News of the Week (May 16-20)

Meta Platforms; Upstart Holdings; PayPal Holdings; Progyny; Match Group; Cresco Labs; SoFi Technologies; Olo; CrowdStrike; Nanox; Macro; My Activity

Today's piece is brought to you by Masterworks:

1. Meta Platforms (FB) -- Leadership Guides Us Through Their Messaging Roadmap at the Inaugural Meta Conversations 2022

Meta announced WhatsApp’s opening of its Cloud API to all businesses globally. According to Zuck, this will allow enterprises to access the business messaging services anywhere, build and customize on top of WhatsApp to create a granular user experience (UX) and also to speed time to customer response.

“Today we are opening up the cloud based version of the WhatsApp business platform. Meta will be the hosting service and will take on all secure hosting including maintenance, network, compute, storage and everything else for free. This means businesses can increase messaging and get real-time access to new features. We think this will be a game-changer for those who build on WhatsApp.” — WhatsApp VP of Product Ami Vora

There are already 1 billion users connecting with a business account across the company’s various messaging services per week and this caters to developers and enterprises by making those experiences better and more personal -- more examples of this later. The new release comes with a dedicated business app on WhatsApp for smaller businesses with “lightweight” messaging inboxes across Meta’s Family of Apps. Meta Business Suite is available for bigger customers while its new “Kustomer” acquisition (which is a messaging first customer resource management tool) will be the backbone of the company’s scalable product for the largest of its customers. As a side note, Forrester thinks Kustomer enhances agent efficiency and efficacy by up to 30% and reduces service costs by up to 88%.

“Kustomer is a messaging first platform built on top of the messaging apps people use most. Phone, email, chat, SMS and of course, messaging. If brings customer conversation seamlessly from every channel into one unified view to treat people like people. Kustomer offers advanced AI tools to offer personal support without any agent intervention and automation to proactively handle problems.” — Co-Founder and now VP of Kustomer Brad Birnbaum

The company also announced a new startup accelerator with Plug and Play (early stage VC).

Some stats:

70% of Meta’s users feel more connected to a business they can message.

65% of Meta’s users prefer messaging over email or call.

Per Gartner, by 2025, 80% of customer service organizations will abandon mobile apps for messaging on a 3rd party platform.

Per Forrester, 50% of U.S. online adults use chat to buy things with that being 62% for people ages 25-34.

Case Studies:

Uber debuted WhatsApp to Ride in a city in India to a reception “it didn’t expect” according to CEO Dara Khosrowshahi. 33% of the riders coming through WhatsApp are brand new to Uber while its new rider rate for the rest of the business is “usually very small.” Khosrowshahi explained that this type of incrementality is quite rare for such a well-known brand and also quite welcome. These riders were also much younger than the rest of the company’s user base which is another large plus. Uber plans to expand this program throughout India and then in Brazil and more major markets eventually.

“WhatsApp is the number one communication platform for us especially in developing markets. It’s the way folks want to communicate and has become a core part of our everyday workflow.” — Dara Khosrowshahi

KLM Royal Dutch Airlines saw call volume spike 500% when pandemic restrictions were put in place. It used a prioritization model within Messenger and WhatsApp to resolve routine inquiries and to free up scarce agent time. It reduced wait times from hours to instant for those inquiries.

Aldi wanted to speed its response to questions about inventory. Through Messenger, it reduced response time from 180 seconds to 3 seconds and was able to re-purpose 8.5% of its customer service staff to other parts of the firm like business development.

The National Australian Bank used Meta’s click to message ads and saw an 83% reduced cost per inquiry and a 6X in lead-generation.

“If we stopped using WhatsApp for Business today, we’d have to open up 25 more stores to mitigate the volume loss.” — South American General Motors Director Bruno Campos

“The faster you can free up your call centers -- which are essentially cost centers -- the sooner you can turn them into profit centers by enabling them to up-sell and cross-sell. And yes, messaging is one of the best ways to generate and qualify leads.” — Meta VP of Business Messaging Matthew Idema

2. Upstart Holdings (UPST) -- An Investor Conference, KBRA Data, a New Partner and Wedbush

a) CFO Sanjay Datta Interviews with Barclays

On using the balance sheet to fund more loans:

“Most of the time, our platform is borrower constrained. There are periods of macro shocks where funding rapidly changes and becomes the constraint. At these times, we have a decision between stepping in with our balance sheet to support volume until the new equilibrium clearing price is found or we can just not originate a bunch of loans. Neither is ideal. In Q1, we stepped in with our balance sheet for about $150 million. In retrospect, we were caught off guard with the visceral reaction by the market to this. In the future, the decision will be to accept the volume volatility and not use the balance sheet as a stabilizing mechanism… that’s the lesson learned.” — CFO Sanjay Datta

Thank you Sanjay. I’d greatly prefer a small volume hit over this decision in the future.

