News of the Week (May 31 - June 3)

Shopify; Match; The Trade Desk; Meta; Upstart; SoFi; CrowdStrike; Olo; Macro; Cannabis; My Activity

1) Shopify (SHOP) -- Introduction

Shopify is at the top of my watch list and I will be covering the name going forward. I wanted to give some general background on the company and the investment case, along with my plans on potentially investing.

a) Qualitative

Shopify powers commerce for businesses ranging from single-person entrepreneurs to Fortune 500 companies like Netflix. It enables seamless creation of beautiful websites -- like many others do -- without needing any expertise on coding to make that happen. I for one -- with zero coding experience -- was able to design & open my own store in about 90 minutes and with no confusion using its application programming interface (API).

Shopify’s service transcends the label of website-builder by creating a deeply functional store to power an end-to-end, delightful shopping experience. It frees merchants to effectively participate in the rapidly growing digital economy and to do so across more than a dozen different omni-channel verticals including marketplaces, social media and pop-up shops. Whether it’s cross-border, e-commerce automation, reporting and data analytics tools, working capital access or fulfillment, Shopify is there to help.

And if you want to use other vendors for a piece of your technology stack -- that’s entirely fine. The company shines with its vast partner integration network which enables broad interoperability all within the Shopify ecosystem. You can link a drop shipping company like Printful with just a few clicks to power on-demand fulfillment, search engine optimizers to enhance marketing returns and so much more. It takes a purely “better-together” mentality by plugging in to nearly every other relevant player in the e-commerce landscape -- including Amazon, Facebook, Google, PayPal etc.

Shopify’s merchant-obsessed, partner-first philosophy works wonders to eliminate potential conflicts of interest. This -- along with frequent design knock-offs -- is why vendors such as Allbirds have left Amazon in the past to focus on their Shopify relationship and to gain control of their lucrative customer data. With Shopify, the merchant brand is ALWAYS front and center.

To put it as simply as possible, Shopify’s mission is to enable all businesses to offer end-to-end omni-channel commerce solutions that were previously only attainable for the largest of firms.

“Shopify’s power comes from infrastructure, merchant solutions and the partner ecosystem.” — Shopify President Harley Finkelstein

b) Two revenue buckets

Number 1 -- Subscription solutions:

This revenue bucket is the company's highest margin business and encompasses Shopify’s platform access fees. It includes purchases of broad plans, apps, design themes and things like domain management. Shopify aims to make these plans as accessible as possible and so its cheapest option starts at just $29 per month. Typically, smaller merchants start out with smaller plans and add more services over time. Furthermore, the variable piece of this revenue bucket ensures that the interests of Shopify and its merchants are aligned: It does better when its sellers sell more and so Shopify will do whatever it can to make that happen. It’s a team effort.

The three main pricing tiers (mainly for small and medium businesses) include:

Basic Shopify ($29 per month)

This comes with all of the standard website building tools and omni-channel selling management Shopify provides. Additionally, it includes 2 staff accounts which gives someone (like an employee or a Shopify partner) the ability to log in to a store to handle orders and work on certain tasks. This is really all an entrepreneur needs to get going.

Shopify ($79 per month)

This includes the Basic package and with 5 staff accounts, professionally curated operational reports, discounted card processing fees etc.

Advanced Shopify ($299 per month)

This plan is the Shopify plan plus 15 staff accounts, automated shipping rate calculation and further card processing discounts.

The premium pricing tier is called Shopify Plus. This is generally for larger enterprises and represents a small percent of its merchants but a much larger percent of its total sales. Vendors here include: Heinz, Unilever, Crayola, The NBA, Tupperware, Adele and 14,000+ others with 4,000 of those joining just in the last 12 months.

Pricing change:

As of August 2021, Shopify’s subscription revenue share model changed for developer apps and themes. It now takes a 0% cut of the first million a developer makes annually and 15% of sales thereafter. It used to be a flat 20% fee. Shopify’s value is greatly enhanced by developers building new tools specifically for its app store which fosters more functionality, use cases and cross-selling potential. In my view, lowering the fee was the right move to thrive in the wildly competitive niche. This switch to tiered pricing ($0 for the first million) is the primary reason why subscription service revenue growth underwhelmed so much last quarter.

40,000 merchants joined Shopify in 2021 directly due to a developer referral. Keeping this community happy is imperative and Shopify was willing to sacrifice short term revenue for long term relationships.

Number 2 -- Merchant Services:

The Merchant Services bucket is growing at twice the rate of subscriptions but is lower margin overall. These features serve as add on capabilities like a payment gateway (Shopify Payments), brick and mortar point of sale, access to the Shopify Fulfillment Network (SFN), and email marketing tools.

Payment gateway meaning -- It's easiest to think of this like a virtual point of sale system. All companies wishing to digitally transact use gateways to connect to a processor like Stipe, merchant accounts and card issuers.

Revenue here comes predominately from the payment gateway and currency conversion services and this product replaces the need to maintain direct relationships with various other gateways. Shopify Shipping and Fulfillment is expected to be a rapidly growing piece of this business over time. More on fulfillment and its “Deliverr” acquisition later.

Perhaps the most compelling piece of this business is the vast up-selling capabilities it has with its clients to bolt on other merchant services and to boost revenue and functionality. It frequently starts merchants on its $29 per month subscription plan and sees those merchants blossom into higher subscription tiers like Shopify Plus. This fosters reliable net dollar retention that makes the company less reliant on solely new customer wins to find growth.

c) Future Growth Vectors beyond Fulfillment and Recent Highlights

Shopify will continue to find ample opportunity to expand within the growth industry that is e-commerce enablement. Most small businesses today still don't have any material online presence. Still, there are other pieces of the business (mostly within the merchant services segment) that are newer, and beginning to show promise for strong future contributions.

“Shopify Markets” -- debuted in 2021 -- is the firm’s cross-border engine allowing merchants to localize their website in several languages and countries with one managed store. This makes global expansion FAR easier by doing things like forecasting demand, automating compliance, calculating taxes and translating site language for more comfortable user experiences abroad.

