News of the Week (June 6-10)

CrowdStrike; SoFi; Progyny; Revolve; PayPal; Olo; Upstart; JFrog; The Trade Desk; Duolingo; GoodRx; Shopify; Macro; Cannabis; My Activity

Today's article is powered by Commonstock:

Welcome all readers! This week, we dissected 12 investor conferences and so much more to deliver you condensed, simplified, thorough takeaways... for free!

1. CrowdStrike (CRWD) -- Investor Conferences & RSA Conference 2022

a) CFO Burt Podbere Interviews with Baird and Stifel

On hiring plans:

“We have a unique opportunity to hire. We’ve seen in the news lately a lot of companies that have done layoffs. We’re going to be the company that becomes stronger during this period by hiring.” — CFO Burt Podbere

Podbere added that CrowdStrike has always featured aggressive hiring plans, but last quarter was the first period in which it hit its hiring targets. Perhaps this is a sign that the competitive environment for adding talent is cooling off and that CrowdStrike’s fortress balance sheet and cash flow generation will allow it to continue playing offense while other tech companies cannot. As a reminder, CrowdStrike has made no changes to this year’s hiring plans and just finished adding a record number of new employees last quarter.

Leadership is encouraging existing and new employees to come back to the office to work as needed but is not mandating it. The company had been a predominately work-from-home entity prior to the pandemic so it was well-equipped to maintain that paradigm if need be.

“Zooms are great for PowerPoint. It’s a little different when you need to collaborate and whiteboard. It becomes more difficult on those technologies. There’s nothing like being in a room together to hash out direction and vision.” — CFO Burt Podbere

On competition and pricing:

Podbere told us how his job title involves every single deal (largest to smallest) passing through his desk for product and pricing approval. This past quarter, he saw zero evidence of deal velocity slowing, competition taking share, or needing to discount more heavily. So far, it’s business as usual.

CrowdStrike’s 18,000 customers are about 5% of what Symantec had just for its legacy anti-virus offering (which Falcon replaces) when it sold. He sees the opportunity to take share as still “early innings” with the best days for the company “ahead of it.”

“The pricing narrative has been concocted by our competition. The reality is that we sell on value. At the end of the day, we’re out there trying to reduce total cost of ownership… by collecting data once and reusing it many times. By doing that, we’re able to enjoy the margins that we see.” — CFO Burt Podbere

“When we go out and compete against -- you’ve mentioned SentinelOne several times -- we win and we’ve been winning for quite some time... We feel like we’re in the most favorable competitive environment we’ve ever been in." — CFO Burt Podbere

On why CrowdStrike’s success has been so sustainable:

"George Kurtz founded this in 2011 when he was competing with Cylance and Carbon Black and there were investors who weren’t sure which would win. We took the patient approach. We weren’t going to build a slightly better mousetrap and put a huge marketing program around it and hope for sustainability. We collected data and used it to create different solutions that could help see things others couldn't." — CFO Burt Podbere

Podbere told us about the business value assessments it runs for each new Falcon customer to calculate savings from using CrowdStrike. Among 3,000 case studies, CrowdStrike has delivered an average 150% ROI in the first 12 months for investors. CrowdStrike can come in and on-board its entire product suite while facilitating the rip and replace of legacy agents with minimal downtime. This is how it gets away with charging more for its services than others do. Pricing power comes from value creation and CrowdStrike’s is immense and concrete.

He was asked about research reports from vendors like MITRE that seem to show SentinelOne being better at threat protection than CrowdStrike (most reports place CrowdStrike first, but some don’t). He explained that as competition “paying to play” for better scores which “CrowdStrike doesn’t need to do to stand out.”

On go-to-market:

“There’s no other company today that’s in security with an e-commerce engine flighted in a way supporting touch-less on-boarding with the sales team. We’ve been working on that for years to reduce friction.” — CFO Burt Podbere

Things like raising the free trial program from 4 to 12 modules, using free trial data to target other relevant product offers to customers and broad channel partner strength were all credited for CrowdStrike’s diminishing buyer friction.

On Falcon Complete (the turn-key service):

“There are competitors announcing a service that looks and smells like Falcon Complete, but it’s not. Most just offer a breach to-do-list. We remediate on your behalf in a largely automated way thanks to Falcon Fusion (which helps automate and augment organizational workflows)… We’re not just telling you there’s a problem, we’re telling you we fixed it. Nobody else is doing that.” — CFO Burt Podbere

b) Founder/CEO George Kurtz Interviews with Bank of America

On why the market has 5Xed since its IPO:

“It’s driven by our customers. They ask us to use data to create a workflow addressing a different use case. So we do. That’s the beauty of having a security platform. When we expand into another adjacency, we don’t have to build yet another product, we already have most of the apparatus built and we just build a new workflow.” — Founder/CEO George Kurtz

On Zero Trust and Identity:

Kurtz was again careful to explain that CrowdStrike is not attempting to be the identity access broker. That’s Ping’s and Okta’s job which are both close CrowdStrike partners.

CrowdStrike is instead shaping its Zero Trust identity product around its bread and butter endpoint/workload niche to prevent lateral movement. This means, if a hacker breaches an especially vulnerable piece of an organizational environment with a phishing campaign to gain credentials, they can’t just freely move throughout the system going forward. The issue with this type of breach is that it doesn't require malware -- the hacker got the needed log-in info separately. So CrowdStrike builds profiles of each authorized employee/login to flag behavior when it differs from norms. When this happens, it sends the alert (called a trust score) to Okta or Ping to re-require multi-factor authorization.

