News of the Week (June 20-24)

The Trade Desk; Meta; Match; CrowdStrike; Upstart; Olo; Progyny; SoFi; Shopify; Macro; Cannabis news; My Activity

Today's article is powered by Commonstock:

1. The Trade Desk (TTD) -- AWS, Albertsons and Netflix

a) AWS

Amazon’s AWS and The Trade Desk announced a new relationship to integrate UID2 -- the open internet anonymous identifier that it built -- into AWS’s data ecosystem. Now, AWS customers will be able to upload and organize their 1st party data through UID2 and into AWS to power more effective, granular and still private programmatic ad placements. Per Amazon, The Trade Desk’s integration meets any and all of its privacy standards by enabling open internet targeting absent of personally-identifiable data sharing.

“Many advertisers are using AWS to deploy their own data warehousing solutions and by being able to deploy UID2 through that system, it should make it seamless for them to utilize that ID.” — AWS Head of Data Collection and Interoperability Advertising Adam Solomon

b) Albertsons

The Trade Desk’s unique ability to connect omni-channel retail marketing dollars to direct, incremental sales via Solimar continues to gain rapid traction. This ability makes retailer impressions worth more to buyers that The Trade Desk represents and creates an environment where everyone is happier -- including consumers who get less ad-load via the relevancy upgrade. Retailers generate more marketing dollars while advertisers can still enjoy compelling returns and consumers get a better experience. What could be better than a win-win-win?

If Walmart, Walgreens and a handful of other retailer giants weren’t enough -- now it’s building a programmatic ad platform for Albertson’s Media Collective and its 2,275 U.S. locations. This is the first national grocer to strike up a relationship such as this one by offering a holistically accurate view of inventory, data and impression value. Pepsi, Mindshare and Unilever were among the first advertisers to tap into this new tool and all are praising the enhanced capabilities of the impression buying process vs. substitutes.

“Albertsons Media Collective and The Trade Desk are redefining what it means for advertisers to reach the right audience and measure their marketing campaigns.” — SVP of Retail Media at Albertsons Kristi Argyilan

c) Netflix

Netflix is reportedly exploring a working relationship with NBC (a close partner of The Trade Desk) and Google on building its advertising platform. No matter how the platform is constructed, it’ll have to source a large cohort of agencies and bidders to create value. Netflix will surely use The Trade Desk to do this as Co-Founder/CEO Jeff Green has told us.

Click here to read my TTD Deep Dive.

2. Meta Platforms (META) -- Creator Marketplace, DOJ, Piper Sandler & The Metaverse Standards Forum

a) Creator Marketplace and Meta Pay

Zuckerberg took to Facebook to announce new creator marketplace products throughout Facebook and Instagram. It’s currently split testing a dedicated creator marketplace on Instagram for better brand sponsor access and better creator monetization opportunities. As part of the announcement, Meta shared that it will not take any cut of creator revenue (paid events, subscriptions, badges etc.) until 2024. Zuck also included the following information:

Creators can now plug subscribers from other platforms into subscriber groups within Meta’s ecosystem -- it calls this “interoperable subscriptions.”

Facebook Stars -- its monetization tool for video and audio content -- is now available to all of its creators to assist earnings growth.

Along those lines, the Reels Play Bonus program (to incentivize content and traffic creation) is expanding.

It will soon allow Reels to be posted on Instagram and Facebook simultaneously.

It’s also expanding its nascent testing within digital collectibles selling and trading:

Zuckerberg and Facebook are determined to carve a prominent niche within the Metaverse space poised to reach $5 trillion by 2030 per McKinsey. While I do view this as the next leg of growth, it’s a very long term leg. And with as hawkish as our monetary climate is, long term speculative bets on projects that some consider outlandish are not in vogue to say the least. That won’t change but neither will Meta’s ambition here.

