News of the Week (March 28 - April 1)

CrowdStrike; Upstart; Meta Platforms; SoFi Technologies; PayPal Holdings; JFrog; Nanox; The Boeing Company; A Note on Yield Curve Inversions; Miscellaneous (Olo & Ayr); My activity

1. CrowdStrike (CRWD) -- Forrester & MITRE

a) Forrester

CrowdStrike was named 1 of 4 leaders by Forrester in the research organization’s Q1 2022 Incident Response Report. It enjoyed top marks in 9 out of 24 metrics used to score companies and also has a much smaller market presence than the other 3 leaders -- which points to a potentially longer, more lucrative comparative runway.

This arm of the company often cleans up the mistakes of competing security solutions for prospective clients by leveraging CrowdStrike’s Falcon platform as well as its forensic investigators and recovery and incident specialists. CrowdStrike’s capable threat hunting team uses the organization's AI/ML engine to automate every possible task for speeding time to remediation.

Incident response is far from CrowdStrike’s most profitable segment, but it’s a phenomenal tool for lead generation. Specifically, $1 spent on this piece of the firm fetches the cybersecurity disruptor nearly $6 in incremental revenue. This was closer to $3 when it went public. While this segment isn’t that exciting in isolation, it opens the door for CrowdStrike to sell its other products that certainly are more exciting and cash generative.

“Once the threat has been contained, the conversation usually turns to how do we stop this from ever happening again?” — CrowdStrike Director of Proactive Services Justin Wissert

Enter CrowdStrike’s “Falcon Complete” full-service platform.

Incident response also opens the organization up to aggregated client lists within cybersecurity insurance firms who frequently lean on CrowdStrike's services to clean up messes; it’s approved by 30+ cyber insurance panels which attempt to to promote coordination and communication of best practices.

“CrowdStrike is recognized across the cyber insurance industry for its ability to stop breaches. This is why many insurance carriers call on CrowdStrike when their clients fall victim to attacks.” — CrowdStrike Director of Proactive Services Justin Weissert

Its deep experience within the legal framework of cybersecurity -- as well as an understanding of when and where 3rd party counsel or IT service is needed -- equips CrowdStrike with an intimate understanding of which engagements are privileged (confidential). This is vital for expediting time to recovery. If you don’t know who is allowed to know and do what, fixing a multi-faceted breach becomes even more daunting and time-consuming. CrowdStrike has a formula for instructing companies on the path of least resistance to return to day-to-day operations.

As a side note, Forrester was not happy with me publishing the actual graphic on Twitter last week and asked me not to do so again. Still, it’s free so if you want easy access to it click here.

In light of Russia struggling to win the war in Ukraine, expectations for cyber-based retaliation in response to significant western aid for Ukraine are rising. This month, Biden explicitly told businesses at a quarterly business roundtable that it is a “patriotic obligation that you invest as much as you can in making sure you have the capacity to deal with cyberattacks.” It’s hard to think of another company within the endpoint and cloud workload niche that is better-positioned to take advantage of this durable tailwind.

CrowdStrike helps its clients actively prepare for cyberthreats via:

Tabletop exercises -- this is essentially an interactive meeting involving the response teams from CrowdStrike and a given client. The topic of the meeting is a made-up breach based on what's most relevant to the specific firm. Together, the two teams work through needed actions and who is actually responsible for doing what.

Red Team Exercise -- CrowdStrike uses its threat hunters to emulate an attack (that is again relevant to the given client) with the actual intention of successfully breaching an ecosystem to reveal security vulnerabilities.

Red Team/Blue Team Exercise -- Same red team exercise but with a defense team in place to gauge progress in addressing uncovered vulnerabilities.

b) ‘MITRE Engenuity (yes, spelled that way) ATT&CK Evaluation’

MITRE’s cyber test evaluating responses to threats that mimic Russian hackers went very well for CrowdStrike. The company demonstrated a perfect prevention score across every step measurement and delivered 96% sub step visibility.

Sub step definition: steps within each piece of the prevention process.

Furthermore, it was the only vendor to depict “native and unified Zero Trust and identity protection capabilities” all engrained in a single platform.