“We would have probably done things differently had he known all of the questions this would raise about our business model, which in our view hasn’t changed at all.” — CFO Sanjay Datta

Also keep in mind that the 2-year yield rising is the greatest cause of this pricing instability. Its rapid rise last quarter (fastest in centuries) caused it but that rise has not even remotely been repeated during this current period.

On how Upstart becomes more resilient:

Sanjay spoke on the need for a continued shift in its funding mix to partners retaining more loans (as I've been saying). This funding source is far more durable and resilient vs. capital markets as cost of capital is lower and loans can be held to maturity rather than needing to be flipped for profit/liquidity.

He also discussed how the Upstart model’s reaction to the rapid rise in the 2-year yield needed to be more immediate. It wasn’t prepared to do this and instead temporarily deployed significant balance sheet resources to react to macro. It’s now investing to make sure the proper automation is built in to the platform so this doesn’t happen again. This bothered me as I would have hoped the automation would have already been built in.

On auto-refinance and indirect auto (point of sale with dealerships):

Upstart has begun the initial roll-out of its indirect auto loan product integration with its software platform built specifically for dealerships. It’s only integrated in about 3 of its 500 dealers today and expects to rapidly ramp that number over the next several quarters as loss curves season and mature. This is the bigger opportunity for Upstart vs. refi but there was an interesting trade-off that Datta discussed: As more loans are mis-priced with legacy underwriting, there’s more refi demand but if Upstart succeeds in indirect auto, then loans will be priced better and there will be less refi activity.

On the new Subaru & VW partnerships:

“These are sort of retail transformation-style deals. Ultimately, you’re selling to the dealership. But at the OEM level, they strike deals which take the form of an endorsement along with some customization and some financial incentives to push adoption. It’s more of a program to grease the wheels. We hope to have more of these OEM deals to announce.” — CFO Sanjay Datta

On what’s baked in to forward guidance:

“We’re taking a somewhat conservative approach due to the wide variance of scenarios right now. Things could unravel further, tightening could push us into a recession… on the other hand, there could be a quicker unwinding of some of this stuff and a quicker return to confidence.” — CFO Sanjay Datta

On mortgages:

“About a million in non-qualifying (don’t have the credit to qualify) loans were issued in 2001. Then the bubble popped in 2008 as subprime volume soared and subprime became a bad word. Now there’s next to 0 non-qualifying loans issued. If you don’t meet qualified loan criteria, you are just out of luck. I think there’s an area of underserved borrowers where we can bring better models to bear and do what we’ve done in personal and auto. And then the process of getting a mortgage is like going to the dentist. It’s not fun and there’s a lot to be automated and improved there. It’s the same playbook in a much bigger market.” — CFO Sanjay Datta

On the international opportunity:

This is in the roadmap, but Upstart will first round out its full credit product suite in the USA before expanding internationally. Datta hinted at global expansion being done through M&A or maybe partnerships to access unique data sets so it doesn’t start from scratch.

On how to know Upstart is better at underwriting:

Datta cited all of the credit and federal agency data on Upstart’s underwriting prowess that I've covered but wouldn’t go into the exact things that make it better -- and leadership never will. Every team with a uniquely valuable algorithm has every incentive to keep the secrets as quiet as possible. We have to lean on 3rd party data to assess the legitimacy of its claims (which has been largely, but not entirely positive thus far).

“The specialists who have been looking at our credit since 2016 would tell you that something is different about the way our credit performs.” — CFO Sanjay Datta

b) New Credit Union Partner

Upstart announced Carolina-based Sharonview as its newest referral program partner -- its largest revenue segment. The two began exploring a relationship a few months ago and are ready to take the next step. Sharonview has over 100,000 members and $1.7 billion in assets under management. It has also been named by Forbes as the best credit union in South Carolina.

Upstart likely has several more of these announcements coming soon as it added 15 partners last quarter but only announced a couple of them. It’s now adding a new partner every week.

c) KBRA Surveillance Report

KBRA released its latest comprehensive report on Upstart’s credit performance. Here are the highlights:

Housekeeping:

All deals priced from 2018-2021 had their credit ratings affirmed or upgraded.

Delinquencies -- as expected -- are trending higher than during the stimulus era.

Cumulative net loss (CNL) trends -- a more important metric -- are also ticking higher as expected but at a slower rate of change.

Upstart amended its conduit contracts with CRB and Finwise. This allows borrowers who experience a temporary income shock to apply for loan modification for payment relief on up to 18% of the loan term if 2 payments have been made.

This was previously 4 payments. Modification requests had been quickly rising but have since leveled off.

Upstart conducted another update its loan algorithm in March 2021 to account for the changing macroeconomic backdrop. Its models will never stop being updated.

Credit Summary for Upstart’s Securitization Trust:

Credit Reserves are above original targets for every single deal (most recent from 2021). Over-collateralization has also remained steady or risen on all of these deals (a good thing).

All deals priced through Upstart’s securitization trusts have CNL projections at or below original estimates (a good thing).

Credit Summary for Upstart’s Pass Through Trust:

Credit Reserves are above original targets for every single deal (most recent from 2021). Over-collateralization has also remained steady or risen on all of these deals (a good thing).

