News of the Week (June 27th - July 1st)

Lululemon; Meta Platforms; CrowdStrike; PayPal; Upstart; Olo; SoFi; Penn National Gaming; Macro; Cannabis; My Activity

1. Lululemon Athletica (LULU) -- New Position

This week, I started a position in Lululemon and it will be the topic of my next deep dive after PayPal is published. For this issue, I wanted to provide a condensed (I promise) view of Lulu’s compelling characteristics and my path for building the position. For my Shopify overview, there was pushback regarding the length and I’m going to do my absolute best to keep this overview short, sweet and still packed with information.

a) Basics

Lululemon is an athleisure apparel company with roots in Canada. The vast majority of its sales come from direct-to-consumer (DTC) e-commerce and owned-stores, both of which provide key company benefits such as holistic access to its 1st party user data to guide product releases. In my view, Lulu has a chance to join Nike and Adidas in terms of ubiquitous global clout and presence with a more luxury niche. This won’t be overnight -- far from it -- but if that process plays out it could provide compelling incremental shareholder value.

b) Performance

I view this company as a high probability 15% revenue compounder for the long term -- which is where management has guided revenue growth for 2021-2026. In 2018, Lulu offered long term 5-year targets and eclipsed them ahead of schedule to offer evidence of its ability to under-promise and over-deliver. And the runway is still quite long. Lulu estimates its total global addressable market opportunity at $650 billion with its 2021 annual revenue representing around 1% of that. Since 2019, it has shown a keen ability to take more market share within adult active apparel than any other company. So the opportunity is immense and Lulu has taken advantage (since inception).

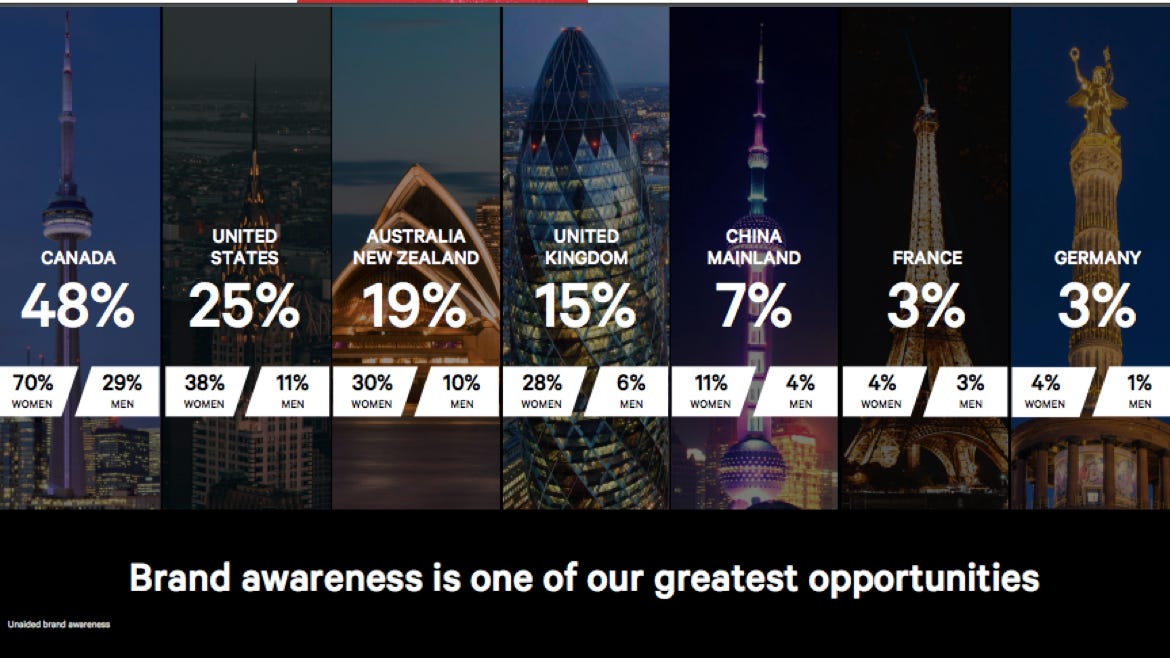

The Canadian firm has excellent brand awareness across North America, but carries very little influence internationally to date. That's changing via international sales compounding comfortably above 30% for the last several years and 30% annualized growth expected to continue through 2026 as it gains brisk traction. There’s a large cohort of customers especially in Europe and China that should naturally be drawn to a brand like this -- so far, so good with much more work to be done.

In terms of margins, performance here has been largely positive as well. Lulu’s selling channels are inherently higher-margin than traditional wholesale to re-sellers, so it boasts a lofty gross margin for a retailer. Specifically, this metric eclipsed 58% during the heat of pandemic tailwinds but has since cooled back off towards 53% -- still strong and better than most in its space. Just 11% of its sales are through “other” channels which include lower margin wholesale with its more profitable endeavors making up the rest.

Since Lulu’s 2018, the company has compounded earnings and revenue at 27% and 24% respectively. As a result, operating margins have reached a robust 22% -- and modest expansion is expected to continue through 2026 with profit growth outpacing the top line.

Interestingly, company owned stores have the best margins out of any selling channel as its complete vertical integration allows it to command a larger chunk of the profit pie. These owned stores possess an operating margin pushing 26%, and as brick and mortar shopping returns, that could push unit economics higher. Impressively, comparable store sales soared 24% YoY this last quarter on the heels of some difficult comps with store productivity surpassing pre-pandemic levels. That was wildly impressive to me in light of China -- representing 15% of its total stores – remaining shuttered during the period.

