News of the Week (July 4th - 8th)

Meta Platforms; Upstart; SoFi; Lululemon; The Trade Desk; Duolingo; Olo; Shopify; Macro; Cannabis; My Activity

Today's piece is powered by Commonstock:

1. Meta Platforms (META) -- TikTok and Various News

a) Tick Tock, TikTok

A bipartisan movement in the Senate Intelligence Committee is calling on the FTC to investigate TikTok. The request is centered on TikTok’s insistence that American consumer data isn’t accessible in China -- when in fact it is. The same BuzzFeed story we discussed last week that leaked audio clips of ByteDance employees having free access to sensitive consumer data started this whole process. It’s likely that much more political momentum will be needed to bar TikTok from operating in the United States. In the off but growing chance that a ban does occur, Meta Platforms along with its social media competitors and YouTube would benefit greatly.

b) Various News

For June, Instagram gained more downloads than TikTok with 57 million to TikTok’s 55 million. The rest of the Family of Apps chipped in over 100 million downloads.

Goldman Sachs channel checks revealed that digital ad spend has been durable thus far, holding up better than expected. Guggenheim issued a note with the exact opposite sentiment. Interesting times.

EU Lawmakers passed the Digital Services Act (DSA) into law which essentially tightens the data sharing and privacy grips of the Digital Markets Act (DMA). The EU is also working on new restrictions of data flows between Meta’s Family of Apps.

One week after Meta announced a delay to launching its “Novi” crypto wallet on WhatsApp, it’s canning the project entirely due to extreme volatility and resource re-allocation. Customers have been asked to withdraw funds. The NFT marketplace is still in full swing, for now.

Meta is removing the Facebook login requirement to use its Oculus device to power broader interoperability. Users will now log in through “Meta Accounts” and Meta Horizon will be the social piece of the experience.

Meta built a new AI model for real time translation of 200 languages.

2. Upstart Holdings (UPST) -- Preliminary Results

Upstart released un-audited Q2 2022 results this week which were largely negative, but with some meaningful green shoots. As we’ve been discussing on the last several issues, 2022 will stink for this company as it suffers from exogenous capital market factors and external funding activity dwindles.

a) The Bad

Upstart posted $228 million in revenue vs. expectations of $300, representing a large 24% miss. It also posted a net loss of $29 million vs. previous expectations of losing $2 million, while the cash flow generation continued. The larger net loss was a product of lower volumes keeping Upstart from extracting as much value out of its fixed cost base as it had been in previous quarters.