This complements Global-E’s offering (Shopify is an investor and partner here) which features these services for higher maintenance clients with more specialized needs.

“Shop” is the company’s consumer-facing shopping assistant. It allows for its merchants to plug their pages into the aggregated feed to target promotions and to juice total payment volume for all involved parties.

This is Shopify's attempt at building a 2-sided network to hopefully emulate Block and PayPal. Having more consumers involved in that centralized shopping product makes it an intrinsically more valuable destination for merchants to market and sell. PayPal for example, has been able to use its 30 million+ merchants (Shopify has 2 million) and hundreds of millions of consumers to create unique, incremental value via data-driven wish lists built by consumers. These are essentially highly reliable consumer demand curves for merchants to observe and utilize. I think this is a great focus for Shopify, but there’s a LONG way to go to catch up here.

This feature integrates fully with Shopify’s back-end to make this an easy integration functioning as merely adding another selling channel to the merchant’s centralized dashboard.

“Shopify Pay” is the company’s checkout accelerator that minimizes clicks to checkout and raises conversion.

“Point of Sale (POS) Pro” is Shopify’s omni-channel POS hardware that connects issuers to processors like a traditional POS but also infuses detailed and simplistic inventory management capabilities.

Merchant adoption here is currently doubling YoY.

Shopify also offers other interesting tools like cart abandonment help. A key differentiator for Shopify and its substitutes is maximizing conversion and approval wherever possible. Shopify’s ability to re-target almost buyers in a fully data-driven manner works wonders in accomplishing this.

Continued up-selling to the Shopify Plus plan will also be key to its long term success.

You’ll notice that the newer products are launching in very competitive fields. Every single mega cap tech company is competing in the payments space, Amazon is trying harder and harder to emulate Shopify’s value, Clover and Block are two out of the countless worthy POS players and formidable gateways like PayPal aren’t just going to give up share because Shopify wants to take it. These projects are all up-hill battles, but Shopify has been winning up-hill battles since its beginning. We’ll see how it can do going forward.

Recent highlights:

Added Deloitte and Accenture as new partners to promote Shopify to its largest clients in early 2022.

Added TikTok shopping for merchants and a Spotify integration to sync product catalogues and display them within the audio streamer’s platform.

Integrated with Buy on Google in 2021 to allow goods to be displayed directly on the search page.

Launched with JD’s marketplace to unlock the Chinese economy and allow its merchants to use JD’s warehouses to sell into China and JD’s 550 million customers.

Shopify will also debut in several more geographies in 2022 to build on its cross-border value and domestic reach.

d) Risks -- Pandemic boost, Stock Compensation and Competition, Competition, Competition

Pandemic boost:

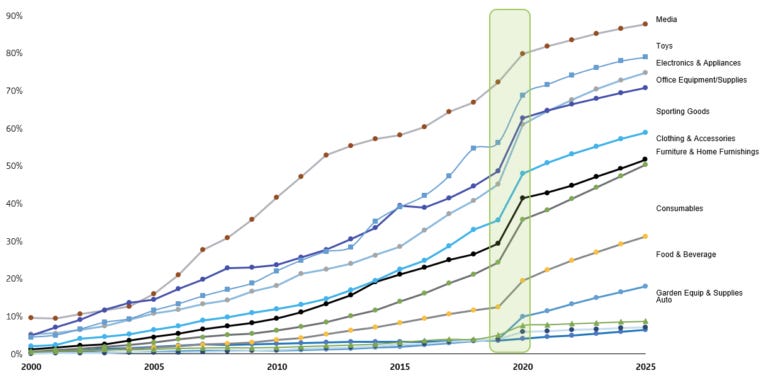

There are few companies that got a stronger boost than Shopify did from social distancing and lockdowns. Businesses were forced to rapidly embrace digital sales channels and that’s Shopify’s bread and butter. As a result, its growth was propelled higher throughout 2021 and the comps for the next few quarters will be quite challenging. This is not so much a long term structural risk as it is a temporary macro-economic hangover from Covid-19 and I think e-commerce growth re-accelerating over time is a safe bet. The e-commerce penetration rate as a percent of total retail sales trend is depicted below:

Stock-based compensation and employee attrition:

Shopify has used its stock as a currency for employee compensation and growth throughout its existence. The stock compensation specifically comes in the form of options with strike prices that are now deeply out of the money. While its depressed share price is something I find compelling, for employees of the company it’s not so much compelling as it is anxiety provoking. This is how a large portion of their net worth is calculated and the value of this currency diminishing could lead to higher employee attrition or more difficulty with competing for talent. I’ve seen anecdotal evidence of this playing out, but nothing all that significant or thematic. To add to the headache, the depressed share price forces Shopify to issue more and more options as its stock price falls to offer the same amount of value. This could accelerate dilution and is a common problem in all of tech. Fortunately, share count growth has recently been more muted.

Competition -- the main risk:

The main risk facing Shopify is talented competition hitting it from every angle. When a company exists in such a rapidly growing space, competition will always follow and Shopify is no different. There are many other website builders vying for share like Wix and WooCommerce and both are finding success. Shopify differentiates vs. those formidable alternatives with deeper partner integrations enabling broader usability. An example that was provided to me was Wix requiring manual input of lines of code to access Facebook Pixels while with Shopify the process is automated. Still, Wix and WooCommerce are strong alternatives and will likely remain that way, but Shopify's $160 billion, briskly growing market leaves room for many winners.

For the sake of brevity and not turning this overview into a 50 page novel, I will focus on Amazon here.

Amazon and Shopify run very different models. Amazon is a 3rd party marketplace that drives unparalleled traffic. Still, this traffic is usually not coming for a specific merchant but instead the aggregated network of sellers that Amazon has built. Shopify -- conversely -- provides white-labeled tools for merchants to build their own, customized website while having their brand ALWAYS at the forefront with full ownership of lucrative consumer relationships. Amazon is the virtual mall while Shopify is the virtual, stand-alone store builder. Considering this, I think there’s room for both players and Shopify is certainly holding its own for now with the platform’s overall merchant traffic passing Amazon late last year -- per Similarweb.