Furthermore, in-store and e-commerce shopping both effectively raise a customer’s engagement with the other Lulu selling avenues. For example, its e-commerce conversion rate has risen 10% over the last few years with credit given to its omni-channel proliferation. The engagement juicing also comes with no additional customer acquisition costs, thus increasing margins still further. I’d just like to point out here that Lulu’s margins are already comparatively excellent. There still may be a tad more expansion to come, but that's not needed to make my thesis work. Just margin maintenance.

In terms of capitalization, the balance sheet is a strength for Lululemon:

$1.3 billion in cash with another $400 million in current liquid assets

Zero debt with a recent mixed shelf offering which could eventually add some debt to the balance sheet.

Bought back $813 million, or a little over 2%, of its shares in 2021 which represents a doubling pace vs. the previous 3 years.

c) Future Opportunities

Global expansion where increased brand awareness creates opportunities.

Expansion into sports like tennis and golf. It recently signed the 15th ranked female tennis player in the world (Canadian Leylah Fernandez) as its first ambassador for the sport. There's a large demographic overlap here.

Partnerships with the Canadian Olympic Committee help as well.

Experiential stores & pop-up shops creating service-oriented use cases. This contributes an added benefit of juicing revenue per user by 15% when a Lulu customer sweats more.

Membership programs launched in fall 2021 to drive loyalty and engagement. For example, its Pinnacle membership involving “MIRROR” offers access to bountiful on-demand remote fitness content and early access to new gear.

Footwear! Inning 1 here.

Collaborations with iconic brands like the University of Michigan to create a dedicated apparel line for its half-million living alumni and 100,000+ students. Go Blue!

Differentiation through new material creation. Its “Science of Feel” platform is a key focus for creating utility building, proprietary fabrics for its apparel.

Depending on the legitimacy of these claims, this could provide rare differentiation within a commoditized industry. For example, its air support bra is the culmination of 5 years of research to help women with yoga poses.

d) Leadership and Hiring Trends

The company’s founder is no longer involved with Lululemon and has a somewhat colorful history. I’ll cover that in the deep dive but for the sake of brevity let’s focus on current leaders.

CEO Calvin McDonald: Disney Board member; Former Sephora and Sears Canada President; 85% Glassdoor rating.

CFO Megan Frank: Sachs Board Member; Former Finance VP at Ross and J Crew.

CTO Julie Averill: Former CIO at REI; Former VP at Nordstrom.

Hiring Trends Via LinkedIn:

Headcount is up 25% over the last 2 years with engineering headcount growth leading the pack by a wide margin at 32% growth.

It has hired around 2,000 new employees since the start of the year but headcount growth has recently slowed.

Average tenure is 2.5 years -- not great or terrible.

e) Risks

The main risk for Lululemon is shorter term macroeconomic volatility. Today’s economic cocktail of record low consumer confidence, generational high inflation and tanking savings rates will all inevitably weigh on discretionary spending. For a firm like this one which caters to a more affluent shopper, it will be relatively insulated from this pain, but certainly not immune. Macro creating more fragile customers also could present another possible issue: Shoppers flocking to cheaper brands. There are countless companies playing in Lulu’s space and most come at a lower price point. So as wallets are stretched, those fringe customers who can just barely afford a Lulu shirt may gravitate to a Gymshark shirt at half the price. I think Lulu’s superior quality will allow them to be somewhat overcome that phenomenon, but we’ll see.

We also must consider chaotic supply chains as a risk for retailers in trying to match dynamic supply and demand on a real-time basis. Many of the largest have struggled to do so, but Lululemon’s vertical integration surely provides some support here. Again, it’s resistant, but not immune.

This management team has also not done all that well with M&A. The MIRROR acquisition could very well eventually be written all the way down as it jumped into a faddish trend at the heat of the pandemic. Thank goodness it didn’t try to buy Peloton. I still think MIRROR can enhance Lulu’s overall omni-channel value proposition, but this deal is not off to a great start and it surely overpaid with the luxury of hindsight.

Finally, athleisure got a large boost from stay-at-home orders. No longer did employees have to wear a suit to work, and many embraced Lulu’s apparel niche as a result. Was that the reason it was able to reach its long term targets so soon? Or will the momentum be more sustainable than that? Work from home is not totally going away and Lulu had been compounding long before Covid-19 entered society’s vocabulary -- so I’m optimistic, but we will have to see. This also goes into the overall risk of a retailer needing to stay on-trend and in vogue to continue garnering market share. Lulu has years and years of demonstrating an ability to do so, but continuation is never a guarantee -- see L.A. Gear in the late 80s.

f) Expectations and Plan

At just under 27X next 12-month (NTM) earnings, Lulu trades right at its 5-year earnings multiple average. At these prices, I think a few things are true. The valuation is compelling enough to start a position and also there could very well be more downside (buying opportunities) ahead. Specifically, 21X forward earnings looks like it will offer Lulu’s stock with significant support and I’ll use the 21X to 27X multiple range paired with macro climate as a guide to filling out my position. With this in mind, I started VERY small with just 18% of a full position. It’s always a marathon and never a sprint, but today that may be even more true. Furthermore, the earnings estimates for Lulu and public companies could be coming down over the year as the economy weakens. I would point out that Lulu has a wonderfully consistent track record of beat and raise, just boosted its own estimates last month and has seen analyst estimates rise accordingly, but these are unprecedented times.

