Introduction:

Olo began its journey as Mobo Systems when Noah Glass founded the company in New York City 16 years ago. The first iteration was born to enable coffee shops to accept orders and payments from mobile phones within what Olo calls the “on-demand commerce” space.

Five years later, Glass and his team pivoted to serving larger, enterprise clients and changed the company’s name to Olo — short for online ordering. Today, it operates as the core connector and enabler for national restaurant chains to economically build a digital business in a world where that is now imperative.

Olo services roughly 1.8 million digital orders per day and according to Glass, the first inning of its remarkable growth story has not even begun. Here I will cover all there is to know about this company, including:

Restaurant Challenges

Olo’s Solution

Olo’s Product Modules

Olo’s Business Model

Olo’s Market

Olo’s Reach and Impact

Financials

Balance Sheet

Valuation

What’s Next?

Leadership and Ownership

Competition and Risks

My Plan

1. Restaurant Challenges

Restaurants face a plethora of challenges making a digital, off-premise business pursuit overwhelmingly daunting.

Off-premise defined: includes take-out, drive-thru, delivery, catering and any ordering process not conducted entirely in-store.

All restaurants sell perishable goods. Near-future expiration dates force restaurants to be nimble with gauging inventory demand. Once prepared, these perishable goods are under strict FDA regulations which mandate when that food can be served or delivered as well as when it must be consumed. If this window of time is not met, the restaurant must throw away its product and eat the cost itself. Selling this food on-premise within the time restriction is simply far easier than attempting to juggle off-premise, digital service along with on-premise dining.

Not only are these products perishable, but a restaurant’s menu is also generally quite fluid. Consumers frequently add to, or subtract from orders; with food allergies so prevalent in our society, forgetting a request could be a matter of life or death. Furthermore, specific locations within a chain can occasionally run out of certain menu items making accurate fulfillment quite the difficult task.

Restaurants trying to embrace off-premise business also have to continue accommodating in-house dining. They can’t simply dedicate all resources to off-premise as on-premise execution requires a great deal of attention to be done effectively.

The combination of perishable goods, fluid menus and on-premise accommodation makes running a brick and mortar business complicated enough, let alone trying to service multiple off-premise channels as well. It’s one thing for a company like Amazon or FedEx to ship a toy or a pair of headphones. The stakes are significantly raised for businesses to thread the service needle when a company is sending something perishable and consumable.

The obstacles don’t stop there.

70% of restaurant chains need up to 4 different 3rd party technology vendors to enable their digital operations.

The vast majority of these restaurants do not have the infrastructure or expertise to develop their own, integrated solutions. To put it plainly: No restaurant is in a position to build a better point of sale (POS) system than Square. In reality, with the multi-channel, multi-location businesses that restaurants run, they often need several POS systems to fully capture demand. The cumulative effect of multiple 3rd parties is inconsistent integration, poor communication and unpredictable service among often antiquated solutions.

Even within an individual chain, frequent usage of franchisee and licensing models for expansion means tech stacks from location to location are often not the same. This merely complicates unification further.

Inconsistent integration makes accepting, organizing and prioritizing orders across on-premise and off-premise channels IN REAL-TIME extremely challenging. Doing so while maintaining a level of customer service to keep people happy is virtually impossible for most chains on their own. They need a trusted integration partner to avoid treating demand fulfillment like a guessing game.

For chains able to effectively embrace their digital opportunity, profitability is a real concern. Restaurant margins aren’t terribly high to begin with. Furthermore, delivery service providers (DSPs) and demand aggregators are expensive (and also vital) pieces of making digital operations a reality.

This part of the value chain commands a large (up to 30%) chunk of the total profits, withholds lucrative consumer data, disconnects consumers from a restaurant’s brand and forces chains to compete against substitutes often on the same marketplace. This is not the greatest situation but is a necessary evil if restaurants want the added volume associated with digital proliferation. Adding this to the issues I highlighted above makes it clear why the restaurant industry has been so hesitant to modernize — and numbers support this assertion.

Before the pandemic began, just 10% of total restaurant sales were digitized according to research from Cowen. This compares to 50% for books and electronics, as well as 20% for American e-commerce as a whole. The pandemic invariably boosted this 10% metric, but there remains a long runway for off-premise restaurant chain operations to grow.

That is exactly the Olo niche.

2. Olo’s Solution

Olo builds customizable application programming interfaces (APIs) to empower off-premise, on-demand commerce while simultaneously improving customer experience. It unlocks digital demand WITHOUT sacrificing access to coveted consumer data and WITHOUT threatening brand equity or profit margins. Chains also forgo the hefty costs associated with building out an internal solution. In other words, Olo is quicker, easier & more efficient.

Application Programming Interface (API) Defined: APIs are blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower access to data services, operating systems and other applications to create an end product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build a platform’s UI and user experience (UX).

Based on the prevalent 3rd party technology integration issues that most restaurant chains face, Olo integrates with over 100 technology platforms in the industry. This ensures compatibility with all relevant technologies — including those built before the dawn of the internet’s ubiquity to guarantee even the toughest of combinations. To date, most chains have had to constantly and manually integrate the various pieces of their antiquated tech stacks — Olo fixes that.

Olo doesn’t replace the solutions a restaurant chain has deployed, but instead acts as an interface layer on top of the various products to conjoin them and bring them to their full economic potential. Broad 3rd party integration is the key to making this happen. This approach means Olo can function as a centralized platform for data and demand aggregation as well as day-to-day decision making for all locations in one place. The effect is higher volumes at lower cost which incrementally feeds the profits of Olo’s clients.

