News of the Week (May 23-27)

The Trade Desk; CrowdStrike; SoFi; PayPal; Meta Platforms; Progyny; JFrog; Olo; Macroeconomics; Cannabis News; My Activity

Today's piece of brought to you by Commonstock:

Welcome new readers -- we're so glad to have you! To have all of our content covering 21 holdings and markets sent to your inbox for free, subscribe below:

1. The Trade Desk (TTD) -- Snapchat & Google

a) Snapchat

Snapchat announced that it'd miss the low end of its next quarter guidance that was set just a few weeks ago. This sent the entire advertising-technology space into a tail spin. I added to my stake in The Trade Desk during the week. The following reasons gave me the confidence to do so:

The Trade Desk’s channel diversification is a wonderful tool to use when a certain piece of the market dries up. Video specifically will get a large boost this year from the 3 largest streamers all deciding to embrace ads more enthusiastically.

All 3 will work with The Trade Desk and supply remains wildly constrained within that specific category.

Not only is Snapchat a tiny piece of The Trade Desk’s impressions, these impressions can be re-directed to other pieces of the market like CTV when need be.

The Trade Desk religiously under promises and over delivers each and every single quarter. It has demonstrated surgeon-like precision in its forecasting abilities over the last several years and throughout macroeconomic tailwinds/headwinds.

It’s a beat and raise and then beat and raise again machine.

The Trade Desk has taken market share amid every single macroeconomic downturn in its existence. Marketing executives must fixate even more on Return on Ad Spend (ROAS) when their budgets shrink. The Trade Desk is what they turn to, to do so.

This is why the company’s structural tailwinds were strong enough to combat every material headwind that its competition blamed this last quarter, and its’s why…

The Trade Desk released an 8-K on Thursday reiterating its guidance offered on the last call. One social media stock mis-stepping in their own forecasting should not have been perceived as a red flag for The Trade Desk, and this filing merely reaffirms that sentiment. A special thank you to the company’s leadership team for deciding to publish this. Much appreciated.

I also added to my other two advertising-related names: Meta Platforms and Match Group (which has seen quite strong app ranking data in recent weeks) as well.

b) Google

For once, there’s broad bi-partisan support on a political issue. Left and right-winged lawmakers are both supporting a bill to ban companies doing more than $20 billion per year in digital advertising revenue from acting as both the supply side and the demand side. If passed, this would effectively break-up Google’s end-to-end advertising platform. Industry experts think this would work wonders in enhancing competition and data sharing. A more level playing field would be objectively good news for The Trade Desk, although it has performed admirably with the scale heavily tipped in Google’s favor over the last several years.

2. CrowdStrike (CRWD) -- More Data

a) Threat Management Research Report

Quadrant Knowledge Solutions’ Threat Intelligence Management report scored CrowdStrike’s Falcon X product higher than any of its competitors in the space after extensive vendor evaluation. Considerations include things like roadmap, integration/interoperability, scalability, sophistication of technology and much more.

The judging analysts praised CrowdStrike’s ability to “remove resource intensive complexity of incident investigation” thanks to its threat hunting and remediation teams. This piece of CrowdStrike’s business (involving human contact and remediation) is its lowest margin revenue chunk, but it does provide a great lead generation opportunity for the company as I've frequently shared in the past. It generates roughly $5 in new, higher margin business from $1 spent on this piece of the organization.

“With its comprehensive capabilities, integrated partnerships, robust value proposition and compelling customer references, CrowdStrike is well-positioned to maintain and grow share in this market.” — per the report

b) Case Studies

Navitas (Global Digital Education Firm):

The on-boarding process and removal of the legacy anti-virus solution took a couple of days, with no downtime.

“During a security review it soon became evident that endpoint detection and response (EDR) was necessary and CrowdStrike was the partner with the most effective solution... It was the right solution 3 years ago, it’s the right solution today and I believe it will be the right solution in another 3 years.” — Navitas Global Head of Information Security Gavin Ryan

Greenhill (Investment Banking Firm):

CrowdStrike fostered a 75% reduction in alerts

Greenhill enjoyed net cost savings of $300,000 annually with material time savings as well. This is important as it shows CrowdStrike's agent consolidation in action and justifies the higher per-endpoint cost that CrowdStrike charges vs. most of its competition.