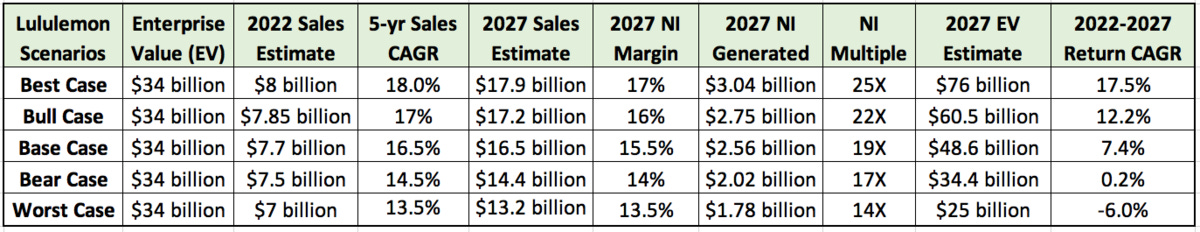

Based on my research into the company and historical results, I think the following 5 scenarios encapsulate where Lulu could be in the next 5 years. I would point out that estimates like these include several rough projections making accuracy a rarity. Please take this with a large grain of salt. Results could surely vary and I do try to lean pessimistic whenever possible when building these models.

2. Meta Platforms (META) -- TikTok and Various News

a) TikTok

The Federal Communications Commission (FCC) has requested that Apple and Google remove TikTok from their app stores. According the head of the agency -- Brendan Carr -- a recent investigation uncovered “serious national security threats posed by TikTok.” Per the report, based on leaked recordings from BuzzFeed, TikTok is actively sharing sensitive American consumer data with the Chinese government.

It’s not likely that this request alone will lead to a ban of TikTok in the Western World, but it is still a sign that governments are starting to work that way. And if TikTok were to lose access to these markets, it’s hard to think of a larger beneficiary than Meta Platforms and its Family of Apps. The Chinese App is already banned in India -- and across many U.S. federal agencies -- where Meta and especially WhatsApp dominate. Later in the week, it was announced that TikTok was working on safeguards to ensure U.S. compliance.

There was also a note out of Truist this week that sees Instagram and Facebook together overtaking TikTok’s short form video market share globally sometime next year. It sees signs of this beginning to play out. Quite the positive surprise if accurate.

b) Various News

Zuck revealed Meta’s plans to hire around 6,500 engineers this year vs. previous plans for 10,000. Zuck was quoted saying “realistically, there are probably people at this company who shouldn’t be… part of my hope of having more aggressive goals is that I think some of you will decide this isn’t for you.” The belt tightening continues as Zuck calls this downturn “the most significant” in the company’s history that includes the Great Financial Recession.

Meta recently uncovered its three latest Metaverse AI models within "Visual-Acoustic Matching, Visually-Informed Dereveberation and VisualVoice.” Visual acoustic matching specifically will eventually pave the way for re-living fond memories.

J.P. Morgan and RBC cut financial estimates for Meta and the rest of the ad-tech space in its coverage network for 2022 amid worsening macro.

Instagram is testing a full screen feed with more of a video-content emphasis. If this sounds like TikTok, that’s the point.

The crypto wallet (“Novi”) that Meta has been working on has been delayed from its planned September WhatsApp launch.

3. CrowdStrike (CRWD) -- AV Comparatives

CrowdStrike’s Falcon product for Mac delivered 100% Malware protection in the May 2022 AV Comparatives Mac Security Test. In the blog post, CrowdStrike highlighted that it continues to test its software with more 3rd party organizations than any other vendor and continues to perform the best among disruptors as well.

The test compared 10 different vendors and their ability to detect and counteract thousands of malicious code blocks, malware and “potentially unwanted applications” (PUAs) most relevant to current hack trends. 5 received perfect scores in the Mac section but CrowdStrike performed worse than most in the PUA and windows-focused sections. Still, it received its 5th straight Mac Security Product award from the research organization.

4. PayPal Holdings (PYPL) -- New Merchant Credit Offering & A Schulman Interview

a) New Merchant Credit Offering

PayPal debuted a new merchant credit card through its WebBank partnership and issued through the Mastercard rail. The card offers 2% cash back with no rewards caps which makes it among the most compelling cash back cards for merchants in the market. It has no annual fees, and APRs ranging from 13.99%-29.99%. Interestingly, the card comes with a digital twin that is immediately eligible for use within app upon business approval. These businesses are also free to print new cards with separate account information for employees under the same umbrella account. With credit cards being the 2nd most common means of business financing this year per the Small Business Credit Survey, this launch is well-timed.

The debut is merely one of countless PayPal initiatives to build its two-sided network. The more value it can provide to merchants, the more merchants will join the platform and then the better, more targeted promotions PayPal can offer to its consumers. This builds consumer growth and spins the flywheel round and round. But this lucrative phenomenon requires providing more value to its stakeholders than its substitutes can which is why incentive-laced PayPal products like this continue to launch.

b) Schulman Interviews with Women’s Wear Daily

This was a short conversation with the following highlights:

Schulman called PayPal’s Pay Later a “top 3” vendor in the space while previously calling it “top 4.” Schulman reiterated that PayPal’s loss rates are lowest in class with approvals best in class.