Upstart’s 2020 deals within its pass-through trust continue to outperform CNL estimates.

All 2021 deals have seen CNL estimates RISE by 2-3%. As the company told us on the last call, certain 2021 vintages have underperformed and this is what they were referring to.

When averaging out all current vs. original CNL estimates -- Upstart continues to comfortably outperform BUT this is a sign that the outperformance is growing more vulnerable as macro rapidly deteriorates. Expected, but still not good.

No trigger rates have been breached.

Upstart continues to be able to place loan pools with capital market investors. In its latest pre-sale report, it cleared about $650 million in total pool balance. This so far has been quite similar to the deal size and frequency we saw in 2021. Furthermore, in this pre-sale report, none of the 2022 transactions have seen their base case CNL estimates rise and delinquency rate rise trends have begun to fortunately level off -- as management told us it had. These base case assumptions were already raised (a bad thing) vs. 2021 but have not been raised again since the deals started seasoning.

All of these issues diminish if Upstart can continue to get its partners to retain a larger portion of the sourced loans. These partners have far better access to capital, less need to quickly sell pools through capital markets, and less 3rd parties to pay in the value chain while still yielding appropriate cash flows. I will be laser-focused on capital market reliance continuing to fall along with management keeping its word of not using the balance sheet for bridge funding again -- just take the volume hit.

d) Wedbush

Wedbush lowered their Upstart price target multiple times during the week. This is not all that important to me but I received a couple questions about it that I wanted to address:

Its bearish views are predominately related to the terrible macro-backdrop. They’re absolutely right about that. 2022 could be a tough year for the company which is why I plan to continue trimming into extreme strength while accumulating into extreme weakness.

The other piece of the concern was uncertainty surrounding how the model would hold up amid a credit cycle and rising delinquencies. In terms of credit cycle commentary, they’re right again. Upstart hasn’t been through a traditional cycle, only credit shocks which it has performed quite well in. If it overcomes the challenges it will be greatly rewarded and if it doesn’t, it won't. I’m optimistic, but we’ll see.

These price targets are commenting on the next 12 months, not the next 5 years. If Upstart can get through the next 12 months intact like I think it will, it should be far smoother sailing as the credit cycle eventually brightens.

Wedbush does not have a personal vendetta against Upstart. They're simply expressing their opinion. Analysts are graded on their opinions. This is not personal.

Masterworks is democratizing access to fine art. For as little as $20 per share, this refreshingly innovative platform allows you to buy shares in a rare Picasso or Banksy without needing millions in disposable income. No longer is this asset class reserved for the top 0.1% -- and that's thanks to Masterworks. Now, all can enjoy the stability that blue chip art has provided across macro-economic cycles and do so with a seasoned team that has returned 14.3% annually since inception. There's a reason why 400,000+ people (including me!) have signed up.

Check out what all the buzz is about here.

3. PayPal Holdings (PYPL) -- Investor conferences & a Debt Raise

a) CEO Dan Schulman Interviews with MoffettNathanson

On the last 12 months and guidance:

“We clearly got ahead of ourselves. We looked at early trends during the pandemic and our assumption sets about how they would play out proved to be wrong. I take full accountability… We’ve changed the way we think about guidance. We now believe that in our guidance, we need to operate under the likelihood of things getting worse going forward, not better. When we looked at the low end of our guide, we thought things might continue to worsen and we ought to make sure that we feel very comfortable that we can deliver of over-deliver.” — CEO Dan Schulman

“There have been many obituaries written about PayPal over the years. I remember when wireless carriers came together and people felt that because they control phones, they’ll control digital payments. Over the last 6-12 months, I can’t tell you how many times people compared us to companies like Fast or Bolt. Through all of this, we’ve grown share.” — CEO Dan Schulman

PayPal continues to expect OpEx growth to fall back to the single digit percent range which would mean significant margin expansion ahead as long as growth doesn’t unexpectedly halt.

A lot of this turbulence is still eBay operating agreement expiration-related (along with the strengthening dollar and lapping credit reserve releases). PayPal will be fully through that headwind in Q3 when industry e-commerce growth should also re-accelerate. I continue to think the 2nd half of the year will be strong for this company. We’ll see.

On market share:

PayPal has 8X the merchant placement vs. its next closest digital wallet competitor

PayPal has 10X the consumer preference rate vs. its next closest competitor.

On user growth:

Schulman responded “yes with an exclamation point, of course we can” when asked if PayPal can continue to sustainably grow users. The top of the funnel has remained strong for PayPal throughout all of this turbulence. The bottom of the funnel (churn) is the main driver of user growth which is why it’s so heavily focused on engagement and the digital wallet. 50% of its user base now has this installed and have shown to double revenue per account and lower churn by 25%.

On Venmo:

“When I speak at college campuses in these massive auditoriums I always ask how many of you use Venmo. It’s like 100% of the class that raises their hands. It’s a phenomenon for that demographic in that age group.” — CEO Dan Schulman

The Venmo MAU issue brought on by new 1099 tax policy has already disappeared.