In other Metaverse news, Meta is changing the name of its “Facebook Pay” digital wallet to “Meta Pay.” Aside from the name change -- according to Zuck -- this will be reconstructed to cater to virtual use cases within identity, ownership and transactions.

b) DOJ -- The Department of Justice and Meta Settlement

The Department of Justice and Meta settled an ongoing lawsuit pertaining to advertising and fair housing laws. Meta will update its advertising targeting algorithms (specifically “Special Ad Audience”) to remove what the DOJ saw as biases against protected classes.

c) Piper Sandler -- Mixed News

Piper Sandler is reporting that Facebook continues to see price-per-impression declines through May with the rate of decline remaining stubbornly high at 19% -- it has seen monthly declines every month in 2022. Conversely, Instagram saw this metric rise by 15% which was far faster growth than January-April. Overall, impression costs for Meta fell by 6% in May vs. 11% in April which hints at pain beginning to fade away as Meta’s ad-stack investments take hold, reels matures and industry e-commerce growth/macro hopefully improves into 2023. Piper Sandler also called out what we discussed last week as a key Meta positive: No tightening privacy news announced by Apple at WWDC.

I continue to think Meta will see its performance briskly improve as we enter the 2nd half of the year and into 2023. So many headwinds all hit the company at the same time and this is why I think the “Meta is dead” narrative is forming. I passionately reject this sentiment.

d) Metaverse Standards Forum

Tech giants, including Meta, formed the Metaverse Standards Forum to foster interoperability of the various metaverse projects happening in parallel and to create broad standards of behavior/development. Other members include Epic Games, Microsoft, Adobe, Nvidia, Qualcomm and many, many others. The Metaverse is a long term project that won’t meaningfully contribute to anything but operating expenses for years to come. Eventually, Zuckerberg sees this business as being even larger than the Family of Apps. We’ll see.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service, am a daily active user and have made it the only place to see my daily transactions.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.

3. Match Group (MTCH) -- Tssk Tssk Bumble

Bumble -- Match Group’s most formidable competitor -- released a fiery blog post this week throwing quite a bit of shade at Match. It accused Match of copying its product, intimidating Bumble (seriously?) and some poor behavior within its apps while trying to establish itself as the “kind” vendor in this concentrated field. I would mention that massive dating apps will inevitably deal with bad actors and Match (not just Bumble) has focused heavily on limiting these outcomes.

But that’s not the main point I wanted to make here. Companies don’t send out notes like this from positions of strength -- but weakness and insecurity. Perhaps Bumble should focus on Hinge quickly passing it as the 2nd most popular dating app globally rather than getting upset at losing to the competition. Match is eating their lunch -- Bumble can get mad about it or they can be better. It’s their choice and they seem to have made the wrong one. It’s not illegal for Tinder to emulate the female-first offering of Bumble, it’s a good business decision and something I as a shareholder applaud.

If Bumble were smart (and regulators allowed it), they would sell to Match Group in an instant. The synergies associated with combining Match’s 50%+ global market share with another successful app would be compelling to say the least, but Bumble won’t sell. Its founder came from Tinder and did not leave amicably. To her, this is clearly personal and if I were a Bumble shareholder that would concern me -- business is not personal. Match is a better company with a better team, Match boasts a more sustainable business model and this childish blog post indicates that in my admittedly biased view.

Click here to read my Match Group overview.

4. CrowdStrike (CRWD) -- Accolades

Zywave and Advisen named CrowdStrike their Cyber Technology Provider of the year. No other next-gen vendor in endpoint security (or identity/network) received recognition.

CrowdStrike was also named as one of India’s Great Mid-Size Workplaces for 2022. This is a key international market for CrowdStrike's future growth.

5. Upstart (UPST) -- Harvard Business Review

In the past year, the Harvard Business School Working Paper Series studied Upstart’s underwriting quality as part of a broader study on uncovering the “invisible prime” borrower through alternative data. Using extensive testing of Upstart’s credit underwriting vs. alternatives, these were the key findings:

Upstart can uncover a large cohort of creditworthy borrowers rejected under legacy models. Variables within employment and education history not included in these models are perhaps the most valuable for determining borrower quality.

30% and 60% of creditworthy borrowers that Upstart approved with sub 680 and sub 640 FICO scores respectively would have been rejected otherwise.

