisions and their liberal counterparts concede to a tax policy in line with tobacco and alcohol, the U.S. can likely finally get this done. With more than 70% of Americans favoring legalization, the pressure is certainly on (as it has been for several years). Find the middle ground!

There will be more hearings all through this next week as Chuck Schumer just debuted his party’s latest attempt at legalization. This has no chance of passing with the current tax structure proposal, to be candid.

Other relevant notes:

The National Institute on Drug Abuse is awarding another cannabis supplier a federal research contract.

New York is establishing public education grants for preparing the next generation to work in the lucrative cannabis space.

Missouri’s cannabis initiative may not have the support to be considered in November.

Texas’s agriculture commissioner is calling for expanded medical cannabis access, and comparing the state’s marijuana position to the prohibition of alcohol in the early 20th century.

Germany, Luxembourg, Malta and The Netherlands are slowly moving to cannabis legalization.

13. My Activity:

I didn’t make any transactions during the week… BUT based on popular demand… my live transactions can now be received via text message or email updates, FOR FREE, through this link. I’m excited to add this new layer of transparency for those interested, and for those who don’t care, I’ll still post my transactions in this section each Saturday. Transparency is king, and I wanted to thank Savvy Trader for giving me the tools to make this happen.