Supply chains haven’t improved much as China ports re-open with still “a tremendous amount of dislocation.”

“We offer the best availability, authorization and loss rates to our merchants.” — PayPal CEO Dan Schulman

5. Upstart Holdings (UPST) -- Two Bearish Analyst Notes & Two New Partners

a) Wedbush and Morgan Stanley

Both Wedbush and Morgan Stanley issued downbeat notes and underperform ratings on Upstart this week. While I don’t really care about their price targets which seemingly react to share movements, I do care about the reason for the research which is what I’ll focus on here.

The research centered on several deals in the asset-backed securitization (ABS) market boasting delinquency rates that are beginning to flirt with their trigger rates. Not good. Encouragingly, most recently the rollover rate trends depict that these delinquencies are coinciding with lower cumulative net loss rates. Wedbush specifically expects triggers to be breached this month although did point out that the rollovers from delinquency to CNL falling could positively prevent this from happening. Wedbush also pointed out that 2022 delinquency trends are well above 2021, but this is expected as stimulus fades away and rates normalize. The end of this stimulus is both a strong demand tailwind for borrowers but a supply headwind for funders as risk builds.

It’s important to note that as Upstart funds a very small percentage of its own loans and has committed to limiting that retainment as recently as this month, this is not a matter of balance sheet risk. It’s a matter of volume growth risk as investors likely begin to demand more favorable terms to fund these transactions or shy away from funding.

While these notes are intimidating, they’re yellow flags to me, not red. We knew that Upstart’s 2022 was going to be the make or break year for it. Either this model only works in a falling rate environment and is not viable for the long term, OR this is exactly when Upstart provides its most value as the lender hunt for adequate yield grows less successful and so they flock to relative strength. Upstart needs to provide that relative strength to survive 2022 and enjoy future years that will surely be kinder to it. I’m cautiously optimistic, but I have done more trimming into strength here than with any other name over the last several months. I hope to slow that trimming and lean back into accumulating at a faster pace as things become a tad less intimidating.

Regardless of whether Upstart successfully navigates these currently choppy waters, markets will take a “guilty until proven innocent” approach to assessing FinTech names like this amid hawkish macro. I feel as though I have time to be patient to fill out the rest of my position.

b) Two New Partners

While capital market news this week was largely negative, conversely, Upstart’s lender partner news was quite positive. First was MidFlorida Credit Union, one of the largest credit unions in the nation. With 430,000+ members and $6.6 billion in assets under management, this is comfortably a top 50 credit union in the United States. The two companies had been working together since December, but now the lender will join Upstart’s referral network -- its largest revenue segment.

Upstart also announced Firelands Federal Credit Union as a new partner this week. Firelands is very small, but this stood out to me for a different reason: It’s a partnership involving Upstart’s white-labeled credit model embedded directly into the Firelands website. That’s what I want from Upstart. Marketplace revenue -- especially via partner retention -- is a key vehicle for building the data treasure chest. Still, to me the grand prize is licensing its underwriting models to partners. This way the marketing budgets and loan placements are solely their responsibility and Upstart can focus on what it does best.

But any form of partner retention -- whether it be via the marketplace or their own site -- is better in my mind than funneling loans through capital markets. And specifically, ABS markets are Upstart’s lowest quality business. Why? Every part of Upstart’s loan-sourcing value chain takes a percentage to participate in the process. With capital markets, origination conduits, the investors and any subsequent owners command a piece while with partner retention, these parties are not present. Translation? Less mouths to feed with partner retention makes delivering appropriate residual cash flow and margins easier.

To make partner retention even more compelling, these partners generally hold the loans to maturity, don’t need to flip the pools for profit, and have access to lower cost of capital. All of this translates into these entities being more durable and reliable sources of funding as macroeconomics worsen like they are now. ABS markets are where Upstart leans when things are extremely good to direct excess demand. That’s really the only time that loan pools can be flipped multiple times for large enough profit margins to make it worthwhile. When times worsen like they are now, it anticipates shifting a much larger portion of funding through its partners which has led to recently slowing ABS issuance data within credit agency organizations. And this needs to continue if Upstart wants to salvage this year.

c) Dave Girouard Interviews with Tom Gardner

On Using the Balance sheet to fund loans:

“We’re not a balance sheet company… we just need to be more disciplined and have technology that’s better at price discovery. That’s what we’re getting toward.” — Upstart CEO/Co-Founder Dave Girouard

Girouard told us that some of the automated loan price discovery Upstart is building in has helped but there’s more work to be done with “more tools to better match supply and demand.” These are the growing pains associated with the young company maneuvering its way through its first credit cycle -- and one that is more rapid and abrupt than what we’ve seen in a long time.