Upstart delivers a 20% lower default likelihood on its borrowers credit payments than alternatives and a 9% rise in credit score.

Upstart’s hidden prime borrowers can raise its lender returns by 1-2%.

“We show that alternative data used by Upstart exhibits substantially more predictive power with respect to default likelihood over traditional credit scores.” — Authors Macro Di Maggio, Dimuthu Ratnadiwakara and Don Carmichael

This study needs more context. It was conducted throughout 2020 and 2021 when Upstart was enjoying lower loss rates on its loans via federal stimulus (which surely helped it more than borrowers catering to affluent coh. This study is encouraging (just like virtually all studies on Upstart have been), but it must continue to be true while macro gets much harder for Upstart to be a sustainably successful company through all credit cycles.

Delivering unique value is far easier with an easy Fed -- and that easiness has abruptly disappeared. 2022 will be both difficult and imperative year for Upstart to prove itself. Future years will be smoother sailing, but today is when Upstart builds partner and investor trust through underwriting outperformance in the face of worsening macro. That's the only way it will get to continue to enjoy the future good parts of the credit cycle. Time will tell.

Click here to ready my Upstart Deep Dive.

6. Olo (OLO) -- New Customer and a Happy Existing Customer

a) Marugame Udon

Olo landed Marugame Udon -- a Japanese restaurant chain -- as its newest brand client. The chain purchased Olo’s Dispatch, Ordering and Rails modules to start. This is a massive win for Olo. Not only does Marugame Udon boast over 1,000 locations globally, but it has plans to 6X its store count outside of Japan by 2027. This makes them a wildly compelling candidate for significant net revenue retention for years to come which is why Olo has focused so heavily on the emerging enterprise segment (5-100 locations). It’s likely that the Marugame Udon relationship will begin in the United States where the restaurant is planning to supercharge its expansion. The organization would be a wonderful partner to embark on Olo’s international expansion earmarked as a long term ambition.

b) Kwik Trip

Olo’s nascent convenience store growth vector is off to a wonderful start. It released a case study involving its first large chain client here -- Kwik Trip and its 700+ locations -- and these are the results for the new client:

70% more digital sales and 50% more orders overall thanks to new tools like order ahead for carryout or curbside pickup in-app.

12% higher check size.

39% 3rd party delivery volume spike.

Automated what had been an entirely manual delivery process to this point.

Employees gained more time to focus elsewhere -- it’s a force multiplier for efficiency.

“Mobile ordering is new for us and the industry. Olo exceeded our expectations by solving several pain points with multiple 3rd party tablets and ordering issues. It helped us own our guest relationship and become a bigger food destination. Week over week, we have not plateaued yet.” — Kwik Trip Digital Marketing and Loyalty Manager David Jackson

With as expeditious and strong as these results are, it would make sense to think other chains are lining up to follow in Kwik Trip's footsteps.

Click here for my Olo Deep Dive.

7. Progyny (PGNY) -- Impact of Roe v Wade Overturning

The Supreme Court overturned Roe v Wade. I have no interest in expressing my philosophical opinion or belief on this decision either way. My goal is that none of my readers know my political leanings. You’re here for stocks, not politics… and so am I.

But still, this particular issue is very relevant for Progyny’s demand and financials which I’ll cover here.

There are a handful of states with abortion laws expected to become instantly more restrictive than they are today. Within the process of In-Vitro Fertilization (IVF), some embryos are discarded and that could now legally be considered unlawful abortion under those state laws. Encouragingly, the only relevant state here with meaningful population is Texas, which has strong fertility treatment laws making this concern a non-issue there. That leaves us with a few other states representing less than 3% of Progyny’s total revenue.

It’s highly unlikely that all of these states would bar fertility treatments as part of their tightening abortion grips, but anything is possible and the worst case scenario revenue hit would be that 3%. But that worst case scenario won’t even be that bad. Why? Fertility tourism is already quite common. The best specialists are frequently located on the coasts and people from these states often fly to other states for better treatment (where IVF will still surely be legal). I think it’s safe to say that prospective parents passionate about having kids will continue to find a way like they have across pandemics, recessions, war and more.