The product was “incredibly easy to implement with deployment taking under an hour” per Greenhill’s Chief Information Officer

c) Zscaler

Zscaler reported results this past week that were quite positive. Why do I care? CrowdStrike and Zscaler are close partners and frequently include each other in large enterprise contracts to combine endpoint/workload and network capabilities. While strong Zscaler results far from perfectly correlate to CrowdStrike’s, it is a decent, positive hint for the firm’s upcoming earnings report. We’ll see how CrowdStrike does.

Commonstock is a friendly community of passionate investors who believe that transparency can elevate discussion and performance. This platform strikes the perfect balance between collaborative debate and uplifting camaraderie. I like to think of it as a more focused, verifiable, productive and kind version of FinTwit -- without all of the noise.

There's a reason why I have linked my portfolio to the service and am a daily active user.

Come join us to see what all of the hype is about. Sign up is free and you'll be glad you did.

3. SoFi Technologies (SOFI) -- CEO Buying, OnDeck, Macro Insulation and Nelnet

a) CEO Buying

CEO Anthony Noto continues to buy more SoFi shares in the open market. This week, he added another $250,000 in common equity. Over the last 10 months, his stake has grown by about 50%. I understand that Anthony Noto is a wealthy man -- specifically, he’s worth about $140 million -- but investing north of $10 million or 7% of his total net worth into the company since last August is still quite significant to me.

b) OnDeck

OnDeck -- the largest online small business lender in the USA owned by Enova -- is partnering with both LendingTree (LT) and SoFi to augment access to small business loans. The partnership will leverage the intuitive interfaces and financial service offerings of LT and SoFi while infusing OnDeck’s AI/ML prowess into the underwriting process to enhance access to working capital. Many, many lending companies claim to have AI/ML algorithms that enhance credit decisioning -- some are right and some are wrong. Regardless, gaining access to a relevant, new dataset always uplifts underwriting quality and this does just that.

P.S -- This sounds like it will directly compete with Upstart’s planned small business product launch coming this year.

c) Macro Insulation

Much concern has been raised about (especially newer) lenders struggling to weather the storm that worsening macro will bring throughout 2022. I see SoFi as relatively insulated from these pressures for the following reasons:

Its banking charter paves the way to a lower cost of capital which helps offset the higher costs brought on by rising rates. More expensive cost of capital will also push more lenders to seek out other savings initiatives. SoFi bundling its Galileo and Technisys offerings with bank sponsor services does just that.

SoFi’s one-stop suite of products has offerings that do well in all environments. For example, its variable-to-fixed refinancing products thrive in rising rate environments along with personal loans for home improvement projects as mortgages for new homes become more expensive.

SoFi’s credit products cater to a very affluent crowd which should be more resistant to macro pressures than less affluent constituencies.

d) Student Loans

The Biden Administration is widely expected to forgive $10,000 in student loan debt for certain borrowers. While this is an intimidating headline for SoFi, it’s actually positioned well to benefit from this news beyond just being diversified from a product suite perspective. This excerpt from my last SoFi earnings review explains why:

In connection with the moratorium, Nelnet -- a prominent student loan player -- is laying off 150 employees. I don’t expect SoFi to follow suit as it has many, many other products to fill the student loan void (for example personal loans have done so in 2021) -- but it’s always possible. As a reminder, the company’s 2022 guidance anticipates the moratorium lasts through the end of the year.

4. PayPal Holdings (PYPL) -- Layoffs & PayPal Ventures

a) Layoffs

PayPal fired around 80 employees at its San Jose headquarters and dozens more throughout its Chicago, Omaha and its Chandler Arizona offices -- per Crain’s. The company has undergone a series of re-structuring events over the last few years, but that has been mainly to re-target its international focus to fewer geographies. These U.S. layoffs are new and continue a series of daily hiring pause and layoff announcements from prominent firms over the last several weeks.