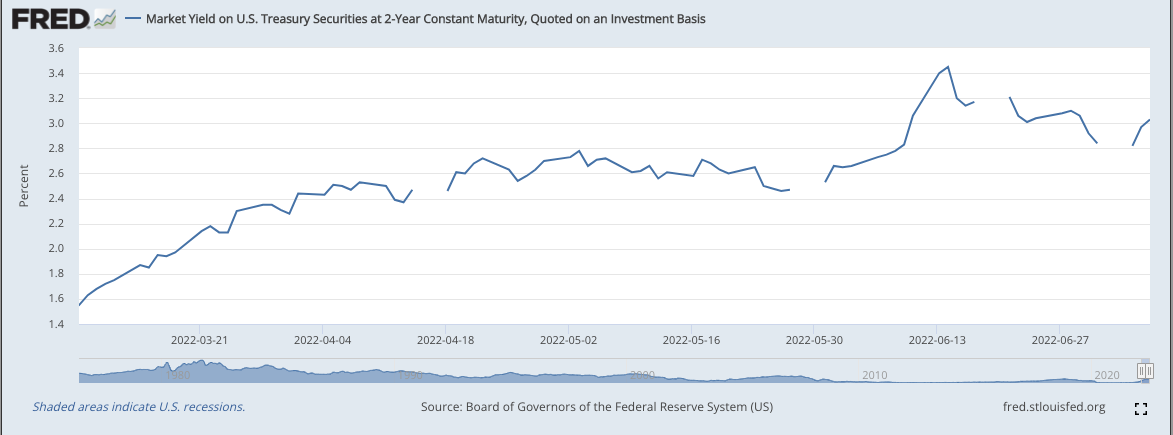

Macroeconomic pressures like a soaring 2-year yield and spiking credit spreads have crippled capital market funding appetite (temporarily) which is still where Upstart finds a slight majority of its revenue. Its operations are readily sourcing new consumer demand, but it is still funding-constrained as institutions tighten parameters with Upstart’s sub-prime niche being the first to go when times get tough. This is a supply-side issue. Last quarter, it remedied this issue with its own balance sheet to plug funding gaps, and markets utterly despised this decision. As a result, this quarter it left its balance sheet out of the funding equation and instead chose to turn down borrowers without partner or investor funding. Frustrating, but necessary.

More negatives:

Upstart-sourced loans passing through capital markets shifted from excess returns in 2018-2020 to missing those expectations by nearly 100 basis points in 2021 -- that’s a wide margin in the lending space.

It only added roughly 3 new (maybe a couple more) lending partners during the period vs. adding 15 total partners in the previous quarter. It does have more time to add new partners before its call in August, but the pace has to meaningfully accelerate to catch back up to the 1 partner per week tempo it was on. Considering that institutional demand will be fragile and inconsistent this year, it needs to rapidly build out the partner roster to make up the difference.

b) The Positives

Upstart took this quarter to clean up its balance sheet entirely. It listened to market pundits telling them to focus on being the marketplace rather than the lender and it took that message to heart. During the period, it converted the nearly $200 million in loans it previously funded with its balance sheet to cash. Given the rising rate environment Q2 experienced -- which makes loans worth less as the yields rise -- this led to a large contra-revenue item and was a growth headwind which will not recur.

Furthermore, the unit economics of its actual loans were strong and strengthening. Contribution margin (which deducts all variable costs floating with demand from revenue) came in a full 200 basis points ahead of expectations at 47%. This is direct evidence of the loan volume that is continuing to churn for Upstart coming with favorable terms for the company. That would not happen unless partners were pleased with the results.

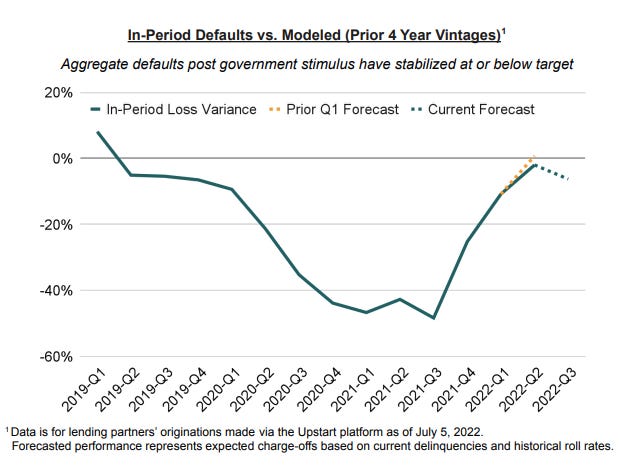

CFO Sanjay Datta in the release reiterated that Upstart’s partner-retained loans have continued to uniformly meet or exceed loss and residual cash flow expectations since 2018 when the program began. While the excess demand -- which is often lower-quality demand -- funneled through capital markets during 2021 looks fragile, partner operations look quite durable.

And that’s how Upstart will be a sustainably successful investment -- by building durable partner retention businesses that are more resistant to macroeconomic cycles. Not by leaning on Asset-Backed Securitization (ABS) markets when times are historically good as that funding will inevitably dry up first when the economy starts to form cracks. A larger partner retention proportion means smoother revenue growth and also better unit economics as there are no investing institutions involved to command a profit. It’s a large win-win.