Click here for my Progyny Deep Dive.

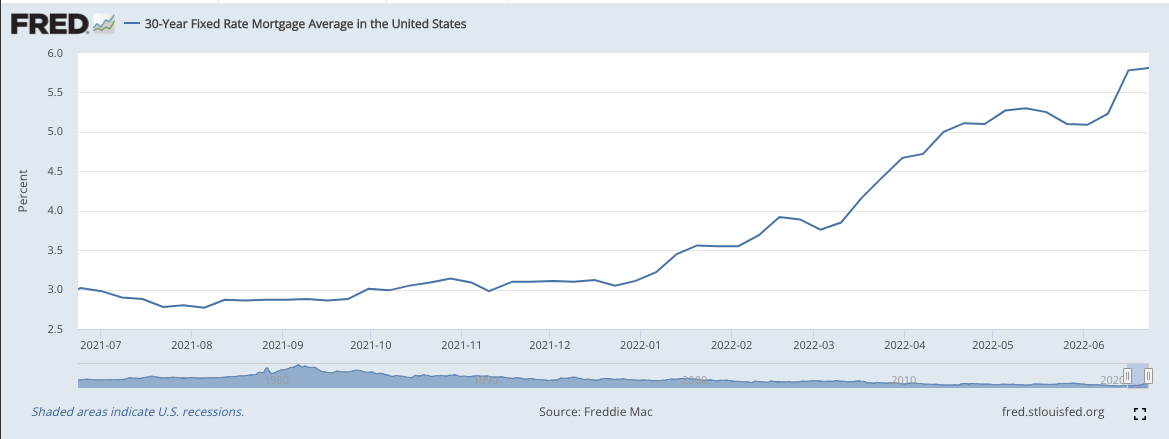

8. SoFi (SOFI)-- Student Loans

The Biden Administration is forgiving about $6 billion in debt for roughly 268,000 borrowers. In normal times, this is SoFi’s largest revenue and profit contributor. Most of this debt forgiveness is within the for-profit college arena and I wanted to take an excerpt from my last company earnings to report illustrate SoFi’s opinion of the impact:

This forgiveness comes out to about $23,000 per that select group of borrowers. Not as ideal as $10,000 obviously, but still a net positive towards this segment’s normalization.

9. Shopify (SHOP) -- The Inaugural Shopify Editions

Shopify debuted “Shopify Editions” a twice-per-year forum to highlight innovation and new products from the company. These Editions center on Shopify’s trailblazing of a different “Connect to Consumer” (C2C) commerce model to empower merchants to reach even more customers with better experiences. This really just means creating more creative ways to sell., Along these lines, Shopify released over 100 new products this year. Here, I’ll highlight the most notable for investors:

Local Inventory on Google.

Allows merchants to sync their inventory with Google’s records to enable selling through that avenue and to give browsers a better and actionable sense of availability.

“Tap to Pay” on iPhone through a Stripe Partnership for Shopify POS merchants.

To further accelerate Shopify’s brick and mortar volume traction as that portion of commerce continues to return.

Allows for more seamless omni-channel expansion without excessive hardware needs.

Twitter Shopping

First of its kind commerce partnership for Twitter to better monetize Twitter’s 40 billion+ annual shopping-related impressions.

Together, the two will allow merchants to display as many as 50 products on their profiles for no cost.

Twitter will not host checkouts like some of its competition does, but will direct these requests to merchants sites for transaction completion.

The product had been beta testing for months and went live this week.

Business to Business (B2B) Selling

Allows Shopify Plus merchants to easily sell to enterprises with the same platform used to sell to consumers. Integrations with NetSuite and other electronic record providers make it easy for merchants to onboard this data.

The tool comes with a wholesale feature for bulk B2B selling to middlemen with features like custom price setting per customer.

Shopify sees this opportunity as larger than its current direct-to-consumer focus.

Shopify Functions + Hydrogen

Functions opens up Shopify’s back end to developers to build on top of for more merchant customization of user experiences while Hydrogen opens up the front-end for allowing more interface and presentment customization.