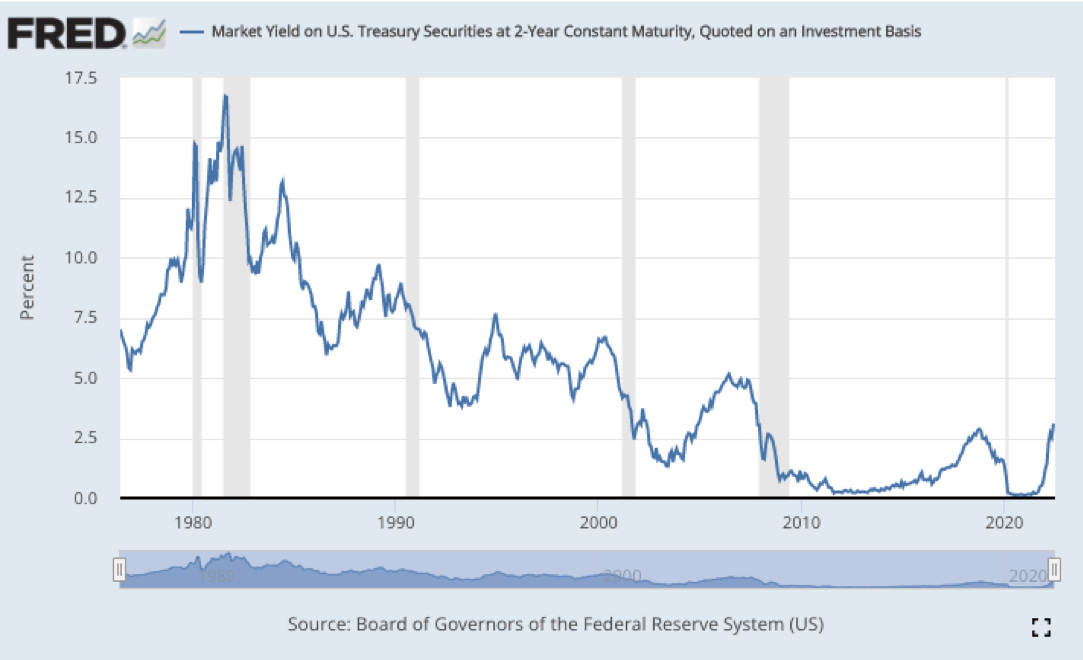

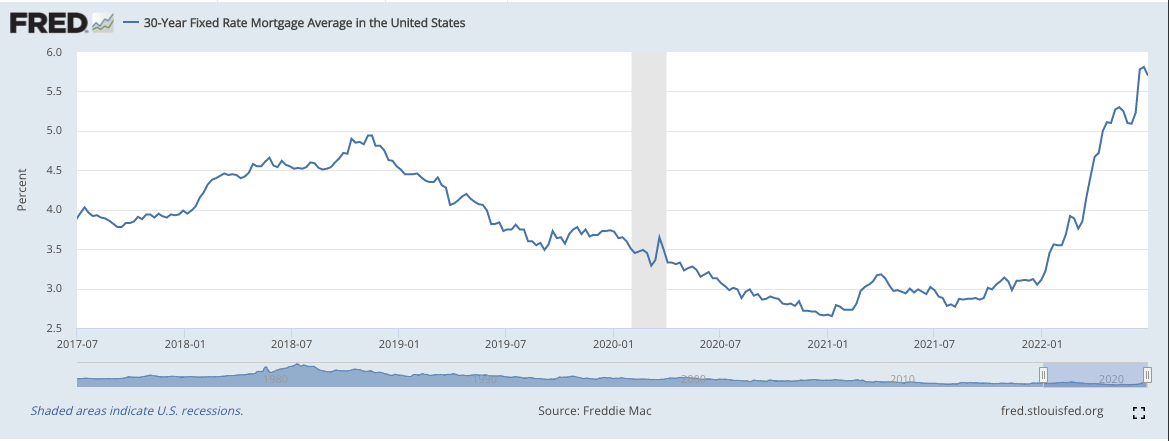

As a reminder, its 2-year yield benchmark rose at the fastest rate in over 200 years during the first half of this year and its loans became 3% more expensive overnight. And despite that, its typical borrower (demand) constraint immediately morphed into a funder (supply) constraint as hectic macro diminished risk tolerance. This was via soaring credit demand coinciding with stimulus fading and savings rates tanking. It was too slow to react. Girouard also discussed how encouraged he was with Upstart’s pricing power. Borrower demand remains robust despite its loans becoming more expensive amid the rising rate environment. Per Girouard, “consumer demand is still super strong.” The key challenge will be economically matching that robust demand with willing supply in 2022.

On not wanting to be a bank:

“In our view, the most impactful thing to do is insert our underwriting technology into the highest fraction of credit origination in the U.S. and eventually the world. You can’t do that as a bank. If you are a tool that every bank, every credit union and every leader can use, that’s a more impactful model. “ — Upstart CEO/Co-Founder Dave Girouard

This is how Upstart builds its data scale to feed and improve its models. By being the Switzerland of lending, it can plug ALL of its partner data sources into its data ecosystem to enhance the underwriting granularity -- with no conflict of interest. This is not possible for stand-alone banks. Furthermore, this edge also allows Upstart to give its partners access to the aggregate data ecosystem so all lenders can take advantage of the scale of Upstart’s growing partner roster. They’re all better together with that becoming truer with every additional partner added. I can assure you it would not have over 50 lending retention partners if it were a bank.

On competition:

“We don’t have others in our face trying to do the same thing… there are few innovating on the problem of credit access and that’s a place we feel we’re really in a class by ourselves… We believe our platform is a potential market share leader in the U.S. personal category.” — Upstart CEO/Co-Founder Dave Girouard

On Two Risks:

Preservation of Upstart’s data and underwriting edge.

Upstart’s ability to adapt to a rising rate environment when its history has been entirely within low rate, dovish environments.

