News of the Week (June 13-17)

PayPal; Duolingo; Meta Platforms; Upstart; The Trade Desk; Lemonade; Macro; Cannabis News; My Activity

1. PayPal Holdings (PYPL) -- Head of Consumer Doug Bland interviews with RBC, Grubhub & a BNPL Update

a) Head of Consumer Doug Bland Interviews with RBC

As a note, Bland came to PayPal as part of its Swift Financial acquisition several years ago. Like most of PayPal’s M&A activity, the acquired leadership generally sticks around which is a great sign of strong culture and integration capabilities.

On Honey:

The Honey acquisition was about driving more two-sided value within PayPal’s network. The entity’s automated deal tracking and wish list building is immensely more valuable when it plugs into tens of millions of PayPal merchants vs. the 700,000 that Honey had beforehand. Furthermore, consumers benefit from far more seamless and broad deal discoverability. PayPal’s north star is maximizing the payment volume processed through its network. To do that most effectively, it needs to stand out from a value proposition standpoint with both consumers and merchants -- and Honey helps accomplish that objective. More merchants will now be attracted to Honey thanks to PayPal’s 400 million+ consumers and more consumers will use Honey with the vast injection of new merchants and deals. It’s a compelling flywheel.

Speaking of Honey, Bland was asked if the platform was nimble enough to shift deal flow away from discretionary purchasing and to necessary goods as inflation rages at generational highs. He indicated that it is nimble enough and is actively doing this today.

On QR Codes and On-Premise:

PayPal leadership has frequently discussed “doing fewer things better” over the last few months. It hadn’t offered more color on where it would actually cut back, but Bland did that this week. The company is moderating investment plans in its QR code endeavors. It’s gaining far more on-premise traction with Zettle and its cards and will focus there instead. Interestingly, Bland told us that there’s a new debit card launch coming soon (he wasn’t supposed to share this but I'm glad he did).

QR is still part of the long term plans, but it’s becoming a smaller piece.

On if PayPal Would Consider Selling BNPL receivables like it did with its consumer receivables a few years ago to Synchrony:

“Yes absolutely. We’re constantly exploring that. We’re not a bank or a lender. We’re a payments tech company." — PayPal Head of Consumer Doug Bland

On Credit Delinquency Trends:

“We see all of the articles that are coming out around credit delinquencies and compression of margins, but we’re a bit unique. We’re not immune… but we feel really good about our position. We have dense customer data… the vast majority of all our BNPL is with existing PayPal customers which is a very different position than if you were a stand-alone BNPL firm trying to learn your way on a one-off transaction basis… This is a credit product and we said that from day 1 even when it wasn’t in vogue to say that. But it is a credit product and we take it responsibly.” — PayPal Head of Consumer Doug Bland

On Venmo:

The drop-off in user growth Venmo experienced after the pandemic pull-forward has now recovered.

Trends with other large merchants using Pay with Venmo are “better than expectations.”

Bland spoke on the extreme caution Venmo has acted with in terms of adding monetization features to ensure it doesn’t turn off its vast, loyal user-base. On the surface, this has resembled slow innovation within the company. It’s starting to press the gas pedal here and is not seeing any negative impacts pertaining to churn or user growth. That is a good sign considering leadership thinks Venmo has a 10X average revenue per account (ARPA) opportunity.

On His Mood in Light of PayPal’s Stock Getting Shellacked:

“I’ve been doing this for a long time and I’ve never been more excited about PayPal and the brands we have with this scale. There’s such an opportunity here to unlock value and that’s exactly what we’ll do.” — PayPal Head of Consumer Doug Bland

b) Grubhub

Grubhub partnered with PayPal and Visa this week to power instant payouts for its drivers through PayPal’s Hyperwallet and Visa Direct. Partnerships and more integration capabilities are an essential piece of PayPal remaining engrained in the competitive payments space. This is a small piece of positive news.

c) Buy Now, Pay Later (BNPL) Update

PayPal introduced a new “Pay Monthly” plan through WebBank for its BNPL product. This launch extends the maximum lifetime of these installment loans with no late fees. It also raises the cap for BNPL purchases from $1,500 max to $10,000. PayPal has clearly telegraphed its plans to extend BNPL to larger purchase sizes and longer maturity schedules. It has found historic success with this installment loan product launch in the face of several competitors already well-entrenched in the space -- so it is leaning in even more to grab incremental share.