“I think identity is our new Endpoint Detection and Response (EDR)... it’s early but we see a lot of similarities with not much competition in this area… Every EDR customer should have it and we’re killing it there.” — Founder/CEO George Kurtz

Considering how monumentally successful EDR has been for CrowdStrike, this perked my ears up in a hurry.

On if competition is leading to any pricing pressure in the endpoint markets:

His short answer -- like Podbere’s -- was no. The longer answer:

“Think about since 2017 and the M&A activity: McAfee sold, Symantec sold, Carbon Black sold, Endgame sold and Cylance sold. There’s a reason why you’ve seen that turnover and it’s in part the success of the technology we’ve built. Most of the other players still continue to only focus on prevention and malware detection. If prevention-only and automated migration with no human intervention was the solution, Cylance wouldn’t be called BlackBerry today.” — Founder/CEO George Kurtz

On CrowdStrike vs. SentinelOne:

“As they say imitation is the sincerest form of flattery. You can’t just paint something purple from red and call it good. As I’ve said before, there’s a difference between a Fiero and Ferrari. They kind of look the same, but there is a big difference. There’s so many architectural differences in our tech that allow us to operate with scale. We replace others because they can’t even get more than 5,000 servers up and running. We come in and replace them time and time again because we can operationalize our technology.” — Founder/CEO George Kurtz

“We build in real time, not batch mode (requiring manual authorization). We stream to the cloud with smart filtering and a single data source powering all of these modules which is something that hasn’t been replicated. You asked about SentinelOne. That’s an anti-virus product that was on-premise and then they bolted a bunch of stuff on. It was never born in the cloud… things all sound the same because people copy what we put out there. But when you get into production, there’s a big outcome difference." — Founder/CEO George Kurtz

Final notes from Podbere and Kurtz:

Podbere wants R&D as a percent of revenue to rise.

The guidance offered is “prudent.” The company “doesn’t guide to running the table.”

Leadership cited IoT & medical devices as a new endpoint vector to find more growth.

Macro pain could actually accelerate CrowdStrike adoption as spend here is not discretionary and its agent consolidation lowers total cost of ownership for its clients. Everyone looking to do more with less (so everyone) can do so with CrowdStrike.

c) RSA Conference 2022 Highlights

Humio for Falcon:

CrowdStrike debuted Humio for Falcon this past week. Humio -- its log management platform -- has been able to deliver multiple seven-figure deal wins since the acquisition last year. Furthermore, it has allowed CrowdStrike to significantly augment its 3rd party data ingestion capabilities to build a more effective Extended Detection and Response (XDR) module on top of its EDR base. As XDR is simply an extension of EDR with more 3rd party data usage, a strong EDR core is a key pre-requisite, which CrowdStrike features.

This week, CrowdStrike announced that it's now offering Humio’s observability as a fully integrated module in the Falcon Platform.

With this new release, Humio will help Falcon’s telemetry (means automated communication across software ecosystems) and data retention capabilities extend to at least a full year. Cybersecurity and observability often go hand in hand -- a full view of your data and any misconfigurations or unwanted authorizations makes keeping a secure tech stack more seamless. Humio helps to uncover those weak spots and the combination of these assets create a tasty, peanut butter and jelly-type offering.

According to the company’s CTO -- Michael Sentonas -- the vast data ingestion needs of threat hunters and incident responders force specialists to trade-off between needed data consumption and storage capacity. Humio eliminates this sacrifice in a cost-effective way. For firms like Tuesday Morning, this combination of Humio and CrowdStrike generated net savings of $150,000 in just 12 months alone.

The Asset Graph -- “Path to Proactive Security Posture Management:”

Cloud evolution over the last decade has quadrupled the range of assets a company has to control and protect. This new Asset Graph allows CrowdStrike to take posture management (vulnerability, identity and permission management) to the next level by offering a centralized dashboard that automates and contextualizes the tracking of changes to configurations within an ecosystem. It calls this process of merging and infusing disparate asset data sources “Asset Resolution.” Just like CrowdStrike can consolidate agents to lower cost elsewhere, it can unite asset contextualization to drive operational efficiency here as well. The graph offers simple visualizations data these interactions to expedite and ease the task completion resulting from it. ServiceNow was announced as a 3rd party data integration partner for this new tool.

This is the 3rd visualization graph emanating from the Falcon Platform:

Threat Graph -- tracks 1 trillion events per day to prevent, identify and address threats. This is the brain of CrowdStrike

Intel Graph -- offers real-time trends in attack techniques being used to keep enterprises one step ahead of hackers.

And now the Asset Graph.

CrowdStrike’s unique ability to collect data once and use it several times for countless use cases continues to play out in real time. This is why the company’s growth has been so stubbornly strong and why its margins are also excellent. It’s wonderful to be a platform and not merely a product that can pop in and out of vogue. As part of the Asset Graph launch, CrowdStrike integrated the capabilities into its Falcon Discovery module with a re-vamped, granular user experience.

2. SoFi Technologies (SOFI) -- CFO Interview with Piper Sandler, a Reverse Split, Insider Buying & Technisys

a) Lapointe Interview

On drivers of the 2nd half of 2022 EBITDA ramp:

Rapid loan and technology segment growth which comes with better margins than its financial services.

Financial services working towards breakeven contribution margin.

The bank charter and its 1.5% cost of capital savings impact kicking in.

On Credit:

SoFi has seen no negative impact to its “gain on sale” margin from holding its loans for a longer period of time. It’s getting the added net interest income AND the same gain on sale profit. This is a product of SoFi’s high quality loan book that continues to set new delinquency rate lows for the company amid worsening macro.