“Rigorous, independent testing is a vital piece of security… that’s why I’m so excited to share these results today… it’s clear that our platform continues to set the industry standard by stopping ransomware, malware and all breaches.” — CrowdStrike CTO Michael Sentonas

CrowdStrike also scheduled a new investor briefing for next week. I’m excited to tune in and share the highlights.

2. Upstart (UPST) -- Founder Interview, Credit Union, ABS Markets & CFPB

a) Upstart Leaders in Lending Podcast Interview with Co-Founder/CEO Dave Girouard

On Crypto:

“I certainly am a student of crypto and believe it could be one of the most overwhelming changes that any of us will experience depending on where it goes… Web3 is truly potentially transformative and is an area that we will be involved in over time." — Upstart Co-Founder/CEO Dave Girouard

As a reminder, last year Upstart led a $145 million Series E fundraise with Tala. Tala is a financial services company that helps 6 million members throughout mainly the developing World. The cash was specifically earmarked for “developing one of the first mass-market crypto products for emerging markets to help make crypto solutions more affordable and equitable.”

“Crypto will likely be part of every financial institution's future and we can be an ally for our partners here to ensure they’re on the right side of things as crypto plays out. When the talent moves so quickly in one direction, it’s almost inevitable that something big will come of it.” — Upstart Co-Founder/CEO Dave Girouard

On early regulator engagement:

“It became very clear to us that lending is just not a do things incorrectly and apologize later or a move fast and break things type of industry. We engaged with regulators from our inception to show that what we’re trying to do is good for everyone. In 2012 we were meeting with CFPB before we had even gotten started. We’ve taken similar approaches with the OCC, FTIC and Federal Reserve as well. It has paid off and is a constant effort... Our nothing to hide, will share anything regulator approach engendered trust over time.” — Upstart Co-Founder/CEO Dave Girouard

On auto:

“In our view, the auto market functions so poorly today that there’s a chance to build a product that leads to better outcomes for all 3 parties involved in the process (consumer, dealer, lender) simultaneously. That’s what we want to achieve -- not putting one of the stakeholders out of business, but creating wins all around. We have that opportunity." — Upstart Co-Founder/CEO Dave Girouard

b) Credit Union

Upstart deepened its partnership with Red Rocks Credit Union this week. This is another small get for the company -- Red Rocks has $360 million in assets and 16,000 members mostly in the state of Colorado -- but yet another sign of Upstart’s growing traction in the credit Industry. The two entities had begun working together late last year but it will now join Upstart’s budding referral network -- which is the loan innovator's largest revenue segment.

Since Upstart became a preferred partner for the National Associated of Federally Insured Credit Unions (NACFU) in 2021, the company has enjoyed rapid adoption among credit unions of all sizes across the nation. Considering that -- on an apples to apples basis -- a credit union lends at nearly 2X the rate of traditional banks, this growth channel will be a core company focus going forward. According to Upstart SVP of Business Development Jeff Keltner, the firm had messed up by not focusing on credit unions along with banks at the beginning of its now decade-long journey -- and it's now a priority.

c) ABS Markets

There was some chatter on Twitter that a senior tranche of an ABS transaction involving Upstart loans had to be re-priced due to tightening conditions within securitization markets. This concerned me a little, but I couldn’t find a single bit of news on the claim after hours of digging -- so I reached out to Upstart’s head of investor relations for comment. His response was short, sweet and all that I needed:

“Not true. Probably why you can’t find any info.” -- Upstart VP of IR Jason Schmidt

Still, ABS markets will tighten this year as monetary policy becomes more hawkish and so liquidity lessens. This should lead to rising delinquencies which Upstart has assumed in its 2022 guide by doing things like requiring relatively higher interest payments to compensate for the incremental risk seen in macro-land. Upstart isn’t helpless in this inevitable tightening, and had assumed it would come for the last 2 years. As a result, it expects to shift more of its origination volume this year to sources like partner retention and whole loan purchases. For partner retention specifically, that also means less 3rd parties involved to command a certain chunk of the overall profits which could make Upstart’s lofty take rate more defensible.

d) Consumer Financial Protection Bureau (CFPB)

According to American Banker, CFPB has recently been sending cases pertaining to fair lending and the Equal Credit Opportunity Act (ECOA) to banks around the nation. Issues including maternity leave, English proficiency, LGBTQ+ and Tribal Lands have been brought to bear which is leading most to assume that stricter enforcement action from CFPB could be coming.