2. SoFi Technologies (SOFI) -- CEO Anthony Noto Interviews with Morgan Stanley & Insider Buying

On Macro from SoFi’s Perspective:

SoFi’s attempt to insulate itself from Macro-cycles is not new. Not only has it sought to do so through product diversification and the bank charter lowering cost of capital, but by adding more funding options as well. In 2018 when the taper tantrum was wreaking havoc on capital markets, SoFi aggressively expanded its funding diversification. This ambition 4 years ago is paying off today.

The banking charter made loan holding more flexible and profitable and that helped greatly, but SoFi still taps into Whole loan markets when the economics are better than simply holding. Its commitment and consistent delivery of variable profit margins per loan of 40-50% along with its relatively affluent borrower cohort have both kept institutional demand for its paper robust through all of this. SoFi’s 7-8% loss rate target is not a goal, but an imperative for the company -- this is how it maintains investor confidence as macroeconomic tailwinds shift to headwinds.

Luckily, SoFi’s institutional demand is satisfied in the Whole loan market and so it hasn’t needed to use securitization markets in a long time. Whole loan investors are more often “hold-to-maturity” players that don’t rely on quick flipping of loan pools to generate profits like in securitization markets. Whole loan markets are far more durable across economic cycles than securitization markets are. These whole loan purchasers -- per Noto -- are seeking out higher quality borrowers and that’s exactly what SoFi provides.

SoFi’s weighted average cost of capital has risen in the very recent past with the sharp rise in the treasury yields it uses as benchmarks. Luckily -- and again thanks to the financial health of SoFi’s typical consumer -- it has been able to pass on the vast majority of this cost increase to its borrowers with volumes still in line with expectations. The end of stimulus -- which cut into loan volumes -- is surely helping with pricing power and inelastic demand here.

Quick Notes on Loans:

Home loans “continue to under-earn relative to where they could be long term, as we’re re-tooling the back-end operation there for purchasing vs. just refinancing loans.”

Student loan volume continues to operate below 50% of normal volume in light of the moratorium.

On Path to Profitability:

Noto told us this week that the financial services segment for the company would become contribution-profit positive by the end of the year. Management likes to say that the segment is already there when you sub out marketing costs, but that item was a massive piece of the top line growth allowing for this profitability inflection. By the end of 2023, the segment will be profitable enough to also cover fixed costs and will thus be generating a positive net operating profit like its other two segments.

Noto also reiterated that stock-based compensation as a percent of revenue would fall from the mid 30% range to single digits by 2024. This is when SoFi expects to become GAAP profitable -- but this timeline is overly conservative. It assumes student loans remains challenged with the moratorium through 2024, doesn’t factor in things such as improvement in the home loan business and ignores expected revenue segments blooming from the banking charter like serving in a sponsor bank role for Galileo clients. These high probability tailwinds would move that profitability schedule up materially.

On the bank:

This has been the central piece of SoFi’s rapid success in attracting direct deposits (which greatly bolsters its customer lifetime value (LTV)). How? It has allowed them to pocket an additional 1.5% in cost of capital to profitably offer the 1.25% annual percent yield (APY) on its savings accounts. It’s the only company with this rate in place without any deposit maximums.

As long as SoFi stays above $100 million in new deposits per week, it does not plan to raise this rate again. But it doesn’t sound like this rate will be lowered either which many, many analysts expected out of the gate. If it needs to, it has significant room to profitably raise its rate further. It just doesn't feel that need yet.

“We’ve only passed 25 basis points of the Fed’s rate hikes onto our consumers (raised APY from 1% to 1.25%) and it’s really doing well where it’s at.” — SoFi CEO Anthony Noto

Separately, the bank charter also puts SoFi in a better bargaining position with those aforementioned whole loan investors. Why? It gives SoFi far more holding period flexibility which raises the bar for what these investors must offer to justify SoFi forgoing the added net interest income.

On Technisys:

SoFi was missing a multi-core technology interface across all products. It had it for lending and payments with Galileo, but will use Technisys as a unifying layer to build one singular platform encompassing every product that an enterprise customer could need. This will also allow SoFi to fully vertically integrate its product suite to drive faster innovation and lower cost.