Pay with Venmo on Amazon will still launch as Amazon’s first digital wallet payment solution sometime this year.

On Braintree’s unbranded processing:

“We were tired of hearing about other players growing faster and that’s just not true. Braintree is more than holding its own with unbranded processing. You look at the client base where we have the overwhelming majority of their full stack processing, Uber, Airbnb, Live Nation, DoorDash Spotify. We’ll continue to move down market as well so when somebody integrates their full stack processing into Braintree, it’s a fully native integration into our most advanced tech stack. It means you’re not popping in and out and in and out of the app. It’s fully linear checkout across Venmo, PayPal, other APMs, Apple, Google. If you’re a merchant, you get all of that." — CEO Dan Schulman

The billions of vaulted cards within Braintree’s ecosystem will also be imperative for powering PayPal’s single-click, upgraded, checkout.

On checkout:

“We offer higher authorization rates with lower loss rates. That combination is generally a trade-off but that’s not the case with us. Small businesses that accept PayPal enjoy 6-8 additional payment processing events per 100 transactions. That’s a gigantic advantage we offer and why small merchants want to accept us.” — CEO Dan Schulman

“There’s also not enough in-site checkout. A lot of that is via legacy integrations meaning when somebody clicks on PayPal, they need to pop out of the site and comeback in. It takes time and is not streamlined. We’re knocking that out one line of legacy code at a time.” — CEO Dan Schulman

50% of PayPal’s churn comes from someone not remembering their log-in. PayPal doesn’t use log-ins much as that info is all available on the dark web so using log-in to verify would lead to immense fraud. Vaulting credit card information and other identifiers to forgo log-ins will therefore be a massive driver of improved churn. That’s a key PayPal focus.

“Eventually, what we’re really trying to work on with our biggest merchants is how to take advantage of all the data and info in our vaults…. for retailers, the biggest issue is not improving conversion at checkout or being better at upstream. It’s that when a consumer comes to a merchant’s page, under 5% actually transact. Imagine if we can give data and information to allow merchants to know who that consumer is and for them to tailor deals once they come in. If you can take that 5% to 10%, it obliterates the slight improvements made at checkout.” — CEO Dan Schulman

On BNPL:

PayPal’s pay later solutions are gaining share by “leaps and bounds.” Schulman thinks the era of VC-funded money-burning competition to grab share is over. Advantage PayPal.

200,000 merchants now offer PayPal’s BNPL upstream presentment (offered on the product page before checkout). This was 65,000 merchants just 6 months ago.

On talent:

“With stock prices all disrupted, there’s talent up for grabs. People are looking for the stable, market leaders who will emerge stronger. We’re fortunate to be in that position.” — CEO Dan Schulman

On guidance and why growth will accelerate:

“Obviously we’ll have to prove it and in generally talk less and act more… There’s some basic math as eBay goes away. That was $1.4 billion in revenue pressure last year and about $725 million this year almost all in the first half. Comps will get much easier and we have a ton of initiatives where even little successes will drive growth.” — CEO Dan Schulman

“We are also winning a ton of new big customers for full stack processing and branded checkout and we know when those are coming in as well. We’re trying to under-promise and over-deliver.” — CEO Dan Schulman

b) VP of Large Enterprise Cindy Turner interviews with Barclays

On Braintree’s value proposition:

“Braintree started as a gateway and a submitter to traditional acquirers (AKA processors) and had the vault. Braintree’s smooth, simple vaulting interface allows merchants to integrate into it once and facilitate payments from anywhere… We’ve since pivoted to full-stack processing… The majority of volume that we process is full stack. It’s on our paper, we price for it and we use a network of traditional acquirers behind the scenes that we move the volume to.” — VP of Large Enterprise Cindy Turner

Other competition only offers the full-stack solution while Braintree offers it while also freeing merchants to pick and choose what they want. Turner even called out a certain competitor with a “rigid fixed bundle of pay in and pay out where they require 3 days of fund holding because their balance sheet structure means payouts can’t occur until their banking partners get paid by a card network.”

Braintree's flexibility allows the merchants to keep whichever part of their tech stack they want in place to avoid costly rip and replace. All of this is done via deep, broad integrations.

On Hyperwallet + Braintree:

“Hyperwallet is really complementary to Braintree and serves most of the same clients. Braintree is to the pay-in as Hyperwallet is to payout.” — VP of Large Enterprise Cindy Turner

On Braintree’s growth:

Braintree has become somewhat ubiquitous with “card not present” digital retailers like TikTok and Uber. Card present transactions will be its next growth lever to pull to maintain 50%+ compounding. Vineyard Vines was the first to launch with this new program. Through geo-fencing, PayPal can identify users once they enter a store and now card present Braintree clients can use that signal to target specific deals to users in real time and to juice conversion and basket size. It has 5-10 more large enterprises in the works for this product and Lucy “hopes to tell us about a dozen Fortune 100 retailers they’re serving” in the coming years.