Upstart is actually a relative beneficiary of CFPB’s tightening grip. Why? It's the only FinTech in the United States with a no action letter from CFPB guaranteeing no ECOA enforcement action -- that’s what an obsession with regulatory transparency from day 1 has led to for the firm. This letter was the culmination of things like Upstart loans being issued to protected classes at a far higher rate vs. the industry average and the more affordable debt it can offer to these protected classes. As/If CFPB becomes more demanding, compliance will become more difficult. There’s no direct Upstart competition with as intimate of an ability to aid in this compliance for its partners.

Click here for my Upstart deep dive.

3. Meta Platforms (FB) -- WhatsApp Upgrade & Help Wanted

a) WhatsApp Upgrade

Meta’s WhatsApp will debut voice messaging improvements over the next month or so. The new features will allow users to:

listen to a voice message while reading a different message.

playback a voice message at different speeds and pause listening while picking up right where a user left off.

record messages in pieces thanks to a pause function to avoid awkward silences.

b) Hiring Spree (per Bloomberg)

Meta Platforms is hiring 2,500 new workers in Canada over the next 5 years with the vast majority working out of the new engineering hub being built in Toronto (but with broad remote work flexibility). Canada’s (and specifically Ontario’s) “deep talent pool and vibrant technology ecosystem” were cited as the reasons for the decision. Some of the new hires will be directed to Meta’s messaging products and “remote presence” team with others specifically working in Reality Labs.

“Canadians in the past have had to move to the U.S. to work for big tech companies. Now we’re saying you can stay in Canada.” — Meta Public Policy Manager Rachel Curran

Meta continues to move full speed ahead in wildly aggressive spending plans to build out its vision of the Metaverse. That’s what a fortress balance sheet (and essentially being banned from any M&A) affords the flexibility to do.

Another small piece of news this week that I found somewhat interesting along these same lines is Wendy’s partnering with Meta Horizon to create the “Wendyverse” -- a virtual, Wendy’s themed world. To be candid, this sounds pretty strange to me -- but innovation often does. I thought nobody would ever buy clothing on a video game and look where we are now. And within the dozens and dozens of fortune Fortune 500 companies embracing this vision, there will spawn both utility-building use cases, and large swings and misses. Meta’s stance as the host, or the builder of these worlds, ensures it succeeds when any of its developers succeed.

4. SoFi Technologies (SOFI) -- A Study and a Time Magazine Accolade

SoFi and Workplace Intelligence together surveyed 800 employees and 800 HR specialists across the nation to reveal how badly needed financial flexibility, utility and health are in the United States:

75% of respondents face “one source of major financial stress.”

51% of respondents feel more stressed about their finances now than ever before.

25% of respondents are taking a second or part-time job as a result of the added stress.

25% of respondents are carrying more credit card debt.

19% of respondents are tapping into retirement savings.

Employees spend 9.2 hours per week on their finances while at work.

91% of employees are committed to improving their financial health in 2022.

Employer commitment to improving employee financial wellbeing fosters:

increased productivity for 86% of employees

lengthier tenures for 86% of employees

happier workers for 84% of employees

better mental and physical health for 84% and 80% of employees, respectively

To put it plainly, a combination of the (unfortunately) growing number of financially stressed Americans motivated to seek improvement is nothing short of ideal for SoFi’s growth. The Fintech player is not a magic bullet for fixing all of these issues. It is, however, a real piece of the puzzle. SoFi's one-stop shop for financial services gives users a far more holistic, birds-eye-view of their financial health while even rewarding them for making smart financial decisions via cash and points. Its re-financing branch actively consolidates and cheapens debt loads as well.

While some banks have prioritized the highest return on equity (ROE) products, SoFi is prioritizing having the full financial services product suite. It wants to be with the user for every single major financial decision and needs the products to do so (without referring business to competition). The approach also means it often gets to successfully cross-sell the highest ROE products and raises the value of SoFi’s customers to the firm to allow it to offer perks like industry leading yields on savings accounts. This survey merely highlights the need for its broad-ranging solution.