“Technisys is really brining clients to the table from the traditional financial industry that wouldn’t have come to the table with just Galileo before…. it’s really complementing Galileo… Galileo was a huge home run and it looks like Technisys will be too.” — SoFi CEO Anthony Noto

On the reserve stock-split:

“The headline is that this is in case of emergency. I’ve lived through the GFC, and dot.com and we’re obviously going through a huge dislocation now… we wanted to give our Board the option to reverse split if we enter an even more irrational market. Our confidence is in no way reflected in the ask to vote. What is reflected is prudent management… we’re one of the few companies to exceed Q1 expectations and raise guidance.” — SoFi CEO Anthony Noto

He is all but obligated to say this, but I still find it somewhat encouraging.

On the future:

SoFi will become an insurance principal at some point. It’s currently shipping about a billion in premiums per year to referral partners but wants to bring this in-house in the coming years.

It will enter tax planning and payment in the future as well.

SoFi plans to launch “SoFi Plus” this year which will be similar to a subscription service where you get a whole host of member benefits in loans, investing rewards and more if you direct deposit with SoFi. This will be free for direct deposit users but will be a paid subscription for others.

b) Insider Buying

Anthony Noto has entered Pac-Man mode with his insider buying spree. In the last 10 months, he has now made 22 separate purchases worth $3.9 million. This represents 2.6% of his combined net worth with nearly 15% of the net worth now in common shares of SoFi (not including options) alone. This is a strong demonstration of ongoing commitment in the face of a large price decline.

3. Duolingo (DUOL) -- Strong Q2 Trends

Last quarter, Duolingo guided to 5.3% sequential revenue growth to reach $85.5 million in Q2 2022 revenue. App store data via Sensor Tower over the first two months of this calendar quarter indicates that sequential growth may be closer to 10% for the period. This is not a perfect indicator, but it is meaningful and positive.

4. Meta Platforms -- Various News

Instagram is catching back up to TikTok. Per App Figures, May downloads for the two apps globally were identical.

Piper Sandler channel checks revealed that cost headwinds resulting from Meta’s Reels transition and Apple were beginning to ease up. This is great news but I think it’s safe to say Q2 will still be a challenge for it amid these obstacles as well as lapping pandemic e-commerce growth, the strong dollar and waning consumer confidence. Still, that’s expected so it’ll be a matter of how gracefully it can overcome what we’re all already fearing.

In its latest attempt to limit speculative spend, Meta Platforms has paused development of its dual camera smartwatch.

Meta added new parental controls on Instagram such as usage time limits.

See the KeyBanc note on The Trade Desk above.

Meta won its appeal against the rejection of its Giphy acquisition by UK Lawmakers although it remains an uphill battle to close this deal. It's ridiculous how difficult it has been for Meta to buy this small firm.

Apple is launching its Oculus competitor next year.

McKinsey sees $5 trillion in total Metaverse spend by 2030.