It also seems that Upstart’s risk algorithms have been effectively re-set to cater to our current environment as Datta told us that Upstart is “currently targeting returns of 10%+.” If this is the case and it can concretely demonstrate that result to institutions, it should have no problem finding funding. Finally, default trends are actually showing glimmers of hope. In Q1 2022, Upstart had anticipated that default rates would fully return to pre-stimulus levels. In reality, defaults have stabilized at a level below that rate.

c) My Take

Priority one was cleaning up the balance sheet and I commend the team for pulling that off in just a few weeks amid the chaotic environment. . Its partners continue to realize effective results from their Upstart loan pools, and that’s the most important revenue channel powering Upstart’s long term viability.

Still, this company intimately relies on capital market funding appetite to be able to match all of its borrower demand with funding supply. That will become less true as the partner roster builds out over time, but for now that is objectively the case. Upstart’s commitment to not use its balance sheet means the risk has shifted from balance sheet to volume growth in 2022. With its sizable $800 million cash position and continued cash generation, I think this company is seamlessly capable of putting its head down and getting through the year -- albeit with challenged growth. It’s worth noting that its authorized buyback now equates to nearly 25% of the company’s enterprise value and it plans to keep buying back shares. Some think this is a mistake, but considering its liquidity and profitability, I disagree. It’s still spending wildly on R&D -- proving that it can simultaneously walk and chew gum thanks to its unit economics.

2023 and beyond will be more inviting when rates peak and capital market cravings return: Institutional supply will turn back on at some point. If we look back and see that Upstart’s loan performance held up on a relative basis and delivered 10%+ returns like it’s targeting despite the terrible backdrop, it will surely be a beneficiary of that funding faucet flowing. At the same time, it will continue to build the partner roster (growth needs to re-accelerate there) to make its reliance on these delicate funding sources less precarious.

I don’t think this underwhelming quarter was a matter of Upstart being less capable than its competitors. In other words, I don’t think this was micro-based failure. I think it was a matter of overly-ambitious guidance from a team that’s new to public markets paired with a macroeconomic climate that didn’t warrant the expectations presented. Delivering 18% YoY revenue growth considering how poor the lending environment has become is quite impressive for a cyclical credit-facilitator like this one. But when living in public markets, expectation management is really all that matters for earnings season, and there the team swung and missed. When things are hectic and uncertain and dynamic, it pays to lean overly pessimistic in forecasting rather than optimistic. It will take them a few quarters of executing to earn back the trust of Wall Street.

Credit and monetary cycles are to be deeply respected. I had been trimming Upstart into strength over the last several months, but that trimming -- while correct and timely -- was insufficient. In light of the Federal Reserve tightening, it was more gradual than it should with the luxury of hindsight. Going forward, for companies connected to these cycles, I will be using macroeconomics to justify the same trimming/accumulation paths -- but with more aggression. I generally consider 33% of a position to be tradable around changes in forward multiples and the macro environment. For these financially-connected firms, that will move to 50% of the position going forward.

The company now trades near its IPO with exponentially more partners, volume and profit dollars than when it publicly debuted. Upstart is down… but not out.

Click here for my Upstart Deep Dive.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service. Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.

3. SoFi Technologies (SOFI) -- Macro Resilience

Many are extrapolating the poor Upstart performance to mean SoFi will struggle as they are both FinTech. Not so fast. I think SoFi will be just fine, and this is why:

Its borrowers are well above average in terms of affluence. They are inherently less fragile with economic downturns.

SoFi offers loan products like variable to fixed re-financing and things like Home Improvement loans which thrive amid spiking rates.

SoFi’s delinquency rates have continued to set record lows as recently as May.

SoFi’s bank charter makes it far less reliant on capital markets for growth. It can use its low cost deposits to profitably fund loans when it makes sense to do so. It doesn’t need to use expensive warehouse facilities like Upstart does as SoFi is actually a bank. So it can take advantage of the demand spike associated with an end of stimulus.