“Oxygen” is the hosting engine for Hydrogen.

Final Products to note:

“Tokengated Commerce” allows merchants to reward customers with “products, perks and experiences” that can be activated anywhere. This is essentially another take on a loyalty program with an NFT twist.

“Dovetale” connects merchants to creators to blaze a pathway to influencer marketing growth.

Click here for my Shopify overview.

10. Macro

a) Update

Not much changed this week from previous weeks. The Federal Reserve continues on its aggressive path of tightening while we continue to get daily signs of economic weakening. I’m still in cash preservation mode despite this week’s bear market rally that I mentioned as a real possibility in last week’s post. I’m in no hurry to deploy cash until exogenous factors in credit markets, commodities, supply chains and more become significantly less negative.

In terms of specifics, there’s (fortunately) not much new to talk about aside from politicians doing their best to ask productive, relevant questions to Powell on Capitol Hill -- spoiler alert: They didn’t. The last few macro sections in my “News of the Week” posts still cover my current outlook accurately. So rather than repeating everything I’ll just direct those who are interested there.

b) Rates, Spreads & More Economic Data-points

Indicators I’ve been religiously tracking to gauge economic cycle cadence (roughly, not perfectly) continue to look fragile. Things like the Atlanta Fed GDPNow estimates remain stable at 0% (with a 60% larger range of estimates) vs. above 2% several weeks ago. If this were to turn negative, it would mean we’re technically in a recession right now. But for now things at least aren’t getting worse -- that could always revert on Monday morning:

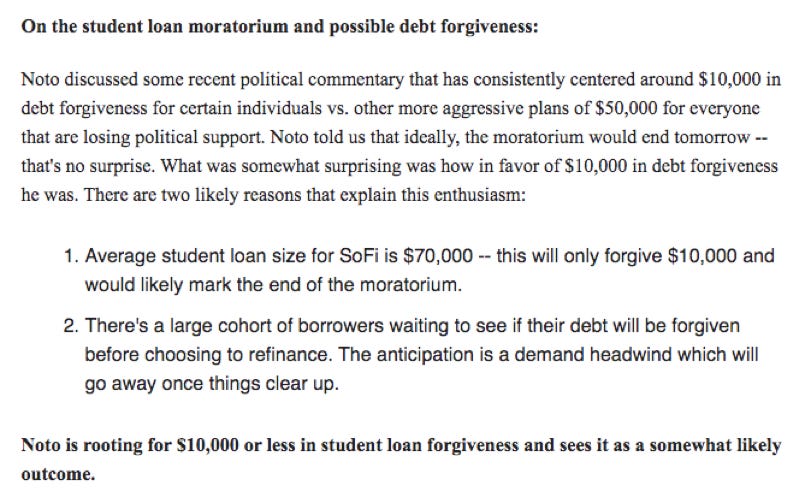

The ICE Bank of America U.S. High Yield Option Adjusted Spread Index churned higher this week to keep setting new multi-year highs (a bad thing):

The 10-2 year yield curve slope steepened a touch as recession fears continue to ebb and flow on a seemingly minute-by-minute basis:

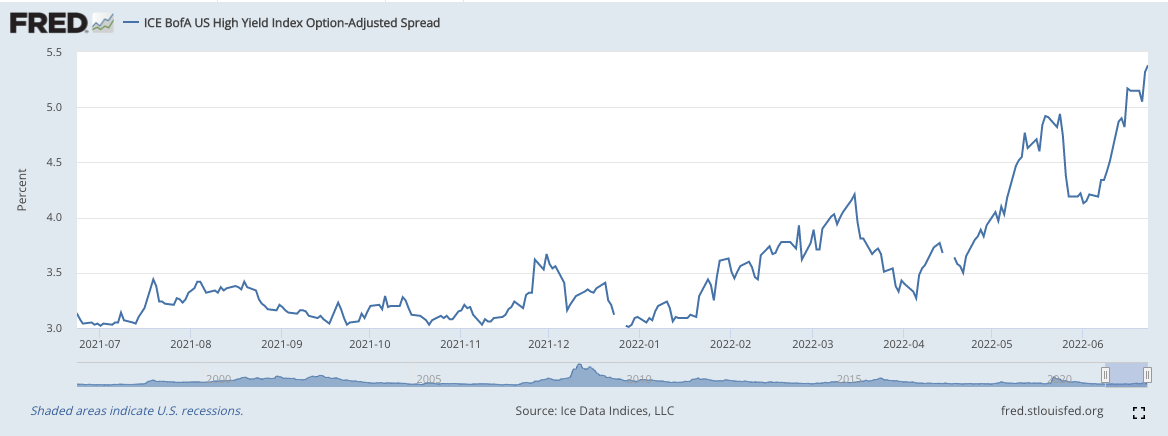

The U.S. Dollar:

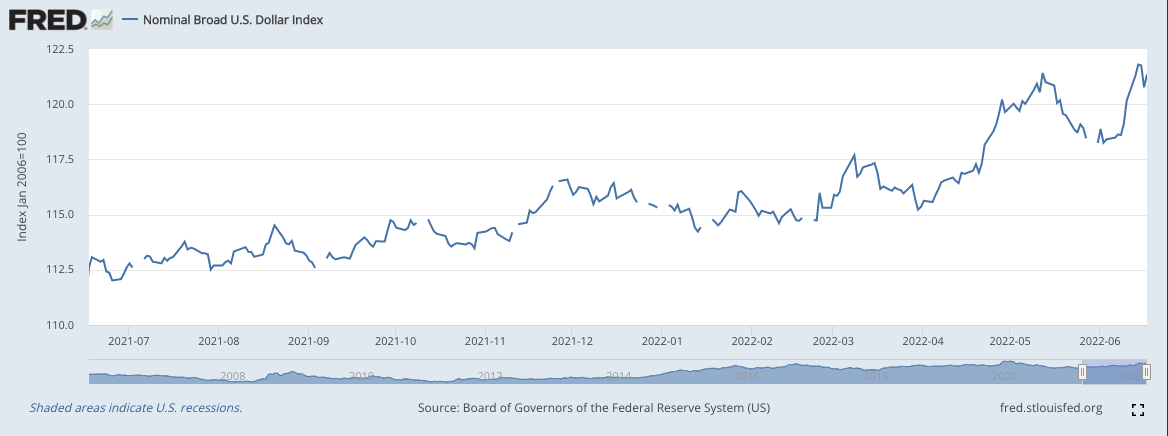

30-year Fixed Mortgage Rates ticked up slightly as well to continue setting new decade-highs:

Commodities:

While oil cools off from recent highs, gasoline fell below $5 per gallon nationally this week (*sarcastically celebrates*) vs. $5.00 week over week ago and $3.08 just 12 months ago.

Feel free to offer a gas tax holiday, but our Econ 101 textbooks show us how counterproductive that artificial demand boost would be in the wake of a supply-based issue; it would simply create deadweight loss within the value chain. We need more refining capacity and production incentives!

Copper’s price also continued to fall to new 12-month lows but remains roughly 31% higher than pre-pandemic levels.

Food prices like corn remain off decade highs set last month but are still at nearly 2X the price of pre-pandemic levels with beef more than 50% above pre-pandemic levels.

These are all supply-side issues exacerbated by war in Russia and the weird effects of stimulus/lockdowns. The Federal Reserve can erode demand but positively impacting supply-based inflation is a far less concrete objective for it. It can’t make Russia renew exports, can’t build more refineries and can’t remove input bottlenecks in the face of still strong demand.

c) Market Notes

Klarna -- a popular Pay Later vendor -- has seen its private market valuation fall from $46 billion to $15 billion over the last few months. We’re rapidly seeing the froth come out of private markets which usually lags aggressive moves in public equity land. This is just another needed sign of healthy normalization.

Netflix announced a small series of layoffs with Ford warning of job cuts as well. There’s no way that unsustainable wage inflation can persist for the long term while our largest companies are actively cutting jobs. We still have far more job openings than workers, but this will push us to an equilibrium in a hurry if it continues like it’s expected to.