5. Upstart -- 2-Year Treasury Yield & The CFPB

a) The 2-Year Yield and 2022 Expectations

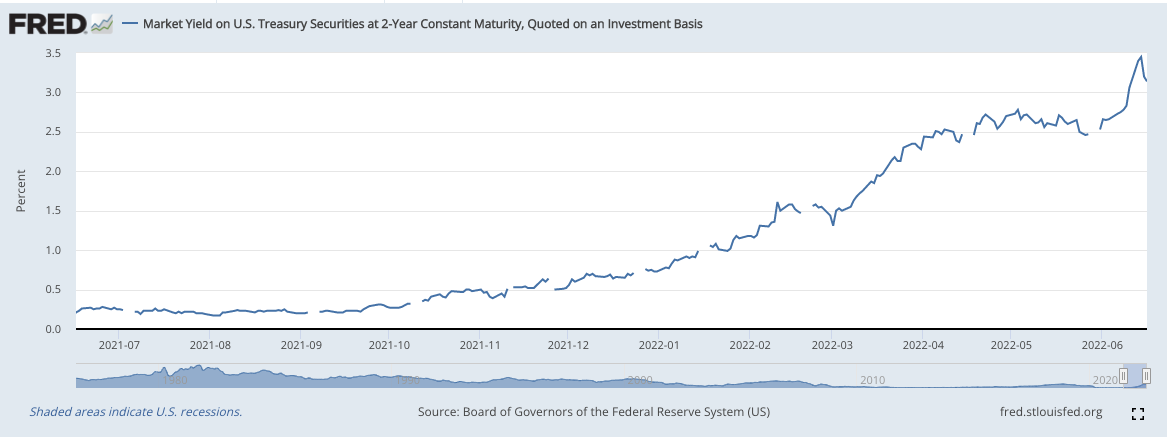

I wanted to address the sharp rise in the 2-year treasury yield as it pertains to Upstart's financials. Upstart’s loan APRs offered through banks rise with the climbing 2-year and -- all else equal -- this cuts into its total volumes. In March, that yield rose by roughly 100 basis points -- at the fastest pace in centuries -- which prompted Upstart’s loan rates to become 3% more expensive instantly for borrowers on average.

It still had ample borrower demand as stimulus ending juiced borrower interest, but it also had less investor funding supply for its loans that it needed in light of a hectic and volatile backdrop. As a result, it used its balance sheet to fund a small chunk of the loans which was universally hated by investors, including me. As a result, it committed to discontinuing the practice and instead, will merely accept volume volatility associated with being in the lending industry across macroeconomic cycles.

Well, the 2-year yield rise unfortunately has not really slowed down. Since the beginning of May, it has risen another 60 basis points which will surely create even more timid institutional willingness to fund. The velocity of this move has also been breathtakingly aggressive which adds significantly to the headache:

Robust borrower demand in the wake of stimulus ending and soaring credit demand growth amid a weakening economy does not matter if capital markets don’t want these loans. After all, Upstart caters to lower tier, non-traditional borrowers which are the first to be turned down when underwriting tightens like it inevitably is now.

This time, that would result in a volume miss rather than a balance sheet scare as Upstart won’t bridge the gap with its own cash. Still, this likely will not be welcomed with open arms by investors.

So? I continue to enthusiastically believe that Upstart is a special company and will overcome this violently difficult environment to see better days and higher share prices ahead. Still, these times will not magically get better and we still likely have some more pain to come -- even with the 2-year now approaching where the assumed Federal Funds terminal rate will be. I have zero interest in selling any shares, but am not expecting this to be a successful stock in 2022. The SoFi’s of the world with their more affluent customer bases boasting larger financial cushions will fare better as soaring inflation makes things like food and gas a larger piece of consumer budgets. Upstart’s borrowers will probably struggle both on an absolute and relative basis.

I’ll continue to use extreme multiple compression to accumulate, but will likely trim more readily than I normally do (as I did after the post-earnings recovery). When zooming out, I think this will be a monumentally successful company based on all of the extensive research I’ve done. But we can’t just zoom past 2022. We have to grit our teeth and get through it -- preferably (in my view) with an elevated cash pile for future accumulation.

b) CFPB

This month, the Consumer Financial Protection Bureau (CFPB) terminated its no-action letter in place with Upstart. I missed this piece of news and @RahulSetty_ on Twitter brought it to my attention. I wanted to thank him for that. You rock.

This classification made Upstart immune from underwriting-based fair lending charges and is now gone. Upstart requested this termination to gain more flexibility with upgrading its underwriting models in light of infusing several new variables into its algorithm in April. The CFPB required more time to verify the legality of these changes which Upstart didn’t have while macro-volatility raged on. This decision makes Upstart both nimbler but also more vulnerable to CFPB charges. Its intimate relationship with this governing body eases much of the concern (along with it requesting the termination), but this is still notable.

6. The Trade Desk (TTD) -- Various News

KeyBanc sees privacy and walled-garden restriction concessions from Alphabet and Meta Platforms in the EU as likely. It sees The Trade Desk as a key beneficiary. I don’t necessarily agree as The Trade Desk is better-equipped to counteract walled gardens than any other player in open internet. Its roster of partners and leading scale help make that a reality. It will benefit, but I see others less capable of overcoming tracking headwinds as larger beneficiaries. Still, it will be a tailwind for the company and I love tailwinds.

In other news, Netflix is reportedly seeking help from Roku and Comcast for launching its ad-supported product. This does not mean The Trade Desk won’t be part of placing bids and -- according to CEO Jeff Green -- Netflix will intimately connect with The Trade Desk to most effectively and profitably power this release. Where else is it going to go for measurable demand side agency and advertiser scale? (hint: nowhere)

7. Lemonade (LMND) -- Ohio & a Hire

Lemonade Car Insurance Launched in Ohio this Week.