Amazon is doing its best to capture and emulate the unique value Shopify provides -- and that must be taken seriously by investors. To do so, it launched Buy with Prime. This allows for the same direct shopper relationships that Shopify trail-blazes to occur within a merchant’s own site (whether that's a Shopify-built site or another) while also tapping into Amazon’s elite, massive fulfillment network. Now, any product listed on the Amazon marketplace can be listed on a 1st party site as well while tapping into all of Amazon’s utility building services like same day shipping and its famous checkout flow. Current Fulfilled by Amazon (FBA) customers solely need to conduct a minutes long integration to gain access. Interestingly, Shopify Co-Founder/Co-CEO Tobi Lutke is trying to sell this as a positive:

“We are actually thrilled with Amazon making a decision to take its amazing infrastructure to share broadly with small merchants. We are happy to integrate this into Shopify just like we did with Meta, Google and TikTok. This is not nearly as zero-sum as some think… the more channels that exist to sell into, the more important Shopify tools become. This is good news.” — Shopify Co-Founder/Co-CEO Tobi Lutke

I think that’s about as optimistic of a spin as you can put on this announcement but it is nice to know he doesn't see any problem with integrating Shopify and this new offering. The news is undeniably intimidating for Shopify as it marks a willingness of Amazon to break down the doors of its walled ecosystem to do a lot of what Shopify does for merchants. Still, Amazon doesn’t offer the same granular e-commerce building options or hands-on customer service of Shopify and doesn’t typically allow for payment gateways outside of its own to be used (although it is now adding Venmo) while Shopify plugs into over 100 of them. Additionally, at their core, merchants know that if they are successful enough, Amazon could compete with them and take their business. Shopify won't.

With all of that said, same day fulfillment is likely a deal-maker for countless organizations wanting to pick or choose between the marketplace approach or Shopify’s offering. Many go with both but many more go with one or another. Because of that, Shopify is heavily investing in fulfillment.

e) Fulfillment and Deliverr

Shopify’s fulfillment ambitions accelerated in 2019 with its purchase of 6 River Systems (6RS). 6RS builds warehouse fulfillment software that Shopify has used as the foundation of its own warehouse software which is now handling all Shopify fulfillment out of its Atlanta facility as of this quarter. The software allows Shopify to deliver packages to over 90% of Americans within 2 days -- but that’s still worse than Amazon.

To try to emulate what Amazon provides, it purchased Deliverr this year for $2.1 billion in an 80% cash, 20% equity transaction.

Deliverr combines disparate pieces of the fulfillment supply chain to unlock direct communication and cohesion for millions of merchants. Like Shopify, it takes a partner-first approach with vendors like Wal-Mart, Amazon and all social media part of its ecosystem.

The key to Deliverr’s value is actually not at all in fulfillment space scale -- and that’s good considering Shopify will never match Amazon’s courier footprint (or FedEx/UPS). Deliverr owns no warehouse space and instead leases square feet as needed while partnering with players like FedEx to scale its distribution capabilities.

Its value is derived from software programs that allow it to intelligently forecast demand to place inventory where it needs to be ahead of purchases. This minimizes inventory (and so working capital) needs for merchants and keeps them far nimbler while also optimizing fulfillment for cost to juice margins by comparing multiple bids. With this new purchase, Shopify is quickly working towards 1 day shipping. In every way, shape and form -- this is a Shopify Fulfillment Network (SFN) upgrade.

The acquisition was both wildly expensive and a much needed shot in the arm for Shopify to compete in fulfillment.

f) Team

To keep this section short (trying my best here), I’m going to focus entirely on Tobias Lutke, Co-founder and CEO of Shopify. Tobi has been building this company for nearly 2 decades from its humble beginnings as a Snowboard shop to the $40+ billion firm Shopify is today. He’s clearly highly capable, talented, and also very polarizing. He takes to Twitter to talk about his stock being undervalued (yuck), he used an NFT as a profile picture for several months (more yuck) and he has made some competitive predictions that now look cringe-worthy when using the luxury of hindsight. His Board of Directors authorizing new founder shares to shore up his ownership amid continued dilution is also something I want to see quickly slow.

And despite all of that, I still think he’s a fantastic CEO. You don’t build a Shopify through the Great Financial Crisis and other macro-shocks by accident. While he certainty comes off as eccentric at times (which is less palatable amid macroeconomic downturns), his track record speaks for itself. His 91% glassdoor rating with 1700+ reviews helps too. I have mixed, but mainly positive views of him and really like the rest of the team that he has built.

g) Quantitative

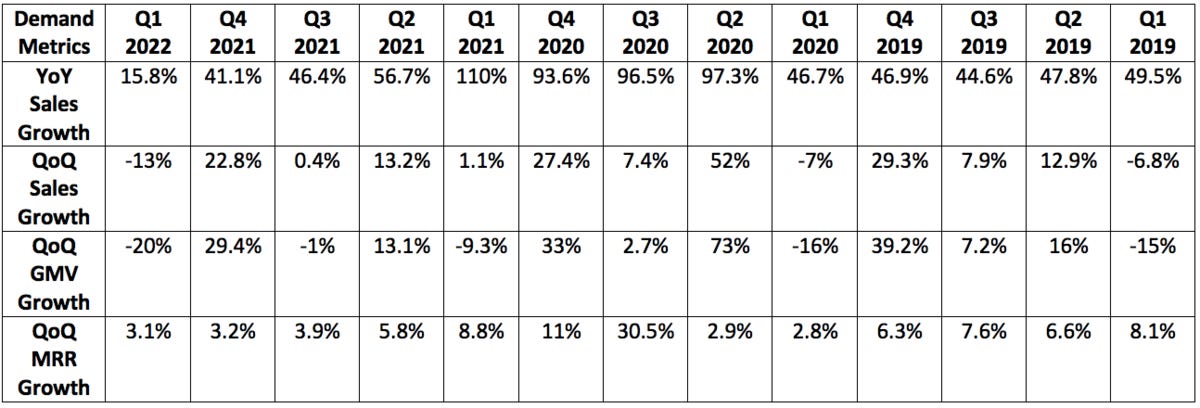

Most recent demand trends (might need to zoom in a bit):

More context on demand:

I generally only go back 2 years with quarterly metric charts. I went back 3 years here to depict how abruptly strong of an influence Covid-19 had on Shopify.