Vs. traditional card present acquirers, Braintree can also handle returns, reporting and servicing which traditional processors/acquirers don’t do.

There’s also an interesting cross-selling opportunity to direct Braintree payment processing to one of PayPal’s own payment methods. It thinks it can reach 20-25% share here to grow its revenue per transaction while giving merchants the added conversion and authorization benefits of PayPal's products.

c) Debt Raise

PayPal priced $3 billion in new debt with rates ranging from 3.9%-5.3% and maturities ranging from 2027 to 2062. Proceeds will partially be used to offer to repurchase the remaining 2022 and 2023 debt maturities it has outstanding -- for which about $1.1 billion was actually tendered -- and the rest for “general corporate purposes.” I’d love to see a more aggressive share buyback which I think is a realistic expectation. I wouldn’t mind more rational M&A either with how far fintech multiples have fallen recently.

4. Progyny (PGNY) -- Investor Conference

Outgoing CEO David Schlanger on Utilization:

“The simplest answer is that utilization is back to normal, pre-COVID levels. In Q4 2021, there was still some Omicron impact on utilization which had recovered by February. As we sit here now in May, that’s still the case. We feel that the pandemic impact is in the rearview mirror.” — CEO David Schlanger

CFO Mark Livingston and Outgoing CEO David Schlanger on Progyny’s Carveout meaning employees of clients must go through Progyny:

“We view that as a significant competitive advantage for us. Other companies like us can’t carve out like we do. To offer the pre-tax benefit we do, you have to be able to coordinate with the main carrier as far as accumulators, co-pays etc. We have hundreds of integrations with virtually every carrier to be able to do that. That wasn’t easy to do and we don’t see other carve-out competitors able to secure that position.” — CFO Mark Livingston

“It’s very difficult to get a carrier to integrate with you and share data. There are hundreds of point solutions that would love to be able to coordinate with carriers. There’s nothing in it for the carriers. We were very lucky in the early days with a few customers that were gigantically influential and forced carriers to integrate with us because they want them to. It got to a point where these customers said you must integrate with Progyny or we’re switching carriers because they were so desperate to have what we were offering. It’s also not easy for a large company to take on these other vendors as they have to build brand new billing systems. For us, the billing goes through the carrier.” — CEO David Schlanger

Outgoing CEO David Schlanger on the selling season:

“We are coming off of a record selling season and the momentum has continued into 2022. All of the ways in which we measure progress are up strongly year-over-year. We feel very good about meeting our internal sales goals.” — CEO David Schlanger

CFO Mark Livingston on margins:

Leadership continues to see material operating leverage from its patient care advocate headcount growth being far slower than new client on-boarding and also the newly negotiated Rx contracts along with economies of scale.

5. Match Group (MTCH) -- Google

Match and Google reached an app payment agreement prompting the company to remove its restraining order request against the tech giant. Match Group had to create a $40 million escrow account rather than paying Google directly for “Android transactions outside of Google Play Billing.” and got the following key Google concessions in return:

Google will now allow Match’s apps to offer alternative payment methods to Google’s without risking being removed from the store. This is vital considering Match’s users pick other payment methods at 3X the rate of Google’s.

Google will grant Match Group “un-fettered access to its consumer data” with the removal of “Google’s complete control over Match’s data.”

Google will approve Match’s app updates that promote the offering of other payment methods.

Google will also work to solve what Match perceives as deficiencies pertaining to user confusion, user safety, data privacy and much more.

This is great news. Still, Match Group will continue to fight for more concessions in connection with its May 9th lawsuit filing. This is a large, large step in the right direction but the battle has not yet been won until Google stops forcing large commissions when they aren’t involved in the payment chain outside of it beginning in their store.

6. Cresco Labs (CRLBF) -- Earnings Review

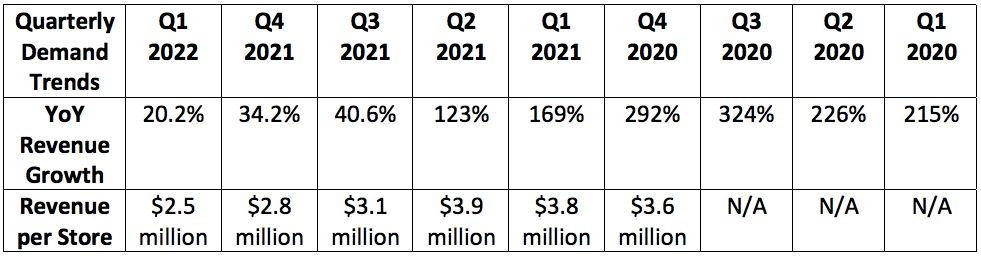

a. Demand

Analysts were looking for $211 million in Q1 2022 sales. Cresco posted $214.4 million, beating expectations by 1.6%.

More demand context:

Cresco’s Sunnyside Dispensary shops remain the most productive in the industry. It continues to believe that retail is a strong ROI bridge to get it to its vision of being the most ubiquitous cannabis wholesaler. I agree.