Lemonade hired New York’s Former Chief Insurance Regulator Scott Fischer as its Head of Government Relations and Co-General Counsel.

8. Macro:

a) This week’s Fed Meeting

The Fed punch bowl is totally empty. Jerome Powell and the Federal Reserve are adamant that the economy and consumer are healthy and will therefore conduct hawkish monetary policy accordingly.

June’s Fed Meeting came with a 75 basis point rate hike vs. forecasts from Powell of 50 basis points just a couple weeks ago. The 8.6% May Consumer Price Index (CPI) and rising longer term Personal Consumption Expenditure (PCE) expectations spooked the officials and were surely meaningfully contributing factors to motivate this hawkish acceleration.

At the same time, economic cracks are clearly forming with the following data points from this week serving as yet more evidence:

The Atlanta Fed GDPNow real estimates for Q2 are 0% vs. over 2% just 60 days ago.

Layoffs from multi-billion dollar firms like Coinbase and Red Fin plus slowdowns in hiring from firms like Spotify remain daily headlines.

The Median unemployment projection for 2024 rose from 3.7% to 4.1%.

The Philly Fed’s Manufacturing Outlook Survey yielded a -3.3 reading which vastly missed estimates of +5.5 and contracted for the first time since 2020.

So? We’re getting the double whammy of headwinds: A Federal Reserve viciously raising the cost of capital and cash flow discounting rates and the economy continuing to weaken while they do. This recipe leaves me in the same position I’ve found myself in over the last several months of weekly posts – I will not fight the Fed. I will continue to hoard cash while all of this plays out. I’m still accumulating, just at a slower pace than I’m adding cash to my account. If you’re a frequent reader, this is not news. At some point, economic health will deteriorate to a point where we get a dovish pivot but I don’t think we’re all that close to that point with as worrisome as inflation readings currently are and as low as unemployment remains; we still have 2 job openings for every applicant seeking employment.

The main issue I see here is that I’m not sure what rate hikes can do to solve supply-based issues manifesting in things like soaring gas and food prices. The Federal Reserve can work wonders in eroding demand with its tool kit, but cannot improve supply. And it’s supply chains within energy, food, labor and more that really are pushing inflation higher and higher along with the growth in M2 supply over the last 2 years. China re-opening will only add to that supply-chain-related challenge. Still, The Fed thinks this demand erosion -- from levels it interestingly considers frothy -- will have a more positive impact on CPI than traditional textbook correlations indicate. This is due to diminishing demand allowing vulnerable supply chains to catch up. We’ll see.

The median Federal Funds rate projection for the end of 2022 is now 3.4% vs. below 2% just one quarter ago. Forecasts rise to 3.8% for 2023 before rate cuts are expected in 2024.

Other interesting notes from the Federal Reserve’s monthly meeting and presser:

Unsurprisingly, Powell thinks a sustainably healthy labor market relies on anchoring long term inflation expectations near 2%. Labor markets remain tight despite recent frequent layoff news.

Recent indicators Powell looks at point to real GDP ticking up while the Fed Now data out of Atlanta says the opposite. Median GDP forecasts are below 2% through 2024.

No new updates on balance sheet runoff/passive quantitative tightening.

It now sees the PCE at 5.2% for 2022 vs. previous expectations of 4.3%

The theme of this press conference was destroying frothy demand to allow supply chains to catch up and that a path to a soft landing (effectively tightening without inducing a recession) is becoming “more difficult.”

