“As the U.S. economy and dining rooms began to reopen, restaurant digital sales proved durable.” — Founder/CEO Noah Glass

a. Demand

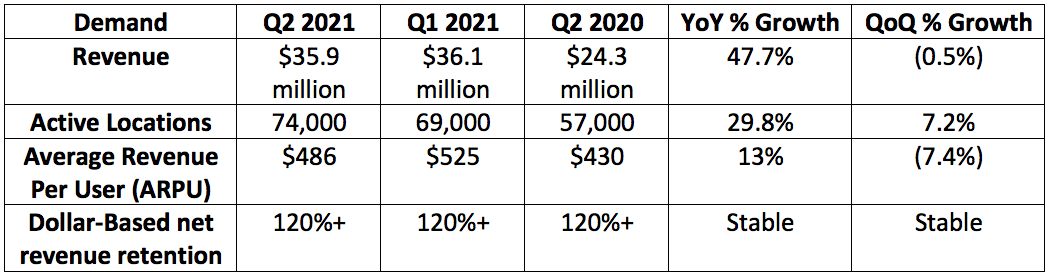

Olo guided to $33.9-$34.4 million in quarterly revenue. Analysts expected $34 million. It posted $35.9 million thus beating the high point of its internal guide by 4.4% and analyst expectations by 5.6%.

The 9,000 active locations Olo has already added for 2021 is what analysts were expecting for the entire year. As a result, it revised that guidance higher to now adding active locations in the “mid-teen thousands” range. This is a result of deployments happening more quickly than expected and strength in bookings replacing those deployments in the pipeline. This bookings metric represents a great forward-looking gauge of demand.

Olo had been expecting a larger decrease in sequential revenues due to re-opening and the wearing off of stimulus benefits. The sequential decrease in transaction volume was solely driven by these two variables.

Platform revenue — Olo’s highest margin and most recurring revenue segment by far — grew 53% year over year driven by both more brands and more volume per location.

“Fluctuations in ARPU can be expected as the number of modules a brand initially deploys varies. This quarter we experienced a great number of initial single-module deployments. These deployments represent a great opportunity to land and expand with our new customers. On a full year basis, we anticipate continued momentum in ARPU as growth in multi-product usage increases. ” — CFO Peter Benevides

b. Profitability

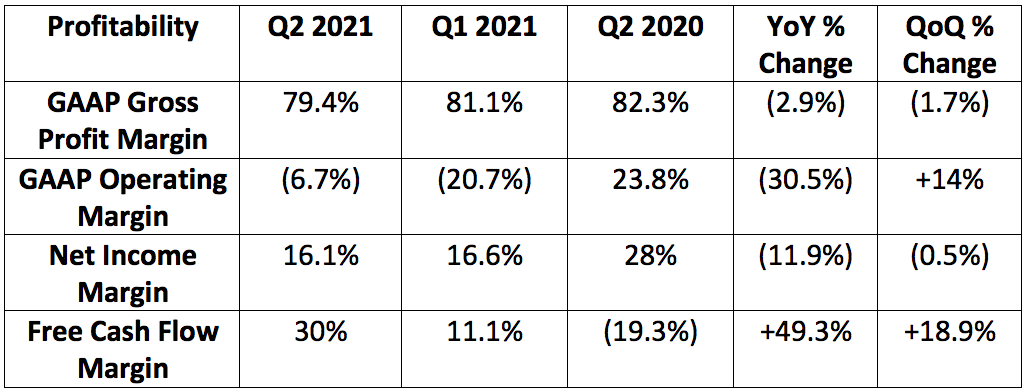

The company previously guided to $2.3-$2.7 million in operating income. It posted $5.9 million thus beatings the high point of its internal guide by 118%.

Analysts expected Olo to earn $0.01 per share during the quarter. It posted earnings of $0.03 per share thus beating expectations by $0.02.

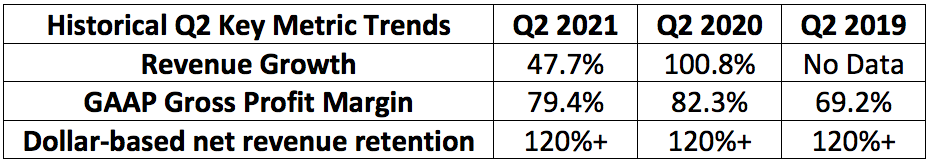

The small sequential and year over year declines in gross margin were driven by an increase in head count and to support rapid growth in locations added to the platform.

The company plans to increase marketing spend as a percent of revenue in the shorter term to support growth. It was 9% of sales this quarter vs. 7% in the comparable year over year period. Similarly, general and administrative (g&a) expenses rose from 17% to 25% of total revenues year over year due to headcount and public company costs. This cost line will decline as a percent of total revenue going forward.

R&d spend continues to dominate the company’s cost structure. This item accounted for 32% of total revenue in the quarter vs. 30% in the year over year period. This will continue to rise in the short term pointing to Olo seeing plenty of opportunity for future product innovation and enhancement.