In recent calls, CEO Dan Schulman has alluded to PayPal’s aggressive hiring during the pandemic being less efficient than the company would have liked to take advantage of pandemic trends that were juicing demand. He and many other prominent executives extrapolated these pandemic trends to be far more permanent than they’ve turned out to be. This is the hangover. Walmart, Amazon, Uber and many, many more are going through similar capacity right-sizing. For context, PayPal's headcount growth sharply accelerated to 33% YoY in 2021 and for more context, these layoffs represent well under 1% of its global workforce.

Layoffs are always a painful decision as they involve the livelihood of human beings. But in this case, it's unfortunately a necessary move. Multiples for fintech and VC-funded cash burners could continue to shrink and PayPal will be in an ideal position to scoop up some of these assets if it can remain nimble and liquid like it has been able to do. Hefty cash flow generation helps, but layoffs for non-vital employees unfortunately do too.

b) Jetty

PayPal’s venture fund invested in Jetty -- a company born to “make home renting more affordable and flexible.”

Jetty’s products include:

Jetty Deposit -- a slick alternative to standard security deposit operating procedures

Jetty Rent -- a “flexible rent payment program”

Jetty Protect -- Renters insurance

A piece of this funding will be earmarked for the creation of new credit products (called Jetty Credit) for renters which PayPal will be intimately connected in creating. This product will automate and streamline rent payment reporting to credit agencies and offer more credit score boosting tools. Jetty’s network of property managers and owners includes over 1 million rental units in the USA.

Venture investments will not move the needle in the short term for large caps like PayPal with tens of billions in revenue. Still, it does hint at where the next frontier of focus will be for the team’s long term vision. Recently, these investments have centered on crypto and blockchain solutions, but this is a different category. Perhaps it’s looking to bring some form of pay later solution to the world of renting? I’m speculating, we’ll see.

c) My Talk with PayPal's Head of Investor Relations

Several interesting notes came from my chat this week with the company's IR Head. All of those notes will be infused into my deep dive which I'm hard at work on. For now, I wanted to share the main highlights:

The company has seen no recent impacts in delinquencies, charge-offs or loss rates from its consumer credit products amid worsening macro. Great news.

The appetite for M&A has somewhat grown in recent months as multiples have become more rational.

Apple and Google are still considered to be more so partners to PayPal than direct competition.

5. Meta Platforms (FB) -- Various News

Meta selected Microsoft’s Azure as a strategic cloud provider to bolster the return on its automation and AI investments in advertising and the metaverse.

It’s also partnered with AWS. In a world that’s increasingly multi-cloud, this makes sense to me to bolster interoperability.

Zuckerberg said this week that the Metaverse business will burn cash for the next 3-5 years. This is not new.

Instagram refreshed its user interface with brighter colors and easier, more obvious access to short form Reels.

Quick note -- Meta loves to be overly conservative with forward guidance. I don’t anticipate it needing to pre-announce results lower like Snap had to do.

6. Progyny (PGNY) -- A New Hire

Arielle Bogorad has been named as Progyny’s new SVP of Employer Market Strategy and Workforce Health Services. Bogorad spent nearly 14 years Cerner Corporation climbing the ladder from Strategist to Senior Director and GM. As the benefits lead at Cerner, her knowledge of competing solutions is immense, and interestingly, Bogorad’s initial interaction with Progyny made her realize how differentiated and impressive the product and approach both were. Bogorad will spearhead client relationship maintenance for Progyny.

7. JFrog (FROG) -- Founder/CEO Shlomi Ben Haim and CFO Jacob Shulman Interview with JP. Morgan

On the basics:

JFrog’s overarching mission is to power liquid, continuous software releases all the way to the endpoint and with enterprise-level scalability via hefty automation. The buzz phrase for this process is “CI-CD” (Continuous Integration and Continuous Delivery/Deployment). The effect is teams knowing exactly where their software packages came from, and where they’re going while offering holistic security throughout that entire process.

For reference, about 10% of software packages come via internal source code, while the other 90% come via open sourced, 3rd party components covered within binary lifecycle management. Source code players like GitHub and GitLab often operate in parallel to JFrog deployments.