Of the $1.7 trillion in outstanding student loan debt, SoFi believes that “hundreds of billions” are priced “far north” of what rate SoFi can refi for. There’s a lot of pent-up demand whenever the loan moratorium is resolved. SoFi is seeing zero evidence of any softening of the economic health of its customer as it caters to a more affluent and macro-economically resilient client.

On Deposits:

Lapointe updated SoFi Bank’s deposits for us during the call. SoFi is now up to $2.2 billion in deposits vs. $1.5 billion a few weeks ago. This figure is now growing “north of $100 million per week” vs. "$100 million per week" as of May.

SoFi’s 1.25% savings APY was credited for this. Others have somewhat similar rates, but those all come with deposit maximums (where the rate falls thereafter) that SoFi’s rate offer doesn’t include.

On Costs:

SoFi expects stock-based comp to fall from 33% of sales well into the single digits over the coming years as going public awards roll-off.

SoFi sees Galileo’s contribution margin at maturity near 40%. Today, it’s spending heavily on it and running it at a 20-30% contribution margin.

“We’ve never been in a better position to navigate what appears to be a tough macroeconomic cycle.” — CFO Chris Lapointe

b) Reserve Split and Insider Buying

A shocking amount of attention has been paid on Twitter lately to SoFi voting to authorize its board to conduct a reverse share split. While reverse splits are generally met with a negative share price reaction, that’s also generally because the company splitting is fundamentally weak. SoFi is not. Its growth remains brisk, its margins continue to quickly expand and its product suite has offered it key insulation from macro-pain. The company is merely doing this to ensure it avoids a forced liquidation event for some institutional holders if its stock dips into penny stock territory: It's a product of historic market turbulence. As long as the company continues to perform, I don’t care about this.

CEO Anthony Noto added $800,000 in new equity to his ownership pile through multiple open market purchases during the week. He’s been buying consistently for over a year.

c) Technisys

Brazil’s prominent Banese Group (one of 5 public banks in the country) is debuting "Desty" -- a new digital bank -- in that market. Technisys is providing the multi-product banking core software to make this a reality. Another key client for Technisys in South America.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service, am a daily active user and have made it the only place to see my daily transactions.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.

3. Progyny (PGNY) -- CEO Peter Anevski and CFO Mark Livingston Interview with Jefferies

Pete speaks on how Progyny wins:

“We are unique in that we focus squarely on outcomes. We are one of the only value based care companies in fertility and with that focus, we’ve been able to demonstrate significantly more favorable outcomes across all key indicators year after year… all of the things that have made us successful to this point we expect to continue and the model is set up for operating leverage year after year as we grow.” — CEO Pete Anevski

Mark speaks On large employee adoption studies:

Per Fertility IQ:

Large companies offering or bolstering their fertility benefits grew 8% YoY with an expansion pace that FertilityIQ co-founder Jake Bialis called “dramatic and startling."

61% of employees receiving adequate coverage feel more loyal to employers with more than half actually staying longer.

Mercer:

42% of companies with 20,000+ employees now offer in-vitro fertilization (IVF) treatment as of end of 2020 vs. 36% end of 2015. Other services like egg freezing and intrauterine insemination (IUI) have even lower adoption rates as out of pocket costs and access remain all-too-common barriers.

23% of large enterprises and 40% of smaller enterprises still offer no coverage. The runway remains very long.

“The trend of coverage is very favorable. Conversations have evolved with prospective clients to why our solution is better from why they should be covering fertility in the first place.” — CEO Pete Anevski

The secular tailwinds of employer adoption (40% of new Progyny clients are brand new to fertility treatment) and women having children later in life (when treatment needs are higher) are allowing Progyny to continue its explosively consistent compounding even as the natural birth rate in the USA falls. This is my thesis playing out: Progyny’s immensely upgraded care would push the United States from 2% of births via assisted reproductive treatment (ART) cycles far closer to 10% like we see in all other developed nations.

Mark speaking on the 2021 and 2022 selling seasons:

He reiterated that all indicators Progyny tracks for 2022’s selling season continue to point to this year being even more successful that 2021’s banner season.

More notes:

Utilization continues to be back at pre-Omicron levels into June.

Economic slowing is not impacting Progyny. This is not discretionary spend for motivated parents and is inherently time-sensitive considering biology.

For reference, fertility treatments grew through the teeth of the Great Financial Crisis.

Employers usually don’t cut medical benefits to tighten their belts when things are tougher.

Progyny delivers significant employer savings which makes them more recession resistant as well.

Roe vs. Wade -- There are 13 states with laws that could potentially impact Progyny as embryo transfer (and there are some that are disposed of within IVF) could possibly be considered abortion. It’s unclear if this will be the case but in Texas (the only populous state of the 13) there are strong fertility treatment laws that remove all concern there.

The other 12 states = 3% of Progyny’s business combined so if all of them were to rule in a worst-case scenario way (outlawing IVF) that’s just a 3% headwind. There would also surely be more fertility tourism from those states to others to combat this small hit.

Competition makes claims about delivering better outcomes but none actually publish data like Progyny does. We’re just supposed to trust them. Progyny has federally-vetted data pointing to its 6-year track record of better and improving outcomes.

It doesn’t see competition like Carrot or Kind Body in its competitive conversations much at this point. And carriers aren’t motivated to compete:

“There are significant advantages with the solution that we’ve built and nobody is catching us. Our key competitor is the traditional carrier and they’ve done nothing different to deal with this as it’s small and they’re not focused on it… it would cost them a lot of money to do what we do and they’d have to start changing all of the other pieces of their business if they did.” — CEO Pete Anevski

4. Revolve Group (RVLV) -- CFO Jesse Timmermans Interviews with Stifel and William Blair

On Revolve’s Story -- funded out of a garage with $50,000:

“Neither of our founders had any fashion experience. From day 1, it has been about using data and creating a better customer experience with things like free shipping, free returns and a home as a dressing room mentality… we continue to do this profitably thanks to a premium price point and customer retention.” — Revolve Group CFO Jesse Timmermans

Despite the company’s successful 2+ decades, it’s still just 3% penetrated in its core demographic of females aged 18-44 with significant room for category and geographic expansion.