Growth from Q2 2020 to Q1 2021 was greatly propped up by the pandemic. The company’s 2-year revenue CAGR for this past quarter was 60% to offer evidence of this pull-forward being aggressive.

The aforementioned change in developer fees hit revenue growth hard in Q1 2022 as well as shifting from gross revenue recognition for its theme sales to net revenue recognition.

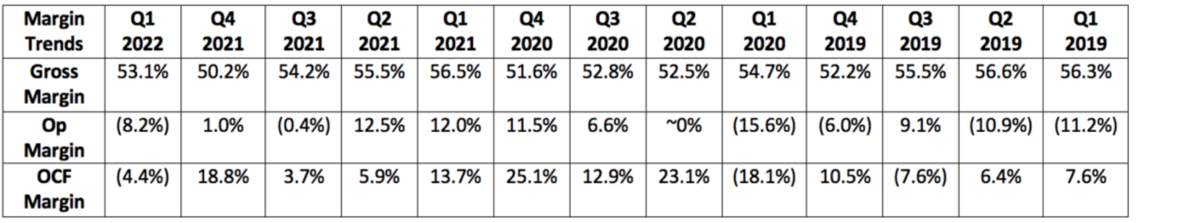

Most recent profit trends (might need to zoom in a bit):

More context on profit:

Shopify continues to invest all gross profit dollars back into product upgrades and geographic expansion. It is not trying to earn operating income but attempting to operate at break-even for now. This is very similar to what the market rewarded Amazon for in it’s early years (very different market now).

Proliferation of merchant services and the change in developer fees are both weighing on margins. A shift back from debit-funding to credit funding as we move past stimulus is also hurting margins.

Shopify’s Q1 2022 GAAP net income margin was (125%) vs. 127.3% YoY and (26.9%) QoQ. This crazy volatility is not unit-economics related in the least -- it is entirely related to unrealized fluctuations in the value of its equity investments. This is not a super important profit metric to track for the company for now -- so I left it out of the table.

Guidance:

Shopify doesn’t provide formal guidance but has offered the following color:

Merchant revenue growth rate will be roughly 2X subscription revenue growth for 2022.

All gross profit dollars will continue to be invested into growth.

$800 million in stock-based comp (partially Deliverr M&A-related)

A similar number of merchants will be added to the platform vs. 2021 (previously thought it would add more than 2021 so this was a guide down).

This weakness was blamed on things like slower e-commerce growth for the industry, supply chain headaches and post-pandemic normalization.

Balance Sheet:

Current liquid assets -- $7.25 billion total:

$2.45 billion in cash and equivalents

$4.8 billion in marketable securities

Liabilities to note:

$200 million in net payables

$910 million in convertible senior notes

Equity:

Issued share count is over 99% of the total authorized shares available. (Look for an authorization for additional shares).

Diluted share count grew by 0.7% YoY and Share count grew by 2.2% YoY this past quarter (all weighted).

In 2021, share count grew by 4.2% vs. 2020 as a whole with diluted share count growing by 3.1% during that period (all weighted).

h) Valuation and my plan

There are many, many things to like about this company, but the valuation is not one of those things. Despite the pullback the stock has seen, it still features a gross profit multiple that is likely close to 13X this year and 9X next year. When moving further down the income statement, the expensive classification remains. It trades for 70X 2023 EBITDA and 140X 2023 earnings (350X this year’s earnings). Bear in mind that as the firm matures, in a normalized, non-growth at-all-cost environment, earnings would be much higher. But this is where we are today.

I think Shopify can compound sales safely at a 25% clip for the next 5 years and can do so while easily getting back to the 15% operating cash flow (OCF) margin it sported in 2020 by the end of the planning period. I don’t think these are aggressive assumptions and would leave us with $17.7 billion in sales and $2.65 billion in operating cash flow. If we were to assume a 25X OCF multiple, we are left with a $66 billion company which would represent a compounded return over the period of 8.4%. Not great, but not terrible.

This is a special company. We have years and years of compounding data to use to support that claim. Still, a forward earnings multiple of 140X is likely too high in this environment and I also don’t think that profit estimates have finished falling based on how aggressive Shopify’s spending plans are. Mr. Market currently hates its philosophy of prioritizing market share over the bottom line and that likely won’t change as e-commerce growth comps remain challenging and inflation/rate hikes dominate headlines. Still, I think the decision is absolutely the right one for the company regardless of it not currently being in vogue.

I’ve decided that I want to own this name at some point in the future, but not yet. It remains at the top of my watchlist and will likely make its way into my portfolio if we can get some more, much needed multiple compression over time.