Most alternative binary lifecycle managers have one repository per type of code. JFrog’s product ties all of these developer technologies into one, interoperable repository (JFrog Artifactory). This creates what management often calls a “single source of truth and record to manage software.” Artifactory serves as the repository for over 30 technologies. When it comes to breaches like Log4J, this frees JFrog to scan a company’s entire software ecosystem in one place and in a fully automated way taking hours vs. weeks for alternatives. To quantify this agent consolidation benefit, a Fortune 100 customer recently moved to JFrog to consolidate from 1800 binary repositories to 1 with Artifactory. This provides immense cost savings and allows JFrog to charge hefty prices for its services.

JFrog runs a hybrid product -- this means both on-premise and cloud. On-premise is really just another way of saying self-managed and includes deployments managed by customers in public cloud environments. Cloud is the same offering but is fully managed in a software-as-a-serve (SaaS) manner.

“All of our customers know that the NorthStar is cloud. But most of our customers will take years to get there. So the hybrid approach provides a lot of value in that transition for our customers… and these products function identically. The largest cloud contract we’ve ever reported from Q1 2022 was from this transition taking place.” — CFO Jacob Shulman

On why customers with ARR over $100,000 is such an important metric:

The platform (full suite) solution for both on-premise and cloud starts right around $100,000-$150,000. This is a far higher margin product for JFrog than selling solutions separately and this momentum has been quite strong with year over year growth over 50% last quarter.

On JFrog Xray (security solution):

Xray thrives in software composition (software bill of materials) security. The Vdoo acquisition jumpstarts their ambitions in things like actual runtime and container security -- which would compete with elite endpoint vendor competition from CrowdStrike, Microsoft, SentinelOne etc. to a certain degree.

Vdoo’s full suite of capabilities is now integrated into Xray as of this week’s user conference. Based on broad interest, there are now plans to offer this as a stand-alone product. Today, it can only be purchased by Artifactory customers.

On competition:

Most of JFrog’s customer wins continue to be replacing home grown solutions (so greenfield opportunity remains abundant).

Artifactory is the market share leader in its niche. Sonatype is the 2nd largest (has been that way for years).

Source code players trying to develop tools for binary management are “very far behind.”

Haim reiterated that public cloud providers including Microsoft remain much more so partners than competition.

JFrog generates a lot of incremental traffic for these partners making the relationship amicable.

JFrog’s business sourced from public cloud referrals is greatly outpacing the rest of its operations.

The multi-cloud approach, thanks to no conflicts of interest, is also a compelling differentiator for JFrog customers vs. going with one public cloud vendor.

As a side note, this company makes so much sense as a takeover target for Google or Amazon. Microsoft may have some trouble with their GitHub ownership but I’m sure they’d love to get their hands on this organization as well.

On 130%+ net revenue retention:

“We continue to see that level as sustainable with factors like Artifactory leadership, increased interest in our security capabilities and the greenfield opportunity of distribution… Average spend per Fortune 500 customer is $200,000… each of these could get to millions in terms of JFrog business volume.” — CFO Jacob Shulman

2022 User Conference Highlights:

JFrog extended its DevSecOps product to the internet of things (IoT) -- this is largely thanks to its Upswift acquisition that completed JFrog’s presence in the software management lifecycle. This tool is called JFrog Connect and comes with complete integrations into the rest of JFrog’s platform and immense scalability thanks to the core binary focus.

This also comes with a low-code “drag and drop” interface that’s accessible to anyone.

JFrog announced a new collaboration with Oracle and a few others on a Blockchain based network for securing software packages and binaries. This is called “Project Pyrsia” and is fully open-sourced.

JFrog announced a new ServiceNow Lightstep Incident Response/Xray integration. This will greatly bolster the ability for developers to proactively meet breaches in ServiceNow’s environment rather than reacting to them.

Together, the 2 are debuting a new software composition analysis tool to scan massive repositories for compliance and vulnerabilities.

8. Olo (Olo) -- New Brand Clients

Olo announced Salt & Straw (20 locations) and Islands Fine Burgers and Drinks (55+ locations) as the company’s newest brand clients. Salt & Straw is starting with 4 modules -- Ordering, Rails, Dispatch and Pay while Islands Fine Burgers and Drinks starts with Ordering, Dispatch and Rails. A few notes on this:

Brands continue to land with more and more modules out of the gate. Similar to a CrowdStrike, each additional module is higher margin business than the first module a client purchases.