Beyond broad integration, every single product Olo offers is white label, and not Olo-branded. Consumers will never see the Olo brand when ordering food, meaning chains can embrace digital without jeopardizing the power of their brand. This translates into enhanced consumer loyalty by raising brand awareness and also boosts profit margins because of the sale becoming more direct-to-consumer (DTC) in nature. With Olo, the brand is at the centerstage of the fulfillment value chain rather than an aggregator like DoorDash.

Olo’s unique white label approach also ensures brands can keep control of their lucrative consumer data and even helps to digest and organize all of this data to assist partners in decision making. Demand aggregators generally restrict which data they’re willing to share with restaurant chain clients. Less consumer data means less informed service and menu-item decisions for chains.

As a result, 70% of Olo’s chain clients stated the primary reason for their original shift to Olo was to take back control of their brand and data. Furthermore — according to the National Restaurant Association (NRA) — 64% of consumers prefer ordering directly with a brand rather than through a marketplace. A combination of familiarity and loyalty powers this preference. Clearly, this white label approach appeals to both restaurant chains and consumers.

3. Olo’s Product Modules

a. Ordering

Olo’s ordering module was its very first enterprise product. With this module, chains build a branded website that enables orders to flow from various direct digital channels. It essentially functions as a white-label, on-demand commerce solution to free a consumer to order from and pay restaurants via mobile, web, voice and more. The module can fulfill orders across all of these pieces of a chain’s operations to help restaurants internally juice volume wherever possible.

Olo’s suite of fully customizable APIs allows a chain to construct digital operations in a way that uniquely captures its specific consumer base. This is far from a one-size-fits-all product.

Ordering also functions as a central logistics platform thanks to all of the broad 3rd party integrations mentioned above. Chains can use the module to enforce day-to-day decision making in one place and across all locations.

More recently, the company has added features on top of Ordering to boost its appeal. This upgrade includes a product-type designed for “ghost kitchens” (virtual food prep kitchens with no dine in capacity) like Guy Fieri’s Flavortown Kitchen which recently became an Olo client. It even added a coupon manager to allow brands to run national digital promotions while leveraging all of the consumer data Olo gathers, arranges and shares with its chain clients.

Finally, Switchboard is a product that supports Olo Ordering. It facilitates the acceptance of phone-in orders by integrating with call centers or in-store agents to place orders through the ordering module.

b. Dispatch

The Dispatch module is Olo’s same hour delivery management solution. It’s important to note: Olo does not fulfill any delivery internally; it has 0 delivery drivers. Olo is merely facilitating delivery for chains in the most effective way possible.

With Dispatch, Olo clients can source and accept delivery orders directly from their ordering module website without the need for a delivery fleet. Here, it’s up to a restaurant what percent of deliveries it wants to fulfill internally — but Olo helps greatly with making that economically vital decision.

In real-time — when the Ordering module receives a delivery order — Dispatch chooses from up to 8 external delivery service providers (DSPs) and any available internal options to optimize for cost and service. Dispatch works with more than 2 dozen DSPs in total.

When DSPs are charging up to 30% for fulfillment, this feature serves as a wonderfully powerful margin tailwind for restaurants by forcing these 3rd parties to compete for the business rather than automatically assuming it at whatever fee they choose. Much like GoodRX brings down prescription prices via price competition, Olo is doing the same for restaurant chains. Dispatch has also enabled chains with internal delivery capacity to reduce their reliance on DSP fulfillment by 50% thus boosting profit margins further.

Beyond bringing down 3rd party commissions, Dispatch coordinates the timing of a DSP’s arrival to ensure food is fresh and fulfillment is timely. With the FDA regulations highlighted above, this is nothing short of imperative. If a specific DSP is not meeting delivery service criteria, Dispatch can exclude them on a per location basis.

The module does allow DSPs to pick and choose where they want to participate in this process, but based on the massive scale Olo enjoys (covered below) it’s increasingly hard for them to not participate. Like all other Olo products, Dispatch seamlessly integrates into all tech stacks and POS systems to guarantee ALL digital demand is captured profitably.

c. Rails

Rails is an internal and external channel manager for the Ordering module. The product has a complete view of all corners of a chain’s business which allows it to accurately communicate with the Ordering module for setting, tweaking and controlling menu pricing and availability. Much like an airline price discriminates based on fluid supply and demand, Rails allows restaurants to do the same. This module is an imperative enabler of the Ordering module’s strong utility.

With Rails, restaurants also no longer need to manually transfer orders from one piece of a technology stack to another — this is done automatically and, in a way to optimize workflow efficiency.

Externally for participating aggregators such as GrubHub, Rails allows these 3rd parties to receive accurate menu data. This means they can all enjoy added volume from submitting orders placed by their users directly into a respective chain’s demand flow. The accuracy elevates consumer satisfaction as well as conversion rates — a profitable win-win.

The Rails module essentially functions as a powerful affiliate marketing tool to economically boost sales for restaurants.

d. Network

Olo Network opens chains up to collecting business from non-marketplace channels like search engines and social media platforms. For example — through a partnership with Google — Olo Network allows chains to place menu items directly on the Google search page where consumers can order without accessing an aggregator’s site. It takes all of this incremental demand and transmits it to the Olo Ordering module to streamline fulfillment.

The product ensures brands have direct and complete access to their lucrative consumer data which, again, demand aggregators generally keep to themselves. Furthermore, Network actively works to limit 3rd party fees taken from aggregators (just like Dispatch) as it funnels these payments directly into a chain’s merchant account and POS system. Less involvement by an aggregator means more profits for a chain.