Cresco’s 1.6% QoQ top line revenue decline compared to a 4.5% decline for the states which it operates in as a whole. It took share.

Cresco remains the top seller of branded wholesale cannabis in the U.S with leading shares in flower and concentrates. It fell to 2nd in vapes vs. 1st QoQ. It remains top 5 in edibles as well with planned edibles launches in Florida looming.

Cresco’s falling revenue per store is the result of rapidly adding new storefronts that take time to mature. Inflationary pressures are also weighing on consumer spending.

For evidence, same store sales rose 9% YoY -- which is well ahead of several other high quality operators.

Cresco now has 50 total dispensaries after adding 4 during the quarter.

Just like every other cannabis grower, management called out tough comps, seasonality (which we are now through) and inflationary pressures for stretching input costs and consumer spending as the reason for the growth slowdown. It is broadly expected that Q2 will also be flat for the industry with growth recovering thereafter. It’s underrated how powerful of a tailwind stimulus and lock downs were for cannabis and this is the hangover.

b. Profitability

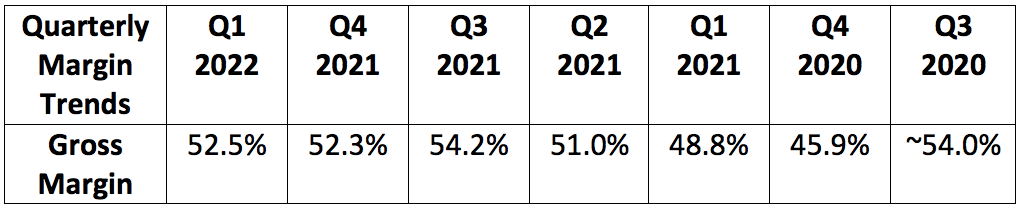

Analysts were hoping for $52.9 million in EBITDA. Cresco posted $50.7 million, missing expectations by 4.2%. Analysts were also looking for a 52.5% gross margin. Cresco precisely met that expectation.

More margin context:

Q4 2021 NI margin is adjusted for a $15 million non-cash impairment charge.

Q1 2022 and Q4 2021 gross margins INCLUDE acquired inventory adjustments. Without this benefit, gross margin would have been in the 50% range for both periods.

The quarterly gross margin trend depicted below also adjusts for changes in the fair value of acquired inventory.

Balance sheet notes:

The company has $179 million in cash on hand.

It has 439.9 million fully converted and diluted shares outstanding vs. 399 million YoY as Cresco continues to use its stock as currency for M&A -- I support this wholeheartedly. Dilution is uniquely palatable to me in this industry for the highest quality operators for two reasons:

We're in a land grab

debt raises are stupidly expensive for cannabis companies

c. Conference Call Notes from Founder/CEO Charles (Charlie) Bachtell

“While Q1 was a slower quarter for the young industry that has been conditioned to expect incredible growth… emerging industries rarely grow linearly, especially with fragmented and conflicted federal and state laws plus some macro pressures hitting everyone… Just like last quarter, our incredible team took everything that this quarter was willing to give.” — Founder/CEO Charlie Bachtell

On Market Positioning:

Cresco leadership believes it will be #1 in branded wholesale and/or retail in Illinois, Pennsylvania, Colorado, Virginia and Massachusetts. It’s already number 2 in Massachusetts despite continuing to work through growing pains with its Cultivate acquisition, some supply issues and one of its first crop harvests yielding lower levels of THC which weighed on selling price (common with first grows). Still, Cresco has “effectively closed the gap” between itself and #1 in the state. Without Massachusetts, Cresco’s revenue actually would have grown 2% QoQ rather than receding 2% QoQ.

Cresco’s decision to end 3rd party wholesaling in California also continues to weigh on growth but it believes these issues are now behind it.

“Our level of depth and breadth in the industry’s largest markets is unrivaled. It provides diversification to insulate us from market to market volatility and will provide the economies of scale that lead to superior margins, brand equity and a long term competitive moat.” — Founder/CEO Charlie Bachtell

Cresco has prime market share positions in 4 states poised for future recreational flipping -- Pennsylvania, Ohio, Maryland and Virginia. It’s also in an ideal position to benefit from New York’s anticipated market blossoming.

Store openings in Florida and Pennsylvania will begin re-ramping later in the year.

On Columbia Care:

Cresco announced its purchase of Columbia Care last quarter to bolster its competitive positioning and footprint. This is still on track to close this year with initial approvals already coming in. As a side note, Columbia Care leadership told us on their recent call that they’re elated with early New Jersey Results.

The planned divestitures of redundant assets in connection with this Columbia Care acquisition are yielding results leadership is “very pleased with.” It wouldn’t offer any specifics but hinted at the $300-$400 million in total proceeds continuing to be a good rough expectation. While this merger will lead to hefty equity dilution, it will also add cash to the balance sheet without having to raise it at the ridiculous interest rates associated with cannabis credit.