Affirm’s delinquency rates renewed their rise in the month of May as inflation and layoffs weigh most heavily on less affluent borrowers (which Upstart also serves). These rates had begun to level off through April.

d) The Japanese Bond Market

Japan’s Central Bank is rapidly accelerating its bond buying program to support its public credit market showing signs of extreme stress. As global rates rise and liquidity erodes, Japan is struggling to keep its benchmark rate anchored as low as it wants (near 0%) to support accommodative policy. This is a move to bolster liquidity while Japan’s massive bond market (corporate portion is 2nd largest in the world) without Federal support has all but lost control. The Yen is at multi-decade lows vs. the Dollar as central banks globally hike rates and Japan remains fully dovish and committed to no rate rises in support of its currency.

Things have gotten so chaotic in Japan that the government and central bank actually issued a joint statement to empathize with the Yen’s historic weakening and their bond market's wild moves. This is just another sign of the global economy continuing to weaken and quite a notably alarming one at that.

e) Using this Time Wisely (copy and pasted from last week’s edition)

I’ve said this before but it bears repeating:

As frustrating as 2022 has been thus far, it’s serving up invaluable data points to figure out which of our holdings are worth holding when hurricane-like macroeconomic headwinds abate.

For the last decade of generous money printing and negative real rates, it’s been unclear which companies are reliant on easy Fed policy to succeed and which can instead depend on a more structural, cyclically-resistant and unique value proposition. Warren Buffett famously said that we find out who has been swimming naked when the tide is out. This is the first time the tide has been out for a sustained period of time since the Great Recession. I’ll be fixating on fundamental execution during these tumultuous months to function as vital evidence for what deserves my time, attention and capital during the next cycle.

I really do not like focusing on macroeconomics. I am a stock picker who loves researching stocks -- but in 2022 a macro focus is a prerequisite in my humble opinion. In the final analysis, equities are correlated risk assets and if the Fed wants the wealth effect reversed to destroy demand, it will be reversed and equities will fall.

11. Cannabis News -- Mainly Per Marijuana Moment

Banking reform has been stripped out of the COMPETES Act. The frustrating regulatory journey continues on like nails scraping against a chalkboard. Don’t you just love politicians? Two things to note here: Banking reform remains a “when” not “if” in my mind and the strongest companies without desperate cash needs will continue to gain more share while the handcuffs are on.

Federal lawmakers continue to push bills through committees to allow for up-listing, taxation and banking relief. There’s no point in getting excited about this until the bills become far more advanced in congress.

The Senate Intelligence Committee convincingly passed a law to allow cannabis users to work in the intelligence community.

Pennsylvania’s House approved state-level banking reform.

North Carolina’s House is trying to block their Senate’s medical cannabis bill from passing.

The MLB will now allow team CBD sponsorships. Another sign of societal normalization.

The Journal Health Economics found that cannabis legalization reduces auto insurance premiums and drunk driving cases. Could we see Progressive hop on the cannabis bandwagon like Amazon did? I’m kidding (I think).

Louisiana’s Government passed bills to expand the state’s budding medical program.

Texas Republicans still oppose legalization but now openly support federal cannabis rescheduling and less restrictive hemp regulation.

12. My Activity:

I took advantage of strength and took profits by trimming 5% of my stakes in Duolingo and JFrog this week; I didn’t do any adding. I continue to be an excited shareholder of both, but wanted to raise a bit of cash following the 50%+ bounces each has enjoyed from recent lows. I’d be happy to add those small pieces back into future market turbulence. My cash position is 20.4% of holdings which fell week over week solely due to strong price action of holdings.

My PayPal deep dive rough draft is FINALLY complete after about 6 months of research -- I’ve been told I’m that I’ve been uttering words like “Venmo” and “Braintree” in my sleep. It’s been sent to the editorial team and should be out in the coming weeks. I won’t announce the date until I know it’ll be ready and won’t rush to get it released as I’m obsessed with quality. The Quarterly portfolio summary will be out shortly as well. I’ll remind you that my portfolio (minus the cash position) is publicly posted on Commonstock.