2. Match Group (MTCH) -- CFO/COO Gary Swidler Interviews with Cowen

On 2022 expectations:

“We’re still not all the way back to pre-pandemic levels, but it’s slowly ticking in the right direction along with our business. We’re around pre-Omicron levels with every new wave having less of an effect on the business. In places like New York that are seeing new spikes, we see no material impact.” — Match Group CFO/COO Gary Swidler

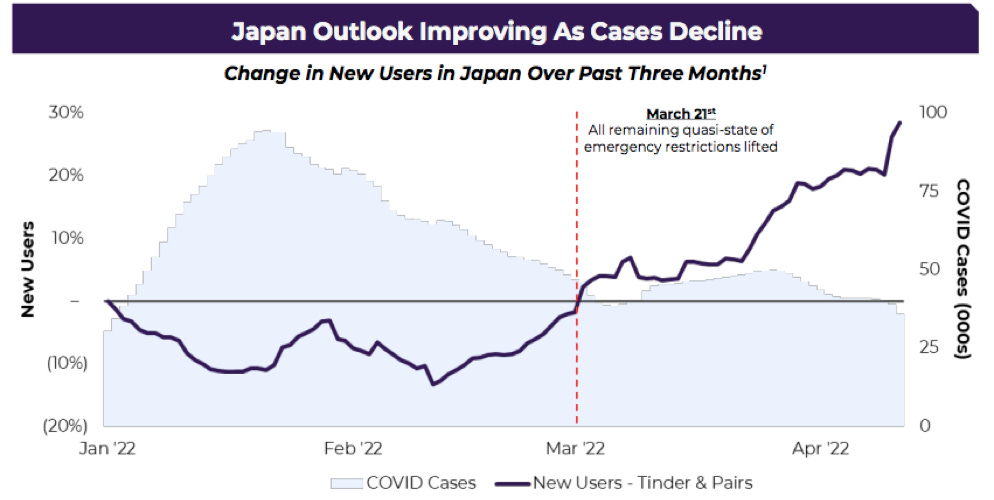

Note that Match does a large chunk of its business in Asia where variant outbreaks have been more recent issues. In Japan specifically, the nation’s recent re-opening led to an abrupt recovery in app downloads and usage. The chart that Match shared on Japan during its last quarter (copied below) has seen the same positive trend continue into June. Match is leaning back into marketing spend there (it has been cautious lately) as the trends of encouraging normalization continue.

On Google Play Fees:

Swidler discussed Apple and Google essentially ignoring new laws from South Korea and The Netherlands as fueling the regulatory fire for ending mandatory usage of their payment methods and the coinciding 30% take rate. For context, a normal online transaction costs around 2-3%.

The Digital Markets Act (DMA) in Europe barred mandatory in-app payments and prevented picking and choosing which business models have to pay the 30% and which companies like Spotify and Uber get special exemptions. This Act created far more severe penalties for ignoring new rules in The Netherlands and other EU nations following suit.

Match expects both Apple and Google to re-vamp their app store policies by the start of next year to remove mandatory in-app payment and discriminatory fees. That would be a 1.5% margin tailwind for Match from Google alone and Apple following suit would only add to this benefit. The USA is now exploring similar moves with the Open App Markets Act. But the DMA got the ball rolling faster regardless.

App store fee relief would free more marketing and R&D spend as the 30% tax goes away. Match expects to pass some of this savings on to its customers if it comes as well.

Google tried to mandate payment methods anyway but the lawsuit Match filed was received favorably by the legal system and the Judge which put added pressure on Google to settle. A $40 million escrow account was created by Match in case the judge sides with Google in the trial by April 2023 (not likely).

On Tinder’s 2022 plans:

The female-oriented monetization services and packages are close to ready to combat Tinder’s male over-indexing. The plan will offer females more control over their experiences and focus on quality of the match vs. quantity. It’s coming second half of the year.

Match is investing heavily in Explore to find people with similar interests and passions.

Virtual gifting is another focus. Plenty of Fish (POF) is beta testing this with live streaming which has been shown to foster larger and larger gifts. This allows for the “whale phenomenon” -- somebody wanting to spend thousands of dollars to stand out. In POF LIVE! streaming you can do that. Doing so on Tinder is hard to do and this will hopefully change that.

On Hinge:

Traction and brand awareness in India continues to build regardless of the app not yet being localized there.

“India is a more serious relationship market. It plays well to Hinge’s strengths.” — Match Group CFO/COO Gary Swidler

Hinge recently launched in Germany -- its first non-English speaking market -- and will start its marketing program there this month. It will continue to localize the product for several more launches throughout Europe in 2022 and then Asia thereafter.

“We know how to do this because we’ve done the same thing with Tinder and we have people on the ground in all of these markets.” — Match Group CFO/COO Gary Swidler

Hinge is now #1 in terms of new downloads in the U.K. and Australia per Swidler and is on track to deliver its $300 million in 2022 sales target.

On Hyperconnect:

Swidler spoke on one of Hyperconnect’s apps -- The Azar app -- and why it has been "slower out of the gate" than Match wanted it to be. He cited the following reasons:

Pandemic outbreaks.

Apple privacy changes which Match responded to and combatted seamlessly. Hyperconnect did not. Match sent a full team to help them with it and now feels it’s in a good place.

Competition.

Azar has recently seen operational stabilization and a return to improvement this quarter. Swidler reiterated his view that this was a great purchase and will be fine longer term.

On marketing and macro-durability:

This conversation partially centered on Facebook marketing being “far less effective” after Apple’s changes and that forcing Match group to find other ways to deploy marketing dollars. It has taken time to find new ways to market efficiently.

He reiterated his view that the advertising market continues to be frothy and expensive. This has prevented them from budgeting as much as they want to on their apps because they won’t invest without a benchmark return on investment (ROI) being cleared.

“We’ve chosen to stick with our ROI discipline and not chase anything… as the economy cools off a bit, we’ll hopefully start to see a little more normalcy in the marketing environment which will help the legacy brands via more spend… I’m rooting for a little bit of a cooler marketing spend environment… it feels like we’re on the cusp of that.” — Match Group CFO/COO Gary Swidler

“The business was very recession-proof in 2008 and saw a bit of a boom as people had more time on their hands. The apps are affordable even if things are bad. I don’t expect to see a significant impact from a downturn on our business. From a marketing level, it might actually give us a bit of a tailwind along with the labor side where it’s been really expensive to hire and retain people over the last 12 months… I would bet on us through a recession.” — Match Group CFO/COO Gary Swidler

3. The Trade Desk (TTD) -- Case Study & Open Internet Data

a) Walgreens Early Indicators

Walgreens’s advertising branch and its self-serve-styled usage of The Trade Desk’s platform is frequently delivering a 6X return on ad spend (ROAS) for the advertisers it sells to.