As a side note, that data point on employee hours per week spent at work on finances should be both terrifying and exciting to every single enterprise. That is a real opportunity to get more out of an existing asset base and thus to feed the profits of any business. Shifting those 9.2 hours from obsessing over delicate finances, to being able to focus on the success of a firm is not just a win for the consumer, but corporate America as well. We can already see that employers are motivated with 75% of respondents committed to adding more benefits to their financial programs in the next 2 years to better attract talent and to foster happier workers. Along these lines, I see SoFi partnering with employers to promote its offering (maybe with special deals) to large employee bases.

“One size does not fit all when it comes to financial well-being and financial education. The research we published today provides employers with actionable insights and forward-looking perspectives on employee expectations to help provide a roadmap for the future of workplace financial well-being." — SoFi EVP and Group Business Unit Leader Jennifer Nuckles

In other news, Time Magazine named SoFi as one of its 20 “innovators” within a list of the most 100 influential companies. While this is surely not a monumental accomplishment, it is still yet another case of an independent 3rd party acknowledging the unique utility that SoFi is creating within Fintech. As a company that went public via-SPAC, any and all of these 3rd party data points are welcomed as we’ve seen a large chunk of companies choosing to go public via that route already flame out.

5. PayPal Holdings (PYPL) -- Deepening Partnerships

PayPal announced a new partnership with the public Italian Bank: Nexi S.p.A which generated roughly $2.5 billion in 2021 revenue. The partnership specifically involves Nexi’s Ratepay product that offers private label financial services for merchants and markets -- most notably Buy Now Pay Later (BNPL) and other financing solutions in Germany and Europe overall. Ratepay will become the exclusive “Payment by Invoice” PayPal checkout partner in Germany -- the 4th largest economy in the world.

In other news, PayPal extended its existing “Happy Returns” software to merchants for free. This software helps to automate the labor intensive tasks of handling returns and exchanges. It even offers data driven exchange suggestions (like the same shirt in a different size) with the ability to accept an exchange or cash back all with one seamless, PayPal-like workflow. This will lower shopper headache and should materially raise online shopper conversion rates.

“Happy Returns has made it possible for us to offer seamless exchanges to our global customer base, helping retain revenue we would have lost." — International President at Gymshark Niran Chana

There’s also an in-person arm (called Return Bars) of this program which simply injects PayPal further into the brick and mortar shopping flow. This product facilitates returns without any labels or boxes needed and equips consumers with an ability to return items via QR code. Finally, the software combines returns from multiple locations to reduce shipping costs.

7/10 customers choose to return through these Bars vs. mail when given the chance, depicting a real desire to continue making in-store shopping a key part of future consumption. That’s why PayPal is so focused here.

As part of the news, Ulta Beauty announced it would raise its Happy Returns locations to 5,000 total vs. 3,700 today. The more utility PayPal can provide to merchants, the more market share via adoption and upstream presentment it will enjoy to juice its overall operations. The more merchants it attracts, the more special deals it can offer consumers to juice its install base and incremental merchant sales as well. It’s good to have a massive, two-sided network like PayPal has.

“We’re encouraged by the increased store traffic and engagement the partnership drives.” — Ulta Beauty COO Kecia Steelman

According to the National Retail Federation, the mean return rate for e-commerce purchases rose by 20% amid the pandemic. This makes seamless returns and fulfillment all the more imperative to reduce friction within this digital process.

Happy Returns is now available in 8 languages to streamline expansion into The EU.

“As return volumes rise, this is a crucial time for merchants to implement efficient and cost-effective solutions to better manage the growing role returns play in retail. Happy Returns delivers a post-purchase solution that helps them retain revenue and gives them a competitive edge in today’s market.” — VP of PayPal's Happy Returns David Sobie

6. JFrog (FROG) -- AWS Gaming and India Partnership

a) Amazon Web Services (AWS) Gaming

Amazon’s “AWS for Games” Initiatives will now be supported by JFrog’s DevOps platform. This will “provide game creators with real-time insight into development pipelines, better collaboration and tools to accelerate game delivery.” JFrog’s platform is already used by 50% of the largest gaming companies globally. Gaming requires a rapid and constant stream of updates (and so scalable, real-time access to binaries) to ensure a continuously current and ever-improving interface and experience. Considering this, DevOps and gaming fit like hand and glove.

b) India Partnership

JFrog announced a new partnership with Softline India to “help companies in India seamlessly and securely deliver software updates from developer environments to the edge.” With the combination, JFrog’s full suite of products will now be made available to the 1.3 billion-person nation to add to the help that Softline provides within asset management, vulnerability management and more. Together, the two will be able to do more for clients in the budding India market set to grow at a 14% compounded annual growth rate through 2025.