“I don’t fear either risk because there’s no evidence of either… the best thing we can do is observe other models and they all tend to be so highly correlated to a credit score that it’s hard to see anything beyond that going on… On the macro environment making our model useless, it’s almost implausible to imagine that as we see how it’s doing vs. traditional credit scores and that’s not a tough fight for us to be frank.” — Upstart CEO/Co-Founder Dave Girouard

“I don’t want to sound like we don’t have things to worry about. There’s much that can go wrong in grabbing the opportunity to prove this out… it’s about how we prove this is going to be the business we see it being in a few years.” — Upstart CEO/Co-Founder Dave Girouard

Girouard didn’t seem concerned about competition or macro conditions drying up Upstart's funding sources. He was much more focused on the risk of the team expanding from personal lending facilitator to a lending facilitator more generally with successful launches into several other products.

On Auto Lending:

“We’re seeing extremely promising early results. Our view generally is that in a few years, you’ll see auto surpass personal loans.” — Upstart CEO/Co-Founder Dave Girouard

Upstart remains in the R&D phase for its Auto Retail product created through its Prodigy acquisition last year.

For the Auto refinance product, Upstart is through the R&D phase and is now actively shifting the balance sheet risk to partners and investors.

Girouard reiterated that margins for the segment will eventually be “very similar” to the personal unsecured business although more of the revenue will be spread over the course of the loan vs. earned up-front.

As a reminder, Upstart’s new products take a few quarters to build and season to a point of creating enough lender trust to motivate their participation. Until Upstart gets to that point, it retains the loans on its balance sheet to build proof of concept. It calls this “R&D.”

On the stock and insider selling:

“The only selling that’s gone on since the IPO is through 10b5-1 plans… I own the vast majority of shares I’ve ever had in Upstart and expect to have them for a very long time.” — Upstart CEO/Co-Founder Dave Girouard

Click here for my Upstart Deep Dive.

6. Olo (OLO) -- Case Study and a New Customer

a) Case Study

Nando’s -- a prominent South African chain -- uses Olo Ordering, Rails, Dispatch and now its on-premise QR code ordering in the USA and Canada. It has been an Olo customer since 2019, but with physical dining quickly returning, it wanted to tap into Olo’s utility-building modules there. It tried to do this internally but struggled with mislabeled orders and delays in service. With Olo’s solution, Nando’s saw:

“Widespread adoption among guests within a year."

Servers getting better tips (+5%) and visit frequency boosted due to improved service flow with no more waiting in lines.

New menu creations inspired by the organized, contextualized customer data it now has at its disposal.

30% growth in the marketable guest database

b) New Brand Client

Blake’s Lotaburger was announced as Olo’s newest client with it purchasing Olo’s Dispatch, Ordering and Rails Modules. It has more than 70 locations.

Click here for my Olo Deep Dive.

7. SoFi Technologies (SOFI) -- Galileo & a New Auto Tool

a) Galileo

Galileo was selected to power Flyp’s “gamified banking-as-a-service” platform. The company’s mobile app went live a few months ago with a gamified rewards system to drive engagement and will use Galileo’s payments, fraud and analytics tools. It also includes a full-service banking platform for re-sellers which Galileo will significantly enhance. This is a small win for Galileo compared to the H&R Block’s of the world it signed in recent quarters.

“Galileo’s extensive track record in fraud prevention and forward-looking technology was the perfect solution.” — Flyp Founder BJ McAndrews

b) New Auto Tool

SoFi debuted a new product allowing consumers to track auto prices in real time. With inflation raging and car prices soaring over the last several months, it’s feasible to think this could be a real value-add for the SoFi suite.

8. Penn National Gaming (PENN) -- Institutional Channel Checks

Analyst Jordan Bender of JMP securities issued a $52 bullish price target on Penn National Gaming. Again, price targets are irrelevant to me, but the reasoning for the issuance in this case was very notable. JMP believes Mr. Market is assuming that the company’s profitability will fall by roughly 25% this year which would mean a bigger hit than during the Great Financial crisis. Well, that impact has not manifested yet, at all. Per the note, “nothing in channel checks” suggest macroeconomic problems. It’s business as usual for the regional casino provider despite soaring inflation, gas prices and consumer anxiety. Barclays echoed this sentiment with a note of its own this week saying Penn is poised to benefit from “pent-up demand for experiences.” I think there’s a lot of room for a positive earnings surprise this quarter.

9. Macro Update

The macroeconomic backdrop continues to be intimidating. I’d ideally like to be at a point where I can enthusiastically focus on stock picking and brisk cash deployment -- but I don’t see markets as being there yet. Macro remains largely negative and so must continue to be the focal point. As a result, my cash position remains elevated at around 20.7% of holdings after this week’s volatility to match my level of caution. For the first time in months, however, I think this week brought with it some real progress (hence the small Lulu purchase).