While this is a fashion company on the surface, it’s really a data company. Its inventory team on the analytics side is twice the size of its creative buyer team, for evidence.

On Revolve’s customer and performance:

Thus far, the customer continues to be strong with “no indications of softening” (again, good to cater to affluent customers in 2022).

Expecting the strongest wedding season in 40 years.

Taking share from department stores and other e-commerce vendors (especially FWRD in the luxury space).

The loyalty program overlap between the REVOLVE and FWRD sites continues to tick up every month.

Revolve sees its 20% owned-brand penetration ticking back up to its previous 36% high VERY SLOWLY over the coming years and with higher margins than the previous peak featured.

5. PayPal Holdings (PYPL) -- CEO Dan Schulman Interviews with Bank of America, Crypto and Apple

a) Schulman Interviews with Bank of America

On competition:

PayPal continues to be 8 times the size of its next closest digital wallet competition in terms of merchant adoption.

For PayPal’s top 55 merchants in Q1 2022 -- it lost checkout share with 5 of them, gained share with 17 and was flat with the rest based on the full-stack processing data it has.

On Checkout:

PayPal’s processing uptime is close to moving from 99.99% to 99.999%.

This sounds irrelevant, but it’s important when you compete with several other comparable products and are doing over a trillion in annual volume.

PayPal is looking to shave “several seconds of checkout latency” off from its flow this year.

PayPal is quickly working to fully remove username and password requirements for checkout. Per Schulman, close to 100% of this info is leaked on the dark web anyway, making this form of confirmation largely irrelevant. Furthermore, forgetting a login contributes 50% of PayPal’ churn which means this could be a big help there too.

This is why the billions of vaulted financial instruments that PayPal has is so key.

On Upstream Presentment and BNPL:

“Upstream presentment is why we went so heavy into BNPL (Buy Now Pay Later). It’s not the economics of BNPL. We have no late fees for consumers, no incremental fees for merchants and deliver a 21% volume increase for merchants with customers using BNPL.” — PayPal CEO Dan Schulman

This is why I see PayPal as sort of the Wal-Mart of the BNPL space. The unit economics stink for this service, so it essentially offers it as an add-on perk and can simply benefit from processing the added volume. It doesn’t need to charge merchants anything incremental to use this.

Schulman took upstream presentment a step further this week. He’s now not just talking about displaying PayPal checkout offers on product pages, but integrating PayPal all the way up to the entry page. To do so, PayPal will lean on the 8 billion vaulted financial instruments it has in its ecosystem to identify customers as they enter a site for merchants. Braintree is a vital piece of that. This identification can be used in real time for seamless one-click checkout, but also for tailoring promotions to shoppers to raise entry to checkout conversion which sits around 5% for most merchants.

“Nobody in the Western world has the amount of data and information we do to help merchants on that and we’re starting trials later this year.” — PayPal CEO Dan Schulman

On Macro:

Schulman thinks we’ll be “hard pressed” to see inflation fall a lot more this year and sees a U.S. recession as a 50%+ probability with European recession chances being higher.

The backdrop has not gotten worse since the company’s last report even though its guidance assumed continued worsening. This could mean upside to future results but we’ll see.

China ports are rapidly opening, but supply chain issues remain in place which makes moving goods from China elsewhere quite difficult today.

“Ironically, this is one of the times when PayPal can do the best in the market because of our checkout advantages and business model. In a year that will not be our best, we’ll still generate $5 billion in free cash flow and we’re still investing in our business while other major competitors are retrenching… this is a chance to double down and we'll take advantage of our strengths in checkout and digital wallet.” — PayPal CEO Dan Schulman

On Braintree:

Braintree checkout is fully native for its customers (meaning entirely in their own app).

This is PayPal's "most sophisticated" tech stack.

When merchants use Braintree, PayPal gets better positioning for its checkout products to add to the value it enjoys.

As a reminder, Spotify, Airbnb, Uber, DoorDash and Live Nation all use Braintree for vast majority of their full stack processing and it continues to “win extremely large customers” per Schulman

b) Crypto

Per CoinDesk, PayPal’s conditional virtual currency license has now officially become a full “BitLicense” from New York State. It’s the 20th vendor in the state to get that classification. In other PayPal crypto news, the company will now allow its customers to move their crypto assets to other wallets and vice-versa. This had been a big ask from its customers and that paired with the hefty fees PayPal collects from these transactions made it an easy decision.

It's also extending crypto to its peer-to-peer (P2P) services.

c) Apple

Apple and Block announced a new “tap-to-pay” integration this week. This prompted Mizuho to issue a research report highlighting how a similar, hypothetical announcement with Venmo would add 20% percent to Venmo’s 60%+ top line growth. I’d like to see this actually get announced before I get excited, but the Block news does hint at a more open Apple philosophy for payments.

6. Olo - Founder/CEO Noah Glass Presents with William Blair and More

Olo Pay:

"Very encouraged” by the initial excitement from prospective Olo Pay customers but the company continues to exclude it from 2022 guidance.

Borderless Pay (vaulted card information for expedited checkout at any Olo restaurant) is in the works for later in 2022.