“Softline always aims to delight our customers with technology that scales to meet their evolving needs. We’re thrilled to partner with JFrog to help make customer lives easier.” — Softline Managing Director Vinod Nair

7. Nanox (NNOX) -- Earnings Review

a) Overview

Nanox generated $1.3 million in revenue for the quarter and $0.2 million in gross profit. The revenue was entirely thanks to Nanox.AI (created via the acquisition of Zebra Imaging) which contributed $300,000 and also $1.0 million in “radiology services” (via its USARAD acquisition). Nanox’s Xray tubes and ARC units are still pre-revenue. GAAP net loss for the quarter was $22 million vs. $19 million YoY -- the added loss was largely via the result of M&A expenses. Nanox has $156.5 million in cash, equivalents and short and long term marketable securities. There’s likely another capital raise coming if it can’t soon deliver net loss improvement.

b) Press release highlights:

“Our technology transfer to Nanox Korea to enable production of our MEMs chip is complete. Production is now underway and we will be in full production by the middle of the year.”

Nanox continues to expect a ramp in shipment of ARC units this year.

It’s building out a permanent assembly line in Dagesh, Israel (some assembly already underway to meet anticipated demand).

This will be capable of churning out “hundreds” of machines per quarter.

“Entered into an agreement with a large (top 30), integrated HC organization in the US for Nanox.AI to be deployed for early detection of cardiovascular disease and osteoporosis.”

There was no further update on the Q-sub (AKA pre-submission to seek edits from the FDA before actual submission) that was sent to the FDA in January. “We are preparing for our second multi-source 510k submission.”

This is considered the second version of the Nanox.ARC.

USARAD received The Joint Commission’s Gold Seal of Approval -- “the leading quality standard from the most widely recognized medical credentialing program in the country" according to company CEO Erez Meltzer.

C) Conference Call notes from CEO Erez Meltzer

On the FDA and multi-source clearance:

“We are in continuous communication with the FDA and believe that this route will be the most expeditious path to more FDA feedback which we believe will be followed by a formal multi-source submission... We expect the Q-sub to lead to thoughtful improvement to the ARC… We’ve made considerable headway to commercialization over the last year, and our team remains committed to deployment of the Nanox.ARC in the months ahead.” — Nanox CEO Erez Meltzer

On M&A integration:

“We are pleased with our ongoing integration of the companies we bought in 2021 and have taken a number of cost reduction measures to streamline operations and power synergies.” — Nanox CEO Erez Meltzer

Nanox is guiding to a total revenue run rate of $12 million annually between USARAD and Nanox.AI for 2022.

On Nanox.AI:

“The American Medical Association (AMA) issued a Category 3 Current Procedural Terminology (CPT) code which enables a potentially broader use of Nanox.AI to help cardiac calcium scoring… We consider this important validation of our technology and a key step towards advanced detection and treatment of cardiovascular disease.” — Nanox CEO Erez Meltzer

On Nanox.ARC updates:

Meltzer reiterated that Nanox has signed 11 service agreements for deployment of 6,500 ARC units. There are no new deals to report and none have been canceled. These units will be deployed in “Africa, Europe and Central America” which will require regulatory approval in those jurisdictions. Erez believes “Nanox will get these approvals in the very near future" but (thankfully) wouldn't try guessing at a date.

Erez was asked how he feels about the Q-Sub timeline considering this is day 77 and the timeline is usually roughly 75 days. His response:

“We did think it would be 75 days when we submitted a few months ago but it took them about 4-5 weeks to respond, schedule a meeting and discuss the process. The Q-sub that we submitted was based on the large amount of comments from the first submission. We fixed all of their comments and from our view -- because the technology is so new -- it seems they are internalizing what we are trying to do. This path of continuous dialogue has proven to be the right one.” — Nanox CEO Erez Meltzer

d) My Take

There were no new blunders to report in this quarter for the first time in a while. This remains my smallest position and I will not add to it until ARC shipments begin. At the same time, this was one of Nanox’s best quarters to date (very low bar to clear) and I have no desire to trim my current position. This was good enough.