Network was born from the reality of what a consumer finds when they search for a specific brand on Google. People often see several links to demand aggregators before the brand’s website that they searched for. Regardless of the actual restaurant having the clout to generate the direct search, consumers are frequently re-directed to an aggregator where chains lose access to data, brand power and profit margin as discussed above.

Now with Olo Network, if a brand is being searched for, they will get the direct to consumer sale far more often.

I asked CEO and Founder Noah Glass about other potential partnerships for Olo Network and I explicitly mentioned Facebook and Instagram as possibilities. I received zero pushback hinting at these deals possibly being on the table in the years to come.

“Olo Network can bring other consumer-facing platforms into the mix of where a consumer can find their favorite restaurant and place an order. Our ambition on behalf of our customers is to put their menus wherever a consumer is looking for food and to put customers in more of a direct relationship with the brand.” — Glass

“I am inspired by the work that Shopify does with Facebook, Instagram and now TikTok. It’s a similar ethos of a motivation to help the brands to transact wherever their customer may be and to let 1000 flowers bloom on the platform. That’s our same guiding principal.” — Glass

e. Rails + Network

The combination of Rails and Network creates a newfound ability for chains to generate demand and levels the playing field for restaurant chains vs. demand aggregators. How?

Without these 2 products, chains cannot spend as aggressively on consumer acquisition compared to a DoorDash for example. This type of aggregator collects more lifetime value (LTV) per dollar spent on consumer acquisition cost (CAC) because they’ve been so successful at accumulating brands onto their platform. This means they can often out-promote a chain’s operations.

With Olo, chains can get more aggressive on spending because they now have actionable visibility into the channels creating profitable growth. Put simply, a dollar spent just became that much more valuable for a restaurant brand thanks to Olo.

f. Additional Products

Serve is Olo’s new user interface (UI) with the aim of presenting food in a more aesthetically pleasing manner. Its engineering team had the goal of limiting clicks per order whenever possible to reduce ordering friction.

According to QSR magazine, the upgrade has directly boosted basket conversion rates by 6% and has reduced time to place an order by 5 seconds while lowering customer interactions per order by 3. The goal of Serve was to streamline the digital ordering and checkout processes and it has already worked.

Serve is also set to be a key part of Olo’s expansion into on-premise dining. It comes with features like QR code scans for menus and kiosk ordering capacity. Olo originally set the ambitious goal of being involved in the majority of its customer’s total orders. Now that it has already achieved this feat, it has set its sights on 100% involvement in a restaurant’s digital orders. Expansion into on-premise service is how the company will do this, and Serve is one of the first steps in this exciting new direction.

Glass’s company has effectively removed the sacrifices that restaurant chains previously had to make to participate in this digital revolution. Now a chain can enjoy the added volume while maintaining control of data and margin. It can participate in off-premise growth without sacrificing quality of service or the power of its brand. So many pain points have vanished because of this company.

4. Olo’s Business Model

Olo generates revenue from platform and professional service fees. Platform fees represent 96% of its total sales year to date and cover all revenue collected from usage of its various modules. Professional service revenue makes up the remaining 4% of total sales and covers sales collected from installing new modules. This segment is not recurring and is lower margin vs. platform revenue.

Olo generally signs 3 year contracts with newly on-boarded brands and 1 year extensions thereafter. It does not seek out individual locations to onboard, but instead entire enterprise chains where it signs exclusive agreements to integrate its software across every single location. This translates into a highly efficient go-to-market approach which shows up in Olo’s strong margins covered below.

Within the platform segment, Olo collects both transaction-based and subscription-based revenue. The Ordering module is subscription-based and charged on a per restaurant basis. Recently, Olo introduced a newer pricing option for chains to buy a fixed number of monthly orders for a fee with additional fees paid per order beyond the limit. The company considers this to be subscription revenue as well.

With the subscription approach Olo is able to grow with its customers as they add new locations. Because the company already serves more than half of our nation’s fastest growing private chains, this should be a powerful growth driver going forward.

The Rails, Network and Dispatch modules are solely transaction-based. Restaurant chains, aggregators and all other participating service providers are charged per usage of the Olo ecosystem.

The usage-based model also means Olo grows as revenue per location grows. Olo’s 51% growth in year over year (YoY) revenue per location plus its users 7Xing average spend from 2018-2020 (to $21 million) both provide explicit evidence of this approach working.

Rails and Dispatch are much newer products than the Ordering module. As these modules continue to gain traction, transaction revenue as a portion of total sales will continue to increase. That trend is playing out with 71% of Olo customers using all 3 core-company modules as of December 31, 2020 (Ordering, Dispatch and Rails) vs. 44% YoY.

5. Olo’s Market

As mentioned above, in recent quarters Olo has adjusted its internal goal of touching 51% of total restaurant transaction volume to now 100% as it works to bolster its on-premise offerings. With this new ambitious target, it has opened itself up to a restaurant total addressable market (TAM) expected to reach $1.1 trillion by 2024 — per The Freedonia Group.

Restaurants as a whole are set to grow at a 9% compounded annual growth rate (CAGR) during that time with off-premise and especially delivery powering the majority of that progress. Specifically, delivery was expected grow from 6.5% of total restaurant sales to 10% even before the pandemic began — Covid-19 only steepened this adoption curve.

Pre-pandemic, 60% of restaurant transactions were conducted off-premise (this includes fast food drive-thru). Even before Covid-19 struck, that 60% metric was poised to grow to 70%-80% by 2025 as off-premise growth continues.

Today, Olo calculates its TAM at $7 billion based solely on the 300,000 enterprise restaurant locations in the United States. That could grow to $15 billion with the successful pursuit of on-premise market share.