According to the Head of the Walgreens Advertising group “this is just the beginning” of their relationship with The Trade Desk.

Solimar -- The Trade Desk’s new programmatic advertising platform -- features a unique ability to granularly connect marketing dollars to purchases/revenue within a retailer’s omni-channel operations. This is why Walmart, Home Depot, Target and so many other retailers have plugged their first party data into The Trade Desk’s ecosystem to gain this edge. Doing so makes the retailer giants' impressions far more targeted and valuable to buyers thus garnering a higher price per impression while still delivering the appropriate Return on ad spend (ROAS) for the demand side. It’s a wonderfully sticky win-win that The Trade Desk is facilitating. This revenue opportunity is both massive and entirely ahead of the company.

b) Interesting Data from the Interactive Advertising Bureau (IAB)

The open internet is now capturing 76% of consumer attention per a survey from IAB. This includes music streaming, gaming, news outlets, streaming and podcasts. Meta, Snap, and all other walled gardens combined for 24%.

In 2021, there was $189 billion in total U.S. digital advertising spend and social media platforms over-indexed with nearly 31% of that total spend. These platforms’ feature excellent targeting and reporting tools that allow them to fetch higher prices per impressions.

Jeff Roach (Chief Strategy Officer at SCS Agency) thinks CTV embracing ads is shifting that walled garden power to streamers with media companies now first on the lists of agencies to buy impressions from -- especially with Apple changes making social media platforms less effective.

CTV growth of 51% (vs. walled garden growth of 39%) in 2021 brought that market to $40 billion. Digital video’s share of total digital ad revenue grew 220 bps (2.2%) in 2021.

“CTV’s growth is a direct result of giving advertising a new opportunity to buy media that results-wise is on par with what walled gardens can offer.” — Jeff Roach

4. Meta Platforms (FB) -- A Big Leadership Shake-Up

The second in command at Meta Platforms -- COO Sheryl Sandberg -- is stepping down from her role. This ends a 14+ year tenure where she played a massive part in building one of the most successful companies ever. Javier Olivan -- who currently serves as Meta’s Chief Growth Officer -- is replacing her. For now, Sandberg will stay on the Board of Directors.

Some are saying that this is great news as Sandberg was the Chief Operator amid several large investigations while others are saying this is catastrophic news for the company. I disagree with both of those opinions -- this is a negative, but not a disaster. Sandberg spent years building a deep bench of talented individuals to groom for her replacement and her remaining on the board signals that this divorce is amicable. There are reports that she just wants to focus on family and philanthropy, but the actual cause is anyone’s best guess. I'll worry if Zuck steps down.

Note that the company’s ticker will change from FB to META on June 9th.

5. Upstart (UPST) -- New Referral Partner and Credit Data

a) New Partner

Upstart announced Mascoma Bank as its newest referral network partner. Mascoma is a 130+ year-old Mutual Bank and a Certified B-Corporation which I think makes this relationship more notable in terms of hinting at Upstart’s sterling reputation. It has 28 branches, $2.64 billion in assets under management and is Headquartered in New Hampshire.

b) Credit Data

Kroll Bond Rating Agency released a new issue report on Upstart’s sourced loans. Here were the highlights:

Upstart cleared another $650 million through capital markets which represents a similar pace to 2021. Capital markets remain open to this company. This credit shifted from FICO bands of 619 and lower more so to scores of 640-720.

Cumulative Net Loss (CNL) Rate expectations for all Upstart securitizations remain at or below the original base case (a good thing) with credit enhancement levels rising for all of the deals (also good).

CNL rate expectations for pass-throughs for all 2021 transactions were raised a few months ago (a bad thing) but the three newest deals all have current CNL estimates at the original base case (a good thing). Perhaps this means the underperformance has reverted.

Loan modification requests continue to rise (a bad thing) after Upstart and CRB revised parameters for request qualifications.

None of this is surprising. 2022 will be a tough year for Upstart to get through and if it can, the future will look much, much brighter. We’ll see how it maneuvers through absurdly choppy waters.

6. Sofi Technologies (SOFI) -- Investing Product Update & Miscellaneous

SoFi is adding 4.5 hours to its trading sessions by extending after hours trading to 8:00 PM EST. With institutions able to transact pre and post market when things like earnings and press releases are generally published, this does level the playing field to a certain extent. It will release other products like options at some point this year.

“Our members’ lives don’t operate 9 to 5 and we’ve certainly learned that over the last 2 years.” — SoFi CEO Anthony Noto

Other SoFi news:

CEO Anthony Noto continued his trend of consistent buying with a $150,000 open market purchase this week.

We also saw headlines circulating around $5.8 billion in student loan debt forgiveness. This does not resolve the moratorium as it was connected to the Corinthian College for-profit chain that defrauded students.

7. CrowdStrike (CRWD) -- Market Share Data, a Case Study and Impact Level 4

I published my review of CrowdStrike’s earnings report earlier in the week. It was a great performance -- again.

a) Market Share

The IDC recently published its market share report for overall Corporate Endpoint Security in 2021. CrowdStrike passed Microsoft -- the previous leader -- during the year and now features a 12.6% total share vs. 11.2% for 2nd place Microsoft. During the earnings call, CFO Burt Podbere expressed great confidence in that new market share lead continuing to widen over time. The endpoint security field overall had a banner year in 2021 -- growing 29% YoY to $10.3 billion in total sales.

b) Case Study

Aronson -- a 60-year-old accounting and tax firm -- deployed CrowdStrike’s endpoint and managed security solutions through the Falcon Platform and saw:

90% less time spent to resolve cyber threats.

75% less time spent on security overall.

Full deployment in under 2 weeks.

c) Identity Boost

Finally, CrowdStrike announced availability of its suite of identity products for the public sector following its Impact Level 4 (IL-4) authorization from the federal government earlier in the year. This green-lighted it to serve all levels of government and defense agencies.