8. Boeing (BA) -- Mixed News

We are still awaiting the cause of the China Eastern Airlines crash last week. While we have been waiting, China Southern Airlines announced the intention to take delivery of 39 737 MAX planes this year with plans to take delivery of 103 total over the next three years. Considering how top-down the Chinese economy is, I’m cautiously optimistic this means the crash was not Boeing negligence-related. We'll see.

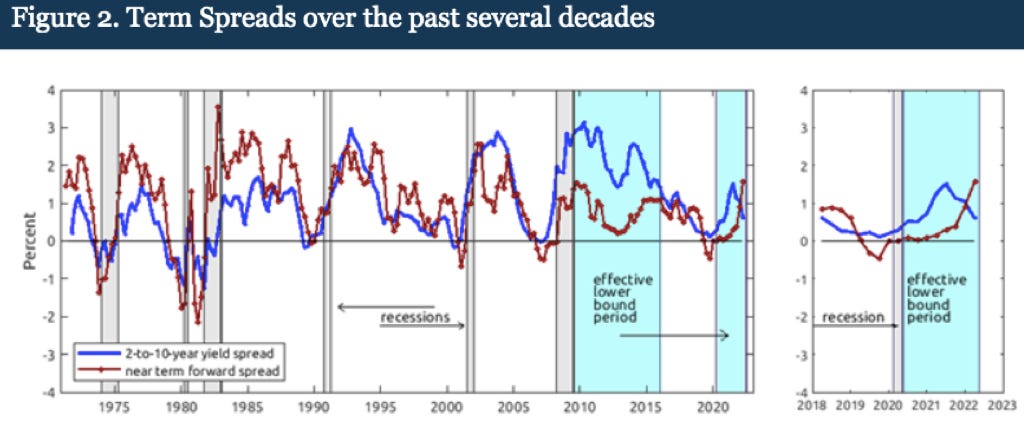

9. Condensing a Great Read from The Fed's Eric Engstrom and Steven Sharpe

The key highlights:

A 2 to 10 year yield curve inversion (when a treasury bond with a shorter-dated maturity fetches a higher yield vs. a treasury bond with a longer-dated maturity) is not nearly as predictive of recessions as other parts of the yield curve.

The two created a "near-term forward spread" measurement based on treasury yields maturing in 18 months or less.

Inversion of any piece of this near-term curve has been far more predictive of future recessions.

This is because these maturities offer a purer gauge of investor expectations for Fed rate policy over the next 18 months than the 2 to 10 year yield.

Investor fear of a near-future recession leads to the expectation for rate cuts within the next 18 months (so lower rates than today) which places downward pressure on this near-term forward spread and can -- if significant enough -- cause an inversion in this part of the curve -- which again has been a far more reliable indicator of future recessions.

Sharpe and Engstrom acknowledged that this rate policy expectation phenomenon does influence the 2 to 10 year yield spread but added that other material long term factors such as risk premiums play a large role as well -- so it's a less pure metric. (Even things like declining population growth can impact long-dated yield spreads so there are several other exogenous factors that play a stronger role as maturities lengthen.)

This near-term forward spread remains healthy and the near-term part of the yield curve is not close to inversion.

This was a great, quick essay. If you have the time I'd highly recommend reading it here.

10. Miscellaneous -- Olo and Ayr Wellness

a) Olo

David Cancel will replace James Robinson (board member for 14 years) on Olo’s Board of Directors. Cancel founded Drift and also previously served as the Chief Product Officer at HubSpot.

“I look forward to watching Olo’s trajectory and continue to be confident in its mission and future success.” -- James Robinson

Click here for my Olo Deep Dive.

b) Ayr Wellness

Ayr Wellness launched its Entourage Vape brand in Florida.

Click here for my broad overview of American Cannabis regulation.

11. My activity

GoodRx jumped from roughly $13 to $20 in a straight line over the last couple of weeks. While I remain excited to own the company, I also wanted to take advantage of this wild volatility and so sold 5% of my position. I would gladly add this small chunk back to my stake if we see more multiple compression in the future. I also made a large Meta Platforms purchase during the week. My cash position is currently 10.8% of holdings.