Its TAM could further grow to $20 billion if it can expand into the small medium business (SMB) segment of the market which represents another 400,000 restaurant locations. This will invariably be a lower-margin endeavor based on on-boarding individual locations rather than national chains — but the company plans to dabble in the niche anyway.

This $20 billion in American restaurant TAM does not consider Olo’s eventual international expansion. Many of its clients already operate globally and according to CEO Noah Glass, Olo’s international opportunity is a matter of being willing to pursue it, not it being fruitful. Successful international expansion would double its TAM to $40 billion.

“We think what we are doing with global brands in the U.S. market does set the table for Olo to work with them in additional markets down the line. We have the flexibility to work with our clients in other markets.” — Glass

The company’s S-1 explicitly states SMB and global expansion are both a when, not an if.

My calculation merely includes restaurant chains, but not other segments of the on-demand commerce market. On a recent earnings call, Glass informed investors that Olo was being “pulled into” other on-demand commerce segments such as grocery — he reiterated that sentiment in my interview with him. Olo is not pursuing this sector yet, but is signing new contracts in the space because grocery chains realize the value Olo provides and are seeking it out specifically. More on this below.

Other on-demand commerce segments like cannabis could be lucrative future growth channel with its $24 billion TAM and 20% CAGR. The company has given 0 indication of pursuing this industry to date.

6. Olo’s Reach and Impact

The compelling combination of Olo’s value proposition and its industry’s long runway for growth lends itself to remarkably broad scale for the organization.

Currently, Olo serves 400 brand customers and 74,000 locations — up 30% year over year and 7% sequentially. It works with over 50% of America’s fastest growing private chains and serves more than 50% of publicly traded restaurant chains in the U.S.

Encouragingly, these clients have been very sticky to date. Olo boasts a 99% enterprise client renewal rate with enterprise stores accounting for 91% of its total locations serviced. These enterprises are also leaning on Olo more and more heavily every year with the company showcasing a net revenue retention rate over 120% since 2018. This means existing clients have been spending 20% more per year on Olo’s platform for several years straight.

QSR Magazine, Restaurant Business Online, and AP News all refer to Olo as the leading ordering platform for restaurant chains and Olo considers itself a “leading SaaS platform” for digital restaurant commerce.

The entity’s digital restaurant business niche got a large boost from the Covid-19 pandemic as on-premise dining temporarily shuttered. 27% of chains added new off-premise solutions in the weeks following Covid-19 coinciding with the historic demand shock. According to eMarketer, 59% of restaurant operators added curbside pickup with 20% adding new online ordering as well. Importantly, more than 70% of surveyed operators will keep these changes with the rest unsure according to the NRA.

The pandemic also led to skyrocketing consumer savings levels with the various stimulus checks hitting bank accounts and discretionary spend collapsing. A portion of this money invariably flowed through the consumer economy and boosted Olo’s operations further.

As a result, amid Covid-19 Olo’s clients saw a 156% increase in YoY digital same store sales and grew its active locations by 53% from 2019 to 2020.

Expecting this type of growth going forward is unrealistic as momentum was undoubtedly pulled forward and our world will normalize at some point. Virus variants continue to pop up, but another full economic shutdown in the United States seems highly unlikely at this point.

So what can we expect? Looking at pre-pandemic growth levels should more accurately inform what investors can anticipate going forward. From 2018 to 2019, Olo’s clients enjoyed 44% YoY digital same store sales growth and the company generated 19% location growth. These metrics are still quite lofty and provide a relevant hint on what to expect for the long term.

“Astonishing flexibility and a powerful ordering engine, combined with ease of use and excellent support, has made Olo critical in helping Five Guys provide the best online ordering experience for our customers” — Five Guys Senior Director of IT Zerrick Pearson

7. Financials

a. Demand

From a demand perspective, Olo has already added approximately 9,000 active locations to its footprint in 2021. These 9,000 locations were what Wall Street was expecting for the entire year. Olo now expects 2021 location additions in the “mid-teen thousands range” as a healthy demand pipeline continues to offer leadership ample confidence pertaining to forward-looking demand. This provides direct evidence that Olo’s growth and dominance was not reliant on a pandemic.

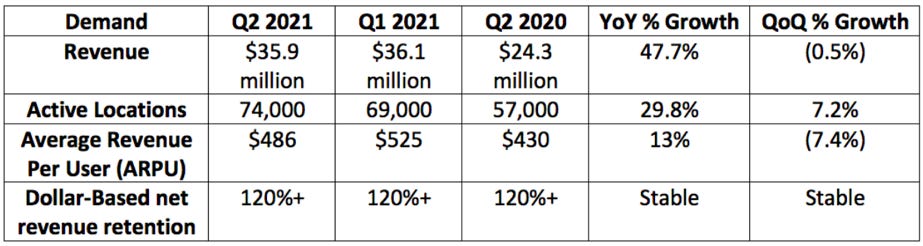

Below is a current and condensed summary of Olo’s sequential and annual demand progress:

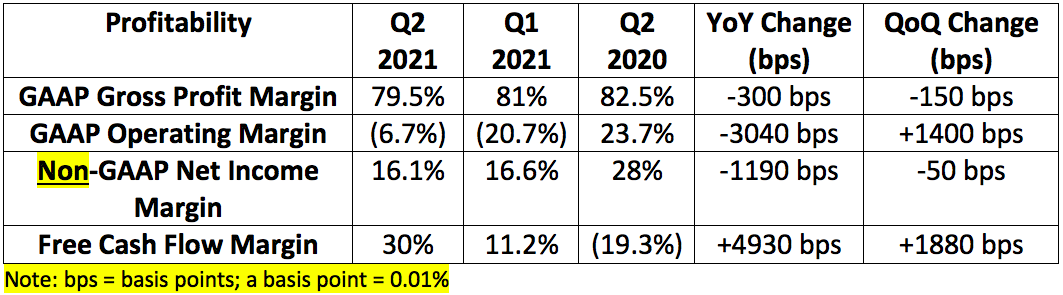

The 47.7% year over year demand growth Olo posted deserves some added context. This quarter was comparing results vs. a period coinciding with peak pandemic lock-down pain. This pain directly boosted Olo’s operations thus giving this most recent quarter an extremely difficult year over year comparison. In-person dining temporarily shuttering invariably fed Olo’s off-premise demand and that phenomenon is depicted in the chart below:

Furthermore, Olo’s platform revenue enjoyed 53% year over year growth. This portion of Olo’s business is by far its most profitable and most recurring.

b. Margins

Olo provides a unique combination of lofty top-line growth and already healthy profitability. Its business model is inherently asset light and economically mouth-watering.

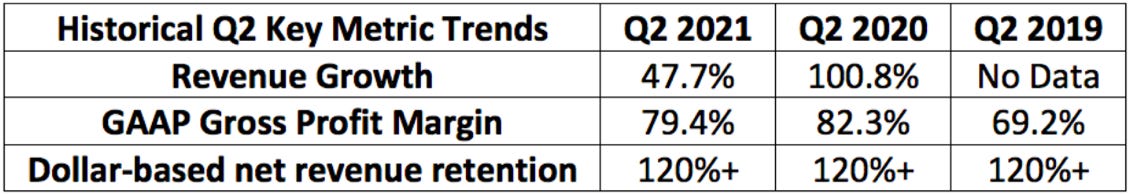

Below is a current and condensed summary of Olo’s sequential and annual margin progress:

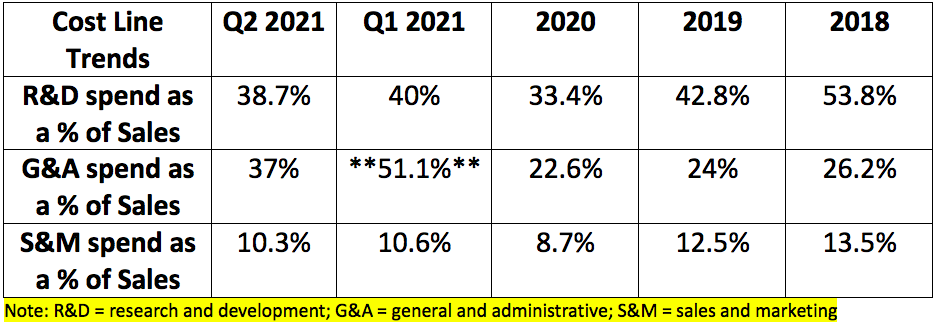

The recent small dip in gross profit margin was driven by higher costs to “support rapid growth” and new locations being on-boarded onto the platform. The company’s operational spend continues to be heavily focused on research and development (R&D) with that cost line making up 38.7% of Olo’s total sales in this past quarter. That type of spend offers evidence of the company seeing plenty of future optionality down the road.

The annual operating and net income margin dips were powered by costs associated with going public, a large charitable stock donation and normalizing marketing spend as we exit the Covid-19 pandemic. The strong cash flow margin proves exactly how profitable this model already is.

“We are committed to investing in growth and we anticipate remaining profitable while we grow although we do expect some near-term decreases in profitability as we scale to address the market opportunity. When comparing sales efficiency within software companies, Olo is among the best of any. We want to race forward into the market opportunity ahead of us.” — Glass

**The spike is related to IPO bonuses, aggressive hiring, a $5.1 million charitable stock donation and going public costs.**

There’s also margin upside in the company’s future. As covered above, the percentage of Olo’s clients using all 3 core modules jumped from 44% to 71% year over year which benefits the company beyond enhanced revenue growth. Similarly to other SaaS platforms with several product offerings (CrowdStrike is a good example), it costs Olo virtually nothing to onboard additional modules for its clients.

Once one module is adopted by a chain, the rest are essentially pure profit for Olo. This means module adoption enhances the company’s profit margins in addition to boosting demand and clearly that trend is entirely positive. The future Olo Pay module (discussed below) and more data analytics modules will only work to embolden this possible upside.

Additionally, the transactional and subscription-based revenue Olo collects means growing client volumes and locations directly feeds the company’s top and bottom lines.

Olo’s margin downside risk comes mainly from the dynamic aggregator competitive environment. More consolidation could work to amass aggregator market power and could theoretically put these aggregators in a better bargaining position with Olo when future contracts are being negotiated.

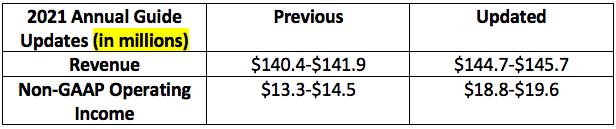

c. Results vs. Expectations

Olo’s 2 debut quarters as a public company were both overwhelmingly positive. It comfortably surpassed analyst estimates and guidance while raising its 2021 demand guidance in its most recent report. CFO Peter Benevides further added that the company is being quite prudent with its forecasting even after the 2 raises.

8. Balance Sheet

As of Olo’s most recent quarter the company had $575 million in cash and equivalents to deploy. It also has around $44 million in net accounts receivable and pre-paid expenses. With the company already free cash flow positive, liquidity is not at all a concern.