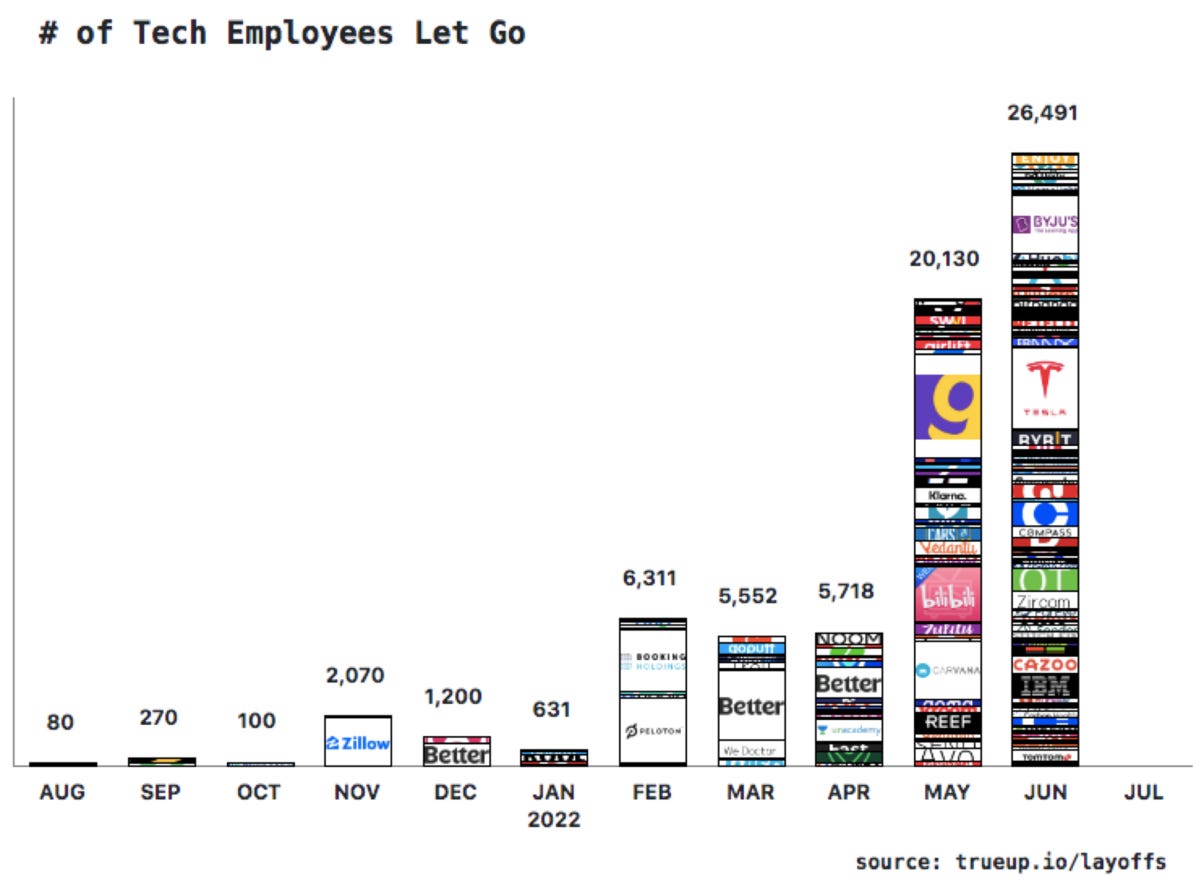

The Federal Reserve remains rightfully committed to taming inflation with rate hikes and balance sheet runoff as the two main tools. While the near future won’t bring a dovish pivot or even a hawkish pause, I do believe that we are slowly getting there, perhaps more quickly than some think as economic cracks deepen. Daily layoff announcements are truly saddening, but as a silver lining, it allows the supply-demand equilibrium within labor markets to find a healthier level of wage growth. We still have nearly 2 job openings for every job seeker which inherently leads to wage inflation and this may be a sign of the wage inflation story coming to an end. For reference, Initial Jobless Claims this week came in at 231,000 vs. 229,000 expected so the layoffs have not yet led to a large negative surprise -- but if they continue, it will.

Beyond employment, commodity prices like gas taking a breather (falling 2% week-over-week), copper tanking (a key leading indicator for growth), and retail bellwethers like Walmart, Target and Amazon all struggling with deflationary inventory gluts -- the back half of this year could look a lot more inviting to a stock picker like me. I could always be wrong and will wait for data green shoots to form before getting too excited while remaining open-minded to pivot if need be.

Bullwhip Effect Definition: When unpredictable fluctuations in demand leading to supply mismatching. This is playing out today with retailers stockpiling too much inventory ahead of supply chain issues & strong demand which is now beginning to fade. This will lead to heavier, deflationary discounting. Michael Burry discussed that this week.

Perhaps the most encouraging green shoot from this past week was the Fed’s favorite Personal Consumption Expenditures (PCE) and core PCE indicators cooling off slightly faster than expected:

Core PCE rose 4.7% YoY and 0.3% MoM vs. 4.8% YoY and 0.4% MoM expected.

PCE rose 6.3% YoY vs. 6.7% expected

This coincided with a strong U.S. Durable Goods number, a surprise to the upside on pending home sales despite spiking prices, and also falling treasury yields.

All of that is objectively positive, but I don’t think we’re yet out of the woods. These falling treasury yields were paired with corporate credit spreads rising to new multi-year highs which, as a combination, hints at rising recession fears.

Speaking of recession fears, the Atlanta Fed GDPNow estimate is now at -2.1% vs. over 2% in May and -1% earlier this past week -- back to back quarters of negative growth would mean we are in a recession right now.