Because it is now a bank, it collects net interest income on deposits and its funded loan book. That offers a great tailwind counter to the rate hike headwind associated with diminished liquidity for a financial services company generating sales via volume.

The company has demonstrated a consistent ability to under-promise and over-deliver.

4. Lululemon Athletica (LULU) -- Spain

Lululemon has officially re-started its international expansion following the multi-year pandemic pause. It’s opening two stores in Spain (Madrid and Barcelona) in the coming months and is launching a localized e-commerce platform there as well. This will be country number nine for Lululemon as it continues to embark on global ubiquity.

International is a key growth channel for Lululemon and will be for quite some time. The combination of years and years of rapid revenue compounding abroad and lower overall brand awareness in these markets vs. North America depicts a tasty recipe for brisk, multi-year compounding. 30%+ growth outside of North America (or a 4Xing of sales through 2026) is what leadership is expecting, and their track record of under-promise and over-deliver gives me confidence in that being attainable. We’re finally back to full speed ahead for Lulu in terms of global expansion. Game on.

Click here for my Lulu overview.

5. The Trade Desk (TTD) -- Industry News

The Trade Desk’s weekly blog post had some interesting data points in it from a 2,000 marketer Nielsen survey. Here are the highlights:

65% of respondents plan to raise their social media spend by up to 50%.

62% of respondents plan to raise their display spend by up to 50%.

Growth in digital channels overall will be above 10% across the board.

52% of respondents plan to decrease their linear TV budgets.

Confidence in ad efficacy is higher across all digital channels vs. legacy.

Click here for my TTD Deep Dive.

6. Duolingo (DUOL) -- Bullish Note

Needham released a bullish note and price target on Duolingo this week. I’ve said it before and I’ll say it again: I don’t care about price targets. But I do care about the source of the bullishness which is what I’ll focus on here.

The upbeat tone was centered on digital language learning poised to compound at 34% through 2025 and Duolingo’s leading brand awareness and market share (by a wide margin) making them the primary beneficiary. Extensive Needham surveys also showed that Duolingo’s larger user base is also more engaged than smaller, competing bases as its extensive split testing over the last several years has paved the way to beautiful, compelling products. That gives Duolingo a keen ability to convert more free users to its budding paid tier. Maybe they read my newsletter :)

What makes me so excited about this company is not language learning, but learning overall. It’s activity expanding into children literature where it’s finding early success and will debut a math product later this year. To me, its software core is seamlessly and readily leverage-able to take all of the learnings from the first product and to model engaging lesson plans across other subjects after it. Duolingo’s market share lead means it has a data share lead and has shown a unique tendency to use this data to further separate itself from the pack with data-driven product enhancements.

Click here for my Duolingo Deep Dive.

7. Olo (OLO) -- Brand Win

Olo landed a small new brand client in Mia’s Table and its 6 locations during the week. The chain launched with Olo Network, Dispatch, Ordering, and Rails. But most encouragingly, it also implemented Olo’s new Olo Pay module which quadruples Olo’s revenue per order. As a reminder, 2022 guidance assumes a $0 Olo Pay contribution while the company continues to sign on new brands with this module for 2022 deployment. Perhaps there’s some upside here.

Click here for my Olo Deep Dive.

8. Shopify (SHOP) -- Layoffs

Please not that this is still just a watch list item for me. I do not own shares, although I'd like to at some point.

Shopify is postponing an overhaul of its compensation structure which would have allowed employees more flexibility in payment via cash. This change had already prompted the company to fire 50+ people as their stock compensation was too far out of whack -- many more offers have been delayed. Considering a large chunk of employee stock options are well below strike prices, this was a way to keep employees around and happy. The earliest this change will happen is now September.