The entity has no outstanding debt, but does have a $35 million credit revolver with $8.6 million left to draw down after allocating $25 million to a DoorDash credit revolver and a $1.4 million letter of credit to lease its headquarters in New York City. Any additional borrowings from this revolver will come with an interest rate of either Pacific Western prime rate + 0.2% or 4.5% — whichever is greater.

9. Valuation

The company’s fully diluted share count is 183.6 million shares. Based on a price of $35/share Olo’s fully diluted market cap is $6.43 billion.

With sales of roughly $145 million expected for 2021, Olo trades at a steep valuation of 44X times fully diluted price to sales and 353X times fully diluted price to operating income. As I mentioned, it did boast a lofty 48% revenue growth rate on the heels of extremely difficult year over year pandemic comparisons in this last quarter — but it’s still pricey in any way you measure it.

I do not pass on companies I’m passionate about owning because I perceive the stock as too expensive — “expensive” is my absolute favorite bear case for any company I own. I do — however — take much smaller initial bites and go slower with accumulation if a certain stock is more expensive. Olo is that certain company and I will touch on how I plan to carefully add to my currently small position below.

10. What’s next

a. Niche Expansion

Olo is still in the early stages of its American restaurant ubiquity. There remain many, many labels to win over and more products to introduce.

Interestingly, the vast majority of chains have tried to create off-premise, digital businesses internally. Many have come to the realization that this is not the most effective way to develop this business and have switched over to Olo. Iconic brands such as Maggiano’s, Bloomin’ Brands and Brinker’s (Chili’s) have all recently transitioned from in-house solutions to Olo’s full product suite which directly points to the concretely positive and incremental value it provides.

As previously discussed, Olo fully plans on entering the SMB world. It’s now directly hiring efforts to growing its list of clients with 5-100 locations which marks an abrupt expansion of its previous, gigantic-chain-only ambition.

International pursuits are very much so in the cards as well. Olo’s client list includes many of the world’s largest chains. These chains already boast global footprints but the company is not yet ready to divert resources away from its domestic expansion. This domestic opportunity simply remains too compelling to not wholeheartedly pursue at this point in time.

“We think that the domestic market is absolutely massive and continues to be severely underserved. Our focus as a company in terms of capital allocation and attention allocation has been on the domestic opportunity because we believe that’s the most efficient way to 10X revenue in the years to come.” — Glass

When the time does come for Olo to blossom into a more globally-focused entity it likely will not be with all of its modules at one time. Much like it solely deployed its Ordering module to Jack in the Box’s locations across the USA this past quarter, Olo will launch modules one at a time internationally to create a path of least resistance. The company continuously depicts an ability to up-sell additional modules to domestic clients and that should be no different in other countries.

It’s also starting to find some success in the fine dining space. Union Square Hospitality deployed Olo’s software across its Union Square Café, Gramercy Tavern and Blue Smoke as well. It’s important to note that Danny Meyer (Shake Shack’s founder) owns this business and is an Olo board member with a 1% stake in the company. To date, Olo has been for more casual enterprises and this could broaden that addressable market.

Beyond new product offerings, Olo sees itself as a servicer of the “on-demand” commerce economy — not just restaurants.

“The big idea of Olo -- as it occurred to 22 year-old me in 2003 -- was not that this was a platform for just restaurants. It was that if we can build this on-demand commerce platform it will first be a platform that restaurants see a lot of utility in, but is really a platform for any brick and mortar store that could benefit from more efficient fulfillment. I think of coffee and restaurants for Olo like books were the initial vertical for Amazon. The first but not the only.” — Glass

Glass also mentioned caterers, convenience stores and ghost kitchens in our interview but nearly all physical stores will be in play eventually:

“In a world where e-commerce players are chipping away at the addressable market for brick and mortar, we can give physical stores the tools to provide a more seamless experience to the end user while leveraging their inherent local advantage.” — Glass

For now, the focus will remain entirely on restaurants as the company is finding zero trouble delivering profitable growth within that niche. It continues to see plenty of opportunities to spend more productive dollars on growth here.

“Our platform being highly adaptable and atomized enables the flexibility for us to get pulled into other verticals while focusing go-to-market efforts on the restaurant space which is massive and something we don’t want to distract ourselves from.” — Glass

As already mentioned, Olo is also pushing into the on-premise dining space. If it has its way, QR codes and connected, on-premise ordering systems will replace the menus we all know today and will limit the mundane tasks waiters and waitresses must perform. No longer will employees have to guess when to visit a table or what to bring — they’ll be told in real-time which should boost consumer satisfaction levels, cut down time per in-person reservation and boost throughput.

Finally, I asked Glass about the long term idea that autonomous fleets will replace human drivers in the delivery value chain. Here are his thoughts on the topic:

“I imagine 3 different futures with autonomous vehicle fleets. One is that they’re owned by restaurant brands that will hub and spoke back and forth between a given location. The second is that 3rd party companies such as Uber/Lyft will continue operating this service just with very different unit economics. The third is that consumers will have their own autonomous vehicle that will run errands for them. The good news is that all of these scenarios are very good for Olo and do not impact our Dispatch or Rails modules.”— Glass

b. Hiring Spree

Olo’s headcount has grown by 98% in the last 2 years to reach 639 strong. It has hired engineers, IT professionals, and operations people all aggressively to support its rapid growth. The company consistently hired roughly 20 people per month for the last 2 years according to LinkedIn and currently has 20 Olo job openings posted for various positions in product development — also according to LinkedIn. This would represent 15% workforce growth if all positions were filled. A company hiring this quickly is a company expecting a long runway for sustained growth.