8. Olo conference -- Case Studies

a) CKE Restaurants (Owns Carl’s Jr. and Hardee’s and the nearly 4,000 locations)

Came to Olo with no App, loyalty program or delivery due to an inability of other vendors to provide these solutions. Went with Olo’s Ordering, Rails and Dispatch modules.

Saw a 5% lift in digital volume and a 20% spike in average order size.

Recently added Google Food Ordering through Olo Network along with a loyalty program.

“Other QSR brands were much further along in their digital evolution and Olo allowed us to get caught up quickly… The partnership has made us digitally relevant.” — CKE CTO Phil Crawford

b) P.F. Chang’s

Uses Olo Ordering, Dispatch, Rails, Host and its Marketing platform.

Olo delivered 388,000 incremental email list opt-ins and 2.5 million new guest profiles.

“Olo’s Host and Marketing solutions give us access to insights like Customer Lifetime Value (CLV) which enable us to customize the dining experience and tailor our innovation to the preferences of our guests. It’s a huge unlock." — P.F. Chang’s COO Art Kilmer

9. Macroeconomic Notes:

a) Market News:

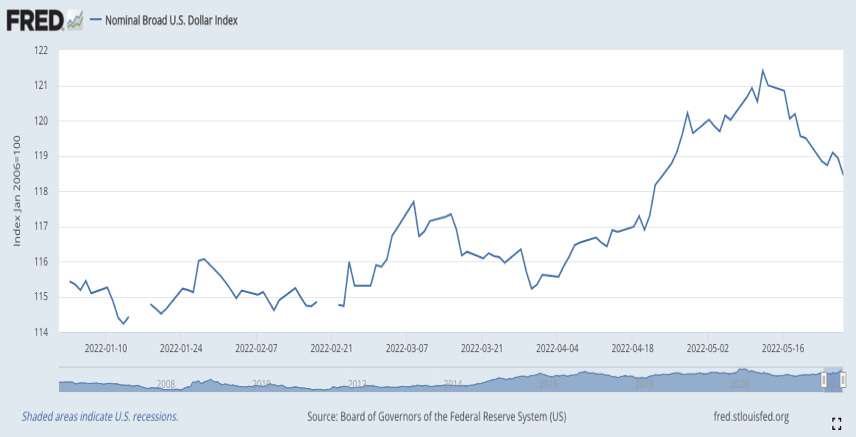

Microsoft guided down its previous expectations during the week due to heightening dollar strength weighing on its post-conversion results. Every single other globally-oriented company with sizable non-dollar-denominated chunks of operations will be impacted by the same rise, but I don’t think it’s necessarily a given that other firms will follow suit with lowered guidance. Why? Microsoft reported earnings on April 26th -- right before the U.S. dollar began breaking out higher. Conversely, Match Group -- which reported on May 3rd -- offered its guidance after a large piece of that move had already happened. Match Group and everyone else reporting later in the period had the luxury of knowing this when they offered guidance -- Microsoft didn’t. Side note: It’s crazy how quickly the dollar exploded higher in that short time period.

Other market headlines:

Tesla’s Elon Musk sent a note to company leadership announcing a hiring freeze and layoffs. According to him (and I quote) he has a “super bad feeling” about recent economic developments. New hiring freezes and layoffs continue to be a daily theme.

NFT sales are down 92% from September 2021. In my view this is an extremely welcomed piece of news and a sign of healthy normalization in capital markets. The froth is coming out. These are the types of things that hint at economic cooling to get us to that dovish pivot from the Federal Reserve that we're all looking for. I don’t see that pivot coming for a few quarters, but this is a small yet positive metric pushing us slightly in that direction.

b) Institutional Notes:

J.P. Morgan released data this week showing that retail call option buying activity continues to set new 52-week lows.

J.P. Morgan’s Jamie Dimon said in an interview this week that the “storm clouds” he saw forming for the economy a few months ago have morphed into a “hurricane.” He told investors to “brace yourselves.”

Data from Goldman Sachs indicates that retail investors have now sold all net U.S. stock purchases over the last 24 months.

The Warren Buffett cliché of “Greedy when others are fearful” is generally spot-on and is a cliché for a reason. There are signs that we are beginning to see real fear and I’m excited to get greedy in the coming months.

c) Beige Book Highlights:

4 of 12 Federal Reserve Districts have reported slowing growth since the last report. 8 expect materially slowing growth ahead.

Labor market and supply chain issues were the 2 most cited challenges by surveyed enterprises.

Most districts reported “strong or robust” pricing increases with 2 districts reporting this was continuing and 3 reporting that inflationary pressures had begun to moderate (good sign but long way to go).

Forward inflation expectations by district:

New York -- 6-7% this year and 3% for the long term.

Philadelphia -- 5.0% 2023 inflation expectation vs. 5.9% expected as of 2 quarters ago.

Atlanta -- 4.2% this year and 3.7% next year. Both were unchanged from the last report.

d) Economic notes:

The Institute for Supply Management (ISM) released its factory activity index during the week which sat at 56.1 (above 50.0 means expansion) vs. 55.4 month-over-month. Analysts expected 54.5 meaning this greatly beat expectations.

Strong manufacturing data continuing to pile up would work wonders in easing recession fears but could allow the federal reserve to get more aggressive in taming inflation with its monetary tool kit. Good manufacturing news right now may not be good news for long duration growth stocks. The question is, are manufacturers simply building inventory in response to supply chain disruptions? Or was this inventory build a miscalculation of consumer demand?

Interestingly, factory employment shrank for the first time since mid-2021 but strength in prices and production levels offset that weakness.

The Atlanta Fed’s GDP Now estimate continues to precipitously fall and is now 1.3% for the second quarter as of June 1st vs. 1.9% just 4 days before that. @Specialsitsnews posted a chart of this on Twitter and I wanted to give him a shout-out for that.