Kwik Trip:

Kwik Trip and its 800+ locations launched carryout, curbside and delivery for its fresh food section. Convenience stores over the last several years have embraced prepared food with open arms and this manifests needs quite similar to restaurants. As a result, Olo is focusing here as a next frontier of expansion to target the roughly 50,000 enterprise chain locations that could use its services. Kwik Trip is launching with Olo’s Ordering module to get this ball rolling.

7. Upstart Holdings (UPST) -- CFO Sanjay Datta Interviews with Bank of America

“I think most of the people within our business continue to remain as convicted as ever about the opportunity and the upside. I don’t think anyone views the stock price as reflective of the fundamentals of our business… we haven’t seen much attrition." — Upstart CFO Sanjay Datta

Annualized loss rates continue to be stable since February at roughly pre-pandemic levels of about 10%. They had abruptly jumped back from 5% after the stimulus impact began to fade late last year, so it's good to see pre-COVID levels serving as a current equilibrium rather than loss rates being even higher. Consumer credit has begun to get more and more stretched lately which could place renewed upward pressure on this current ceiling.

“While generation-high inflation levels are uncharted waters for digital lending, there are great offline lending proxies from prior periods showing a 10-15% rise in expense base doesn’t impact default probability all that materially. It’s really a matter of employment levels remaining robust. Inflation leading to monetary policy pushing us into recession would have a large impact on employment levels and hurt defaults.” — Upstart CFO Sanjay Datta

On why it doesn’t just sell its credit API as a service and call it a day:

The actual process of data collection is imperative to feeding Upstart’s credit models. It’s happy to white label its API and application process to embed it directly into externally branded sites while it controls the process and shares the data. But if you were to just use the model and run your own process, the efficacy could fall by up to 50%.

On funding philosophy:

Partner based funding is about 25% of Upstart’s volume and growing consistently. These are hold to maturity institutions with access to the lowest cost of capital in the world. Overall, they’re not very sensitive to macroeconomic cycling.

About 37.5% of Upstart’s volume (and shrinking) comes from fast credit hedge funds relying on asset-backed securitization (ABS) markets for funding. This bucket relies on quick trades for profit so it is quite sensitive to spreads, worsening liquidity, and macroeconomic volatility. This is Upstart's most fragile funding bucket which is one of many reasons why I want more partner retention.

The remaining 37.5% is also funded by investors but these are also hold-to-maturity institutions that have been resilient to the recent macro-worsening. Partner retention is preferred over this bucket but it is better than leaning on funds using ABS markets for all funding.

Two things are happening to its coupons right now. First, investors are requiring higher returns due to recession fears and then default rates are rising which pushes coupon rates higher as well (coupon = default rate + required return). Somewhat counter-intuitively, the rising loan prices offered by Upstart are still leading to its platform being funding constrained while it's borrower constrained in normal times. This is a product of stimulus fading away and is why Upstart stepped in last quarter to fund about $150 million in volume. It won’t do this again but will instead take the volume hit.

“In Q1, we had more borrowers than funding dollars. even at new higher market rates. We thought it would be a good use of our balance sheet to absorb the excess demand and traffic it through secondary markets later on… obviously the market reacted unhappily to that… I think it wants us to be that marketplace that reacts to the vagaries of the market and accepts volume volatility as a result. The takeaway for us is that we’ll just keep our balance sheet out of it and reserve it for R&D.” — Upstart CFO Sanjay Datta

Datta reminded us that Upstart’s take rate doesn’t correlate with partner and investor yields. If a customer wants to originate one of its loan requests, it gets referral and servicing fees which have been stable over the last several years. When ABS markets were churning instant 8% profits last year, Upstart wasn't growing its take rate as a result. Upstart -- per Datta -- has had the chance to raise this rate many times, but decided against it in order to generate more volume and to more expeditiously feed and season its credit algorithms. That's its current bias which I support.

On CFPB’s recent statement against black box AI lenders and looking into denials:

Datta spoke on the Consumer Financial Protection Bureau (CFPB) recently cracking down on “explainability” of AI lending models. This refers to explaining to regulators and customers how approval decisions are made and why certain borrowers were rejected to ensure no foul play. This explainability is easy with rules-based FICO systems, but much harder with algorithms digesting and leveraging 1600 variables per decision.

According to Datta, Upstart “pioneered” explainability with CFPB and is the only AI lender deeply embedded with the CFPB’s operations. He also offered an interesting stat that 50% of Upstart’s research and development spend on its models is actually centered around creating new models to better explain its old ones. This is a key focus for Upstart already… meaning tighter regulation could actually be a net positive for the company.

8. JFrog -- Management Conferences & A Guide Up?

a) CFO Jacob Shulman and CEO Shlomi Ben Haim Notes

Key Highlights:

No slowing in enterprise data usage like some other cloud players have discussed as the efficiency raising automation it delivers becomes more important during tough times.

JFrog sees a 5X+ revenue opportunity with even its most mature customer relationships.

JFrog has now reached volume minimums with the public cloud providers prompting those providers to compensate their sales team for selling JFrog.

Reiterated 30%+ growth guide for the long term.

The 32 different code languages that Artifactory supports is “by far the most” in binary repositories.

Remember that source code tools from GitHub and Continuous Integration (CI) tools from the Atlassian’s of the world are COMPLEMENTARY, not competition.

JFrog is the first and only company in its space to support Apple’s new programming language -- Swift -- as Apple transitions from source code management to binary automation.

b) Guidance?

A few news outlets reported that JFrog revised its quarterly guidance. It left its revenue guide unchanged but raised its profit outlook. The company did not publish a press release or filing on this so I’m really not sure if it’s a legitimate announcement. Either no news or good news.