Many of the fixed costs are incurred up-front meaning more module adoption = higher incremental margins.

Olo Pay quadruples the revenue opportunity per order that Olo facilitates. Several of the recent new brand announcements have included Olo Pay and the company’s 2022 guide doesn’t assume any contribution from the module.

Olo continues to rapidly grow its roster on new “emerging enterprise clients” (between 5-99 locations) as its sales team investments continue to bear fruit. It's signing on multiple new emerging brands per week at this point.

9. Macroeconomic notes

Not much has changed from the last few News of the Week issues where I extensively talked about why I continue to keep an elevated cash position while macro-turbulence plays itself out. If you’re interested in reading more about that, the “macro” sections from the last several issues go into it.

Before I get into the macroeconomic topic I wanted to cover this week, here are a few quick interesting notes to cover from the past few days:

Savings rates are lower than they’ve been since the beginning of the Great Financial Crisis.

Passive quantitative tightening (letting bonds on the Fed’s balance sheet mature without replacing them) will begin next week at $47.5 billion per month vs. the $4+ trillion the balance sheet has grown by (100%+ growth) since 2020.

New housing sales data vastly disappointed this week.

New layoffs and hiring pauses continue to be a daily theme.

Manufacturing data out of the U.K. looks bleak.

Raphael Bostic (not a voting member) is calling for a potential pause to tightening by September.

BlackRock’s Rick Rieder thinks the move in yields has already happened in 2022 -- which makes sense considering inflationary comps will normalize and the CPI will hopefully, precipitously fall -- and so far he has been correct.

All of this is painting the same picture -- the economy is slowing, but needs to continue cooling off further before the Federal Reserve makes the dovish pivot we’re all looking for. Corporate credit spreads are fortunately beginning to reverse their widening trend (see image below), but there remains, a long, long way to go while we now head into QT. We’ll get through this, but there’s likely still more pain to come. My cash position is remaining elevated because of this opinion I have. I still think that pivot is months away but I reserve the right to be wrong and if I am wrong I will react accordingly.