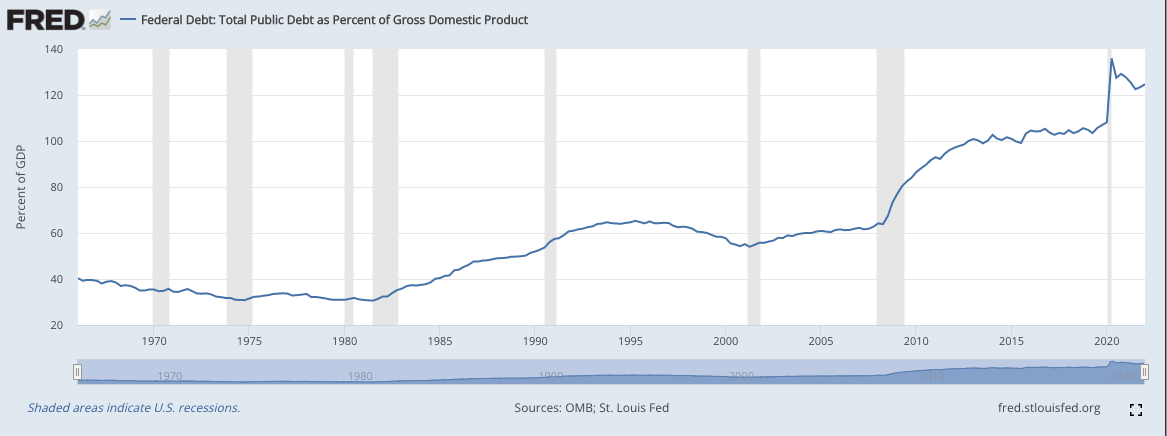

b) Paul Volcker 2.0?

Powell was careful in his press conference to mention and reiterate that 75 basis point rate hikes would not become “frequent” -- although it’s a possibility for next meeting. To me, this was a nod to worried investors to assure them we won’t get Volcker 2.0 (raising interest rates more than 10% in a matter of several months). This is encouraging but isn’t surprising. Why? Our debt to GDP ratio is now well over 120% which doesn’t allow for that aggressive hiking path to be emulated. Volcker was dealing with a debt/GDP ratio below 40% which made hiking a more affordable maneuver for the federal government in terms of covering higher interest payments.

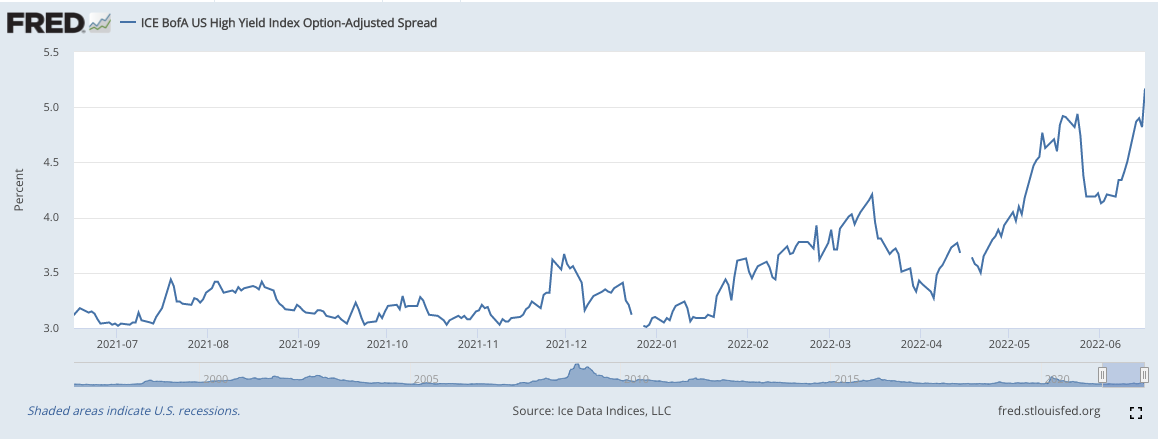

c) Rates and Spreads

The ICE Bank of America U.S. High yield option adjusted spread Index set 20-month highs this week as risk aversion builds and liquidity diminishes. Credit spreads refer to how much more yield a lender requires for taking on incremental risk. When liquidity is abundant and times are great, these spreads are small. Today, not so much:

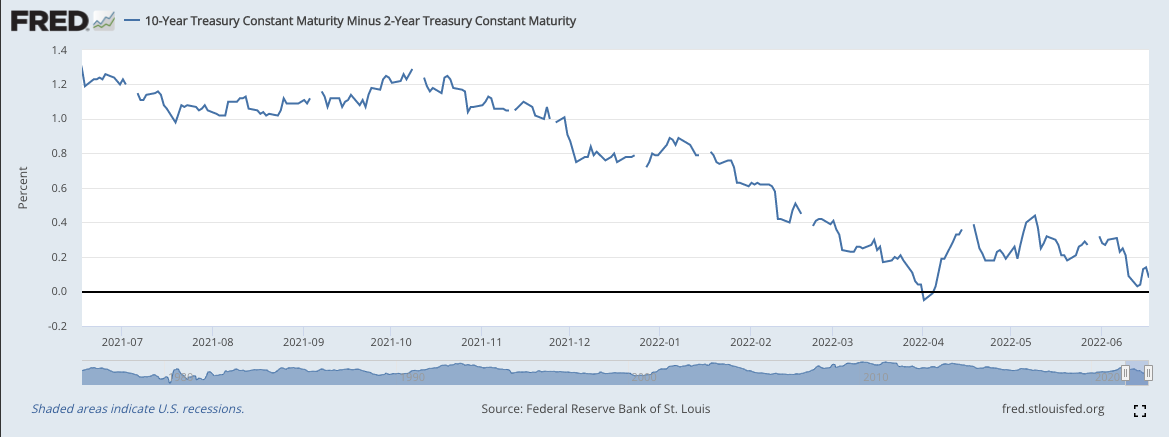

10-2 year yield curve slope continues to flirt with inversion (a somewhat strong recession indicator):

Both of these metrics are signs of economic confidence and expectations weakening while the Federal Reserve tightens under the assumption that the economy is largely full speed ahead.

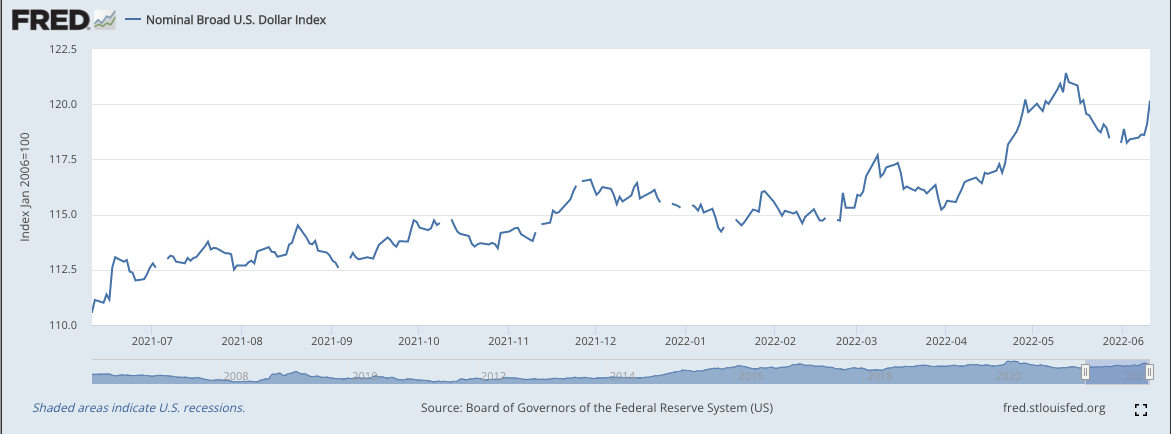

The U.S. Dollar also continues to push higher and higher vs. other major currencies which will be yet another growth headwind for global companies this year:

d) Mortgages

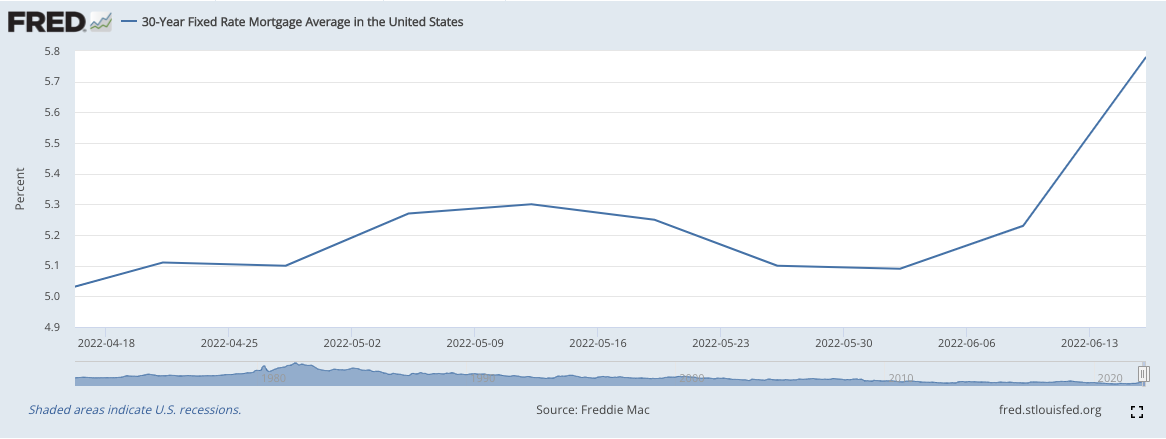

30-year fixed mortgage rates have risen by over 80% in 2022 from roughly 3.2% to 5.8%. During that time, home prices also rose by around 40%, meaning the cost of the average home has more than doubled in 2022 alone. Yikes. That’s why housing starts fell to its lowest level in over a year in May. Average FICO scores for mortgage applicants are at record highs while housing equity leverage is near record lows and this will likely only continue as accessibility diminishes with costs. It's incredible how quickly this market turned. Amazingly, this past week delivered the fastest rise in this metric we’ve seen since Black Monday in 1987.

Similarly to oil, these issues are intimately connected to the supply chain meaning it’s not clear if rate hikes will help nearly as much as building a lot more affordable housing supply into weakening demand -- good luck convincing any builder to do that. When pairing this with rising cost of living in other categories and the wealth destruction brought on by equity markets tanking, it’s hard to see the consumer being as healthy as the Federal Reserve thinks it is (at least, not for long).

Especially if continued high-profile layoff news continues and eventually hits the unemployment rate, how could the consumer remain healthy? The main help here would be pumping more oil or the war in Ukraine ending, but neither seems to be on the table today.

e) Market News:

Goldman Sachs says net equity selling last week into this week was the largest ever recorded.

The put/call ratio is working back towards multi-year highs.

Per Bloomberg, Hedge Fund selling cadence during a 2 day stretch early this week was the fastest ever recorded.

Oracle earnings were actually stellar. Adobe was fine too.

This data all hints at oversold conditions primed for another aggressive dead cat bounce. If we get this bounce (which is far from certain), I’d likely use it to raise a bit more cash for future deployment.

f) Use This Time Wisely

As frustrating as 2022 has been thus far, it’s serving up invaluable data points to figure out which of our holdings are worth holding when hurricane-like macroeconomic headwinds abate.

For the last decade of generous money printing and negative real rates, it’s been unclear which companies are reliant on easy Fed policy to succeed and which can instead depend on a more structural, cyclically-resistant and unique value proposition. Warren Buffett famously said that we find out who has been swimming naked when the tide is out. This is the first time the tide has been out for a sustained period of time since the Great Recession. I’ll be fixating on fundamental execution during these tumultuous months to function as vital evidence for what deserves my time, attention and capital during the next cycle.

I really do not like focusing on macroeconomics. I am a stock picker who loves researching stocks -- but in 2022 a macro focus is a prerequisite in my humble opinion. In the final analysis, equities are correlated risk assets and if the Fed wants the wealth effect reversed to destroy demand, it will be reversed and equities will fall.

9. Cannabis News

Attorney General Garland informed the public that the Justice Department is actively reviewing rules covering federal cannabis law. Apparently Biden is “monitoring cannabis policies that aren’t working." Monitor faster, Mr. President.

Colorado teen cannabis consumption is falling.

Nancy Mace -- a GOP House Member who loudly supports cannabis reform -- fended off challenges in her primary attacking her on cannabis reform. Clearly, many GOP voters don’t see cannabis reform as any kind of deal-breaker.

Maine’s regulated cannabis rollout is cannibalizing black market sales faster than other states have experienced. Hopefully, this will become a case study of how to regulate in other states struggling with thriving black markets years after reform.

Maryland, New Mexico and several other states continue to slowly work towards cannabis reform amid broad bi-partisan support.

A note to politicians heading into midterms:

Cannabis is more popular than all of you among American voters -- by a large, large margin. Embrace it, or get left behind.

10. My Activity

I added to Progyny during the week. In light of this week’s volatility -- despite the small purchase -- my cash position rose to 21.8% of holdings.

I have two remaining announcements:

I am raising my maximum cash position from 25% to 33%. This means the new cash band is 5%-33%.

I am no longer planning on allocating any capital to Masterworks. It’s a fine idea but I see liquidity today for future equity accumulation as too valuable to use for this.