While stock prices shouldn’t matter in the short term to investors like myself, they certainly matter to employee option package value. And when stock comp packages are worth next to zero while you can go get a job elsewhere to see that package re-set, why wouldn’t you? This is Shopify’s response to combatting that attrition issue that countless companies are currently dealing with.

Click here for my Shopify overview.

9. Macroeconomic Update -- Fed Minutes and More

a) Highlights from the Fed Minutes

Nothing all that surprising came from the Fed’s Minutes released this week. As expected, the next meeting will come with either a 50 or 75 basis point hike to the federal funds rate as supply-side-fostered inflation continues to be their main priority. The Fed will likely hike beyond the neutral rate (in line with longer term inflation expectations) to cool off price increases and to give supply chains a chance to normalize post-pandemic. It’s fine with accepting slowing growth if that means cooling inflation readings.

Interestingly, the Fed also hinted at getting to that neutral rate or slightly above it by 2023 when it thinks it’ll be positioned to "adjust policy" if economic data warrants it. Perhaps that’s why rate cut expectations were moved up from 2024 to 2023 this week.

b) Green Shoots

Green Shoots continued to pop up this week after the slightly better than expected PCE reading last week. The 5 and 10 year treasury breakeven rates -- the difference between nominal yields on a treasury security and the comparable Treasury Inflation Protected Securities which reveals inflation expectations -- are near 12-month lows and have been moving in the right direction:

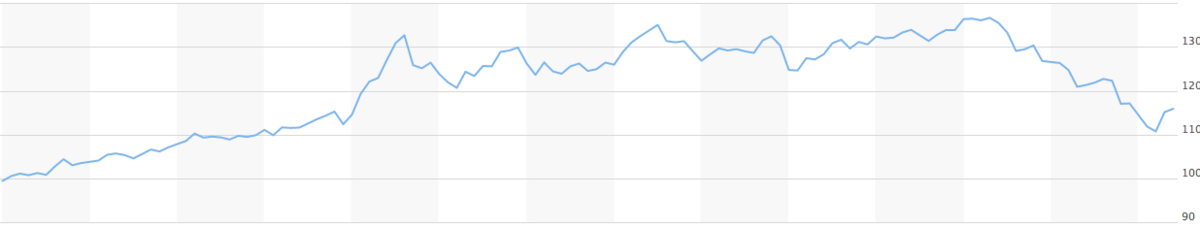

Perhaps the most important objective of the Federal Reserve (especially with how strong employment is today) is keeping long term inflation expectations anchored close to its 2% target. That’s the clearest sign of markets thinking of the Federal Reserve as credible rather than out of control. It looks like its tools are beginning to work. Other evidence can be found in cratering wheat, corn and other commodity prices along with encouraging signs in the energy market. Wholesale gas prices -- which are a leading indicator for retail gas prices -- are tanking which will inevitably provide much-needed relief at the pump:

Mortgage rates also fell at the fastest pace since 2008 along with treasury yields cooling from their local highs:

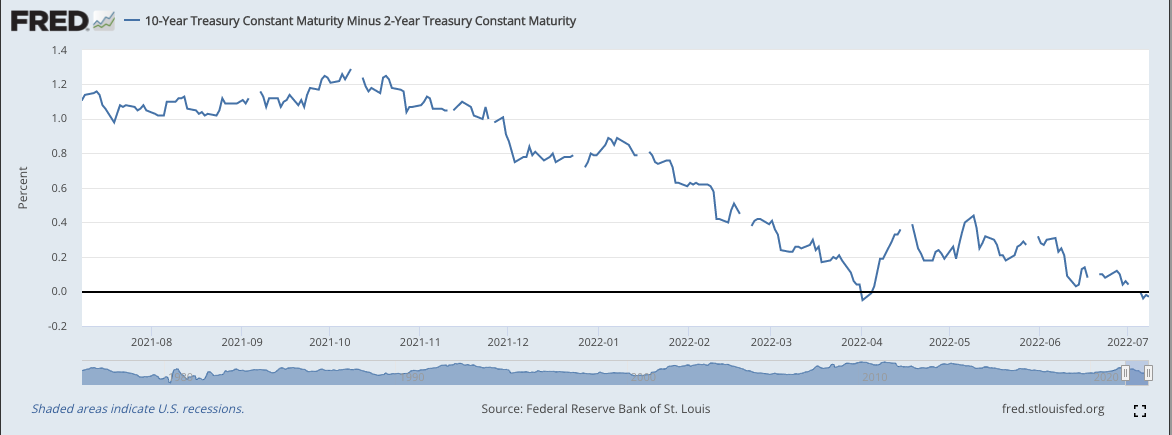

This strange combination of still hawkish policy paired with falling inflation expectations, an inverted yield curve, elevated (but now thankfully falling) high yield corporate credit spreads and tanking commodities is a clear indication that Mr. Market is discounting a high probability of a recession.

Continued strong payroll data this week (+372K vs. +270K expected) simultaneously gives the Fed consent to remain quite hawkish which makes recession even more likely.

I don’t think that a recession should be feared by growth investors. The “soft-landing” (hiking with no recession) everyone discusses is quite rare -- hawkish cycles almost always overshoot and lead to economic downturns. But these downturns are actually what will erode demand and inflation and give the Fed permission to conduct a dovish pivot. It’s walking a fine line between conceding economic weakness for slower price increases -- and if history is any indication, this walk will be far from seamless. When it finally goes too far is when discount rates can begin to fall once more and when future cash flows of long duration assets will become more and more valuable. We need the pain to get to the other side.

c) Other Interesting Market Headlines

Mastercard reported consumer spending up 9.5% in June as real growth hopefully continues.

Net bullish options activity is setting 4 year lows to depict how negative sentiment has gotten.

Goldman cut its GDP forecast from 1.9% to 0.7%.

The Western World is discussing a price cap on Russian oil around $40-$60 per barrel.

The U.S. just wrapped up its fastest 3-month rise in credit debt since GFC.

Potential roll back of Chinese Tariffs are coming.

The ISM’s key Non-Manufacturing (services) PMI came in well ahead of expectations at 55.3 vs. mean estimates of 54.3. This was still the lowest reading in a few years, but is a sign that non-manufacturing business activity remains robust. Anything above 50.0 implies expansion.

Job openings are beginning to fall from extremely high levels. For May, total openings were 11.25 million vs. 11.68 million in April. This is encouraging, but is falling slower than expected and has a long way to go with still 2 job openings per 1 job seeker.

Crude oil inventories rose by 8.2 million barrels vs. expectations of shrinking by 1.2 million barrels. Still, gas and distillate supplies remain quite low and stressed.

Elon is no longer planning on buying Twitter. Get the popcorn ready.

11. Cannabis News -- Mainly Per Marijuana Moment

Arkansas, Oklahoma and Nebraska (~ 9 million Americans) all collected needed signatures to vote on cannabis reform in November.

Minnesota legalized THC-infused edibles and beverages. Green Thumb and Verano are the only two growers with a heavy presence in the state and its nearly 6 million Americans.

New York is laying the hammer on charging un-licensed cannabis operators if they continue to sell -- a move to combat the still thriving black market.

Washington D.C. Medical patients no longer need a doctor’s recommendation. This will essentially function like a slightly more restrictive rec-program.

Senator Warren and other leaders are calling on Biden to re-schedule cannabis… for the 1,044,294th time.

The National Defense Authorization Act includes several cannabis reform items. It did last year too before those items were stripped out. We’ll see what happens this time.

Columbia Care has officially approved its combination with Cresco Labs.

12. My Activity

No trades this week. Going forward, I’ll continue updating transactions from the week here, but will also be doing so through a service called SavvyTrader. This allows those who are interested to sign up for (free) real-time alerts and text message/email notifications to bring my transparency to the next level. I'm excited to offer this to interested readers.