On Regulation:

“Any form of federal banking and tax reform would be material, but the demand for cannabis and state accessibility progress continue to be the bellwether for the cannabis thesis.” — Founder/CEO Charlie Bachtell

“Cannabis has a unique catalyst that most categories do not have -- a robust shadow market sitting alongside us and an illicit U.S. cannabis market that’s conservatively estimated to be in excess of $100 billion annually.” — Founder/CEO Charlie Bachtell

This $100 billion market is 4X the current size of the legal market. As a reminder, when alcohol prohibition ended, it took several years for the black market to dissipate. I expect it to dissipate over the coming years in this industry as well. But it will take a long time.

“From my perspective as the CEO of Cresco and the Chairman of the National Cannabis Roundtable, we have never been closer to achieving some form of federal regulatory reform... All job creation, social equity and economic impacts start with normalized banking and taxation.” — Founder/CEO Charlie Bachtell

On Illinois:

“There are some encouraging things coming out over the last hours and also the anticipated hearing day that could result in the lifting of the stay on the issuing of those 185 lottery winners to open new dispensaries. There's also more movement for an additional 50 lottery winners to be picked… Unlikely that we see new stores in the state in 2022.” — Founder/CEO Charlie Bachtell

Cresco has capacity to add several more doors to its Illinois supply network and is “eagerly awaiting” that opportunity.

Week over week buying of its FloraCal brand (premium flower) in Illinois is growing 20% following the strong debut last month. These sales are largely incremental and not cannibalizing its other brands. It will launch this brand in Michigan, Pennsylvania and then Florida next. FloraCal is now the 4th leading California flower brand vs. barely cracking the top 10 a few quarters ago. As pricing pressures are most intense for the lower quality brands, this expansion should help Cresco combat that headwind.

d. Notes from CFO Dennis Olis

On gross and EBITDA margins:

gross (and EBITDA) margin fell sequentially via pricing pressure in Massachusetts. Higher SG&A due to 4 store openings also weighed on EBITDA margin. The ending of its 3rd party California business is helping offset this compression. Cresco continues to think it can maintain a gross margin over 50%.

“We continue to see improvement from the investments we are making in organizational structure, automation and growing cultivation yields to offset the likelihood of further price compression… We have room for operating leverage, especially on the wholesale side, as we exit a seasonally slower part of the year.” — CFO Dennis Olis

On cash burn:

The operating cash burn was entirely related to adding inventory to insulate itself from supply chain issues and to prepare for its FloraCal brand launch in Illinois (which again went extremely well). It expects positive cash flow for the rest of the year.

On directional outlook:

Sales trends continued to improve into March, April and May but management said it was too early to get excited about this.

Owned brands remain around 40% of overall retail sales for Cresco.

On pricing stability in California:

“California is following the Colorado, Washington, Oregon pattern of boom, bust then a rebuild with whoever is left standing. We’re seeing greater support in California, but we’re not ready to call California being through that process yet.” — CFO Dennis Olis

e. My Take

I agree with Cresco’s team: It took everything markets were willing to give this quarter. Fortunately, markets will be willing to give a whole lot more in future quarters and Cresco has positioned itself to be a key beneficiary.

P.S.

For evidence of how big of a valuation headwind not being listed on major exchanges is, please see Bright Green and its several billion dollar valuation. It has no revenue, just a Nasdaq listing. Imagine what will happen when profitably growing cannabis companies in the United States with comparatively microscopic valuation multiples are given this same opportunity. It’s a when, not if. Patience.

7. Sofi Technologies (SOFI) -- Insider buying

CEO Anthony Noto purchased another $350,000 in stock during the week. He has made 10 purchases so far during the year which has raised his common equity stake by 11.5% (and by 45% since August 2021). A board member also made a $100,000 purchase during the week.

8. Olo (OLO) -- Customer Wins and a Case Study

a) Wins (plural)

Bubbakoo’s Burrito’s (10+ locations) -- With its Network, Dispatch, Ordering, Rails and Pay Modules

gusto! (10 locations) -- With its Network, Dispatch, Ordering, Rails and Pay Modules

30 Flemings (70 locations) -- With its Ordering and Rails Modules

Fuzzy’s Taco Shop (nearly 150 locations) -- To help with online catering orders

Snarf’s Sandwiches and Snarf Burger -- With its Ordering, Dispatch and Rails Modules.

As a reminder, Olo is expecting $0 from Olo Pay in its 2022 guidance while it continues to rapidly onboard the module with new clients. Hello upside?

b) Case Study

Broken Egg Café and its roughly 100 locations leaned on Olo starting in 2020 to overcome the daunting pandemic environment and to rapidly pivot to off-premise. Since launching with Olo’s Ordering, Dispatch and Rails modules, the chain has enjoyed an abrupt spike in off-premise sales as a percent of total business from 2% to pushing 12%. This has not fallen with the return of on-premise dining. All 3 modules also exponentially bolstered average ticket size.