And many of our brightest economists fear a 9 or 10 handle on the CPI next month while U.S. May Personal Spending grew at half the rate expected in May. So we still have generational-high inflation readings paired with a weakening consumer -- experiencing decade-low savings levels -- who makes up the majority of GDP growth. Yuck. Chinese port re-openings will be a great event for combatting supply-chain induced inflation over the longer term, but for now it merely serves as another dynamic headache for global supply chains to figure out. And finally, I’ll remind everyone that the University of Michigan’s Consumer Confidence reading is currently at record lows.

All of this is a long way of saying: Patience. Things are starting to look a little bit better, but these things need to show more meaningful signs of improvement before I accelerate my accumulation cadence and let my cash position start to meaningfully fall.

A few more data points hinting at froth coming out of markets:

The S&P 500 is off to its worst start to a year in decades.

NFT prices are down 70% since April.

Restoration Hardware (affluent consumers) lowered guidance offered just a few weeks ago.

Klarna is raising cash at a $6.5 billion valuation vs. $45.6 billion with its last round.

BlockFi is rumored to be selling to FTX for a few hundred million while it fetched a $4+ billion valuation last year.

J.P. Morgan cut its Q2 GDP forecast from 2.5% to 1% with Q3 cut in half from 2% to 1%.

Carvana is struggling to get its auto loan pools securitized.

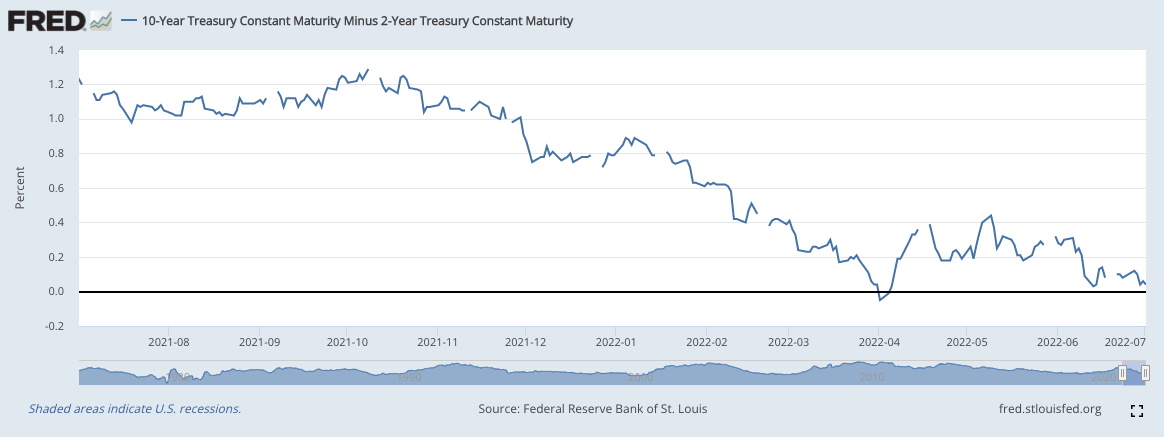

10-2 year yield slope continues to flirt with inversion -- a key recession indicator:

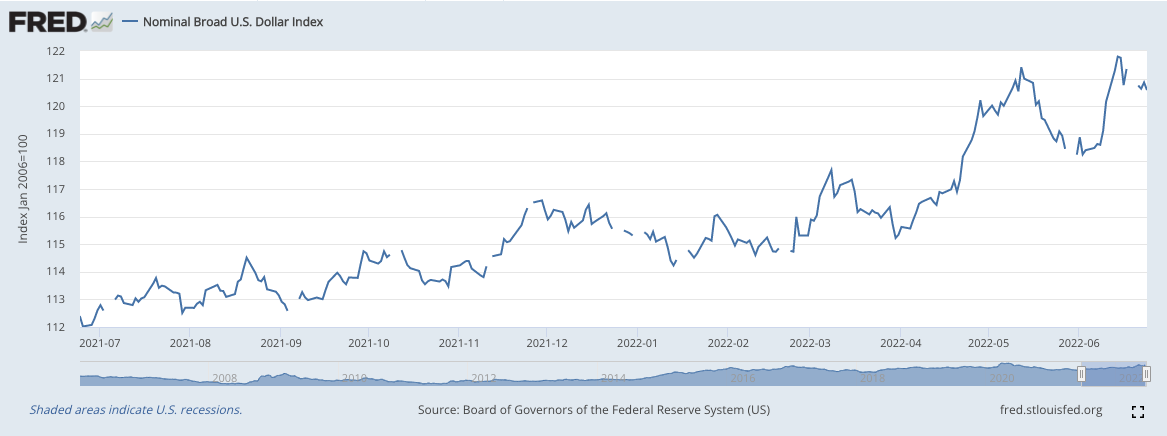

The U.S. Dollar continues to cool off from recent highs offering international firms with a much-needed tailwind to offset severe headwinds:

10. Cannabis News -- Mainly per Marijuana Moment

Innovative Industrial Properties reimbursed Green Thumb $55 million upon completion of the 300,000 square foot Danville Pennsylvania facility.

U.S. Department of energy granted $3.74 million to Texas A&M to create hemp-derived building materials. Hemp is more efficient and environmentally friendly than wood -- by a wide margin.

Perlmutter and a group of bipartisan lawmakers are now trying to pass Cannabis Banking Reform through the National Defense Authorization Act, again.

11. My Activity

I started a position in Lululemon this week and also made small SoFi and Revolve Group adds. My cash position is at 20.7% of holdings.