In its most recent quarter Olo did explicitly call out difficulty in locating qualified people to fill its numerous roles. The labor market remains tight but it has been able to match candidates with openings thus far.

c. Olo Pay

Olo is also in the process of debuting a brand new module — Olo Pay — which is set to launch at some point next year. The company is already beta testing the product with a few of its brands to gauge satisfaction and to work out the remaining kinks. One of the main topics of my interview with Glass was how this debut will impact Olo’s value-creating integrations with over 100 technology partners including POS systems such as Par. The takeaway: The module is far more of a complement to these existing solutions rather than a substitute.

Olo Pay will not compete with physical POS systems for market share, but instead will debut new functionality within the payment processing space where titans such as WorldPay and Bank of America preside.

Importantly, Olo Pay won’t directly compete with these behemoths either — it will uplift and intensify the value the processors provide to restaurant chains and their investors.

“I don’t see our work on Olo Pay negatively impacting our relationship with POS players and will not replace the payment processors we integrate with.” — Glass

So then what will Olo Pay do for Olo’s clients?

Olo Pay will function as a unifying layer that integrates disparate payment solutions to enable the fulfillment of digital restaurant payment while ensuring happier customers and more profitable operations. If it sounds familiar, that’s because it should be: This product has the same philosophy of connection and collaboration that all of Olo’s modules have come with thus far. Consistency is key.

According to Glass, “Olo Pay will be a digital gateway into the existing in-store payment processors” so that all digital demand is re-routed into one centralized location. Payment providers specializing in on-premise processing will not be replaced, they’ll be a supported piece of this endeavor.

This unifying layer will mean a consumer does not have to enter credit/debit card information online each time they order through a brand location with a different POS system or merchant. A single on-boarding of consumer data will now be communicated to every chain’s location — regardless of inconsistent technology stacks. Easier ordering means higher conversion rates and boosted revenues for Olo and its clients.

Olo Pay also helps in another compelling fashion. Digital payment processing comes with inherently higher chargeback and fraud rates for restaurant chains. Because Olo Pay plugs digital demand directly into a brand’s on-premise technology system, it will also help lower these financial hindrances as well.

Glass has frequently discussed the ability to add more data analytics services for his company’s users. More modules in this area will likely be launched in the future.

11. Leadership and Ownership

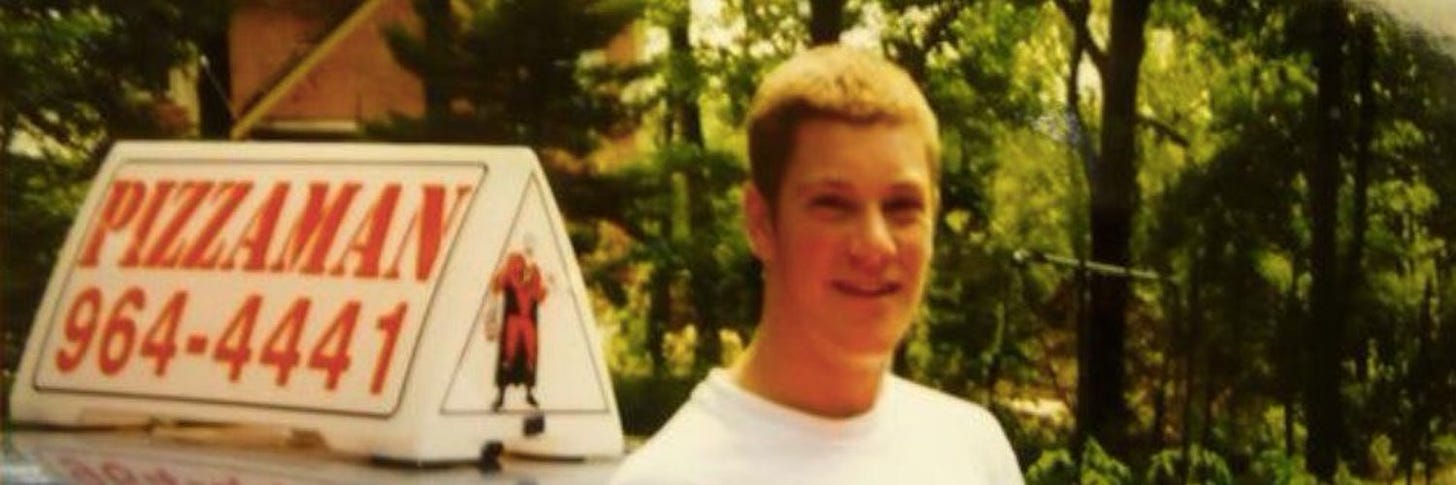

The company’s founder — Noah Glass — still serves as Olo’s Chief Executive today. Glass has a fascinating story.

At the age of 22, he skipped Harvard business school when his mentor — David Frankel — convinced/inspired him to accept seed funding to start Mobo Systems (Olo’s predecessor). The idea was born from Noah delivering pizzas in college, and seeing firsthand how much better he could make the experience. Fast forward to today, and Glass has been named National Restaurant News’ most powerful restaurant executive for 2020. He’s also a Trustee for the Culinary Institute of America.

With limited reviews, Glass sports a lofty 96% approval rating on GlassDoor and his employees are quite loyal. All 12 original Olo team members remain with the company 15 years later and the company’s average executive tenure is over 8 years.

“We have miles to go before we sleep. I’ve been running Olo for over 15 years. I’d sign on to do it for the rest of my career, if given the chance. I’ve never been more excited about Olo’s opportunity and driven by our mission than I am today. Luckily, that has been true each day that I can remember and I’m confident that it will be true for a lifetime of tomorrows.” — Glass

Matt Tucker serves as the company’s COO and President. Tucker previously served as the COO at Payfone, the CEO at Rely Software (purchased by Odyssey) and the VP of Sales and Marketing at Lending Tree. Tucker has overseen multiple IPOs (including Olo’s) throughout his career.