Olo has $575.2 million in cash on the balance sheet with virtually 0 debt.

c. Guidance Updates

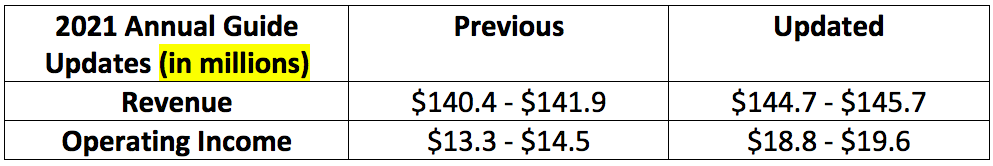

3rd quarter guidance is as follows:

$36-$36.5 million in revenue

Analysts were expecting $34.6 million

$3.4-$3.8 million in operating income

“We continue to be prudent in our approach to forecasting.” — Benevides

d. Operational highlights

Declining DoorDash Rails revenue concentration (& risk):

DoorDash Rails fees made up 17.6% of total Olo revenue in the comparable 2020 period.

This fell to 13.8% of total Olo revenue this quarter.

Rails is Olo’s channel management and aggregation module.

71% of Olo’s clients use all 3 core company modules vs. 44% pre-pandemic.

Grubhub agreed to partner with Olo on its Rails module. Grubhub’s demand aggregation will now feed directly into every Olo client’s digital demand. This represents the final national aggregator holdout to join the Olo Rails ecosystem and brings Olo’s total delivery service provider (DSP) footprint to more than 2 dozen. Adding demand aggregators in the past has directly led to increased volumes for Olo’s clients. This integration will take place over the next few quarters.

“Olo is fulfilling its promise to serve as a common carrier, ensuring a level playing field for all aggregator partners.” — Glass

According to Glass, “Brands such as Smoothie King have touted the benefits of the Grubhub partnership and how it ensures accurate menus and error reductions to greatly enhance service.” This is the first brand to beta-test the new integration.

Product Updates

Olo finished up the development of its Serve module — a private label mobile app version of its digital ordering product. This debut has already boosted brand partner conversion rates via cutting mean time to order by 5 seconds. Olo will not charge for access to this feature, it’s an add-on front-end service for the platform.

“The new Serve mobile app allows brands to offer an app version of their digital presence without the need for large custom budgets.” — Glass

Olo added a new performance tool to its existing Rails module. This gives brands a better sense of how well their businesses are performing across all channels of demand.

It continues to beta-test its Olo Pay module with a few key clients.

e. Management Commentary on Customer Wins

Olo signed Potbelly Sandwich Shop on as a new brand client in the quarter. Potbelly went with Olo to replace its legacy tech stack. This follows national brands like Outback, Chili’s and many more all deciding to migrate from their internal digital software solutions to Olo’s.

“Potbelly re-platforming to Olo again demonstrated that leading restaurant brands can no longer simply check the box with any digital ordering solution. They need to meet the needs of the on-demand consumer by utilizing what we believe is the most sophisticated on-demand commerce platform in the industry.” — Glass

Jack in the Box added Olo’s Dispatch module (a delivery fulfillment and price-comparison tool) to boost digital ordering. Jack in the Box utilizes its own internal digital ordering platform but was able to seamlessly integrate it into Olo’s Dispatch ecosystem. This demonstrates the power and convenience of Olo’s open source approach and 100+ technology partners.

“Jack in the Box is an exciting example of our success within the quick service restaurant (QSR) category. As it’s the largest component of the restaurant industry (by locations and revenue), QSR represents a true greenfield opportunity. — Glass

Some additional Olo QSR clients include:

Checker’s

Rally’s

Culver’s

Dairy Queen

Thighstop — Wingstop’s new virtual concept — launched using Olo’s modules in “a matter of weeks.”

Olo added Subway as a client as well with the national chain integrating Olo Rails into its digital ordering ecosystem.

“As the restaurant industry deals with record-setting consumer demand amid limited labor supply, Olo is a force multiplier for restaurant operations by automating manual tasks and removing redundancies.” — Glass

Delivery is still just 8% of total industry transactions vs. 6.5% pre-pandemic. Within digital demand specifically, non-delivery orders still make up nearly two-thirds of total digital orders. Interestingly, 1% of that digital demand is coming from on-premise ordering marking a shift in the industry to digital touching 100% of volume. There remains a long runway for growth here.

Olo is beginning to move to smaller enterprise clients as well. In the quarter the company boosted its sales force specifically for what it calls “emerging enterprises.” This is defined as chains with 5-100 locations.

f. My Take

Olo continues to fire on all cylinders. Free cash flow generation is strong, and growth is lofty despite the tough year over year comparison. It is exceeding expectations as we exit the Covid-19 crisis pointing to real sustainability in its growth trajectory. Recording 9,000 active location adds in 2 quarters vs. the 4 quarters analysts had expected it to take Olo is very positive.

I’m excited to see Olo Pay debuted in the coming quarters. To me, this represents a large step in the organization enhancing and rounding out its value proposition for restaurant chains. I will do nothing but add to my position over time, but the company is quite expensive so I will remain slow with accumulation of its shares. I’m looking at $30 per share to begin adding to my currently small stake.

Thank you for reading! My Olo deep dive will be published later in the month. For my broad overview of the company, click here.