9. The Trade Desk (TTD) -- Publisher Win

Vox Media -- which just debuted its own supply side platform in programmatic advertising -- will use The Trade Desk as its exclusive demand-side platform partner. Advertisers had long complained to Vox about difficultly accessing its impressions -- with The Trade Desk now firmly in the equation, that problem will surely abate. As part of the relationship, Vox will also onboard its first party data into UID2 -- an anonymously targeting identifier The Trade Desk built (but does not own) to counteract 3rd party cookies degradation and to sustain the open internet overall.

This merely continues a long, long list of publishers and journals embracing The Trade Desk. Over the years, Apple and Google making cross-app data sharing and tracking more difficult has weighed heavily on this industry that relies on relevant ads for survival. As a result, they’ve had to form new alliances and their overwhelming partner of choice on the demand side to do so has been The Trade Desk. It’s good to be a market leader, and the superior outcomes and innovations that this company delivers help to ensure that remains the case.

That continuously growing and market-leading position gives the firm an unparalleled supply of open internet 1st and 3rd party data to foster even more granular and profitable (but private) advertising targeting. It’s a compelling data flywheel that continues to turn and turn with each new prominent partner plugging their inventory into The Trade Desk’s budding bidding platform.

10. Duolingo (DUOL) -- The company was added to the Russell 2000 and 3000

11. GoodRx (GDRX) -- PBM Inquiry & Pausing

The Federal Trade Commission (FTC) is investigating Pharmacy Benefit Managers (PBMs) and their impact on drug pricing and access. As part of the research, the 6 largest PBMs in the USA will have to offer detailed business practice reports. The investigation will center around claw-back fees, patient steering, opaque reimbursement, rebates and more. All of these issues are discussed in my deep dive of GoodRx's business.

GoodRx generates the vast majority of its pricing coupons for consumers through PBM cash-pay businesses. Any regulation impacting their ability to provide compelling discounts would at the very least force GoodRx to find another way to offer savings or could completely overhaul its business model (which I think is more likely).

This is frustrating for me -- the business provides immense, desperately-needed consumer value and now trades for roughly 15X earnings and a PEG ratio well below 1.0X. Still, the combination of leadership’s inability to guide through the pandemic and this piece of regulatory noise is leading me to pause my accumulation in the company for now. I’m not selling any shares.

12. Shopify (SHOP) -- Shopify Audiences and Various Other News

a) Shopify Audiences

Last month, the company debuted a new merchant tool called Shopify Audiences to streamline targeted customer acquisition. Shopify Plus Merchants using this tool can uncover high likelihood buyers based on “proven intent” which has already been seen to raise conversion and deliver impressive return on ad spend (ROAS) for beta testing merchants. For BlenderBottle specifically, this tool has delivered a 6X ROAS. It also integrates into all ad networks to promote ultimate consumer choice (like all Shopify products try to do). The product is fully compatible with Facebook and Instagram to promote seamless syncing and will soon expand to TikTok, Microsoft Advertising and more.

With this powerful new tool, all a merchant has to do is select a SKU that it wants to raise the sales for. After that, Shopify’s program aggregates an audience from its large merchant and buyer network and sends that to the merchant’s advertising network. The software extends beyond lead generation to actually measure how the customer matching worked with detailed results reports. This takes all of the guess work out of marketing for merchants -- they can simply observe their ROAS through Shopify Audiences.

Commerce enablers have recently done more and more to help their merchants with marketing as Google and Apple make social media marketing and data sharing/tracking/targeting more difficult. For example, this is very similar to PayPal’s Store Cash program and some others which tailor marketing to high intent buyers and those who started but didn’t finish the checkout process.

“We know merchants may have to pay 2X what they did a year ago to find a customer… we’ve also seen ROAS drop amid growing difficulty of using marketing to find buyers. That’s why we’re launching Shopify Audiences to fix it without compromising privacy.” — Shopify VP of Product Kaz Nejatian

b) Various Other News

Shareholders approved a vote to grant Tobi Lutke a “founder share” that guarantees his 40% voting power in the company as long as he remains the CEO and maintains an equity stake above 1.1%. This is a key vote of confidence in the company’s polarizing leader. Shareholders also approved the 10-1 stock split.

Research out of Wells Fargo indicates that Shopify experienced a 13% monthly decline in visits and 5% decline in unique visitors for the month of May. Not great, but also not surprising or alarming. Like much of the e-commerce space, Shopify is struggling with lapping the 3-5 year e-commerce demand pull forward brought on by the pandemic -- it's not a Shopify issue in my view, but an industry pandemic hangover issue. The Wells Fargo analyst team expects Shopify’s GMV and revenue to underwhelm this quarter per its research findings.

I think an e-commerce re-acceleration as we get through tough comps is all but inevitable over time and that Shopify will be a key beneficiary. The next few quarters -- however -- will likely be tough for it. I'm staying patient here (still just on watchlist).

Shopify invested in Codat -- a company trying to “build the internet for business data” -- along with J.P. Morgan and Plaid.

Shopify was listed as one of nine partners for Apple’s planned BNPL product launch.

Shopify’s BNPL product is expanding the payment schedule options. It still offers 4 installment payments, but now also monthly payment plans for up to 12 months.

The BNPL product has been shown to juice merchant AOV by 50%, and reduce abandoned cart rate by 28%.

It also helps merchants tap into Shopify’s 100 million shopper user base -- which is larger than almost any other competitor besides the PayPals and Blocks of the world.

13. Macroeconomics

a) Economic Data:

CPI results vs. expectations:

We got 8.6% YoY CPI growth vs. 8.3% expected and 8.6% last month.

Unfortunately, 1% month-over-month growth greatly exceeded 0.7% expectations.