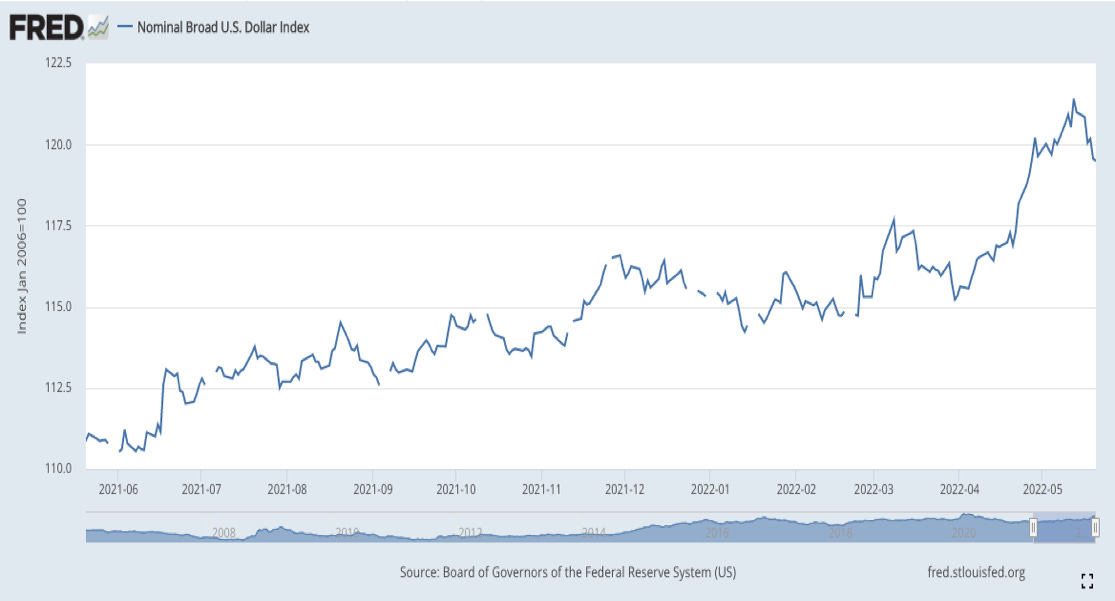

This week, I wanted to discuss something positive in macro-land actually beginning to play out for public companies -- the dollar is beginning to cool off. The historic rise we’ve seen from the dollar index over the last 3 months has added yet another headwind to operational performance in 2022. When U.S-based companies generate significant portions of their sales in currencies other than the dollar, these sales must be converted back to dollars for reporting purposes. The stronger the dollar is relative to other currencies, the less dollars companies end up with in sales once the conversion has taken place. For a company like Match Group, this was expected to reduce its revenue growth rate next quarter by a full 5%. Meta Platforms and countless other firms are impacted as well despite their best efforts to hedge a portion of the risk.

Recently, that aggressive move higher in the dollar has abruptly pivoted, and that could be a much needed exogenous tailwind to combat the difficult environment companies find themselves in, in 2022.

We’ve also begun to see steepening of the 10-year/2-year yield spread which hints at ebbing recession concerns for now:

While these are all encouraging signs, we’re far from out of the woods. China re-opening will place renewed pressure on commodity inflation, war still rages on in Europe, Microsoft and Apple are materially raising wages to combat inflation while slowing hiring for new workers and credit spreads remain quite fragile compared to where they’ve been. To put it plainly, the combatting tailwinds and headwinds for rising prices and economic growth are difficult to level set -- and so I’ll let them play out rather than casting my prediction. We don’t need to time the bottom, and trying to is a loser’s game. I don’t care if I miss the first 10-20% move in the next bull market.

Finally, Personal Consumption Expenditures (PCE) rose by just 0.2% in April which represents the slowest rate of positive change since 2020. From a year over year perspective, the PCE fell from 6.6% growth last month to 6.3% this month. The core PCE -- which doesn’t include food or energy -- was largely in-line with expectations at 0.3% month-over-month growth. This is the 3rd consecutive monthly measure of 0.3%. Year over year, the core PCE fell from 5.2% last month to 4.9% this month. Good news, but still a long way to go (noticing a theme?). This is a key barometer for Federal Reserve inflation measurement and it’s beginning to show signs of cooling off. This is not surprising: As inflationary comps normalize and supply chain shocks work through our system, this is expected. The key will be how quickly inflation falls back to a more neutral rate between 2-3%. Some think that will happen next year, others think it could take 5+ years. Rather than predict, I will react to the inflationary trends.

I look forward to getting back to a point where macroeconomics is not the main topic of conversation within markets. I don't think we're there yet.

10. Cannabis News -- Mainly per Marijuana Moment

Rhode Island’s Governor signed the state’s cannabis legalization bill into law. The state has the 2nd highest population density in the union and Green Thumb is the grower primed to benefit.

The Journal of Safety Research published a report indicating that California Dispensaries have a 100% compliance rate for not serving underage users.

South Dakota got enough signatures to place cannabis legalization on November’s ballot. Maybe law-makers will actually support the expressed desires of its citizens this time around.

Killeen Texas will have decriminalization on their ballot this year.

Support to pass SAFE Banking remains broad. We’ll see if this can finally get done. For some evidence on what up-listing would mean for growers, see Bright Green with its billion+ valuation and no sales. That’s all from a Nasdaq listing.

Georgia voters approve of legalization at an overwhelming 80% clip.

Delaware and Kansas continue to slowly work towards cannabis reform.

In just one month, New Jersey has eclipsed a $290 million revenue run rate with sales rapidly growing week after week.

11. My Activity

I added to Match Group, Meta Platforms and The Trade Desk during the week. My cash position sits at 21.2% of holdings. Note that while I only disclose specific transactions weekly, my account is linked to Commonstock and my transactions are visible there on a daily basis. It doesn't show my cash position, but it does show what I've been accumulating/trimming.

Have a wonderful long weekend.