9. CrowdStrike (CRWD) -- Case Study and Accolade

a) Globe Telecom Case Study

CrowdStrike fostered Enhanced speed and visibility

90% faster on-boarding for the Falcon platform vs. competition

The platform lightened security team needs thanks to the Falcon OverWatch threat hunting team

b) KupperingerCole Accolade

KupperingerCole -- a research organization similar to Gartner or SE Labs -- named CrowdStrike its top vendor for endpoint protection (EPP) and endpoint detection and response (EDR). Here’s how it views the competitive landscape (zoom in):

10. Nano-X Imaging (NNOX) -- Earnings Review

a) Results

Nanox generated $1.8 million in sales vs. $1.3 million last quarter and $0 YoY. 94% of this revenue came from its teleradiology business with the rest coming from Nanox.AI and Nanox.Marketplace.

The teleradiology segment generated $700,000 in non-GAAP gross profit for a margin of 41.1% while it other segments generated a gross loss of $2 million. GAAP net loss for the quarter was $21.7 million and it has roughly $140 million in cash, equivalents and securities on its balance sheet.

There are 52.1 million shares outstanding vs. 51.8 million QoQ due to Nanox.AI meeting a performance benchmark from the previous Zebra Medical Imaging M&A agreement.

b) Call Notes from CEO Erez Meltzer

Nanox received Q-sub feedback and will now either submit an updated Q-sub and then a formal 510(k) or submit the 510(k) if there are no further information requests. It’s still possible that the FDA will require clinical trials. Nanox has also begun the process of obtaining the equivalent clearance in the EU.

Nanox expects to sign more agreements in 2022 for deploying its multi-source Xray machine. “1 or 2” of these conversations are now advanced.

“I feel very good about Nanox’s results during the first quarter as CEO. But all of us recognize there is more to do. We hope to provide additional updates in the coming weeks and months.” — CEO Erez Meltzer

c) My Take

Brian Feroldi describes Nanox perfectly: This is a lottery ticket. Upside is immense. Execution risk is also immense. I will continue to hold on to my tiny stake and have no interest in adding or trimming. I would consider adding if Arc deployment finally begins.

11. Macroeconomic Backdrop

Fed commentary during the week expressed consistent support for back to back 50 basis point rate hikes in June and July -- as expected. There continues to be less appetite for heftier hikes, although Chairman Powell himself would not rule it out by refusing to offer concrete forward guidance in the wake of extreme uncertainty.

Interestingly, Walmart and Target reported disappointing results for reasons that some found surprising -- inventory gluts. That’s new. The two retailers had been building inventory levels to combat supply chain chaos and now are having to begin heavier markdowns to move the inventory. This should be a deflationary force considering how large these two companies are (but inflationary forces remain far more intense). Demand for both was strong which hints at continued consumer resilience, but margins were terrible due to this issue as well as soaring freight costs. Tough times for everyone.

Other macro notes:

J.P. Morgan thinks gas prices will surpass $6 per gallon by August.

Aggregate GDP forecasts continue to precipitously fall.

Goldman Sachs released an interesting note that for every $100 invested this cycle, just 2% has been redeemed. It’s using this as a key datapoint providing evidence for capitulation still being ahead, and I agree.

Credit spreads continue to widen per Bank of America data as Powell acknowledged tightening credit market conditions. This is what the Fed would ultimately react to with any future dovish pivot -- not growth stocks. They don’t care about our growth stocks.

The Empire Manufacturing metric and new orders vastly disappointed this week.

Hiring pauses are becoming a daily headline.

If you’re noticing a negative trend, you’re right. We’re in a weird place right now. Rate hike and balance sheet runoff plans must continue to combat inflationary pressure -- which is a core Fed mandate. At the same time, things like inventory gluts, yield curve flattening, underwhelming manufacturing data and tanking consumer confidence out of the University of Michigan (Go Blue) point to a weakening economy ahead. Still, it will have to weaken much more for the dovish pivot we’re looking for to finally come. They’ll eventually step in, but have to hit demand harder with the tools in their tool kits to allow supply chains to finish catching up and for prices to fall.

To me, we still have several more months of this playing out. For now, I’ll continue slowly accumulating shares of thriving firms into multiple compression but will do so at a slower pace than I continue to deposit funds -- so my cash position will keep growing. When I’ve become more confident that the pandemic bubble has gotten closer to being done deflating, I’ll accelerate the accumulation and allow my cash position to fall. It’s not time for that yet. I won’t time this perfectly, but that’s my plan of action for boosting my perceived odds of success.

12. My Activity

I trimmed about 8.5% of my Upstart position during the week. After adding post earnings, the stock had more than doubled off of its lows and I wanted to take some profit to add flexibility for future accumulation. Considering how wildly volatile this name has been, that will be my plan going forward while continuing to stay mainly invested in the name as long as fundamental performance doesn't deteriorate further.

I also added to Penn National Gaming and Revolve Group during the week. My cash position is largely unchanged week-over-week at 21.5% of holdings. I have no cash infusions coming for at least the next month.