We got a 6.0% YoY core CPI (strips out food/energy) vs. 5.9% expected and 6.2% last month with month-over-month growth of 0.6% ahead of 0.5% estimates.

This report was predominately negative with even used car prices continuing to surge. This provides the Federal Reserve license to continue on its aggressive path of tightening. If anything, this will make them even more aggressive.

The University of Michigan's Consumer Confidence Index results vs. expectations:

We got a reading of 50.2. This is the lowest number in the history of the metric since it began 50+ years ago (lower than at the bottom of the pandemic). This sharply fell from 58.4 month-over-month and was expected to be 58.0. Large, large miss.

While this is intimidating, it's all part of the process of hawkish policy fostering much-needed economic normalization to begin our next cycle and bull market at some point in the future.

One-year inflation expectations rose to 5.4% from 5.3% with five-year inflation expectations jumping from 3% to 3.3%. Not great.

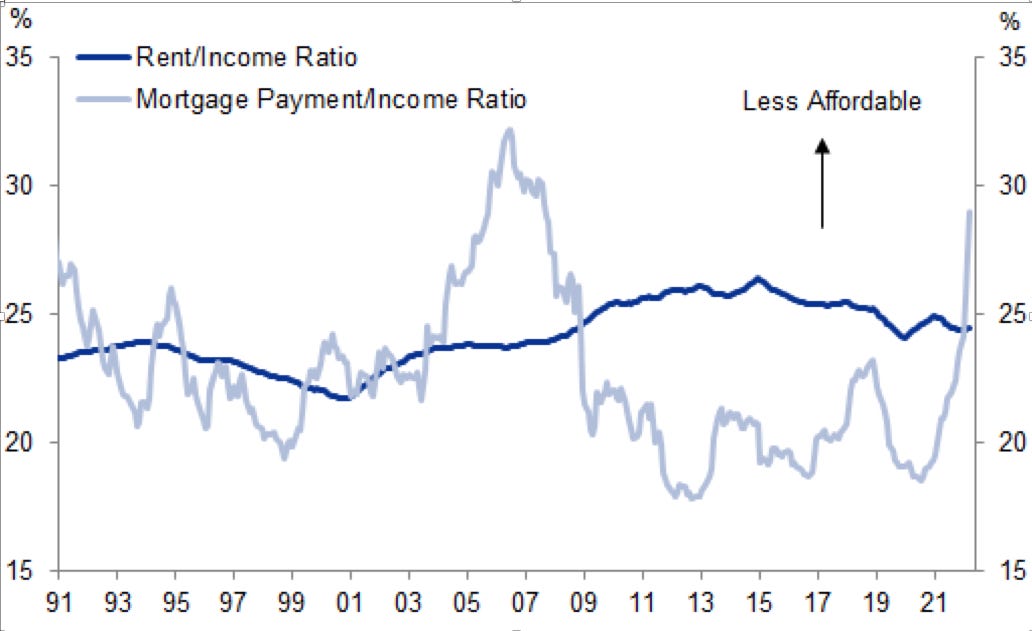

Mortgages

Mortgage demand is now setting decade lows with rising rates and falling consumer confidence.

Foreclosures are still well below pre-pandemic levels and my man Special Situations tweeted a great chart of mortgage payments as a percent of income sharply rising:

U.S. Household net worth fell for the first time in 2 years in the first quarter by $500 billion to $149.2 trillion.

Per GasBuddy, the average price for a gallon of gas in the United States rose about $5 during the week for the first time ever.

This is 67% higher than average prices just 12 months ago.

Supply issues remain firmly entrenched due to domestic policy and war. Now, China port re-openings (if that doesn’t reverse) will place added pressure on global energy price. Weird times. Best for me to react to the data rather than try to forecast what is wildly unpredictable at this point in my view.

Atlanta Fed Now real GDP forecast estimates for this quarter are now below 1%. They were above 2% less than a month ago.

The World Bank cut its global growth forecast to 2.9% from 3.2%.

Visa and Mastercard continue to report robust credit card data with consumer credit in the United States continuing to rise well beyond expectations and savings rates falling.

This creates a precarious situation of needing to lean more on credit for non-discretionary spend, which could be where this resilience is coming from.

A note on Fed talk:

The Federal Reserve has a few powerful tools in its tool kit to influence pricing and employment. Perhaps one of the most abstractly powerful tool is its dialogue that often seems wildly contradictory from one day to the next. What gives? The Federal Reserve knows that its words can impact credit yields and spreads and also knows tightening credit will be a big piece of reining in generation-high inflation. So? If it can get markets to do its work for it via things like spread widening or an equity multiple contraction (which dampens demand by reducing the wealth effect), it doesn’t actually need to be as aggressive with rate and balance sheet policy. The Fed doesn’t want a recession and wants that coveted soft landing for the economy. The rhetoric is a way to slowly talk the markets down and hold its hand through well-spelled out policy shifts. It wants to fully eliminate the element of surprise.

It’s merely trying to push things in the direction it wants to see things go and I feel that -- like in most cases -- actions speak so much louder than words. Individual comments should be taken with a grain of salt (especially if they board member is non-voting.)

b) Market News

Meta Platforms removed plans to release its augmented reality (AR) glasses in 2024. This continues a theme of pulling back on more speculative projects to focus on cash flow and Meta is far from alone in that ambition.

Twilio is now laying off workers (like many other quality firms).

Rumors surfaced about a potential purchase of Roku by Netflix. The two companies have an intimate history together, but talks don’t seem to be advanced.

Docusign -- a poster-child for pandemic pull forward -- continues to slow.

Apple announced a BNPL product during its developer conference. There weren’t any announcements pointing to incrementally tightened data tracking and sharing for advertisers which was well-received by Meta Platforms and others in the advertising space.