Peter Benevides is Olo’s CFO. He rose through the ranks with Olo starting as the VP of Finance and ending up here. Benevides previously was the VP of Finance at Urban Daddy and currently serves as a board member at the University of Rhode Island.

The board of directors has several interesting highlights. Its chairman is Brandon Gardner — a Founding Partner and President of The Raine Group.

As previously mentioned, Danny Meyer is a member of the board. Meyer founded Shake Shack and Union Square Hospitality and is an icon in the restaurant industry; David Frankel is also a board member. Frankel is a partner at Founder Collective: A company providing the seed funding for Olo as well as Coupang, Buzzfeed, Seatgeek, Pillpack and more.

Other board of director highlights include:

A former CFO at Shopify

The Senior VP and Global Head of Strategic Partners at Expedia Group

Olo has not yet filed a proxy statement with updated ownership stakes since going public and its lockup expiration is today (September 8th). The ownership structure will likely change in the coming weeks but based on its S-1, the most current notable ownership information available is as follows:

Noah Glass 8.9%

Brandon Gardner & Collin Neville (The Raine Group) 27.9%

James D. Robinson & RRE Ventures 13.9%

Tiger Global Management 14.3%

David Frankel (Raqtinda Investments) 10.7%

12. Competition and risks

Olo’s pure-play competitors within building private label websites for digital restaurant business includes Tillster Inc — a Popeye’s and Pizza Hut partner — as well as ONOSYS; Novodine; Xenial. Its closest competition from a POS perspective is Xenial and NCR Corporation. Par and Toast are more payment competitors that function as a supplement rather than a substitute as I explained above.

One of Olo’s core value creators for chains is its ability to bring together and integrate 3rd party technology platforms all in one place. This means Olo leans on the capabilities of other companies that it partners with. This dependence makes expanding into new product categories somewhat more complicated. Olo must balance remaining a trusted ally for software companies in the restaurant industry while also taking advantage of all the new opportunities it sees coming its way.

The competitive considerations do not stop there. When Olo’s execution is as strong as it is, that will inevitably invite deep-pocketed competition into the equation. It’s feasible to think Square, PayPal and LightSpeed will release products more closely overlapping with Olo’s at some point.

Olo also works as a close partner as well as a competitor for demand aggregators such as Uber Eats. These aggregators generate more profit by fulfilling an order without going through Olo. But at the same time, Olo has ingrained itself deeply enough into the restaurant chain footprint to make it an imperative part of operations for these aggregators. Eliminating Olo would be self-defeating for aggregators as Olo drives meaningfully incremental and lucrative volume for their operations.

DoorDash — the aggregator Olo currently works with the most frequently — presents a unique competitive threat to this software company. DoorDash has been wildly successful at collecting market share in the delivery space making it a core piece of Olo’s operations. This quarter, the fees Olo collected from DoorDash’s usage of its Rails module made up 13.8% of Olo’s total sales. While this fell from 17.6% in the year over year period and from 19.3% for 2020 as a whole, it still depicts modest concentration risk.

To make this relationship more precarious, DoorDash has not always fully cooperated within this alliance and there’s no guarantee it will continue to play ball in the future. The delivery giant has already debuted a white label delivery product to mimic that piece of Olo’s appeal. This product does not allow restaurants to compare pricing and service levels of various delivery bids — if a restaurant wants to select the optimal bid for certain variables it has to do so manually. DoorDash’s product does — however — allow restaurants to maintain a larger chunk of their brand equity and data which does dampen Olo’s differentiation to a certain extent.

Furthermore, DoorDash recently sued Olo for overcharging it on fulfillment and access fees for $7 million in damages. DoorDash discovered this when it purchased Caviar — a luxury food delivery service — and witnessed Olo charging the two different fee-structures.

Glass and Olo dismissed these allegations as baseless and the dispute ended with the signing of a new multi-year contract as well as no amounts payable by Olo to DoorDash. Still, it does point to this relationship being somewhat fragile. When Olo is servicing the majority of public chains and our most promising private chains, it’s difficult to think DoorDash would stop working this entity — but anything is possible.

To mitigate the concern of this risk, Olo recently reached an agreement to add GrubHub to its Rails ecosystem. This was the last national delivery service provider holdout to join forces with Olo and offers even more evidence of Olo’s irreplaceable position within this complex value chain.

13. My Plan — Slow and Steady

Olo currently makes up 1.5% of my total holdings. I have invested 1.2% of my available funds into the company and plan to invest another 0.8% in the coming months and years amid any stock weakness. Its value proposition is clear to me, its growth is impressive and its unit economics are envious — but it’s still an expensive stock.

The lock-up expiration is on September 8th (today) and could possibly provide some stock price turbulence for investors like myself to opportunistically accumulate shares. Events like these are my favorite buying opportunities as they generally create stock noise that is completely unrelated to the fundamental performance of a company. In Olo’s case that performance is elite.

I see this as a company that can easily eclipse $1 billion in revenue in the coming years to coincide with its remarkable profitability. There is a long way to go before we get there, but so far so very good. Barring any abrupt change to my thesis, I’m elated to own this for the long term.

Thanks to Founder & CEO Noah Glass for the exclusive interview and thank you for reading!

Brad, did you decide to add following the pullback after lockup? If not, what price do you feel most comfortable adding?

Great stuff Brad. I fully appreciate the time and effort that can go into writing such detailed deep dives.