Consumer confidence came in at 106.4 vs. 103.9 expected. This beat expectations, but is still the lowest reading since February.

U.S. Private payroll vastly underwhelmed (128,000 adds vs. roughly 300,00 expected) with further downward revisions which could mean ebbing hiring velocity as private employers echo the dozens of announcements we’ve seen across public markets. Rising cost of capital and the plethora of other macro issues like inflation stretching budgets are likely a cause.

Not to sound harsh, but this is a needed piece to deflate the pandemic bubble -- job openings continue to be quite lofty (JOLTS job openings sit at a gaudy 11.4 million which is near record highs) and this will ease some of that challenge while also likely placing downward pressure on wage inflation over time.

Total payroll data differed from the private payroll disappointment. Total non-farm payroll data for May was 390,000 jobs added vs. 328,000 expected. This just continues a trend of confusing, contradicting economic data which has largely been negative lately. I’ll continue to let this data come in and for macro turbulence to play out before I get more aggressive with my accumulation.

Labor force participation ticked up to 62.3% and is now just 110 basis points below pre-pandemic levels.

The Fed’s Loretta Mester hinted at 50 basis point rate hikes continuing beyond August which would be more aggressive than current expectations indicate.

The Purchasing Managers’ Index (from the ISM) and the S&P Global U.S. Services PMI from May were both revised lower.

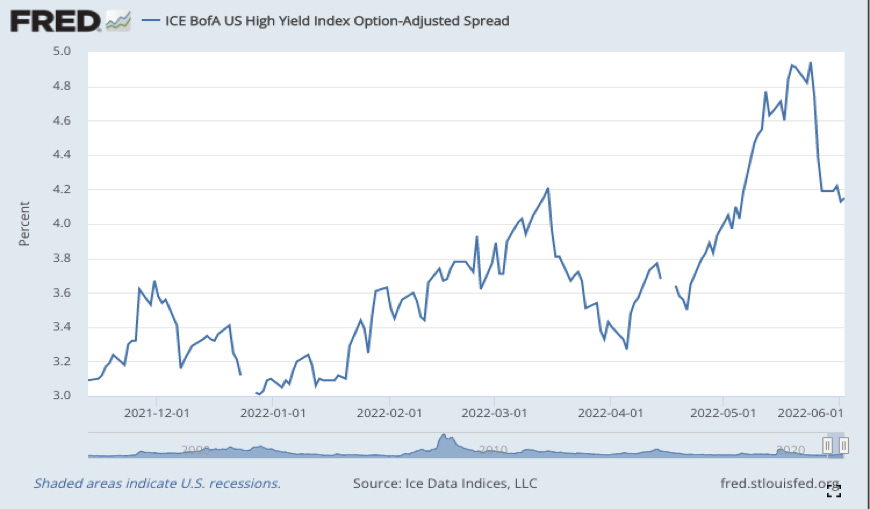

U.S. high yield option-adjusted corporate spread remains well off of its previous high but did slightly tick back up this week:

Specifically, we’ve seen BBB rated option adjusted spreads slightly reverse its recently encouraging downtrend but CCC rated spreads were fortunately flat on the week.

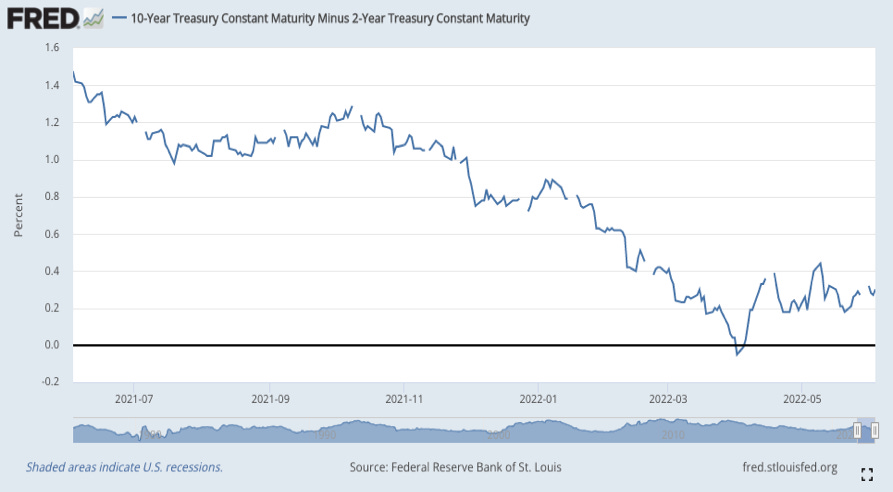

The popular 10-2 year yield spread widened slightly this week (a good thing for economic data but also for more aggressive Federal Reserve policy):

10. Cannabis News -- Mainly Per Marijuana Moment:

A Judge in Illinois lifted the license stay preventing nearly 200 more dispensaries from opening. This would nearly triple the dispensary count in Illinois to almost 300. Both Green Thumb and Cresco have extra capacity to supply many, many more stores and now hopefully this years-long legal battle resolving itself will allow them to do just that. BTIG Analyst Camilo Lyon thinks this could add roughly $200 million in annual sales for Cresco and about $170 million for Green Thumb. And the up-front costs have already been incurred to build out the needed capacity meaning this incremental revenue will likely be high margin.

Minnesota’s Governor signed a bill reiterating the legality of CBD.

Cannabis Legalization in heavily conservative counties in California, Maine and Nevada support full cannabis legalization at an average rate of 47%.

New York’s Senate passed a law that mandates public insurance carriers include medical cannabis expenses.

North Carolina’s Senate approved a medical cannabis legalization bill.

The U.S. Virgin Islands is quickly moving towards cannabis reform.

Louisiana legislators sent a new bill to their Governor to provide exemptions for state workers legally using cannabis.

San Marcos, Texas collected the needed signatures to vote on decriminalization in November.

11. My Activity & Cash Position

I added to Progyny and Green Thumb during the week. My cash position is 21.3% of total holdings.