Thoma Bravo cut their takeover price for Anaplan while Zendesk is no longer considering selling in light of an underwhelming bid environment.

Legend Stanley Druckenmiller sees a recession in 2023 and does not think we’ve seen a bottom in markets. He has been shorting all year. His opinion was based on expected aggressive monetary policy to combat inflation and this week’s elevated inflation readings certainly add to that likelihood.

Barclays changed their next rate hike prediction to 75bps from 50bps following this week’s CPI.

AMD sees a 20% revenue growth CAGR for the foreseeable future with expanding margins. It had an investor day that I found extremely impressive. Lisa Su rocks.

c) FRED Data

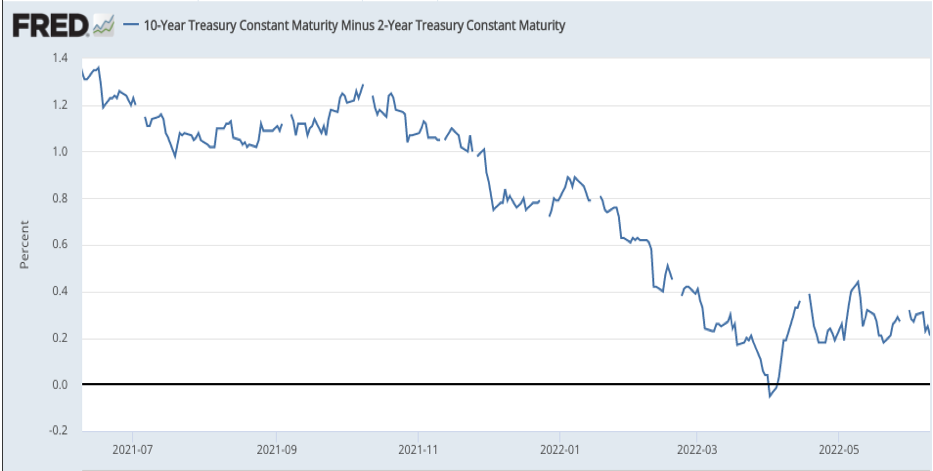

10-year/2-year yield curve spread -- the curve began to compress again this week as recession fears again build. This is why Buffett calls markets Mr. Market -- it’s irrational, moody and unpredictable on a daily basis:

This flattening is a factor of a quickly rising 2-year yield which is the benchmark that loans for companies like Upstart use to price. Its continued rise is not a good thing, although the rate of change has luckily slowed which is very important for loan price stability.

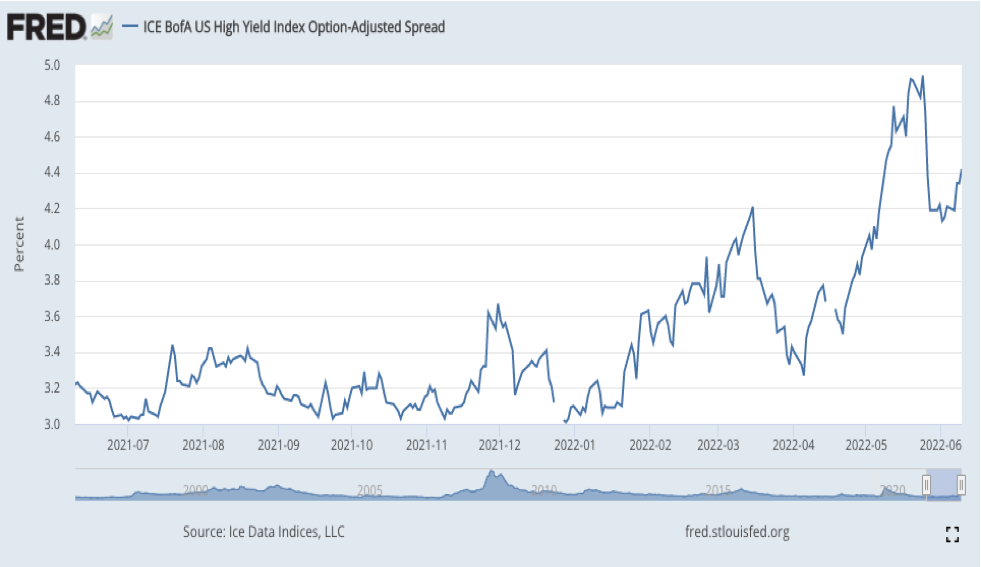

Similarly, high yield credit spreads began to worsen once more:

My takeaway from all of this is the same as it has been: Times are tough; we will get through this; we likely have more turbulence and noise and surely have more tightening to come. I will continue to accumulate shares of thriving companies but will keep doing so at a pace that is for now slower than my cash infusion cadence. That has not changed and I’m not ready to pivot to a more aggressive accumulation plan. I’ll keep letting macroeconomic data come in and will let you know in real-time as things change for the better or worse over time. These are uncharted waters and there’s no reason to try to be a hero.

14. Cannabis News:

West Virginia is working to medical cannabis ballot inclusion this November.

Mississippi is overwhelmed with medical cannabis applications post reform.

Delaware legislators upheld the governors rejection of cannabis reform.

Pennsylvania’s House Finance Committee green-lighted a bill to remove cannabis from 280E inclusion at the state level. This would allow for deduction of ordinary business expenses from the state, but not federal, tax bills.

North Carolina’s Senate offered final authorization to send its medical cannabis bill to the House floor for vote.

The U.S. Conference of Mayors wants cannabis banking reform.

15. My Activity

I added to Olo and Cresco Labs during the week. My cash position is roughly 21.1% of holdings.